Elegran Brooklyn Market Update: July 2025

Rihards Gederts - Elegran

Rihards Gederts - Elegran

Overall Brooklyn Market Update: JULY 2025

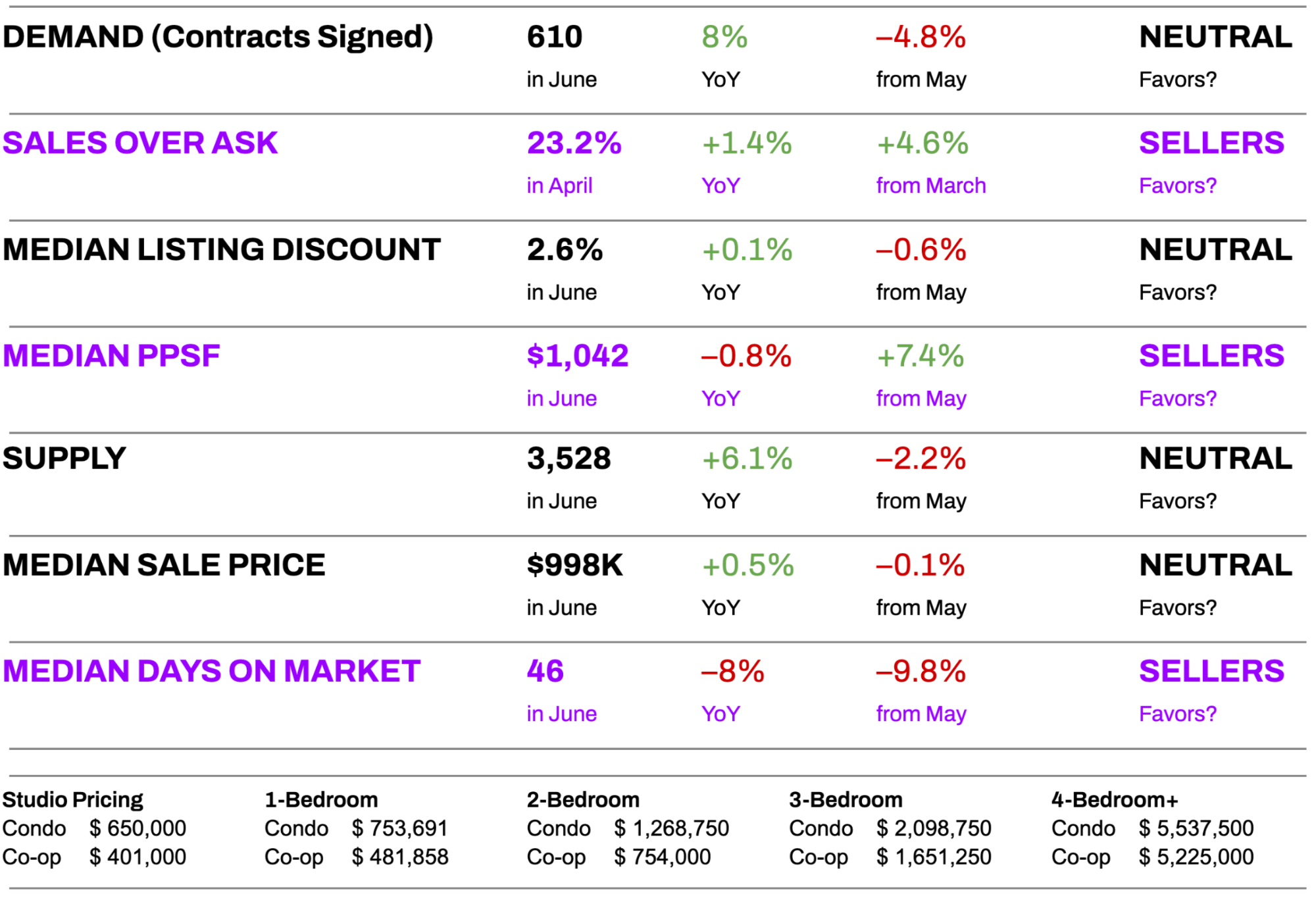

Brooklyn Market Pulse¹

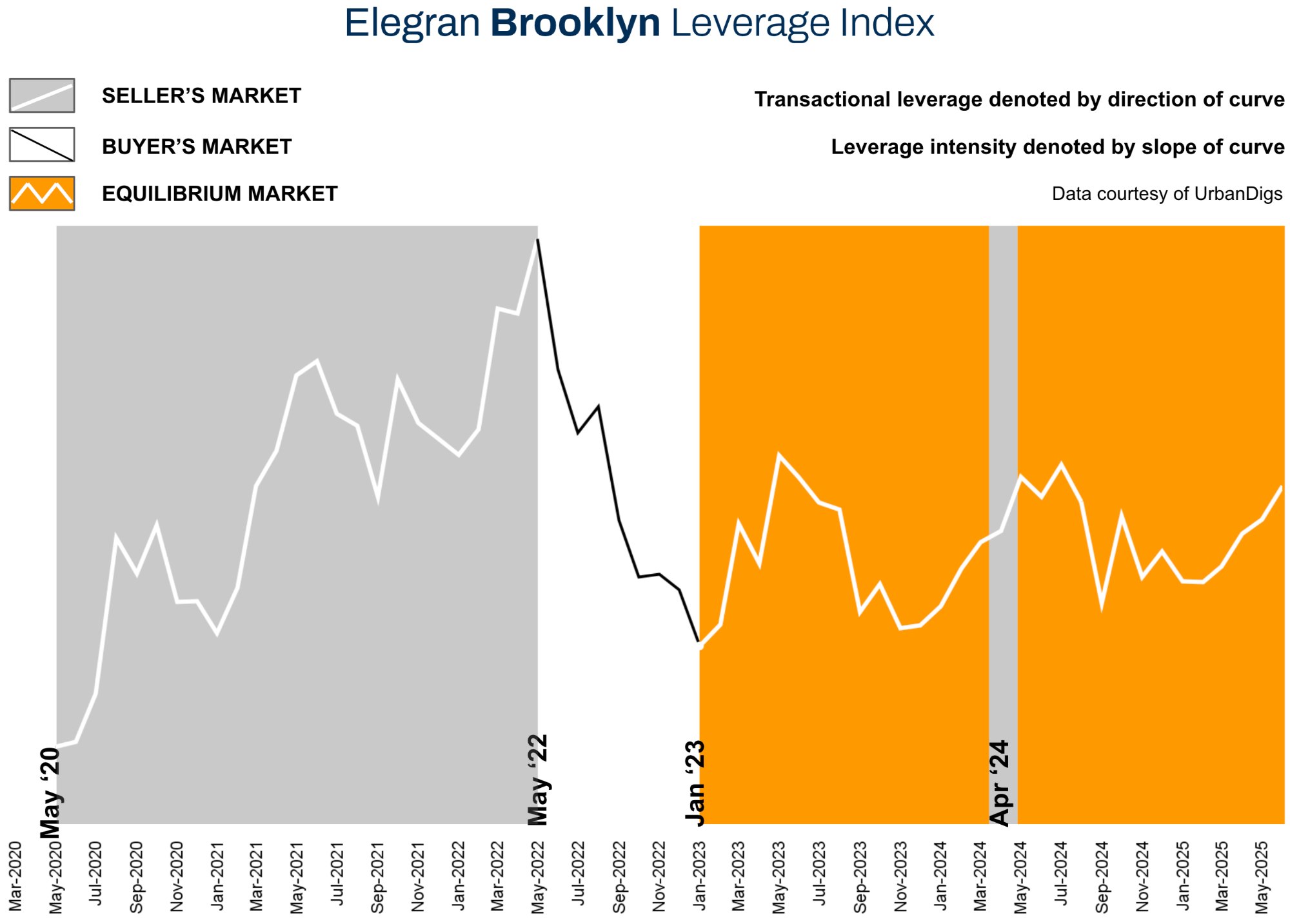

Elegran Brooklyn Leverage Index

The Elegran Brooklyn Leverage Index² is powered by four indicators: supply, demand, median price per square foot (PPSF), and median listing discount.

It informs us whether the current market is a buyer’s or a seller’s market, i.e., which party possesses transactional leverage. Looking at the graph below, this is indicated by the direction of the curve, where:

- An increasing trend from left to right indicates a seller’s market

- A decreasing trend from left to right indicates a buyer’s market

Our indicator also informs us regarding the relative strength of that leverage, indicated by the slope of the curve, where:

- A gentle slope indicates a weak advantage by one party over the other

- A sharp slope indicates a strong advantage

It’s not the numbers that matter—it’s the direction and slope of the curve. In June, Brooklyn’s momentum picked up again, and the Elegran Brooklyn Leverage Index rose. While we’re still in a relatively balanced market, the shift is leaning in favor of sellers.

What’s driving this change? Homes are selling faster, buyers are negotiating less, and the price per square foot is on the rise. Even though contract activity dipped slightly from May, it’s still notably higher than this time last year, and that’s giving sellers more confidence.

The bottom line: This isn’t a runaway seller’s market, but if a home is priced right and shows well, the current environment is working in the seller’s favor.

