Elegran Manhattan Market Update: August 2025

Overall Manhattan Market Update: AUGUST 2025

Seasonal Slowdown, But Sellers Hold the Edge as Global Buyers Reengage

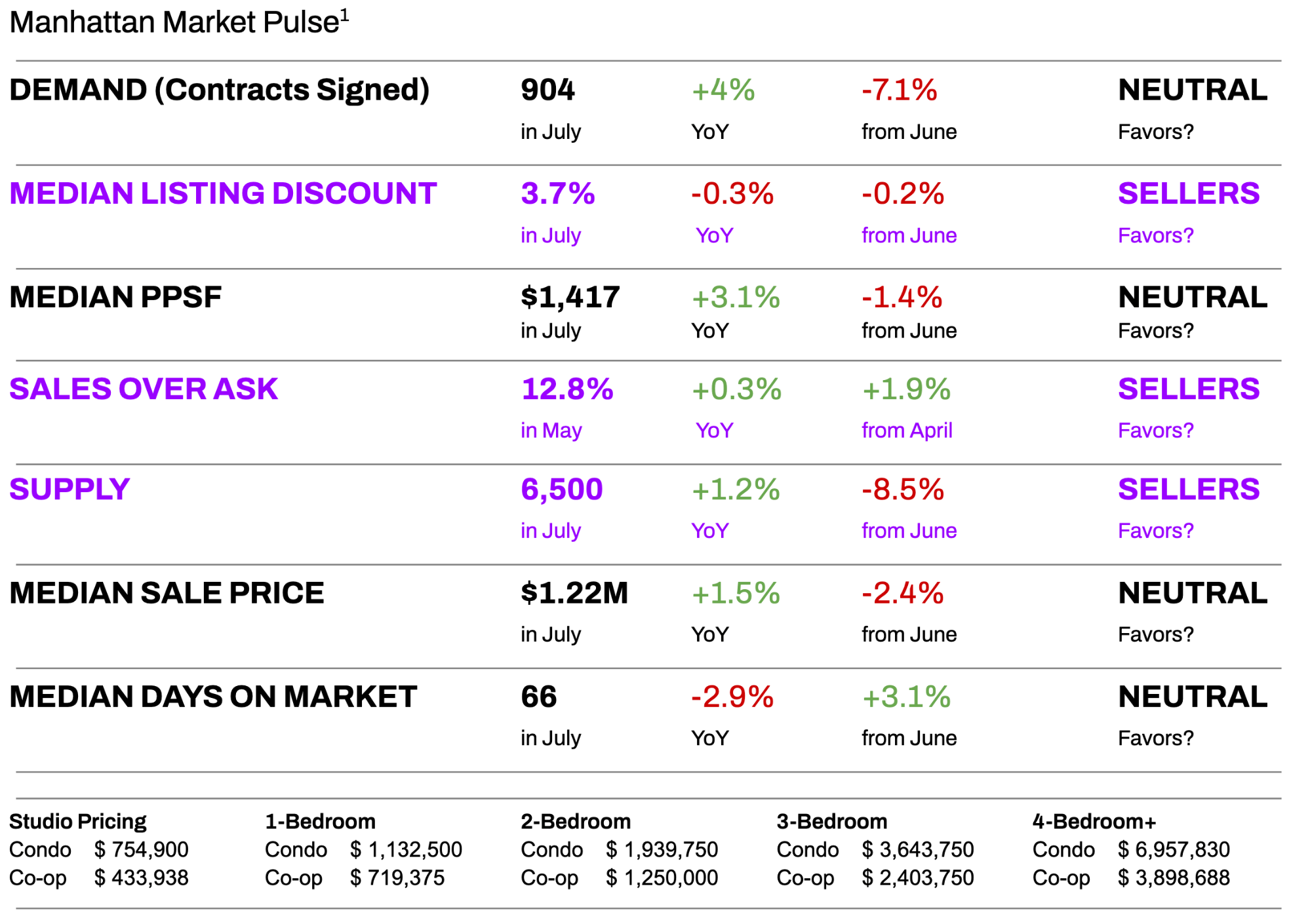

The Manhattan market cooled slightly in July, following typical seasonal patterns. Yet despite a modest dip in monthly contract activity, seller-side leverage strengthened across key indicators. Inventory dropped by 8.5% from June, listing discounts narrowed again, down to a median of 4.5%, and high-end, all-cash transactions helped support price levels. The coop resale market, largely inaccessible to investors and foreign buyers and more dependent on financing, is showing signs of flipping into a buyer’s market.

