Elegran Manhattan Market Update: January 2024

JANUARY MANHATTAN MARKET UPDATE: A Balanced Holiday Season

December, a typically quieter month for contract activity in Manhattan was busier than expected, thanks to declining interest rates which motivated some buyers to get off the sidelines. Contract activity was 5% higher in December 2023 compared to December 2022 in the borough.

Look for a continued increase in sales activity heading into and through the spring, especially if mortgage interest rates continue their recent decline.

SALES

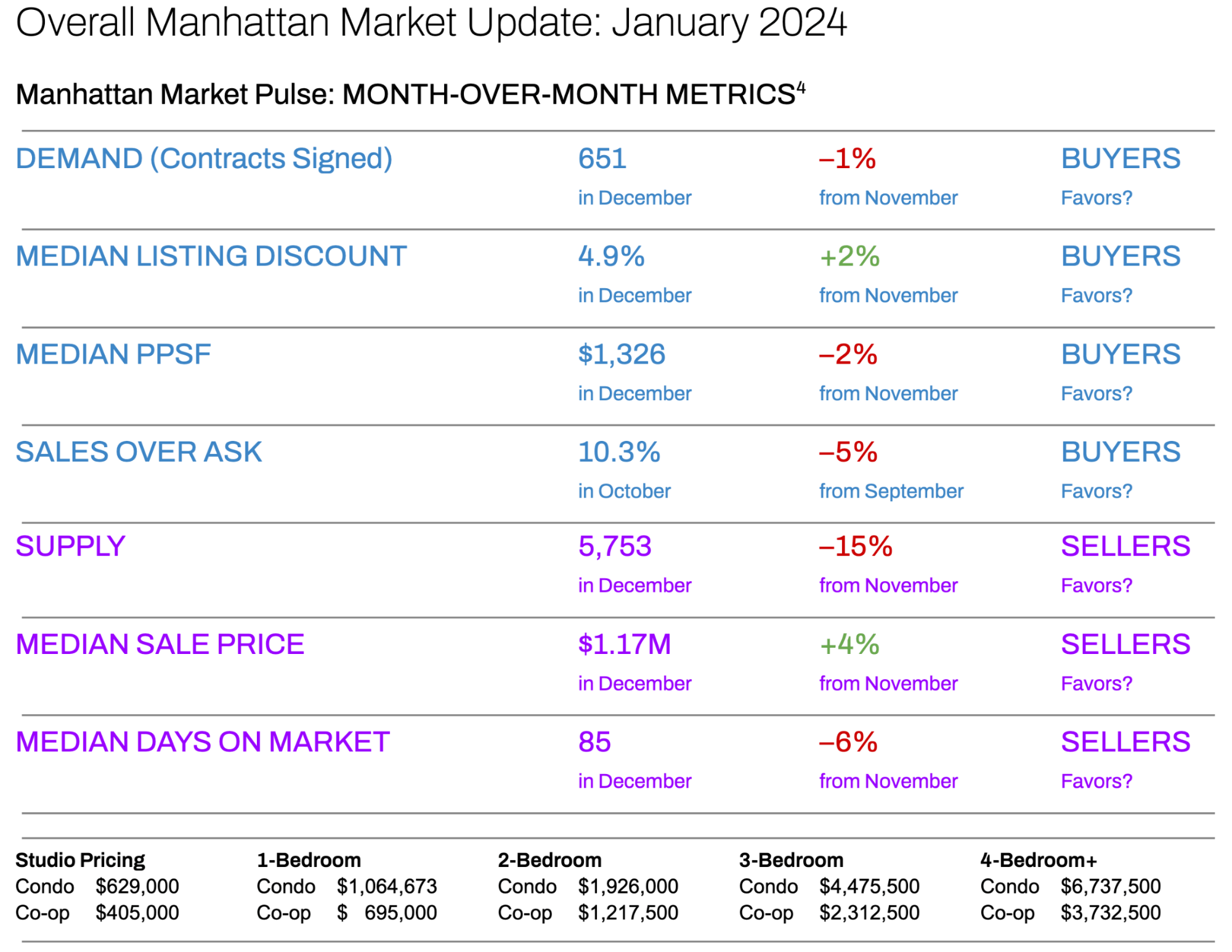

“Neutral” markets don’t exist because buyers and sellers are constantly playing tug-of-war for leverage. At times (e.g., the past 8 months), there’s no clear winner as buyers & sellers reach equilibrium.¹

- Last month, buyers had a small advantage.

- This month, based on the data, it’s a stalemate between buyers and sellers; although the market reality is buyers have the upper hand in terms of negotiability for properties on the market longer than 90 days or that have had price reductions.

