Howard Hanna NYC Brooklyn Market Update: November 2025

Howard Hanna NYC Brooklyn Market Update: November 2025

Balanced Market with Buyer Tailwinds Emerging

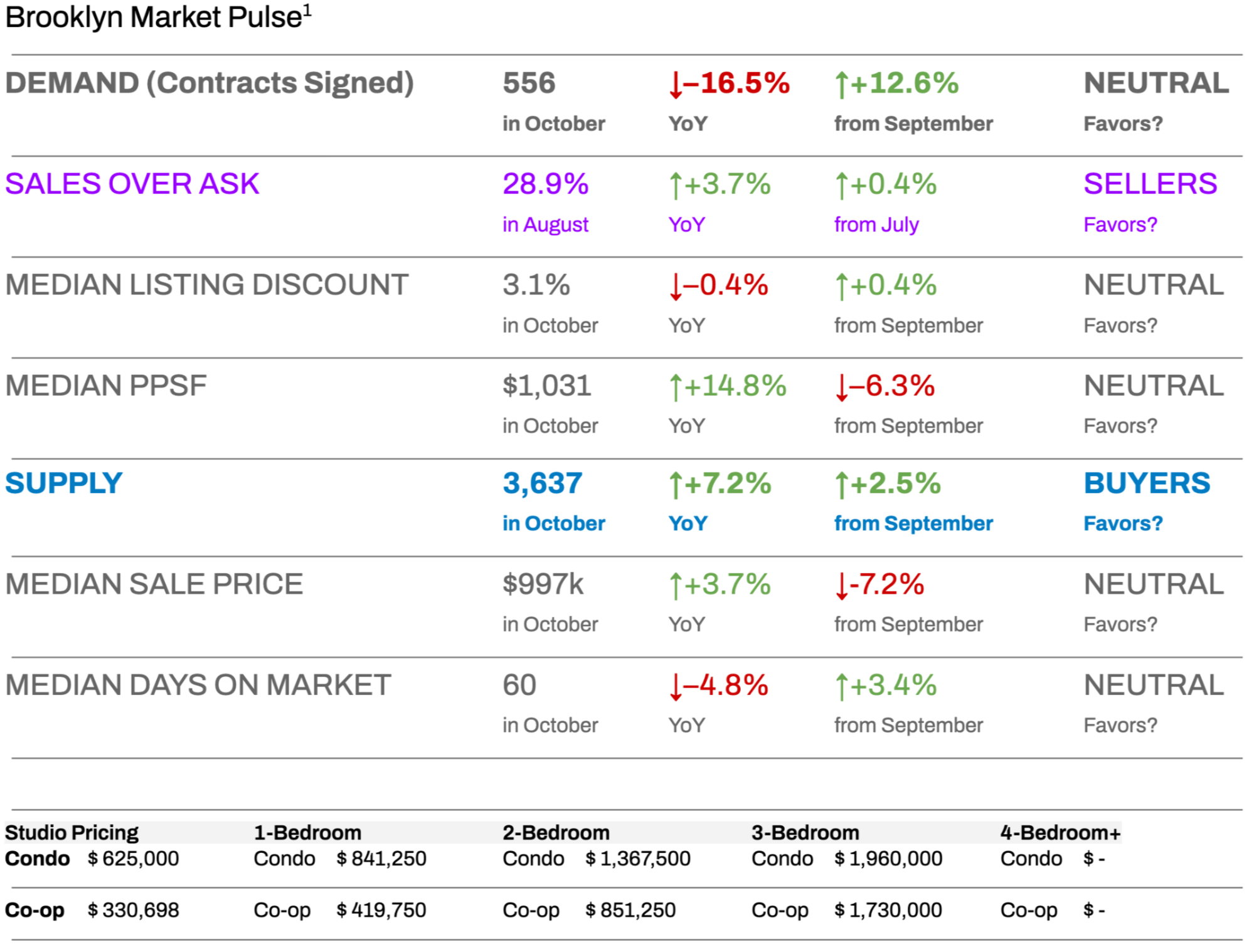

Brooklyn’s residential market entered a more balanced phase in October, though momentum subtly favored buyers. Contract activity rose 12.6% month-over-month to 556 deals—typical for an autumn rebound—but remained 16.5% below October 2024 levels, signaling a more cautious demand environment year-over-year. Inventory climbed to 3,637 active listings, a 7.2% annual gain, giving buyers more choices than they’ve had all year.

Despite the improved buyer position, sellers are still transacting near expectations: 29% of sales closed above ask, listing discounts averaged just 3.1%, and the median days on market remained relatively quick at 60. Price-wise, median PPSF declined 6.3% from September to $1,031, but that figure still reflects a 14.8% YoY increase—confirming resilience in underlying values.

