Weekly Manhattan & Brooklyn Market: 9/5

Week of 9/5/23

Temporary Demand Setback Due to Travel and Academics

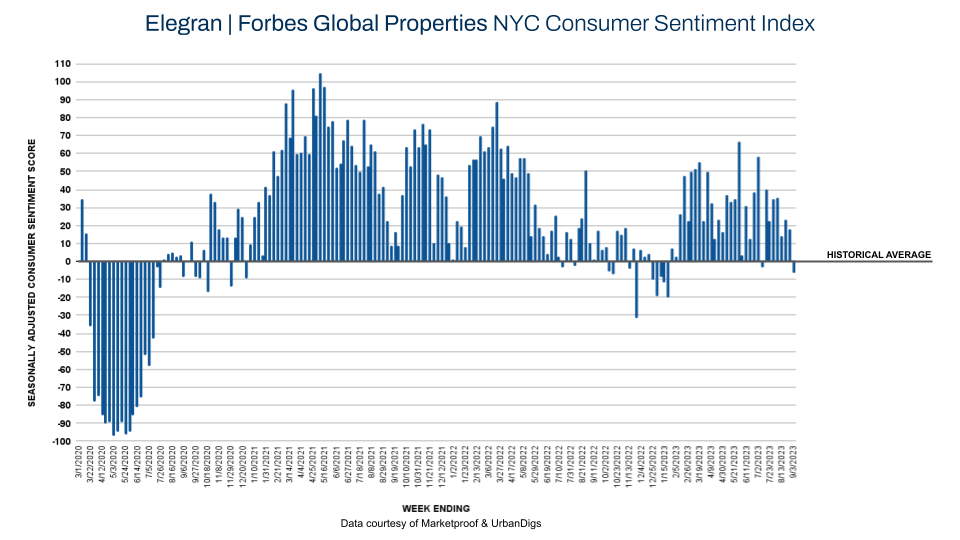

In this week's real estate update, we're witnessing a rare occurrence – our Elegran | Forbes Global Properties NYC Consumer Sentiment Index took a dip, landing at -7. This translates to a 7% dip in demand for NYC residential properties compared to pre-pandemic levels. This marks only the fifth time this year that demand has slipped into negative territory. The culprits? The summer travel wrap-up and the academic year kickoff.

However, it's important to note that this dip in demand is likely to be temporary. We're gearing up for the fall season, known for its listing and demand surge.

As we observe the borough-level sentiment, Manhattan's sentiment slid from -2 to -21. Meanwhile, Brooklyn's consistently positive stance since July 2020 cooled from +63 to +22. While Manhattan's demand dance has moved up and down this year, Brooklyn's real estate enthusiasm is keeping its groove intact.

