Weekly Manhattan & Brooklyn Market Update: 7/21

Buyers Shift Focus? Brooklyn Supply and Sentiment Climb in July

While Manhattan cools down in line with typical summer trends, Brooklyn bucks the seasonal slowdown with an uptick in listings, raising the question: is Brooklyn poised to lead late-summer momentum?

As we move deeper into July, Manhattan’s market continues its familiar seasonal deceleration: supply dropped for the seventh consecutive week, now sitting at 6,716 homes. While 283 new listings did come online (up 2% from the previous week), overall inventory still remains 2% lower than the same period last year. Pending sales dipped modestly by 0.6%, marking the third week in a row of decline, suggesting the peak buying season may be behind us.

In contrast, Brooklyn is gaining steam. Inventory rose to 3,472 homes, with a notable 16% jump in new listings week-over-week, and an 8% increase compared to this time last year. Although pending sales slipped for the fourth consecutive week (down 2.3%), buyer engagement shows strong signs: 115 contracts were signed, a 32% increase from last week. That pushed the Elegran Brooklyn Consumer Sentiment Index from +22 to +59, highlighting resilience in key submarkets like Park Slope, Williamsburg, and Bed-Stuy.

Meanwhile, Manhattan contract activity rose 12%, helping lift the Elegran Manhattan Consumer Sentiment Index from +6 to +17. This upward tick—amid falling supply—suggests that well-priced, move-in-ready properties continue to attract buyers even in a quieter season.

