Howard Hanna NYC Manhattan Market Update: November 2025

Howard Hanna NYC Manhattan Market Update: November 2025

Year-End Demand Surge Tilts Market Back Toward Sellers

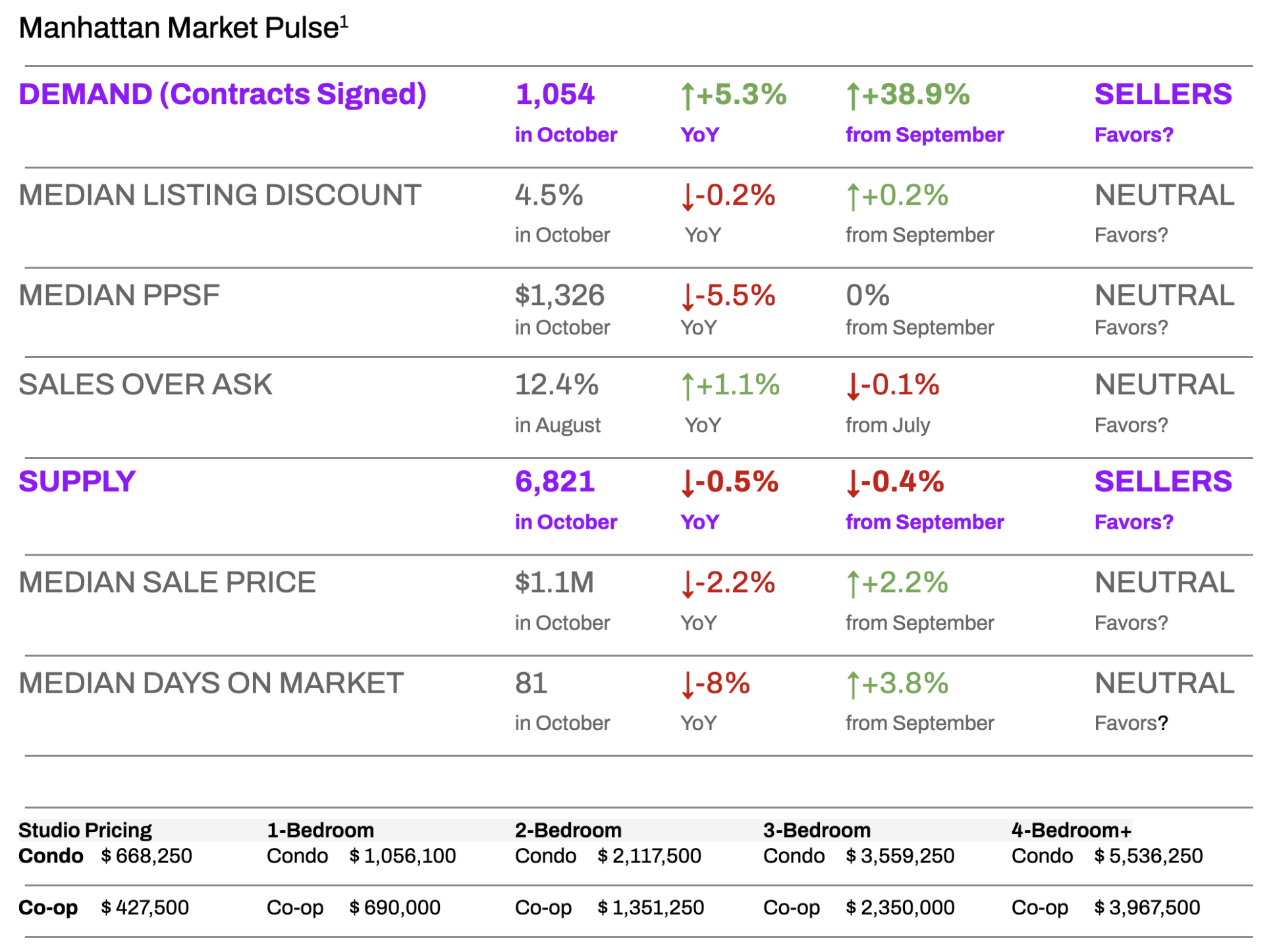

Manhattan’s October performance was among the strongest of 2025, with contracts signed rising 38.9% month-over-month to 1,054—also 5.3% above October 2024. Inventory tightened to 6,821 listings, granting sellers a window of leverage before the expected holiday slowdown.