A total of 904 contracts were signed, up 4% year-over-year, while the median price per square foot reached $1,417, up 3.1% from 2024. Although price growth moderated compared to spring, Manhattan continues to command a premium—especially for well-located, move-in-ready homes. The data shows a 16% pricing premium on renovated versus non-renovated units.

Rental prices hit yet another all-time high record in July. The initial 10-12% spike in rents, driven by the FARE Act, which went into effect June 11th and shifted broker fees from tenants to landlords, has stabilized to a 5.3% increase. We're seeing lease renewal rates at an all-time high, fueled by last year's good cause eviction legislation limiting most lease renewal increases to 8.79% (5% + inflation, which is 3.79% this year). While moving costs have been lowered for some renters by removing fees and building them into rent, we aren't seeing that translate into increased renter activity in the market due to supply constraints. Rental vacancy is at a 5 year low, back to, or slightly under, pre-COVID levels, reinforcing a landlord-favored environment in an already tight market.

At the same time, a weaker U.S. dollar has reignited interest from international investors. NYC real estate is now estimated to be 10–17% cheaper in local currency for European, UK, Canadian, Japanese, and Chinese buyers than it was at the start of the year. These global buyers are targeting new development condos, Midtown luxury units, and pied-à-terre properties—helping prop up demand as domestic volume softens.

The Elegran Manhattan Leverage Index confirms a sustained, upward trend in seller leverage—particularly across mid-to-high-end inventory. While August remains quiet due to travel and seasonality, listing preparation is ramping up ahead of a typically busier post-Labor Day market.

Elegran Manhattan Leverage Index

The Elegran Manhattan Leverage Index² is powered by four indicators: supply, demand, median price per square foot (PPSF), and median listing discount.

Direction Matters:

- An upward-sloping curve = seller’s market

- A downward-sloping curve = buyer’s market

- The steeper the slope, the stronger the advantage for either side

Sellers continued to benefit this summer in Manhattan, as many late-spring contracts reached the closing table in July—especially in the investor and cash-heavy segments. As expected, July and August reflect a seasonal slowdown, with lighter buyer activity typical of the vacation months.

While early August may still feel quiet, momentum is beginning to build behind the scenes. Many sellers are preparing for fall listings, and by late August, we expect the market to start shifting into its next active phase.

