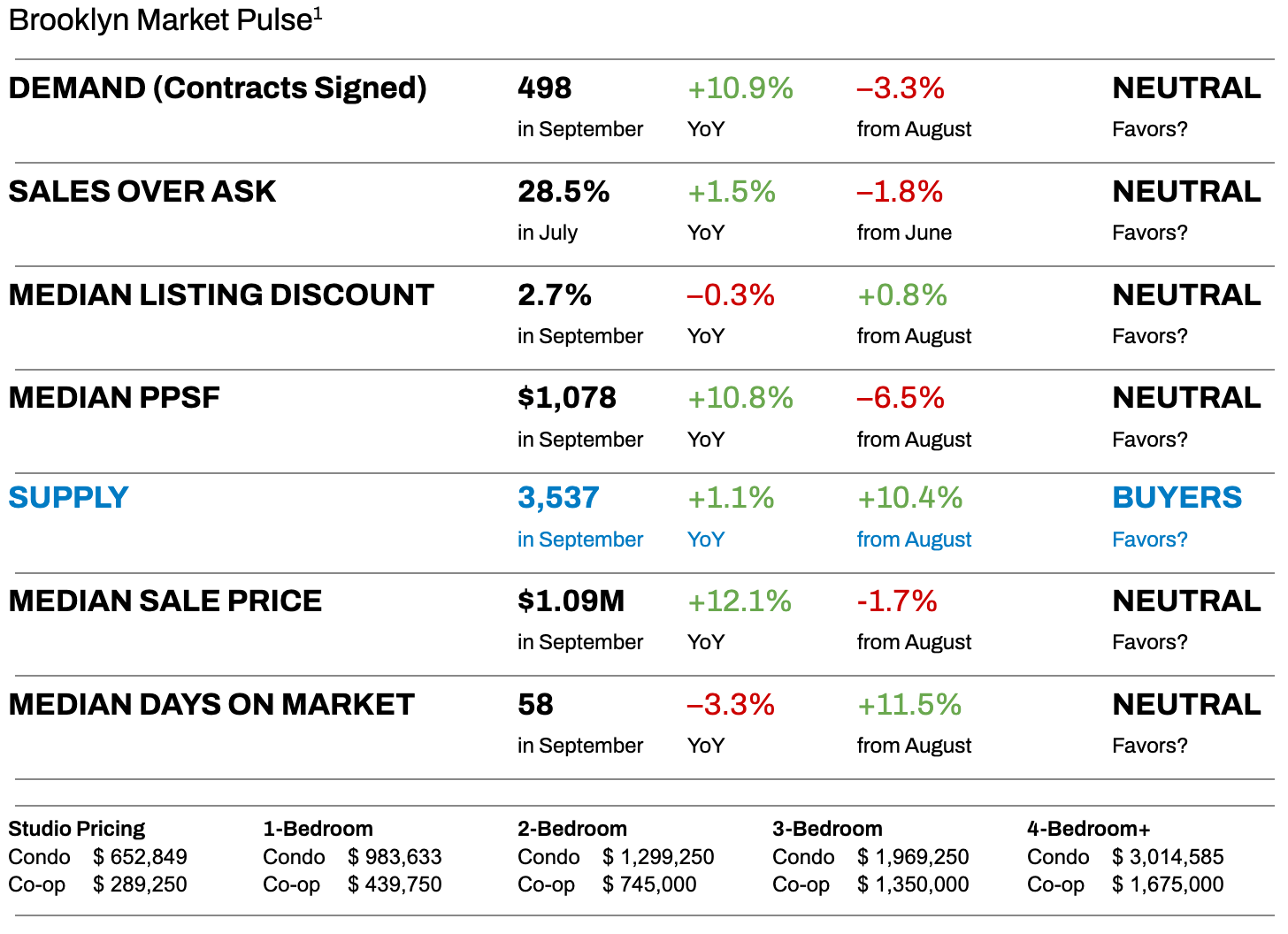

Elegran Brooklyn Market Update: October 2025

Overall Brooklyn Market Update: OCTOBER 2025

Fall Listing Surge Tilts Market Toward Buyers

Brooklyn’s housing market took a noticeable turn in September, as an influx of new listings gave buyers more breathing room. Active inventory jumped about 10.4% month-over-month – the biggest supply boost all year – and edged slightly above last fall’s level.

With more choice on the market, buyers didn’t rush: 498 contracts were signed, roughly 3% fewer than in August, though still ~11% higher than September 2024 - a sign that demand in 2025 remains stronger than a year ago despite cooling momentum.

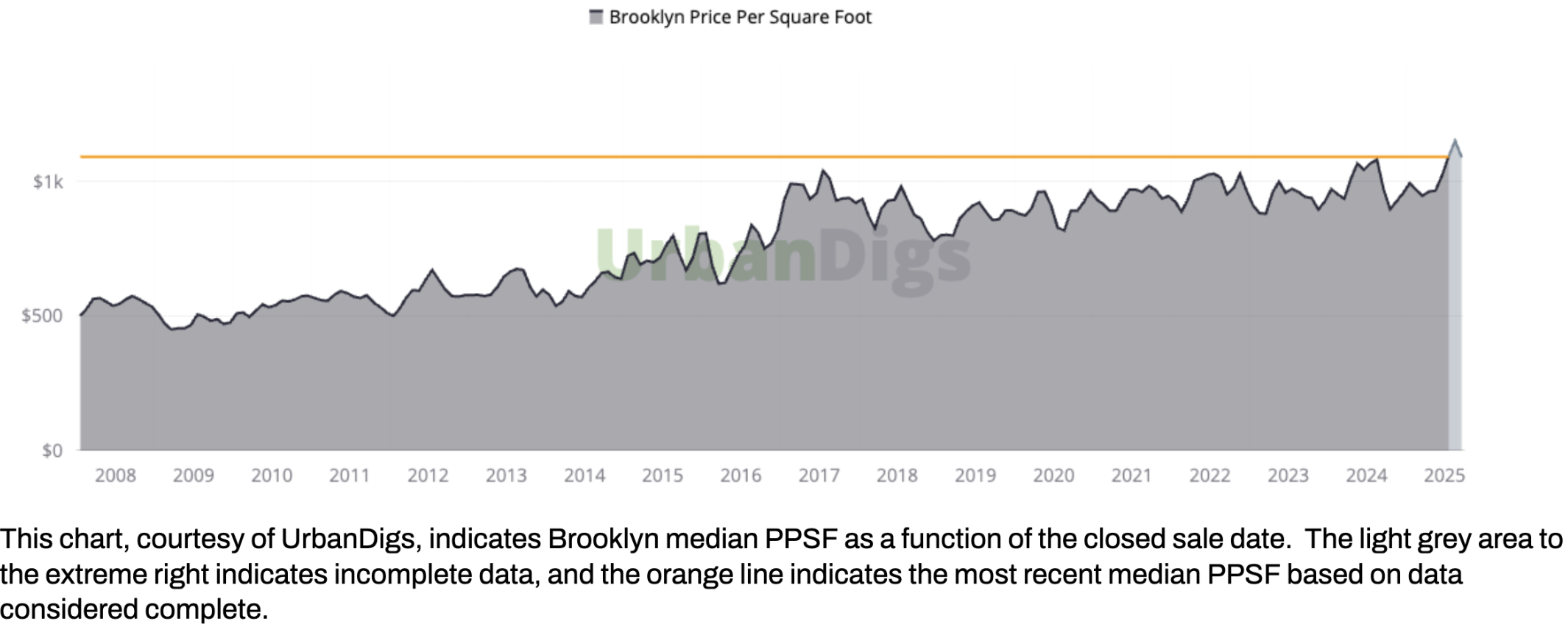

Prices showed the first hints of softening: the median price per square foot dipped to $1,078 (down 6.5% from August’s record) and median listing discounts widened to 2.7% off ask (up from summer’s historically constrained ~1.9%). However, part of the elevated median still reflects strength in the luxury segment – particularly along the waterfront – where new developments such as Williamsburg Wharf and One Domino Square have boosted contract prices through a steady run of high-end sales.