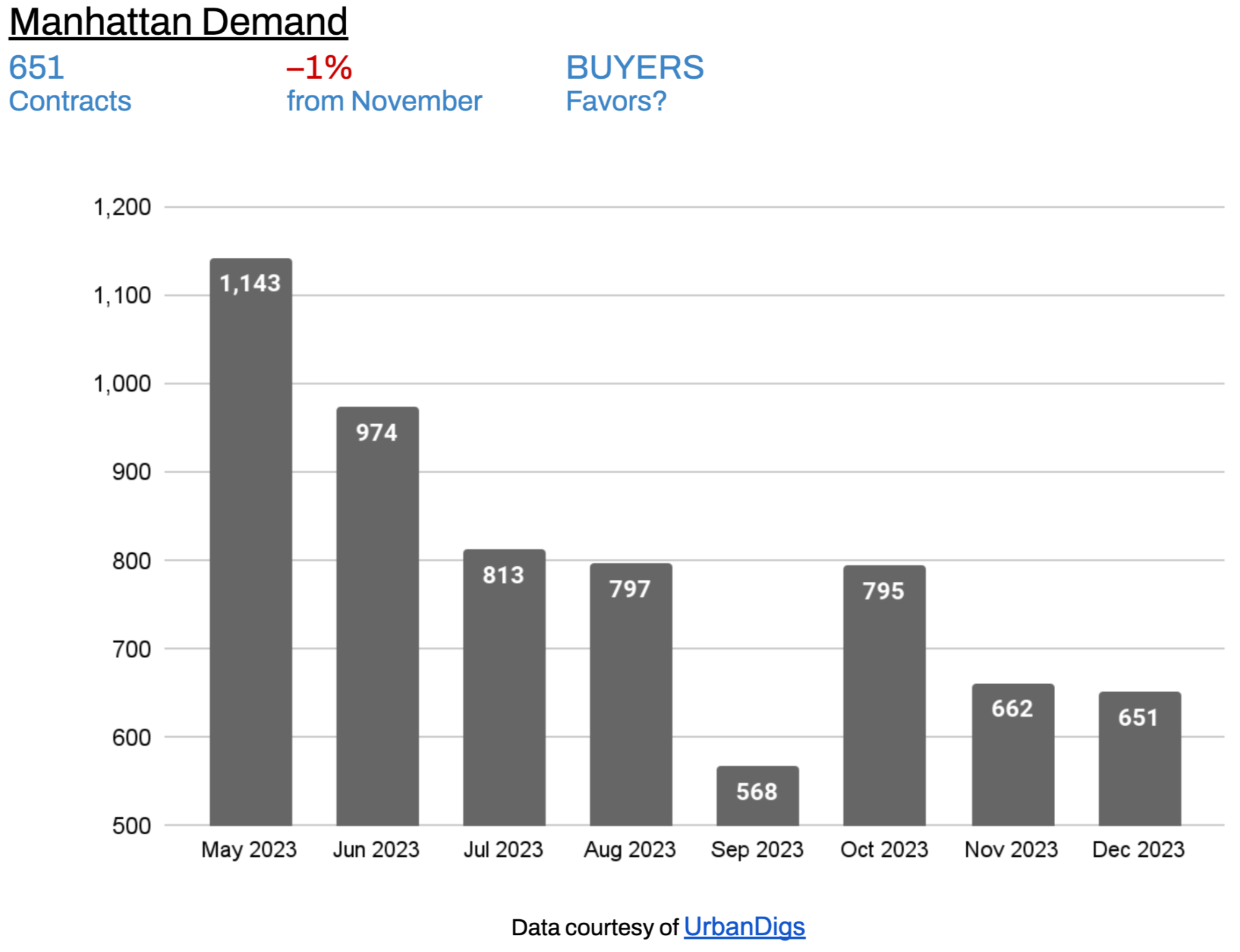

- Demand (measured by contracts signed) was down slightly, in the buyer’s favor.