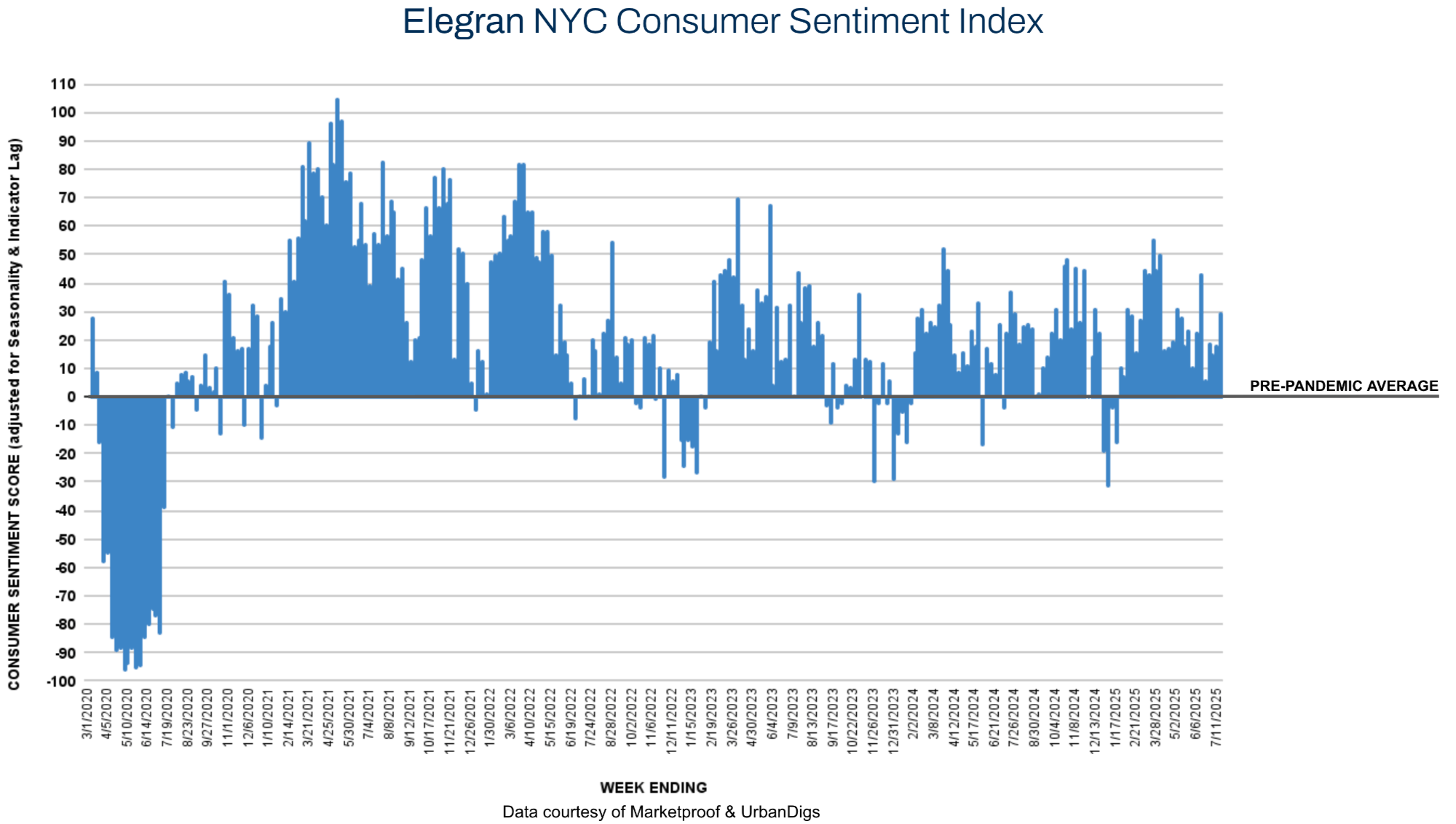

Lastly, based on a relatively active week across both boroughs, the combined Elegran Consumer Sentiment Index rose from +18 to +29.

With August on the horizon, we’ll be watching closely to see if Brooklyn’s strength translates into higher closing volume, or if Manhattan’s constrained supply will keep the market competitive for serious buyers.

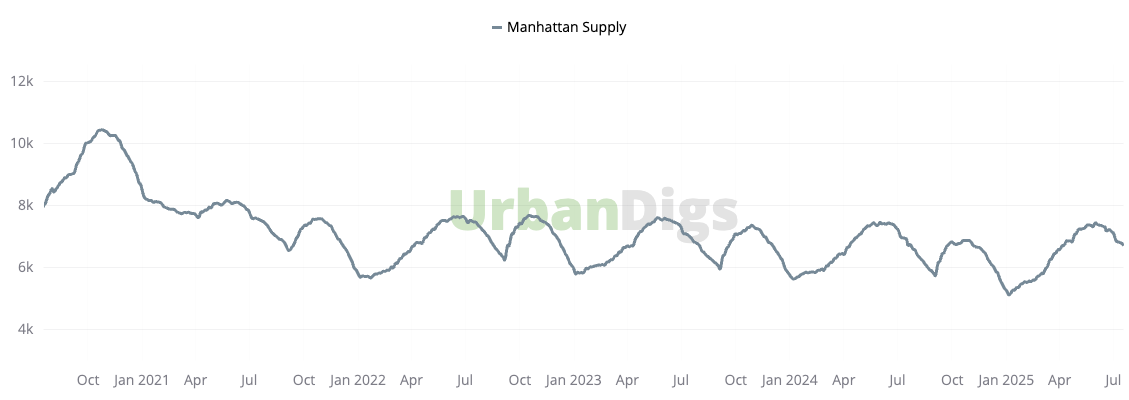

Manhattan Supply

Active inventory in Manhattan declined for the seventh straight week, now totaling 6,716 homes—a 1.5% decrease from the prior week. This continued downtrend is consistent with historical summer patterns, where sellers often hold listings until post-Labor Day. While 283 new listings hit the market—a modest 2% week-over-week increase—supply remains 2% lower than the same week in 2024. The bump in new listings is likely a delayed effect from the July 4th holiday period, though overall volume remains muted by seasonality.