Manhattan Supply

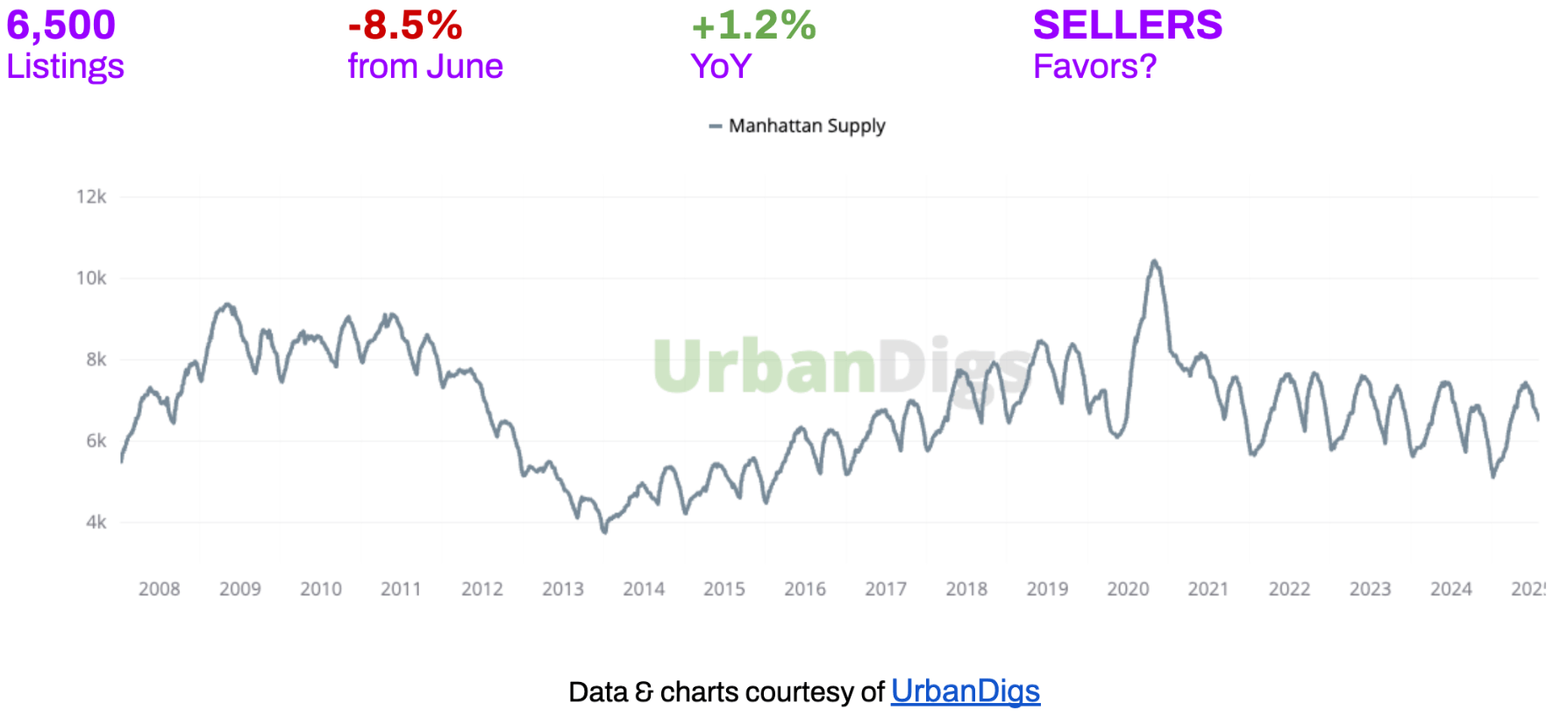

Manhattan Supply: Turnkey Listings Scarce as Active Supply Falls Below 6,500

With 6,500 homes on the market, inventory is down 8.5% from June but up 1.2% year-over-year. The summer slowdown is driving lower new listing volume, especially for turnkey homes. Sellers with well-positioned listings are seeing faster movement and stronger offers.

What This Means for You:

BUYERS: Less inventory means fewer options, especially at entry and mid-level price points. Be prepared to move quickly when quality listings appear.

SELLERS: You have an opportunity to stand out. With fewer homes coming online, well-presented and well-priced listings can attract attention and close efficiently.

Looking Ahead: As August wraps, expect supply to tighten further before listings ramp back up in September.