Sellers can’t quite call all the shots anymore, yet Brooklyn is no bargain bin. In fact, nearly 28.5% of homes still sold above asking price, only slightly below last year’s pace, underscoring that well-priced, desirable listings remain competitive.

Add in a record-high median rent (~$3,950) that’s pushing some renters to consider buying, and a backdrop of 6.5% mortgage rates stabilizing after the Fed’s first rate cut in years, and you get a market in transition. Overall, Brooklyn enters the fall more balanced than it’s been in months: buyers have gained leverage, but it’s not a buyer’s market outright - it’s a market in flux, testing whether these buyer-friendly trends will persist through the rest of the year.

Big picture: October is likely the busiest remaining month of 2025 for sales. After that, many house-hunters will postpone searches to January, so if you’re a seller, now’s the time to capture active buyers; if you’re a buyer, you might see motivated sellers as the year-end approaches.

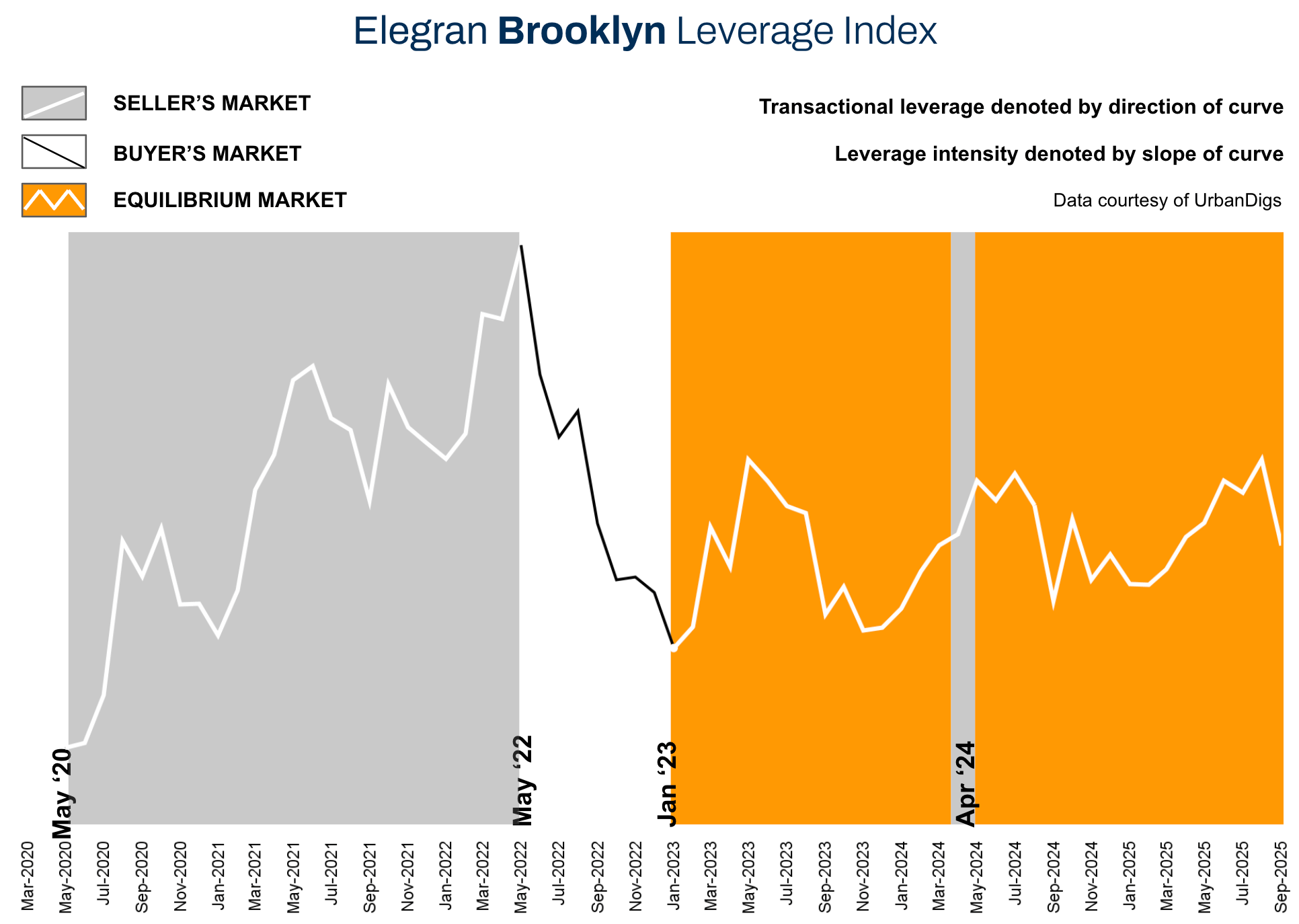

Elegran Brooklyn Leverage Index

The Elegran Brooklyn Leverage Index² blends four market signals - supply, demand, median price per square foot, and median listing discount - to capture the balance of power between buyers and sellers.

Direction Matters:

- An upward-sloping curve = seller’s market

- A downward-sloping curve = buyer’s market

- The steeper the slope, the stronger the advantage for either side

In September, three of the four metrics tipped toward buyers on a monthly basis. Inventory was the standout: a 10% surge in listings gave buyers notably more options (and negotiating power). Pricing also bent in buyers’ favor - median PPSF pulled back from August’s peak and discounts crept up, indicating sellers had to concede a bit more. Contract signings, meanwhile, slowed slightly from August (though remained higher than a year ago), tempering the seller’s market momentum we saw over the summer. In short, Brooklyn’s market balance shifted toward neutral in September, after many months of sellers firmly in control. What’s Driving the Shift?

Stubbornly high mortgage rates and economic caution have curbed some buyer urgency, while the post-Labor Day listing surge eased the scarcity that was propping up prices. Still, Brooklyn’s appeal and low overall inventory kept the floor under prices - we’re seeing moderation, not a free-fall. Looking ahead, October’s data will be telling: if listings remain abundant and sales don’t spike, expect the leverage index to continue drifting downward (favoring buyers) into the winter. But if an autumn uptick in deals occurs or supply tightens again, sellers could reclaim a bit of their lost edge.