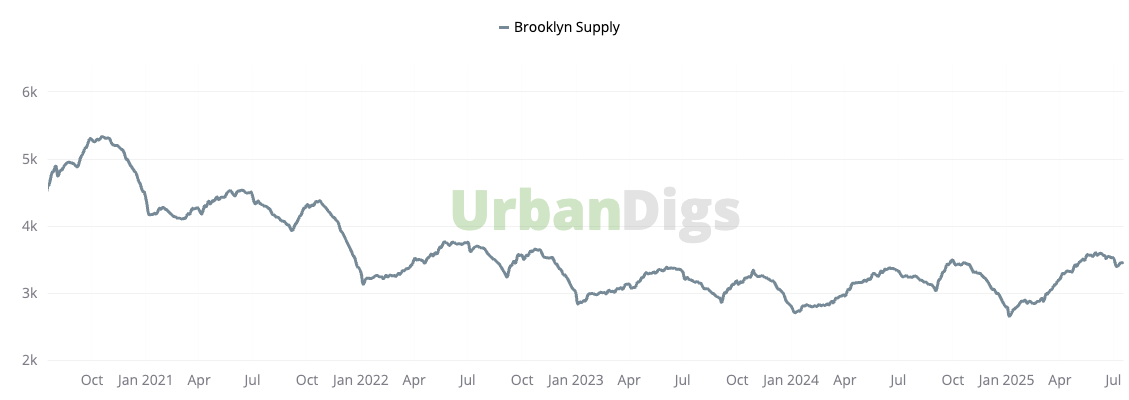

Brooklyn Supply

In contrast to Manhattan, Brooklyn supply showed notable growth, rising to 3,472 homes—marking its second consecutive weekly gain. A total of 195 new listings came online, representing a 16% increase week-over-week and 8% year-over-year. This momentum suggests that sellers in Brooklyn are taking advantage of renewed buyer interest and less inventory competition. With rising listing activity concentrated in areas like Prospect Heights, South Slope, and Williamsburg, the borough may be setting up for a stronger-than-expected August.

Data courtesy of UrbanDigs

Manhattan Pending Sales: Pending sales in Manhattan edged down 0.6% to 3,411 units, marking the third consecutive weekly decline. This softening reflects a seasonal tapering in buyer urgency, common in the second half of July.

Brooklyn Pending Sales: Brooklyn pending sales also declined, falling 2.3% to 2,177 contracts—its fourth consecutive weekly dip. While this may point to a plateau in buyer activity, it’s worth noting that new supply and increased sentiment may counterbalance this in the weeks ahead.

