Elegran Brooklyn Market Update: August 2025

Overall Brooklyn Market Update: AUGUST 2025

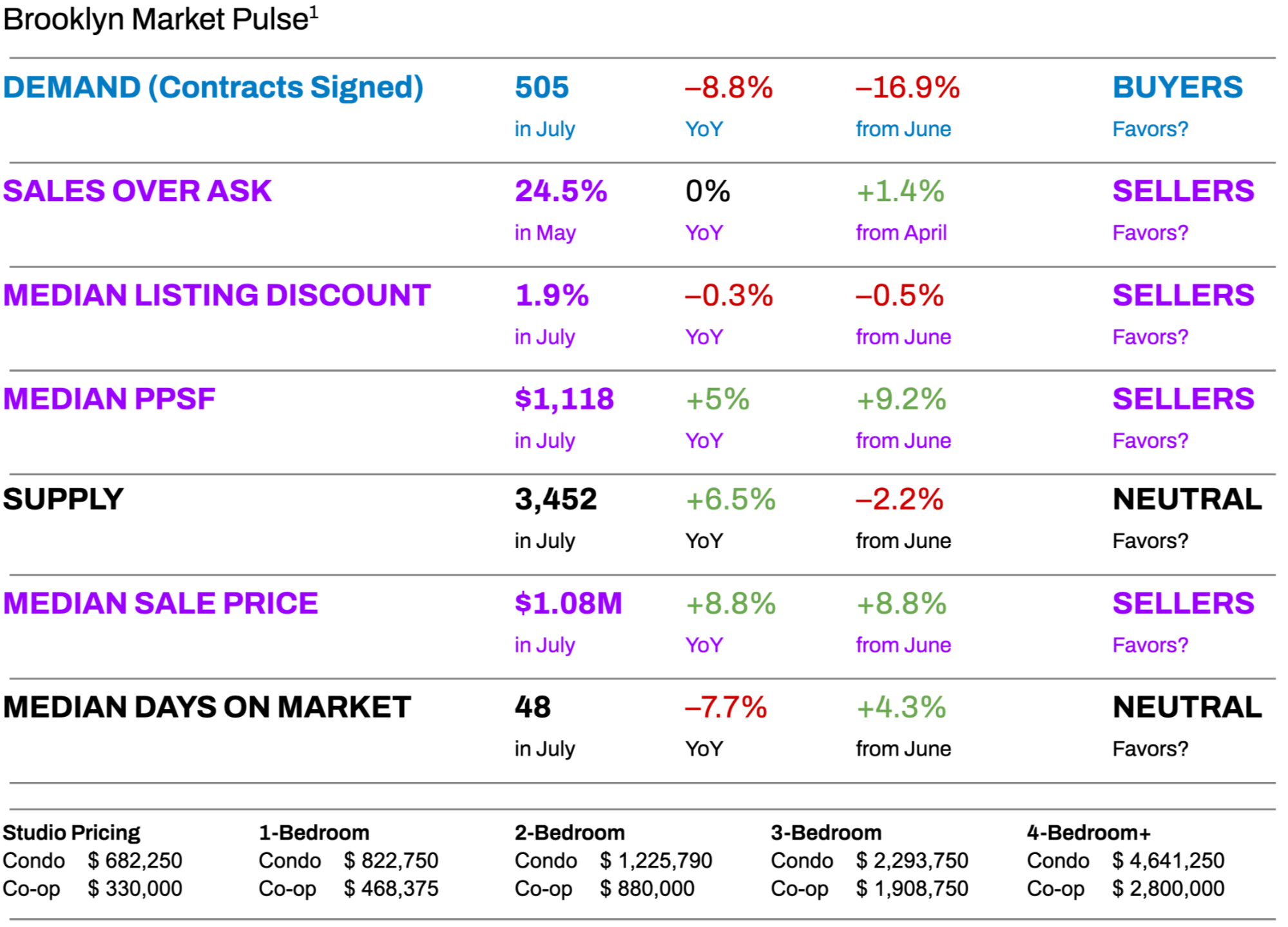

Market Pulse: Affordability Pressures Mount as Market Stalls in a Summer Holding Pattern

Brooklyn’s residential market in July 2025 painted a split picture: contract activity dropped to its lowest level since early 2025, yet prices and negotiation leverage continued to favor sellers. With only 505 contracts signed, down 16.9% month-over-month and 8.8% year-over-year, it’s clear that buyer hesitation has returned—but it hasn’t translated into widespread price relief.