Brooklyn Supply

Brooklyn Supply: Inventory Jumps 10%, Easing Pressure

Brooklyn ended September with 3,537 active listings, a substantial +10.4% jump from August and about +1.1% year-over-year. In one month, the borough went from summer scarcity to a much healthier fall inventory. This surge - typical after Labor Day, but larger than usual - means buyers finally have more choices than at any time earlier this year. That said, supply is still relatively tight by historical standards. In other words, the pressure has eased slightly, not vanished. Good homes priced right will still get snapped up, but buyers can afford to be a bit more selective than over the summer.

What This Means for You:

BUYERS: With more listings hitting the market, you’re facing less competition per property than a few months ago. This gives you a chance to shop around and negotiate – you might not need to rush into a bidding war the moment a listing appears.

SELLERS: With a wave of new inventory, buyers have alternatives, so pricing competitively is crucial. An overpriced property will sit while more reasonably priced neighbors sell. Focus on making your listing shine (staging, high-quality photos, smart pricing) right out of the gate.Stand out or risk getting overlooked.

LOOKING AHEAD: Supply may level off in October and then decline toward the holidays as unsold listings get pulled from the market. Use this window while choices are broader: buyers have the upper hand until inventory tightens again. By early winter, we anticipate inventory will contract, so sellers who don’t find a buyer this fall might regroup and wait until spring.

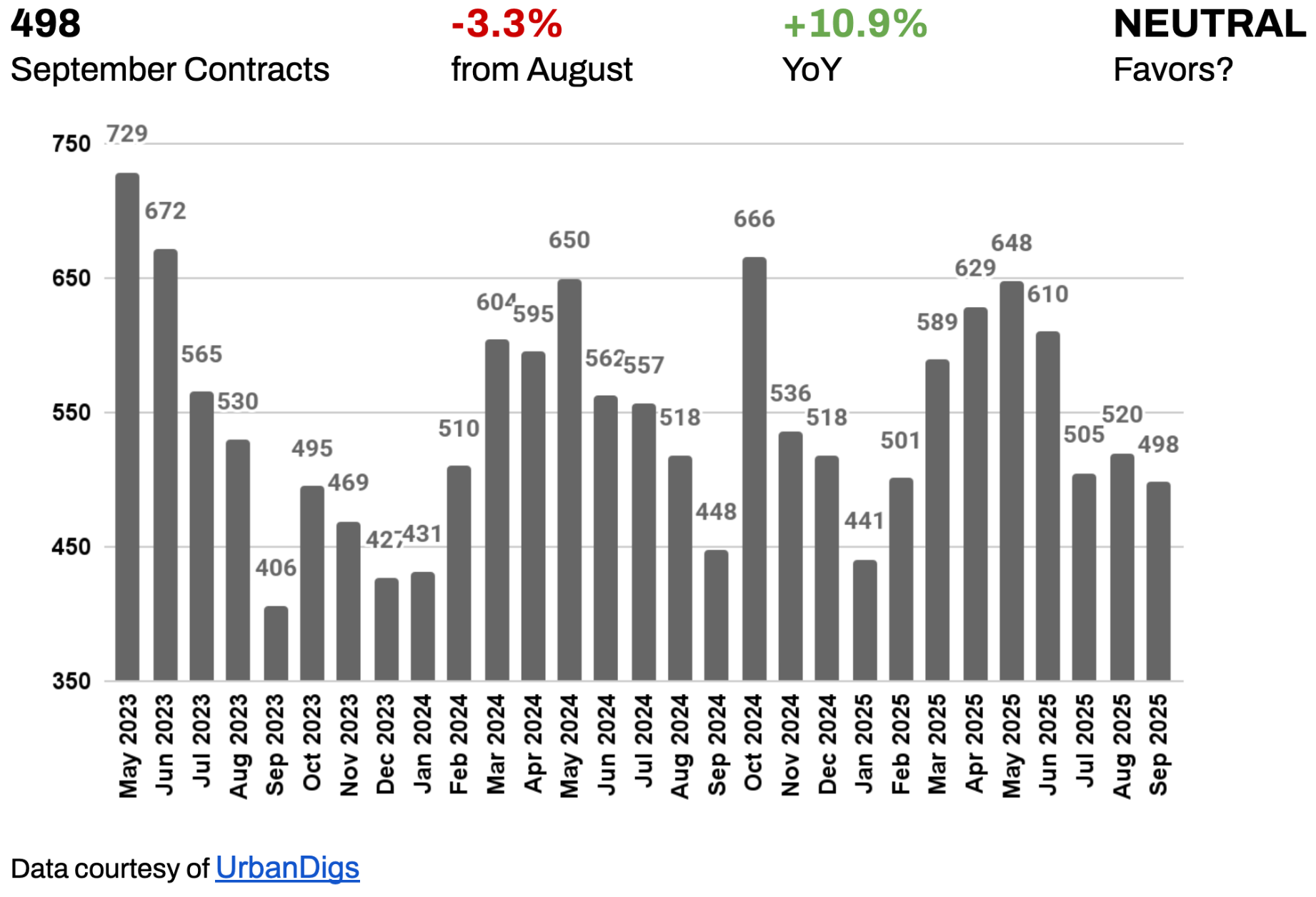

Brooklyn Demand

Brooklyn Demand: Contract Activity Slips, Still Beats Last Year

There were 498 contracts signed, about –3.3% fewer deals than in August, defying hopes that the post-summer listing surge would spark a big jump in sales. Many house-hunters took their time, exploring the new inventory rather than rushing to sign. However, it’s important to note that demand is stronger than it was a year ago – contract volume was roughly +10.9% higher than in September 2024.

In essence, Brooklyn saw a modest pullback in deal pace from the summer month prior, but is still operating at a higher baseline of activity than last fall. Buyers are out there, just moving more deliberately. With more homes to choose from and no urgent fear of missing out, they felt little urgency in September. Some are negotiating harder or waiting for price adjustments, given the breathing room. Overall, Brooklyn’s fall demand can be described as steady but not frenzied.

What This Means for You:

BUYERS: If a property you like has been on the market for a few weeks, you might snag it below asking or with favorable contingencies (things that were hard to get when the market was hotter). Just remember, the best homes can still get multiple offers – if something is truly special and just listed, don’t assume no one else will jump on it.

SELLERS: An ambitious (too high) listing price is risky in this environment – buyers will pass you over and see if you blink first with a price cut. To get a deal done, align with the market: price your property based on recent fall sales. Work with your agent on a proactive plan (refresh your photos/marketing, tweak the price, highlight unique features) to spur action. In short, patience alone won’t sell your home now; strategy and flexibility will.

LOOKING AHEAD: October and early November often bring a last burst of activity before the year winds down. We anticipate a mild uptick in contract signings in October as some buyers refocus and try to secure a home before the holidays.