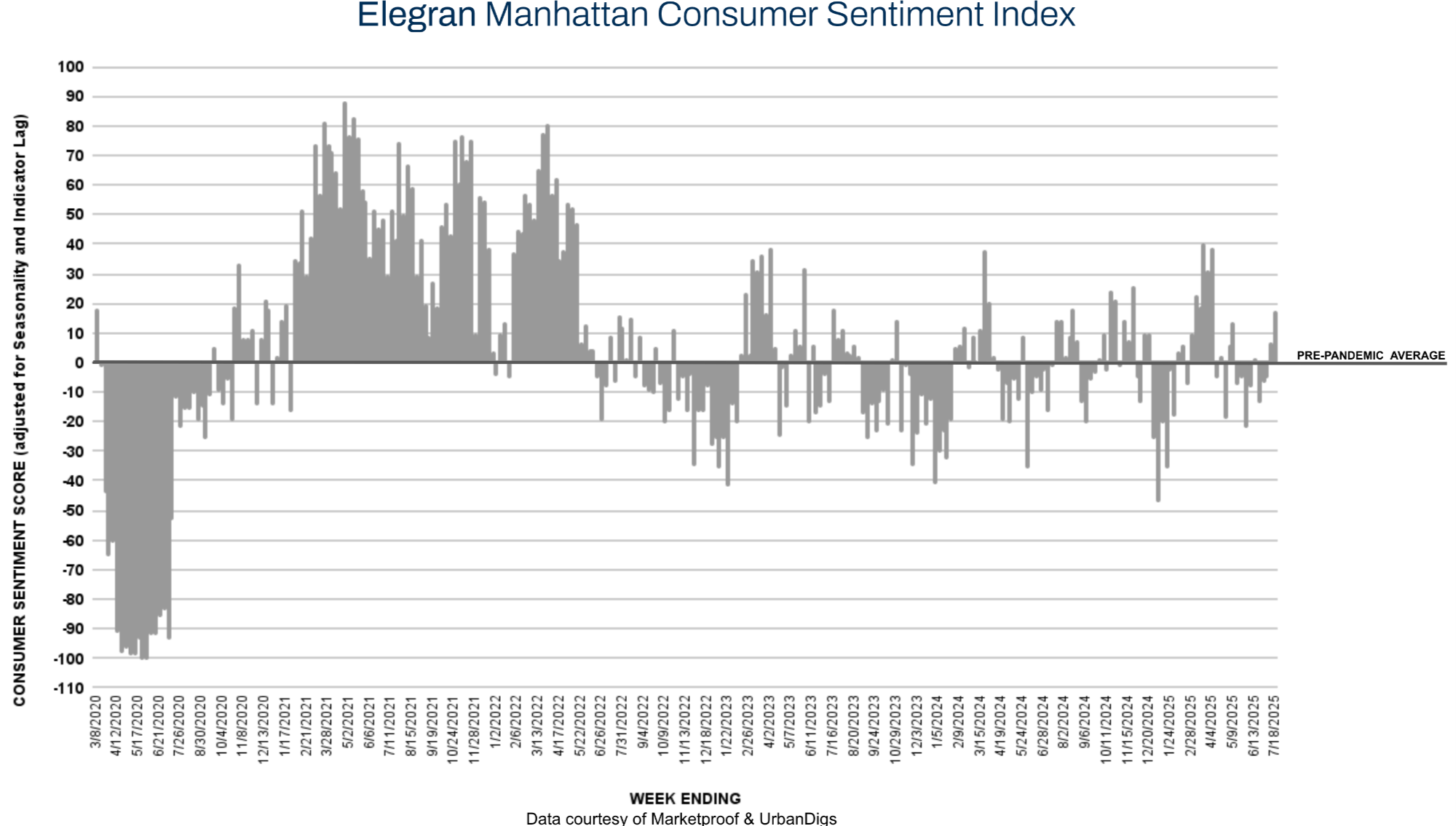

Manhattan Consumer Sentiment

Despite softening pending sales, Manhattan contract activity rose to 212 signed contracts this week—a 12% gain from last week and 3% above the same time last year. As a result, the Elegran Manhattan Consumer Sentiment Index increased from +6 to +17. This rebound signals that while the broader market is in its summer lull, serious buyers are still transacting—particularly for well-located, competitively priced inventory.