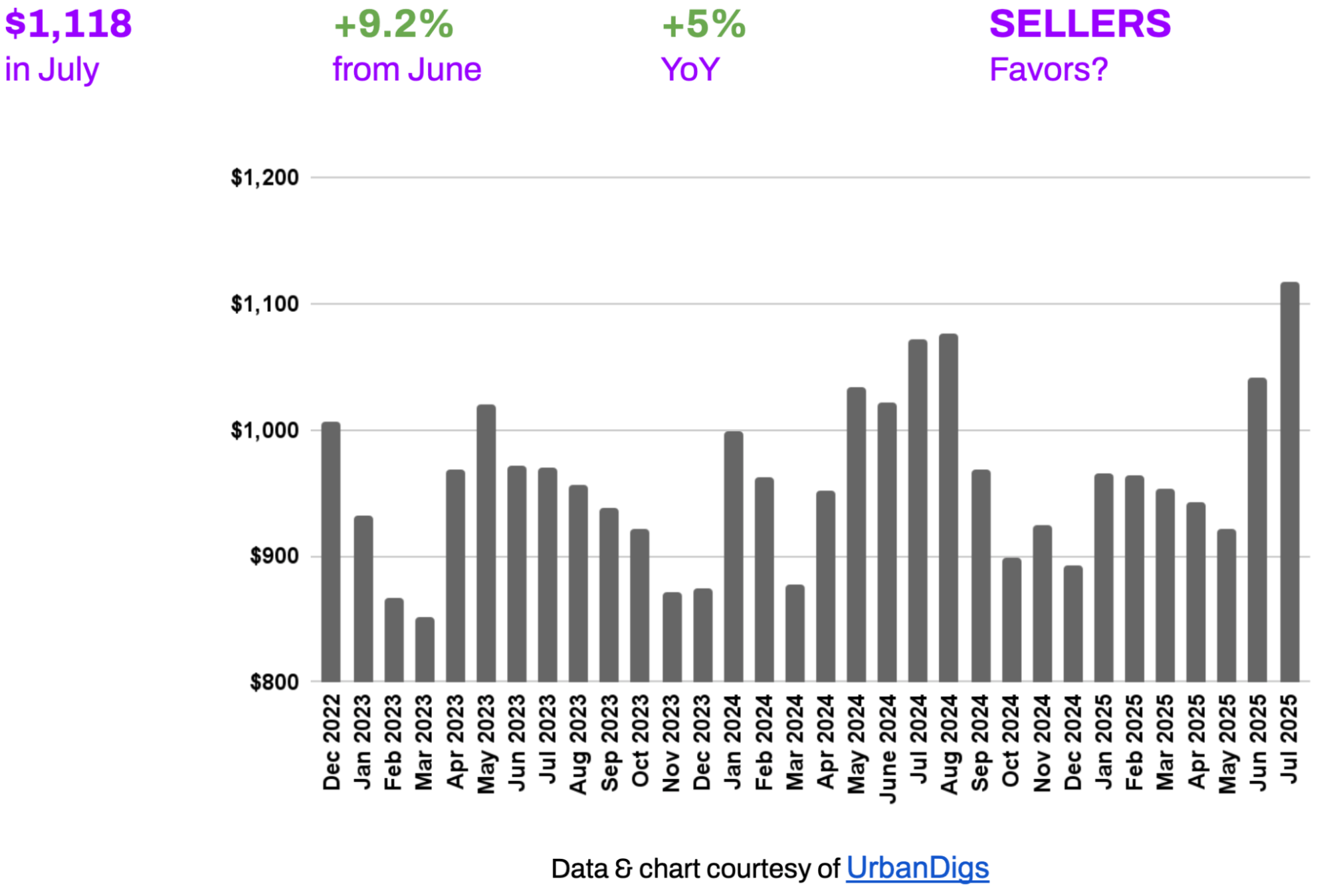

Instead, sellers largely held firm on pricing, pushing the median price per square foot to $1,118, a 9.2% increase over June and 5% year-over-year. Median listing discounts also tightened to just 1.9%, the lowest margin in over a year.

This is a market in limbo—defined not by urgency, but by caution.

Affordability remains the pressure point. Mortgage rates around 6.8%, coupled with rising PPSF, are sidelining some buyers, particularly in core neighborhoods like Park Slope, Williamsburg, and Downtown Brooklyn. Meanwhile, well-prepared listings—especially in the luxury and renovated brownstone segments—are still commanding near-ask offers.

Looking Ahead: Repricing or Reacceleration?

August and September will be pivotal in determining whether the summer cooldown is seasonal or structural. Here are three key dynamics to watch:

- Fall inventory surge: Historically, September sees a spike in new listings. If buyer demand doesn’t rise in parallel, we could see price corrections or longer DOM in Q4.

- Mortgage rate shifts: Even a small decline in rates could pull back in cautious buyers. But persistent 6.5–7% borrowing costs will continue to filter out rate-sensitive segments.

- Price sensitivity increases: Buyers may begin walking away from listings priced too far above market—even in prime areas.

Final Takeaways

Buyers: Use August strategically. Less competition gives you room to negotiate—particularly on homes with 30+ days on market or cosmetic shortcomings. Just don’t expect big discounts on fresh, turnkey listings.

Sellers: If your property is move-in ready and priced in line with recent comps, you’re still in a strong position. But if you're not seeing interest in the first 2–3 weeks, it's likely time to revisit your pricing.

Investors: Cap rates remain steady between 3.0–3.4%, and the U.S. dollar’s weakness continues to drive foreign investor interest in income-producing multi-family and new boutique condos across Brooklyn.

