Weekly Manhattan & Brooklyn Market: 11/6

Week of 11/6

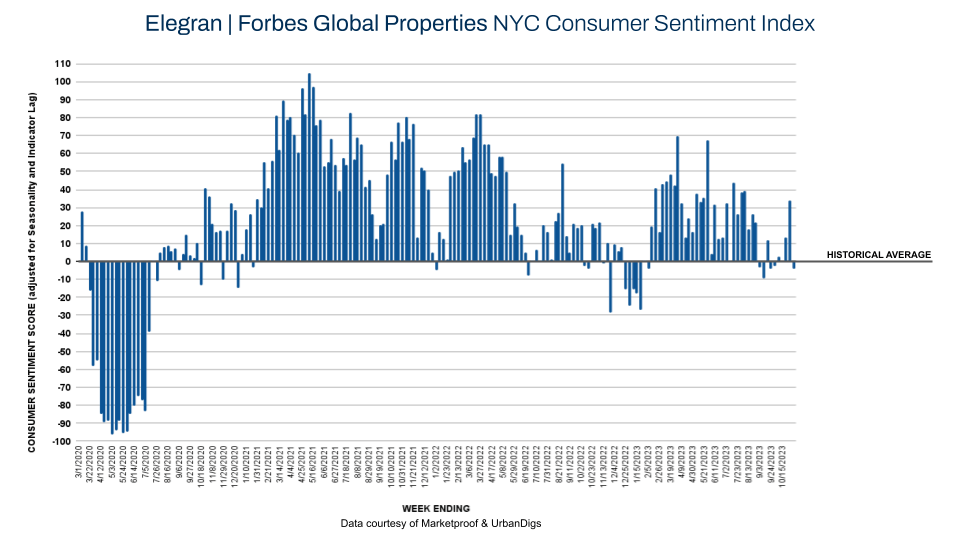

Surprising Early Peak and Cooling Sentiment in NYC's Fall Real Estate Market

This week, we observe a substantial dip in the Consumer Sentiment Index, dropping from +34 to –4. This suggests a 4% decrease in the attitude towards NYC residential real estate relative to the pre-pandemic benchmark.

This decline, to some extent, stems from a potentially early peak in Fall demand, which became evident when pending sales began their decline two weeks ago. Several external factors are also exerting pressure on the market. Geopolitical unrest, with the conflict in Israel and Gaza as a significant stress point, a stumbling stock market, and escalating interest rates have collectively sapped the momentum from the Fall market.

As we move towards winter, a period typically associated with market slowing, NYC still expects to maintain a level of activity consistent with the long-term pre-covid average. Our ongoing analysis of supply and demand, along with consumer sentiment shifts, aims to deliver an informed and transparent view of NYC's unique real estate dynamics.

