Elegran Brooklyn Market Update: September 2025

Record Prices and Tight Supply

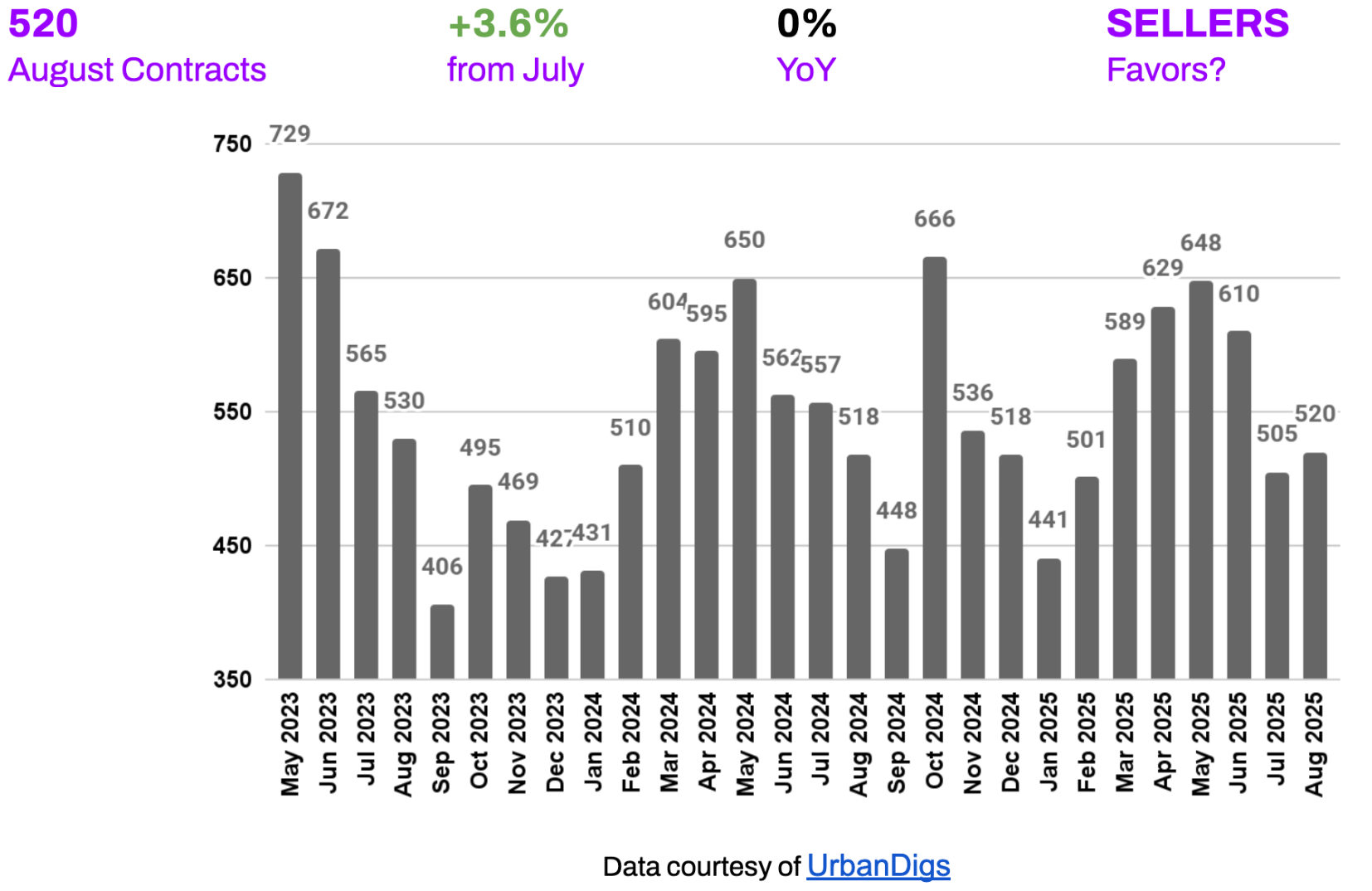

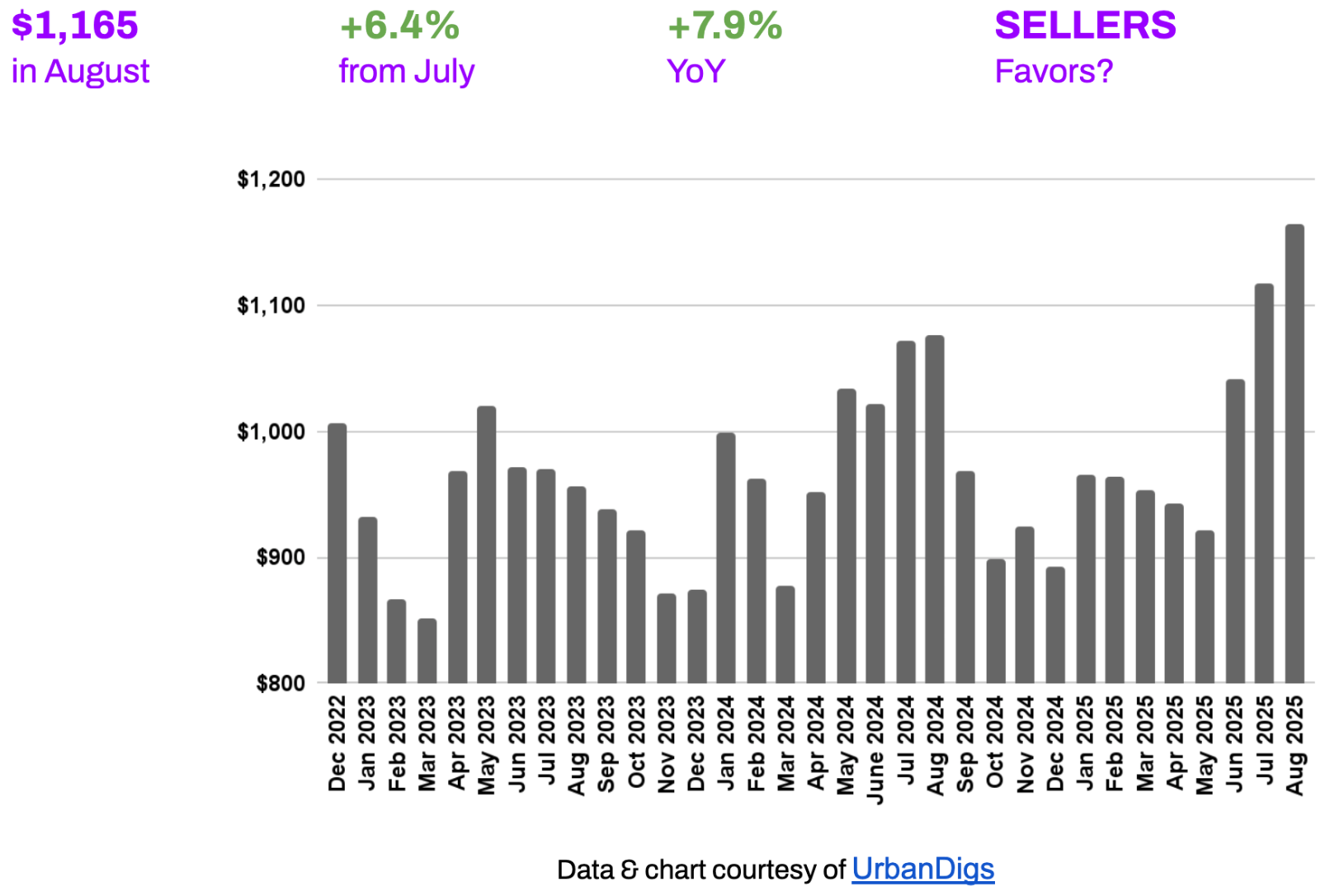

Brooklyn’s housing market ended the summer on a strong note, with prices hitting record highs even as buyer activity remained subdued. The median price per square foot reached $1,165 in August, a 7.9% jump year-over-year and the highest level on record. At the same time, buyers had slightly more inventory than last year (+3.3% YoY), but listings still fell 8.1% from July, keeping supply lean by historical standards.

