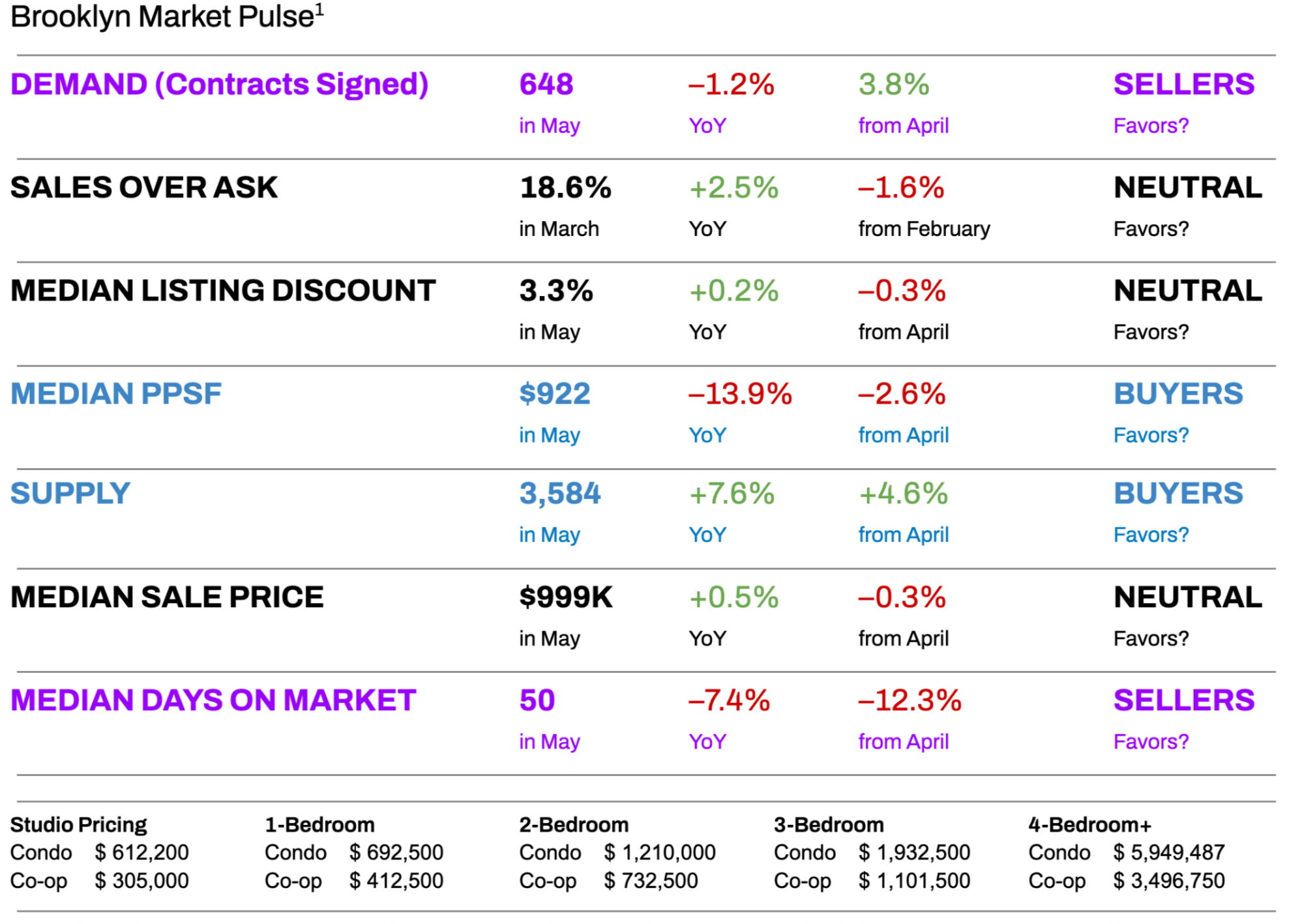

Elegran Brooklyn Market Update: June 2025

Overall Brooklyn Market Update: JUNE 2025

Strategic Momentum: More Listings, Smarter Pricing, and Balanced Opportunity

As summer kicks off, Brooklyn’s real estate market is gaining traction—not with the frenzy of past years, but with steady, strategic momentum. The numbers from May paint a picture of a borough in balance: sellers still hold a slight edge, but buyers are re-entering the market with more options, better pricing, and clearer expectations.

Contract Activity Rises—Buyers Are Still Moving

Brooklyn recorded 648 signed contracts in May, up 3.8% from April. While this figure is just shy of last year’s total (down 1.2%), it signals resilience in the face of elevated mortgage rates and ongoing economic uncertainty. Today’s buyers aren’t speculating—they’re purchasing based on personal milestones and long-term value, a sign of a more mature and sustainable market cycle.

Inventory Expands—but Not Excessively

The number of active listings rose to 3,584—a 4.6% increase from April and a 7.6% jump year-over-year. That means more choices for buyers without creating the kind of supply-demand imbalance that weakens seller leverage. Well-priced homes continue to move quickly, but sellers must be sharp: more listings mean buyers are taking time to compare.