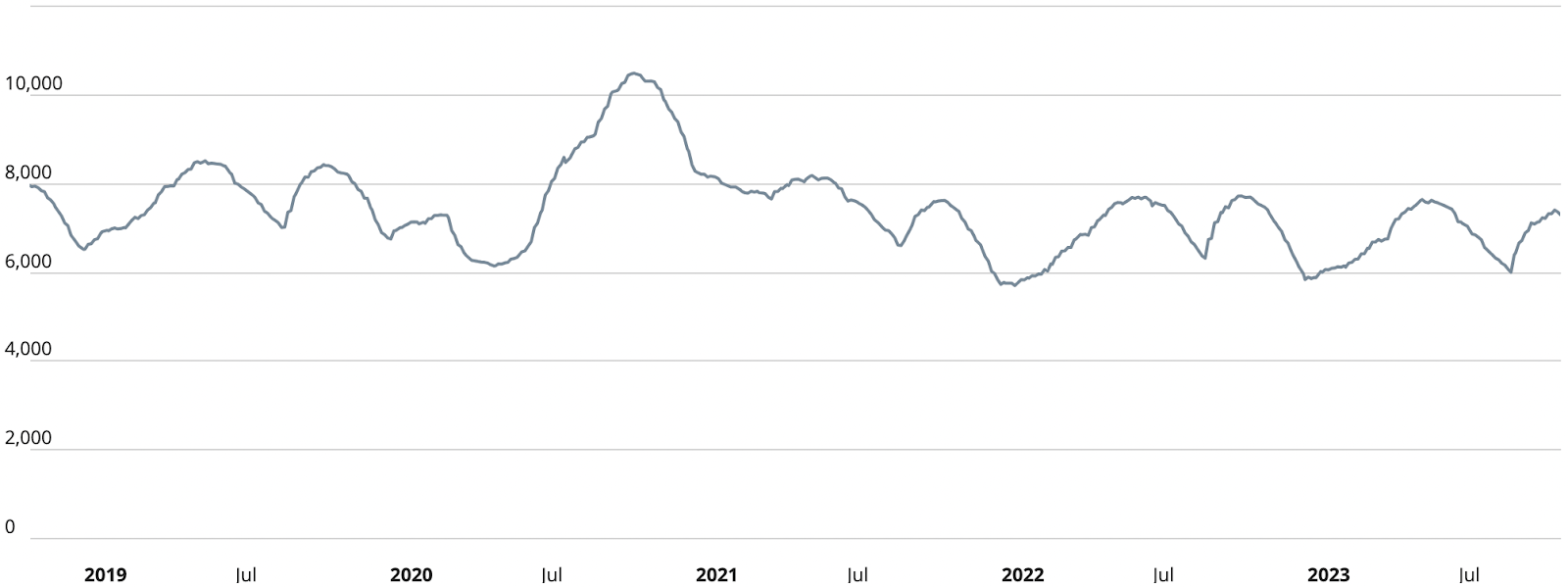

Manhattan Supply

Manhattan's real estate supply dynamics have taken a turn as anticipated, reaching a seasonal high last week.Through the end of the year, we can expect to see a rapid contraction in the number of available units. However, the abundance of supply still overshadows the demand, with a current ratio of 7,288 units available against 150 units closed this week.

Brooklyn Supply

Brooklyn's real estate supply peaked last week and is expected to decline towards year-end. Currently, with 3,330 units on the market far exceeding the week's demand of 123 units, buyers are presented with many choices. This surplus aligns with the distinctive nature of New York City's market, which contrasts with the tighter, more competitive national markets.