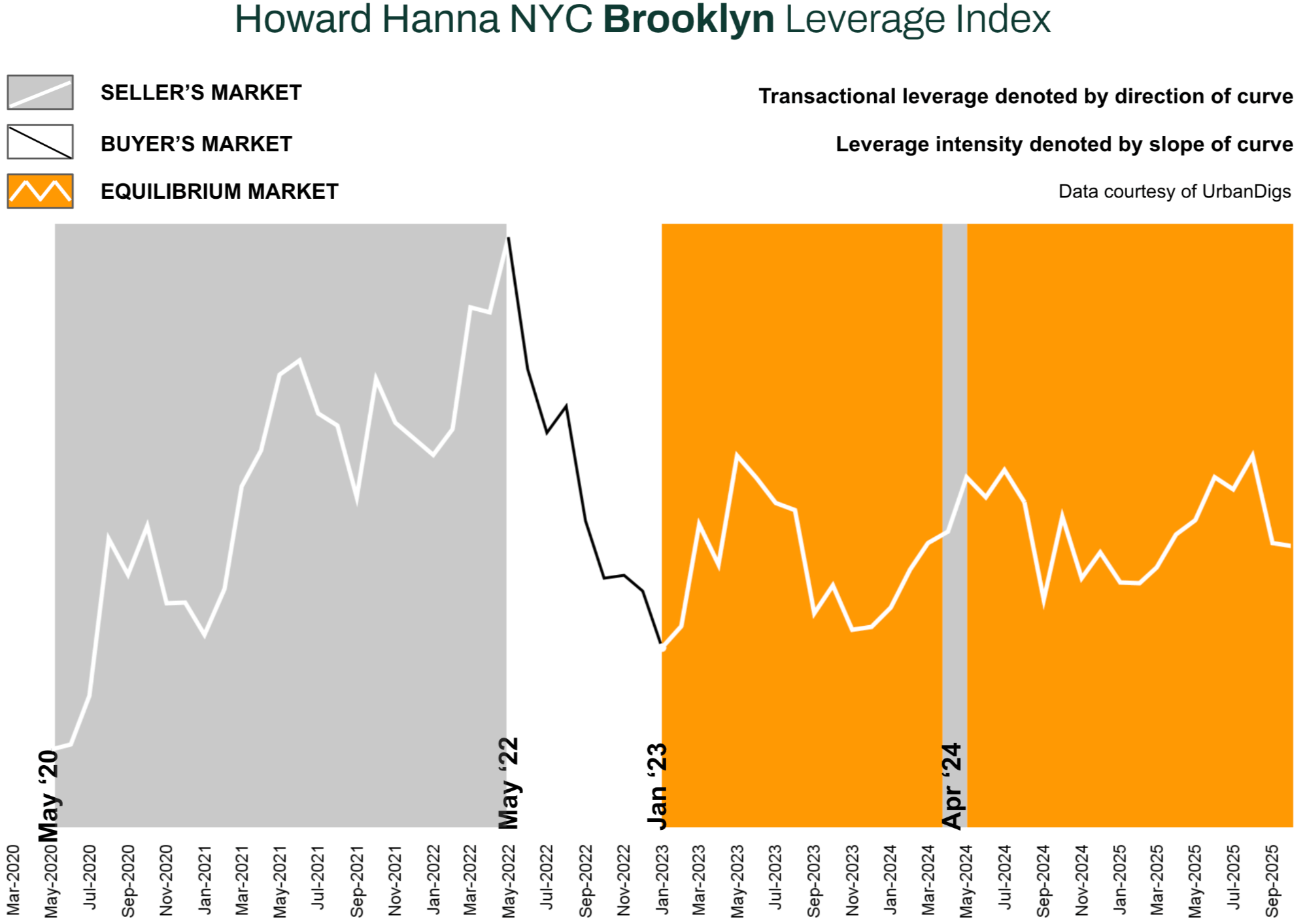

The Howard Hanna NYC Brooklyn Leverage Index remained in neutral territory for October, but tilted modestly toward buyers. Three of four key metrics—demand, PPSF, and listing discounts—held steady, while rising supply shifted the power balance incrementally. This translated into a more negotiable environment, especially for buyers willing to act before year-end.

Meanwhile, Brooklyn’s rental market continues to operate at elevated levels. Median rent registered at $3,925—flat month-over-month but still 7.5% higher than last year. Roughly one in three leases involved a bidding war, highlighting the persistent scarcity of rental inventory.

Looking ahead, the market is likely entering a seasonal slowdown. Expect listings to be pulled in November and December, temporarily constraining supply and giving remaining sellers a potential edge. However, uncertainty surrounding incoming mayor Zohran Mamdani’s affordability-focused platform may add hesitation among both buyers and investors as policy direction takes shape. Interestingly, despite refusing to take an official stance while on the campaign trail, Mamdani personally voted in favor of ballot proposals 2 - 5, which all passed, and are widely considered to be pro-real estate industry and pro-new development. This may signal a more real estate friendly administration than headlines may lead us to believe.

Key Takeaways:

- The market is balanced, but rising supply and slower YoY demand shift slight leverage to buyers.

- The Howard Hanna NYC Leverage Index indicates mild buyer advantage, though conditions remain competitive.

- Price trends are plateauing—sellers must price realistically to avoid stagnation.

- Rental dynamics remain tight, with landlords in full control and bidding wars still common.

- Political and monetary policy shifts could influence early 2026 sentiment—timing matters.

Howard Hanna NYC Brooklyn Leverage Index

The Howard Hanna NYC Brooklyn Leverage Index² blends four market signals - supply, demand, median price per square foot, and median listing discount - to capture the balance of power between buyers and sellers.

Direction Matters:

- An upward-sloping curve = seller’s market

- A downward-sloping curve = buyer’s market

- The steeper the slope, the stronger the advantage for either side

In October, the Brooklyn market remained broadly neutral but leaned slightly in favor of buyers. Three of the four key indicators - demand, median price per square foot, and listing discount - held steady, while supply rose meaningfully, tipping the balance marginally toward buyers. As a result, the Leverage Index suggests a modest buyer advantage for the month, though conditions overall remained relatively balanced.

Brooklyn Supply

Brooklyn Supply: Inventory Ticks Up, Giving Buyers Breathing Room

Brooklyn ended October with 3,637 active listings, a +2.5% increase from September and a +7.2% rise year-over-year. In one month, the borough went from late-summer scarcity to a healthier fall inventory. Buyers now have more choices than at any point earlier this year, though supply is still relatively lean by historic standards. This October boost may be one of the last before the holiday slowdown kicks in.

- Buyers: With more listings hitting the market, you’re facing less competition per property than a few months ago. Take advantage of the breathing room – you can afford to compare options and negotiate, rather than rushing into a bidding war immediately.

- Sellers: New inventory means buyers have alternatives, so pricing competitively is crucial. An overpriced listing will likely sit on the market while better-priced homes sell. Make your property stand out (think smart pricing, great photos, and staging) from day one – aim to be the compelling choice in your segment.

- Looking Ahead: Expect supply to level off or dip as the holidays approach, since many unsold listings get pulled in late Nov/Dec. Use the current window while choices are broad: buyers have the upper hand until inventory tightens again. By winter, inventory will likely contract, so sellers who don’t find a buyer this fall may wait until spring’s traditional listing surge.

