Elegran Brooklyn Market Update: September 2023

Brooklyn Market Update: Supply Shortage Keeps Brooklyn a Seller’s Market to Some Extent

In this comprehensive Brooklyn market update for September 2023, we examine the key metrics, including supply, demand, median prices, and listing discounts. As the transition from summer to fall unfolds, we share insights into whether conditions favor buyers or sellers, ultimately determining which party holds the transactional leverage.

We will also explore the dynamic realm of Brooklyn rentals and offer invaluable insights for investors. With rental prices reaching new heights, prospective buyers grapple with the decision of whether to rent or buy in a market that presents its own set of challenges. Meanwhile, investors encounter unique opportunities and considerations.

Now, let’s deep dive into the numbers and trends that define the Brooklyn real estate market this month.

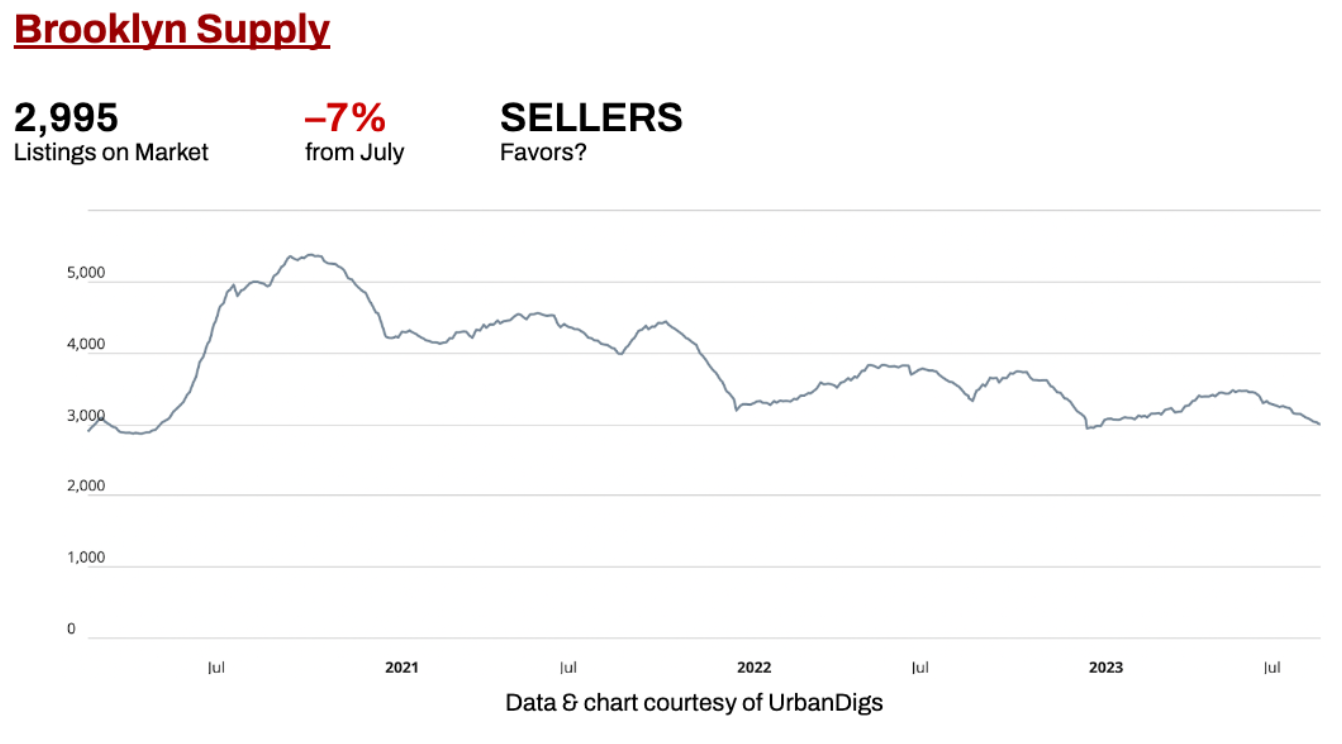

Brooklyn Supply

In September 2023, Brooklyn's housing market witnessed a significant supply shift. There are currently 2,995 listings on the market, marking a 7% decrease from the previous month. This decline has implications for