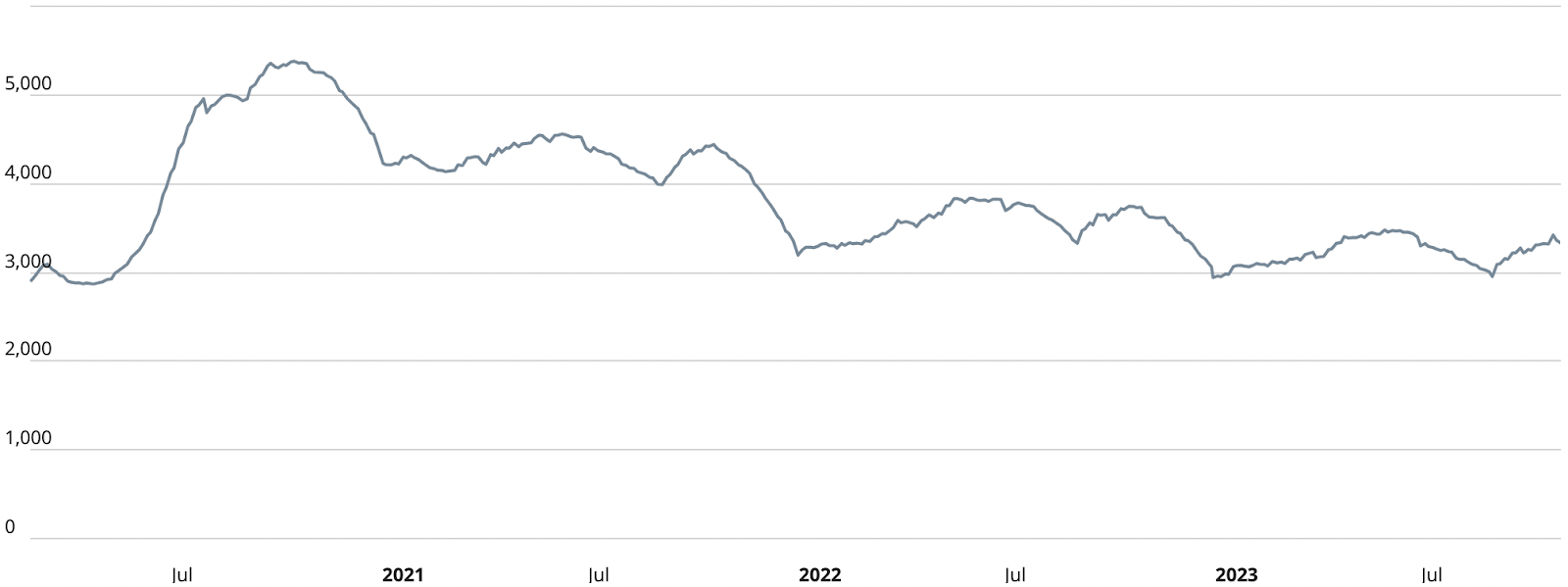

Manhattan Pending Sales

Manhattan’s pending sales have taken an unexpected downturn over the past two weeks. This week's count stands at 2,484 pending sales, indicating an early arrival of the seasonal high, a full month ahead of schedule. This premature decline suggests a shift in market activity that could signal a variety of underlying factors affecting buyer engagement and could potentially influence market trends as we approach the winter months.

Brooklyn Pending Sales

Brooklyn's pending sales this week tally at 1,846, reflecting a similar trend to Manhattan with an early and unanticipated downturn. Historically peaking in late November or early December, the figures suggest that this year's peak may have already occurred. This premature decrease could be indicative of broader market shifts or specific local factors influencing Brooklyn's real estate dynamics as we move into the final stretch of the year.

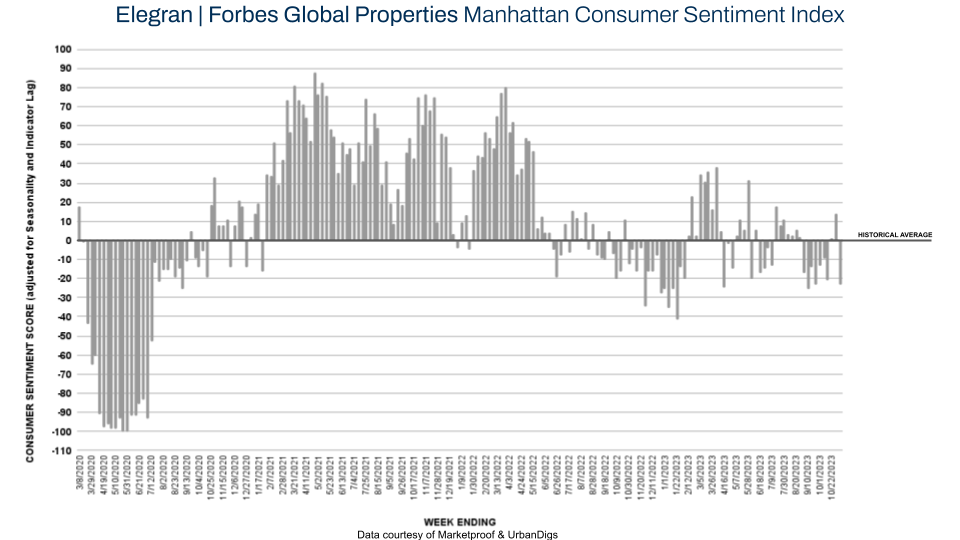

Manhattan Consumer Sentiment

This week in Manhattan, the Consumer Sentiment Index has seen a significant drop, plunging from +14 to –23. This change in attitude towards Manhattan residential real estate is attributed to various factors including the premature peaking of fall demand, geopolitical unrest, a declining stock market, and rising interest rates. These elements have collectively contributed to the subdued sentiment and are reflective of a broader hesitancy in the market. With buyer activity slowing, the number of contracts signed has decreased to 150 this week, down from 210.