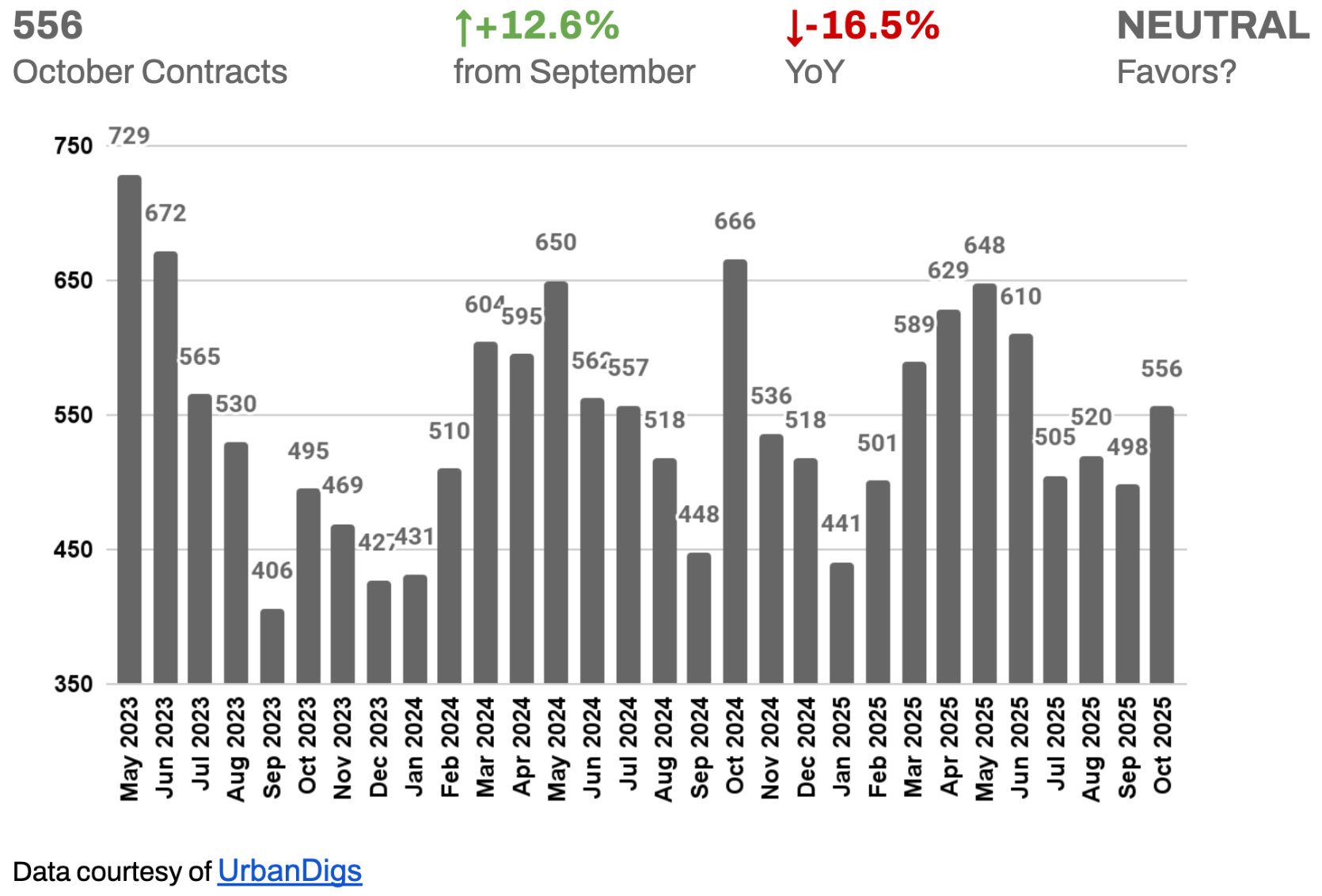

Brooklyn Demand

Brooklyn Demand: Seasonal Rebound With Cautious Buyers

Contract activity picked up in October, with 556 deals signed – about +12.6% more than September’s total. This uptick suggests a typical autumn boost as some buyers refocused after summer. However, demand was still down 16.5% compared to last October, indicating a cooler market pace than a year ago despite the greater inventory.

In essence, buyers are out there and willing to act, but they’re moving more deliberately than last fall, taking time to shop the expanded supply rather than snapping up homes frantically.

- Buyers: A slower year-over-year pace means you don’t have to feel as rushed as last year. If a home you like has been on the market a few weeks, you may have room to negotiate on price or terms. That said, the very best listings can still attract multiple offers – don’t assume no one else will jump on a well-priced, special property.

- Sellers: Buyer caution is higher now than last year, so an overly ambitious asking price is risky – house-hunters will likely pass on an overpriced unit and wait for a reduction. To get deals done in this climate, align with the market on pricing from the start.

- Looking Ahead: As we move past October’s bump, seasonality kicks in. November and December typically see a slowdown in sales as many buyers and sellers turn their attention to the holidays. Don’t be surprised if deal volume eases heading into year-end. Serious buyers might still try to secure a home before New Year’s, but many will postpone searches to January. For sellers, this means the pool of active buyers will thin – if you need to sell, price sharply and be ready to negotiate; if you can wait, early spring 2026 may bring a fresher cohort of buyers.

