Elegran Manhattan Market Update: July 2025

Rihards Gederts - Elegran

Rihards Gederts - Elegran

Overall Manhattan Market Update: JULY 2025

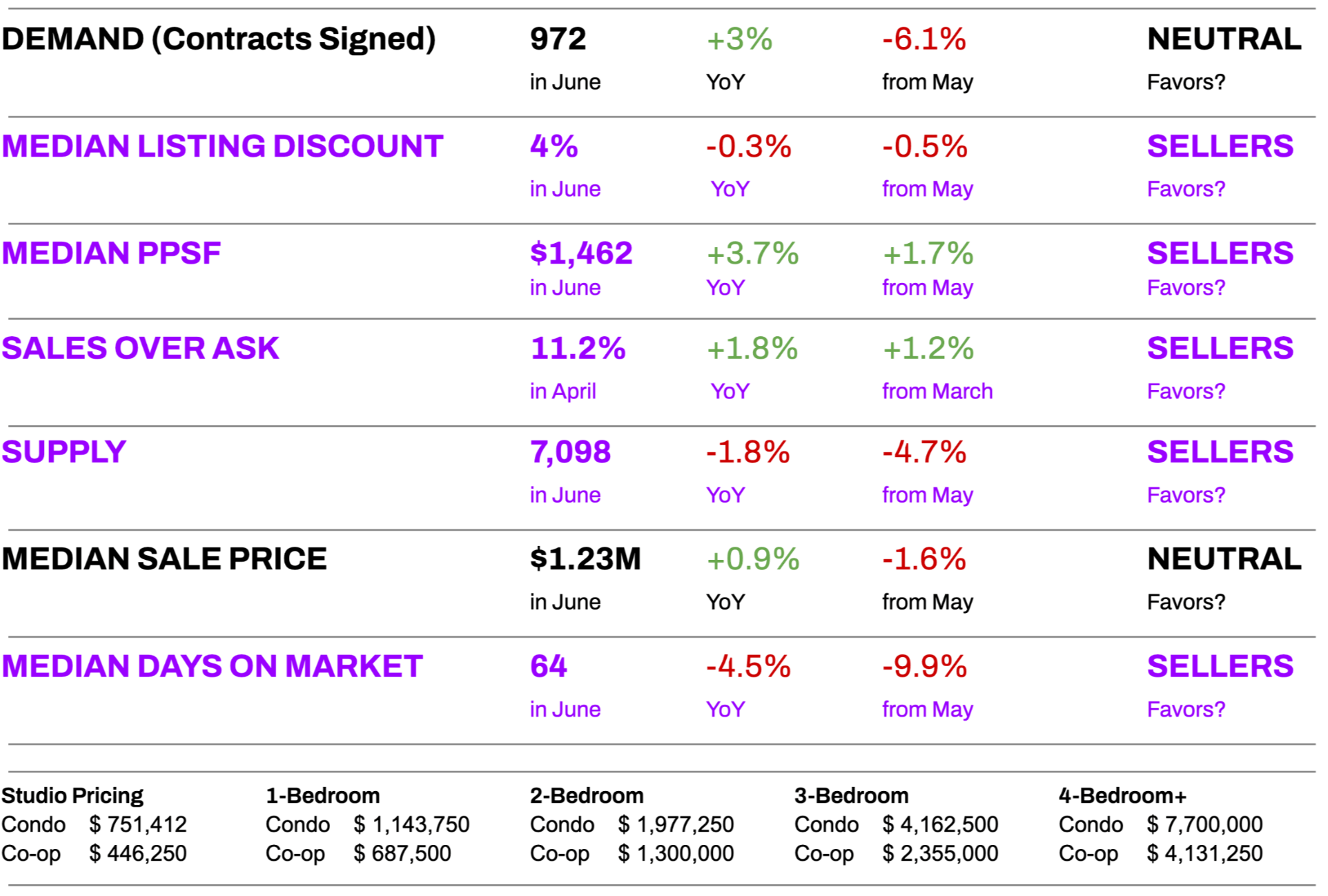

Manhattan Market Pulse¹

A Balancing Act Between Stability, Seasonality, and Shifting Rental Dynamics

The Manhattan real estate market in July reflected a tale of two forces: a stabilizing sales environment shaped by seasonal trends, and a rental market in flux following the rollout of the FARE Act. While pricing, supply, and buyer behavior in the sales market followed a familiar summer pattern, the rental sector is undergoing a more abrupt and still-unfolding shift.

In the sales market, Manhattan continued to show measured strength. The median price per square foot rose to $1,462, up 3.7% year-over-year and 1.7% month-over-month, evidence that buyers are still willing to pay a premium for turnkey, well-located properties. Median listing discounts narrowed to just 4%, the third straight month of tightening negotiability. However, these figures primarily reflect contracts signed in the spring, when buyer activity was stronger. As summer progresses, the pace has cooled slightly: contracts signed in June totaled 972, down 6.1% from May but still 3% above those in June 2024, indicating that demand remains stable, albeit more selective.

Inventory is also tightening. There were 7,098 active listings in June, down 4.7% from June and 1.8% from a year ago. Fewer new listings are coming to market, especially those that are move-in ready, which is creating more competition among buyers in key segments. At the same time, buyers are becoming more value-conscious. Those at the entry and mid-market levels are proceeding with caution, while luxury buyers, on the heels of a strong stock market recovery over the last three months, continue to transact more confidently, often in all-cash deals. International buyers are also benefiting from a weakened dollar, which is driving increased demand from international buyers in the borough.