Prices Recalibrate—Opening the Door for Value-Driven Buyers

Brooklyn’s median price per square foot dipped 2.6% from April and is down 13.9% compared to last year, landing at $922. This isn’t a crash—it’s a market adjustment. Prices are aligning with buyer expectations and financing realities, creating real opportunity in neighborhoods with solid fundamentals.

Smarter Pricing = Faster Sales

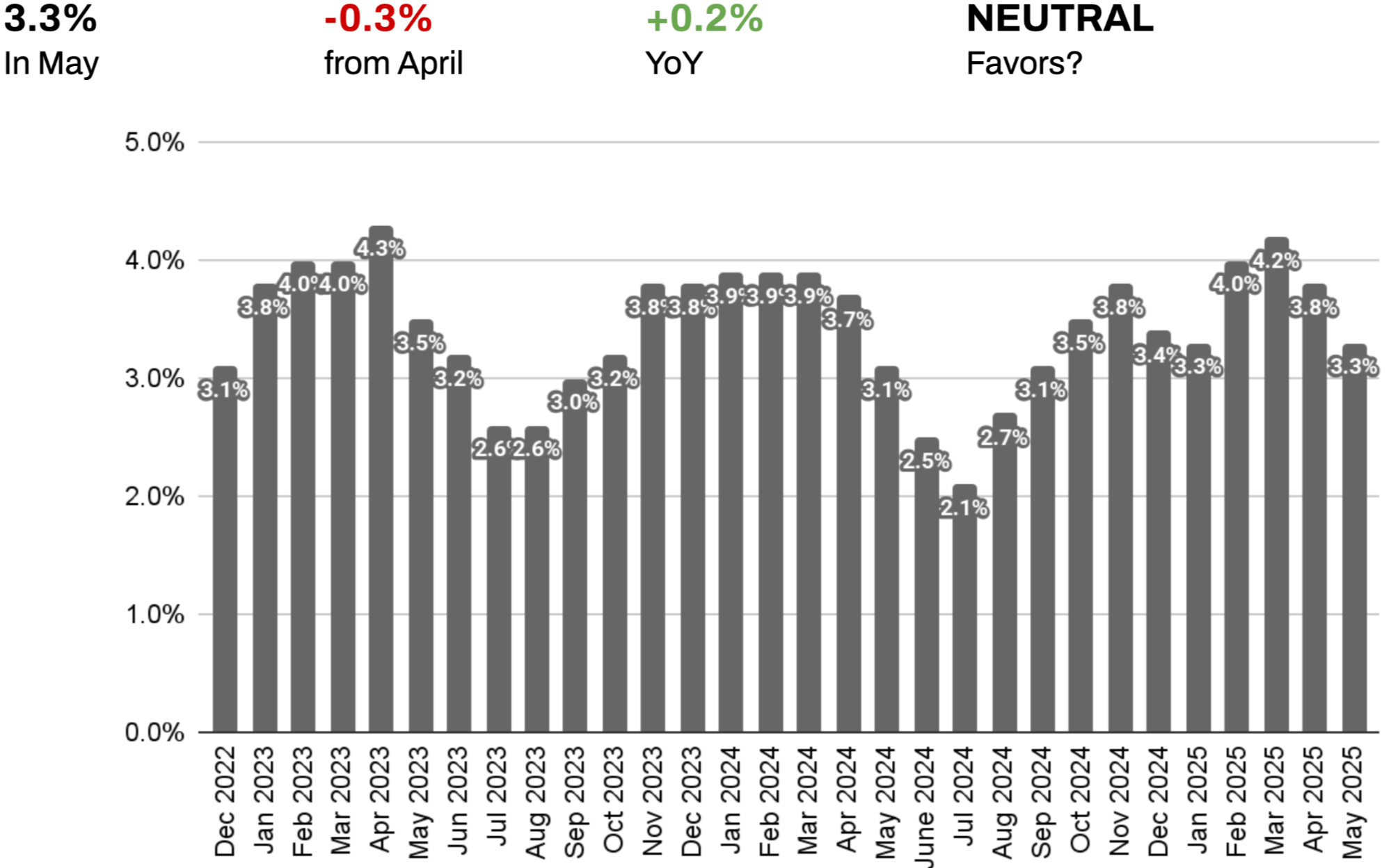

The median listing discount narrowed to 3.3%, suggesting that sellers are getting more accurate with their initial pricing and that buyers are responding to fair value. Homes priced within 5% of recent comps sell quickly with minimal negotiation. Meanwhile, overpriced properties are seeing extended days on market and eventual price cuts.

The Rental Market: Slight Softening, Still Competitive

Brooklyn renters saw a small break in April as median rents dipped 2.7% to $3,600. Year-over-year, rents remain flat, but average rent per square foot actually increased by 3.4%, driven by demand in premium buildings. As more rental inventory hits the market, tenants may find modest negotiating power in less competitive buildings, but landlords still largely hold the advantage, especially for well-located, amenity-rich properties.