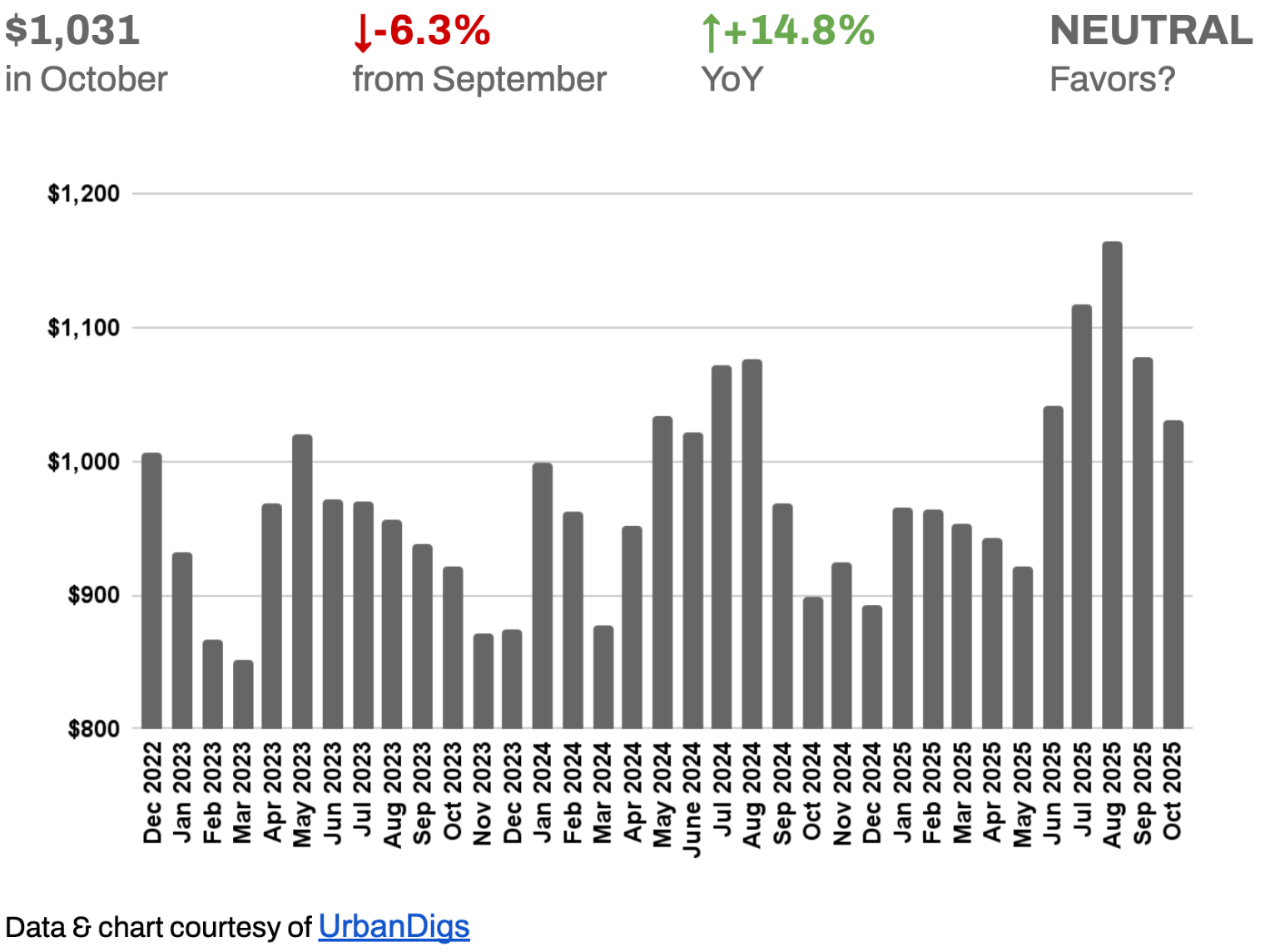

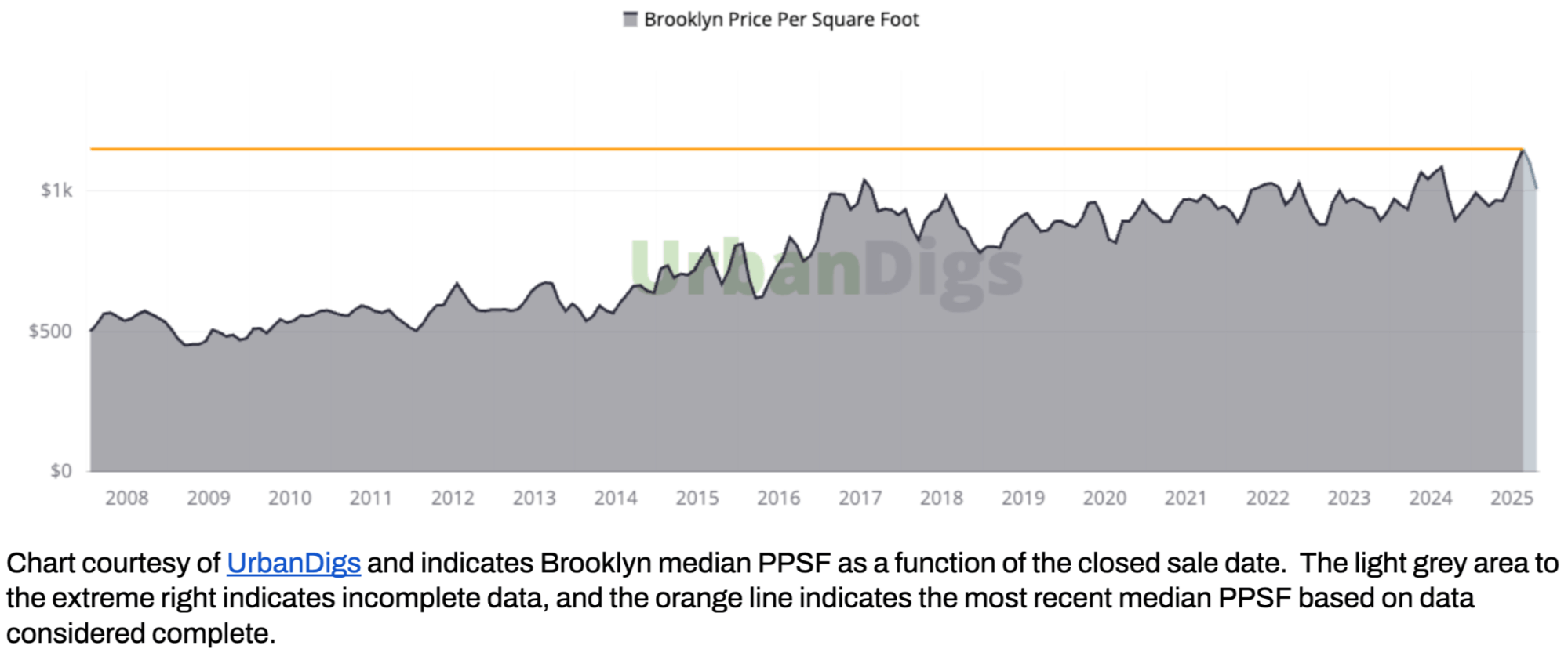

Brooklyn Median PPSF

Brooklyn Median PPSF: Modest Buyer Leverage Returns

Brooklyn’s median price per square foot for closed sales in October was $1,031. This represents a notable drop of 6.3% from September’s record high, indicating that prices have finally cooled a bit after the summer’s peak. However, PPSF remains up 14.8% year-over-year, a testament to how much values surged over the past year. In short, pricing eased off the highs but is still significantly stronger than last fall – a sign that sellers trimmed expectations slightly to get deals done, while buyers gained a bit more negotiating power than they had over the summer.

High borrowing costs and the rise in inventory applied gentle downward pressure on prices, but Brooklyn hasn’t seen any drastic price correction.

- Buyers: The slight dip in price-per-square-foot means prices are bending in your favor, albeit gradually. You have more negotiating power on price now than you did a few months ago – use it wisely. Don’t expect deep bargains (prices are still up annually), but do leverage the recent softening to negotiate a fair deal.