Brooklyn Supply

Brooklyn Supply: More to Choose From, But Still a [Comparatively] Tight Market

At the end of June, Brooklyn had 3,528 homes on the market, down slightly from May, but 6% higher than this time last year. That means buyers have more to choose from than they did last summer, but it’s still a far cry from the pre-2022 days when inventory was more abundant.

What This Means for You:

BUYERS: You’ll find more options than last year, but the best homes are still going quickly. If you see something you love, be prepared to act quickly.

SELLERS: With more listings on the market, buyers have more choices, so pricing and presentation are key. The well-priced, well-prepped homes are the ones that get snapped up.

Looking Ahead: If inventory remains steady or declines further, sellers could experience stronger pricing power as we head deeper into the summer.

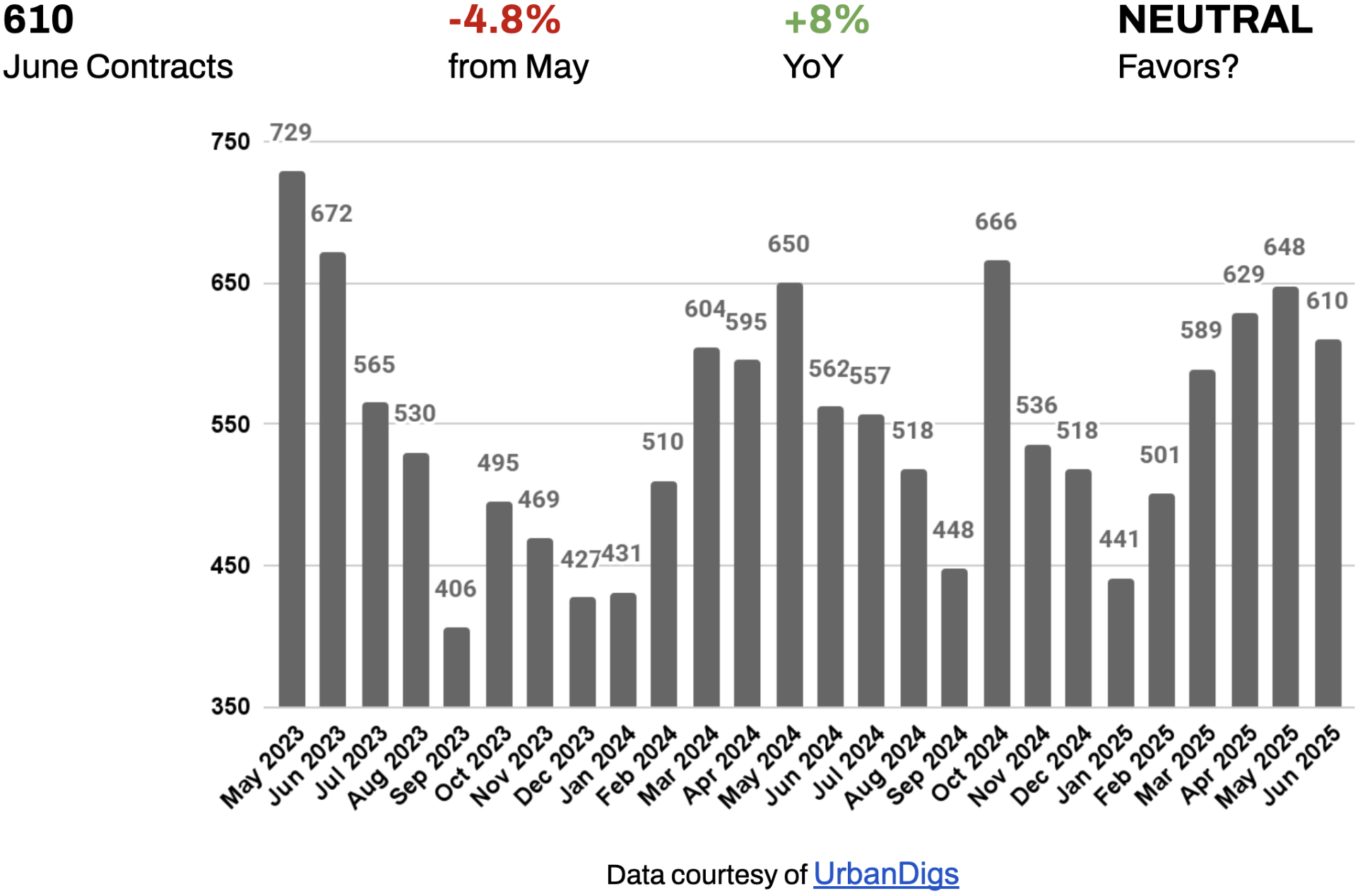

Brooklyn Demand

Brooklyn Demand: Steady Interest, Especially in the Mid-Market

In June, 610 homes went into contract across Brooklyn. That’s a slight dip from May (down 4.8%), which is typical for early summer, but still 8% higher than this time last year.

