Weekly Manhattan & Brooklyn Market: 9/11

Week of 9/11

Demand Dips: Labor Day Lull or Interest Rate Impact? Fall Season to Decide.

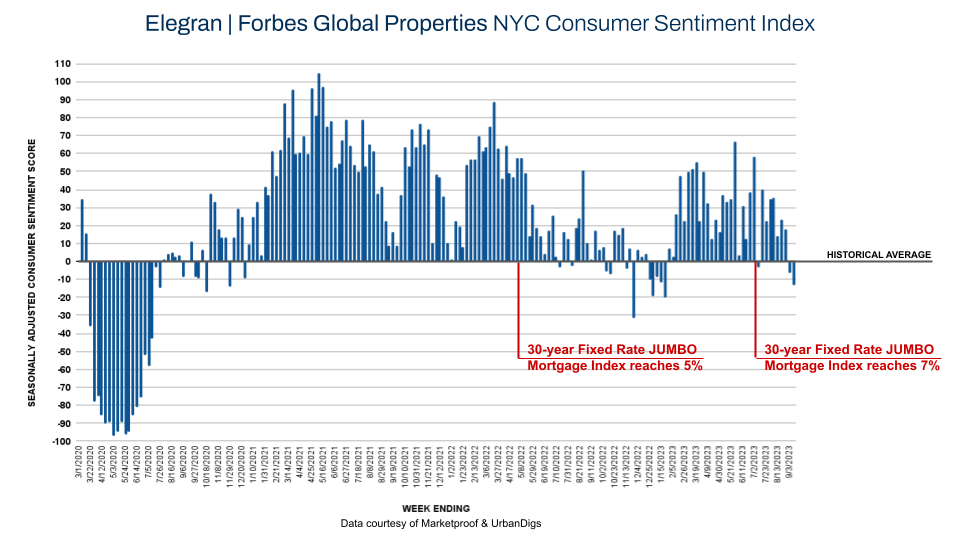

We're 36 weeks into 2023, and here's what stands out: The Elegran | Forbes Global Properties NYC Consumer Sentiment Index has gone negative for only the sixth time this year, posting a score of –13 this week. This indicates a 13% drop in NYC residential real estate demand from pre-pandemic levels. However, let's frame this in context: Labor Day week traditionally sees slower sales due to holiday travel and shorter workweeks. So, this dip isn't surprising—it was anticipated.

The larger trend to watch is the interplay between rising interest rates and buyer sentiment. Historically, as rates go up, demand softens and a look back to May 2022 brings clarity. After the 30-year Fixed Rate JUMBO Mortgage Index passed through 5.0% in 2022, our Consumer Sentiment Score began trending downward decisively, even passing into negative territory before an impressive recovery in 2023. Now, with rates inching toward 7%, the question is: are we seeing history repeat or just a seasonal blip?

But while higher rates might deter some, many have been waiting on the sidelines, hoping for stable or lowered rates. If they perceive current rates as the new norm, potential buyers might jump into action.

Let’s dive into this week's metrics, setting the stage for a revealing fall season.