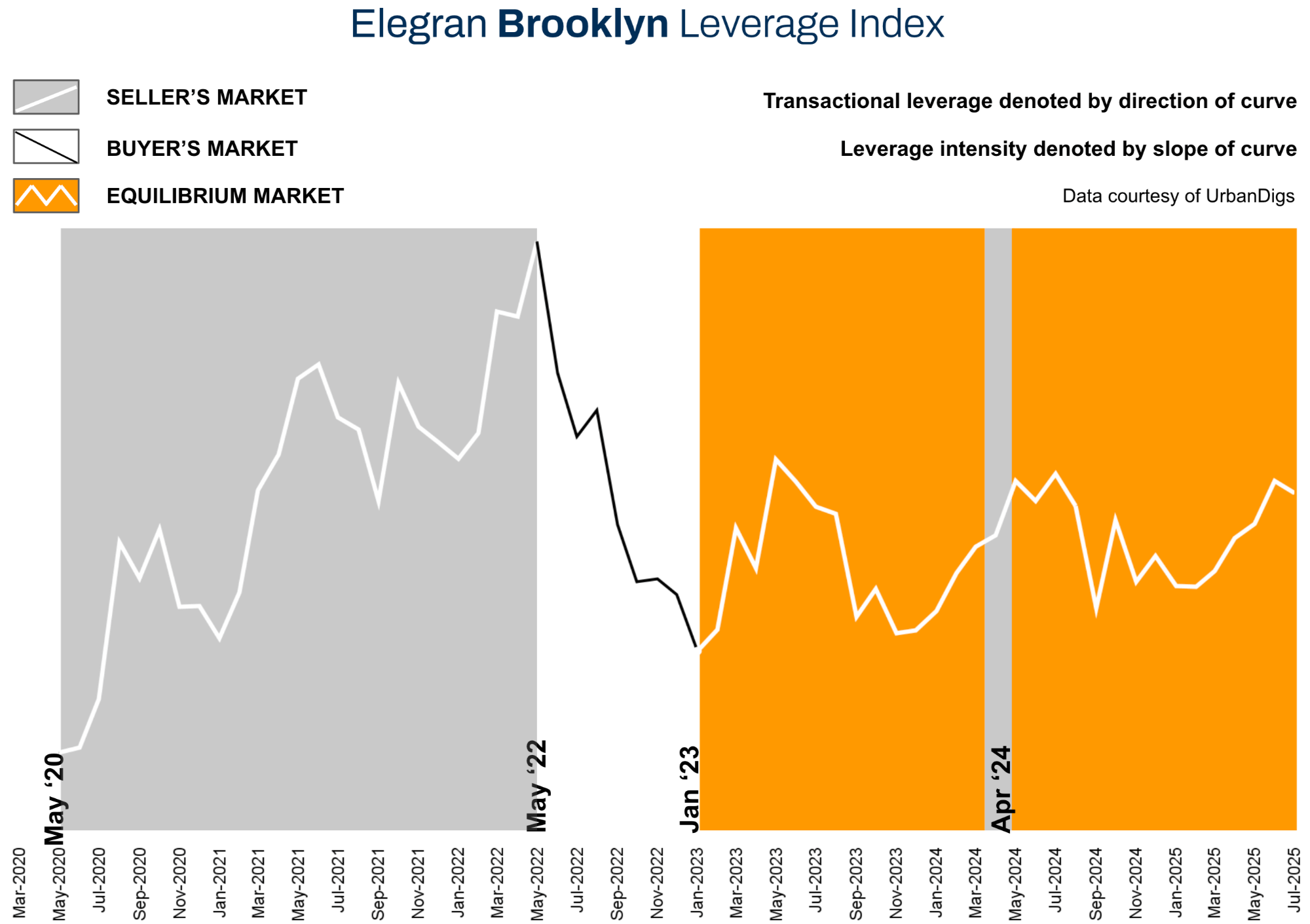

Elegran Brooklyn Leverage Index

Slight Dip in Leverage Index Suggests Market Is Tilting Toward Buyers

The Elegran Brooklyn Leverage Index² is powered by four indicators: supply, demand, median price per square foot (PPSF), and median listing discount.

Direction Matters:

- An upward-sloping curve = seller’s market

- A downward-sloping curve = buyer’s market

- The steeper the slope, the stronger the advantage for either side

The Elegran Brooklyn Leverage Index ticked downward in July, reflecting a softer buyer turnout and a slightly more balanced market than earlier this summer.

What’s Driving This Shift?

- Contracts signed dropped 16.9% from June and 8.8% YoY, reflecting reduced buyer urgency

- Yet prices (PPSF) and sales over asking remained strong, meaning motivated buyers are still paying for quality

- Inventory stayed neutral, not flooding the market but not contracting either

This suggests a psychological hesitation among buyers, possibly due to elevated mortgage rates and pricing fatigue—not a collapse in demand fundamentals.

Look out for August data to clarify if this is a temporary pause or an early shift in the market cycle.