The takeaway? While the market is following its usual seasonal rhythm, buyer activity is holding strong, especially in the mid-price range.

What This Means for You:

BUYERS: You’re not alone out there. While inventory isn’t overwhelming, the best homes are still attracting attention fast. If you find something that checks your boxes, don’t wait too long, as other buyers are ready to act.

SELLERS: The year-over-year jump in contract activity is a good sign: demand is steady, and buyers are serious. That said, June’s slight slowdown means that pricing and presentation still matter, and homes that show well and are priced correctly are the ones that receive offers.

Looking Ahead: July is typically a quieter month, but activity is expected to pick up again in September as the fall market begins.

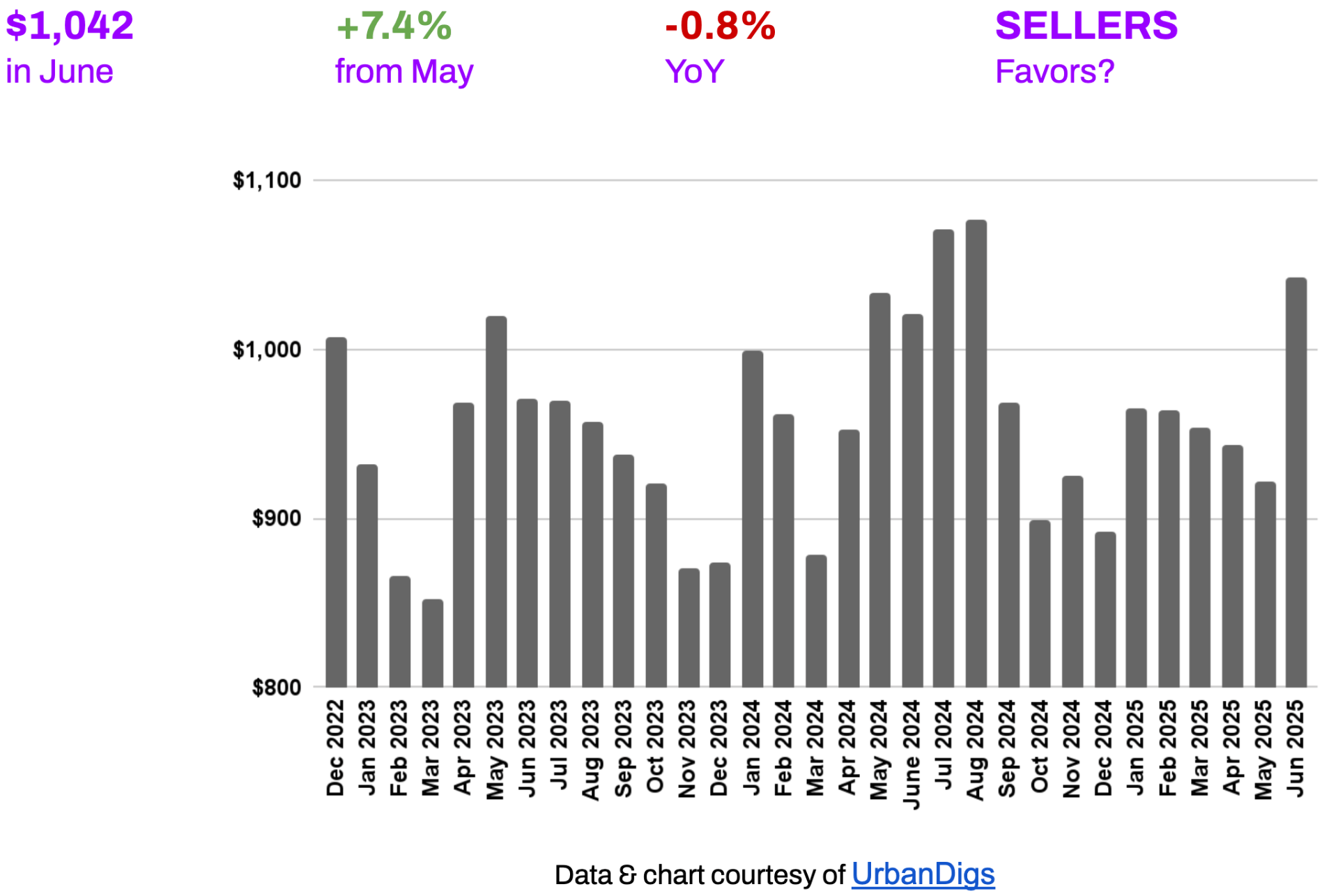

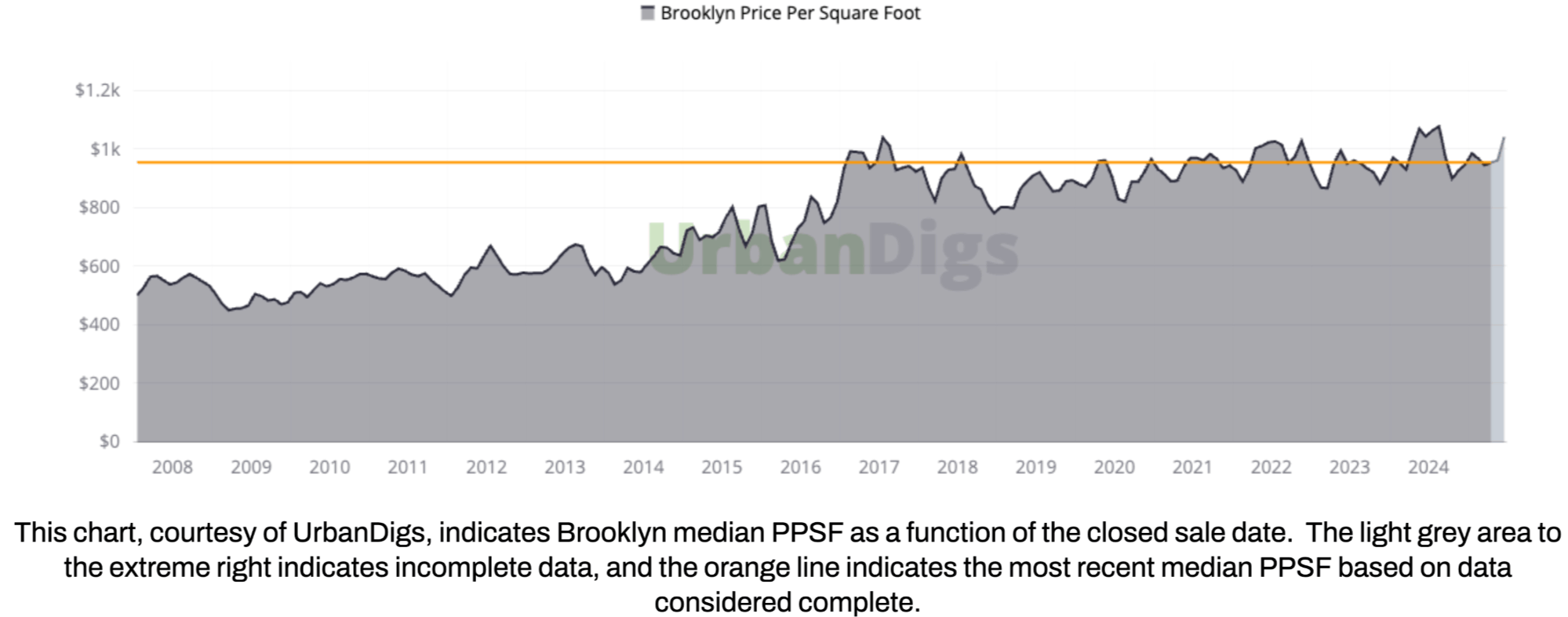

Brooklyn Median PPSF

Brooklyn Median PPSF: Prices Rise as Buyers Prioritize Value

In June, Brooklyn’s median price per square foot rose to $1,042, a 7.4% jump from May and holding steady compared to last year. This indicates that buyers are still willing to pay a premium, but only when a home truly delivers on value.

What This Means for You:

BUYERS: The top-tier homes are still going for top dollar. Focus on what matters most to you—location, layout, and light—and ensure the price reflects the quality and lifestyle you’re getting. Don’t stretch just to win a bidding war.

SELLERS: If your home is well-maintained, well-presented, and priced competitively, now is a great time to list. Buyers are active and ready to pay for quality.

Looking Ahead: If prices per square foot continue to rise, sellers can expect stronger pricing power heading into the fall.