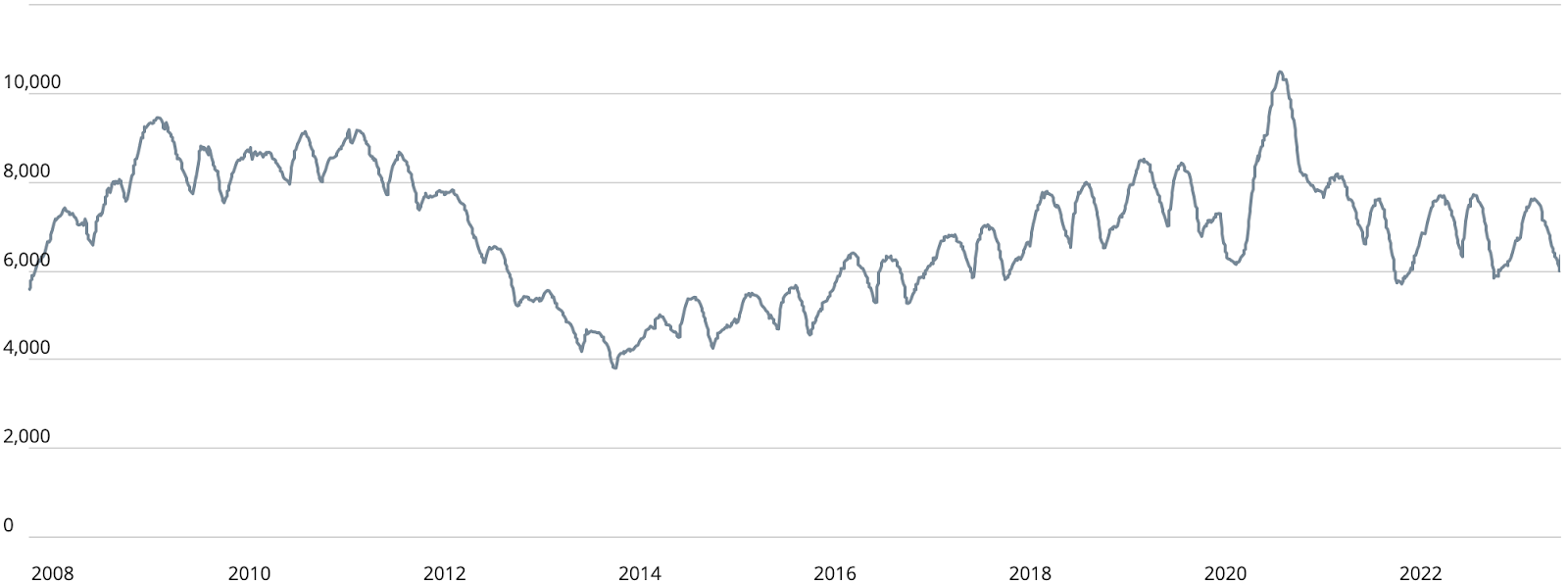

Manhattan Supply

Following last week's prediction, Manhattan's property supply has seen an anticipated rebound, climbing from 6,066 units to 6,371 this week. This isn't the work of a crystal ball, but rather an observation of consistent seasonal patterns seen over the past 15 years.

Nationally, a limited supply often leads to significant price inflations due to heightened demand. However, NYC's real estate landscape operates differently. Here, even at the low point with 6,066 units juxtaposed against a demand for only 143 units, there's a significant supply cushion. This ensures buyers in Manhattan continue to enjoy a myriad of options, rather than facing the constraints seen in many other markets.

Brooklyn Supply

Brooklyn's supply pattern, much like Manhattan's, exhibits cyclic behaviors. As forecasted, the supply saw an upswing from its recent bottom of 2,995 units, reaching 3,084 units this week.

While this borough may not have as extensive a historical data set as Manhattan, the trend remains clear. Even at the valley of nearly 3,000 available residences, the demand was logged at 90 residences. This means, for potential buyers in Brooklyn, there's a significant pool of choices available, keeping the market well-balanced and ensuring that there's more than ample supply to meet the current demand.

Manhattan Pending Sales

Following historical data, Manhattan typically sees one of two annual peaks around June. As expected, this metric experienced a dip this week, moving from 2,861 to 2,782 units. We anticipate this number to reach its trough either by the month's end or early next.

With the fall listing season on the horizon, it's intriguing to speculate how these figures will evolve, especially in light of current market dynamics.

Brooklyn Pending Sales

Brooklyn's real estate landscape is also characterized by ebbs and flows. Recently, Brooklyn witnessed one of its two annual peaks in pending sales. This week saw a slight decrease, with numbers moving from 1,984 down to 1,971 units.

Given the trends, we anticipate a continued decline leading into October. With the backdrop of shifting interest rates and the imminent fall listing season, it's crucial to keep a close eye on how these metrics unfold in Brooklyn's dynamic market.