The Mortgage Landscape: This Is the New Normal

Mortgage rates continue to hover around 6.7–7.0% for a 30-year fixed jumbo loan, and that range is expected to stick through 2026. The good news? Buyers and sellers are adjusting. Rather than waiting for lower rates, they’re pursuing creative financing solutions—rate buydowns, ARMs, and closing cost negotiations—to make deals work in today’s environment.

What This Means for You

The Brooklyn market is in a rare window of balance. Inventory is up, pricing is realistic, and demand remains healthy. For buyers, this is an opportunity to re-engage with greater negotiating power and more choice. For sellers, it’s a moment to lead with strategy—pricing smartly, staging well, and capitalizing on buyer motivation without overreaching.

This summer isn’t shaping up to be a sprint—it’s a season of smart plays. Those who are prepared, decisive, and realistic will come out ahead.

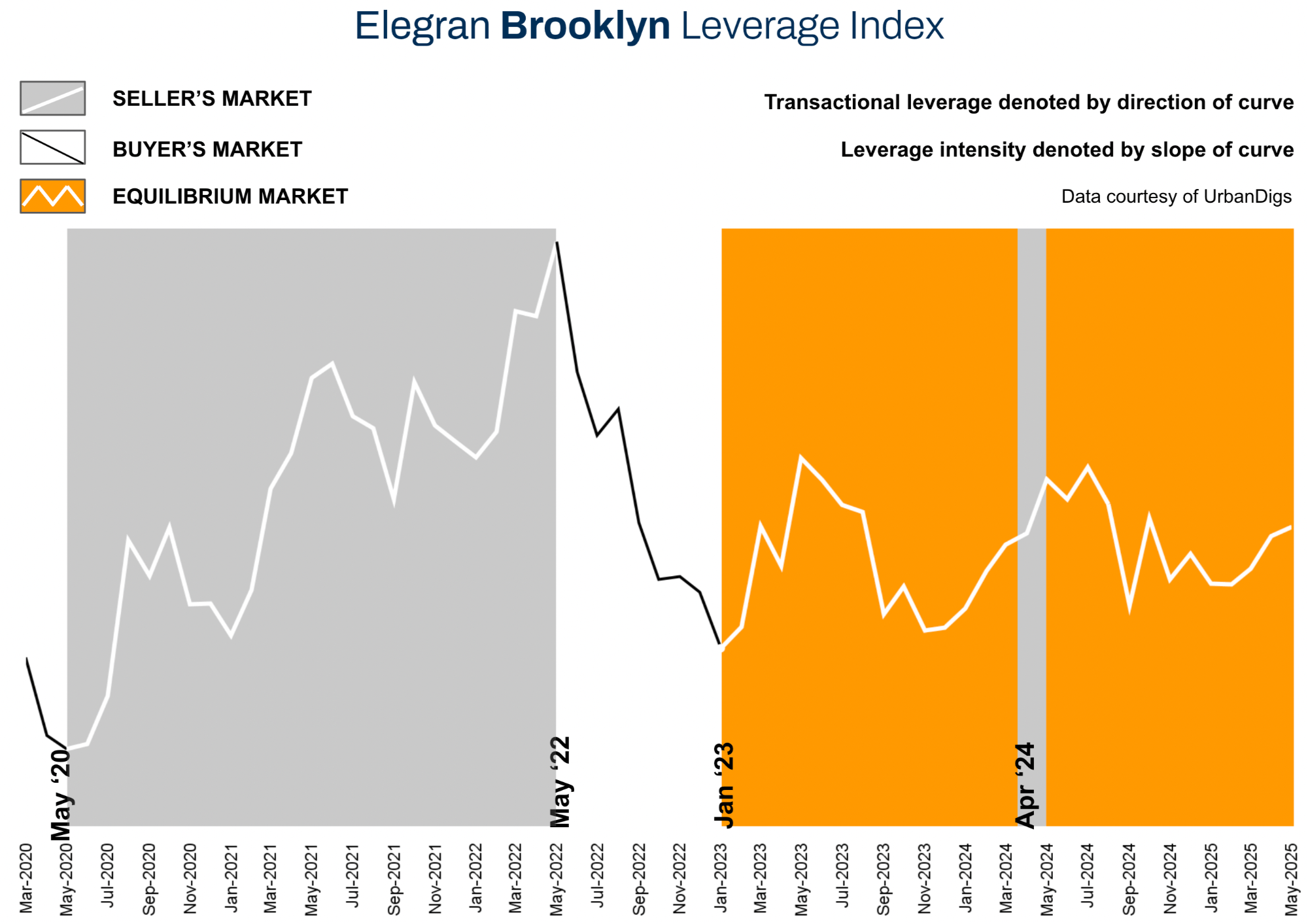

Elegran Brooklyn Leverage Index

The Elegran Brooklyn Leverage Index² is powered by four indicators: supply, demand, median price per square foot (PPSF), and median listing discount.