both buyers and sellers. Buyers face a reduction in options, potentially intensifying competition. Conversely, sellers benefit from this decreased supply, potentially driving up demand and fostering competitive offers. Brooklyn's supply levels tend to follow a seasonal pattern, historically hitting their lowest point in early September, aligning with the current trend. Heading into the fall, expect supply to increase temporarily during the Fall market.

- BUYERS? Fewer options.

- SELLERS? Less competition.

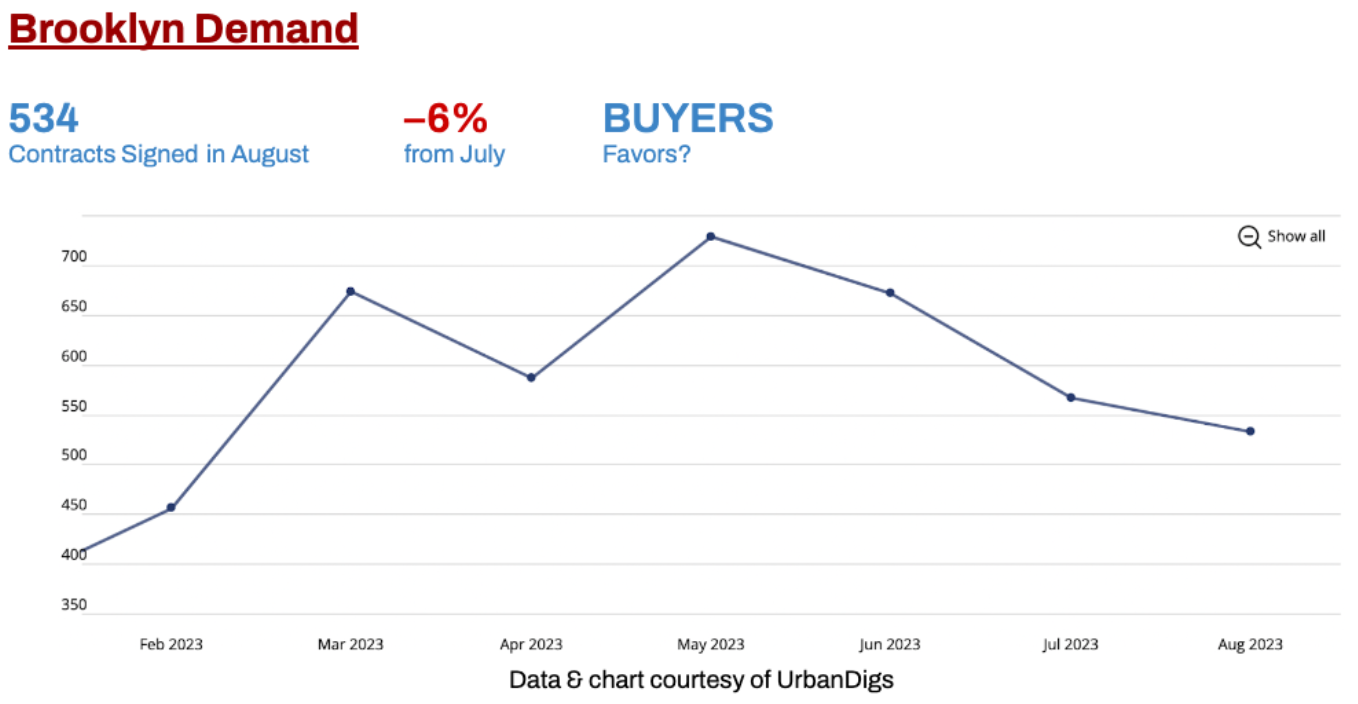

Brooklyn Demand

This month, Brooklyn real estate market is witnessing shifts in demand, significantly affecting both buyers and sellers. Last month, 534 contracts were signed, reflecting a 6% decrease from the prior month. For prospective buyers, this decline means reduced competition and potentially more time for property evaluation. On the flip side, sellers face a less active market, necessitating strategic adjustments in pricing and marketing strategies to attract buyers. Recognizing historical demand patterns helps contextualize the current market conditions, ultimately aiding in navigating Brooklyn's evolving real estate landscape.

