Elegran Brooklyn Market Update: July 2023

Photo By: Josh Wilburne | Unsplash

Brooklyn Market Update: Seller’s Market, Possibly as Part of a Broader Buyer’s Market

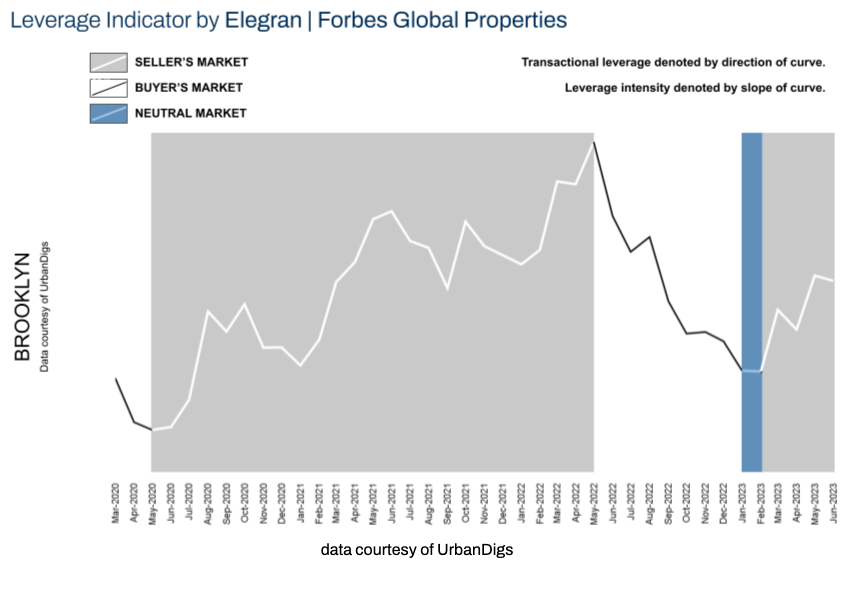

Elegran’s Leverage Indicator is a comprehensive market snapshot, providing insight on who has most transactional leverage. It tells us who the market currently favors – Buyers? or Sellers?

Four metrics power it:

- SUPPLY

- DEMAND

- MEDIAN PRICE/SF

- MEDIAN LISTING DISCOUNT

Between May 2022 and January 2023, the market experienced a pronounced buyer's market, indicating that buyers had more leverage during that period. However, since then, the balance of leverage has shifted predominantly in favor of sellers. But it is unclear whether this signifies a sustained seller's market in Brooklyn, or if it resembles the temporary seller's markets that occurred from May 2020 to May 2022 within a broader buyer's market.

Overall, the Brooklyn market is discerning but liquid.

Now, let's delve into each of the four metrics individually to better understand why there is a seller's market in Brooklyn and what implications it holds for buyers and sellers.

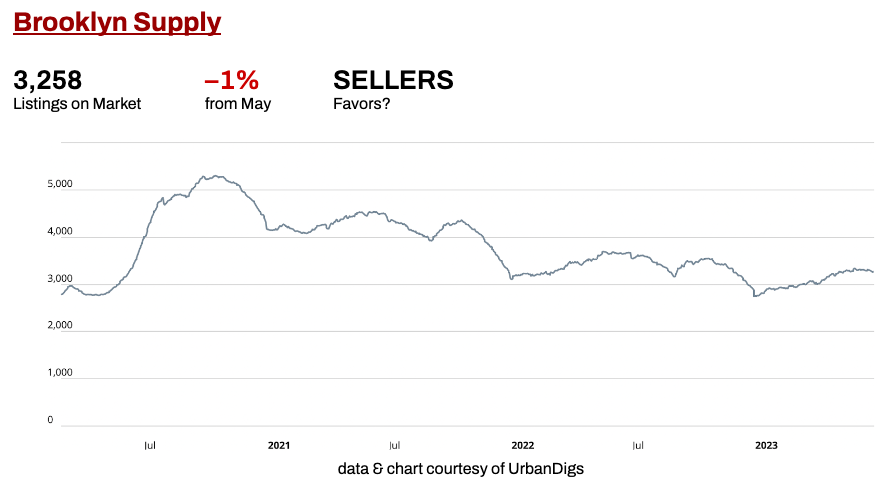

Brooklyn Supply

Using 2022 as an almanac, Brooklyn's supply level peaked in June and will trough in late August or early September. What does receding supply mean for:

- BUYERS? Fewer options.