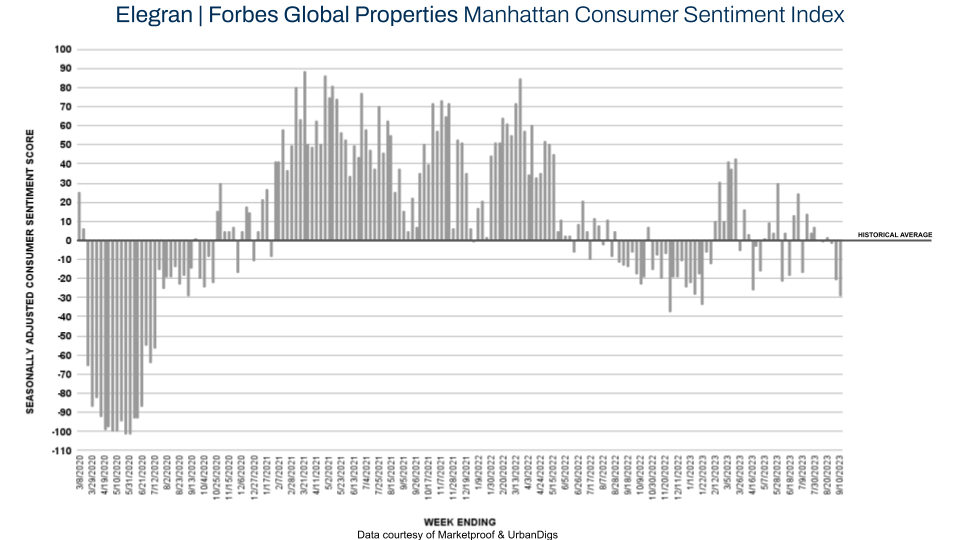

Manhattan Consumer Sentiment

The pulse of Manhattan's real estate market can often be gauged by consumer sentiment, and this week brought noteworthy shifts. The Elegran | Forbes Global Properties Manhattan Consumer Sentiment Index reported a drop, moving from a -21 score to a more pronounced -29.

In raw numbers, this translates to 123 contracts being signed this week, a decrease from the 143 signed the previous week. While several factors might be at play, the interplay between the rising interest rates and the consumer's confidence will be pivotal in the coming weeks. We'll continue to monitor these indicators closely, offering clarity in an ever-evolving market landscape.

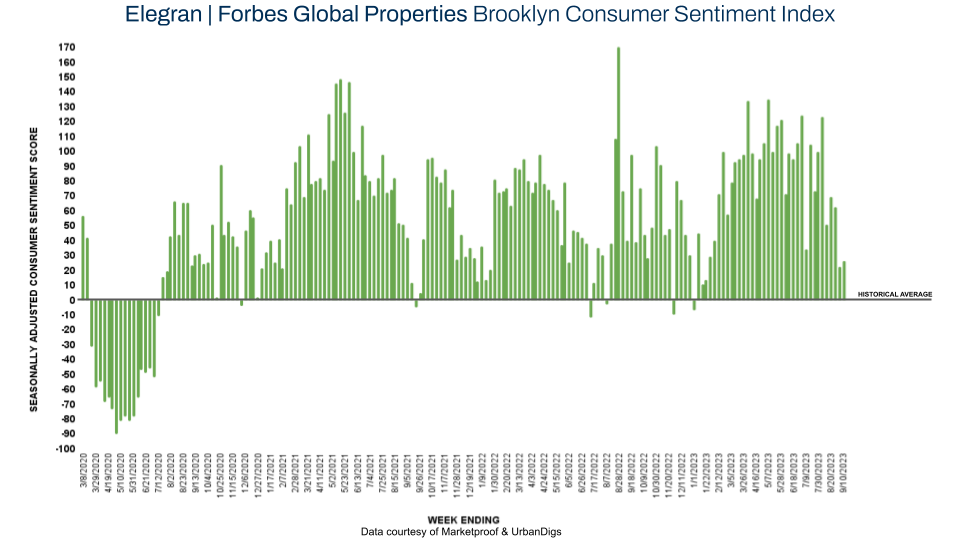

Brooklyn Consumer Sentiment

This week, the Elegran | Forbes Global Properties Brooklyn Consumer Sentiment Index climbed to +26 this week, a modest rise from +22 the previous week. This uptick signifies that Brooklyn's consumer sentiment is currently 26% above its seasonally adjusted pre-pandemic average. It's impressive to highlight that this sentiment has been consistently robust, surpassing the historical average since July 2020.

As for actual market activity, 94 contracts were inked this week, a slight increase from the 90 signed last week. With rising interest rates and an upcoming fall listing season, the consistent strength in Brooklyn's consumer sentiment will be an aspect to keep a close eye on in the forthcoming weeks.

New Development Insights

As reported by Marketproof, this week, 41 new development contracts were reported across 32 buildings. The following buildings were the top-selling new developments of the week:

- ONE HIGH LINE (West Chelsea)

- BROOKLYN POINT (Downtown Brooklyn)

- 50-07 5th Street (Hunter’s Point)

Each reported 3 contracts.

Categories

Recent Posts

Stay in the Know!

Sign up to receive our monthly newsletter

GET MORE INFORMATION