Manhattan Supply

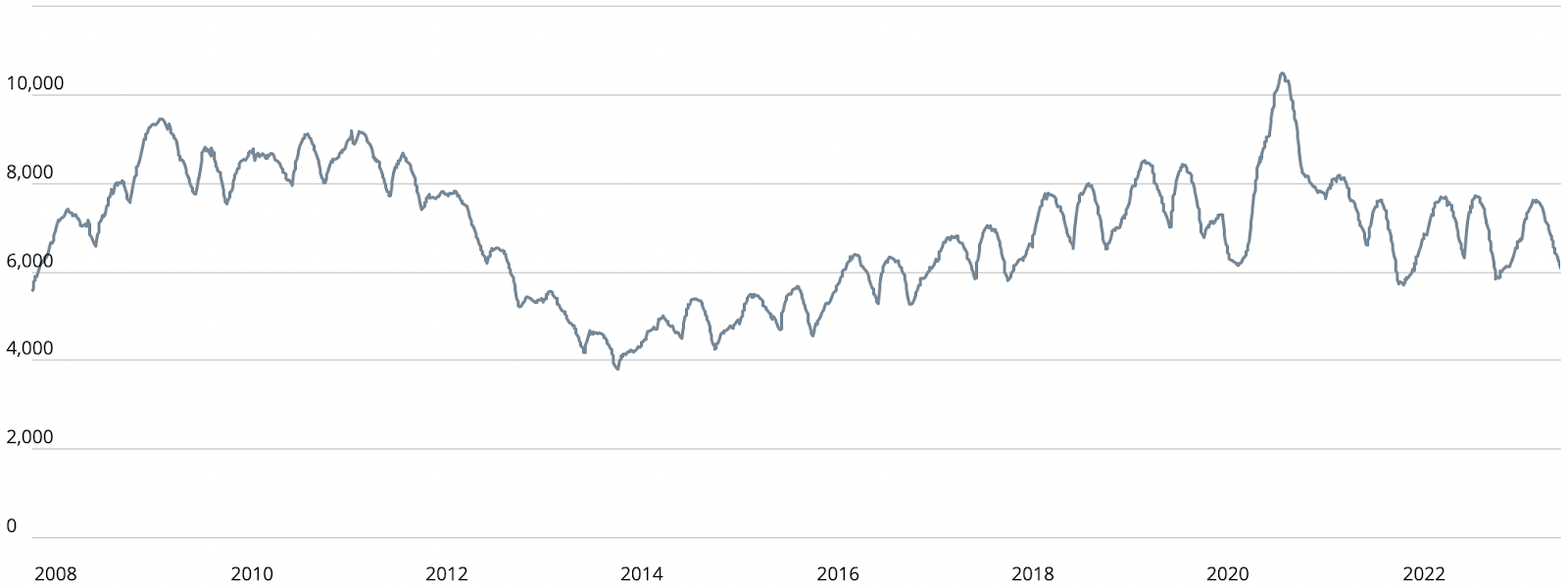

Shifting our focus to Manhattan's real estate supply, the numbers tell an interesting tale. Supply went down from 6,208 units to 6,066 units this week. Brace yourself, because we're on the cusp of hitting the supply floor in the coming weeks before the rise begins in full swing during the fall.

With around 400 contracts making their weekly debut against a supply backdrop of 6,066 units, the pricing needle won’t move under demand pressures.

So, while the supply's tune might be changing soon, it won't be the one calling all the shots in the market.

Brooklyn Supply

Let's dive into Brooklyn's real estate supply – it's got its own rhythm and rhyme. Supply made a graceful descent from 3,041 units to 2,995 units this week. And just like its Manhattan counterpart, we're eyeing a potential supply floor soon, likely within the next week or so.

But the supply-demand ratio alone isn't going to give prices a wild ride. With more units up for grabs than needed to meet a weekly demand of about 200 units, prices should stay fairly steady.

So, as we groove along, keep an eye on the supply pulse. It's got its own dance, and it's about to make a move.

Manhattan Pending Sales

Switching gears to Manhattan's pending sales, it's like looking at a familiar chart. We were right on track with the first peak out of two, which hit its stride in June. So as anticipated, the numbers this week slid from 2,938 units to 2,861 units. Hang tight, because we're expecting this trough to linger for about 30 to 45 days.

If you're watching the pendulum swing, know that we're right on schedule for this familiar dance. The rhythm will pick up again before you know it.

Brooklyn Pending Sales

Now, let's talk about Brooklyn's pending sales – it's like catching a well-rehearsed performance. Just like Manhattan, Brooklyn has hit its first peak out of two annual crescendos. The numbers dipped from 2,026 units to 1,984 units this week and this decline is set to continue well into October.