- SELLERS? Less competition.

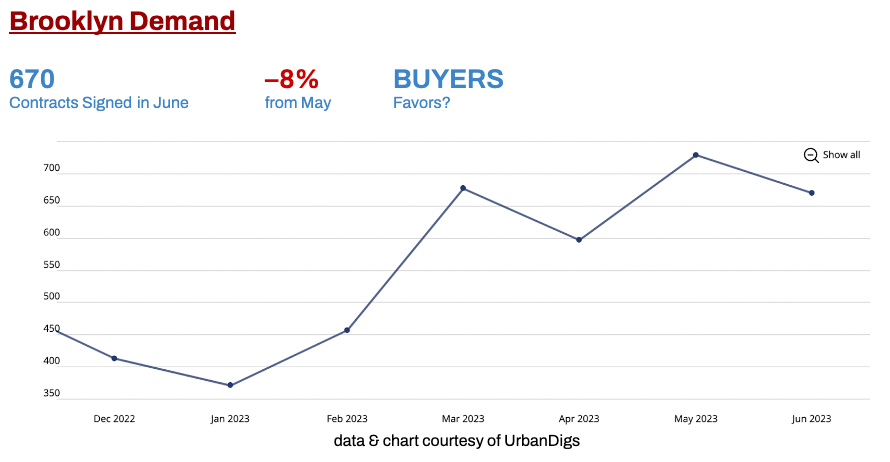

Brooklyn Demand

Not surprisingly, demand is pulling back after the Spring peak. What doe this mean for:

- BUYERS? Less competition.

- SELLERS? Less activity.

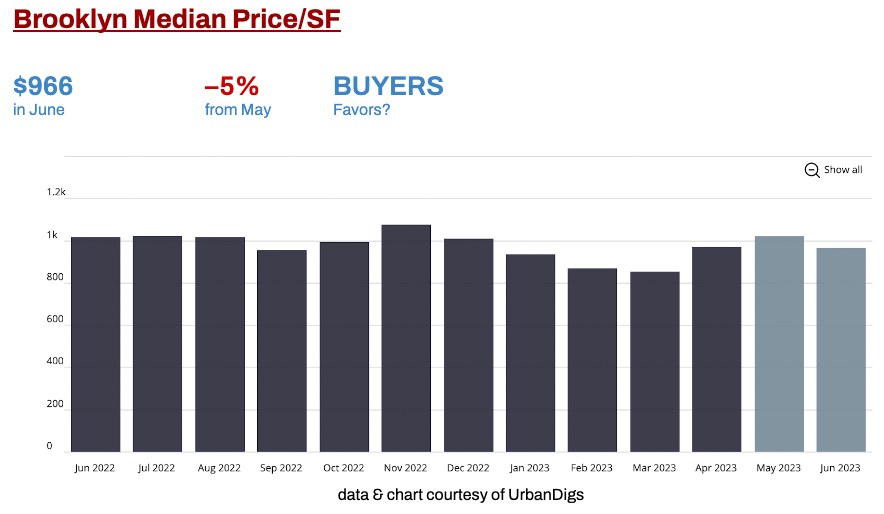

Brooklyn Median Price/SF

After peaking in May, the median price per square foot returned some of its recent gains. What does this mean for:

- BUYERS? Price/SF is moving in their favor.

- SELLERS? Price/SF is moving against their interest.

Brooklyn Median Listing Discount

The median listing discount has retreated over the past three months. What does this mean for:

- BUYERS? Discounts are moving against their interests.

- SELLERS? Discounts are moving in their favor.

Elegran | Forbes Global Properties Leverage Indicator: Brooklyn

Elegran | Forbes Global Properties' Leverage Indicator provides valuable insights into whether the current market conditions favor buyers or sellers, indicating which party holds the transactional leverage. The direction and slope of the curve in the graph below indicate this information.

