Zooming Out on Mortgage Rates and NYC Pricing for Some Much Needed Perspective

Keeping things in perspective, we must not let the fear and stress catalyzed by rising mortgage rates force us to forget that the mortgage rate we see on our current statement is not forever. We can simply refi when, and if, rates improve. Industry experts suggest that a refi pencils out (i.e., covers the origination fees) if the spread between your rate and current rates is greater than 50bps.

In a NYC market characterized by both rising rates and rising rents, who are the big winners, if any? Leveraged investors. And they should hold, Hold, HOLD. Their mortgage rate is most likely lower (perhaps significantly so) than today’s rate and their rental income is probably the highest it’s ever been… as is their cap rate.

What if you’re interested in purchasing right now? Economics would dictate that — not considering the myriad of other factors for a moment — rising rates will eventually apply downward pressure on pricing, right? So, our instinct may be to wait for a less expensive entry point. However, as Jared Antin, Elegran’s Director of Sales, points out, NYC is the least leveraged area in the country so prices here would be the most resistant to a price pullback.

As an investor, you should see that prices are well off all-time highs, while rents are soaring at record levels. For that reason, cap rates are at historically normal or high levels and NYC is an attractive opportunity.

As an end user, these record high rents have to tilt the rent VERSUS buy scale in favor of buy, despite the rising rates. And, again, if rates drop in the future; simply refinance.

Looking to sell and upgrade? It’s a difficult decision to trade a lower mortgage rate for a higher one. But if more space is a necessity, then interest rate takes a back seat, prices are still relatively affordable and you can always refinance later.

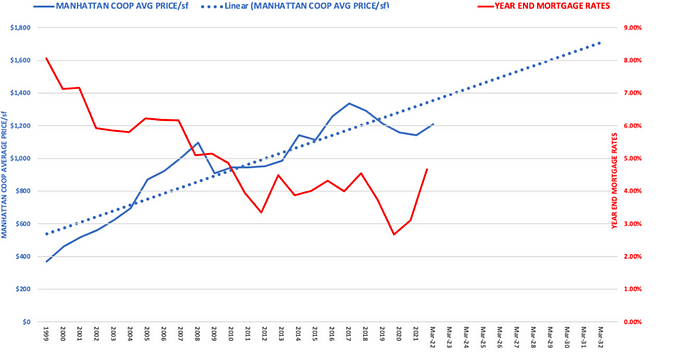

The key takeaways from the graph above are:

- Manhattan average price/sf (using average co-op price/sf as proxy for all product types) has more than tripled in the past 23 years (data courtesy Miller Samuel Inc).

- The linear trendline forecasts that Manhattan average price/sf will appreciate a healthy 43% over the next decade.

- Mortgage rate has nearly been cut in half over that same period, so — while well off recent lows — rates are still historically very affordable (data courtesy fred.stlouisfed.org).

Categories

Recent Posts

Stay in the Know!

Sign up to receive our monthly newsletter

GET MORE INFORMATION