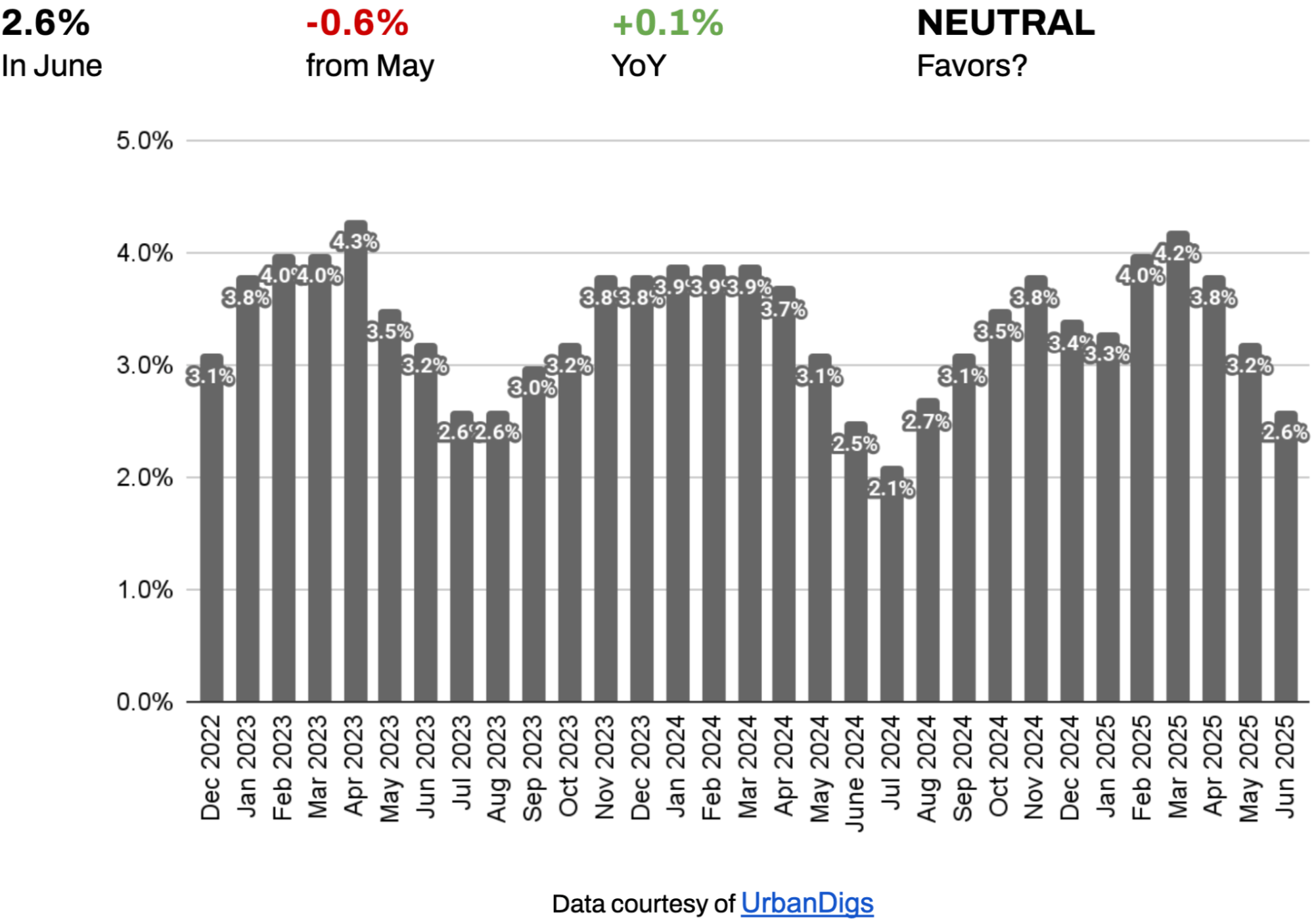

Brooklyn Median Listing Discount

Brooklyn Median Listing Discount: Smaller Discounts, Smarter Pricing

In June, the average listing discount in Brooklyn dropped to 2.6%, down from 3.2% in May. That’s the third month in a row of tighter negotiation margins, showing that sellers are pricing more realistically, and buyers are stepping up when the price is right.

What This Means for You:

BUYERS: Don’t count on big price cuts. Well-priced homes are selling close to their asking price, especially if they’re new to the market. If a listing has been sitting, you may have room to negotiate, but otherwise, be prepared to act quickly and competitively.

SELLERS: Today’s buyers are well-informed and selective. Listings priced in line with recent sales are getting strong offers. Overpriced homes, however, are often overlooked. The key is to be realistic and strategic from day one.

Looking Ahead: If current trends continue, don’t expect discounts to grow. In fact, they may shrink even more heading into the fall market.