It informs us whether the current is a buyer’s or a seller’s market, i.e., which party possesses transactional leverage. Looking at the graph below, this is indicated by the direction of the curve, where:

- An increasing trend from left to right indicates a seller’s market

- A decreasing trend from left to right indicates a buyer’s market

Our indicator also informs us regarding the relative strength of that leverage, indicated by the slope of the curve, where:

- A gentle slope indicates a weak advantage by one party over the other

- A sharp slope indicates a strong advantage

It's not just the exact numbers that matter - it's the direction and slope of the trend. In May, the market tilted slightly in favor of sellers, with contract signings up and listing discounts tightening. However, rising inventory and a narrowing median PPSF suggest buyers still have leverage. Heading into summer, the market remains relatively balanced, with a slight edge to sellers.

Brooklyn Supply

Data & chart courtesy of UrbanDigs

More Homes, More Options: Why Now’s a Smart Time to Buy in Brooklyn

Brooklyn’s housing market saw a 4.6% inventory boost in May, bringing the number of active listings to 3,584—up 7.6% from last year. That means more choices for buyers, even as supply still sits below pre-2022 levels.

With inventory growing faster than contracts being signed, the market is shifting away from the intense competition of last spring. Buyers now have slightly more breathing room, and sellers must be mindful of pricing and presentation to stand out.

What This Means for You:

BUYERS: This is your window. More listings provide more leverage, especially on homes that have been sitting for 30+ days. Prioritize move-in-ready properties in established neighborhoods—or look for value in homes that need updates, where there may be room to negotiate.

SELLERS: With buyers comparing more options, pricing smart is everything. To stand out, your home needs to shine—whether through condition, location, or a compelling price point. Overpricing could mean a longer time on the market.

Looking Ahead:

Inventory will likely level off by late summer. If you’re buying under $1.5M, act now while selection is greatest—those price points tend to tighten first.