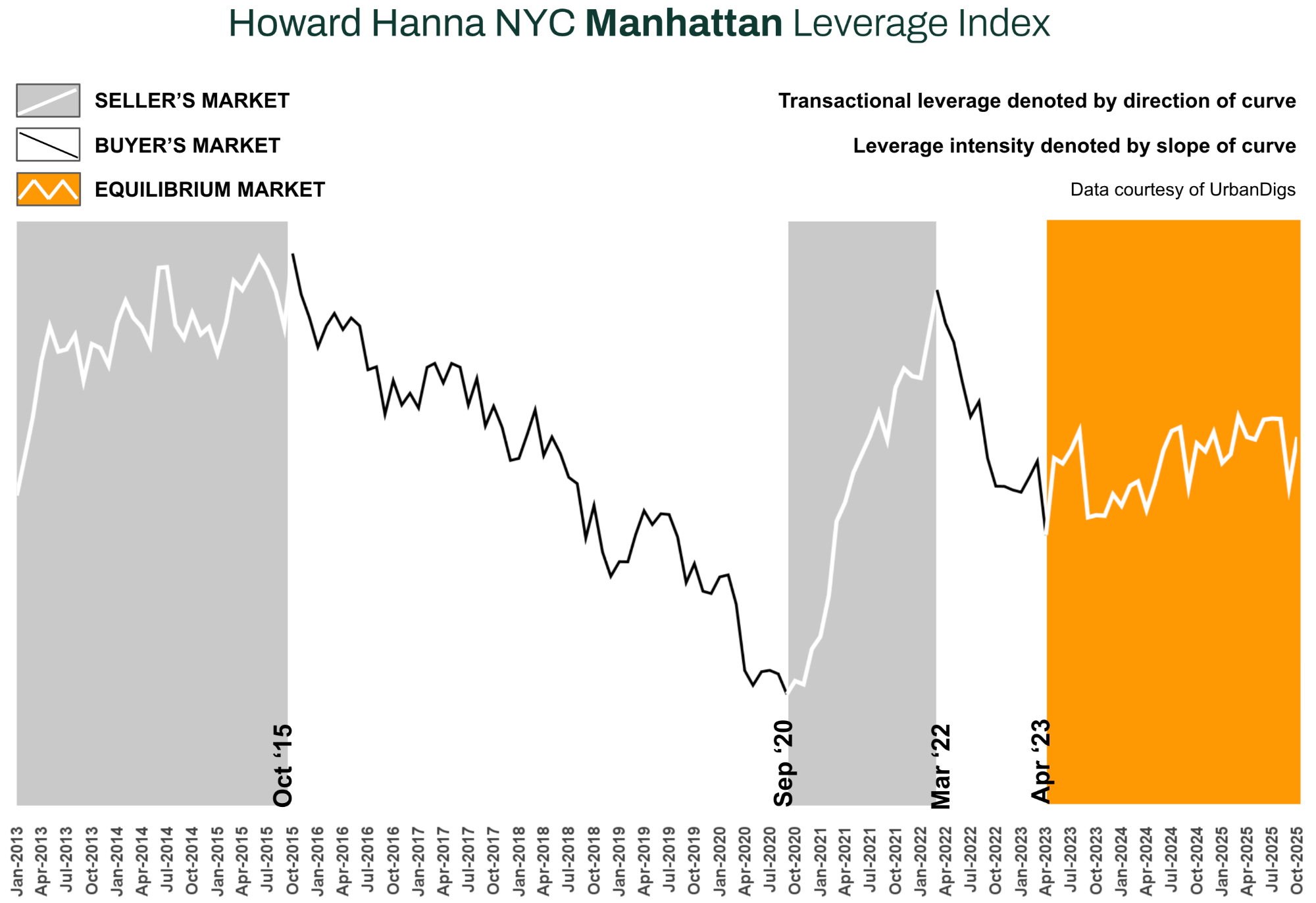

The Howard Hanna NYC Manhattan Leverage Index confirmed this shift, tilting back toward a seller’s market after a more neutral reading in September. Two of four core indicators—rising demand and falling supply—moved decisively in sellers’ favor.

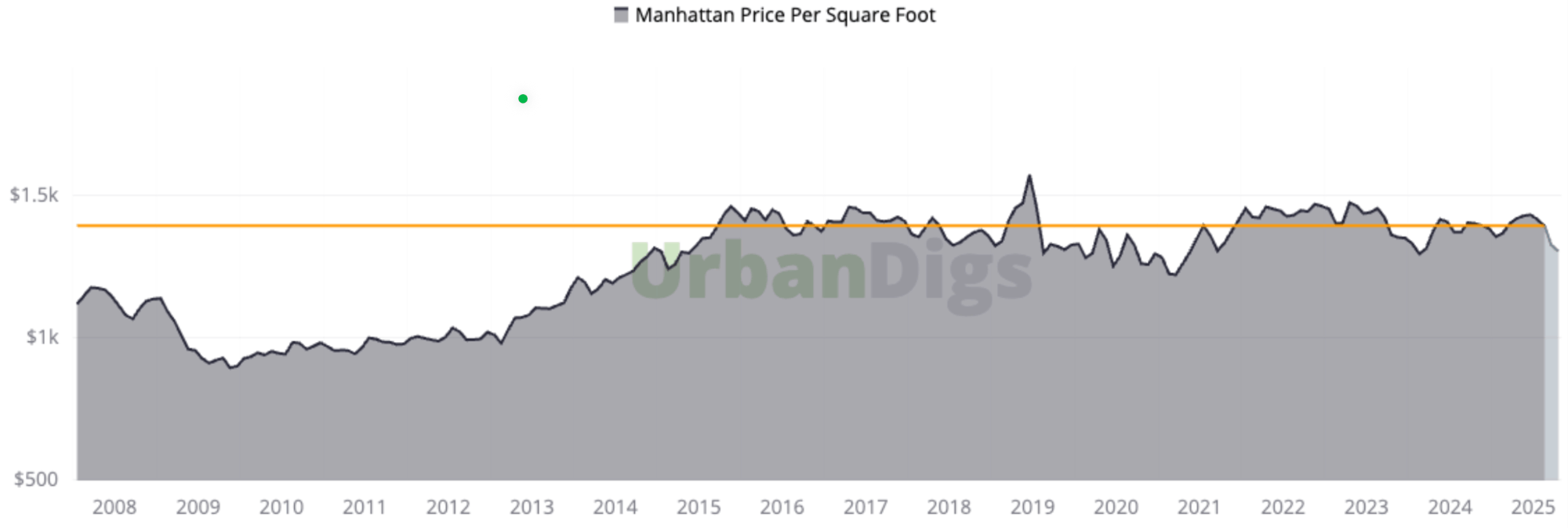

Despite heightened activity, pricing remained steady: median PPSF held at $1,326 (flat MoM), and the median sale price remained at $1.1M. Listing discounts averaged 4.5%, and median days on market dropped to 81—both indicators showing continued pricing discipline and market velocity. Rents remained near historic highs at $4,550, up 8.3% YoY, with vacancy holding at 2.1% and bidding wars still present in roughly 1 in 5 leases.

Adding a layer of uncertainty, Zohran Mamdani’s mayoral win has introduced potential policy shifts focused on housing affordability. While no specific legislation is in place yet, real estate stakeholders are watching closely as future rent control or development restrictions could impact both investment strategy and pricing dynamics in 2026.

Interestingly, despite refusing to take an official stance while on the campaign trail, Mamdani personally voted in favor of ballot proposals 2 - 5, which all passed, and are widely considered to be pro-real estate industry and pro-new development. This may signal a more real estate friendly administration than headlines may lead us to believe.

The financing landscape continues to shape behavior. Mortgage rates have eased modestly to ~6.4%, providing marginal relief, but the “rate lock” effect is keeping resale inventory suppressed. Owners with ultra-low pandemic-era rates remain unwilling to sell, maintaining upward pressure on values despite affordability headwinds. International buyers have re-entered the market on the back of a ~5% weaker U.S. dollar, while domestic investors remain selective, targeting repositioning plays or improved cash-on-cash returns.

Key Takeaways:

- Manhattan real estate regained momentum in October, with demand rising sharply and inventory slipping.

- The Howard Hanna NYC Manhattan Leverage Index signals a clear tilt toward sellers in current conditions.

- Political shifts and sustained high borrowing costs will shape sentiment heading into 2026.

- Pricing remains stable, but seller success depends on precision—not optimism—in list strategy.

Howard Hanna NYC Manhattan Leverage Index: Index Tilts Back Toward Sellers

The Howard Hanna NYC Manhattan Leverage Index² blends four market signals - supply, demand, median price per square foot, and median listing discount - to capture the balance of power between buyers and sellers.

Direction Matters:

- An upward-sloping curve = seller’s market

- A downward-sloping curve = buyer’s market

- The steeper the slope, the stronger the advantage for either side

In October, Howard Hanna NYC Manhattan’s Leverage Index ticked upward, tilting back toward a seller’s market as two of the four metrics – surging contract activity and shrinking inventory – moved in sellers’ favor. This marked a reversal from September’s slight buyer-leaning conditions. The year-end momentum was likely the last burst before the holiday lull, giving sellers a brief window of improved leverage in negotiations.