Manhattan Demand

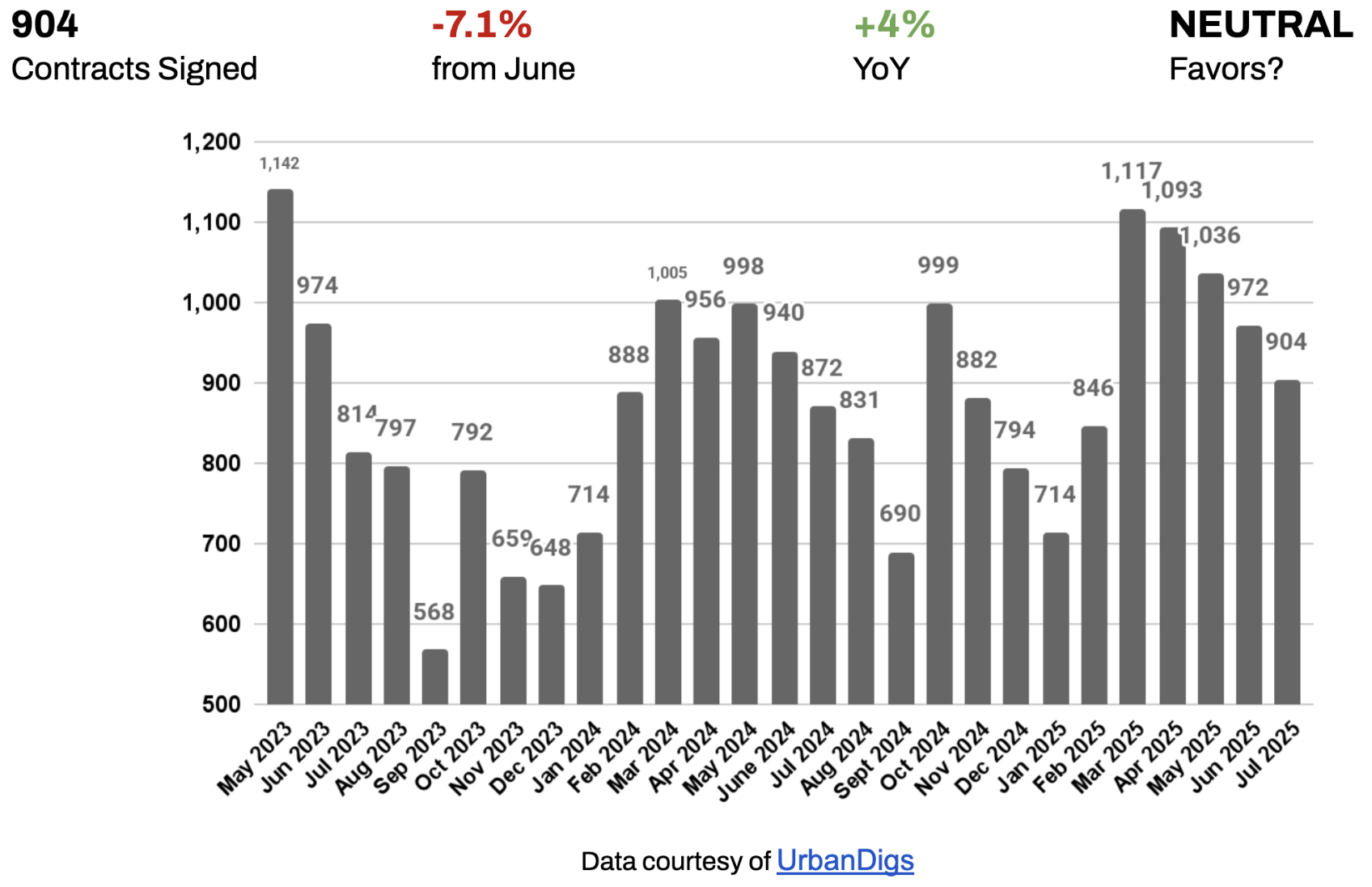

Manhattan Demand: Demand Softens Month-over-Month, but Remains Ahead of 2024

904 contracts were signed in July, down 7.1% from June but up 4% from last year. While the pace slowed, buyer activity remains strong relative to 2024, especially at the high end.

What This Means for You:

BUYERS: Serious competition remains in the luxury segment. For mid-market buyers, expect less urgency but still limited room for negotiation.

SELLERS: Buyer interest is holding, particularly for renovated and well-located units. Set pricing based on recent comps to encourage swift action.

Looking Ahead:

As the vacation season winds down, expect buyer activity to begin ramping up by mid-September.