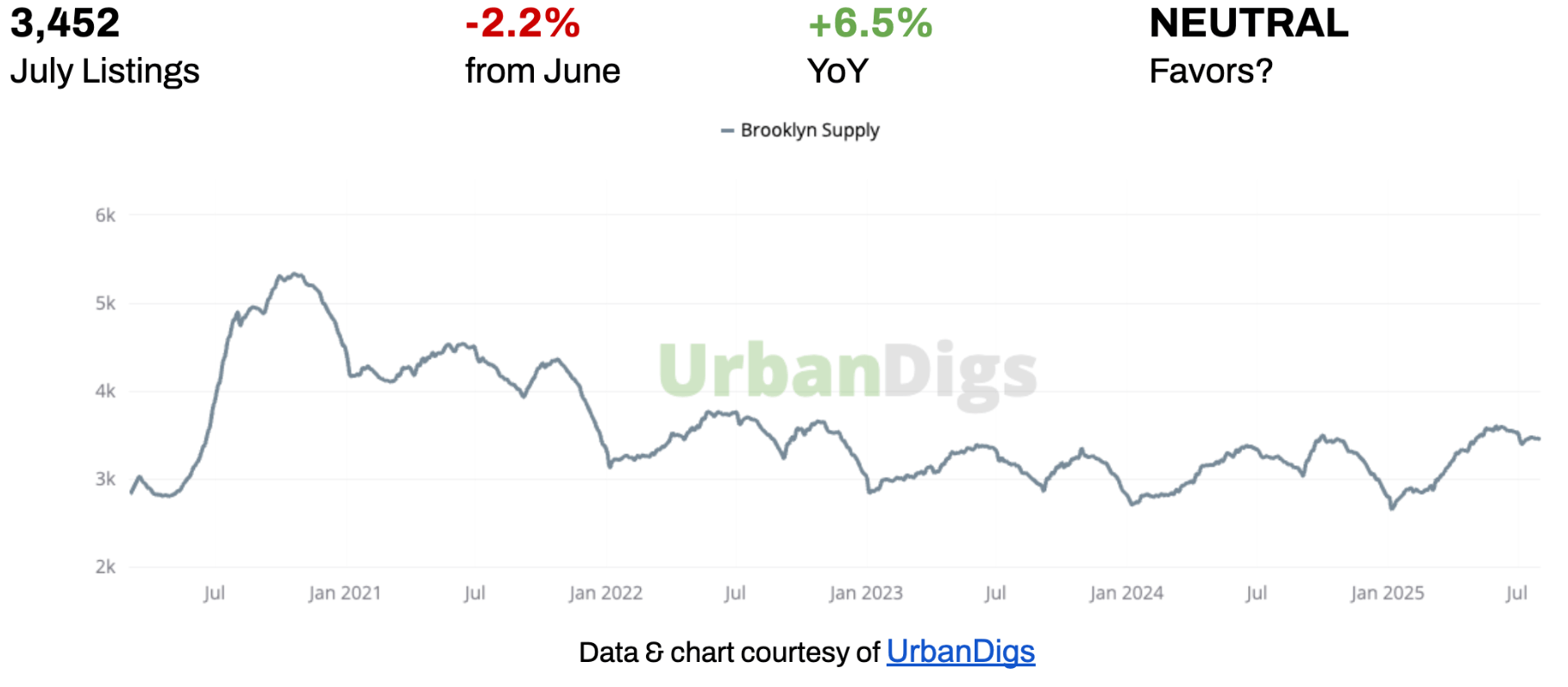

Brooklyn Supply

Brooklyn Supply: Inventory Steady But Still Subdued

Brooklyn ended July with 3,452 active listings, a 2.2% decrease from June, but a 6.5% increase year-over-year. That means more choices than in July 2024—but still significantly below historical norms. Today’s market remains undersupplied in that context.

While we’re seeing new listings come online, they’re not outpacing the pace of buyer absorption, especially in core brownstone areas and new developments.

What This Means for You:

BUYERS: You’ll find slightly more inventory than last summer, but don’t expect dramatic expansion. The most desirable listings (e.g., renovated townhomes, 2BR condos in elevator buildings) still move quickly.

SELLERS: Buyers are more selective, so condition, layout, and value matter to avoid price cuts later.

Looking Ahead: August is often a slower listing month. However, September typically brings a surge in new supply. Buyers may regain leverage if that happens without a parallel increase in demand. If you’re selling, consider listing before Labor Day to beat the rush.