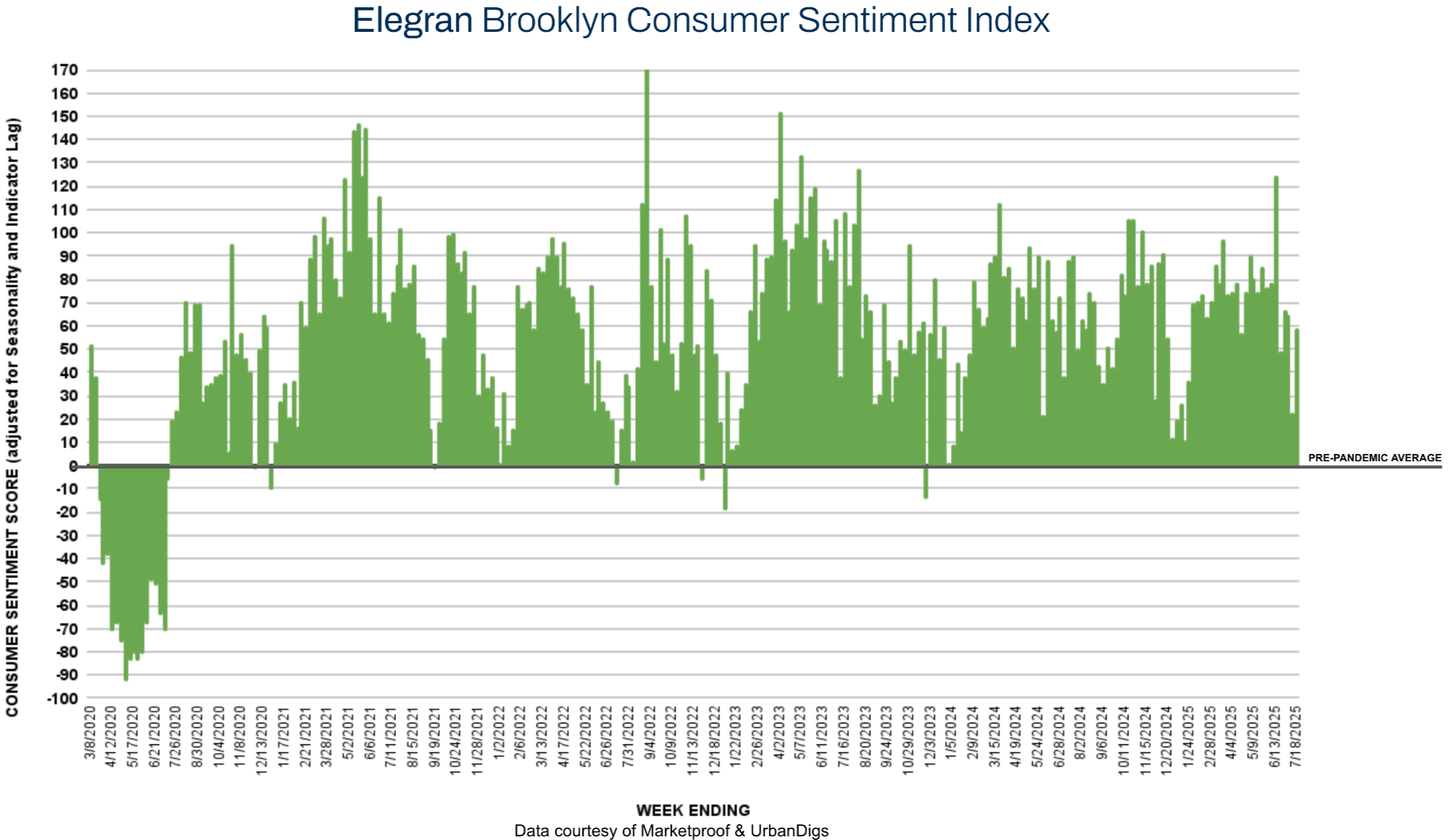

Brooklyn Consumer Sentiment

Brooklyn experienced a sharp uptick in contract activity, with 115 deals signed—a 32% increase from the prior week. Although this figure remains 17% below last year’s level, the jump in weekly activity pushed the Elegran Brooklyn Consumer Sentiment Index from +22 to +59. The surge reflects a strong buyer response to fresh inventory, especially in family-sized units and newer developments in prime neighborhoods. This trend may indicate early signs of a late-summer demand wave building in Brooklyn.

New Development Insights

Marketproof reported that 48 new development contracts were signed in 38 buildings this week. The following buildings were the top-selling new developments of the week:

- The Greenwich By Rafael Vinoly (Financial District) signed 8 contracts

- One Wall Street (Financial District), Sutton Tower (Sutton Place), and One Domino Square (Williamsburg) each signed 2 contracts.

If you would like to chat about the most recent market activity,

feel free to contact us at info@elegran.com or

connect with one of our Advisors.

About Us

Welcome to Elegran, where our mission is to revolutionize the world of real estate. Founded in 2008 by Michael Rossi, our journey began with an unwavering drive for motivation, innovation, and a genuine care for our clients.

As an independently owned brokerage, we pride ourselves on our elite team of "advisors," offering a personalized touch that goes above and beyond the traditional real estate experience. Armed with robust data insights, we empower our clients to make informed decisions that lead to success.

Our passion lies in turning your real estate dreams into reality, and we are committed to providing exceptional service at every step of the journey.

Categories

Recent Posts

Stay in the Know!

Sign up to receive our monthly newsletter

GET MORE INFORMATION