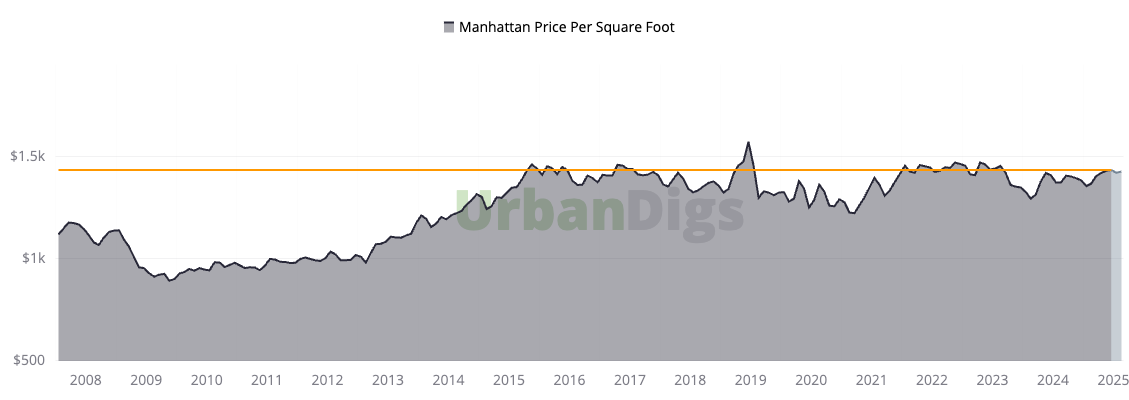

Manhattan Median PPSF

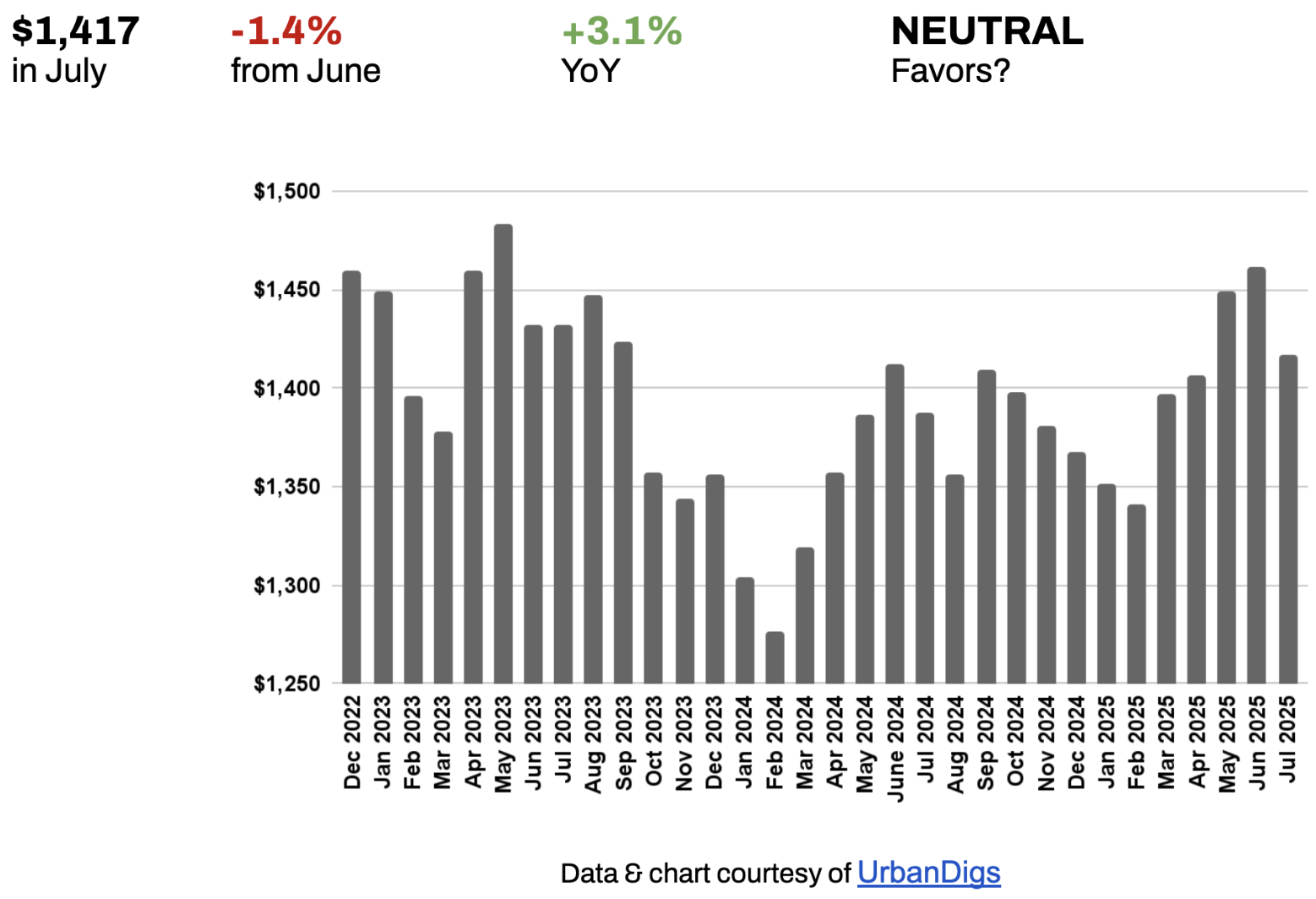

Manhattan Median PPSF: Prices Edge Down from June, but Stay Above 2024 Levels

The median price per square foot settled at $1,417, down 1.4% from June but up 3.1% from last year. This pricing reflects deals signed earlier in the spring and is supported by all-cash luxury transactions.

What This Means for You:

BUYERS: Expect to pay a premium for quality, especially in full-service buildings or prime neighborhoods. Inventory refresh may bring more optionality in the fall.

SELLERS: Even with a slight month-over-month dip, PPSF remains near recent highs. Strategic pricing will be key to maximizing results in a more selective market.

Looking Ahead:

With limited new inventory and global interest rising, price stability should hold into early fall.