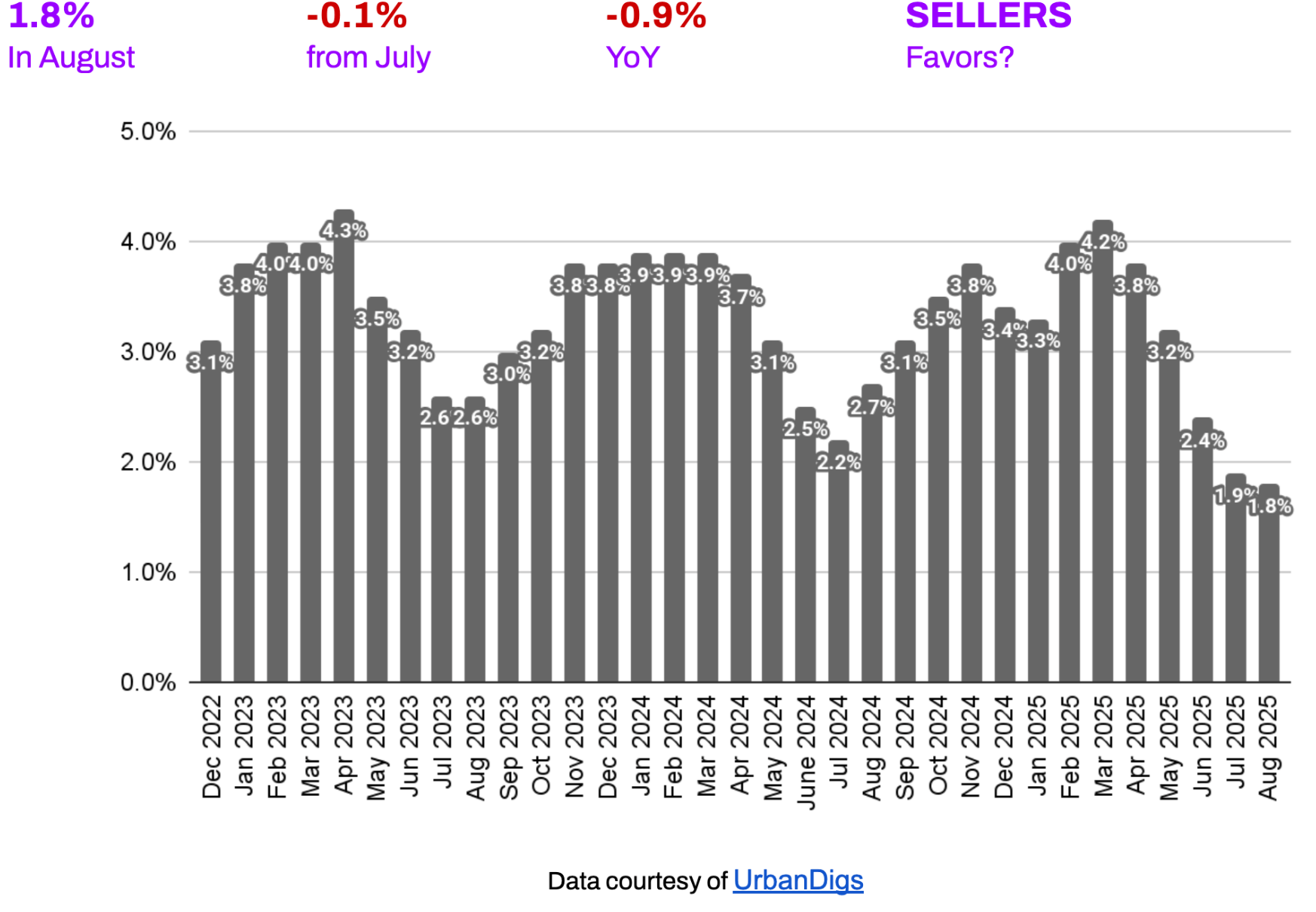

Contract activity showed a modest rebound, with 520 deals signed (+3.6% from July, flat YoY), signaling that demand has stabilized but not surged. Sellers maintained leverage, with listing discounts narrowing to just 1.8% – the smallest in nearly three years – and nearly one in three homes closing above ask, a clear sign that competition for well-priced listings remains fierce.