- BUYERS? Less competition.

- SELLERS? Less activity.

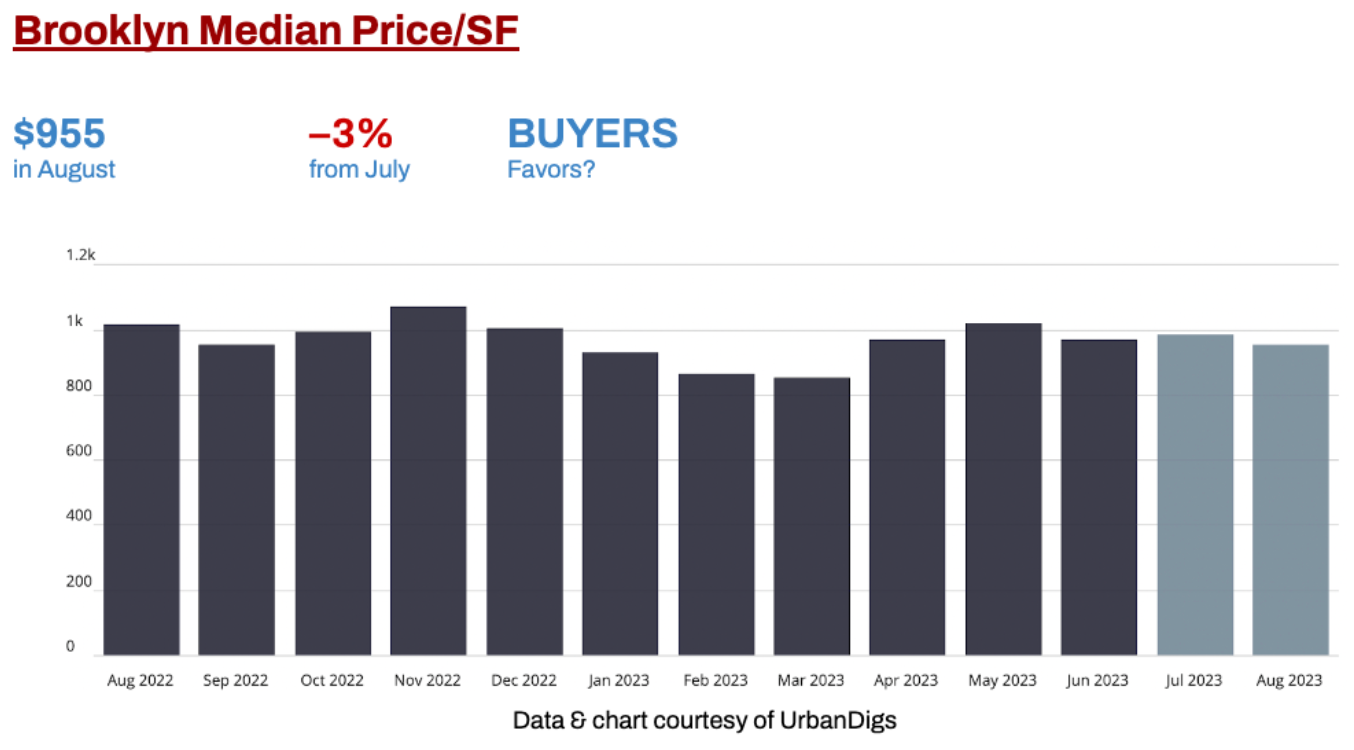

Brooklyn Median Price/SF

In September 2023, the median price per square foot is a pivotal metric defining the Brooklyn real estate market. With a median price per square foot of $955 in August, marking a 3% decrease from the previous month, this metric holds significant implications for both buyers and sellers. For buyers, a declining median price per square foot suggests potentially more affordable properties, aligning with their interests in securing value. Sellers, however, may face the challenge of adapting pricing strategies to remain competitive in a market where property values per square foot are on the decline.