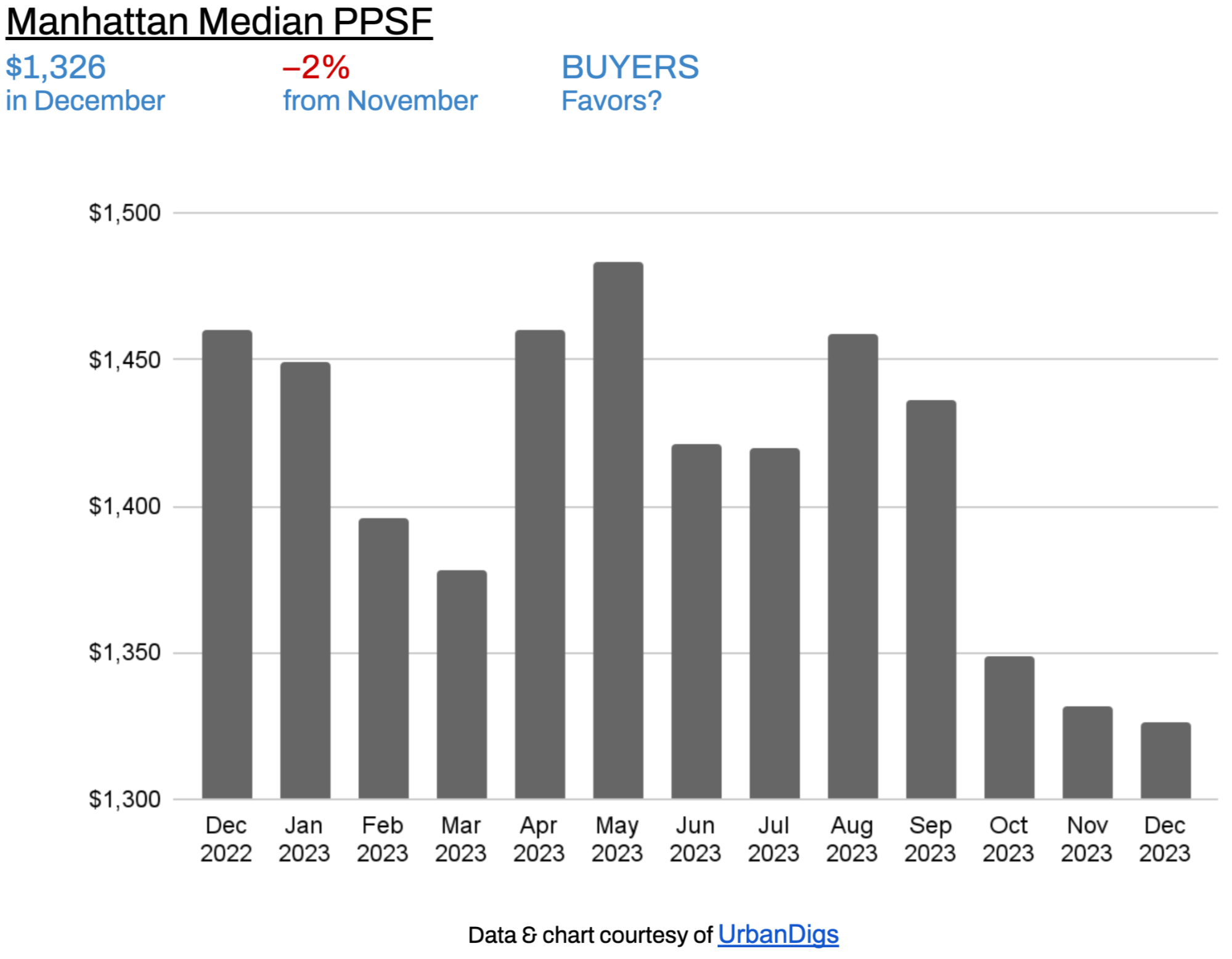

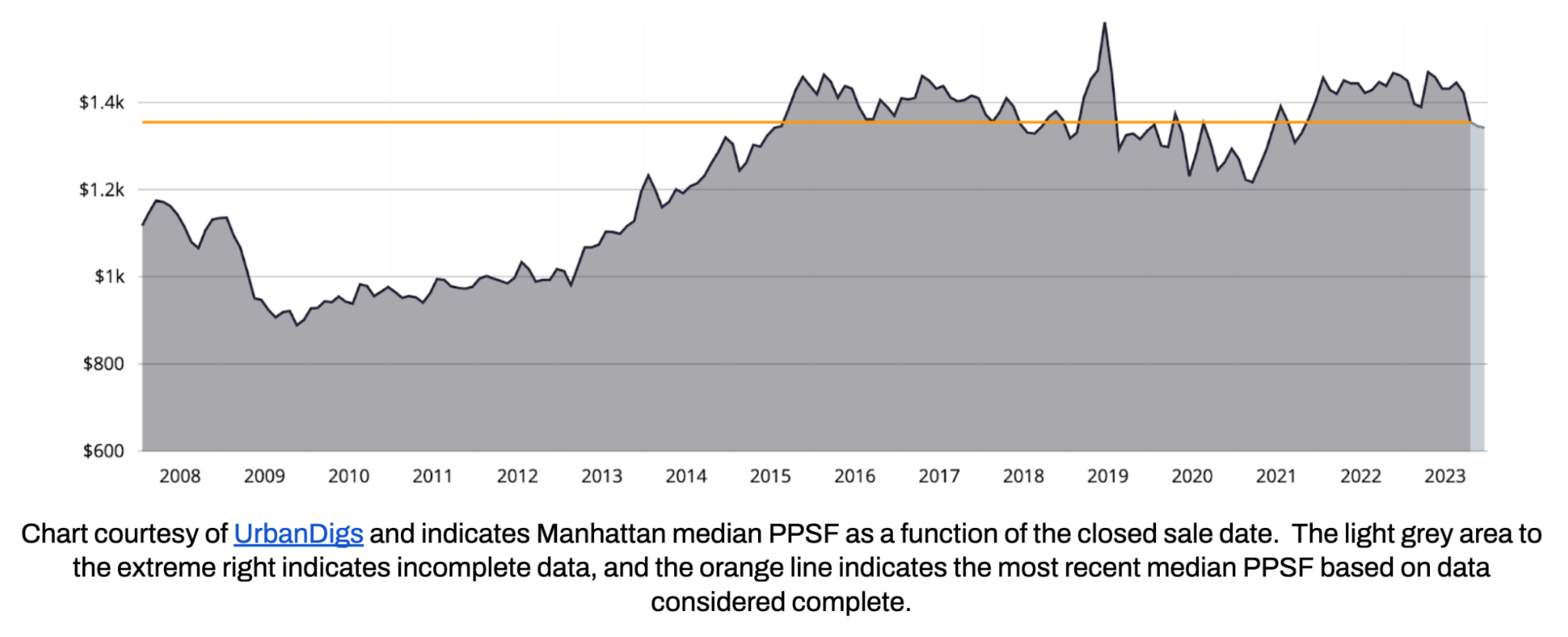

- Median PPSF (Price Per Square Foot) was down, in the buyer’s favor.