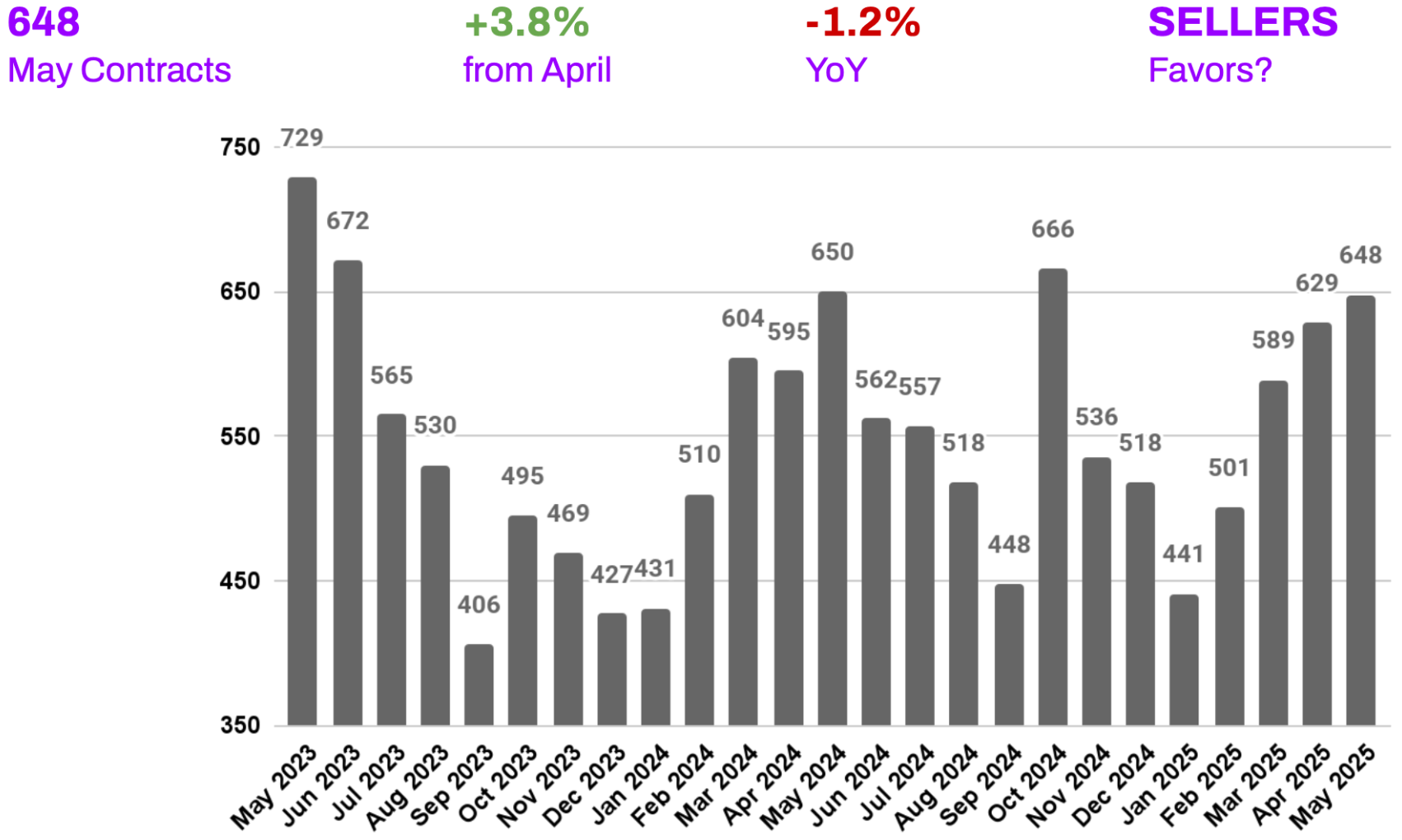

Brooklyn Demand

Data courtesy of UrbanDigs

Brooklyn Buyers Stay Active—Even with Economic Uncertainty

Brooklyn saw 648 homes go into contract in May, up nearly 4% from April. While that’s slightly below last year’s numbers, it’s a strong sign that buyers are still moving with purpose, even as interest rates stay high and the broader economy sends mixed signals.

Rather than chasing trends, today’s buyers are focused on their real needs, driving steady, healthy activity in the market.

What This Means for You:

BUYERS: You’re not alone—but you’re not in a frenzy either. Competition is more manageable, especially for homes that are mis-priced or have been on the market for a few weeks. Get pre-approved and be ready to act quickly when the right place comes on the market.

SELLERS: Today’s buyers are thoughtful and selective. If your listing isn’t seeing strong interest after two weeks, it’s likely time to revisit the price or refresh your marketing. The homes that sell now stand out for value and presentation.

Looking Ahead:

We’re in a more mature, stable market than the pandemic-era one. That means fewer bidding wars, more time for decisions, and pricing that reflects real value, not hype. As we move into summer, expect steady activity, not a race, but a marathon.