- Sellers: After a long stretch of record-breaking prices, the market is hitting some resistance. Buyers are price-sensitive, armed with data showing prices just eased. This doesn’t mean you won’t get a great price – it means you must price realistically and be open to minor concessions. If you’re listing now, understand that aiming for last summer’s peak pricing may backfire; instead, position your home as a standout value to secure a buyer in this plateauing market.

- Looking Ahead: With inventory higher and the typical winter cooldown coming, expect pricing to remain under gentle pressure through the next couple of months. We’re likely in a plateau-to-slight-downtrend phase for PPSF – think small incremental dips rather than any steep drop. Sellers who aren’t urgent might hold off until the spring 2026 selling season; those who do list in winter should prioritize competitive pricing.

Buyers, keep an eye out for year-end opportunities – a seller eager to close by Dec 31 might be more flexible, allowing you to snag a property at a relative bargain.

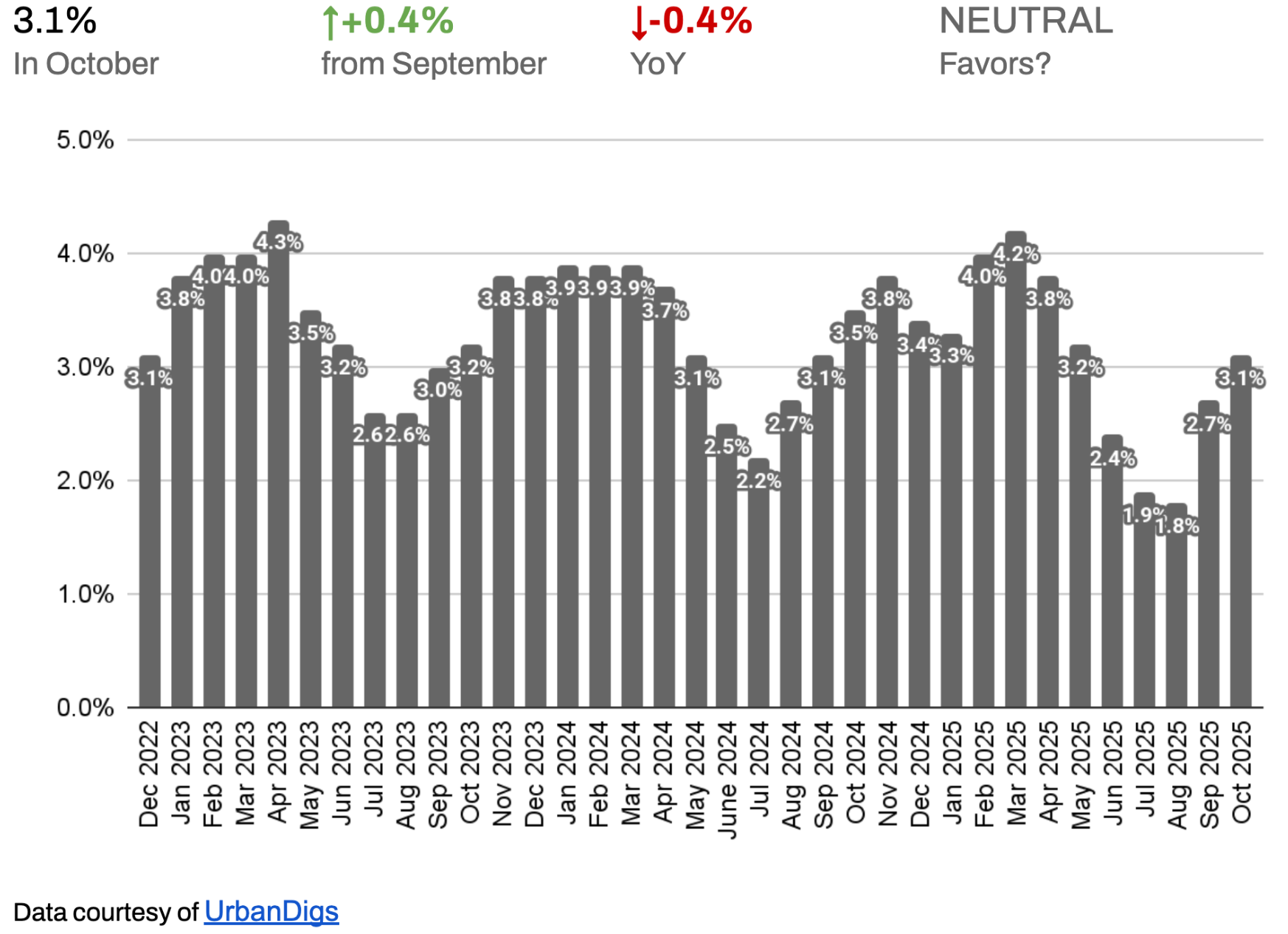

Brooklyn Median Listing Discount

The median listing discount (the percent below asking price that homes ultimately sell for) was 3.1% in October. This is up slightly from September (by about 0.4 percentage points), meaning sellers had to budge a bit more on price this month. Still, it’s slightly lower than last October’s 3.5%, so sellers are conceding a touch less than they did a year ago.

In context, a 3.1% discount is relatively small – many properties are selling very close to ask. The modest uptick from summer’s ultra-tight 2–3% discounts hints that buyers have gained a tad more leverage, but overall, well-priced listings continue to command near-asking sale prices.

- Buyers: With average discounts only around 3%, don’t expect huge price cuts – Brooklyn homes are largely selling near their list prices. However, the fact that discounts widened slightly means you might have a bit more room to negotiate than you did in the spring or summer. If a listing has been on the market a while (or had a price reduction), that’s your cue to negotiate more aggressively.

- Sellers: Brooklyn is still no bargain bin – most sellers are getting 97%+ of their asking price on average. To be one of them, price your home correctly out of the gate. Today’s buyers have more choices and will skip over overpriced listings, but if you’re in the right ballpark, you likely won’t have to give much ground. Remember that a small 2–4% discount can clinch a deal in this market; it’s far better than sitting unsold and facing a larger price cut later.