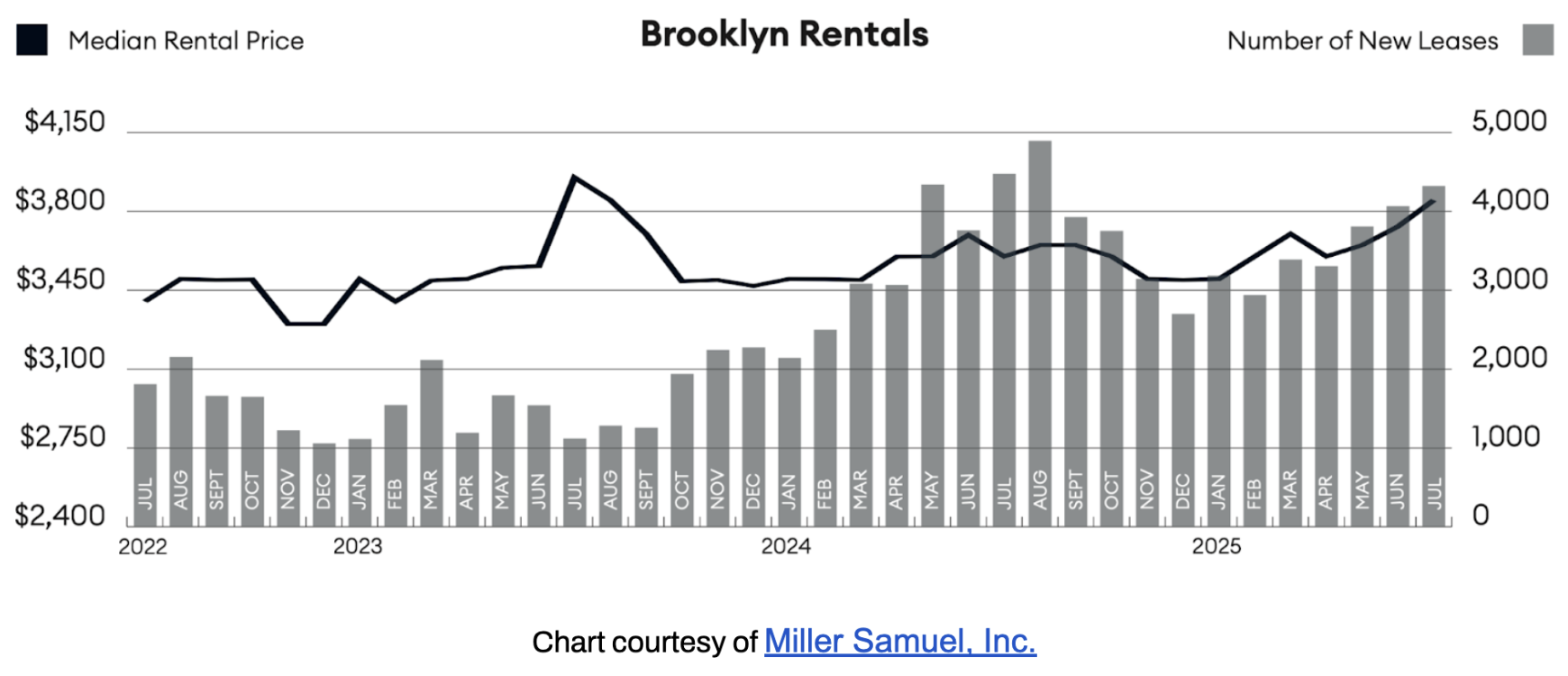

On the rental side, Brooklyn’s median rent climbed to $3,850 in July, the second-highest on record and 6.9% higher than last year. However, new lease signings slipped for the second time in three months, and listing inventory fell YoY for the first time in 18 months, pushing many renters to renew leases rather than chase limited new options. The FARE Act added modest upward pressure, but the bigger driver is a persistent mismatch of strong demand and constrained supply.