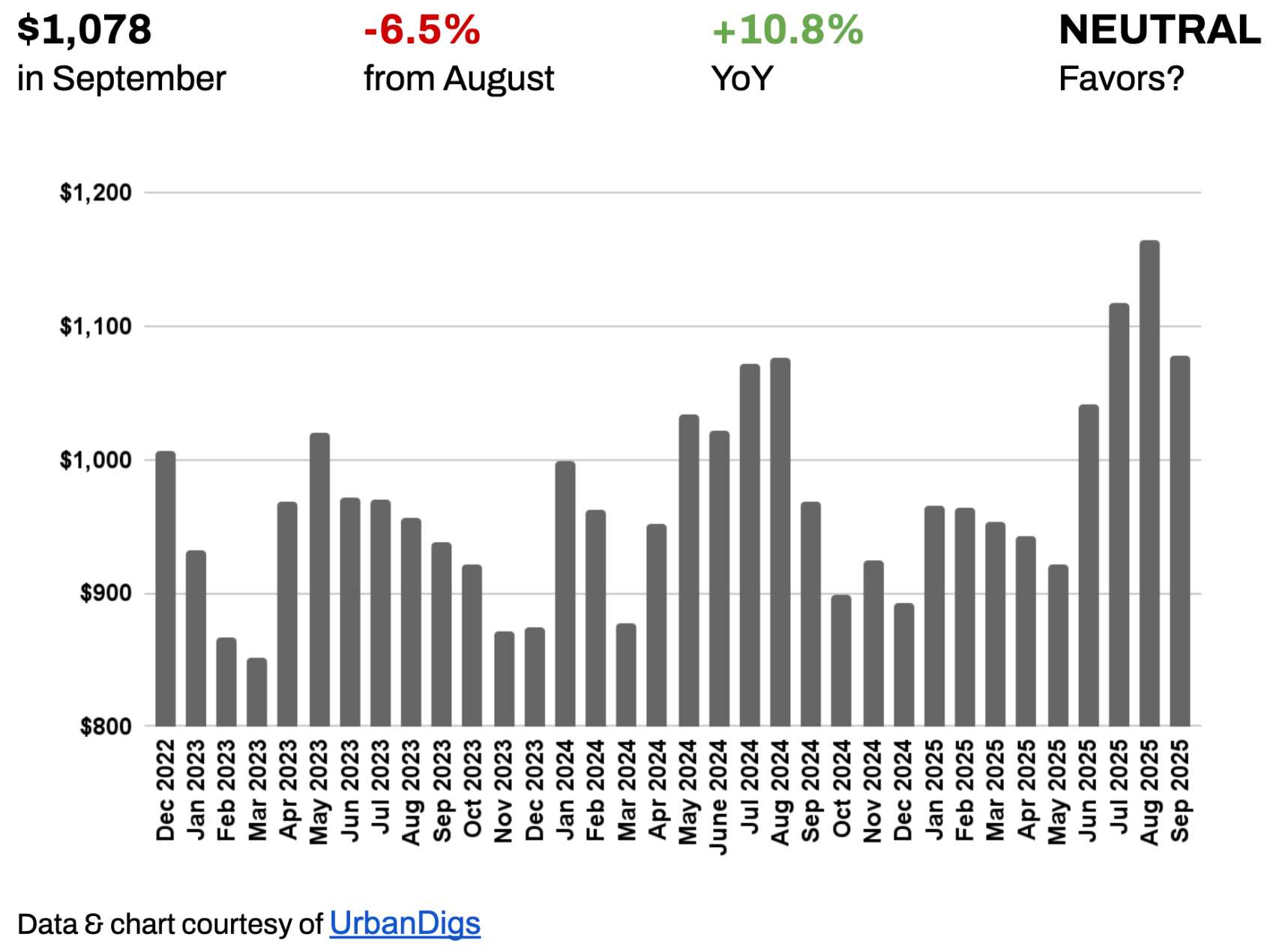

Brooklyn Median PPSF

Brooklyn Median PPSF: Prices Ease Off Peak Highs

Brooklyn’s median price per square foot for closed sales in September came in at $1,078. That’s down notably from the record ~$1,155 in August (a –6.5% monthly drop), indicating that prices finally cooled a bit. Year-over-year, however, PPSF is still up ~10.8% – a testament to how strong price growth has been in the past year. This month-to-month dip suggests sellers had to trim expectations to get deals done, and buyers successfully negotiated slightly better pricing than they could have a few months ago. Affordability concerns (with high rates) and the increase in inventory have applied gentle downward pressure.

What This Means for You:

BUYERS: The slight dip in PPSF means Brooklyn’s prices are bending in your favor, if only gradually. Bottom line: you have a bit more negotiating power on price now than you did in the summer - use it wisely.

SELLERS: After a long run of record-setting prices, the market is finally hitting resistance. If you’re coming on the market now, you must recognize that buyers are price-sensitive and armed with data showing prices just eased.

LOOKING AHEAD: With inventory higher and seasonal slowing ahead, expect pricing to remain under gentle pressure in the next couple of months. We’re likely in a plateau-to-slight-downtrend phase: think small, incremental price adjustments rather than any dramatic swings. Sellers, if you don’t need to sell this winter, you might hold off for the traditional spring bump – but if you do proceed, understand that pricing realistically will be the key to securing a deal.

Buyers, keep an eye out for year-end opportunities – a seller who needs to close by New Year’s might be more flexible, potentially letting you snag a property at a relative bargain (by Brooklyn standards). Overall, we anticipate Brooklyn’s PPSF to hover around these levels or dip a bit more through year-end, then reset depending on 2026 market conditions (which will hinge on inventory and interest rates).