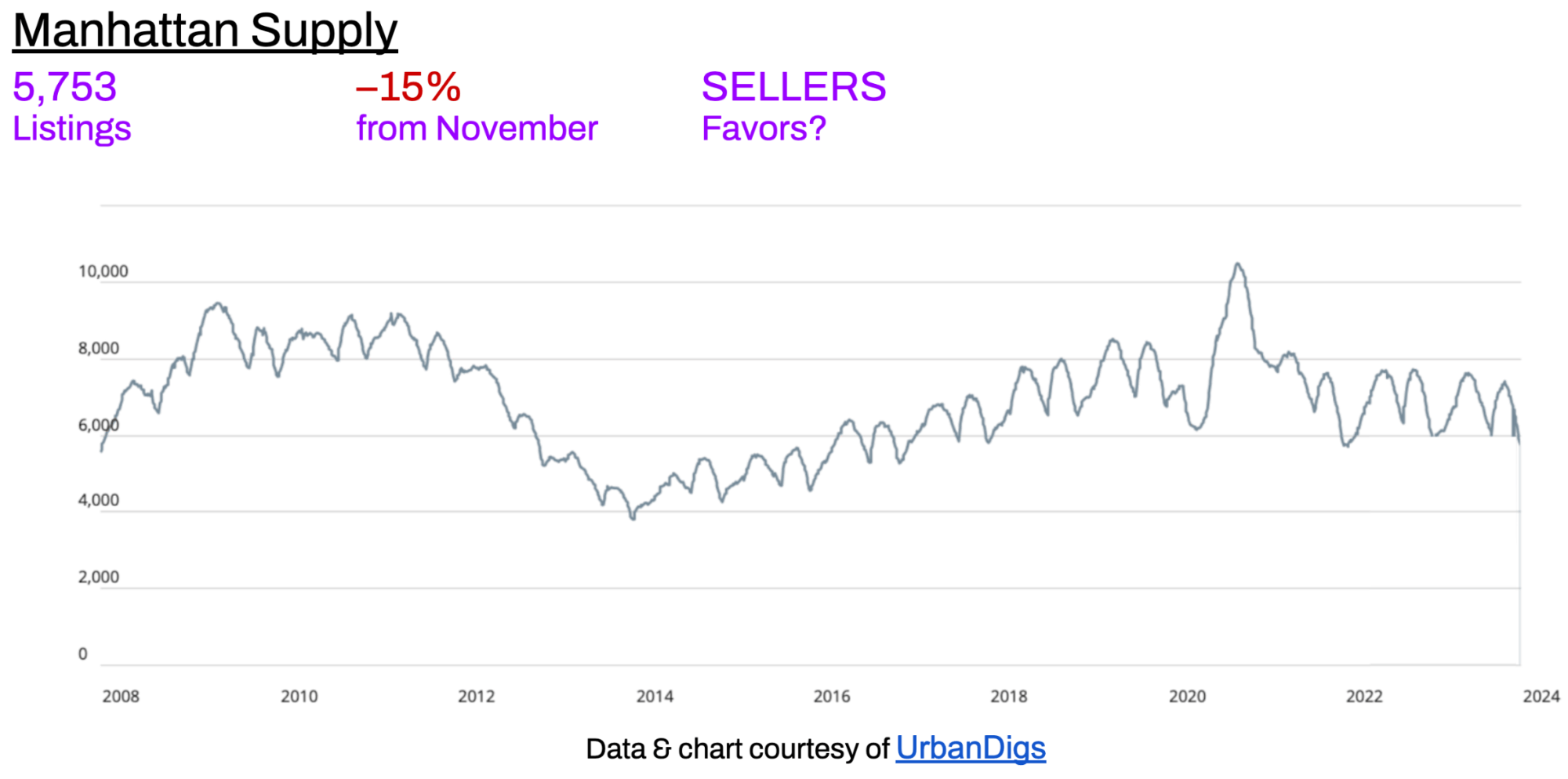

- Supply was down, in the seller’s favor.

- Median Days on the Market were down, in the seller’s favor.