Manhattan Supply

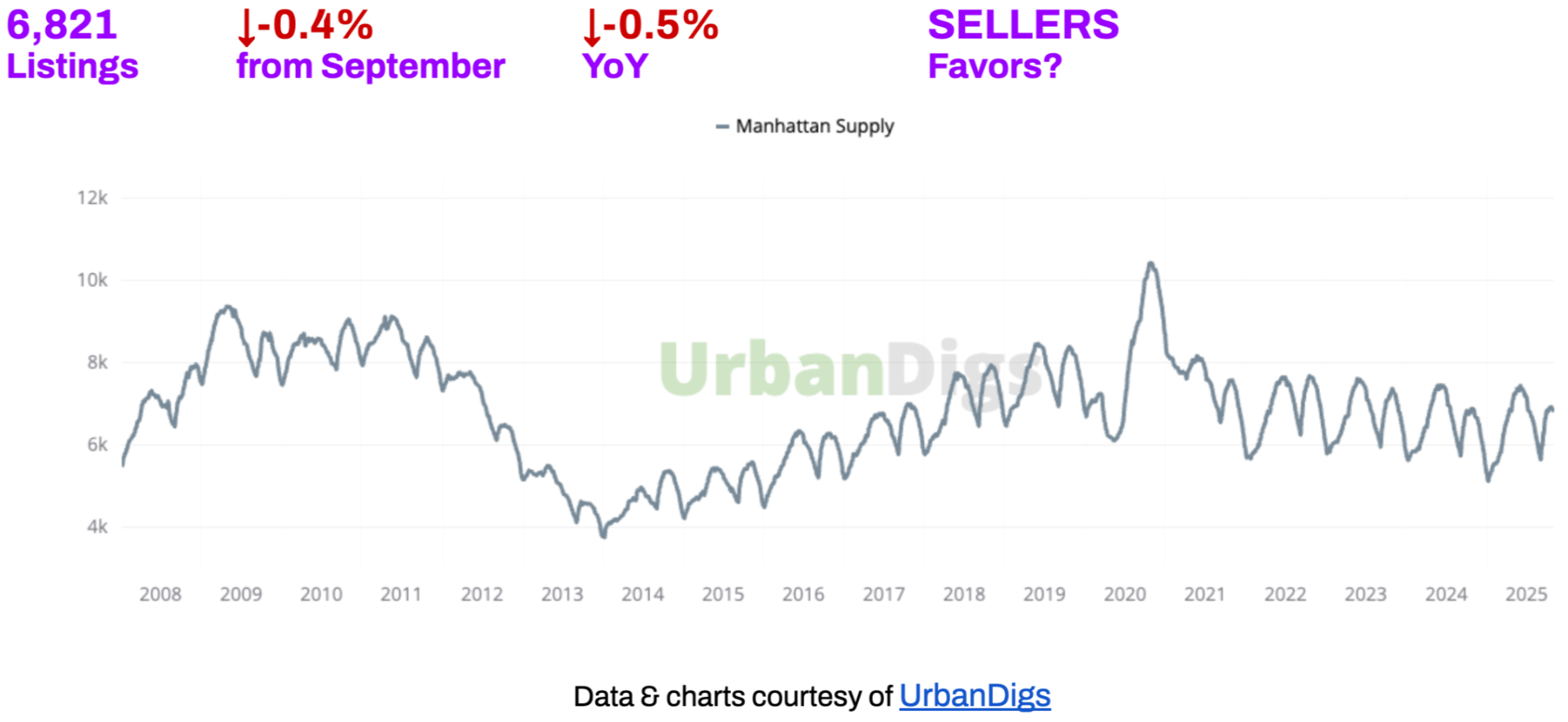

Manhattan Supply: Inventory Continues to Tighten

Manhattan’s active inventory contracted slightly in October, ending the month at approximately 6,821 listings (about –0.4% from September and –0.5% year-over-year). This modest dip in supply, coming right before the holidays, means buyers had even fewer options to choose from.

With inventory so lean by historical standards, conditions in the sales market have tilted back toward sellers in the near term – there is simply less competition for any given listing, which bolsters sellers’ negotiating position.

What This Means for You:

BUYERS: In this tight inventory environment, prepare to act decisively when you find a well-priced home (and consider widening your search criteria), but also know that the holiday season may bring a temporary lull in new listings.

SELLERS: A shortage of listings works in your favor. With fewer homes on the market, your property faces less competition and stands out to serious buyers. It’s an advantageous moment to list if you price your home correctly.

Looking Ahead: Many owners locked into ultra-low mortgage rates are reluctant to sell, which will likely keep supply tight into early 2026. In short, Manhattan’s housing stock should stay constrained – a trend that will continue to give sellers a slight edge going into the new year.