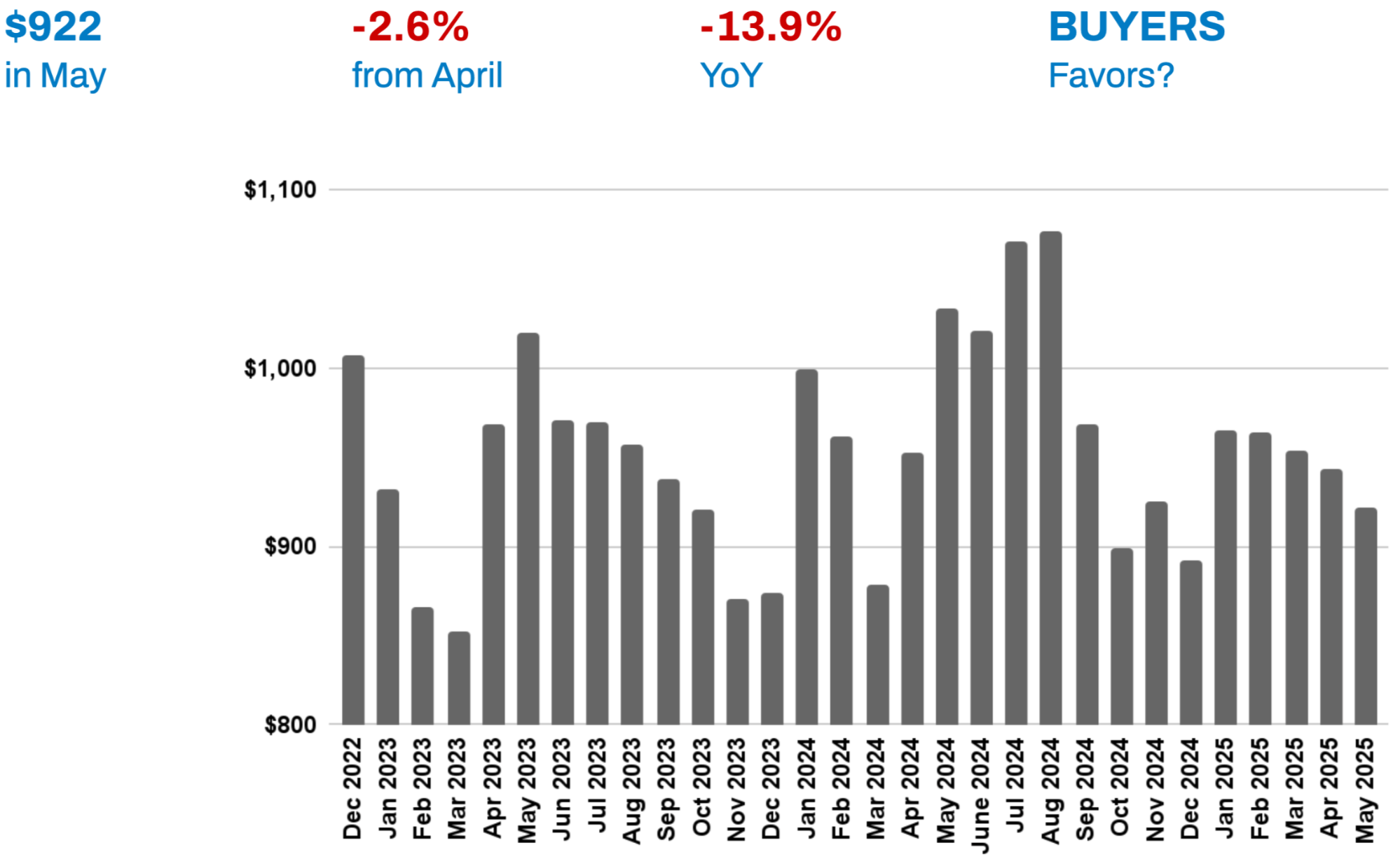

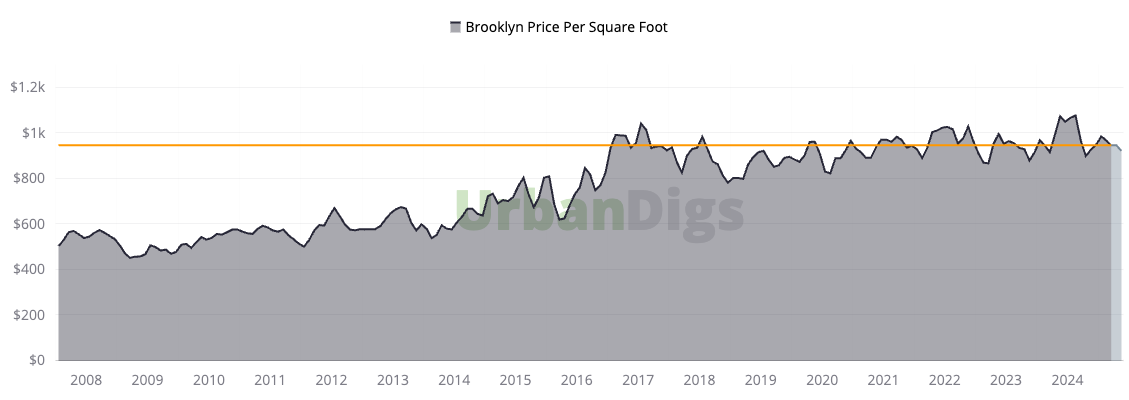

Brooklyn Median PPSF

Data & chart courtesy of UrbanDigs

Brooklyn Prices Adjust—Opening a Window for Buyers

Brooklyn’s median price per square foot dipped to $922 in May—a 2.6% drop from April and nearly 14% lower than this time last year. But this isn’t a crash—it’s a recalibration. Prices align with today’s market reality, creating opportunities for savvy buyers without signaling weakness in Brooklyn’s long-term outlook.

For sellers, it means adjusting expectations from pandemic-era highs and focusing on a smart strategy to stand out.

What This Means for You:

BUYERS: This price drop translates into more buying power, especially in areas that saw sharper corrections. It’s a great time to re-enter the market in established neighborhoods with solid fundamentals, where today’s pricing could reflect a multi-year low and future upside.

SELLERS: Now more than ever, pricing it right from day one matters. Homes that are priced competitively are moving faster and netting stronger offers. Overpricing can lead to price cuts and longer time on market, costing you both time and money.

Looking Ahead:

Neighborhoods with good transit, parks, and amenities show more price stability, while fringe areas are still adjusting. For long-term buyers and investors, this could be the moment to lock in value before the next upward cycle begins.

Brooklyn Median Listing Discount

Data courtesy of UrbanDigs

List It Right, Sell It Fast: Why Accurate Pricing Matters Now

In May, the average discount between asking price and final sale narrowed to just 3.3%. That means sellers are pricing more realistically, and buyers are responding. Well-priced homes are moving quickly with minimal negotiability, while overpriced listings are sitting longer and seeing steeper cuts. The market is becoming more efficient—and that’s good news for both sides.

What This Means for You:

BUYERS: Expect fewer deep discounts—but more fair pricing from the start. When a home is priced right, it won’t last long. Be ready to act fast on listings that check your boxes and fall within recent comps.

SELLERS: The data is clear: homes priced within 5% of market value sell in under two months with minimal negotiation. Overpricing upfront often backfires, leading to longer market time and lower final sale prices after reductions. Price it right, and you’ll move faster and sell stronger.

Looking Ahead:

As pricing accuracy improves, we’ll continue to see quicker sales and tighter negotiations. For buyers, that means more confidence in listed prices. For sellers, it means the best strategy is getting it right the first time.