RENTALS

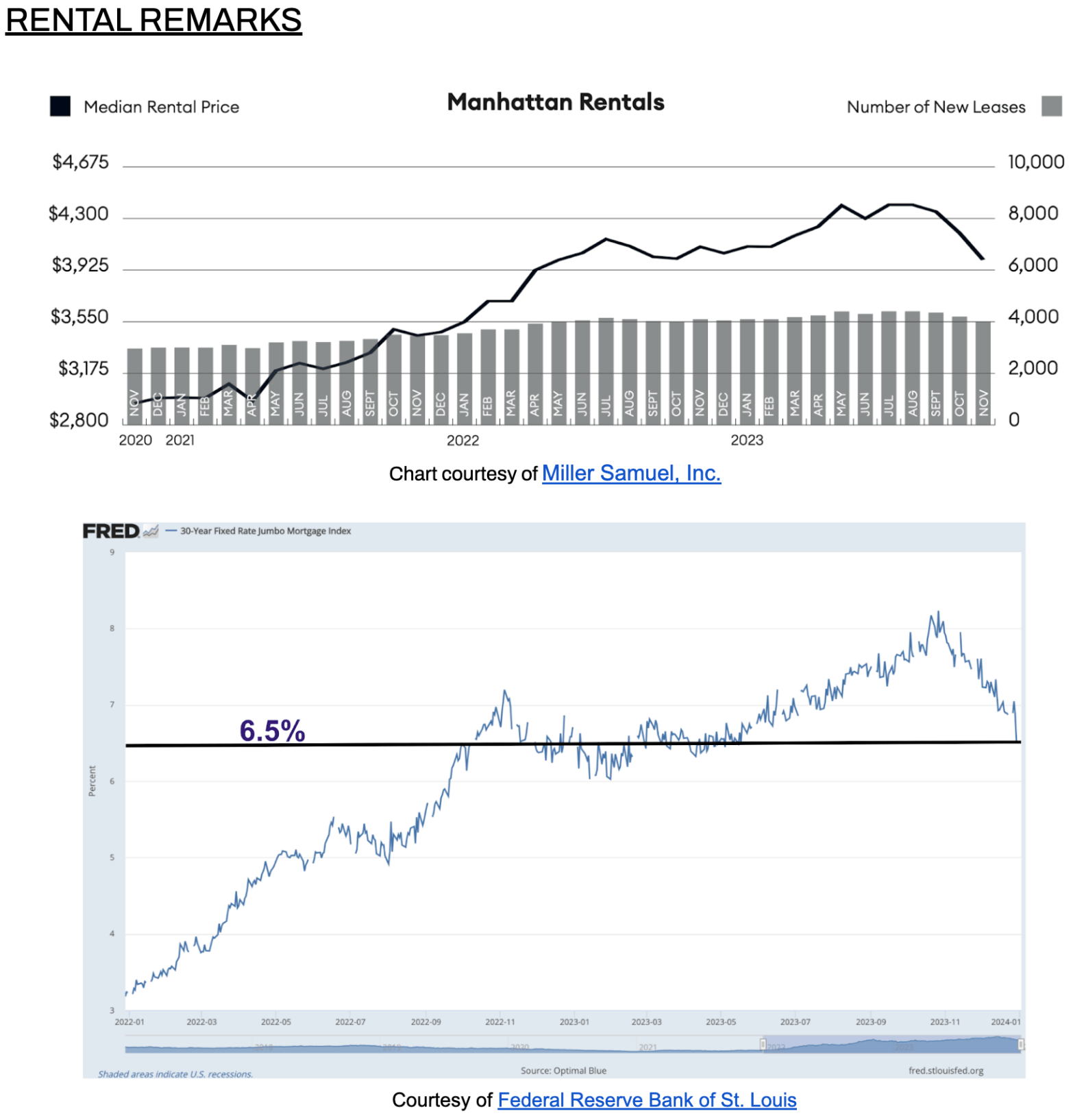

- From the all-time high of $4,300 in May & July, the median rental price has retreated to $3,995.

- Rents have retreated from recent all-time highs and the rental market is experiencing a seasonal softening, with rental asking prices decreasing slightly and some apartments offering concessions.

- The rent versus buy scale may feel equally punitive on both sides, with rents still near all-time highs and mortgage rates near their decades-long high as well.²

INVESTMENTS

Total return is generated by net rental income & price appreciation.

- All-cash buyers can expect a cap rate between 2.5% - 3%.

- Since the average JUMBO mortgage rate APR is 6.51%³, there is no net rental income on leveraged purchases.

- Depending on when they purchased and their national currency, foreign investors may experience robust returns upon sale.

