Elegran Brooklyn Market Update: August 2023

Brooklyn Market Update: Seller's Advantage Softens as Demand Dips

Our August report is your window into the latest trends and metrics that are shaping Brooklyn's vibrant and significant real estate market, often seen as a leading indicator for New York City's broader property trends.

Using the Elegran | Forbes Global Properties' Leverage Indicator, we shed light on the market's state of play through four key metrics:

- Supply

- Demand

- Median Price Per Square Foot

- Median Listing Discount

These metrics are instrumental in determining the leverage between buyers and sellers. Currently, Brooklyn is experiencing a softening of the seller's market due to a decrease in demand, impacting all housing segments from studios to two-bedroom properties.

In this update, we'll dive into these critical metrics, exploring their implications for buyers, sellers, and investors. As the seller's market begins to lose momentum, new opportunities may be emerging. Let's delve into the details of this shifting landscape to unearth the underlying nuances and possibilities.

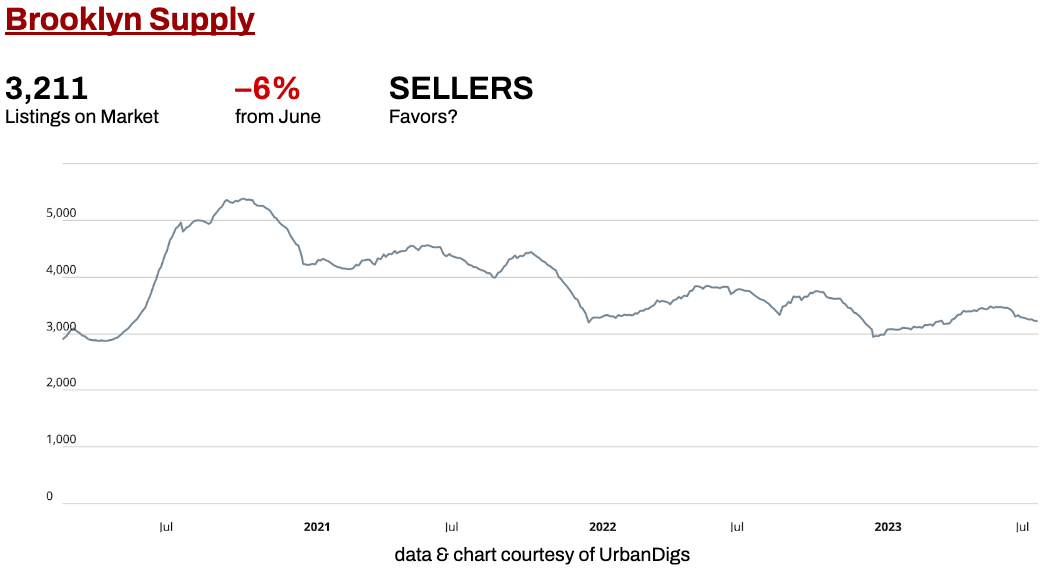

Brooklyn Supply

As we delve into the Brooklyn real estate market, the first key metric to consider is Supply.

Brooklyn's real estate supply has been following a seasonal trend, reaching a peak in June 2023 and is now on a decline as of late August. The total listings on the market currently stand at 3,211, indicating a 6% decrease from the previous month. While these changes are not unexpected, they impact both buyers and sellers:

- BUYERS? The decrease in supply translates to fewer options to choose from, potentially making it more challenging to find the ideal property.

- SELLERS? The drop in supply can be advantageous as it means less competition.