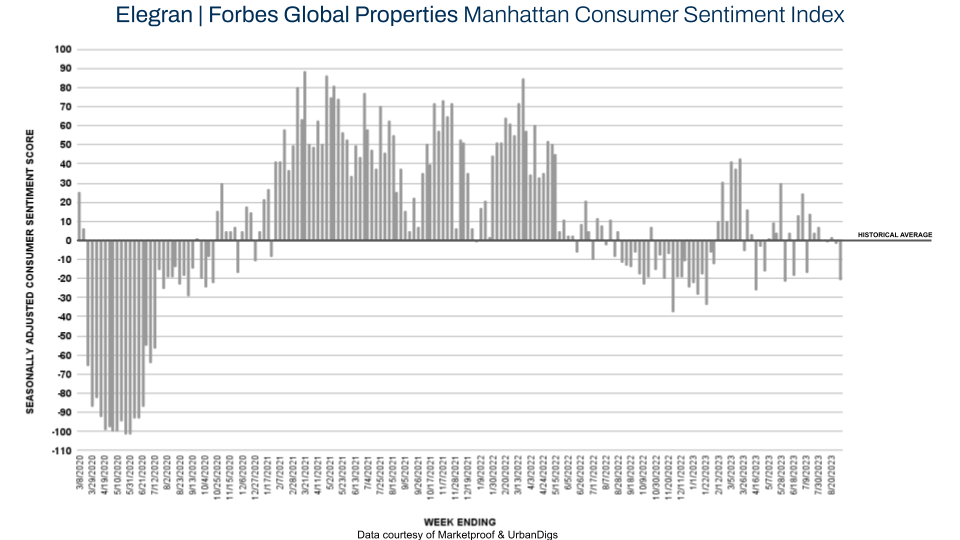

Manhattan Consumer Sentiment

Over to Manhattan's consumer sentiment, the landscape has experienced notable fluctuations this year. In the current week, the Elegran | Forbes Global Properties Manhattan Consumer Sentiment Index dipped from -2 to -21, and 143 contracts were signed, a decrease from the 179 contracts signed the preceding week.

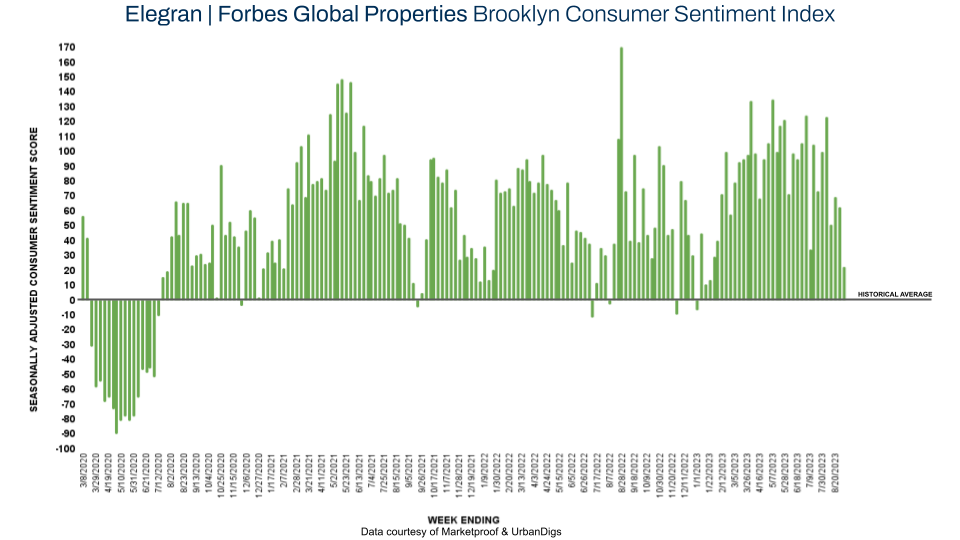

Brooklyn Consumer Sentiment

Let's turn our attention to Brooklyn's consumer sentiment. This week, there's been a noticeable shift. The Elegran | Forbes Global Properties Brooklyn Consumer Sentiment Index dropped from +63 last week to +22. This means that consumer sentiment is currently 22% higher than its pre-pandemic average. This positive trend has been consistent since July 2020. This week, 90 contracts were signed, down from 119 the previous week.

New Development Insights

As reported by Marketproof, this week, 50 new development contracts were reported across 39 buildings. The following buildings were the top-selling new developments of the week:

- 35 HUDSON YARDS (Hudson Yards)

- THE GREENE (Long Island City)

Each reported 4 contracts.

If you would like to chat about the most recent market activity, feel free to contact us at info@elegran.com or connect with one of our Advisors.

About Us

Welcome to Elegran, where our mission is to revolutionize the world of real estate. Founded in 2008 by Michael Rossi, our journey began with an unwavering drive for motivation, innovation, and a genuine care for our clients.

As an independently owned brokerage, we pride ourselves on our elite team of "advisors," offering a personalized touch that goes above and beyond the traditional real estate experience. Armed with robust data insights, we empower our clients to make informed decisions that lead to success.

Distinguished as the exclusive member of the invitation-only Forbes Global Properties network in NYC, Elegran proudly stands at the forefront of excellence. This exclusive partnership broadens our horizons, enabling us to connect buyers, sellers, and investors with extraordinary luxury properties not only in New York City but across the globe.

Our passion lies in turning your real estate dreams into reality, and we are committed to providing exceptional service at every step of the journey.

Are you ready to experience the Elegran difference? Dive into the possibilities at www.elegran.com and embark on an unforgettable real estate adventure with us.

Categories

Recent Posts

Stay in the Know!

Sign up to receive our monthly newsletter

GET MORE INFORMATION