Elegran Manhattan Market Update: September 2023

Manhattan Market Update: Supply Shortage Keeps Manhattan a Seller’s Market to Some Extent

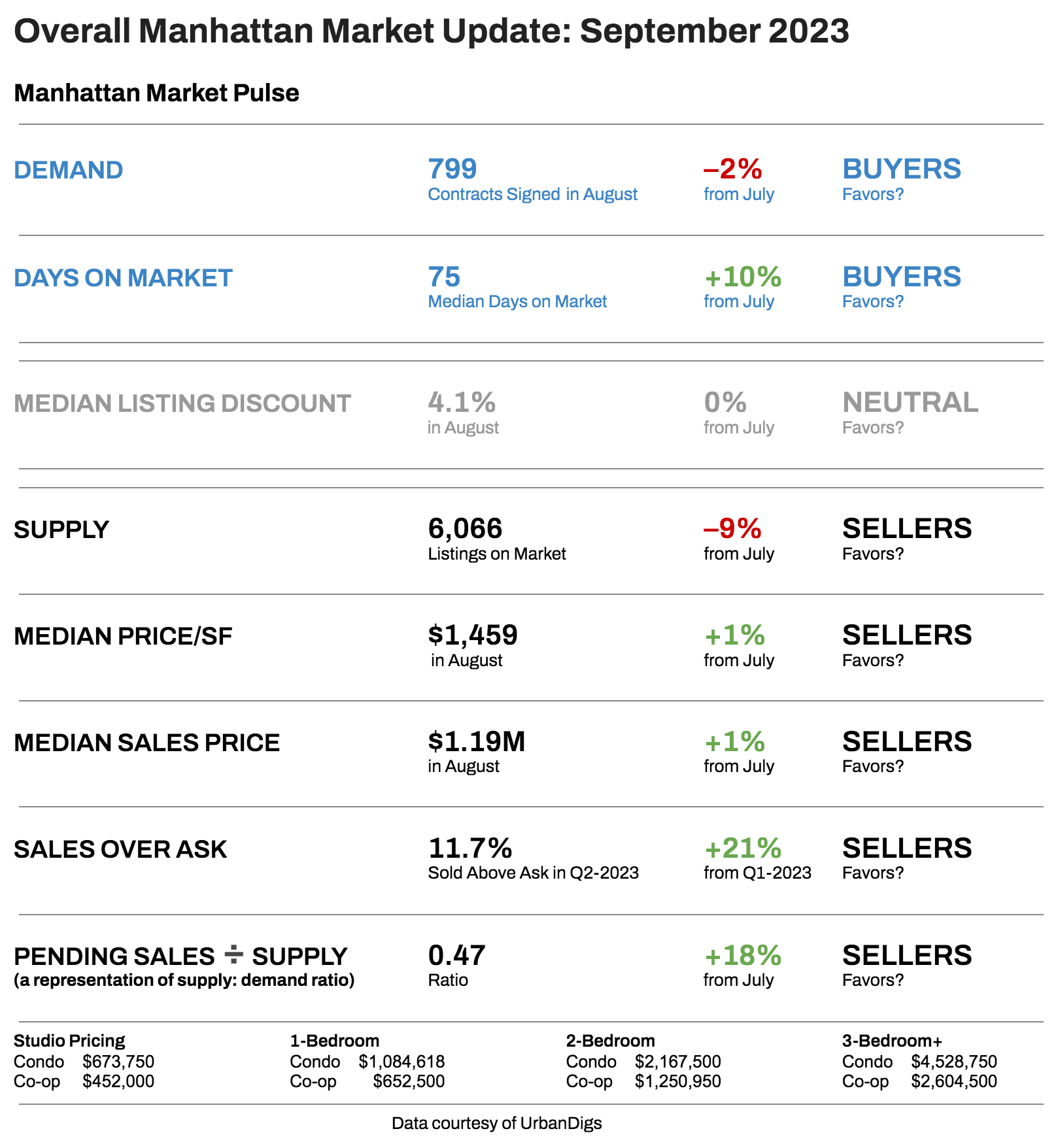

As summer slowly gives way to fall, the Manhattan housing market continues to experience shifts and fluctuations, with key metrics shaping the balance of power between buyers and sellers. In this update, we dissect the data that drives the Elegran | Forbes Global Properties’ Leverage Indicator, a comprehensive tool that gauges whether conditions favor buyers or sellers, and to what extent. We'll explore the critical factors of supply, demand, median price per square foot, and listing discounts to provide you with a clear picture of the current real estate climate in Manhattan.

Additionally, we'll delve into the intriguing world of Manhattan rentals and investor insights. As rental prices remain high, potential buyers grapple with the decision of whether to rent or buy in a market that seems equally challenging on both fronts. Meanwhile, investors face unique opportunities and challenges, driven by factors like cap rates, mortgage rates, and the strength of the US dollar.

Now, let’s deep dive into the numbers and trends that define the Manhattan real estate market this month. Whether you're a seasoned investor, a prospective buyer, or simply interested in the state of real estate in this iconic city, we will help you navigate the ever-evolving Manhattan real estate landscape.