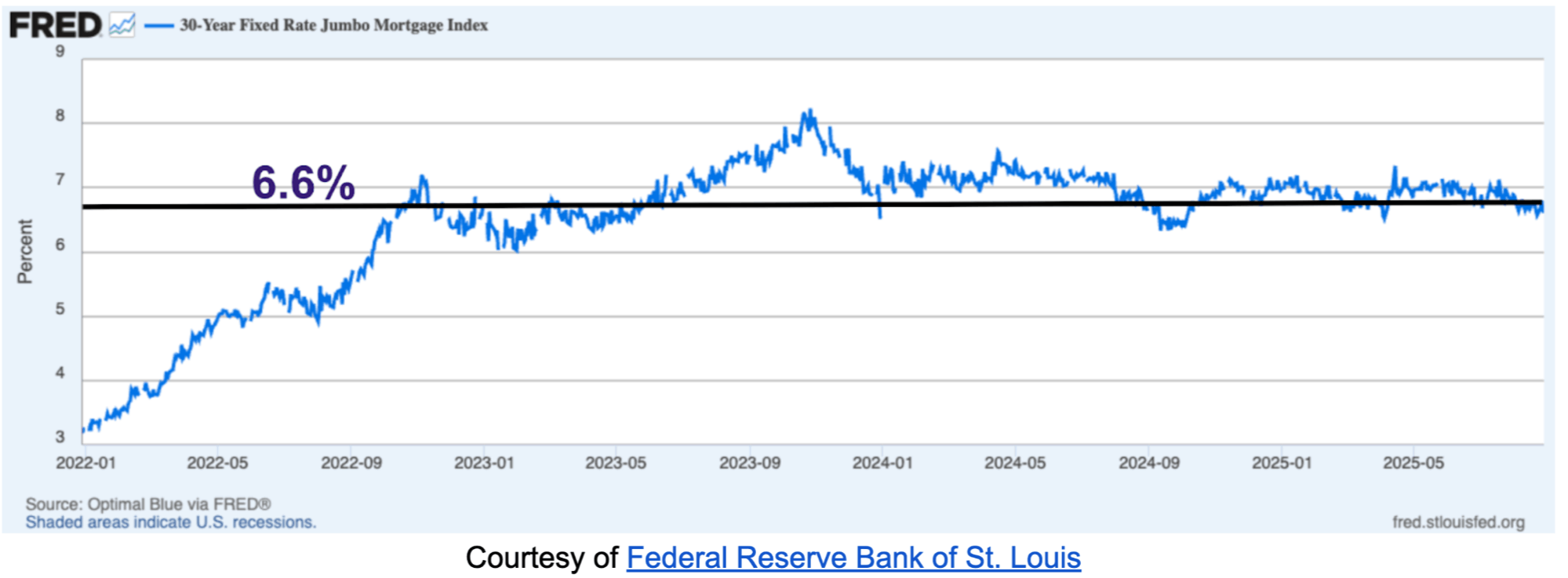

Mortgage rates around 6.6% remain the main affordability hurdle, but international buyers are increasingly eyeing Brooklyn as a relative value compared to Manhattan, thanks to a weaker U.S. dollar.

Overall, Brooklyn enters the fall market with record pricing, tight supply, and resilient buyer demand. The coming months will reveal whether a seasonal surge in listings finally eases pressure, or if sellers will retain their firm grip on the market.