But the real disruptor this month was on the rental side. While May data showed Manhattan median rents hitting a record high of $4,571, the period following the FARE Act has seen asking rents jump even higher. According to preliminary data from UrbanDigs, the median asking rents in Manhattan and Brooklyn surged 11% and 6%, respectively, in the 10 days following the June 11 implementation, compared to the 10 days prior. At the same time, thousands of rental listings vanished from public portals as landlords adjusted to the new requirement to cover their broker fees. What was meant to reduce upfront costs for tenants may, ironically, be making renting more expensive and harder to navigate, especially for those unfamiliar with NYC’s rental landscape.

Looking ahead, the sales market is expected to stay steady through August before picking up again after Labor Day. If you’re a buyer, this is a moment to act strategically, especially if you find a listing that checks your boxes. For sellers, low inventory provides a window of opportunity, but it’s crucial to price thoughtfully. And for renters? Stay alert. This evolving landscape is likely to continue shifting as the implications of the FARE Act play out in real time.

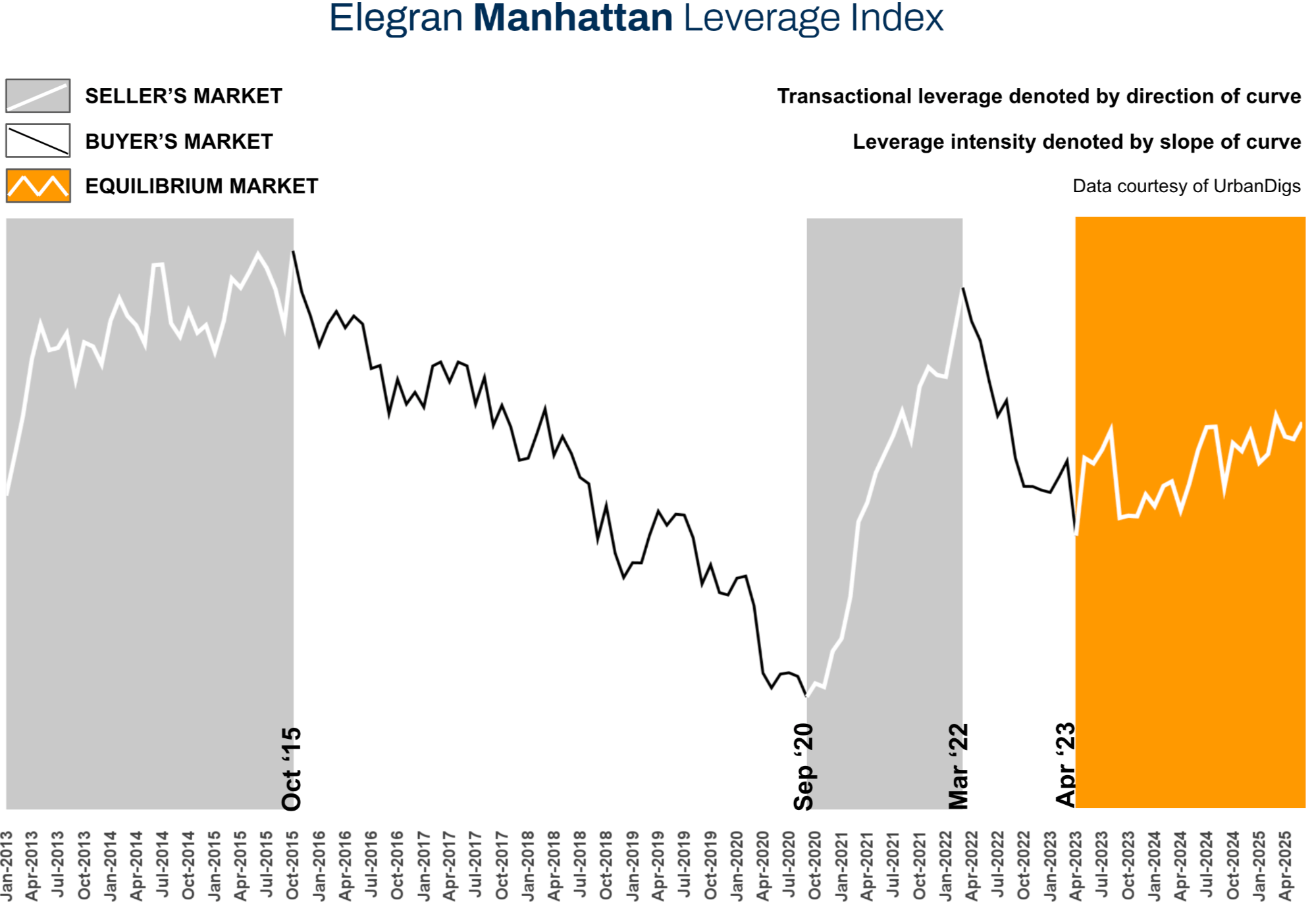

Elegran Manhattan Leverage Index

The Elegran Manhattan Leverage Index² is powered by four indicators: supply, demand, median price per square foot (PPSF), and median listing discount. It informs us whether the current is a buyer’s or a seller’s market, i.e., which party possesses transactional leverage. Looking at the graph below, this is indicated by the direction of the curve, where:

- An increasing trend from left to right indicates a seller’s market

- A decreasing trend from left to right indicates a buyer’s market

Our indicator also informs us regarding the relative strength of that leverage, indicated by the slope of the curve, where:

- A gentle slope indicates a weak advantage by one party over the other

- A sharp slope indicates a strong advantage

Currently, the data suggests rising seller leverage in Manhattan, but this is largely based on deals from earlier this spring, when buyer activity was stronger. As we move into summer, the pace has cooled slightly, and today’s market feels a bit more buyer-friendly than the numbers might suggest.