Brooklyn Median Listing Discount

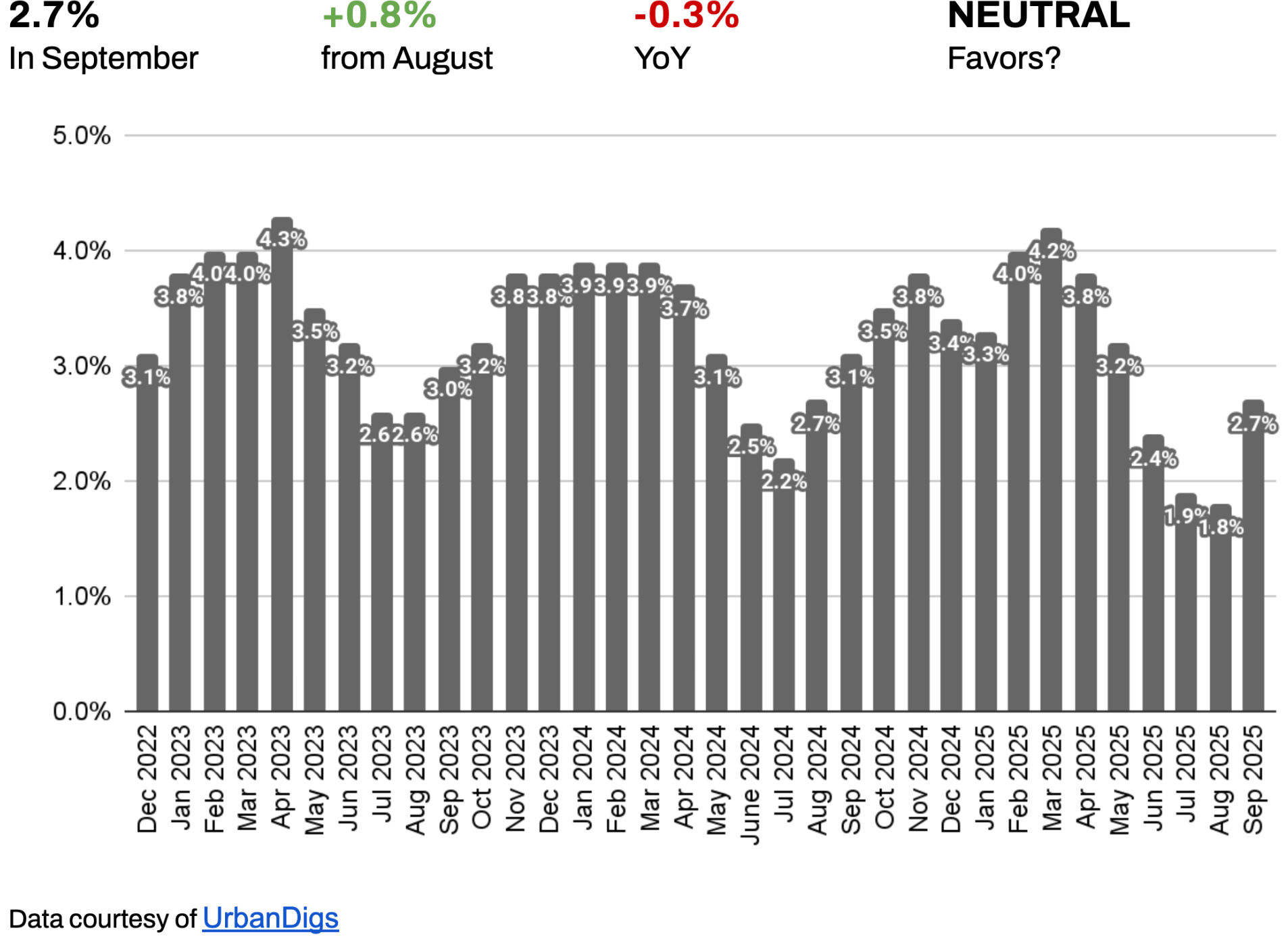

Brooklyn Median Listing Discount: Negotiating Room Widens (Slightly)

The median listing discount – how far below the asking price homes ultimately sell for – expanded in September, giving buyers a bit more wiggle room. The median sale came in at around 2.7% below the last asking price, which is up from about 1.9% in August and the highest discount Brooklyn has seen in nearly a year. However, it’s still slightly smaller than last September’s ~3.0% discount, so on a yearly basis sellers are about as firm as they were a year ago. This contrasting picture (bigger discounts than summer, but slightly smaller than last fall) suggests we’re in a neutral to slight buyer-leaning territory on negotiations. Many Brooklyn sellers in September had to concede a couple more percentage points off their asking price to strike a deal, compared to the almost full-price deals of mid-summer. Even so, a 2–3% discount is historically very low.

What This Means for You:

BUYERS: If a home has been listed for a while or recently cut its price, you’ve got leverage to negotiate harder. Use your agent’s guidance on what similar homes have sold for and how long the target property has been on the market. Importantly, focus on value – if a home is obviously overpriced, you might get more than a 3% discount, but if it’s priced fairly to begin with, a small discount (or even full ask) might be all you get. The key is that you can now counteroffer without the fear of losing the deal immediately, which is a refreshing change from the no-negotiation environment of last year.

SELLERS: Buyers are coming in with offers and expecting some give-and-take. This doesn’t mean you have to slash your price – remember, a 2-3% dip still means you’re getting 97-98% of your asking price on average, which is excellent. The takeaway is price right and be willing to negotiate a little.

LOOKING AHEAD: As the fall progresses and inventory potentially builds further or sales slow, we could see median discounts widen a bit more – perhaps edging into the 3–4% range by late fall or winter. This would grant buyers a touch more leverage on average. However, unless market conditions shift dramatically, deep discounts are unlikely; we’re not expecting a return to the days of routinely 5%+ off ask in Brooklyn in the immediate future. Sellers should plan for negotiations to remain relatively tight through year-end – big price cuts likely won’t be necessary if you’re priced right, but small compromises will be. For buyers, any incremental rise in discounts is welcome – by year’s end you might find that getting 3-4% off is the norm.

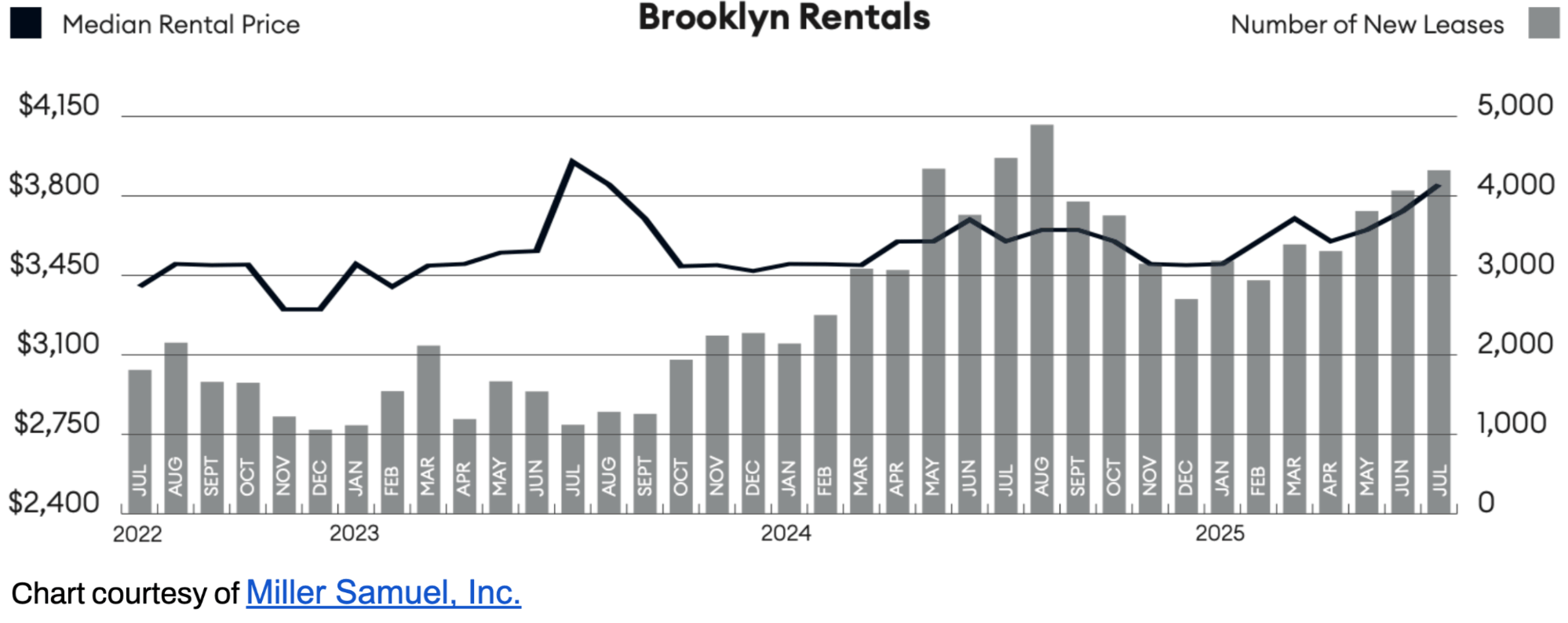

RENTAL REMARKS

Record-High Rents Fuel Fierce Competition

Brooklyn’s rental market remains red-hot, in contrast to the slight cooling on the sales side. Median rent in recent data hit approximately $3,950 per month – the highest on record for Brooklyn. That’s up 2.6% from the previous month and about 8.2% higher than a year ago, a staggering annual jump for rents.³ Average rents are similarly eye-popping (the second-highest ever recorded). What’s driving this? Insatiable demand and limited supply.