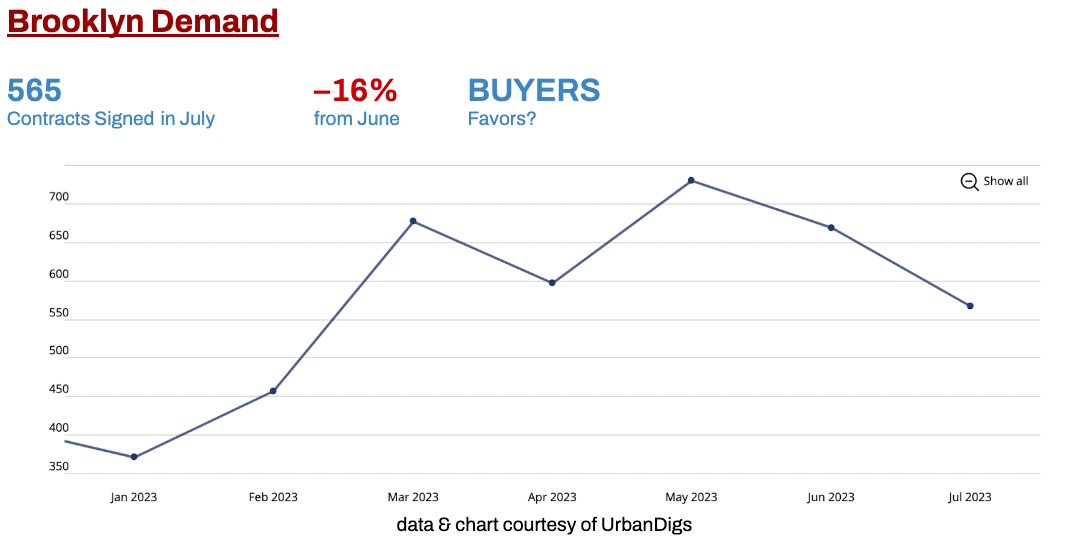

Brooklyn Demand

Demand is another crucial pillar that shapes the Brooklyn real estate market. It provides insight into the appetite of buyers and the vibrancy of the market.

There were 565 contracts signed, marking a 16% decrease from the preceding month of June. As we've come to expect, demand usually recedes after a Spring peak. The current pullback illustrates this typical market rhythm, and its implications are noteworthy:

- BUYERS? The reduction in demand means less competition, affording buyers potentially more leverage and time in making their purchase decisions.

- SELLERS? With less activity and fewer contracts being signed, sellers may need to exercise patience and potentially adapt their strategies to attract buyers.

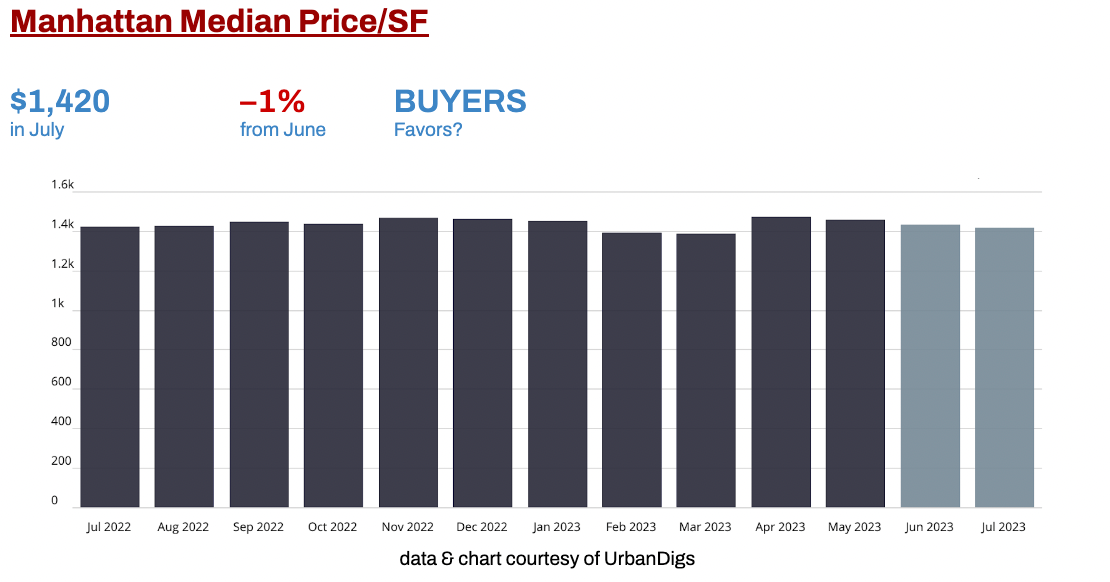

Brooklyn Median Price/SF

Median Price Per Square Foot (Price/SF) is another key metric that illuminates the value trends in the Brooklyn real estate market. This statistic offers an important perspective on property pricing.

After peaking in May, the Price/SF has retreated slightly. In July 2023, the median Price/SF in Brooklyn was $950, representing a decrease of 3% from June. This change suggests a slight easing in property values, which can impact the market in distinct ways:

- BUYERS? The downward trend in Price/SF is moving in their favor, potentially making properties more affordable.

- SELLERS? Sellers might find this trend less favorable as Price/SF is moving against their interest, suggesting that property values are moving in a downward direction.

Brooklyn Median Listing Discount

The Median Listing Discount is a vital metric that offers insights into the negotiation power in the Brooklyn real estate market. It represents the median percentage difference between the final sale price and the last listing price.

Over the past four months, the median listing discount has been on a downward trend, favoring sellers to a degree. In July 2023, the median listing discount in Brooklyn was 2.7%, showing a decrease of 18% from June. This reduction indicates sellers are accepting slightly lower discounts, which hints at the negotiation dynamics in the market:

- BUYERS? Shrinking discounts suggest a tougher negotiating environment, creating a challenge for buyers on price negotiations.