If you’re thinking of buying, this moment could offer a window of opportunity—before momentum potentially shifts back toward sellers in the fall.

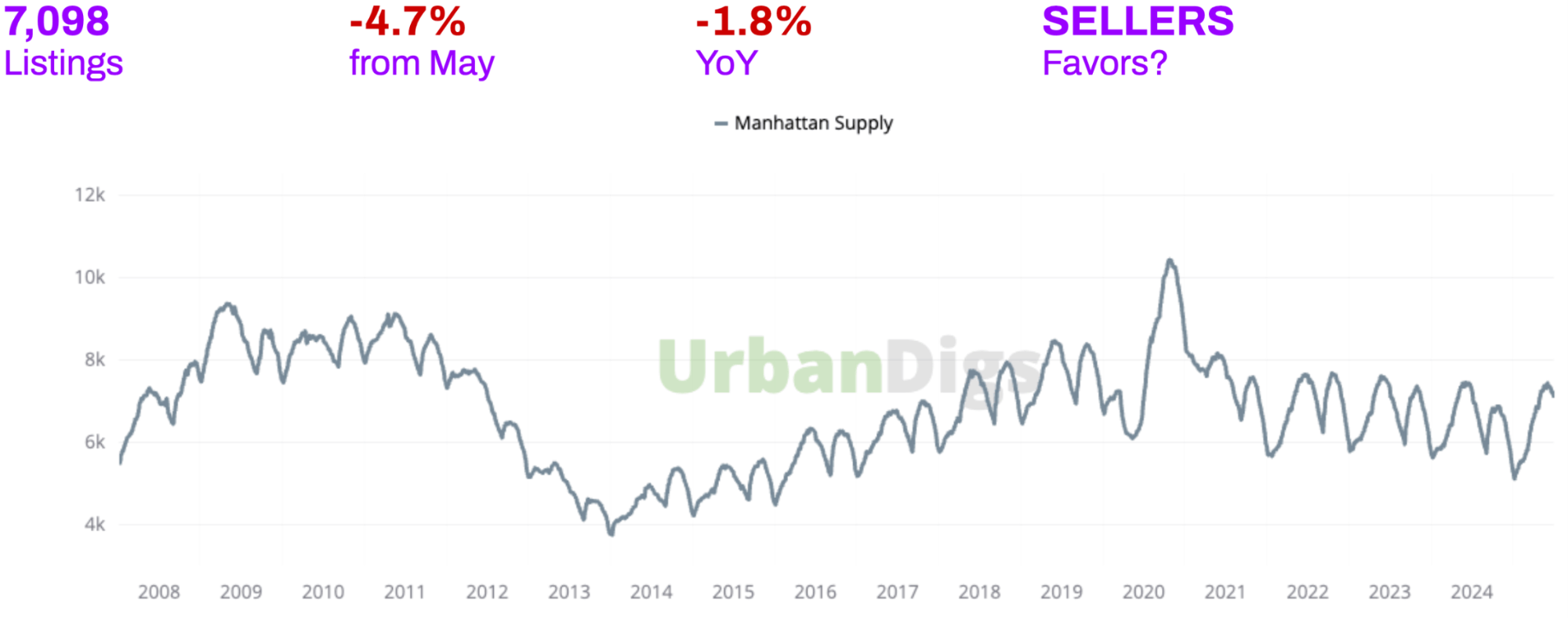

Manhattan Supply

Data & charts courtesy of UrbanDigs

Manhattan Supply: Inventory Tightens

Manhattan inventory continues to tighten. With 7,098 homes on the market, supply is down 4.7% from May and 1.8% from last year. That dip reflects steady absorption, especially of high-quality, well-priced listings. As summer continues, expect fewer new homes hitting the market, particularly turnkey properties that are move-in ready.

What This Means for You:

BUYERS: If you’re shopping this summer, be prepared. Competition is intensifying for the best homes, and new inventory will be scarce until after Labor Day. Ensure your financing is in place, and act promptly if something aligns with your needs.

SELLERS: With fewer listings out there, you have less competition, but don’t confuse low inventory with a runaway market. Spring sales will likely represent the peak pricing for the season, so price strategically. Overpricing now could lead to longer days on the market and missed opportunities.

Looking Ahead: If you’re a buyer who needs to move soon, don’t wait if you see a home that checks your boxes. If your timing is flexible and you haven’t found the right fit, consider waiting for a wave of new listings this fall, when the post-Labor Day market tends to pick up.