The recent FARE Act (which shifted broker fees to landlords) is also a factor: landlords are effectively baking those costs into rents, keeping prices elevated. In short, Brooklyn renters are facing historically high costs and intense competition, with landlords firmly in the driver’s seat.

FOR RENTERS: Buckle up – it’s tough out there. With rents at record highs, budget carefully and be prepared to act fast when you find a place you like. Have your paperwork ready (pay stubs, credit info, reference letters) because desirable rentals are disappearing in days, sometimes hours. Expect little to no negotiating room on rent; in fact, be mentally prepared that you might have to offer above the asking rent if there are multiple applicants (which is very common right now).

If you can, consider searching in the off-peak season (late fall or winter) when competition usually eases and landlords might be slightly more flexible. Also, think creatively: perhaps expand your search to slightly less sought-after neighborhoods or consider concessions like a two-year lease (locking in today’s rate longer) if offered. Above all, if your current situation is workable, renewing your lease might be your best bet – even a 5% increase on renewal could be a bargain compared to jumping into the open market where new rents are up 8%+ from last year. This is a market where preparation and decisiveness are key to securing a home.

LANDLORDS: This is as close to ideal as it gets on the landlord side. Demand is robust, supply is tight, and you hold the cards. Quality tenants are out there, and many are willing to pay a premium to secure a place. Still, with great power comes great responsibility: pushing rents too far above market can backfire if a unit sits vacant. The sweet spot is to price at the top of market, but not beyond it. In many cases you’ll find renters will pay what you ask (or more), especially if your unit is in good condition and well-located. Since the FARE Act means you likely cover the broker fee now, factor that into your pricing strategy (most have, which is partly why rents jumped).

LOOKING AHEAD: Finally, be mindful of the season: we’re heading into the cooler months when demand typically softens a touch. It could be worth locking in a longer lease now at a great rate, rather than risking vacancy in November/December. Overall, it’s a landlord’s market – just handle it smartly to maximize your returns and minimize future hassle.

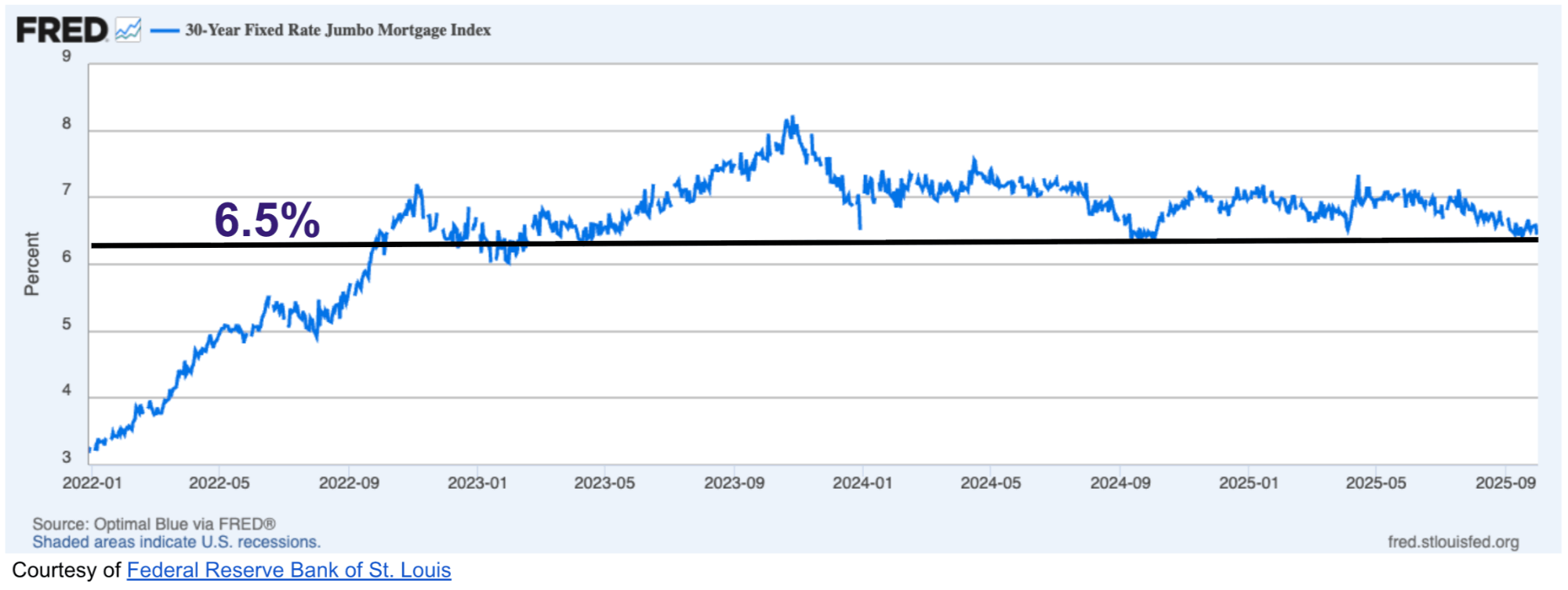

MORTGAGE REMARKS

Mortgage Rates: High Rates Plateau, First Sign of Relief

Financing a home purchase remains considerably more expensive than it was a few years ago, but there are signs that the worst may be behind us. As of early October 2025, 30-year fixed jumbo mortgage rates (which many Brooklyn buyers rely on, given high purchase prices) are hovering around 6.5%⁴, with average APRs in the low 6%⁵ range. These figures are roughly on par with where rates stood for most of the summer, and actually a hair below the peaks seen in mid-2025 when some jumbo quotes touched 6.8–7%. In other words, mortgage rates have plateaued, establishing a new normal in the mid-6s for now.