Manhattan Demand

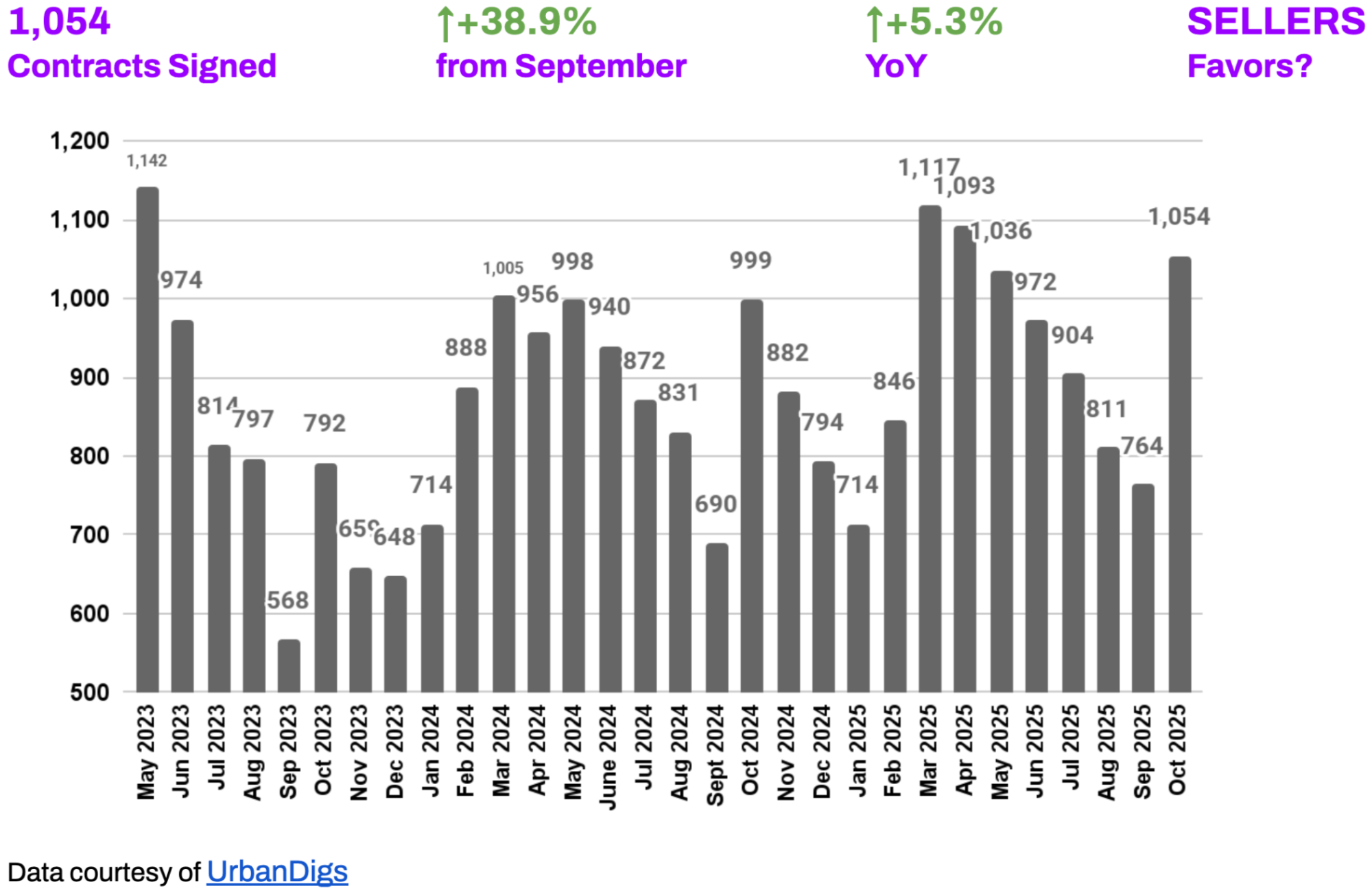

Manhattan Demand: Deal Activity Surges Before Holidays

Buyer demand surged in October. There were 1,054 contracts signed across Manhattan – a massive +38.9% increase from September’s level and about +5.3% more than the same time last year. This spike in deal volume made October one of the busiest months of 2025 for sales activity.

The year-end rush was likely the final push by many buyers to secure a deal before the typical winter slowdown; after a quieter late summer, purchasers jumped back into the market in force during the fall. Such robust contract activity, paired with falling supply, shifted the fall market dynamics in favor of sellers for a brief period.

What This Means for You:

BUYERS: If you didn’t find a home in the October wave, take heart that the coming holiday period should be calmer. Use the slower winter months to regroup and prepare; you may encounter fewer bidding wars in November/December, and some sellers might be more flexible before year-end. However, don’t entirely bank on a discount – the most coveted listings are still drawing interest even in the off-season.

SELLERS: October’s boom in contract signings shows that plenty of buyers are out there, motivated to transact. If your property is still on the market, try to capitalize on any remaining post-fall momentum – there are serious buyers who missed out and are eager to make an offer. That said, as the holidays approach, buyer traffic will thin. Early in the new year, buyer demand could re-energize again, especially if interest rates ease further, so be ready to hit the ground running in January if you plan to list or relist.

Looking Ahead:

We anticipate a quieter final two months of 2025. Looking further out, the fact that contract activity was up year-over-year in October (+5.3% YoY) is a positive sign for underlying demand going into 2026. Barring any economic shocks, buyer interest should remain relatively healthy next year – but expect a slow start in the deep winter before the market wakes up for the spring cycle.

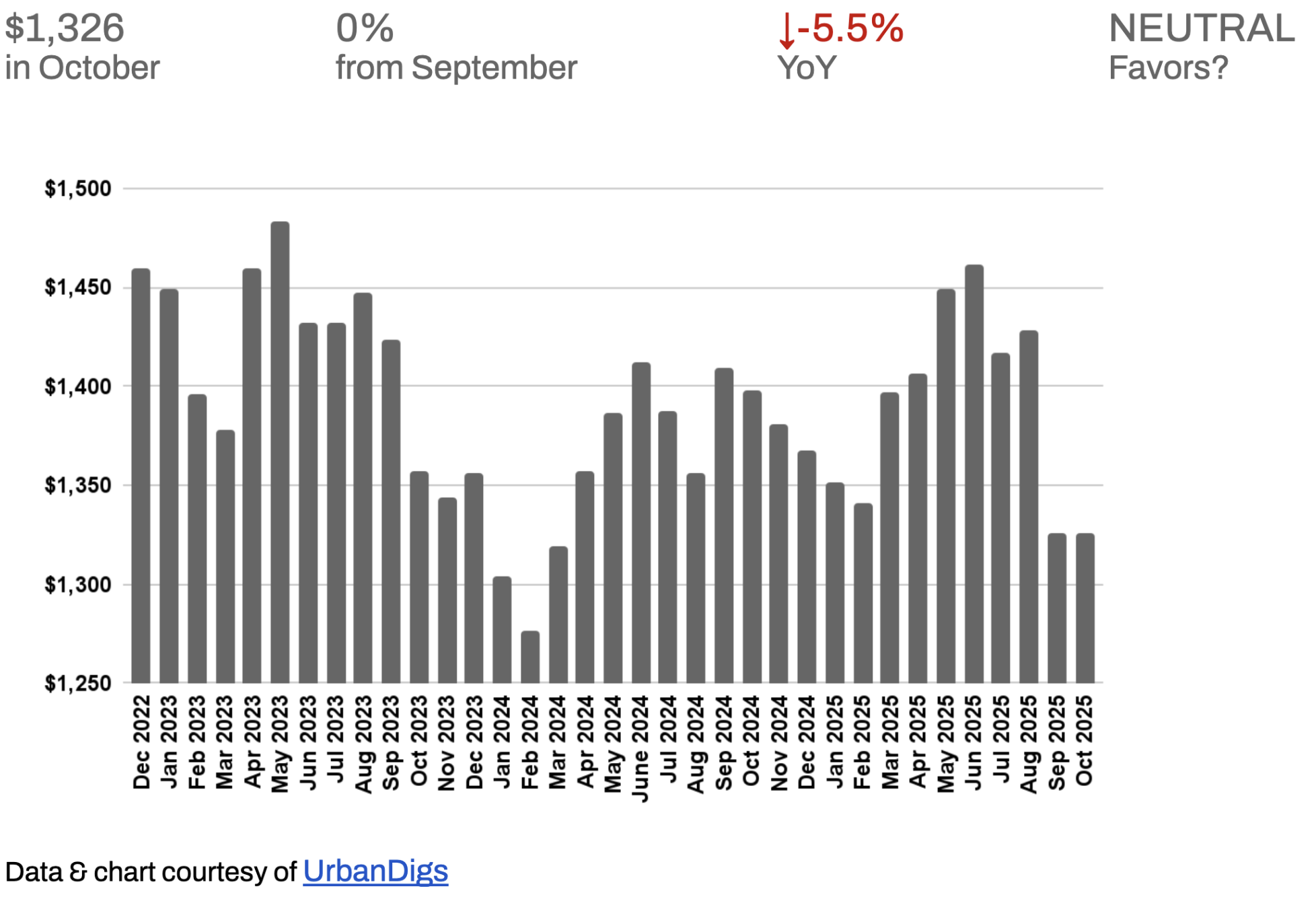

Manhattan Median PPSF

Manhattan Median PPSF: Prices Steady and Resilient

Manhattan’s median price per square foot (PPSF) held roughly $1,326 in October, showing virtually 0% change from September. On a year-over-year basis, median PPSF was about –5.5% lower than October 2024, a mild annual dip. In other words, prices have been broadly stable month-to-month, even as they are slightly softer compared to last fall.