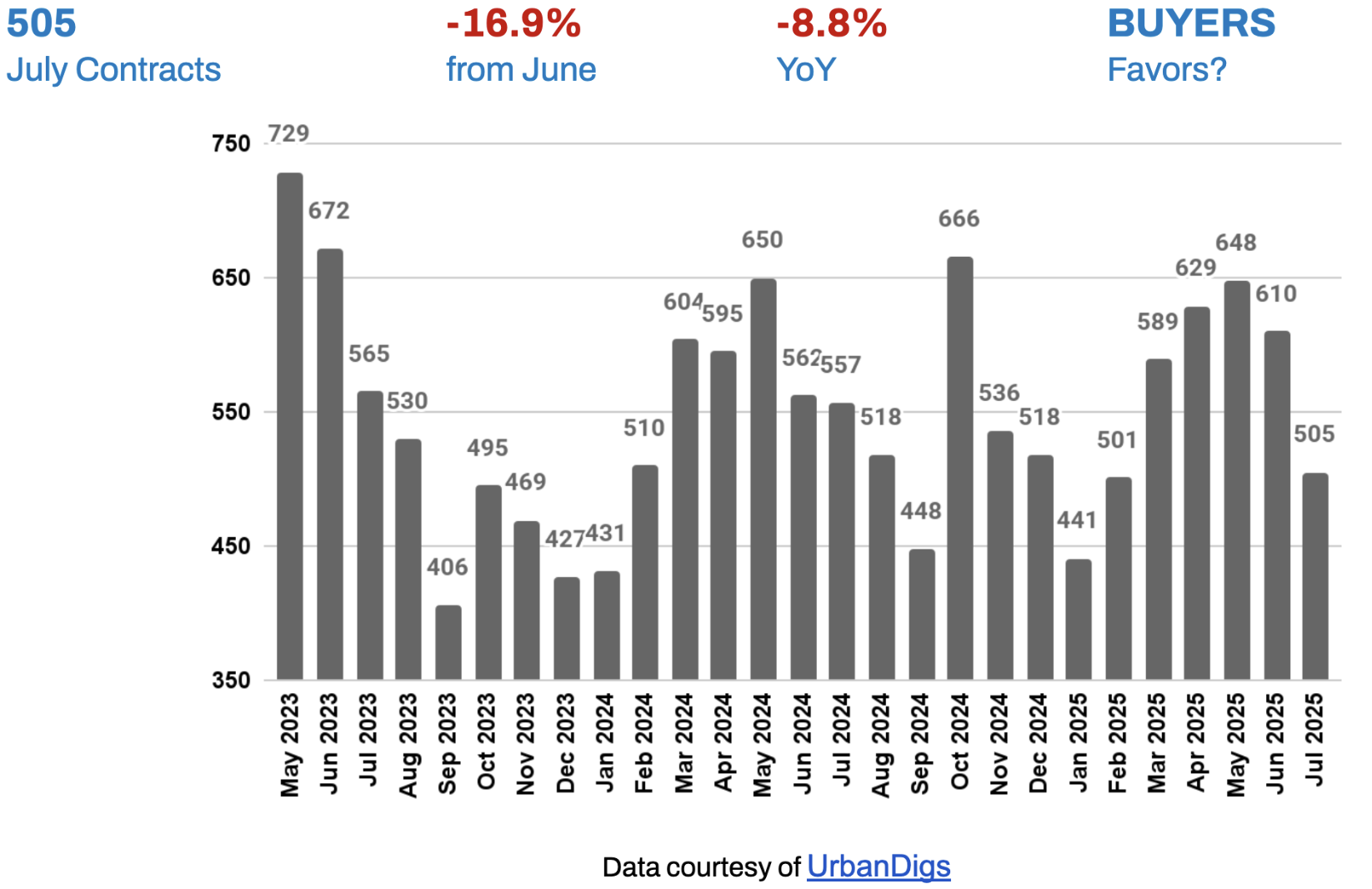

Brooklyn Demand

Brooklyn Demand: Just 505 Contracts Signed in July

In July 2025, only 505 contracts were signed in Brooklyn—a steep 16.9% decline from June and 8.8% lower than July 2024. This marked the lowest monthly contract activity since early 2025, underscoring a noticeable cooling in buyer urgency.

But the numbers alone don’t tell the full story. Historically, July is a quieter month, with buyers distracted by travel, summer break, and postponed decisions. However, two deeper trends are at play:

- Mortgage Rate Fatigue: With jumbo 30-year rates hovering around 6.8%, some buyers are pressing pause—not exiting, but waiting for better leverage or more inventory.

- Affordability Strain: PPSF continues to rise, stretching budgets in key submarkets like Williamsburg, Park Slope, and Downtown Brooklyn. Unlike prior slowdowns tied to external shocks, this one appears to be a buyer-driven recalibration. Demand fundamentals remain strong—but urgency has faded.

What This Means for You:

BUYERS: Fewer competing offers and longer days on market mean more room to negotiate, especially on listings that have been sitting since spring. Use this moment to reassess what value looks like—a smart layout or location may now matter more than a price tag alone.

SELLERS: The days of multiple offers out of the gate are slowing. If you’re listing in August or early fall, pricing realistically based on comparable sales and condition is key. Don’t assume spring pricing holds. You may still get your number—but only if your listing is compelling.

Looking Ahead:

The big question is whether this is a seasonal breather or a longer pullback. If rates stay high and pricing doesn't adjust, we could see demand flatten in September. But if supply increases and sellers get more flexible, buyers could re-enter quickly—especially as school starts and decision timelines accelerate.

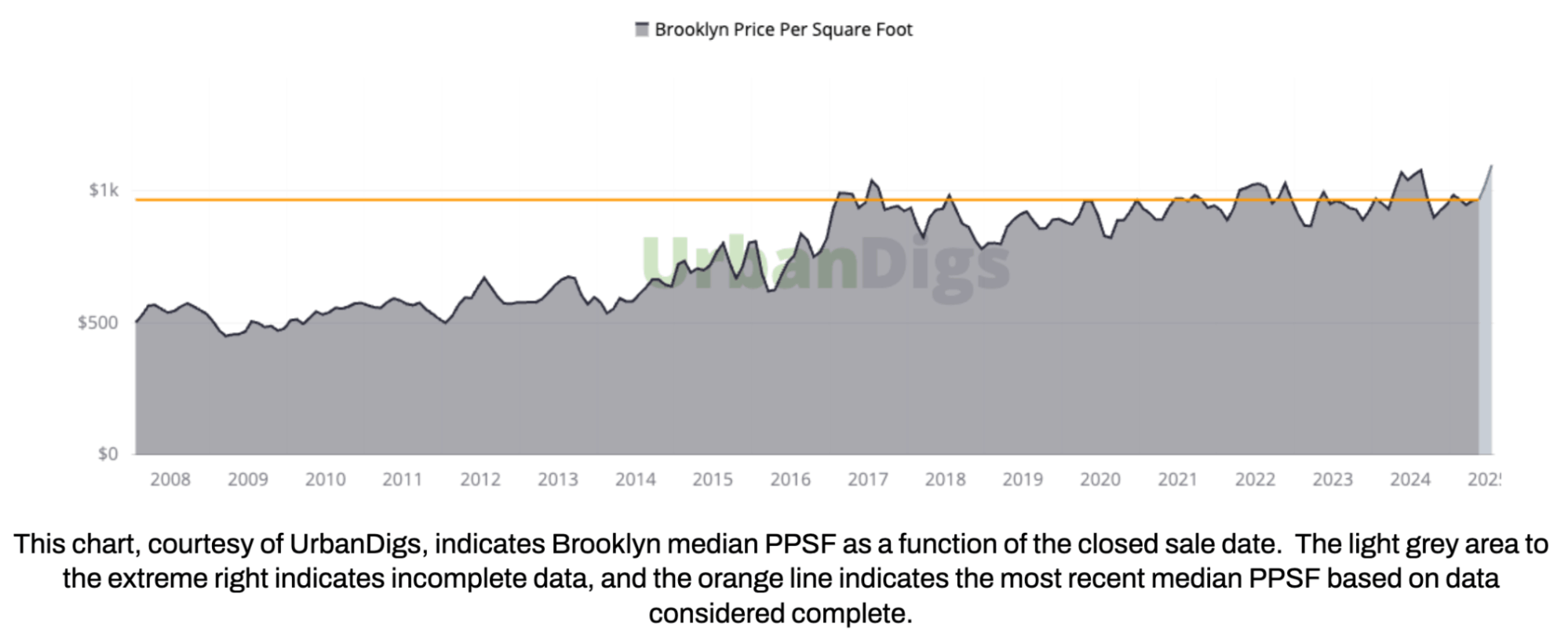

Brooklyn Median PPSF

Brooklyn Median PPSF: Price Per Square Foot Reaches New Heights - But Why?