- Looking Ahead: If demand cools further in the winter, discounts could widen slightly as motivated sellers negotiate more to unload units before year-end. Conversely, if inventory pulls back, sellers who remain on the market may keep the upper hand, holding discounts in check. Likely we’ll see low-single-digit discounts persist through the winter. Sellers should be prepared for savvy buyers asking for a bit off the top, and buyers should approach negotiations realistically – Brooklyn isn’t seeing fire sales, but a well-informed offer stands a good chance of scoring a fair discount in the slower season.

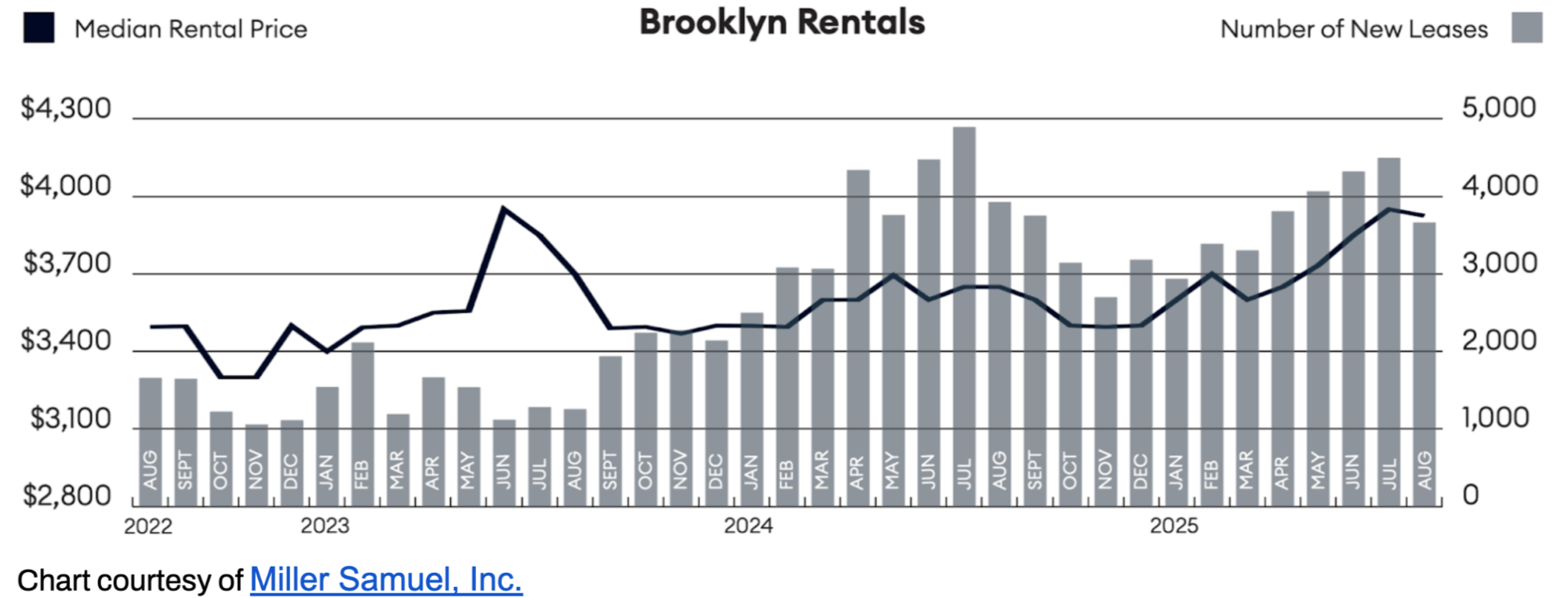

RENTAL REMARKS

Brooklyn’s rental market remains red-hot. The median rent in September was $3,925, which slipped a modest 0.6% from the August peak, but is still 7.5% higher than a year ago – near the highest level on record. In fact, median and average rents have increased annually for seven consecutive months, now hovering around their second-highest figures ever³. Demand is so robust that roughly 1 in 3 new leases involve a bidding war, and many apartments continue to rent at or above asking price (landlords haven’t had to offer discounts in over two years).

Interestingly, the number of new lease signings has fallen year-on-year for the third straight month, suggesting that faced with steep rents, more tenants are renewing leases or staying put. All told, Brooklyn rentals are pricey and competitive, with tenants feeling the squeeze and landlords firmly in the driver’s seat.

- Renters: Be prepared for fierce competition and very little wiggle room on price. It’s not uncommon for desirable rentals to go for full ask or even higher, given one-third of listings see bidding wars. If you’re hunting, have your paperwork ready and consider stretching your search timeline – it may take longer to find a deal within budget.

- Landlords: The ball remains in your court. Vacancy is low and demand is high, so you can confidently ask for top-dollar (and you might get multiple interested parties). That said, the slight month-to-month dip in rent could hint at approaching affordability limits for tenants. Keep an eye on interest rates and the sales market – if buying becomes more attractive relative to renting or if new rental supply comes on line, you may need to temper expectations.

- Looking Ahead: Barring any large economic shifts or a surge in new inventory, rents should stay elevated through year-end. Winter usually brings a tiny bit of relief in rental demand, but don’t expect a dramatic drop – the market’s underlying strength means prices will remain near record levels into early 2026. Any significant relief for renters would likely require either a robust increase in supply (more units coming to market) or a pullback in demand, neither of which is clearly on the horizon yet.