- SELLERS? On the flip side, this trend could spell good news for sellers, indicating they're securing closer to their asking prices.

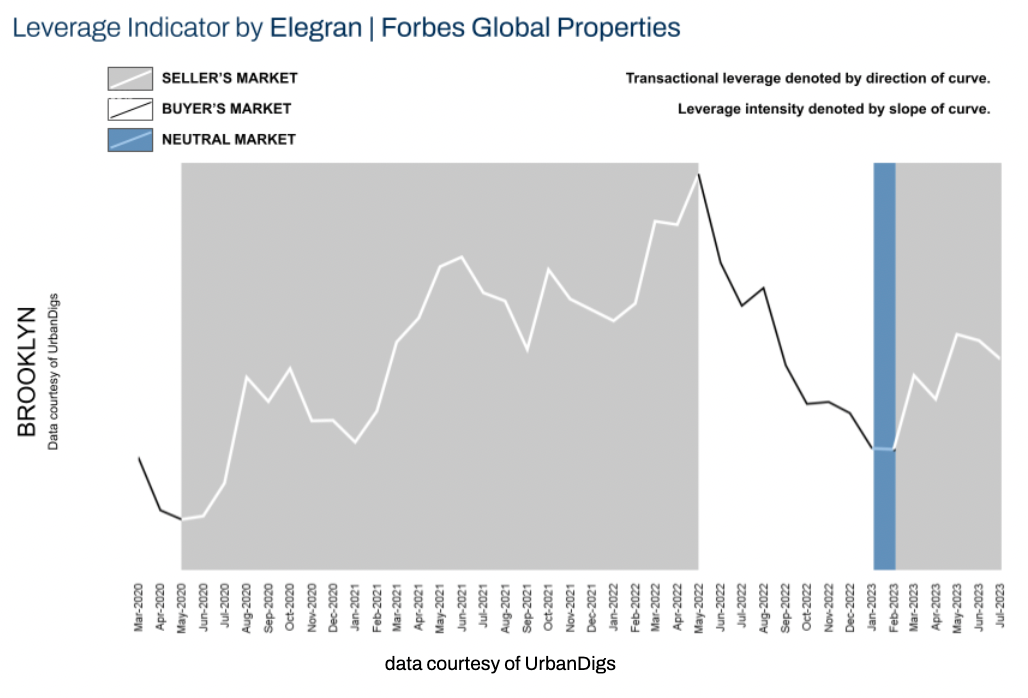

Elegran | Forbes Global Properties Leverage Indicator: Brooklyn

Our Elegran | Forbes Global Properties' Leverage Indicator serves as a key tool to understand the current power dynamics between buyers and sellers in the Brooklyn real estate market. By synthesizing our four core metrics (Supply, Demand, Median Price/SF, Median Listing Discount), it provides a snapshot of market conditions and transactional leverage.

The trend of the Leverage Indicator reveals that from May 2022 to January 2023, Brooklyn was firmly a buyer's market. Since then, however, the tide has turned, and sellers have been enjoying the upper hand.

Recently, over the past two weeks, we've observed a shift. The seller's advantage has started to wane, primarily driven by a noticeable, albeit seasonal, decrease in demand. This weakening in the sellers' market suggests that the transactional leverage may be shifting back toward the buyers, potentially offering more bargaining power for property seekers.

We'll continue to monitor and analyze these trends. Whether you're a buyer eager to capitalize on shifting trends or a seller looking to secure the best deal, staying informed with our Leverage Indicator will keep you ahead of the curve in the dynamic Brooklyn market.