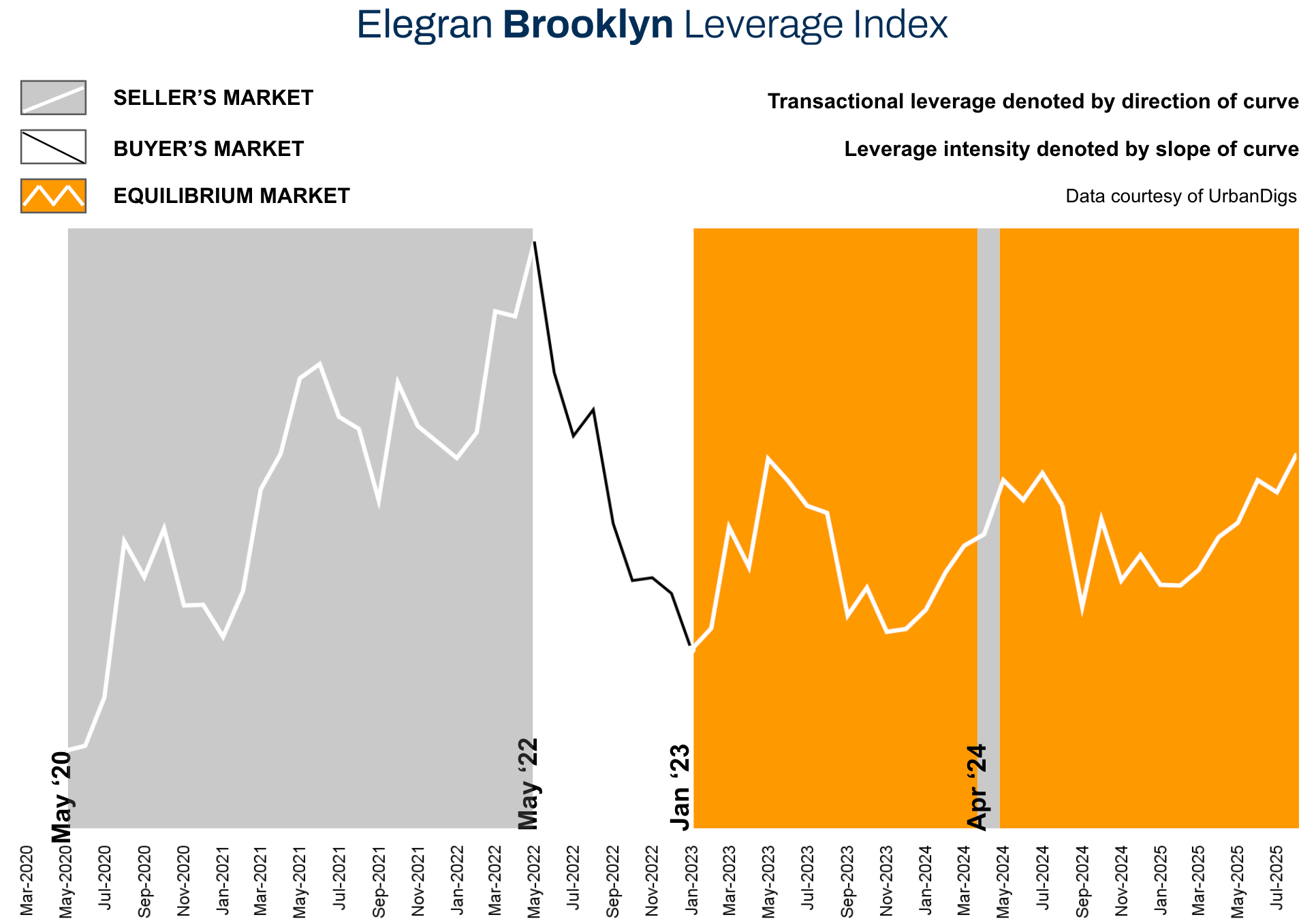

Elegran Brooklyn Leverage Index

Slight Dip in Leverage Index Suggests Market Is Tilting Toward Buyers

The Elegran Brooklyn Leverage Index² is powered by four indicators: supply, demand, median price per square foot (PPSF), and median listing discount.

Direction Matters:

- An upward-sloping curve = seller’s market

- A downward-sloping curve = buyer’s market

- The steeper the slope, the stronger the advantage for either side

In August, the Elegran Brooklyn Leverage index softened slightly, reflecting a mixed market: buyer activity ticked up modestly (contracts signed rose 3.6% from July, holding steady year-over-year) and inventory increased annually, tilting conditions a bit more in buyers’ favor than earlier in the summer. At the same time, sellers maintained pricing power – the median discount fell to 1.8% and PPSF hit a record high – which kept the overall market advantage from swinging too far. In short, Brooklyn’s late-summer market appears more balanced than it’s been in months, though not decisively in either side’s hands.

What’s Driving This Shift? High mortgage rates and economic uncertainty have tempered some buyer enthusiasm, but persistent low inventory and Brooklyn’s enduring appeal keep prices elevated. The slight August changes likely also reflect seasonality – summer often brings fewer listings and slower sales, which can momentarily ease pressure on buyers.

Looking ahead, the coming fall data will reveal whether this was a temporary summer lull or the start of a broader shift. September’s numbers will be key to watch.