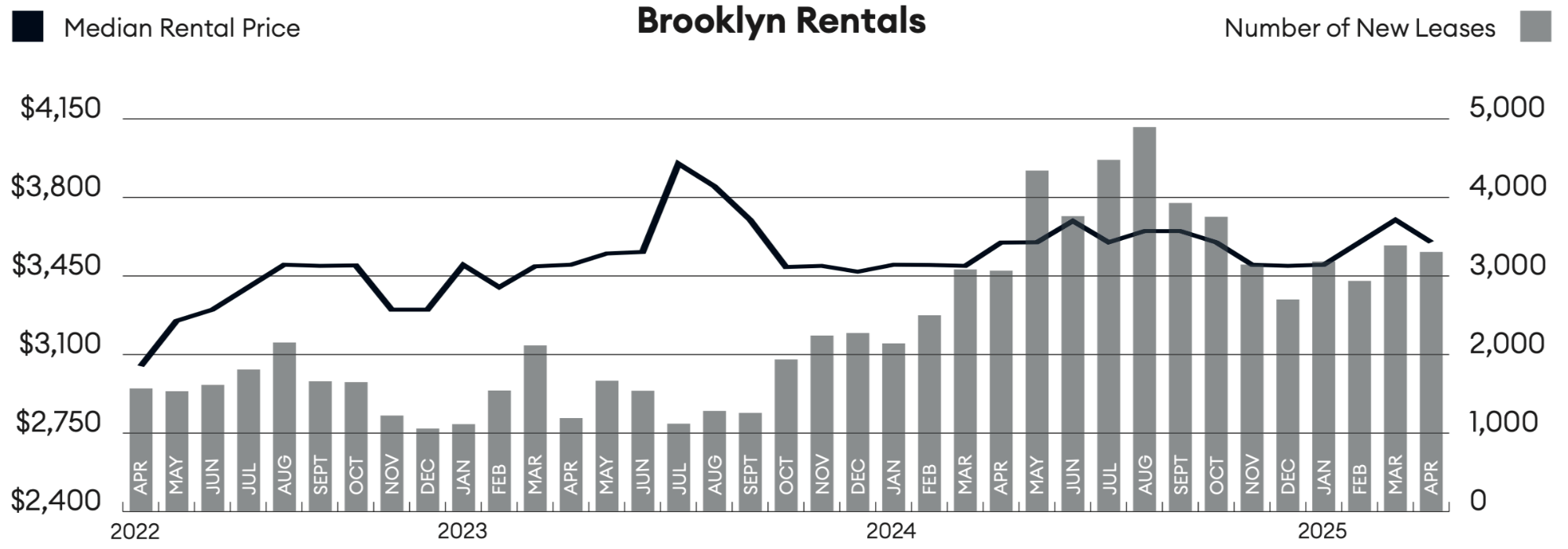

RENTAL REMARKS

Chart courtesy of Miller Samuel, Inc.

Brooklyn Rents Cool Slightly—But the Market Holds Steady

Brooklyn renters got a bit of relief in April, with median rents dipping 2.7% to $3,600, although year-over-year prices are holding flat. But dig deeper, and the story is more nuanced: average rent per square foot actually climbed 3.4% over the past year, driven by steady demand in prime, well-located buildings.³

With more listings hitting the market and new leases on the rise, renters are starting to regain some slight leverage, especially in older buildings or less competitive areas.

What This Means for You:

RENTERS: Now’s a smart time to negotiate. In buildings without full amenities or in quieter neighborhoods, you may be able to ask for concessions, better terms, or slight rent reductions. But don’t expect deals in the most in-demand locations—they still command top dollar.

LANDLORDS: While some tenants have gained room to negotiate in less competitive buildings, the overall market still favors landlords, especially in well-located, updated properties. Demand remains strong for units with amenities, good layouts, and access to transit. Strategic pricing is key, but many landlords can still lease quickly without major concessions.

Looking Ahead:

Expect a more nuanced rental market this summer. While tenants may find slight relief in certain segments, overall conditions remain tight, especially in prime locations. Landlords with well-positioned properties will likely retain pricing power, but flexibility may be needed in older or less amenitized buildings if inventory grows.