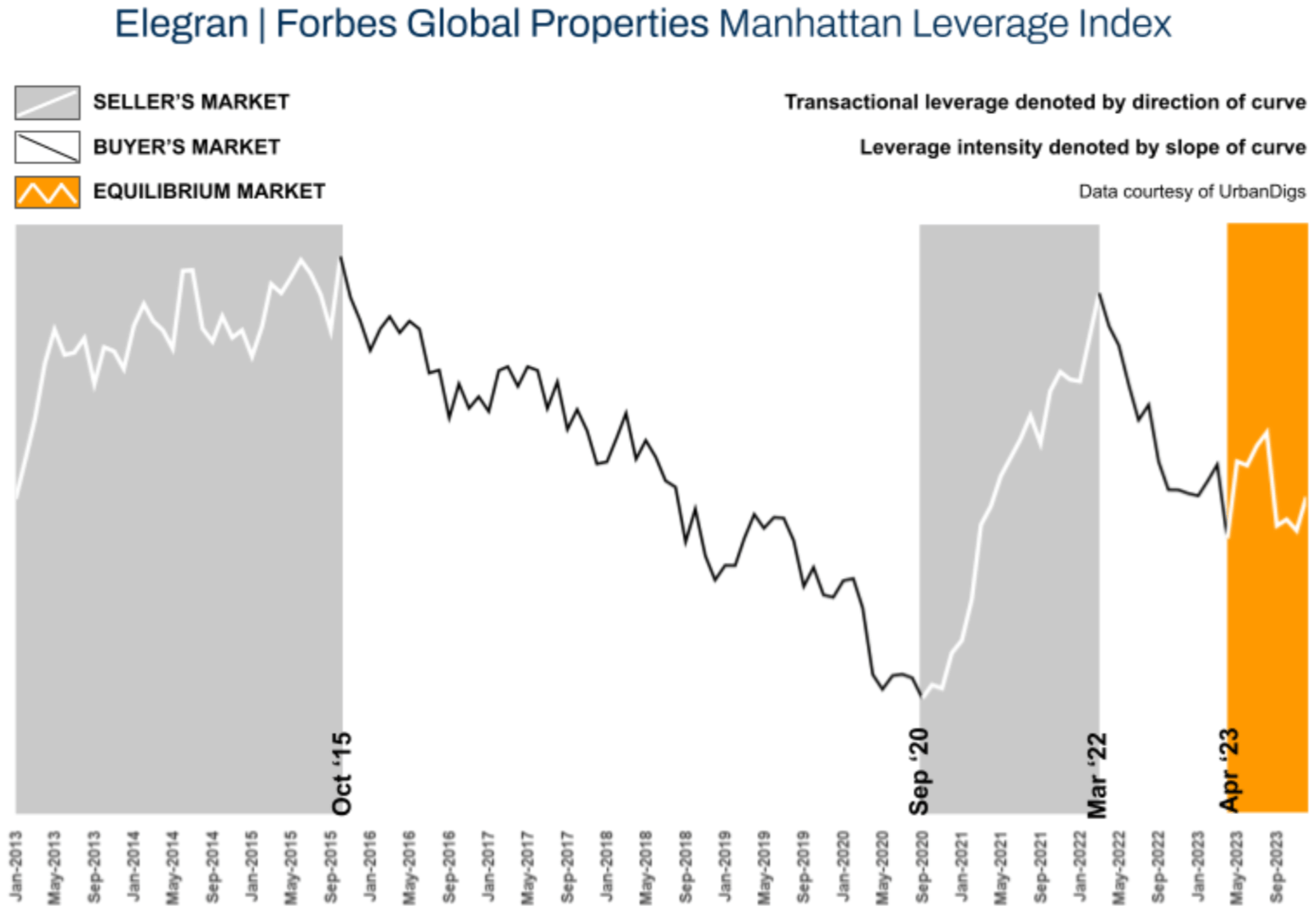

Elegran | Forbes Global Properties Manhattan Leverage Index

The Elegran | Forbes Global Properties Manhattan Leverage Index is powered by the four indicators on the following four pages. It informs us whether the current is a buyer’s or a seller’s market, i.e., which party possesses transactional leverage. Looking at the graph below, this is indicated by the direction of the curve, where:

- An increasing trend from left to right indicates a seller’s market

- A decreasing trend from left to right indicates a buyer’s market

Our indicator also informs us regarding the relative strength of that leverage, indicated by the slope of the curve, where:

- A gentle slope indicates a weak advantage by one party over the other

- A sharp slope indicates a strong advantage

But it’s not the numbers that are important. What is important is the direction and slope of the curve. And the curve between April and December has been anything but flat. There has been an intense and continued leverage tug-of-war between buyers and sellers. Last month, buyers pulled the metaphorical rope in their direction. This month, it’s a stalemate.

Manhattan supply has followed a similar cadence - pandemic excluded - for the past decade, as the chart above clarifies. A seasonal decline in the metric defines December. What does this mean for?

- BUYERS? Supply continues to decrease.

- SELLERS? Competition continues to decrease.

Expect supply to increase in January and continue into the spring months, increasing choice for buyers and competition for sellers.

Demand (measured by contracts signed), following the seasonal trend observed in November, continued to decrease in December. What does this mean for?

- BUYERS? Less competition.

- SELLERS? Less activity.

Contract activity was 5% higher in December 2023 compared to December 2022, in large part because declining mortgage interest rates pulled some buyers off the sideline.

The median PPSF is at the lowest point in the past 12 months and down 11% from May’s high. What does this mean for?

- BUYERS? Prices are moving in their favor.

- SELLERS? Prices are moving against their interests.