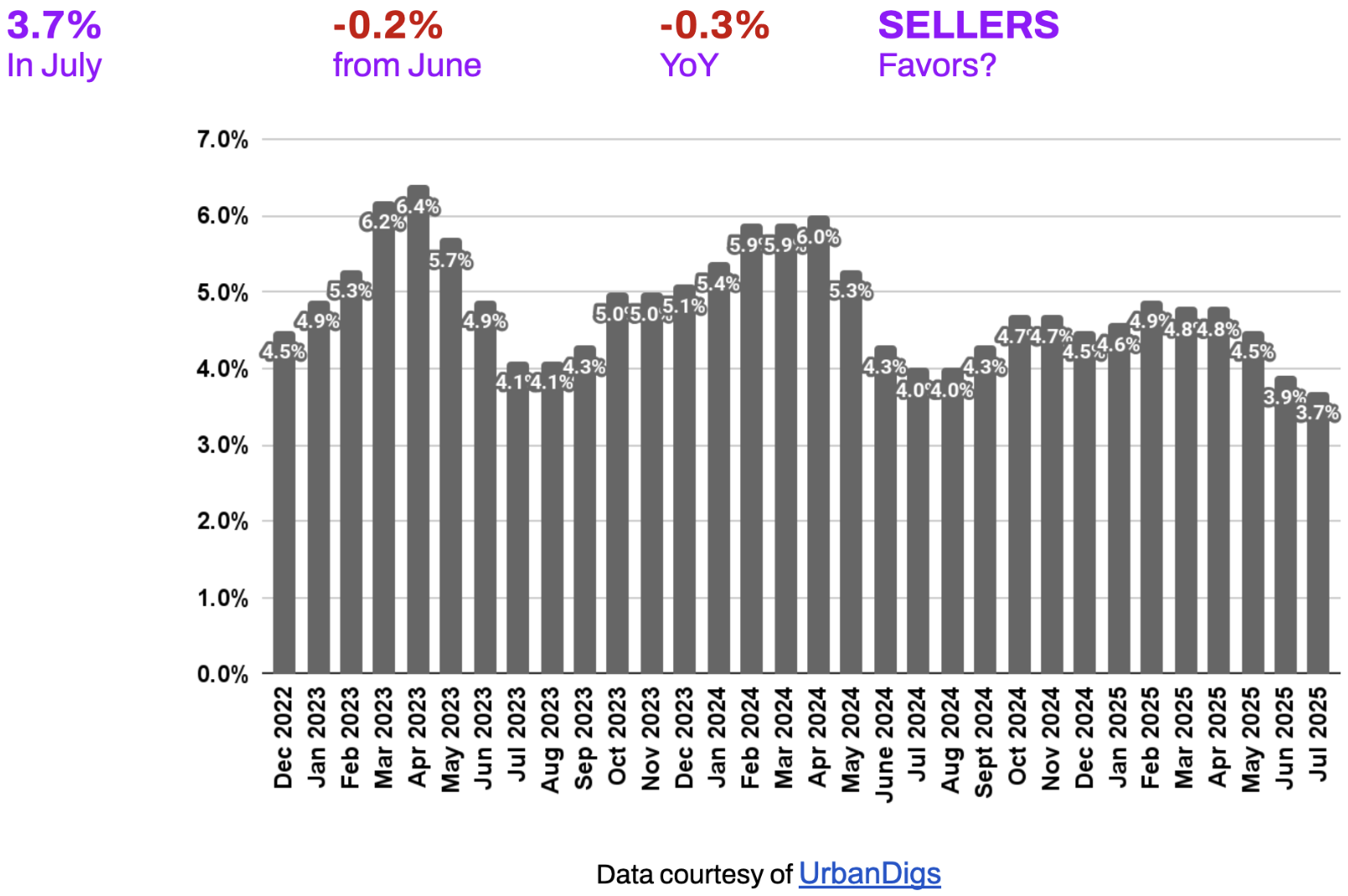

Manhattan Median Listing Discount

Manhattan Median Listing Discounts: Buyers Face Less Negotiating Room as Discounts Continue to Compress

Listing discounts narrowed again to just 3.7%, down from 3.9% in June. This marks the fourth straight month of compression, indicating that sellers are pricing smarter and buyers are willing to meet expectations.

What This Means for You:

BUYERS: Deep discounts are rare. Focus on fair value and be ready to negotiate quickly if the listing is in line with comps.

SELLERS: You’re in a good position—especially if your home is priced accurately from the outset.

Looking Ahead:

Expect listing discounts to remain tight through Labor Day unless there’s a notable uptick in new inventory.