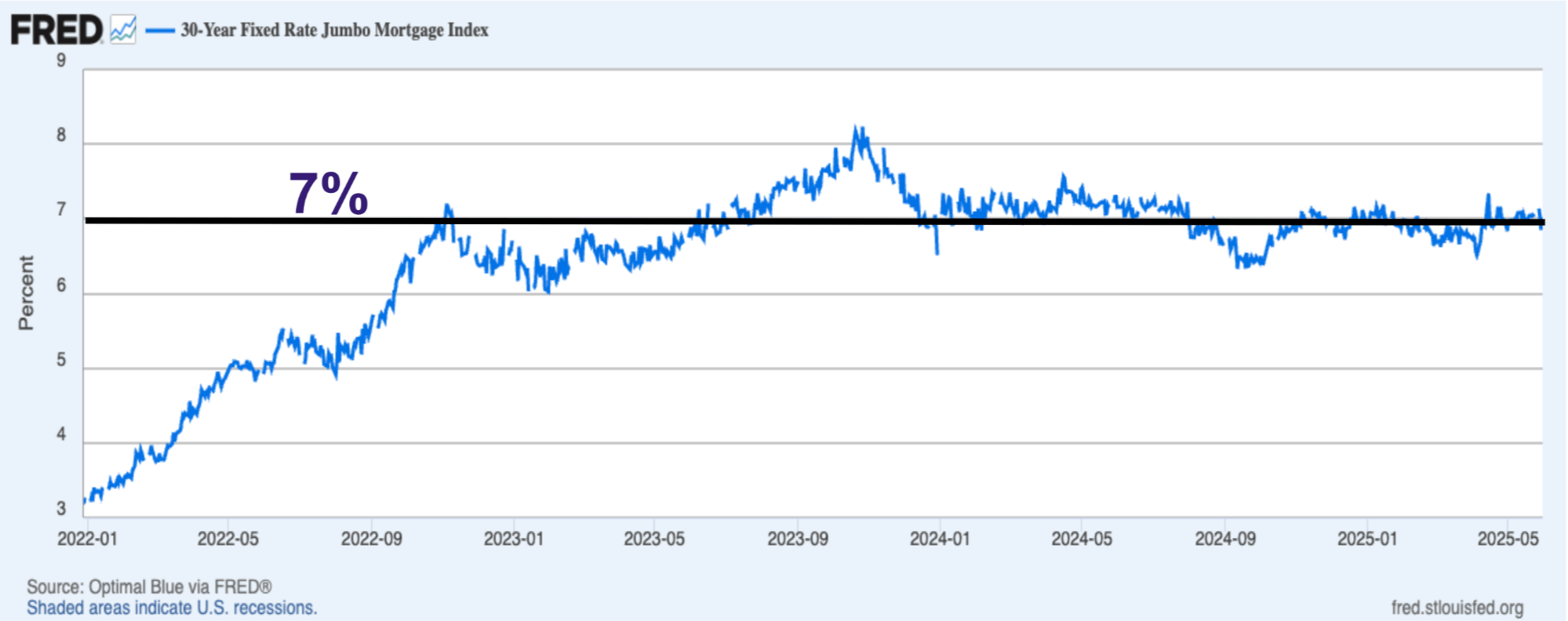

MORTGAGE REMARKS

Courtesy of Federal Reserve Bank of St. Louis

Mortgage Rates: The New Normal, and What It Means

The 30-Year Fixed JUMBO Mortgage Index now sits at 7.0%⁴, with an average APR of 6.7%⁵. While this feels steep compared to the 3–4% range of just a few years ago, economists now agree: this is the new normal, at least through 2026.

Current and short-term forecasts project rates to remain in the 6.5% to 7% range through the foreseeable future—unless a major economic shift occurs.

But here’s what’s changed: buyers and sellers are no longer on the sidelines. Instead of waiting for “perfect rates,” people are acting based on life milestones, housing needs, and market opportunities.

For buyers, this means exploring rate buydowns, ARMs, and negotiating closing cost credits. For sellers, it’s understanding how your existing low-rate mortgage might impact both your timing and buyer interest.

The market isn’t frozen—it’s evolving. And so should your strategy.

INVESTOR INSIGHTS

For real estate investors, returns come from two places: rental income and property value growth. Right now, all-cash buyers in Brooklyn are seeing cap rates between 3% and 3.4%, which can offer steady income in a stable market.

However, for investors relying heavily on financing, today’s 6.7% average jumbo mortgage rate makes it tough to turn a profit on rent alone. That said, timing matters—and for international investors, a strong U.S. dollar could translate to major gains when it’s time to sell, depending on exchange rates.

Bottom line: the investment case in Brooklyn remains strong, especially for those playing the long game or coming in with strategic currency advantages.

The light grey area to the extreme right indicates incomplete data, and the orange line indicates the most recent median

PPSF based on data considered complete.

References

1. Data courtesy of UrbanDigs

2. According to the Elegran Brooklyn Leverage Index

3. Data courtesy of Miller Samuel, Inc.

4. Data courtesy of Federal Reserve Bank of St. Louis

5. JUMBO mortgage rate APR data courtesy of Bank of America, Chase, and Wells Fargo

If you would like to chat about the most recent market activity,

feel free to contact us at info@elegran.com or

connect with one of our Advisors.

About Us

Welcome to Elegran, where our mission is to revolutionize the world of real estate. Founded in 2008 by Michael Rossi, our journey began with an unwavering drive for motivation, innovation, and a genuine care for our clients.

As an independently owned brokerage, we pride ourselves on our elite team of "advisors," offering a personalized touch that goes above and beyond the traditional real estate experience. Armed with robust data insights, we empower our clients to make informed decisions that lead to success.

Elegran proudly stands at the forefront of excellence. Our passion lies in turning your real estate dreams into reality, and we are committed to providing exceptional service at every step of the journey.

Are you ready to experience the Elegran difference? Dive into the possibilities at www.elegran.com and embark on an unforgettable real estate adventure with us.

Categories

Recent Posts

Stay in the Know!

Sign up to receive our monthly newsletter

GET MORE INFORMATION