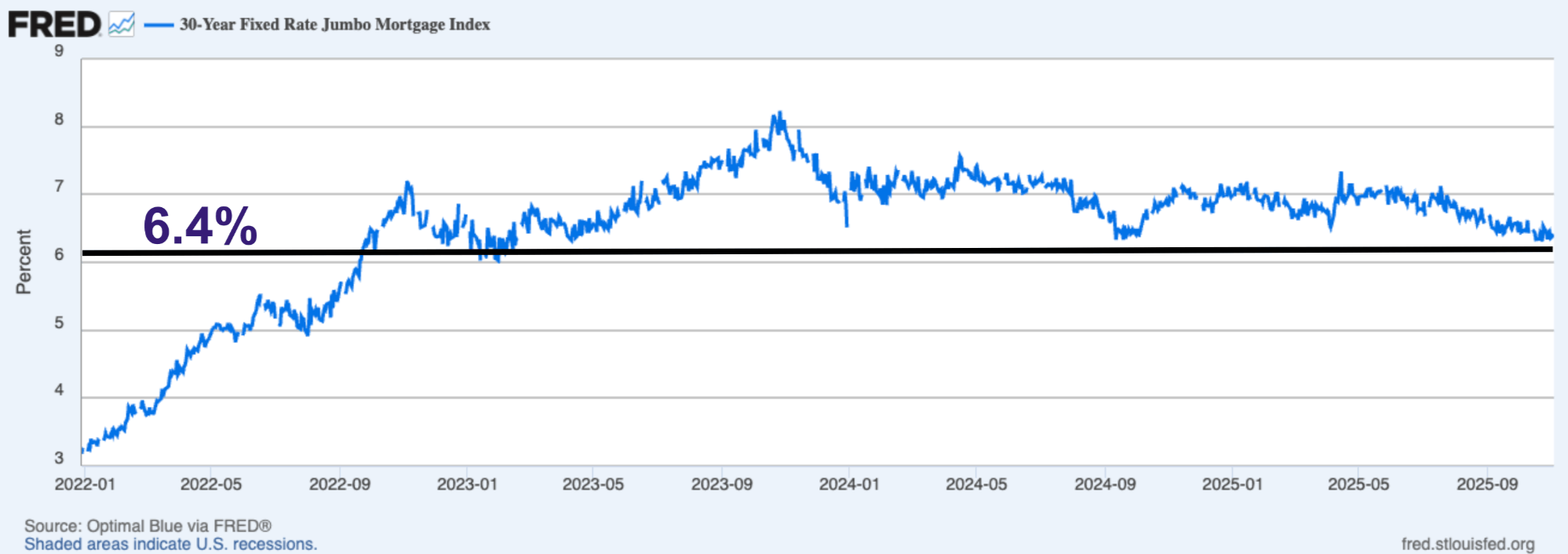

MORTGAGE REMARKS

Mortgage Rates: Rates Ease Slightly, but “Rate Lock” Constrains Supply

After reaching 20-year highs this summer, mortgage rates have eased modestly following two Federal Reserve cuts. As of early November, the average 30-year jumbo rate sits around 6.4%⁴, down from midsummer’s 7%+ peak. This offers a mild affordability boost, with average APRs now in the low 6% range⁵.

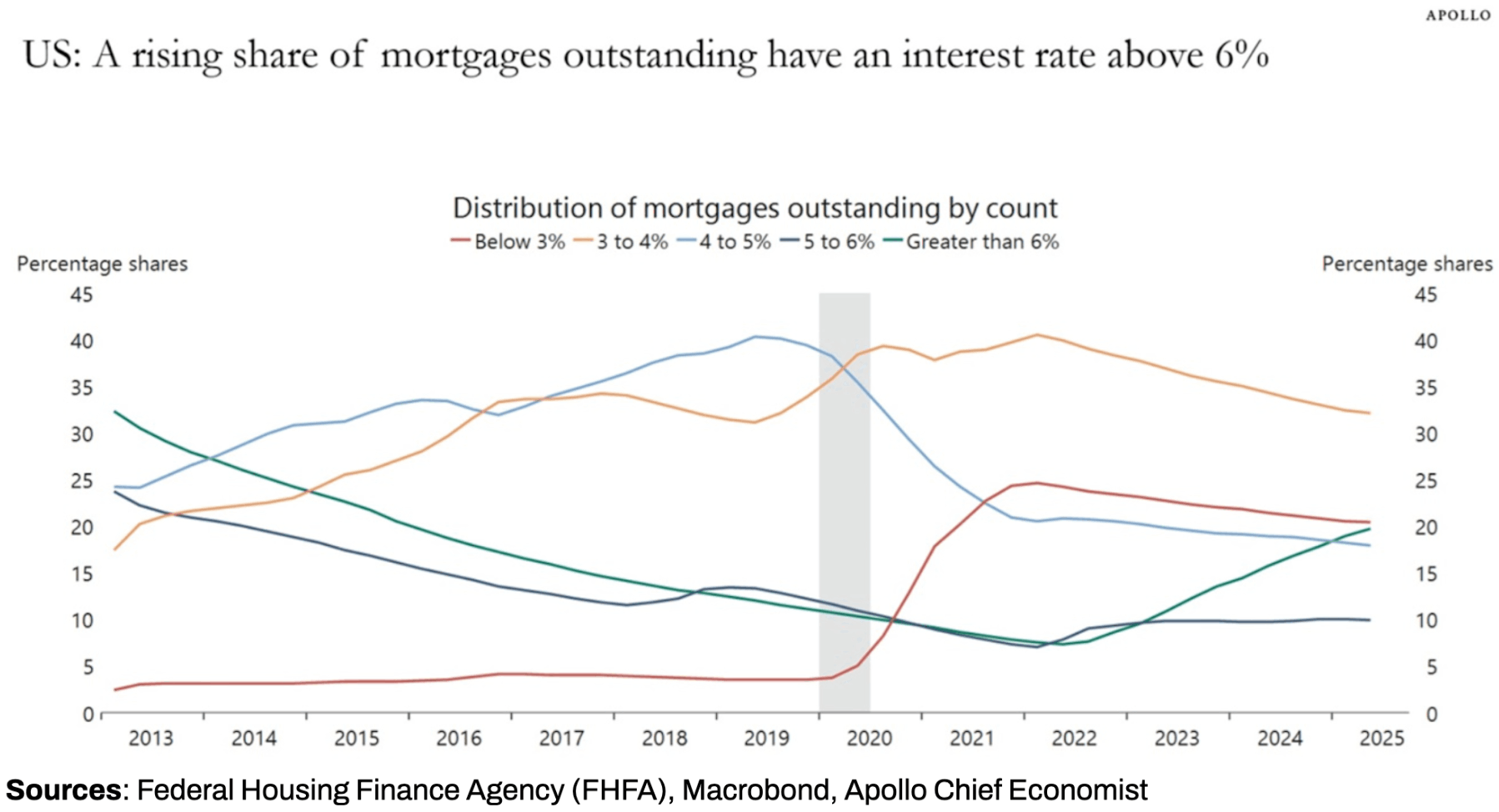

This modest drop offers buyers some relief: a 0.5 percentage point cut can lower monthly payments by ~$300 on a $1M loan. But rates are still high by historical standards, and affordability remains a challenge. Meanwhile, many homeowners are locked in ultra-low rates in 2020–2021 and are choosing to stay put, unwilling to trade up into a 6%+ mortgage. This creates a pronounced “rate lock” effect, limiting resale inventory.