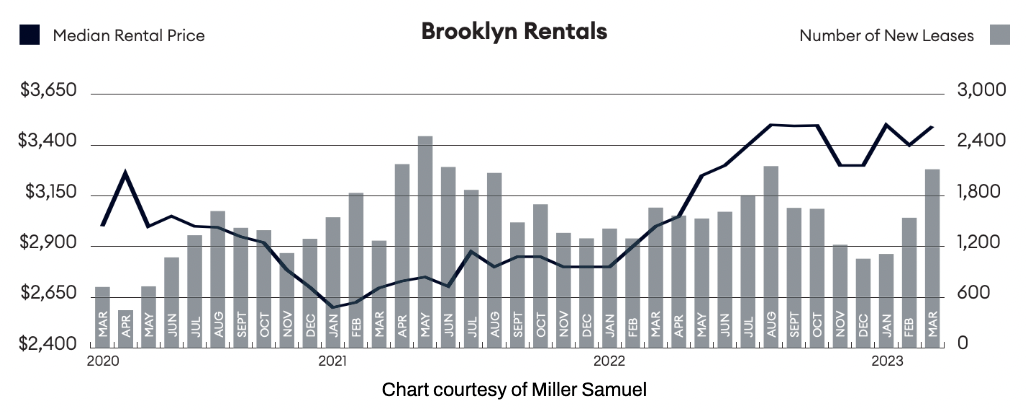

Rental Remarks

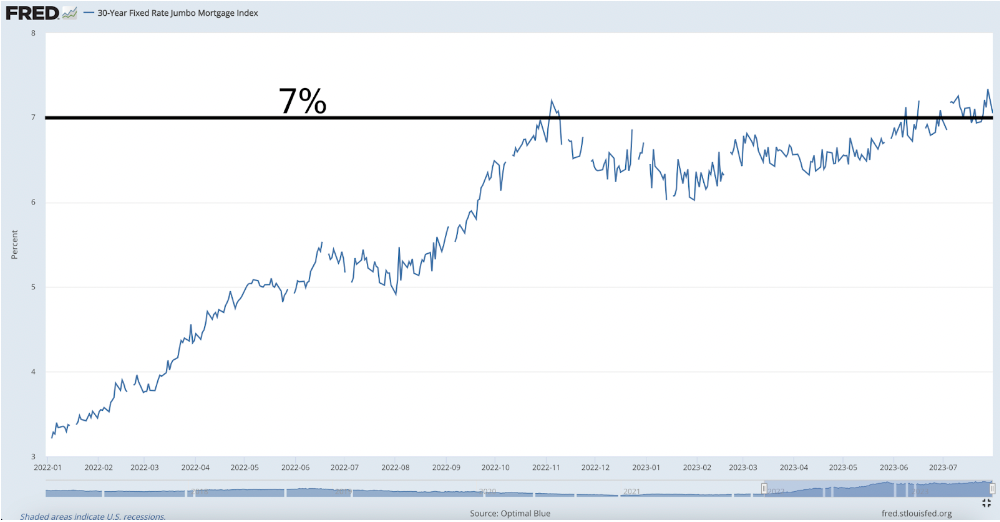

Rental trends in Brooklyn also provide essential insights into the real estate landscape. As of June 2023, the median rent in Brooklyn is hovering at its all-time high. Despite the high rental prices, the prevailing average 30-year JUMBO mortgage rate stands at 7.052%.

This scenario creates a "catch-22" for renters who are considering the cost-benefit analysis of renting versus buying, as both options present their unique financial challenges.

The persistence of high rents and mortgage rates highlights the strength and demand in Brooklyn's real estate market, despite the broader shifts in the housing landscape.

Investor Insights

Investor Insights provide a critical perspective on the opportunities and challenges in the Brooklyn real estate market. Brooklyn cap rates currently range between 2.5 - 3.5%. Paired with the current average mortgage rate of 7.052%, leveraged investments may not provide immediate net income potential. However, there's more to this picture than meets the eye.

On one hand, the scenario suggests challenging conditions for investors reliant on leverage. However, for all-cash buyers, high rents in Brooklyn offer potential opportunities for steady rental income.

The impact of exchange rates adds another dimension for foreign investors. For foreign investors looking to sell, a relatively strong USD can be favorable. Depending on their native currency, they could realize significant capital gains upon selling their Brooklyn real estate assets. Conversely, a weakening USD presents an opportune moment for foreign investors to buy into Brooklyn's real estate market. This investment could bring stability and potential for price appreciation.

These varied conditions highlight the multi-faceted nature of Brooklyn's real estate market, offering diverse opportunities for different types of investors. It's essential to stay informed and agile to capitalize on these evolving circumstances.

If you would like to chat about the most recent market activity, feel free to contact us at info@elegran.com or connect with one of our Advisors.

About Us

Welcome to Elegran, where our mission is to revolutionize the world of real estate. Founded in 2008 by Michael Rossi, our journey began with an unwavering drive for motivation, innovation, and a genuine care for our clients.

As an independently owned brokerage, we pride ourselves on our elite team of "advisors," offering a personalized touch that goes above and beyond the traditional real estate experience. Armed with robust data insights, we empower our clients to make informed decisions that lead to success.

Distinguished as the exclusive member of the invitation-only Forbes Global Properties network in NYC, Elegran proudly stands at the forefront of excellence. This exclusive partnership broadens our horizons, enabling us to connect buyers, sellers, and investors with extraordinary luxury properties not only in New York City but across the globe.

Our passion lies in turning your real estate dreams into reality, and we are committed to providing exceptional service at every step of the journey.

Are you ready to experience the Elegran difference? Dive into the possibilities at www.elegran.com and embark on an unforgettable real estate adventure with us.

Categories

Recent Posts

Stay in the Know!

Sign up to receive our monthly newsletter

GET MORE INFORMATION