This stability in pricing, despite October’s surge in sales, underscores a resilient market – heightened demand has not pushed prices up significantly, likely because buyers remain price-conscious and interest rates are higher than a year ago.

What This Means for You:

BUYERS: The good news is that despite a frenzied fall for sales, prices haven’t suddenly skyrocketed. With values relatively flat, you’re not chasing a rapidly rising market. Use any holiday lull in activity to negotiate strategically – you have an opportunity to secure a home without paying a steep premium, since pricing is basically stable.

SELLERS: High buyer demand and lean supply are tilting leverage in your favor right now, but buyers are very attuned to value. Pricing smartly is key: properties listed at a fair market price are selling relatively quickly, whereas overpriced listings will stagnate.

Looking Ahead: Importantly, many homeowners with ultra-low pandemic-era mortgage rates will likely stay put, which should keep inventory limited and prevent any major price softening in the near term. In practical terms, Manhattan prices are poised to remain resilient into early 2026. The slight seller’s edge we see now will probably carry over after New Year’s, meaning we’re entering 2026 with a stable pricing landscape.

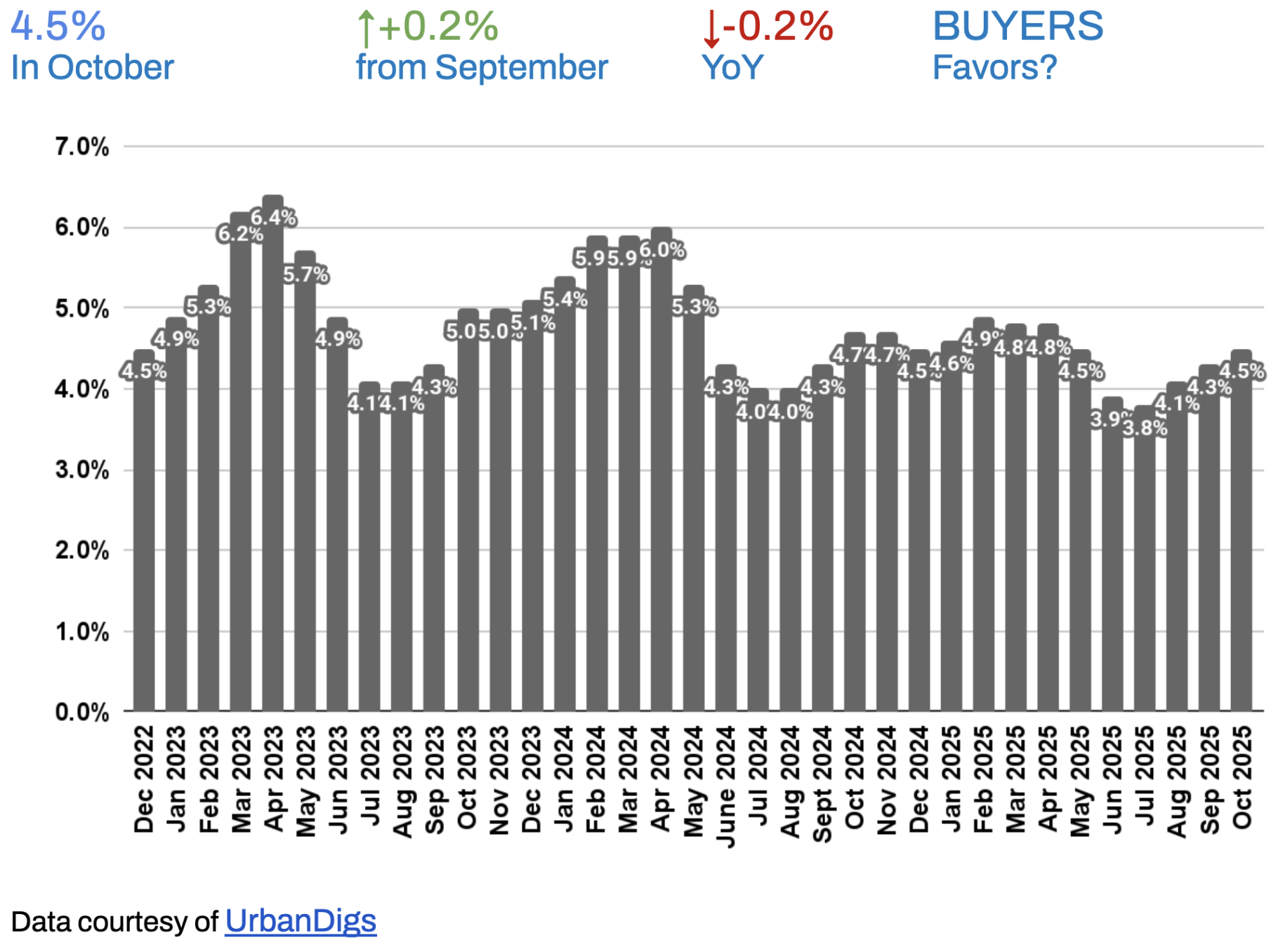

Manhattan Median Listing Discount

Manhattan Median Listing Discount: Negotiations Remain Balanced

The median listing discount – the percentage difference between the final selling price and the last asking price – held around 4.5% in October. This is barely changed from September (up only a tenth or two) and actually a touch lower than the ~4.7% median discount a year ago. In essence, buyers on average paid 95.5% of asking price last month. Such a small discount indicates that most properties are still trading very close to their asking prices.

Negotiations remain fairly balanced: earlier in 2025 (spring/summer), many sellers were getting deals at or even above ask, effectively zero discount, but by fall buyers have regained a bit of bargaining room. However, a mid-4% average discount is modest by historical standards – this is not a market of deep price cuts.

It suggests sellers, for the most part, are pricing realistically and buyers are willing to pay near-ask for desirable listings, resulting in agreements being struck with only minor concessions on price.