Brooklyn’s median PPSF hit $1,118, up 5% YoY and 9.2% from June. That’s a sharp move, particularly considering falling transaction volume. Why the spike?

- More luxury product is selling relative to mid-market

- Condo resales in Williamsburg, Dumbo, and Fort Greene are skewing upward

- Sellers are leaning into the “quality over quantity” pricing approach

This makes affordability a growing concern for entry-level buyers and underscores a key market trend: volume may fall, but Brooklyn remains expensive.

What This Means for You:

BUYERS: Sticker shock is real—but it’s not across the board. The rise in PPSF is being driven by sales of well-finished or larger units, not a broad surge in pricing for all inventory. If you're open to homes that may need light cosmetic updates, you could find better value per square foot. Don’t be discouraged by headlines—drill into comps by neighborhood and condition.

SELLERS: This is your moment—if your home is move-in ready and priced strategically. High PPSF doesn’t mean all properties can stretch the price ceiling. But if you’re listing a modern condo, renovated brownstone, or anything with outdoor space or elevator access, you’re in a prime pricing window.

Looking Ahead:

If high PPSF levels persist while contracts stay low, it could create affordability pressure heading into the fall. That may force sellers to adjust pricing in Q4, especially if inventory increases. However, if fall demand rebounds, current pricing levels may hold—particularly in established, well-connected submarkets.

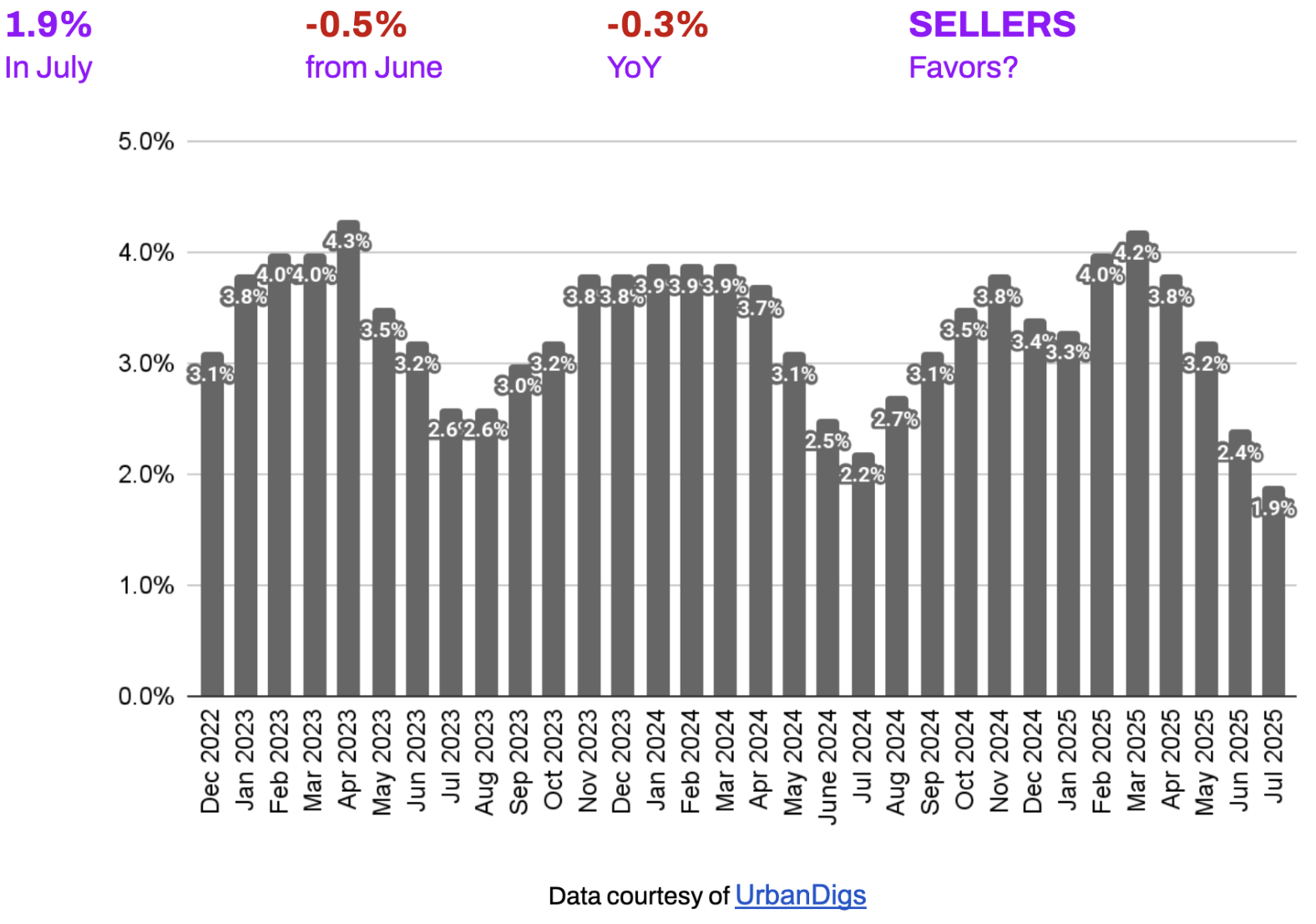

Brooklyn Median Listing Discount

Brooklyn Median Listing Discount: Sellers Hold Their Ground as Listing Discounts Tighten Again

In July, the median listing discount in Brooklyn fell to 1.9%, down from 2.4% in June, marking a 0.5% month-over-month contraction and a 0.3% year-over-year tightening. This is the lowest discount level since late 2022, and it reflects a clear trend: sellers are not retreating, even as buyer activity softens.