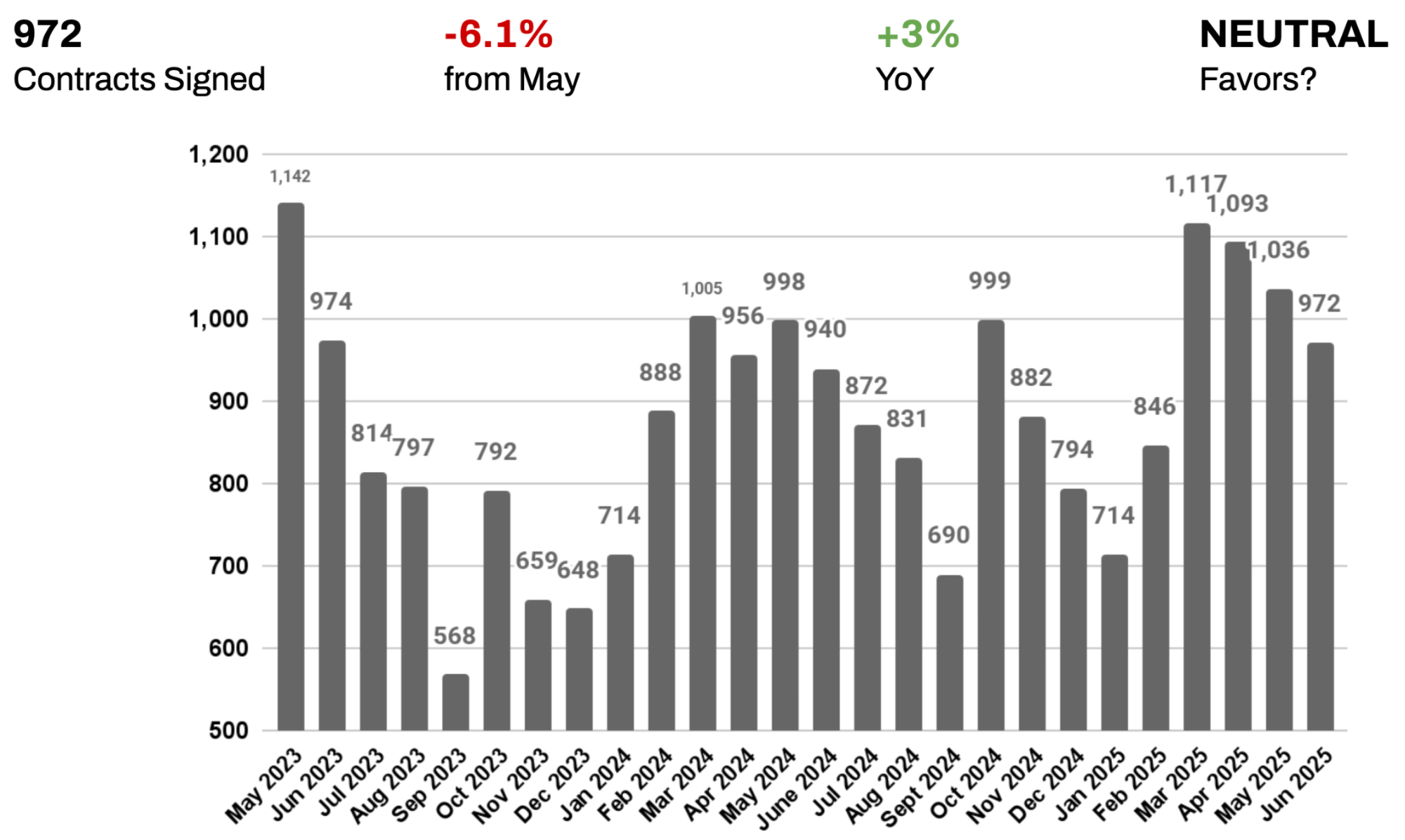

Manhattan Demand

Data & charts courtesy of UrbanDigs

Manhattan Demand: Manhattan Buyer Activity: Cooler Pace, Steady Interest

In June, 972 contracts were signed in Manhattan, down 6.1% from May, which aligns with seasonal trends, and up 3% compared to last year. This positive sign indicates that buyer interest remains resilient despite higher mortgage rates and economic uncertainty.

Today’s buyers are more measured and value-focused. They’re showing up for homes that are priced right and move-in ready, and walking away from anything that feels overpriced or in need of renovation, without a commensurate discount.

At the top of the market, it’s a different story: the luxury segment is booming, with 69% of Q2 transactions closing in cash, a record high. A strong stock market and a weakening U.S. dollar have attracted high-net-worth and international buyers, driving prices higher and reducing available inventory. The median luxury sale price rose to $6.5M, up 9% year-over-year.

Meanwhile, entry and mid-market buyers are taking a more cautious approach. Many are including mortgage contingencies, which signals a more thoughtful, negotiation-friendly environment in this segment. That means a slower but still active pace.

What This Means for You:

BUYERS: The market is moving at a more manageable pace, but good listings still attract competition, especially at higher price points. Be prepared to act quickly if the right property appears.

SELLERS: Demand is stable, especially for homes that are priced well and in good condition. If you meet the market where it is, you’ll attract serious buyers and potentially close quickly.

Looking Ahead: July is typically one of the quieter months of the calendar year. Expect similar activity in August, followed by a resurgence in momentum in early fall.