According to the chart, there was a significant buyer's market from May 2022 to January 2023. However, since then, sellers have primarily held the leverage. It is challenging to determine whether Brooklyn has shifted into a sustained seller's market or if this recent trend resembles the occurrence of multiple temporary seller's markets within a broader buyer's market from May 2020 to May 2022. But we know that at least for now, sellers have the leverage.

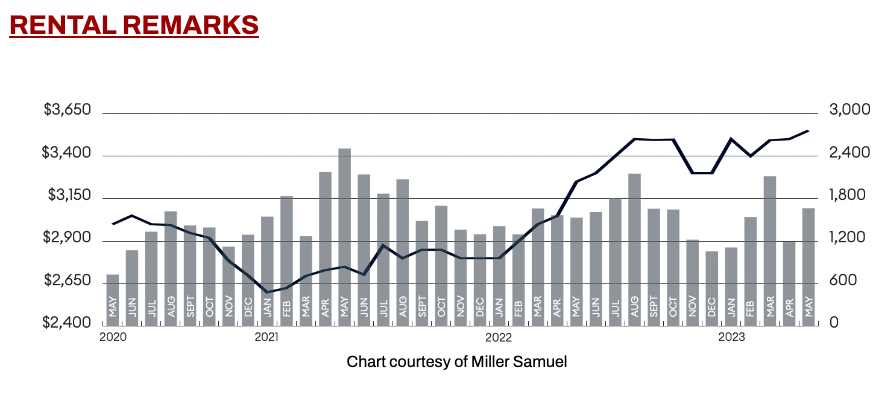

Rental Remarks

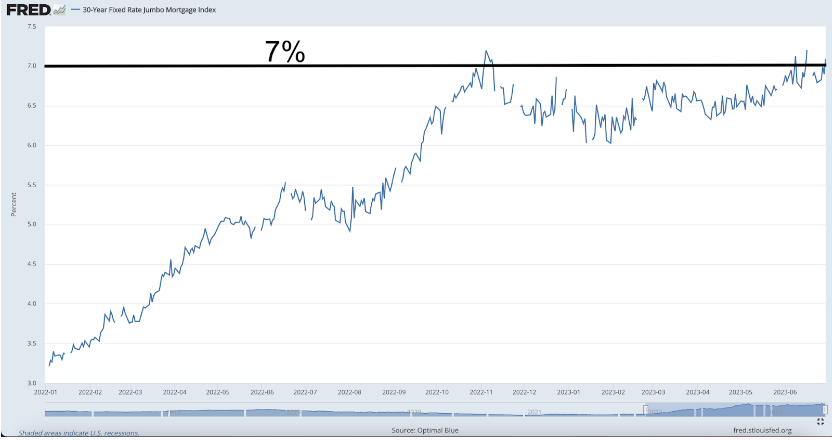

The median rent in Brooklyn set a new high*, and the average 30-yr JUMBO mortgage rate is 7.09%. It’s a “catch-22” for renters, as the rent versus buy scale may feel equally punitive on both sides.

* May 2023 numbers, as June 2023 data is not yet available

Investor Insights

With Brooklyn cap rates between 2.5 - 3.5% and mortgage rates at 7.09%, there is no net income potential on leveraged investments. However, with rents at all-time highs, opportunities exist for all-cash buyers.

On the sell side, a relatively strong USD affords foreign investors, depending on their native currency, the opportunity to realize significant capital gains upon selling their assets.

On the buy side, the weakening dollar creates opportunities for foreigners to purchase Brooklyn real estate and lock in its notorious stability and potential for price appreciation.

About Us

Elegran’s mission is to ‘humanize the world of real estate’ through a client-first and a thoughtful technology philosophy. A distinguished Forbes Global Properties member for New York City’s five boroughs and winner of the Most Innovative Brokerage Award from Inman, Elegran’s talented team of agents delivers client-centered service, resulting in eight times more sales volume sold per agent than the industry average.

Categories

Recent Posts

Stay in the Know!

Sign up to receive our monthly newsletter

GET MORE INFORMATION