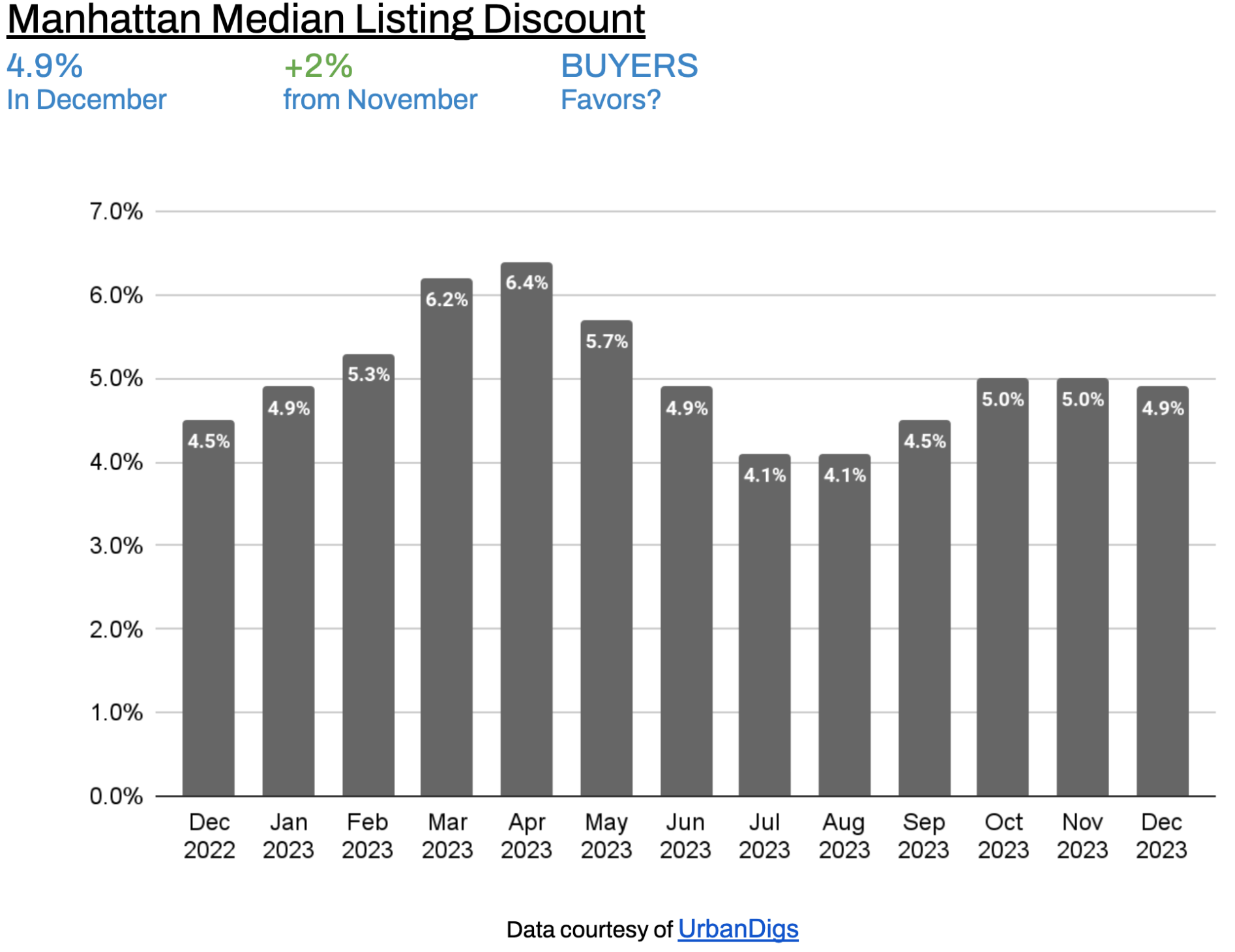

The median listening discount in December aligns closely with the figures observed in November, indicating relative stability. What does this mean for?

- BUYERS? In December, no significant change, but slightly favorable for buyers.

- SELLERS? In December, minimal change, yet slightly unfavorable conditions persist.

In November⁵, the median rent in Manhattan cooled slightly but remains near record highs. The 30-Year Fixed Rate JUMBO Mortgage Index⁶ is trending at 6.5%, and the average JUMBO APR is 6.51%⁷. So, it’s a “catch-22” for renters, as the rent versus buy scale may feel equally punitive on both sides.

INVESTOR INSIGHTS

The total return is driven by net rental income and capital appreciation. For all-cash investors, Manhattan cap rates are currently 2.5 - 3.0%. Unfortunately, for those investors using a large percentage of leverage, there is no net income potential, with the average JUMBO mortgage APR at 6.51%. On the sell side, the COVID rebound is now fully realized, so any potential for future capital appreciation will be generated by future price inflation. Timing and a strong USD may afford foreign investors, depending on their native currency, the opportunity to realize significant capital gains upon selling their assets.

References

1. According to the Elegran | Forbes Global Properties Brooklyn Leverage Index

2. Data courtesy of Miller Samuel, Inc.

3. Mortgage data courtesy of fred.stlouisfed.org

4. Data courtesy of UrbanDigs

5. December 2023 data is not yet available

6. Data courtesy of Federal Reserve Bank of St. Louis

7. JUMBO mortgage rate APR data courtesy of Bank of America, Chase, and Wells Fargo

If you would like to chat about the most recent market activity, feel free to contact us at info@elegran.com or connect with one of our Advisors.

About Us

Welcome to Elegran | Forbes Global Properties, where our mission is to revolutionize the world of real estate. Founded in 2008 by Michael Rossi, our journey began with an unwavering drive for motivation, innovation, and a genuine care for our clients.

As an independently owned brokerage, we pride ourselves on our elite team of "advisors," offering a personalized touch that goes above and beyond the traditional real estate experience. Armed with robust data insights, we empower our clients to make informed decisions that lead to success.

Distinguished as the exclusive member of the invitation-only Forbes Global Properties network in NYC, Elegran proudly stands at the forefront of excellence. This exclusive partnership broadens our horizons, enabling us to connect buyers, sellers, and investors with extraordinary luxury properties not only in New York City but across the globe.

Our passion lies in turning your real estate dreams into reality, and we are committed to providing exceptional service at every step of the journey.

Are you ready to experience the Elegran difference? Dive into the possibilities at www.elegran.com and embark on an unforgettable real estate adventure with us.

Categories

Recent Posts

Stay in the Know!

Sign up to receive our monthly newsletter

GET MORE INFORMATION