Weekly Manhattan and Brooklyn Market Update: 11/10

NYC Market Cools as Policy Shifts and Seasonality Take Hold

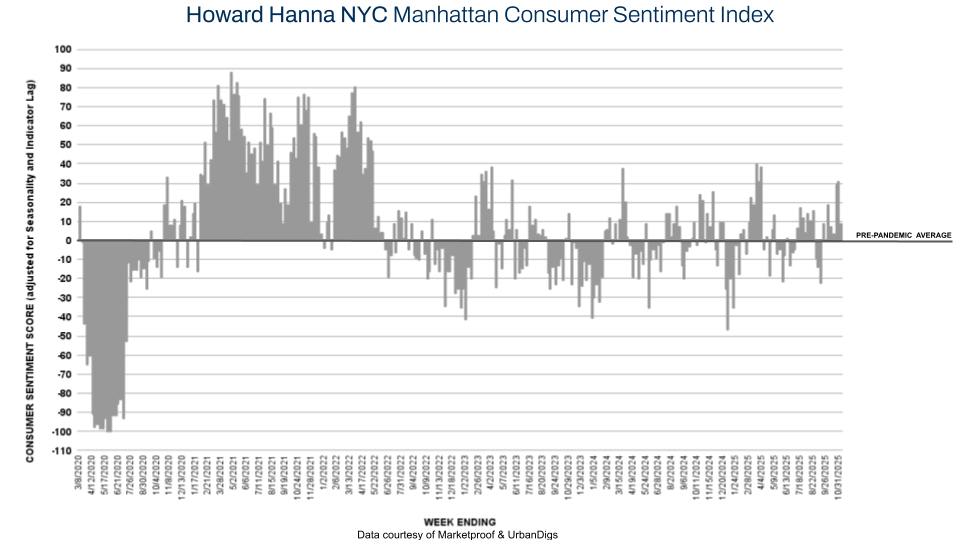

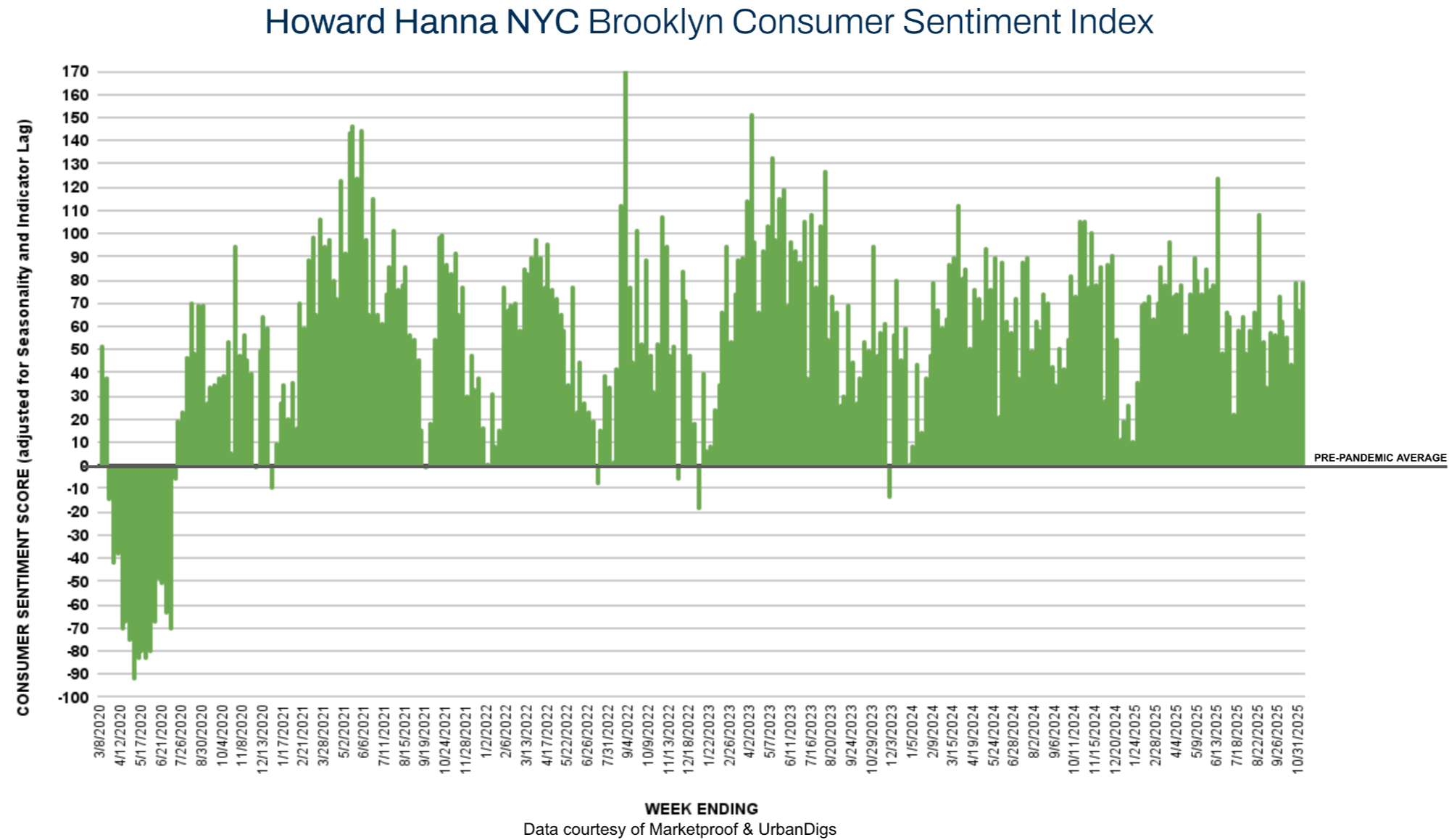

The New York City market is easing into its late-fall phase. Manhattan’s inventory is trending down after a strong October, while Brooklyn’s supply begins to stabilize. The Howard Hanna NYC Consumer Sentiment Index slipped from 40% to 24%, underscoring both seasonal caution and political recalibration following Mayor-elect Zohran Mamdani’s unexpected victory.

While uncertainty often follows new leadership, early signals from the Mamdani transition suggest a pragmatic stance toward property owners and housing supply — potentially softening concerns about anti-development rhetoric. Nevertheless, the market remains structurally sound. Contract volume continues to outperform last year’s lows, and buyer engagement remains steady in the sub-$2M category.

Political Watch: Real Estate Faces the Mamdani Era

Mamdani’s win is reshaping expectations across the real estate sector.

Despite campaign trail tension, his support for ballot proposals 2–5, all of which passed, indicates a more development-friendly posture than headlines imply. His appointments — notably Maria Torres-Springer, a seasoned former Deputy Mayor — are being viewed as a stabilizing influence.

Industry leaders from Hudson Companies and SPONY (Small Property Owners of New York) report early discussions focused on property tax reform and small landlord relief, not punitive regulation.

In short: the narrative may be shifting from confrontation to collaboration — though the proof will come in 2026 policy outcomes.

Manhattan Supply: The Seasonal Pullback Begins

Manhattan’s inventory fell to 6,641 homes (–2.9% WoW, –0.7% YoY) as sellers began their pre-holiday pause. New listings dropped to 225 units (–21% WoW, –15% YoY), confirming the start of the annual winter contraction. This tightening is healthy: it prevents oversupply and keeps pricing steady even as transaction velocity slows.

Brooklyn Supply: Early Retreat Before Thanksgiving