What This Means for You:

BUYERS: You have slightly more negotiating power now than you did in the ultra-competitive spring and summer. On average, paying about 4–5% below a home’s asking price is the norm, so use that as a benchmark in your negotiations. This means if a property is listed at $1,000,000, many sellers are settling around $950k–$960k.

SELLERS: The market is not giving buyers massive discounts on well-priced homes – the typical wiggle room is only a few percentage points off list price. What this means for you: if you price your property too high above market value, buyers will simply pass you by, and you could end up with a much larger price cut later.

Looking Ahead: We anticipate that listing discounts will stay in this balanced range through the winter. Unless there’s a major change in supply or demand, there’s little reason to expect either a buyer-favorable drop (larger discounts) or a seller-favorable surge (bidding wars over ask becoming common in sales). In short, heading into 2026 the negotiation playing field should remain relatively level – a continuation of the “near-ask” dealmaking we see now.

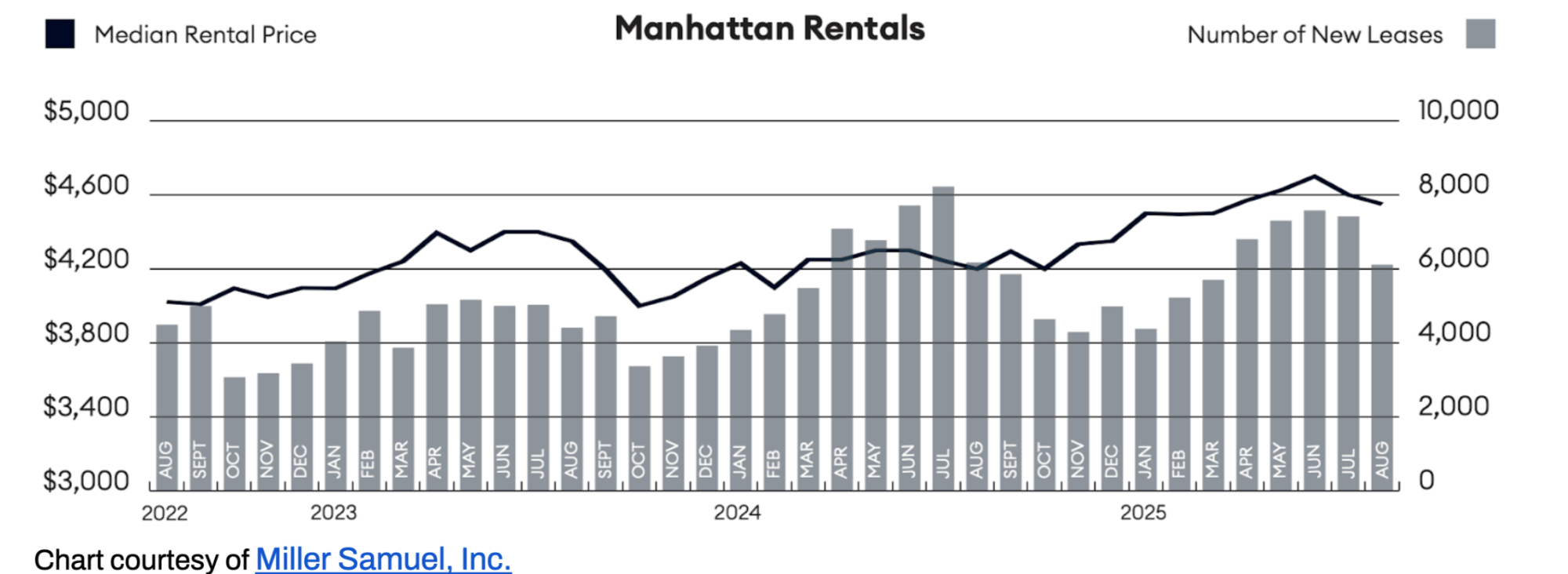

RENTAL REMARKS

Rental Market: Rents Near Record Highs, Landlord Advantages Persist

Manhattan’s rental market remains near historic highs even after a slight late-season breather. In September 2025 (the latest data available), the median rent in Manhattan was about $4,550, which is down a slight 1.1% from August’s all-time peak but still 8.3% higher than a year earlier³.

That annual jump puts rents at one of their highest levels on record – essentially, tenants are paying almost 10% more than last year for the same apartments. Inventory in the rental market is still extremely tight as well: vacancy rates are below long-term norms (around 2.1% in September, vs. ~3% historical average), and many tenants are choosing to renew leases rather than face the open market.

Thanks in part to new pro-tenant regulations and the sheer lack of available units, landlords continue to hold strong negotiating power. In fact, bidding wars are still occurring on roughly 1 in 5 rental listings, even as we head into fall. Seasonal effects are providing a small window of relief for renters – the autumn months typically see rents level off or dip slightly – but overall the NYC rental environment remains heavily landlord-favored.

Even with a 1% ease-off from the summer peak, Manhattan rents are astronomically high, and competition for quality apartments is fierce (with multiple prospective tenants often vying for the same unit).

What This Means for You:

- Renters: Manhattan rents are still near record highs (only about 1% below the summer peak), so any relief you feel right now is unfortunately minimal. Take advantage of this brief seasonal dip while it lasts – you might find a landlord slightly more flexible in winter than they were in the summer – but remember that vacancy is scarce and competition remains intense. Roughly one in five apartments is still renting above the asking price in bidding wars, a sign that demand far outstrips supply.

- Landlords: With vacancy rates below normal and median rents about 8% higher than last year, you retain strong pricing power. Even as we enter the winter lull, well-priced rentals can still spark bidding wars (roughly one in five listings is getting multiple offers). You should remain confident in asking top-dollar for your units. That said, if you want to fill a vacancy faster during the slow season, consider offering a small perk.

- Looking ahead: The winter months should keep rent growth in check – we don’t expect new record highs in the dead of winter, which offers renters a brief breather from the steep increases. However, without a significant influx of new inventory, Manhattan’s rental market will remain historically tight. By early spring, demand will likely ramp up again, and the landlord's advantage will return full-force. That means high rents and tough competition will persist into 2026.