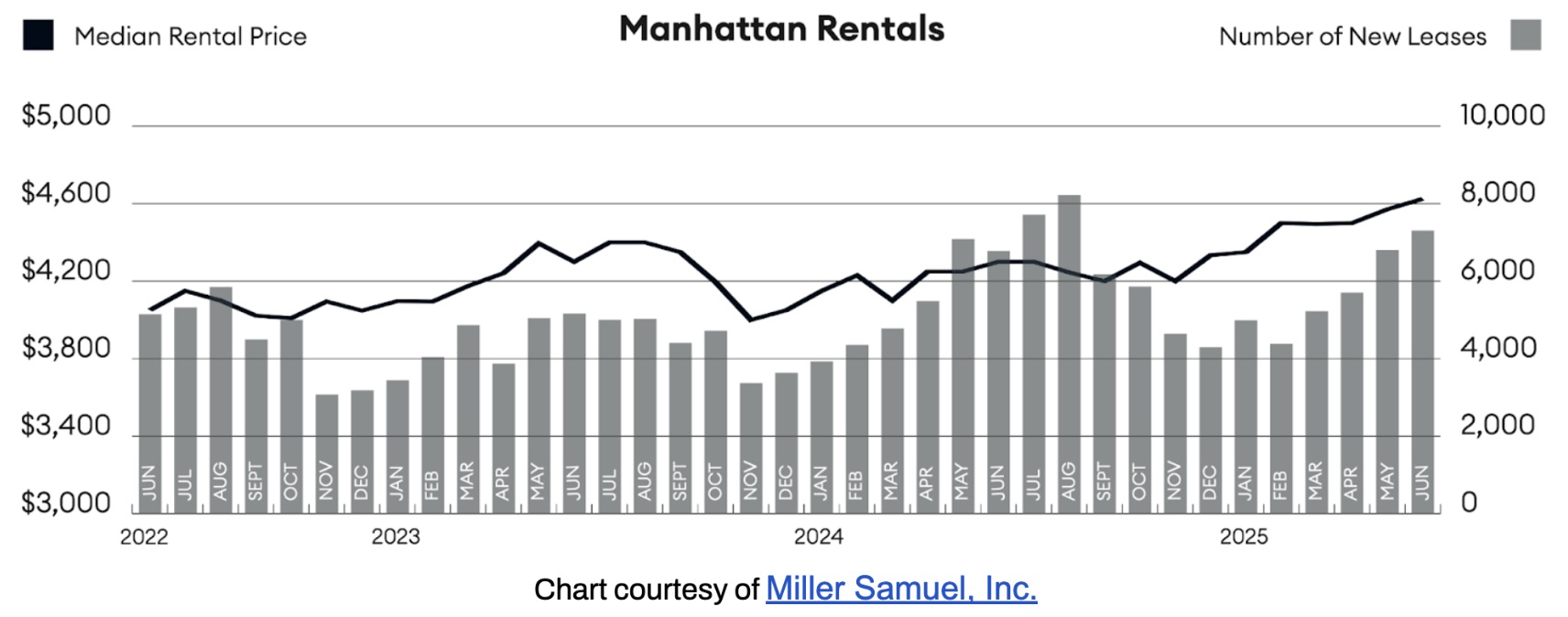

RENTAL REMARKS

Rental Market: Manhattan Rents Hit a New Record—And Could Climb Higher Post-FARE Act

Manhattan median rent hit $4,625 in June, a new record. That’s a 1.2% increase from May and 7.6% year-over-year. Lease activity remains high, with one in four deals closing above the last asking price.³

While the FARE Act has shifted broker fee responsibility to landlords, rent growth appears more tied to demand and limited vacancy than to the policy change. Still, landlords may continue adjusting lease structures as compliance becomes more consistent.