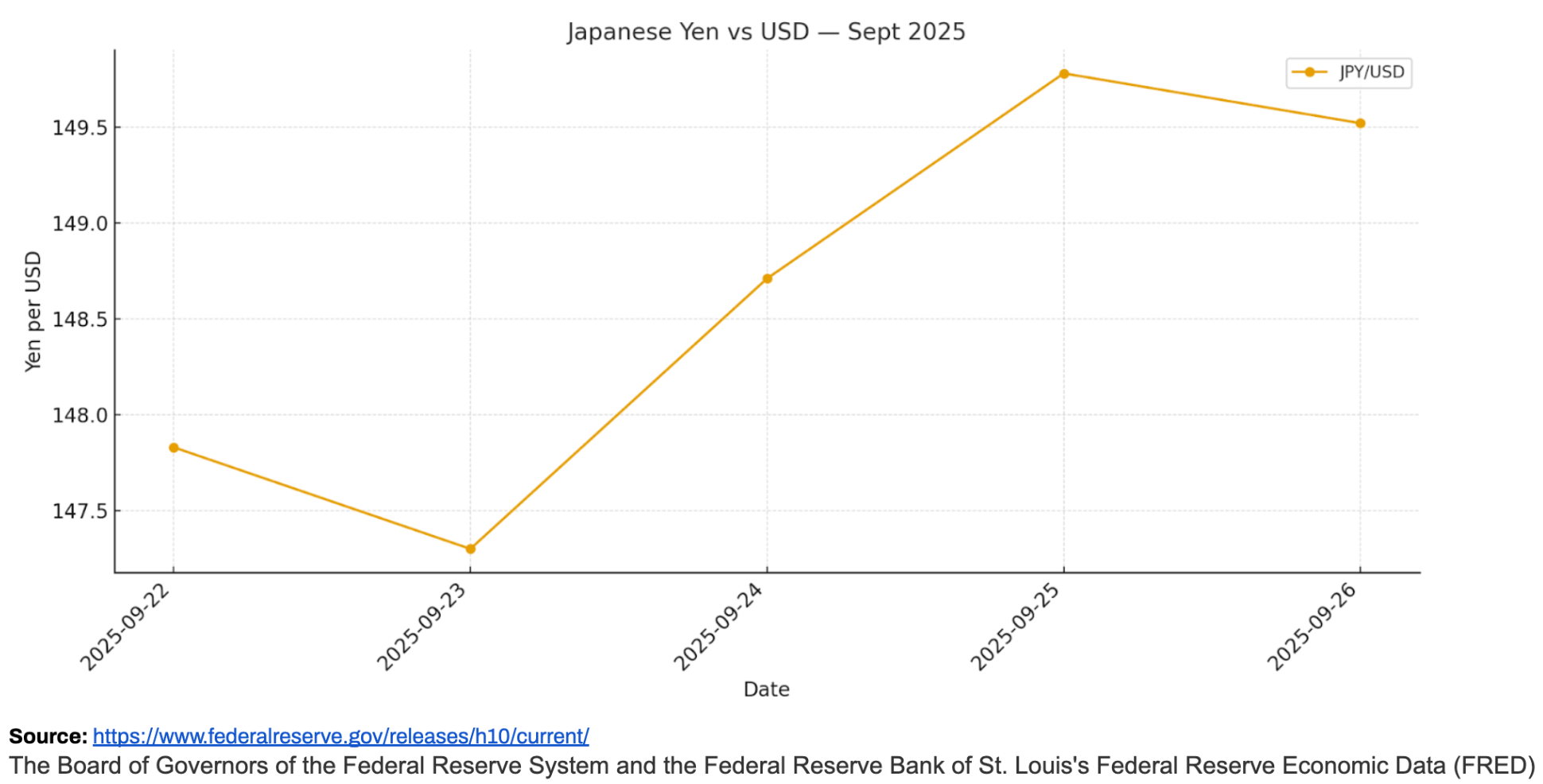

A notable development influencing sentiment is the Federal Reserve’s recent rate policy shift. In late September, the Fed announced a 0.25 percentage point cut to its benchmark interest rate – the first rate reduction in years, bringing the federal funds target range down to around 4.0–4.25%. While this doesn’t directly and immediately slash mortgage rates, it’s an early signal that the era of tightening monetary policy is ending.

What This Means for You:

Buyers: Be prepared to budget for high monthly payments – even though rates have dipped slightly, we’re still in the mid-6% range for 30-year loans. As a rule of thumb, every $100,000 of mortgage at ~6.5% interest translates to around $620-630 per month in principal and interest. That adds up quickly in Brooklyn, where loan sizes often run into the hundreds of thousands or millions. To navigate this, consider strategies like putting down a larger down payment (to borrow less), looking at slightly lower-priced properties to stay within a comfortable monthly payment.

Sellers: High mortgage rates shrink the buyer pool for any given price point. Even wealthy, qualified buyers pay attention to monthly costs and banks’ lending limits. This means you might notice fewer total bidders in the market, and those who are shopping often have firm ceilings on what they can pay. In practice, this environment rewards sellers who price competitively and work with serious, finance-approved buyers. Overall, understanding the financial pinch buyers are in will help you strategize with your agent to make your listing attractive despite the high-rate backdrop.

LOOKING AHEAD: The consensus among many economists and housing experts is that mortgage rates will likely stay in this mid-6% neighborhood for the rest of 2025. The Fed’s recent rate cut is a turning point, but it’s a small one – they are signaling caution and a slow approach to easing. For planning purposes, though, buyers and sellers alike should probably assume that 6%± mortgage rates will be the norm for the coming months. If you’re a buyer on the fence hoping for 4% rates again – that’s not likely in the near future.