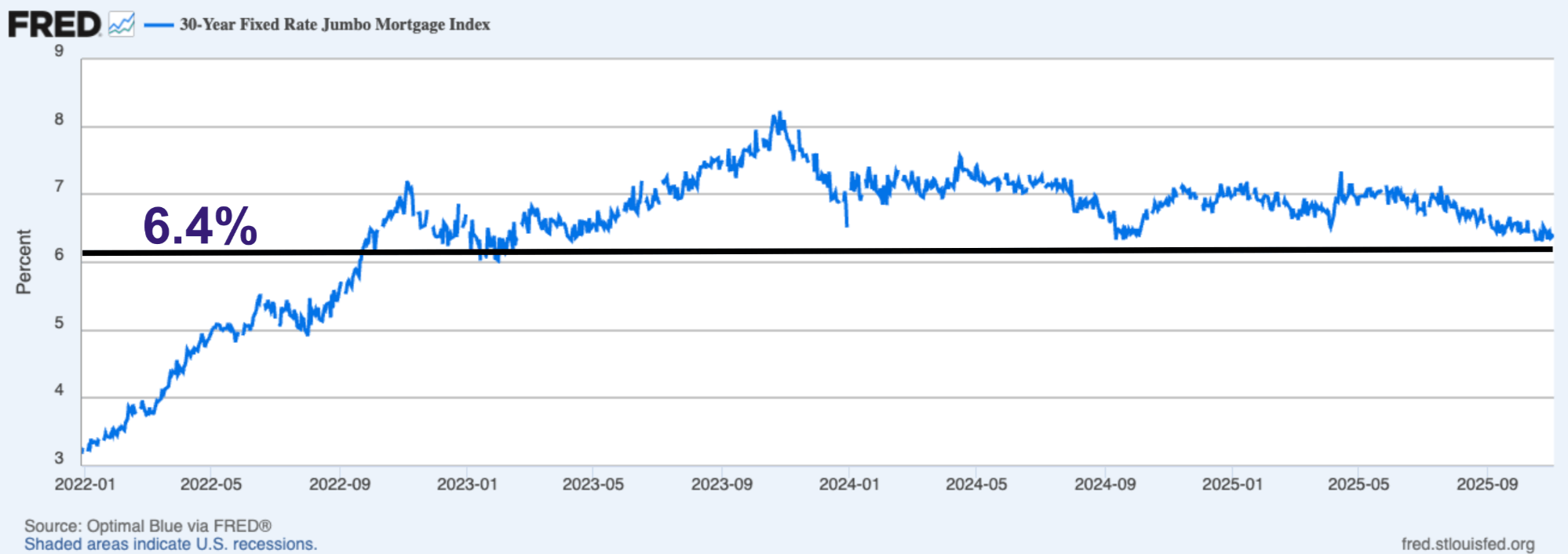

MORTGAGE REMARKS

Mortgage Rates: Slight Relief for Buyers, But “Rate Lock” Keeps Inventory Tight

After reaching 20-year highs this summer, mortgage rates have eased modestly following two Federal Reserve cuts. As of early November, the average 30-year jumbo rate sits around 6.4%⁴, down from midsummer’s 7%+ peak. This offers a mild affordability boost, with average APRs now in the low 6% range⁵.

For example, a 0.5% rate drop cuts monthly costs by ~$300 per $1M loan. Still, rates remain elevated by historical standards (vs. 3–4% pre-2022).

This has created a “rate lock” effect: owners with ultra-low rates from 2020–21 are staying put, unwilling to trade up to higher-rate loans. As a result, resale inventory is extremely tight—fewer new listings mean prices stay resilient despite reduced demand. Buyers who are still in the game (especially cash buyers or those pre-approved) face less competition and may negotiate favorable terms.

On the seller side, limited inventory helps listings stand out. But the smaller buyer pool—constrained by affordability—requires sharp pricing and flexibility. Despite fewer transactions, well-positioned homes still attract offers.

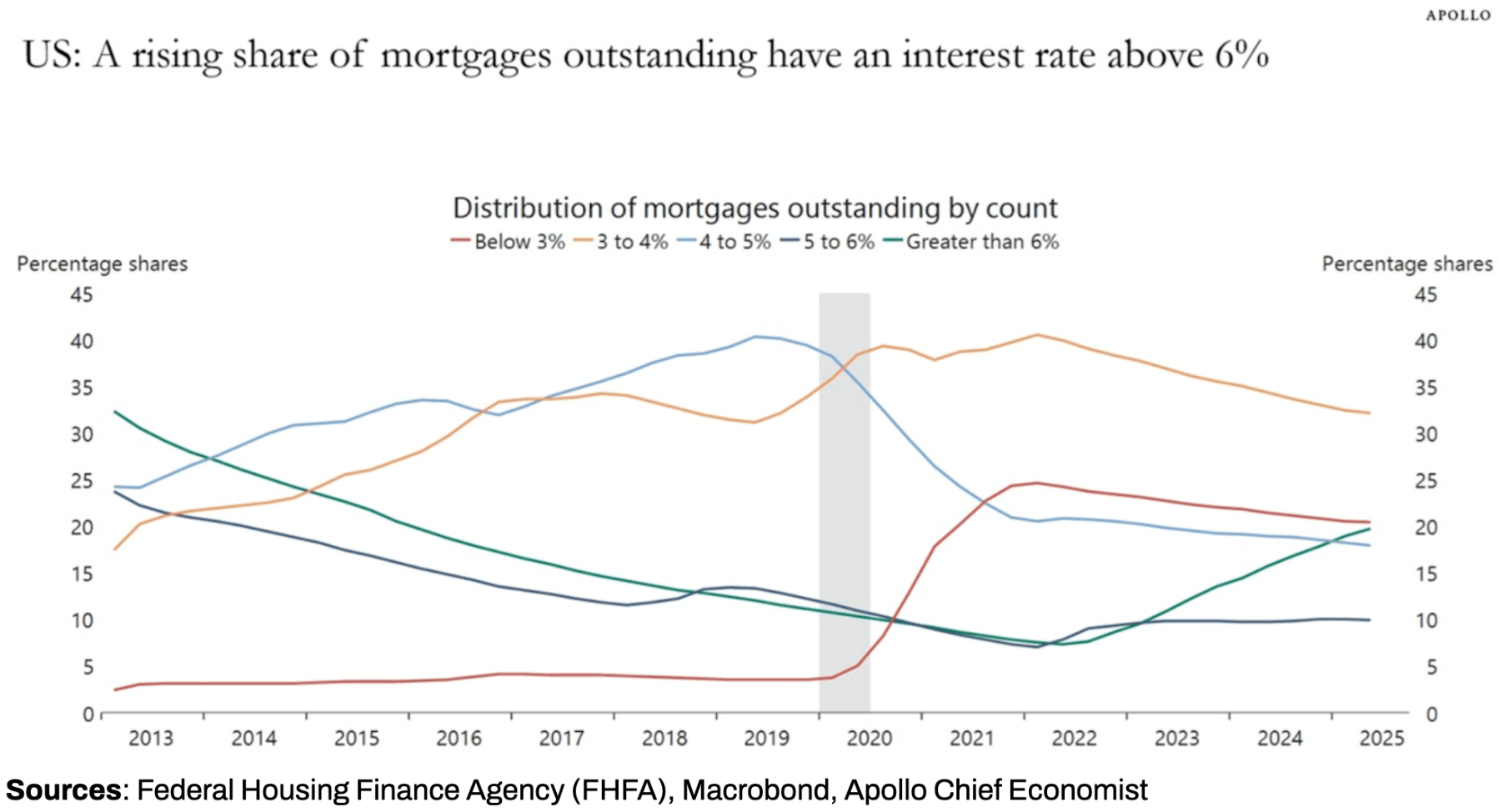

The backdrop: roughly 1 in 5 U.S. mortgages now carry rates above 6%, locking many homeowners in place and keeping listing volumes low. In prime Manhattan submarkets, this lack of mobility has helped support prices⁶.

