- Register

- Sign In

- Agent Emailoffice@elegran.com

- Agent Phone+1(212) 729-5712

Mortgage Rates Retreat Again Today, Nov. 20, 2023. That’s Good News for Homeseekers

by CNET

Here's what dipping mortgage rates mean if you're in the market for a home loan.

Though mortgage rates remain high compared to a few years ago, improved economic data and signs of cooling inflation have triggered rates to fall over the past three weeks. Experts say it’s been a welcome surprise for homeseekers, who are facing the worst housing affordability in four decades.

A handful of important mortgage rates trended lower over the last seven days. Both 15-year fixed and 30-year fixed mortgage rates dropped off. We also saw a reduction in the average rate of 5/1 adjustable-rate mortgages.

The surge in mortgage rates, limited for-sale inventory, and expensive home prices have resulted in a reservoir of pent-up demand from anxious and ready homebuyers, said Jared Antin, managing director at the real estate agency Elegran. As soon as average 30-year fixed mortgage rates fell below 8% earlier this month, home loan applications increased two weeks in a row, according to the Mortgage Bankers Association.

There’s always volatility when it comes to mortgage interest rates, which are influenced by an interplay of macroeconomic factors, such as inflation, job growth and the bond market, as well as investor confidence and global events.

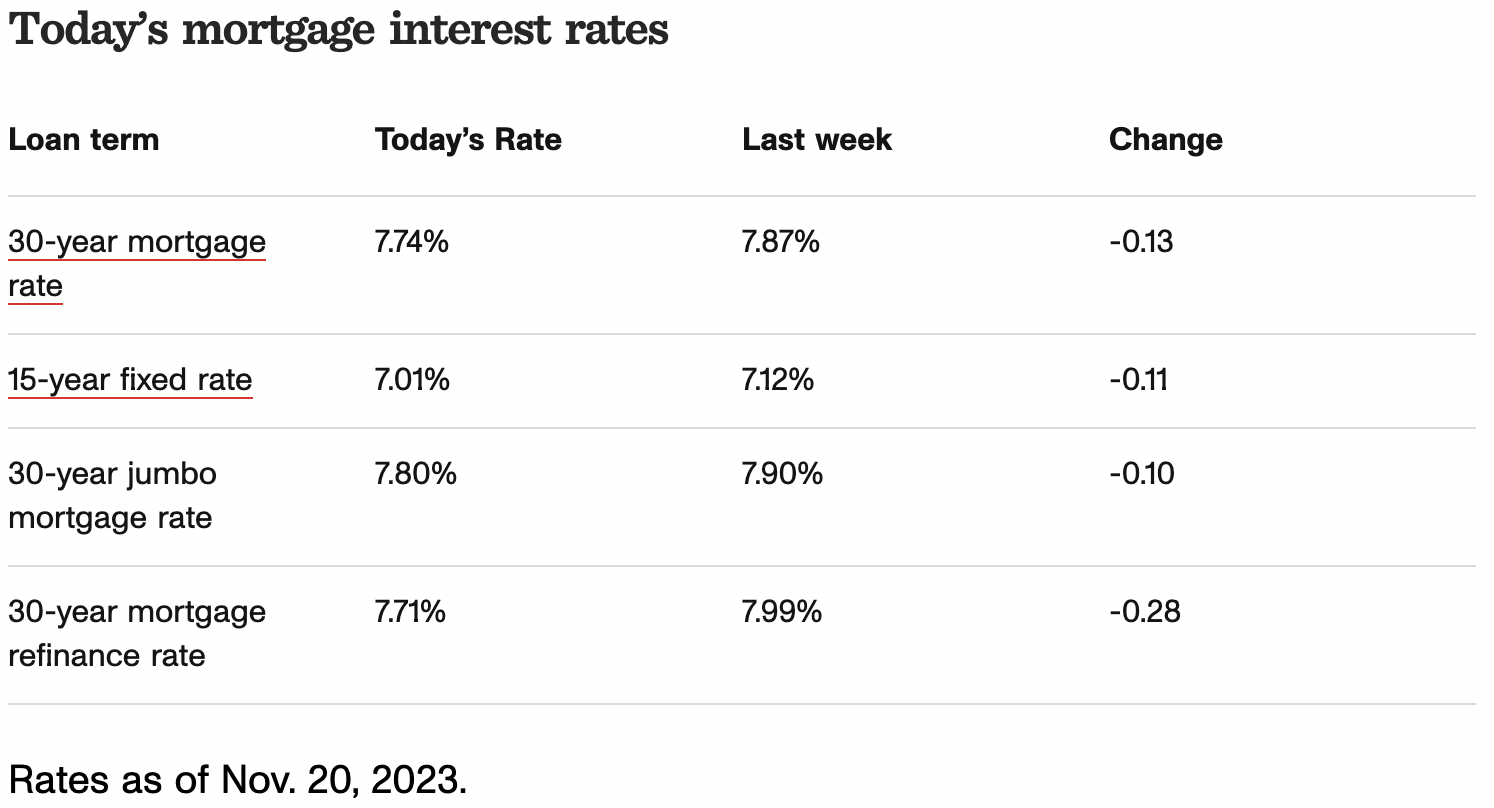

Today’s average mortgage interest rates

If you’re in the market for a home, check out how today’s mortgage rates compare to last week’s. We use data collected by Bankrate to track changes in these daily rates. This table summarizes the average rates offered by lenders nationwide:

What is influencing mortgage rates right now

Though the Federal Reserve does not directly set mortgage rates, they’re affected by the government’s monetary decisions. Since early 2022, with the onset of aggressive increases to the federal funds rate to combat inflationary pressures, mortgage rates reached record-high levels.