Brooklyn’s supply declined to 3,551 homes (–2.3% WoW, +7.6% YoY), its first contraction after a month of growth. New listings fell to 139 units (–24% WoW, –20% YoY) as more sellers exit the market early for the season. Still, YoY inventory growth remains positive, offering buyers a wider selection than last fall — especially in mid-range price bands where demand remains durable.

Manhattan Pending Sales: Pending sales decreased +2.6% to 3,011 units.

Brooklyn Pending Sales: Brooklyn’s pending sales rose +1.5% to 1,795 units.

Pending activity remains resilient, reflecting deals initiated during October’s brief surge now moving toward close.

Manhattan Consumer Sentiment: Slower but Steady

Contracts signed fell to 212 (–17% WoW, –5% YoY), sending the Howard Hanna NYC Manhattan Consumer Sentiment Index down from +31% to +9%.

This aligns with historic seasonality — Manhattan’s November contract pace typically dips 10–20% versus mid-fall levels as buyers and sellers shift focus to year-end planning.

Brooklyn Consumer Sentiment: A Last Burst of Energy

Brooklyn recorded 138 signed contracts (+8.7% week over week, –10% year over year), lifting buyer sentiment from 67% to 79%. This late-season uptick could mark one of the borough’s last bursts of 2025 activity before the typical Thanksgiving slowdown. Overall, residential sales remain below last year’s pace.

New Development Insights

Marketproof tracked 29 new development contracts across 23 buildings. Top performers included:

-

212 West 72nd St (Lincoln Square), One Manhattan Square (Two Bridges), and The Florian (Gramercy Park) each signed 2 contracts.

If you would like to chat about the most recent market activity,

feel free to contact us at contact@hhnyc.com or

connect with one of our Advisors.

Howard Hanna NYC brings the nation’s largest independent and family-owned brokerage to New York City, uniting the strength of a national network with the insight and sophistication of a local firm. Formed through joining forces with Elegran Real Estate, Howard Hanna NYC delivers a seamless, full-service experience backed by more than 15,000 agents across 500 offices in 14 states. The firm’s forward-thinking, agent-first culture continues to shape the future of real estate across Manhattan and the Tri-State area.Learn more at www.howardhannanyc.com.

Categories

Recent Posts

Stay in the Know!

Sign up to receive our monthly newsletter

GET MORE INFORMATION