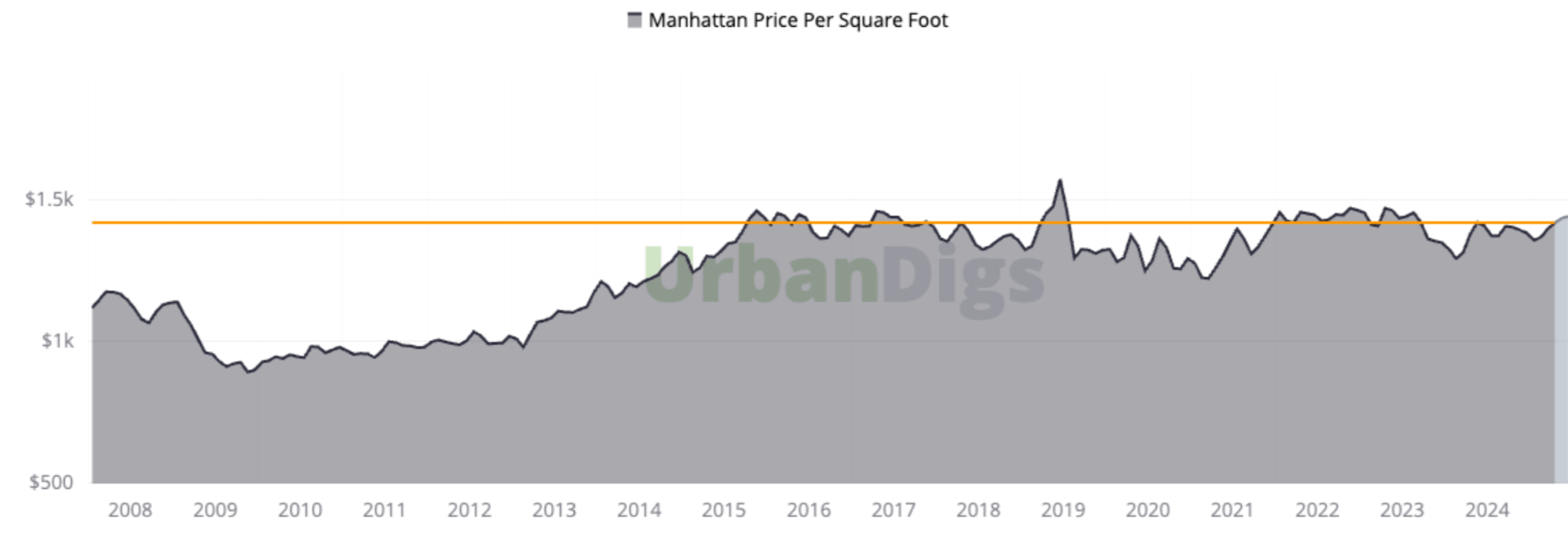

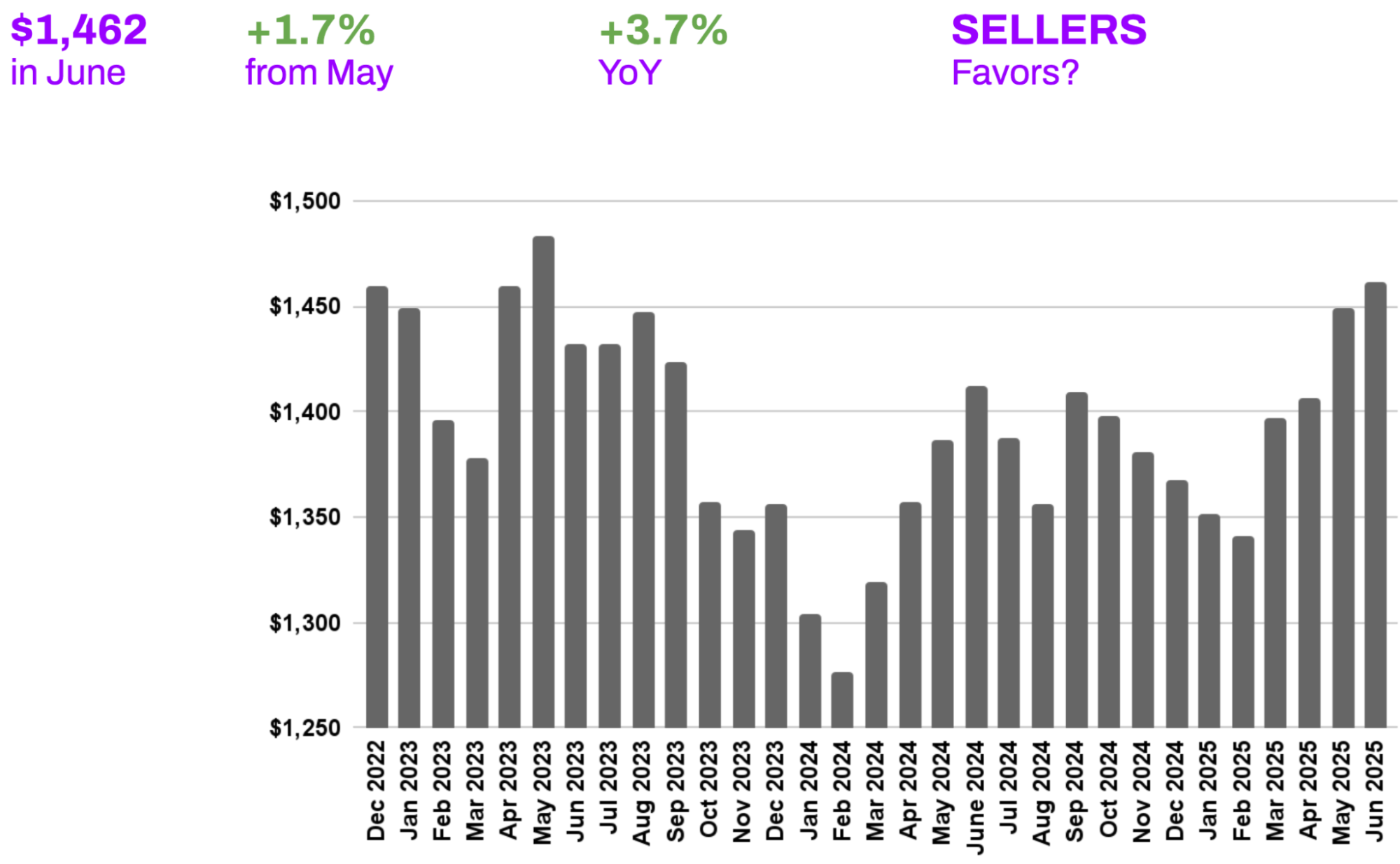

Manhattan Median PPSF

Data & chart courtesy of UrbanDigs

Manhattan Median PPSF: Sustained Price Confidence Signals Market Stability

In June, the median price per square foot in Manhattan rose to $1,462, up 1.7% from May and 3.7% year-over-year. This steady upward trend reflects growing confidence, especially in prime neighborhoods with move-in-ready homes and standout amenities. Buyers are still willing to pay a premium, but only when the property truly delivers.

That said, this higher price point is largely tied to deals that were signed in March or April, when buyer activity briefly spiked. Since then, some of that momentum has eased, and pricing power has started to shift back slightly toward buyers, particularly as much of the best inventory was scooped up earlier in the season.

What This Means for You:

BUYERS: Expect to pay more for homes in great locations and top condition. However, if you’re price-conscious, focus on listings that have been on the market for 90+ days or have seen price reductions, as these often signal more seller negotiability.

SELLERS: Prices are holding firm, but only for homes that are well-priced, well-presented, and well-marketed. If your home checks those boxes, especially in the luxury tier, you’re still in a strong position.

Looking Ahead:

We expect pricing to hold steady through the rest of summer, then resume its upward trend as new inventory and fresh buyer demand return in the fall.

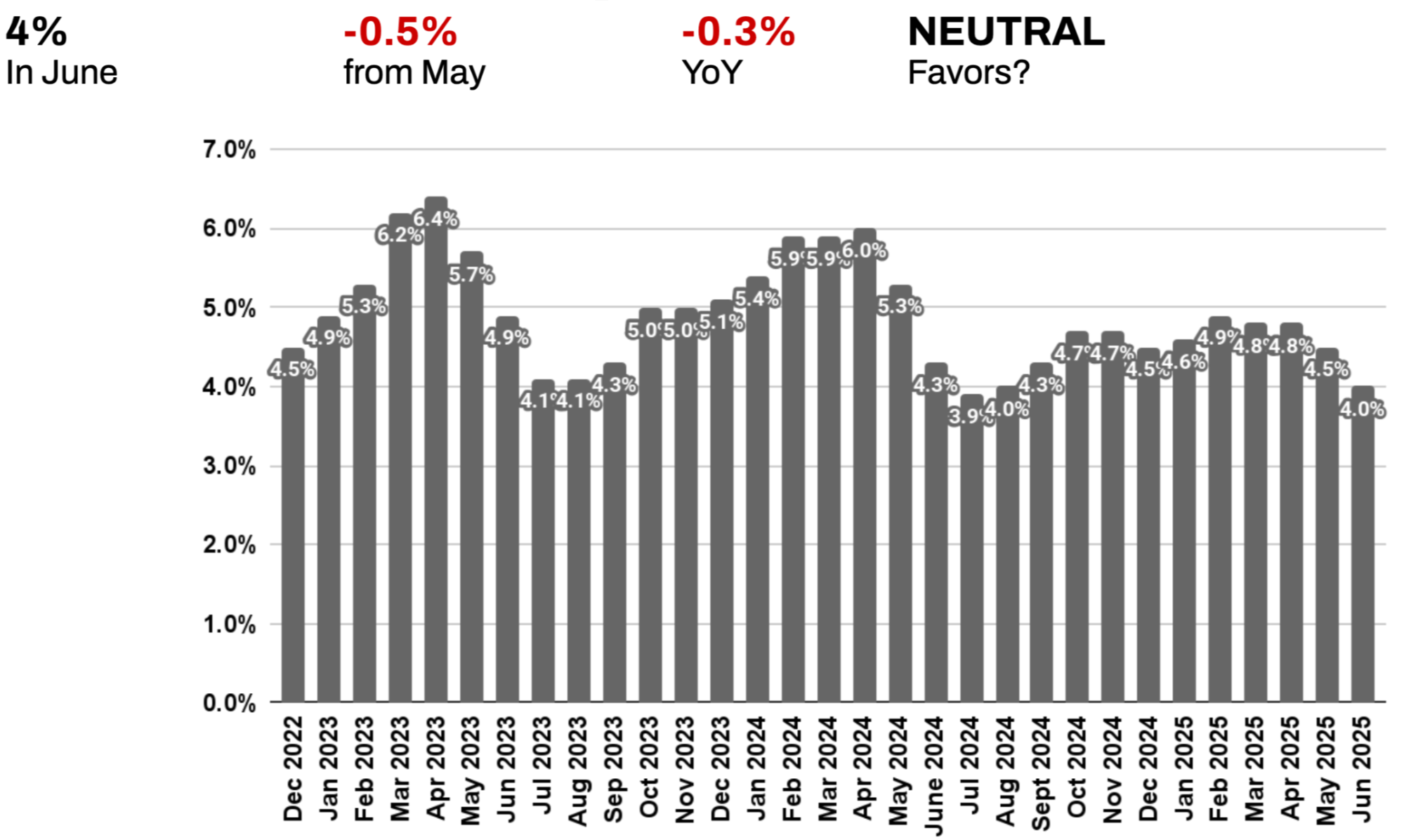

Manhattan Median Listing Discount

Manhattan Median Listing Discounts: Negotiability is Shrinking – And That’s a Good Sign

In June, the median listing discount in Manhattan was just 4%, down slightly from May and from the same time last year. This is the third consecutive month that discounts have narrowed, indicating that sellers and buyers are finally meeting in the middle. It’s not just that sellers are standing firm, it’s that more homes are being priced right from the start.