Manhattan Supply

As we bid farewell to the summer season, the supply of available properties in Manhattan is on a downward trajectory. This month, there are 6,066 listings on the market, down 9% from last month. With supply decreasing, buyers may find themselves facing a more limited pool of options. Conversely, sellers can celebrate the diminishing supply. Less competition could empower sellers to potentially set more favorable terms and secure better offers. Manhattan's supply dynamics indicate a shift toward a sellers' market. Heading into the fall, expect supply to increase temporarily during the Fall market.

- BUYERS? Fewer opportunities.

- SELLERS? Less competition.

Manhattan Demand

In our ongoing exploration of Manhattan's real estate landscape, we turn our attention to the pivotal metric of demand. Our data shows a 2% decrease in contracts signed in Manhattan from July to August. With fewer buyers actively entering the market, competition for properties may soften. This could potentially provide buyers with more negotiation power and less pressure to rush into decisions. On the other hand, the decrease in contracts signed signifies reduced buyer activity. Sellers may need to adjust their expectations and pricing strategies accordingly. While they may face less competition from other sellers, they should also anticipate a potentially longer time on the market. Manhattan's demand dynamics indicate a slight shift towards a market where buyers have the edge.

- BUYERS? Less competition.

- SELLERS? Less activity.

Manhattan Median Price/SF

The median price per square foot in Manhattan has seen a recent uptick, signaling a market that's leaning toward sellers. Our data reveals a 1% increase in the median price per square foot in August. This uptick signifies that buyers may need to adjust their budgets and expectations. On the flip side, sellers can find solace in this trend. The data confirms that the median price per square foot is moving in their favor. This potentially allows sellers to command higher prices for their properties, reflecting positively on their bottom line.

- BUYERS? Price/SF is moving against their interest.

- SELLERS? Price/SF is moving in their favor.

Manhattan Median Listing Discount

Manhattan's median listing discount remains in a neutral position, providing both buyers and sellers with a relatively stable environment for negotiations. Recent data indicates that the median listing discount remained stable from July to August, with no change. For buyers, this stability suggests a balanced playing field. While it's not a strong advantage for either party, it means that buyers can expect consistent pricing when they negotiate on properties. This consistency also implies that sellers can maintain their pricing strategies without having to make substantial concessions

- BUYERS? A Neutral Playing Field

- SELLERS? Maintaining a Steady Course

Elegran | Forbes Global Properties Leverage Indicator: Manhattan

The Elegran | Forbes Global Properties Leverage Indicator serves as a compass, guiding us through the shifting sands of the market and revealing which party holds the upper hand: buyers or sellers. The direction of the curve on this graph indicates whether the market is tilted in favor of buyers or sellers. Furthermore, the slope of the curve informs us about the strength of that leverage.

As we scrutinize the data, a clear trend emerges. Since April, our data has consistently reinforced a significant shift in Manhattan's real estate landscape - it's unequivocally a sellers' market. As we anticipate the upcoming fall listing season, sellers can take solace in the steadfastness of this trend, knowing they are entering the market from a position of strength.

Rental Remarks

In July*, the median rent in Manhattan reached levels on par with the records set in May. However, this seemingly stable rental market is met with an interesting conundrum for renters. The average 30-year JUMBO mortgage rate hovers around 7.5%, making the decision to rent versus buy a property feel equally challenging on both sides of the scale. Renters are confronted with the need to weigh their options carefully amidst these competing factors.

*August 2023 data is not yet available.

Investor Insights

All-Cash Opportunities

For investors eyeing Manhattan's real estate, the landscape presents a unique set of considerations. Cap rates in Manhattan typically range between 2.5% to 3.0%, and mortgage rates stand at 7.5%. This combination makes it challenging to find net income potential on leveraged investments. However, with rents near all-time highs, opportunities abound for all-cash buyers who can capitalize on the robust rental market.

Global Currency Opportunities

Foreign investors find advantages in Manhattan's real estate market. The strong USD can yield capital gains upon asset sale and highlights the city's global appeal. Simultaneously, a weaker dollar opens doors for international buyers to invest in Manhattan's stable and potentially appreciating real estate market.

If you would like to chat about the most recent market activity, feel free to contact us at info@elegran.com or connect with one of our Advisors.

About Us

Welcome to Elegran, where our mission is to revolutionize the world of real estate. Founded in 2008 by Michael Rossi, our journey began with an unwavering drive for motivation, innovation, and a genuine care for our clients.

As an independently owned brokerage, we pride ourselves on our elite team of "advisors," offering a personalized touch that goes above and beyond the traditional real estate experience. Armed with robust data insights, we empower our clients to make informed decisions that lead to success.

Distinguished as the exclusive member of the invitation-only Forbes Global Properties network in NYC, Elegran proudly stands at the forefront of excellence. This exclusive partnership broadens our horizons, enabling us to connect buyers, sellers, and investors with extraordinary luxury properties not only in New York City but across the globe.

Our passion lies in turning your real estate dreams into reality, and we are committed to providing exceptional service at every step of the journey.

Are you ready to experience the Elegran difference? Dive into the possibilities at www.elegran.com and embark on an unforgettable real estate adventure with us.

Categories

Recent Posts

Stay in the Know!

Sign up to receive our monthly newsletter

GET MORE INFORMATION