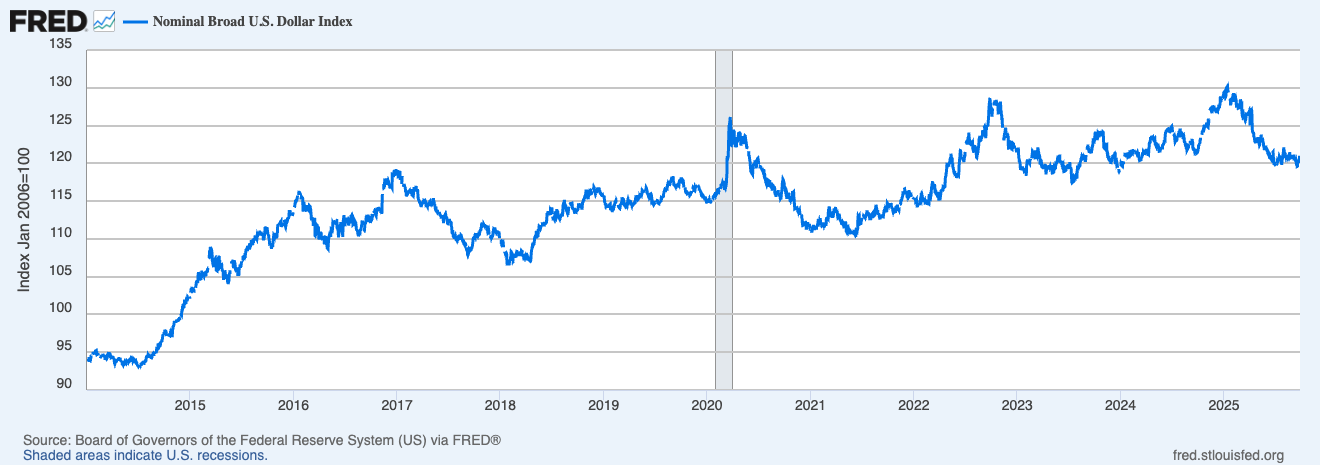

INVESTOR INSIGHTS

Weak Dollar Keeps Foreign Demand Strong; Local Investors Play the Long Game

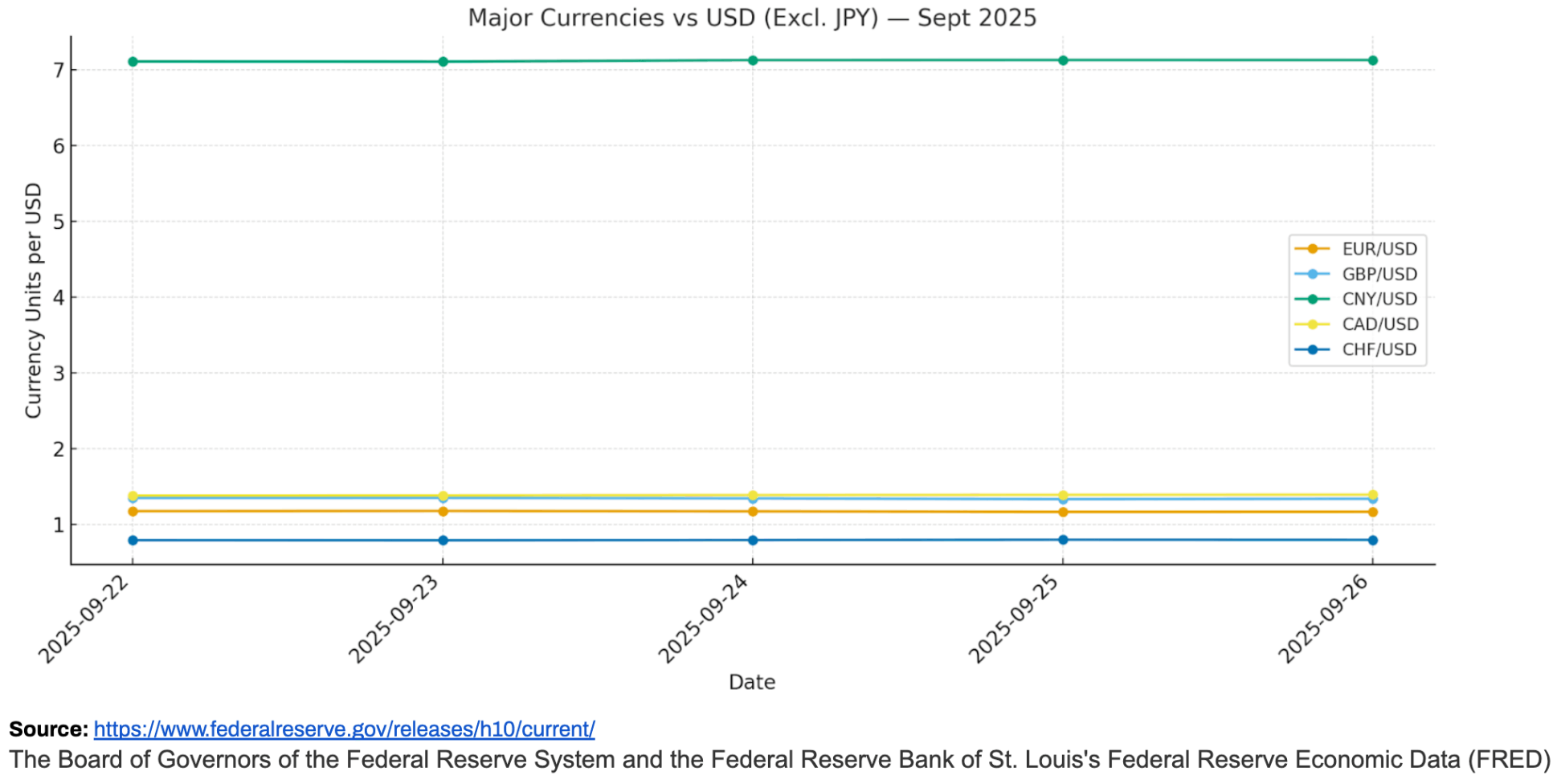

The current Brooklyn market presents a two-sided story for real estate investors. On one hand, global investors are taking advantage of currency shifts – a weaker U.S. dollar in 2025 has effectively put Brooklyn real estate “on sale” for those buying with stronger foreign currencies. On the other side, domestic investors and everyday New York landlords are navigating the harsh math of high interest rates and slim rental yields, prompting a more cautious approach.

International buyers have been notably active, and September kept that trend going. The U.S. dollar has depreciated on the order of 10–15% against currencies like the euro, British pound, and Canadian dollar since early 2025. This means an apartment that might have cost an overseas buyer €1,000,000 equivalent last year might be only ~€850,000–900,000 today purely due to exchange rates – a substantial discount before negotiations even begin. Unsurprisingly, savvy foreign buyers are seizing this opportunity.

What This Means for You:

DOMESTIC INVESTORS: Meanwhile, domestic investors (from individual condo landlords to professional developers) are contending with the highest financing costs in over 15 years. Borrowing at 6-7% when rental yields (cap rates) in Brooklyn are often only 3-4% means many investments have a negative carry in the short term – monthly expenses (mortgage, taxes, common charges, etc.) outpace rental income unless a huge down payment is made. This squeeze is leading local investors to be much more selective and strategic.

Rather than chasing marginal deals, many are focusing on unique opportunities: for instance, small multi-family buildings or townhouses where cap rates might be a bit higher (or where they can add value through renovation); estate sales or listings that have lingered and can be acquired at a relative discount; or properties that might not yield much now but are expected to appreciate significantly (like buying in an up-and-coming neighborhood or snagging a premier property at a good price and holding it as a long-term store of value).

INTERNATIONAL BUYERS: This is a moment of opportunity. With the dollar weaker, your foreign capital can secure you a property in Brooklyn at what amounts to a significant discount compared to just a year ago. Additionally, the cooling of the market means you’re often not fighting off as many competitors as you would have in the frenzied market of 2021 or 2022. If you’re purchasing in cash (as many international buyers do), you are especially insulated from the current interest rate issues, and that can make you an attractive bidder to sellers.

LOOKING AHEAD: The foreign buyer wave is likely to persist through the coming months, especially if the U.S. dollar remains soft. Many analysts predict the dollar will stay relatively range-bound or weak as the Fed slows down its tightening and other economies catch up. This means Brooklyn could continue to see elevated international interest into 2026. We’ll be watching if this demand starts pushing certain segments of the market back up (for instance, will luxury prices firm up or even rise due to foreign capital?). For domestic investors, the outlook will improve if and when financing costs come down. Should mortgage rates dip in 2026, we’d expect more local investors to re-enter the market aggressively, potentially snapping up properties before prices climb again. In the meantime, those domestic players who strategize and invest selectively now – while a lot of others sit on the sidelines – could be in a great position. They may face less competition for deals in the short term and stand to benefit from both operational improvements and market appreciation over the long term.

References

1. Data courtesy of UrbanDigs

2. According to the Elegran Brooklyn Leverage Index

3. Data courtesy of Miller Samuel, Inc.

4. Data courtesy of Federal Reserve Bank of St. Louis

5. JUMBO mortgage rate APR data courtesy of Bank of America, Chase, and Wells Fargo

If you would like to chat about the most recent market activity,

feel free to contact us at contact@hhnyc.com or

connect with one of our Advisors.

About Us

Welcome to Elegran, where our mission is to revolutionize the world of real estate. Founded in 2008 by Michael Rossi, our journey began with an unwavering drive for motivation, innovation, and a genuine care for our clients.

As an independently owned brokerage, we pride ourselves on our elite team of "advisors," offering a personalized touch that goes above and beyond the traditional real estate experience. Armed with robust data insights, we empower our clients to make informed decisions that lead to success.

Elegran proudly stands at the forefront of excellence. Our passion lies in turning your real estate dreams into reality, and we are committed to providing exceptional service at every step of the journey.

Are you ready to experience the Elegran difference? Dive into the possibilities at www.elegran.com and embark on an unforgettable real estate adventure with us.

Categories

Recent Posts

Stay in the Know!

Sign up to receive our monthly newsletter

GET MORE INFORMATION