What This Means for You:

BUYERS: Deep discounts are currently rare. Instead of holding out for major price drops, focus on homes that are fairly priced for their location, condition, and features. For a better chance at negotiation, consider listings that have been on the market for 90 days or more, or those that have seen recent price reductions.

SELLERS: The market is rewarding smart pricing. Overpriced listings are still sitting, but homes that reflect current market value are attracting attention and offers.

Looking Ahead:

If inventory continues to tighten and buyer demand stays steady, discounts will likely remain slim. However, some seasonal softness in August may give buyers temporary leverage, especially with listings that were overpriced at launch and are now adjusting to secure a deal.

RENTAL REMARKS

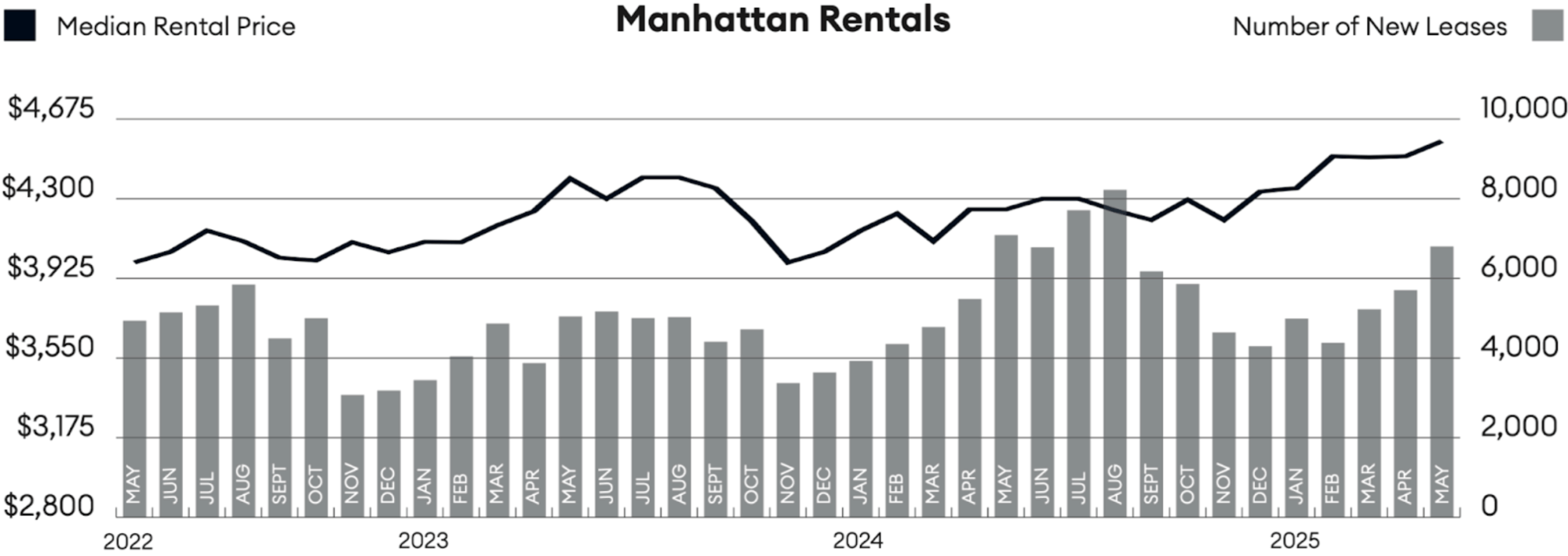

Chart courtesy of Miller Samuel, Inc.

Rental Market: Manhattan Rents Hit a New Record—And Could Climb Higher Post-FARE Act

In May, Manhattan’s median rent hit $4,571, setting a new all-time high for the third time in just four months. That’s up 1.6% from April and nearly 8% higher than a year ago, a strong sign that demand remains high and supply is still tight.³

What’s next? We may see rents rise even further this summer, following the rollout of the FARE Act, which took effect on June 11, 2025. The new law shifts the broker fee to the party hiring the broker. While this change was designed to lower upfront costs for renters, many landlords are already adjusting by raising monthly rents to absorb the extra expense they now face.

Because May data reflects conditions before the FARE Act took effect, June and July will provide a clearer view of how the new law is truly impacting rental prices. That said, early signs are striking: In the 10 days following the law’s implementation, Manhattan’s median asking rent jumped 11%, while Brooklyn saw a 6% increase, compared to the 10-day period just prior. These early shifts suggest landlords are already adjusting pricing in response to the law’s new cost structure.