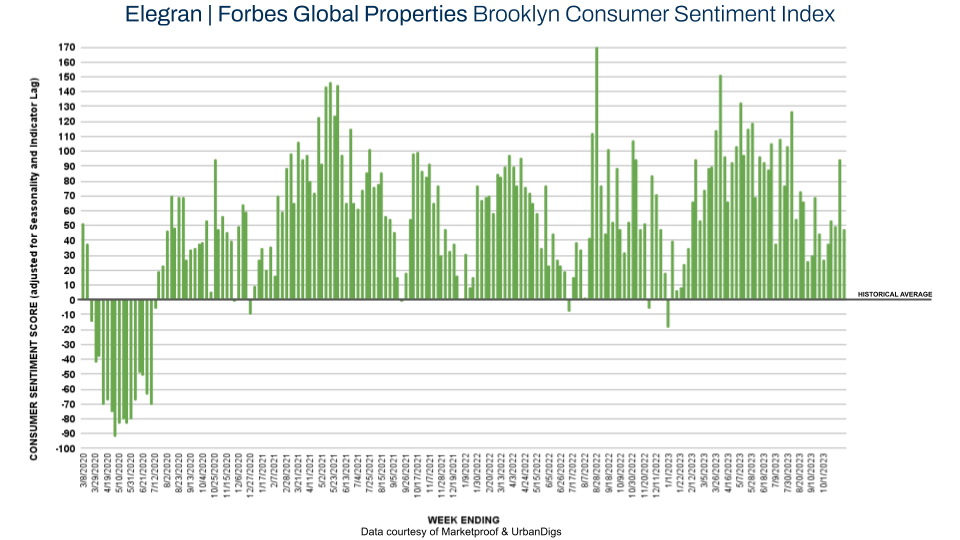

Brooklyn Consumer Sentiment

Brooklyn's Consumer Sentiment Index has halved from +94 to +47 this week, a sharp reduction. Yet, our chart still indicates that sentiment is 47% above its pre-pandemic average. Despite the fall, consumer confidence in Brooklyn has largely remained stronger than historical averages since July 2020. The drop this week, while significant, continues to highlight Brooklyn's resilience and attractiveness to buyers, with 123 contracts signed versus 134 the previous week, suggesting sustained interest in Brooklyn's real estate market.

New Development Insights

Marketproof reported that 27 new development contracts were signed in 24 buildings this week. The following buildings were the top-selling new developments of the week:

- GREENWICH WEST (SoHo)

- 450 WASHINGTON (Tribeca)

- 134-16 35TH AVENUE (Flushing)

Each reported two contracts.

If you would like to chat about the most recent market activity, feel free to contact us at info@elegran.com or connect with one of our Advisors.

About Us

Welcome to Elegran, where our mission is to revolutionize the world of real estate. Founded in 2008 by Michael Rossi, our journey began with an unwavering drive for motivation, innovation, and a genuine care for our clients.

As an independently owned brokerage, we pride ourselves on our elite team of "advisors," offering a personalized touch that goes above and beyond the traditional real estate experience. Armed with robust data insights, we empower our clients to make informed decisions that lead to success.

Distinguished as the exclusive member of the invitation-only Forbes Global Properties network in NYC, Elegran proudly stands at the forefront of excellence. This exclusive partnership broadens our horizons, enabling us to connect buyers, sellers, and investors with extraordinary luxury properties not only in New York City but across the globe.

Our passion lies in turning your real estate dreams into reality, and we are committed to providing exceptional service at every step of the journey.

Are you ready to experience the Elegran difference? Dive into the possibilities at www.elegran.com and embark on an unforgettable real estate adventure with us.

Categories

Recent Posts

Stay in the Know!

Sign up to receive our monthly newsletter

GET MORE INFORMATION