Elegran Brooklyn Market Update: October 2022

Overall Brooklyn Market Update: October 2022

For the past 3-months, Brooklyn’s contract volume has been at or very near parity with the historical average. Why is that important? Because it is a monumentally victorious headline. ^GSPC (the S&P 500 index) ended September down 25% YTD and mortgage rates ended September higher by 100% YTD yet, despite these intense headwinds, buyers are participating in the market as normal.

With every passing challenge, the hue of NYC’s blue chip status on the world stage continues to grow deeper and more vibrant. We’ve previously published vis-a-vis NYC real estate’s incredible resilience — after the 9/11 tragedy; after the 2007–2009 stock crash; after Hurricane Sandy and after COVID. New York City’s bona fides as a low volatility hard asset is incontestable and Brooklyn joins Manhattan as an important part of that story.

Brooklyn Supply

Total supply increased 6.5% to 3,433 units for sale, due in large part to the 931 new listings that were uploaded during September. We can expect a bump in those numbers again next month since, historically, October is the high mark of supply. Brooklyn inventory is still well shy of the record high reached in 2020 as uncertainty prompted increased listing activity and significantly lower, too, than 2021 as sellers leveraged record demand.

Brooklyn Buyer Activity

As measured by signed contracts, consumerism was in line with the historical average yet significantly off the tally of the two previous years.

However, this is to be expected — and welcomed — since 2021 and the majority of H1–2022 witnessed a record number of residential reservations due to both the manifestation of COVID-driven pent-up demand and the expedition of future demand driven by rising mortgage rates. The continuation of inflated absorption would have ultimately become unhealthy and adversely affected future markets. Since July (PLEASE REFER TO CHART BELOW), contract volume has been at or very near parity with the historical average, a strong signal that Brooklyn’s market was in fact not overbought and that the market corrected itself (i.e., reverted to the mean) in time and in avoidance of such adverse effects.

Brooklyn Monthly Contract Activity

History suggests that next month’s contract volume will bump up again, no doubt a function of September’s surge in listings.

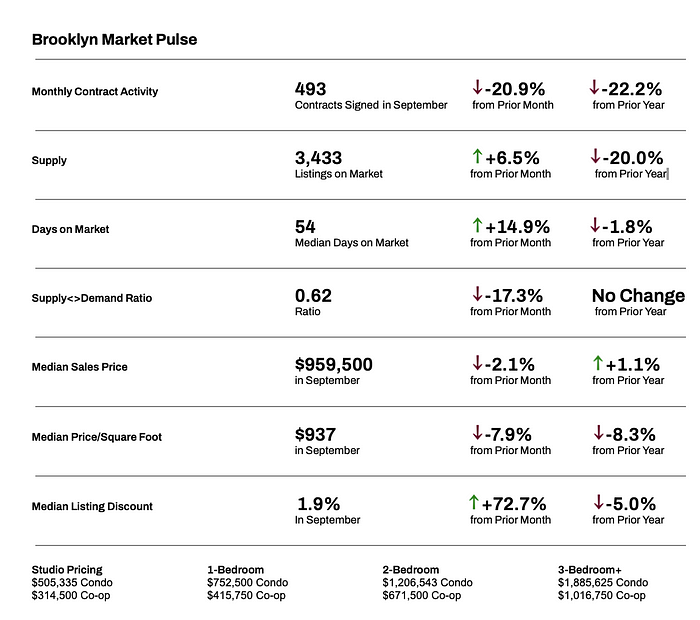

Brooklyn Market Pulse

Currently at 0.64, the ratio of demand (as measured by pending sales) to supply, decreased 17% from August.

The graph below tracks the monthly aggregate of demand (as measured by contracts signed), supply and median price/sf. It indicates that Brooklyn is firmly in the grips of a buyer’s market as stock market and mortgage rate woes have driven down demand.

Pricing & Discounts

At $959,500, median sales price is little changed compared to last month and the same time last year, yet price per square foot, currently $937, was down approximately –8% across both time periods. This suggests that larger residences are now selling for the same price. September’s listing discount, 1.9%, has been ticking up, but is still lower than any point during 2019–2021.

What this means for…

Buyers:

- Brooklyn is firmly in the grips of a buyer’s market due to retreating demand. Remember, a buyer’s or seller’s market suggests which party feels the urgency to transact and, in the case of a buyer’s market, it is the seller who feels that urgency. Conversely, buyers have ample product, ample time and prices moving in their favor.

Sellers:

- Need to be aware that buyers are in the driver’s seat for the time being.

- Expect competition in the form of more sellers coming to market next month. Carefully monitor the comps and be responsive with asking prices to stay competitive and relevant to buyers.

- Pay attention to homes that were taken off the market, as that can be a good indicator of what may have been priced too high.

- Sellers who are not commanding their desired sales price should consider renting their home instead, at least for a year or two, and capitalize on the strong rental market and high rents.

Renters:

- The rental market is as competitive as ever with rents remaining stubbornly high, although there are signs that the peak of pricing has recently passed.

- Much of the new-to-market rental supply is coming from tenants who received Covid-era rent prices and are now priced out of the apartments as their renewal rents skyrocketed.

Investors:

- Current market conditions create an opportunity for cash-investors (who are either liquid, or able to trade out of another real estate investment) to invest in Brooklyn real estate.

- Brooklyn presents relative value compared to national markets that experienced steep price appreciation over the last 24-months, now overheated with little to no room for near-term growth.

- The strong rental market may create a floor for sales prices, offering sellers the option to rent their home for 1–2 years if they are unable to command their desired sales price.

Categories

Recent Posts

Stay in the Know!

Sign up to receive our monthly newsletter

GET MORE INFORMATION