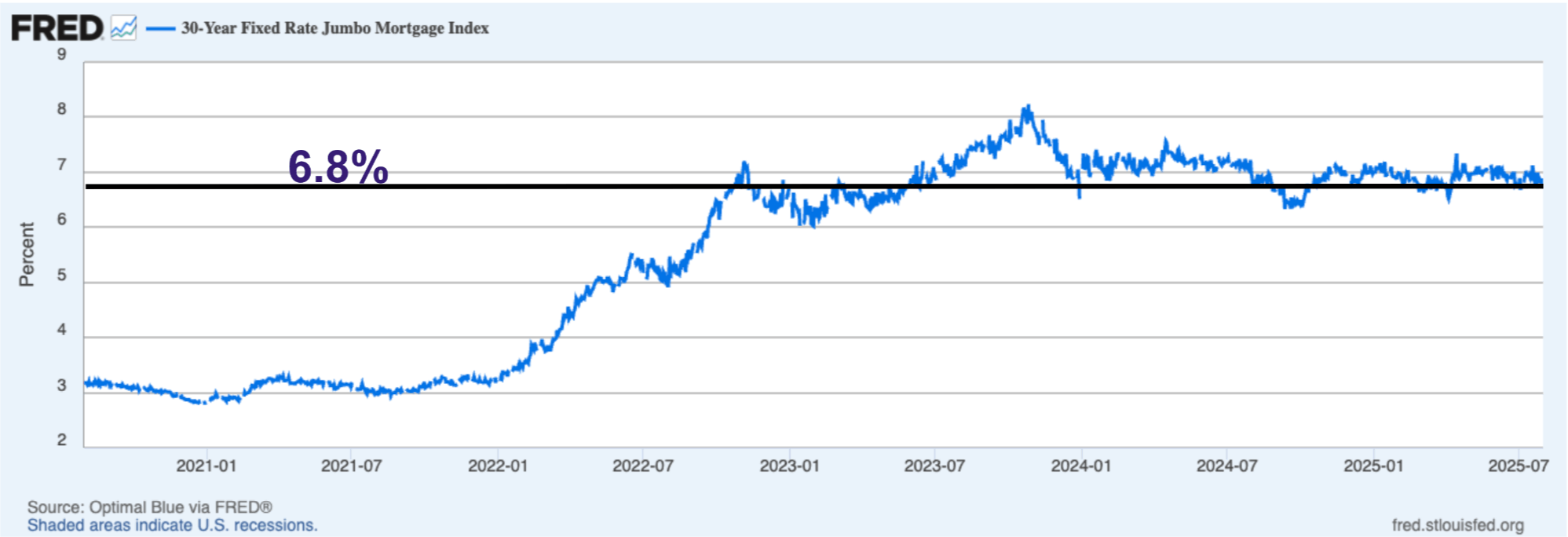

MORTGAGE REMARKS

Mortgage Rates: Borrowing Costs Up Again, But Market Adjusted Long Ago

Jumbo 30-year fixed mortgage rates rose to 6.8%⁴ in July, with average APRs near 6.6%⁵. These elevated rates are no longer a surprise and have largely been absorbed into buyer behavior.

What This Means for You:

BUYERS: Budget for higher monthly payments and consider locking in rates ahead of expected fall competition.

SELLERS: Higher rates are still impacting affordability, so overpricing risks prolonged time on market.

Looking Ahead: Barring economic surprises, rates are expected to stay range-bound through Q4.

INVESTOR INSIGHTS

Weaker Dollar Fuels Surge in International Buyer Activity

International buyers are returning to the Manhattan market. A softer U.S. dollar has made NYC properties 10–17% cheaper in local currency terms for European, UK, Canadian, and Japanese investors.

What This Means for You:

Domestic Investors: Look for yield in long-term hold properties with value-add potential. Cap rates remain stable at 3.0–3.4%.

International Buyers: Now is a prime window to buy in USD before demand increases further. Focus on:

- New development condos

- Luxury resale in Midtown and FiDi

- Pied-à-terre units in core markets

Looking Ahead: Brokers should highlight FX advantages in international marketing. Expect rising global activity through the fall as currencies realign and dollar-based pricing looks attractive.

References

1. Data courtesy of UrbanDigs

2. According to the Elegran Manhattan Leverage Index

3. Data courtesy of Miller Samuel, Inc.

4. Data courtesy of Federal Reserve Bank of St. Louis

5. JUMBO mortgage rate APR data courtesy of Bank of America, Chase, and Wells Fargo

If you would like to chat about the most recent market activity,

feel free to contact us at info@elegran.com or

connect with one of our Advisors.

About Us

Welcome to Elegran, where our mission is to revolutionize the world of real estate. Founded in 2008 by Michael Rossi, our journey began with an unwavering drive for motivation, innovation, and a genuine care for our clients.

As an independently owned brokerage, we pride ourselves on our elite team of "advisors," offering a personalized touch that goes above and beyond the traditional real estate experience. Armed with robust data insights, we empower our clients to make informed decisions that lead to success.

Elegran proudly stands at the forefront of excellence. Our passion lies in turning your real estate dreams into reality, and we are committed to providing exceptional service at every step of the journey.

Are you ready to experience the Elegran difference? Dive into the possibilities at www.elegran.com and embark on an unforgettable real estate adventure with us.

Categories

Recent Posts

Stay in the Know!

Sign up to receive our monthly newsletter

GET MORE INFORMATION