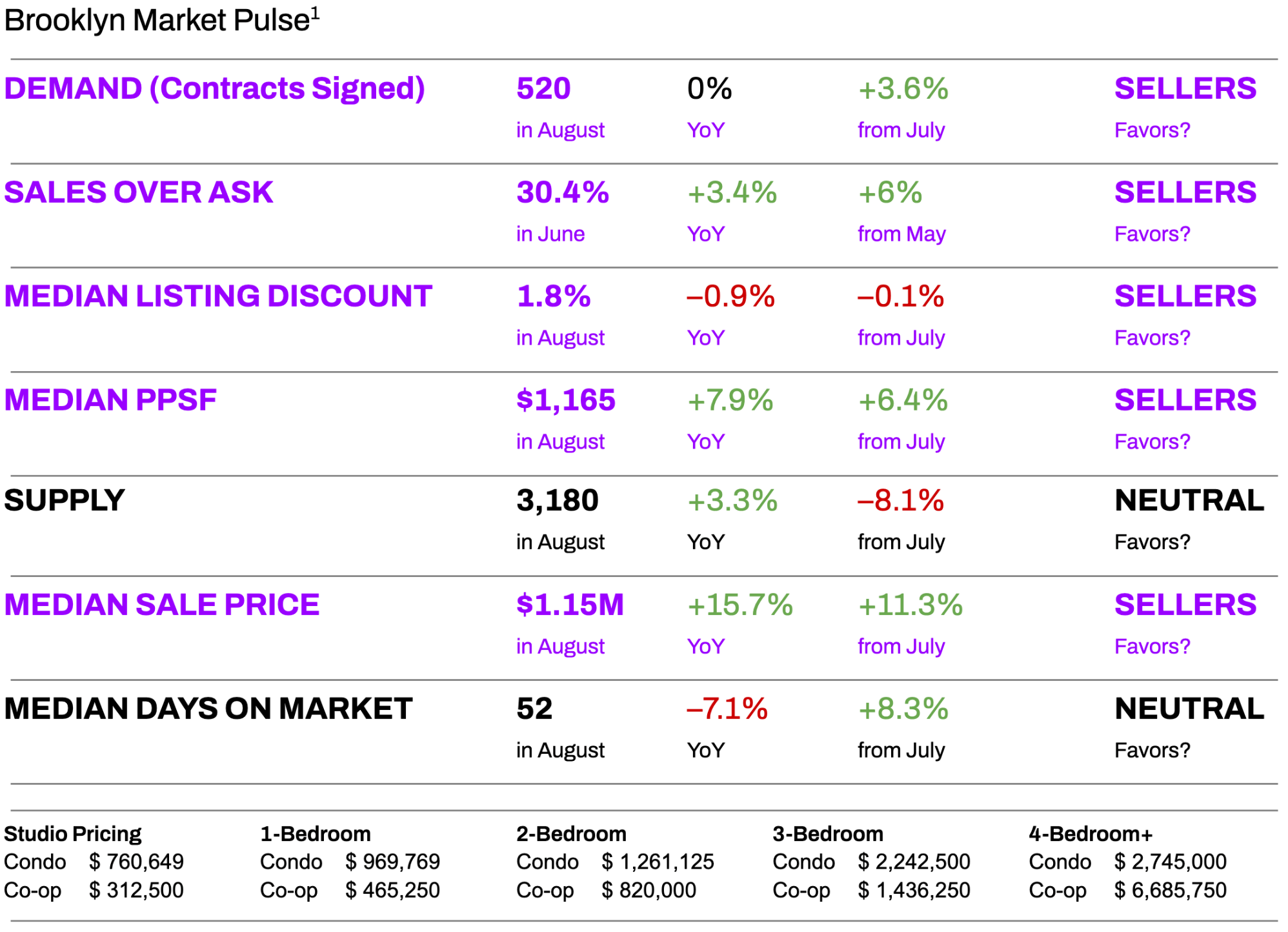

Brooklyn Supply

Brooklyn Supply: Inventory Rises YoY but Remains Tight

Brooklyn ended August with 3,180 active listings, down 8.1% from July but up 3.3% year-over-year. Buyers have more options now than last summer – yet inventory is still below historical norms, meaning the market remains undersupplied overall.

What This Means for You:

BUYERS: Slightly higher inventory than a year ago gives you a bit more choice. Take advantage by keeping a close eye on new fall listings – more homes should hit the market in the coming weeks. Just remember that quality listings are still limited, so when you find the right place, be ready to move quickly and make a strong offer (the best homes are still getting snatched up fast).

SELLERS: Even though there are more listings on the market compared to last year, the drop in inventory from July means less competition for you right now. Leverage this window: consider listing your property sooner rather than later this fall, before a wave of new inventory arrives. Pricing is key – buyers have more choices than last year, so a well-priced home will attract attention quickly, whereas an overpriced one may sit.

Looking Ahead: We anticipate inventory will increase in September and October as the fall selling season ramps up. That will gradually give buyers more bargaining power through the end of the year. Sellers should plan for more competition; it’s wise to price and market aggressively early in the season. If instead inventory stays unexpectedly low, sellers will retain their advantage a bit longer – but the safer bet is to expect a busier fall marketplace.