- BUYERS? Price/SF is moving in their favor.

- SELLERS? Price/SF is moving against their interest.

Brooklyn Median Listing Discount

In August, the median listing discount was 2.2%, marking a 15% decrease from the previous month. This shift holds significant implications for buyers and sellers alike. Decreasing listing discounts signal reduced opportunities for cost savings for buyers, prompting them to refine negotiation strategies. Conversely, sellers stand to benefit, as a diminished listing discount suggests greater pricing leverage and potentially fewer price concessions. This consistent trend of decreasing discounts over the past five months underscores the need for both parties to adapt to the evolving market conditions.

- BUYERS? Discounts are moving against their interests.

- SELLERS? Discounts are moving in their favor.

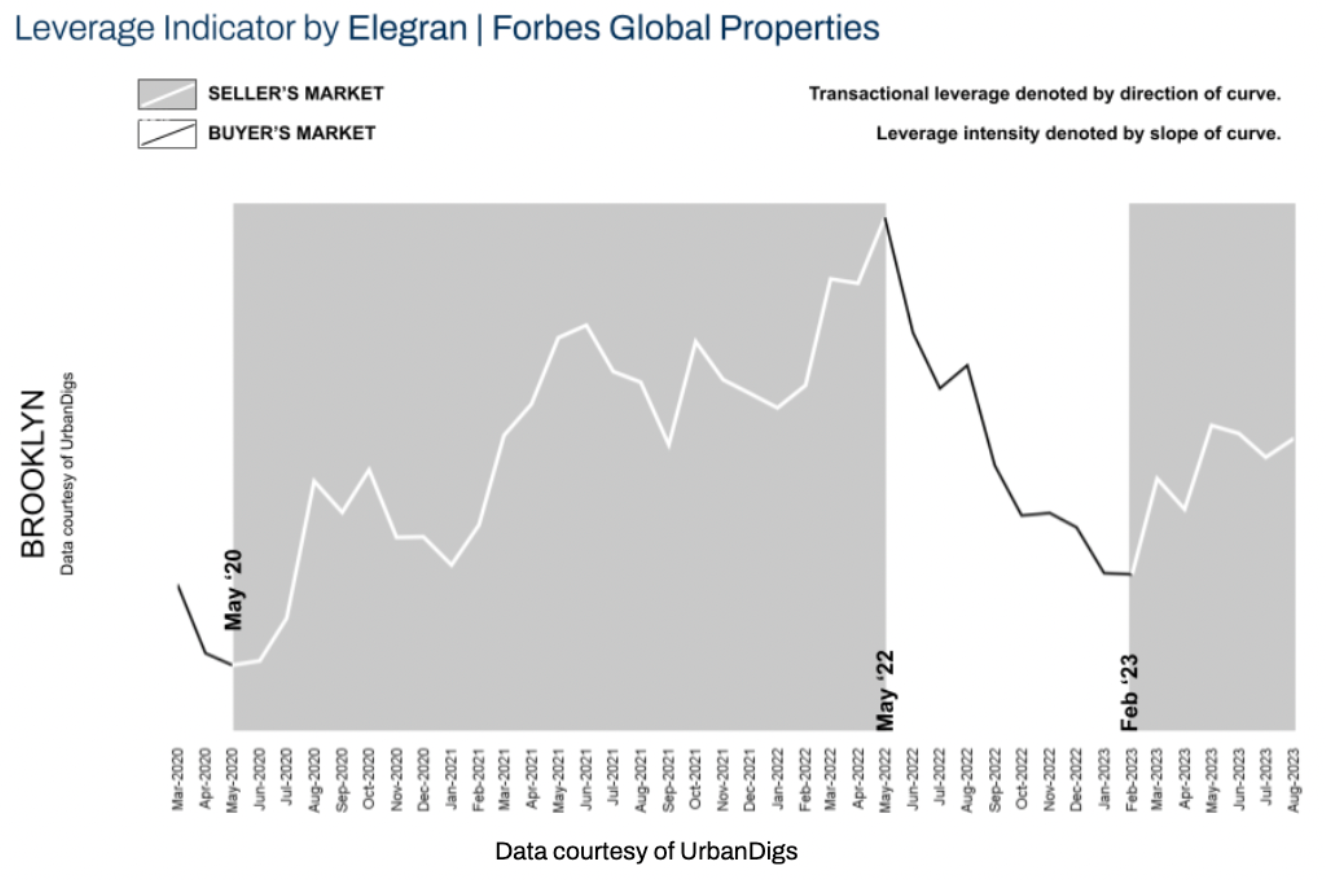

Elegran | Forbes Global Properties Leverage Indicator: Brooklyn

The Elegran | Forbes Global Properties Leverage Indicator serves as a compass, guiding us through the shifting sands of the market and revealing which party holds the upper hand: buyers or sellers. The direction of the curve on this graph indicates whether the market is tilted in favor of buyers or sellers. Furthermore, the slope of the curve informs us about the strength of that leverage.

As our data shows, the indicator's insights have been pivotal, highlighting a decisive shift from a buyer's to a seller's market in Brooklyn since February. As we look ahead to the approaching fall listing season, sellers can find reassurance in the consistency of this trend, understanding that they are commencing their journey into the market from a position of considerable strength.