What This Means for You

Buyers: While rates are still high, the dip to ~6.4% is a welcome reprieve. Budget for ~$620/month per $100K borrowed. With fewer buyers active, competition is thinner—giving you room to negotiate if you’re well-prepared or buying with cash.

Sellers: Take advantage of low inventory, but recognize most buyers are budget-conscious in this high-rate climate. There are simply fewer qualified shoppers at these levels, so pricing realism and deal flexibility are essential.

Looking Ahead: Expect the “rate lock” dynamic to continue into 2026. Even if rates inch lower, they’re unlikely to return to pandemic-era lows. A gradual thaw may lift deal volume slightly, but not enough to significantly shift the pricing equilibrium.

INVESTOR INSIGHTS

Weaker Dollar Lures Foreign Buyers, Locals Stay Strategic

Market Overview

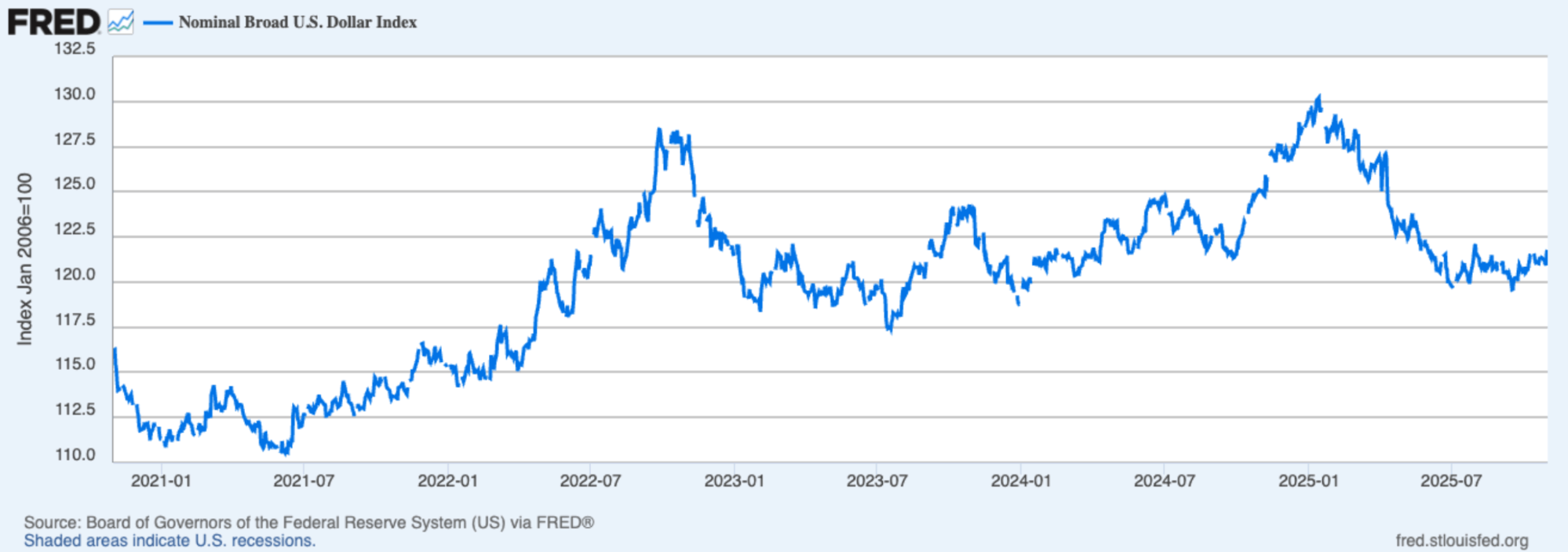

In 2025, a ~4–5% drop in the U.S. dollar has made Manhattan real estate effectively cheaper for foreign investors — a $5M property now feels closer to $4.75M when converted from euros, pounds, or yen. This FX advantage, paired with Manhattan’s status as a stable, long-term asset, has sparked renewed international interest, particularly in luxury condos and new developments.

Meanwhile, local investors face a tougher equation. Mortgage rates hovering around 6–7% and soft rental yields (3–4%) make traditional leveraged plays unattractive. Many domestic players are either sitting on the sidelines or hunting for long-term value-add opportunities, distressed assets, or improved cash-on-cash returns through repositioning.

Key Insight: Global capital is moving actively. Local capital is more cautious, waiting for financing costs or price expectations to shift.

What This Means for You

Domestic Investors:

- Prioritize cash flow and value creation plays (e.g. repositioning, distressed assets).

- Avoid chasing deals that don’t pencil; hold cash until rates fall or discounts emerge.

- Many local buyers are waiting for a better entry point in 2026.

International Investors:

- The FX window offers a built-in discount — now is an opportunistic entry point.

- Manhattan’s fundamentals remain robust, and a stronger future dollar could enhance ROI.

Looking Ahead:

- A rate dip in 2026 could unlock inventory and restore deal velocity.

- Policy shifts from the new city administration may impact investor incentives.

- Expect a bifurcated market: global buyers actively buying, domestic buyers selectively bottom-fishing.

References

1. Data courtesy of UrbanDigs

2. According to the Howard Hanna NYC Manhattan Leverage Index

3. Data courtesy of Miller Samuel, Inc.

4. Data courtesy of Federal Reserve Bank of St. Louis

5. JUMBO mortgage rate APR data courtesy of Bank of America, Chase, and Wells Fargo

6. Sources: Federal Housing Finance Agency (FHFA), Macrobond, Apollo Chief Economist

If you would like to chat about the most recent market activity,

feel free to contact us at contact@hhnyc.com or

connect with one of our Advisors.

Howard Hanna NYC brings the nation’s largest independent and family-owned brokerage to New York City, uniting the strength of a national network with the insight and sophistication of a local firm. Formed through joining forces with Elegran Real Estate, Howard Hanna NYC delivers a seamless, full-service experience backed by more than 15,000 agents across 500 offices in 14 states. The firm’s forward-thinking, agent-first culture continues to shape the future of real estate across Manhattan and the Tri-State area.Learn more at www.howardhannanyc.com.

Categories

Recent Posts

Stay in the Know!

Sign up to receive our monthly newsletter

GET MORE INFORMATION