Fewer listings mean tight supply and firmer pricing — especially in desirable areas like prime Brooklyn — where homeowners are holding the line. Serious buyers with financing or cash have less competition and can sometimes negotiate modest concessions. Sellers, despite a smaller buyer pool, benefit from fewer competing listings.

Nationally, about 1 in 5 mortgages now carries a rate over 6%. This widespread rate lock is constraining mobility, keeping prices firm even as transaction volume slows⁶.

What this means for you:

- Buyers:

Today’s ~6.4% jumbo rate is a slight improvement from this summer’s 7%+ highs. Monthly payments remain elevated (roughly $620 per $100K borrowed), so budget accordingly. But one silver lining: fewer casual buyers means less competition. If you’re well-qualified or buying with cash, you’re in a strong position to negotiate in this slower, rate-adjusted market. - Sellers:

Rates are the dominant force shaping the market. With many would-be sellers sidelined, your listing faces less competition — but buyers are budget-conscious. The pool is smaller, and serious. Price realistically, stay flexible, and recognize that most buyers are operating with tight affordability constraints. - Looking Ahead:

The “rate lock” dynamic is unlikely to break soon. While slightly lower rates in 2026 might improve deal flow modestly, the shift will likely be gradual. Expect low resale inventory and steady pricing to continue shaping the Brooklyn and Manhattan markets into early next year.

INVESTOR INSIGHTS

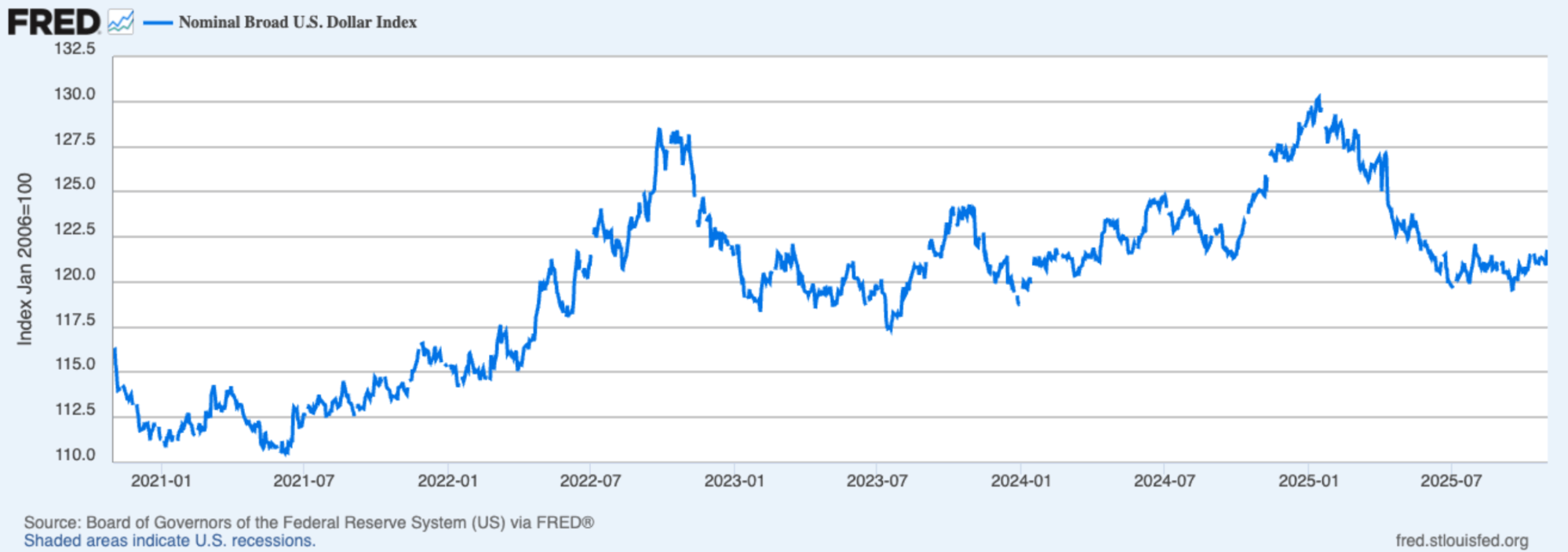

Softer Dollar Tilts Advantage to Foreign Buyers

In 2025, a weakened U.S. dollar (down ~4–5% YTD vs. major currencies) has quietly shifted the playing field. For overseas investors, this currency dip offers a built-in discount: a €1M NYC property now effectively costs ~€875K–€880K vs. €920K a year ago. That 5% FX edge makes Brooklyn more affordable and appealing, especially for global buyers transacting in euros, pounds, or yen.

Foreign capital is flowing in from Europe, Asia, and the Middle East, targeting both luxury condos and mid-tier value plays. For institutions and private buyers alike, improved conversion rates are creating a better entry point than 2024. Combined with Brooklyn’s higher rental yields relative to Manhattan, the borough offers both pricing advantage and income upside — a compelling formula in a global investment landscape.

What This Means for You:

Domestic Investors:

The weak dollar doesn’t help U.S. buyers directly — but it does mean intensified competition from global capital. Foreign interest can prop up property values but may also limit discount opportunities. Local investors should focus on fundamentals: solid rental yields, strong submarkets, and financial leverage. Those who understand Brooklyn’s micro-markets, financing nuances, and tenant demand are better positioned than FX-driven foreign buyers.

Looking Ahead:

If the dollar stays soft or weakens further, expect global demand to remain strong into 2026. That will help support prices and liquidity. Policy shifts or a dollar rebound could change the landscape, but barring major moves, overseas interest should persist. For local investors, expect a globally competitive field — and stay alert to market changes, financing costs, and city regulations that could shift the balance.

If you would like to chat about the most recent market activity,

feel free to contact us at contact@hhnyc.com or

connect with one of our Advisors.

References

1. Data courtesy of UrbanDigs

2. According to the Howard Hanna NYC Brooklyn Leverage Index

3. Data courtesy of Miller Samuel, Inc.

4. Data courtesy of Federal Reserve Bank of St. Louis

5. JUMBO mortgage rate APR data courtesy of Bank of America, Chase, and Wells Fargo

6. Sources: Federal Housing Finance Agency (FHFA), Macrobond, Apollo Chief Economist

Categories

Recent Posts

Stay in the Know!

Sign up to receive our monthly newsletter

GET MORE INFORMATION