This is the fourth consecutive month of discount compression, suggesting that negotiation margins are shrinking, not expanding—despite slower sales volume. In other words, sellers may be facing fewer offers, but they’re standing firm on price expectations, especially for renovated or turnkey homes.

Historically, higher listing discounts are a signal of either stale inventory or mispriced listings. The current tightening suggests many sellers are pricing more strategically upfront, leaving less room for back-end negotiation.

What This Means for You:

BUYERS: Don’t expect dramatic price cuts—especially in well-priced, recently listed homes. However, if a home has been sitting for more than 30 days or shows signs of overpricing (e.g., mismatched comps, poor condition), you may find leverage. Use this market to target listings that need updating or have been overlooked—not those that are newly listed and staged to perfection.

SELLERS: This data validates that well-prepared, appropriately priced homes are selling near ask. If you're pricing based on outdated spring comparables or sentiment, you may sit for weeks or face reductions. On the flip side, homes priced right are still moving quickly, especially in neighborhoods with limited supply (e.g., Carroll Gardens, Clinton Hill, Windsor Terrace).

Looking Ahead: If demand doesn’t rebound in the fall, we may see discounts widen slightly heading into Q4. However, as of now, sellers remain in control of the pricing narrative. Buyers may gain some leverage on less competitive listings, but the market is still rewarding precision pricing and condition over anything else.

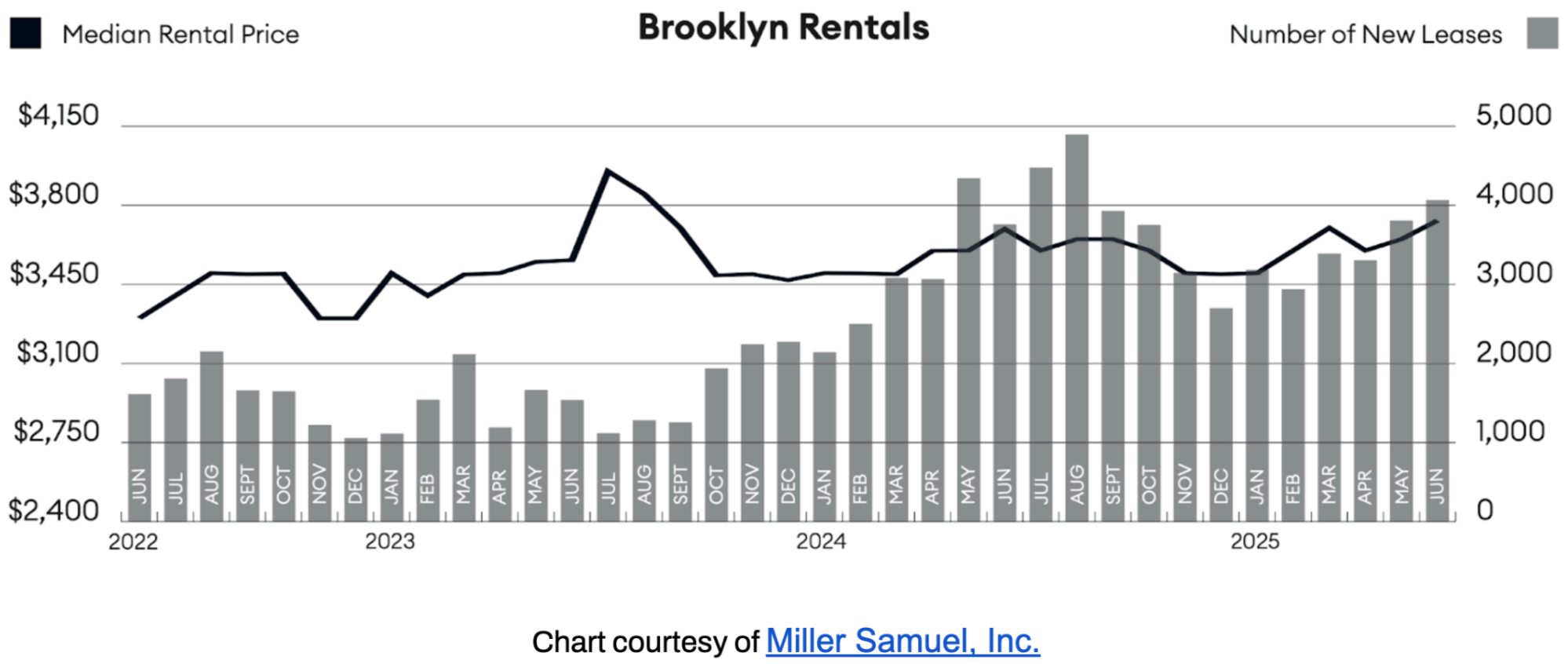

RENTAL REMARKS

Rental Market Reaches New Thresholds - Rents Now Testing Resistance Levels

The median rent reached $3,733, a 2.3% monthly increase and 1% higher YoY. Price per square foot hit a record high for the fifth time in six months. One-third of new leases signed above asking, driven by competition for renovated or conveniently located apartments.³

Two trends are converging:

- Renter demand remains high, especially from buyers priced out of ownership

- Landlords are responding with price hikes, banking on continued strength through fall

But rents may be nearing affordability ceilings, especially in non-luxury products. Expect some resistance if wage growth and concessions don’t rebalance the equation soon.