The Fed has kept interest rates steady since late July, but mortgage rates continued climbing due to market expectations of further rate hikes. Most major mortgage rates finally saw significant dips after November’s interest-rate pause, a shift in the 10-year Treasury yield and weaker jobs data, which was then followed by a better-than-expected inflation report.

Experts anticipate we might be nearing the end of the central bank’s rate-hike cycle, which could signal the start of a slow recovery in home loan rates. “If markets believe that the Federal Reserve will adopt a permanent pause, it is reasonable to expect a decline in mortgage rates, following the trend of the 10-year yield for US Treasuries,” said Carlos Garriga, senior vice president and research director at the St. Louis Federal Reserve.

While any mortgage forecast is an estimate at best, it’s not unreasonable to predict downward pressure on rates as the economy continues to cool, according to Rob Cook, chief marketing officer at Discover Home Loans. “As we get more economic data heading into next year, there will be a focus on whether the recent economic trends hold or change,” Cook said.

But homeseekers should keep in mind that even when the Fed stops hiking interest rates, it generally takes 12 months before there are substantial drops, according to Niladri Mukherjee, chief investment officer at TIAA Wealth Management. For mortgage rates to be more affordable, the Fed would have to start cutting rates, which won’t happen until 2024 at the earliest.

Calculate your monthly mortgage payment

Getting a mortgage should always depend on your financial situation and long-term goals. The most important thing is to make a budget and try to stay within your means. CNET’s mortgage calculator below can help homebuyers prepare for monthly mortgage payments.

What is a good loan term?

When picking a mortgage, remember to consider the loan term, or payment schedule. The most common mortgage terms are 15 years and 30 years, although 10-, 20- and 40-year mortgages also exist. Mortgages can either be fixed-rate and adjustable-rate mortgages. The interest rates in a fixed-rate mortgage are set for the duration of the loan. The interest rates for an adjustable-rate mortgage are only fixed for a certain amount of time (commonly five, seven or 10 years), after which the rate adjusts annually based on the current interest rate in the market.

When choosing between a fixed-rate and adjustable-rate mortgage, consider the length of time you plan to live in your home. If you plan on living long-term in a new house, a fixed-rate mortgage may be the better option. Fixed-rate mortgages offer more stability over time compared to adjustable-rate mortgages, but adjustable-rate mortgages may offer lower interest rates upfront. As a result, a growing share of homebuyers are leaning toward ARMs.

30-year fixed-rate mortgages

The 30-year fixed-mortgage rate average is 7.74%, which is a decline of 13 basis points from seven days ago. (A basis point is equivalent to 0.01%.) A 30-year fixed mortgage, the most common loan term, is a good option if you’re looking to minimize your monthly payment. A 30-year fixed rate mortgage will usually have a lower monthly payment than a 15-year one, but often a higher interest rate.

15-year fixed-rate mortgages

The average rate for a 15-year, fixed mortgage is 7.01%, which is a decrease of 11 basis points from seven days ago. Though you’ll have a bigger monthly payment compared to a 30-year fixed mortgage, a 15-year loan will usually be the better deal if you can afford the monthly payments. You’ll usually be able to get a lower interest rate, pay less interest in the long run and pay off your mortgage sooner.

5/1 adjustable-rate mortgages

A 5/1 adjustable-rate mortgage has an average rate of 6.92%, a decrease of 5 basis points from the same time last week. You’ll typically get a lower interest rate (compared to a 30-year fixed mortgage) with a 5/1 ARM in the first five years of the mortgage. But you could end up paying more after that time, depending on how the rate adjusts with the market rate. For borrowers who plan to sell or refinance their house before the rate changes, an ARM could be a good option. If not, changes in the market may significantly increase your interest rate.

How to shop for the best mortgage rate

You can get a personalized mortgage rate by contacting your local mortgage broker or using an online calculator. To find the best home mortgage, take into account your goals and current finances. Be sure to look at the annual percentage rate, or APR, which reflects the mortgage interest rate plus other borrowing charges. By comparing the total cost of borrowing from multiple lenders, you can make a more accurate apples-to-apples comparison.

Your specific mortgage rate will vary based on factors including your down payment, credit score, debt-to-income ratio and loan-to-value ratio. Having a higher down payment, a good credit score, a low DTI and LTV or any combination of those factors can help you get a lower interest rate.

The interest rate isn’t the only factor that affects the cost of your home. Be sure to also consider fees, closing costs, taxes and discount points. You should shop around and talk to several different lenders from local and national banks, credit unions and online lenders to find the best mortgage for you.

Though mortgage rates and home prices are high, the housing market won’t be unaffordable forever. It’s always a good time to save for a down payment and improve your credit score to help you secure a competitive mortgage rate when the time is right for you.

Recent Posts

Stay in the Know!

Sign up to receive our monthly newsletter