Rental Remarks

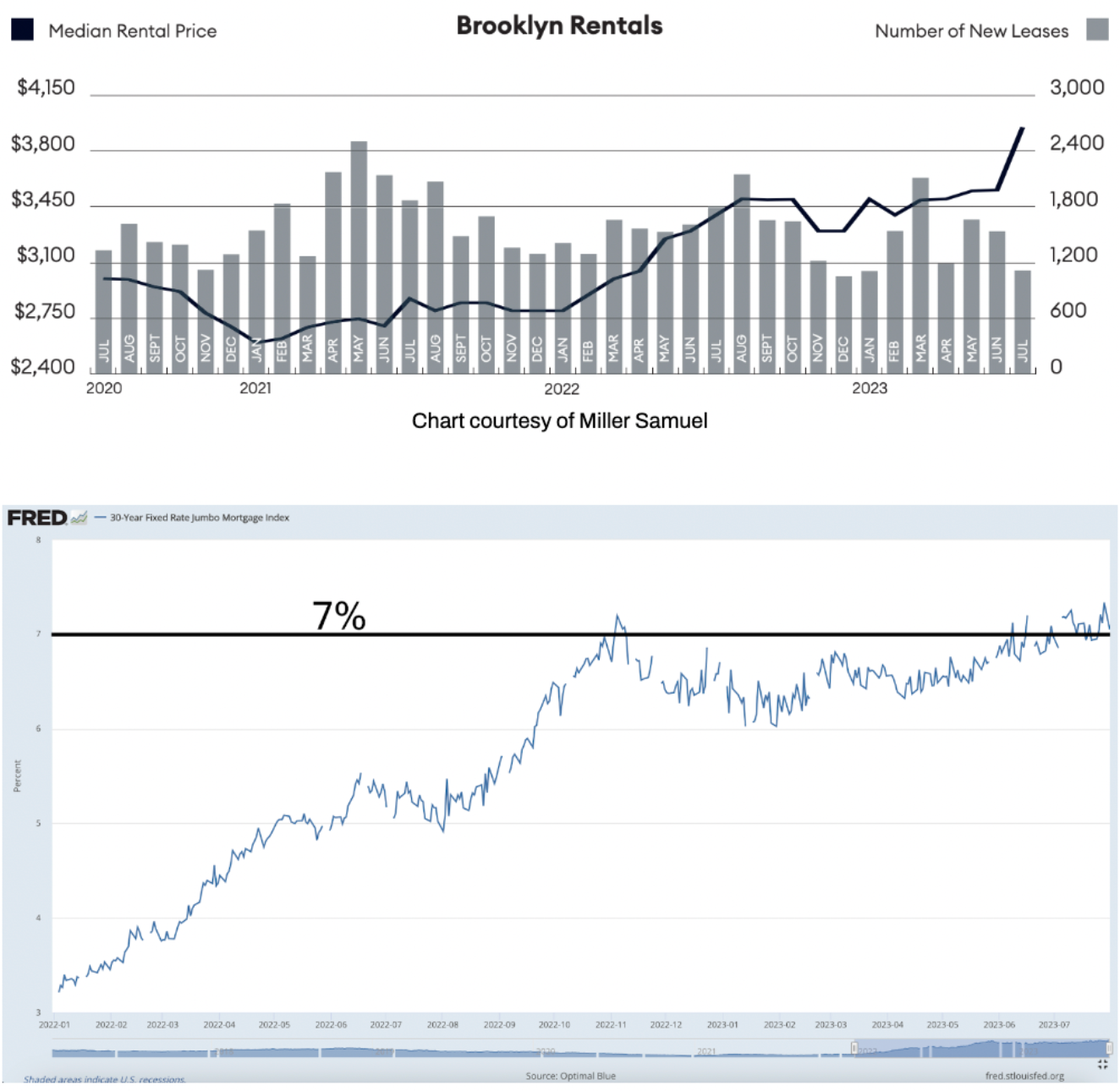

The rental market in Brooklyn is in a state of flux, offering a dynamic landscape for both tenants and landlords. As of now, the median rent in Brooklyn has surged significantly, setting a new all-time high, particularly in July 2023, with data for August not yet available. This upswing in rental prices has left potential tenants contemplating the age-old rent-versus-buy dilemma, as both options seem to carry their own unique challenges in a market where affordability is a pressing concern.

Meanwhile, the average 30-year JUMBO mortgage rate hovers around 7.5%, adding an additional layer of complexity to the decision-making process for those considering homeownership.

*August 2023 data is not yet available.

Investor Insights

All-Cash Opportunities

For investors, the Brooklyn market presents a mixed bag of opportunities and challenges. With cap rates ranging between 2.5% and 3.5%, and mortgage rates at their current levels, leveraged investments may not seem as lucrative. However, with rents soaring to all-time highs, all-cash buyers may discover pockets of opportunity.

Global Currency Opportunities

Internationally, the strength of the US dollar is a crucial consideration. Depending on their home currency, foreign investors may realize substantial gains when selling their assets due to the robust USD. Conversely, a weakening dollar creates opportunities for foreign investors to enter the Brooklyn real estate market and benefit from its stability and potential for price appreciation.

If you would like to chat about the most recent market activity, feel free to contact us at info@elegran.com or connect with one of our Advisors.

About Us

Welcome to Elegran, where our mission is to revolutionize the world of real estate. Founded in 2008 by Michael Rossi, our journey began with an unwavering drive for motivation, innovation, and a genuine care for our clients.

As an independently owned brokerage, we pride ourselves on our elite team of "advisors," offering a personalized touch that goes above and beyond the traditional real estate experience. Armed with robust data insights, we empower our clients to make informed decisions that lead to success.

Distinguished as the exclusive member of the invitation-only Forbes Global Properties network in NYC, Elegran proudly stands at the forefront of excellence. This exclusive partnership broadens our horizons, enabling us to connect buyers, sellers, and investors with extraordinary luxury properties not only in New York City but across the globe.

Our passion lies in turning your real estate dreams into reality, and we are committed to providing exceptional service at every step of the journey.

Are you ready to experience the Elegran difference? Dive into the possibilities at www.elegran.com and embark on an unforgettable real estate adventure with us.

Categories

Recent Posts