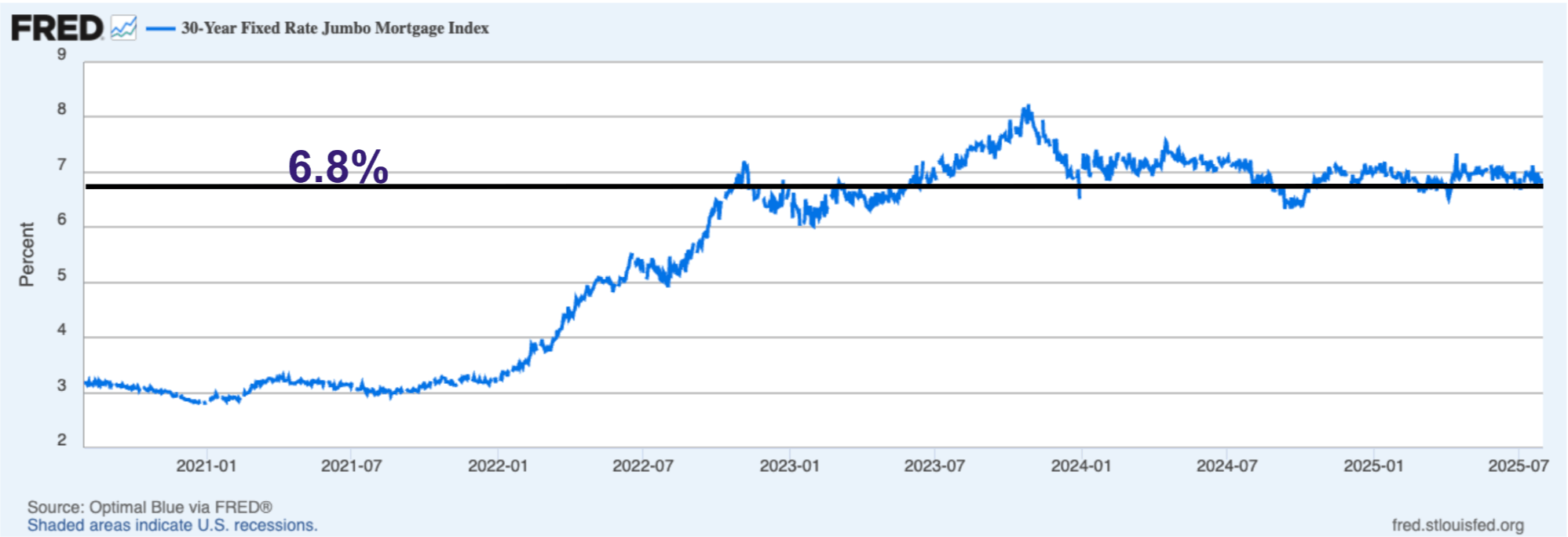

MORTGAGE REMARKS

“Higher for Longer” Now the Baseline

Mortgage Rates: Higher Costs Are the New Normal in Brooklyn, Too

Buyers face 30-year jumbo mortgage rates around 6.8%⁴, with average APRs near 6.6%⁵. These are not shocking anymore, but they continue to impact affordability.

Market Implication: Demand is not disappearing, but it's becoming more concentrated among those with flexibility and liquidity. And cash buyers (especially foreign ones) are re-entering in select neighborhoods.

INVESTOR INSIGHTS

Foreign Investment Revives in Brooklyn

As the U.S. dollar weakens against global currencies, Brooklyn has re-emerged as an attractive entry point for international buyers. Compared to Manhattan, Brooklyn offers:

-

Better price-per-square-foot ratios

-

Strong cultural lifestyle appeal

-

Growing rental yields in areas like Crown Heights and Greenpoint

Cap rates remain steady at 3.0%–3.4% for income-producing properties, particularly in small multi-family buildings.

Buyer Tip: Boutique condo developments, brownstone conversions, and 2–4 family homes in up-and-coming corridors are gaining traction with both international and domestic investors.

References

1. Data courtesy of UrbanDigs

2. According to the Elegran Brooklyn Leverage Index

3. Data courtesy of Miller Samuel, Inc.

4. Data courtesy of Federal Reserve Bank of St. Louis

5. JUMBO mortgage rate APR data courtesy of Bank of America, Chase, and Wells Fargo

If you would like to chat about the most recent market activity,

feel free to contact us at info@elegran.com or

connect with one of our Advisors.

About Us

Welcome to Elegran, where our mission is to revolutionize the world of real estate. Founded in 2008 by Michael Rossi, our journey began with an unwavering drive for motivation, innovation, and a genuine care for our clients.

As an independently owned brokerage, we pride ourselves on our elite team of "advisors," offering a personalized touch that goes above and beyond the traditional real estate experience. Armed with robust data insights, we empower our clients to make informed decisions that lead to success.

Elegran proudly stands at the forefront of excellence. Our passion lies in turning your real estate dreams into reality, and we are committed to providing exceptional service at every step of the journey.

Are you ready to experience the Elegran difference? Dive into the possibilities at www.elegran.com and embark on an unforgettable real estate adventure with us.

Categories

Recent Posts

Stay in the Know!

Sign up to receive our monthly newsletter

GET MORE INFORMATION