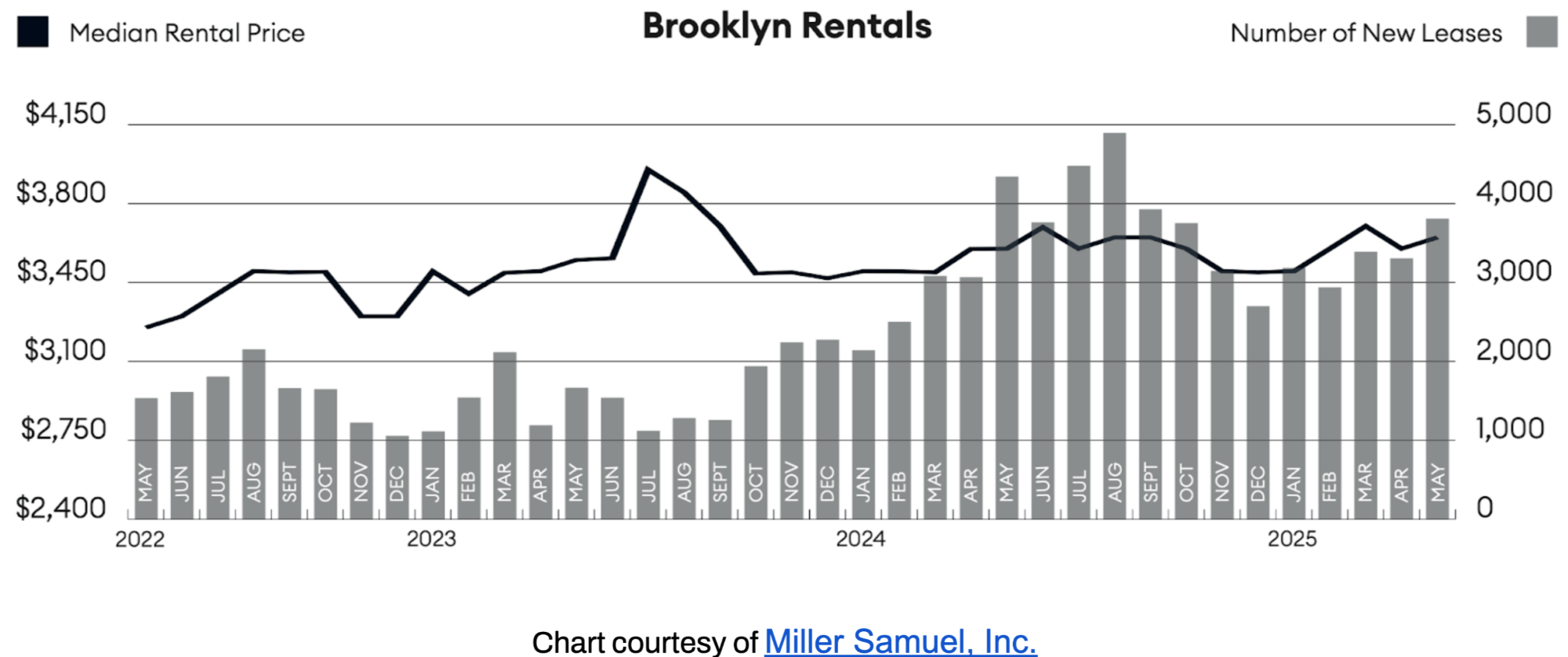

RENTAL REMARKS

Brooklyn Rental Market: Post-FARE Pressures Begin to Build

The median rent in Brooklyn bounced back in May, increasing to $3,650 month over month, which marks a 1.4% increase and a similar year-over-year increase of 1.4%. Average rental price per square foot rose annually to the highest on record. Also important to note that new lease signings declined year over year for the first time in twenty months.³

What’s next? We may see rents rise even further this summer, following the rollout of the FARE Act, which took effect on June 11, 2025. The new law shifts the broker fee to the party hiring the broker. While this change was designed to lower upfront costs for renters, many landlords are already adjusting by raising monthly rents to absorb the extra expense they now face.

Because May data reflects conditions before the FARE Act took effect, June and July will provide a clearer view of how the new law is truly impacting rental prices. That said, early signs are striking: In the 10 days following the law’s implementation, Manhattan’s median asking rent jumped 11%, while Brooklyn saw a 6% increase, compared to the 10-day period just prior. These early shifts suggest landlords are already adjusting pricing in response to the law’s new cost structure.