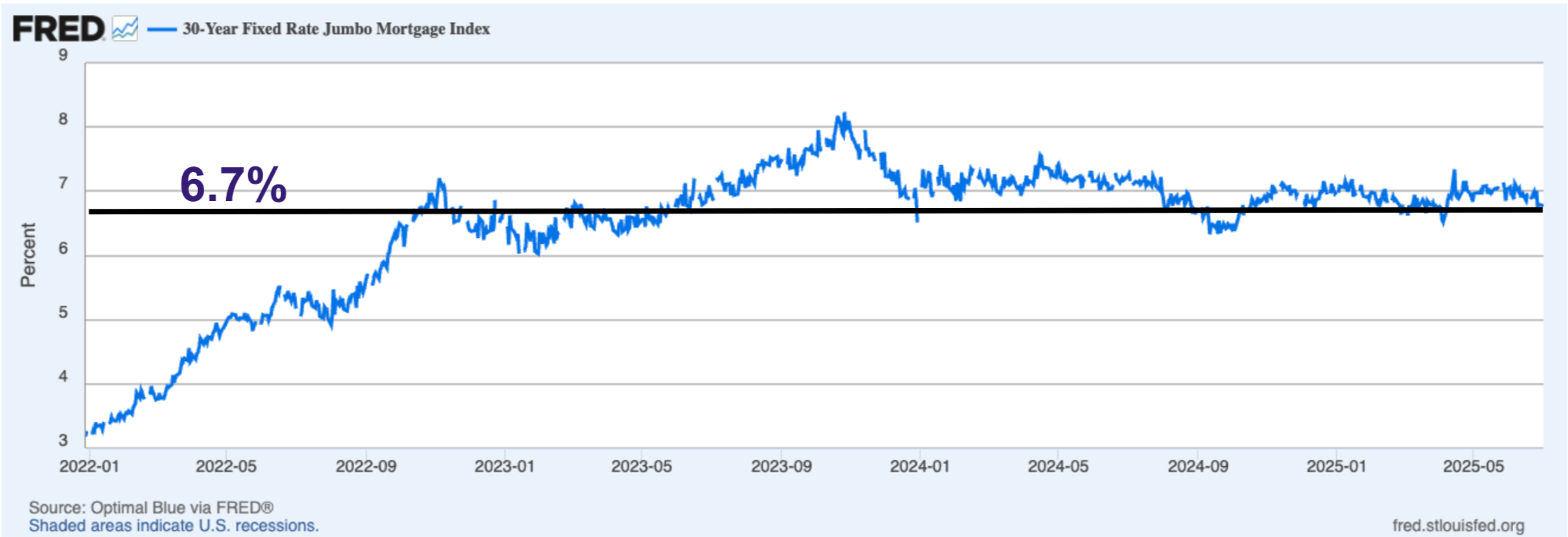

MORTGAGE REMARKS

Courtesy of Federal Reserve Bank of St. Louis

Mortgage Rates: Rates Normalize as Buyers Adapt to a New Financial Reality

Jumbo mortgage rates have stabilized around 6.7% for a 30-year fixed⁴, with APRs hovering near 6.5%⁵. While still elevated historically, this new rate environment has been largely absorbed by both buyers and sellers. The market has stopped waiting for “perfect rates” and is moving forward based on life needs.

INVESTOR INSIGHTS

A Weaker Dollar Makes Manhattan More Attractive to Global Buyers

As the U.S. dollar softens, international buyers are finding more opportunity in Manhattan real estate, especially those making all-cash purchases.

For all-cash investors, current cap rates in Manhattan range from 3.0% to 3.4%, offering stable, predictable income. While financing deals can be tighter in today’s rate environment, international buyers benefit from stronger currency exchange rates, which may also work in their favor at resale.

What This Means for You:

Domestic Investors: Seek long-term upside in well-located properties, especially those with value-add potential.

International Buyers: Your local currency goes further in Manhattan. This is a good time to lock in deals, especially for all-cash purchases. Global investors, particularly from Europe and Asia, can acquire U.S. real estate at more favorable exchange rates.

Looking Ahead: Looking ahead, we may see more foreign capital flowing into NYC real estate. While moderate inflation is expected to continue, keep an eye on any sudden U.S. policy shifts that could quickly strengthen the dollar again. For now, global conditions are aligning to give international buyers an advantage.

Chart courtesy of UrbanDigs and indicates Manhattan median PPSF as a function of the closed sale date.

The light grey area to the extreme right indicates incomplete data, and the orange line indicates the most recent median PPSF based on data considered complete.

References

1. Data courtesy of UrbanDigs

2. According to the Elegran Manhattan Leverage Index

3. Data courtesy of Miller Samuel, Inc.

4. Data courtesy of Federal Reserve Bank of St. Louis

5. JUMBO mortgage rate APR data courtesy of Bank of America, Chase, and Wells Fargo

If you would like to chat about the most recent market activity,

feel free to contact us at info@elegran.com or

connect with one of our Advisors.

About Us

Welcome to Elegran, where our mission is to revolutionize the world of real estate. Founded in 2008 by Michael Rossi, our journey began with an unwavering drive for motivation, innovation, and a genuine care for our clients.

As an independently owned brokerage, we pride ourselves on our elite team of "advisors," offering a personalized touch that goes above and beyond the traditional real estate experience. Armed with robust data insights, we empower our clients to make informed decisions that lead to success.

Elegran proudly stands at the forefront of excellence. Our passion lies in turning your real estate dreams into reality, and we are committed to providing exceptional service at every step of the journey.

Are you ready to experience the Elegran difference? Dive into the possibilities at www.elegran.com and embark on an unforgettable real estate adventure with us.

Categories

Recent Posts

Stay in the Know!

Sign up to receive our monthly newsletter

GET MORE INFORMATION