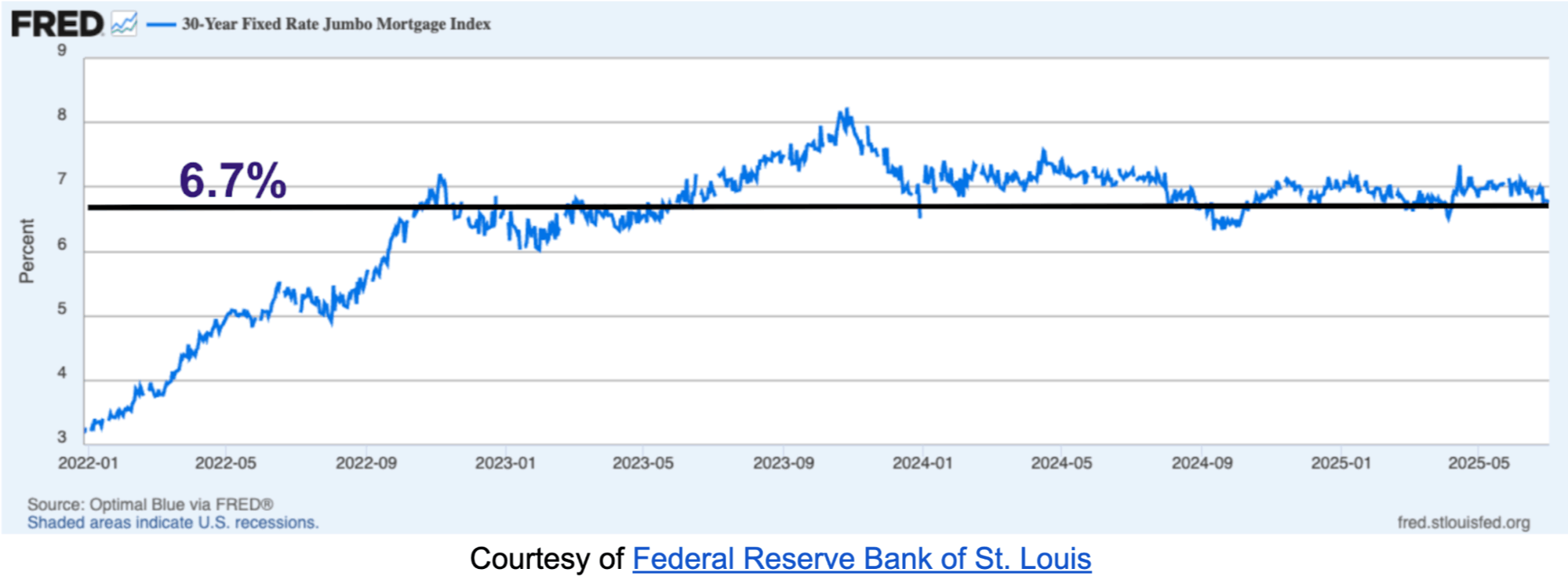

MORTGAGE REMARKS

Mortgage Rates: The New Normal Settles In

Jumbo mortgage rates have stabilized around 6.7% for a 30-year fixed⁴, with APRs hovering near 6.5%⁵. While still elevated historically, this new rate environment has been largely absorbed by both buyers and sellers. The market has stopped waiting for “perfect rates” and is moving forward based on life needs.

INVESTOR INSIGHTS

A Weaker Dollar Makes Brooklyn More Attractive to Global Buyers

As the U.S. dollar softens, international buyers are finding more opportunity in Brooklyn real estate, especially those making all-cash purchases.

For all-cash investors, current cap rates in Brooklyn range from 3.0% to 3.4%, offering stable, predictable income. While financing deals can be tighter in today’s rate environment, international buyers benefit from stronger currency exchange rates, which may also work in their favor at resale.

What This Means for You:

Domestic Investors: Seek long-term upside in well-located properties, especially those with value-add potential.

International Buyers: Your local currency goes further in Brooklyn. This is a good time to lock in deals, especially for all-cash purchases. Global investors, particularly from Europe and Asia, can acquire U.S. real estate at more favorable exchange rates.

Looking Ahead: Looking ahead, we may see more foreign capital flowing into NYC real estate. While moderate inflation is expected to continue, keep an eye on any sudden U.S. policy shifts that could quickly strengthen the dollar again. For now, global conditions are aligning to give international buyers an advantage.

References

1. Data courtesy of UrbanDigs

2. According to the Elegran Brooklyn Leverage Index

3. Data courtesy of Miller Samuel, Inc.

4. Data courtesy of Federal Reserve Bank of St. Louis

5. JUMBO mortgage rate APR data courtesy of Bank of America, Chase, and Wells Fargo

If you would like to chat about the most recent market activity,

feel free to contact us at info@elegran.com or

connect with one of our Advisors.

About Us

Welcome to Elegran, where our mission is to revolutionize the world of real estate. Founded in 2008 by Michael Rossi, our journey began with an unwavering drive for motivation, innovation, and a genuine care for our clients.

As an independently owned brokerage, we pride ourselves on our elite team of "advisors," offering a personalized touch that goes above and beyond the traditional real estate experience. Armed with robust data insights, we empower our clients to make informed decisions that lead to success.

Elegran proudly stands at the forefront of excellence. Our passion lies in turning your real estate dreams into reality, and we are committed to providing exceptional service at every step of the journey.

Are you ready to experience the Elegran difference? Dive into the possibilities at www.elegran.com and embark on an unforgettable real estate adventure with us.

Categories

Recent Posts

Stay in the Know!

Sign up to receive our monthly newsletter

GET MORE INFORMATION