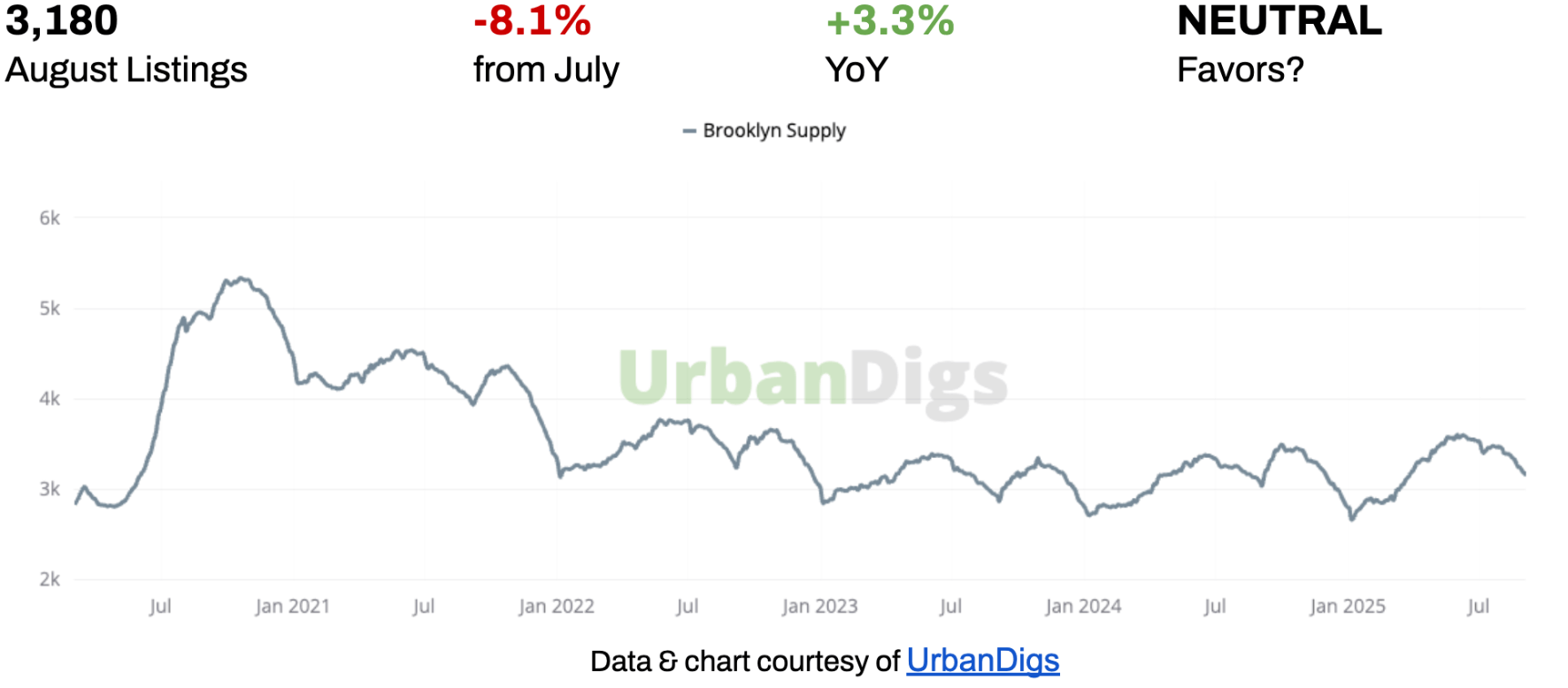

Brooklyn Demand

Brooklyn Demand: Contract Activity Inches Up After Summer Lull

In August, 520 purchase contracts were signed in Brooklyn – a minor rebound of +3.6% from July’s low point, and exactly the same volume as August 2024. This slight uptick follows one of the slowest months in recent memory (July) and suggests buyer demand may have stabilized for now. Still, contract activity remains well below spring levels, reflecting both seasonal slowdowns and buyer caution in the face of higher interest rates.

What This Means for You:

BUYERS: With fewer people signing contracts than in the spring, you’re facing less competition per listing than during peak market frenzy. In many cases, you might not be in a bidding war, which can open the door to negotiating price or contingencies. However, don’t assume every listing is a free-for-all – the most desirable homes (think newly renovated or perfectly priced) are still seeing multiple offers, so stay prepared to act decisively when needed.

SELLERS: A slower contract pace means you can’t count on buyers flocking to your door instantly – you need to stand out. Make sure your property is show-ready and priced competitively, because buyers have become choosier. The good news: serious buyers are still in the market, and nearly a third of deals are closing at or above the asking price.

Looking Ahead:

We don’t foresee a huge surge in buyer activity until later in the fall. September contract volume will likely remain on par with August (or even dip slightly, given typical post-summer doldrums). A more noticeable uptick could arrive in October as fresh listings and cooler weather bring some buyers back. In general, expect steady but modest demand this fall – unless interest rates drop or some economic catalyst boosts buyer confidence.

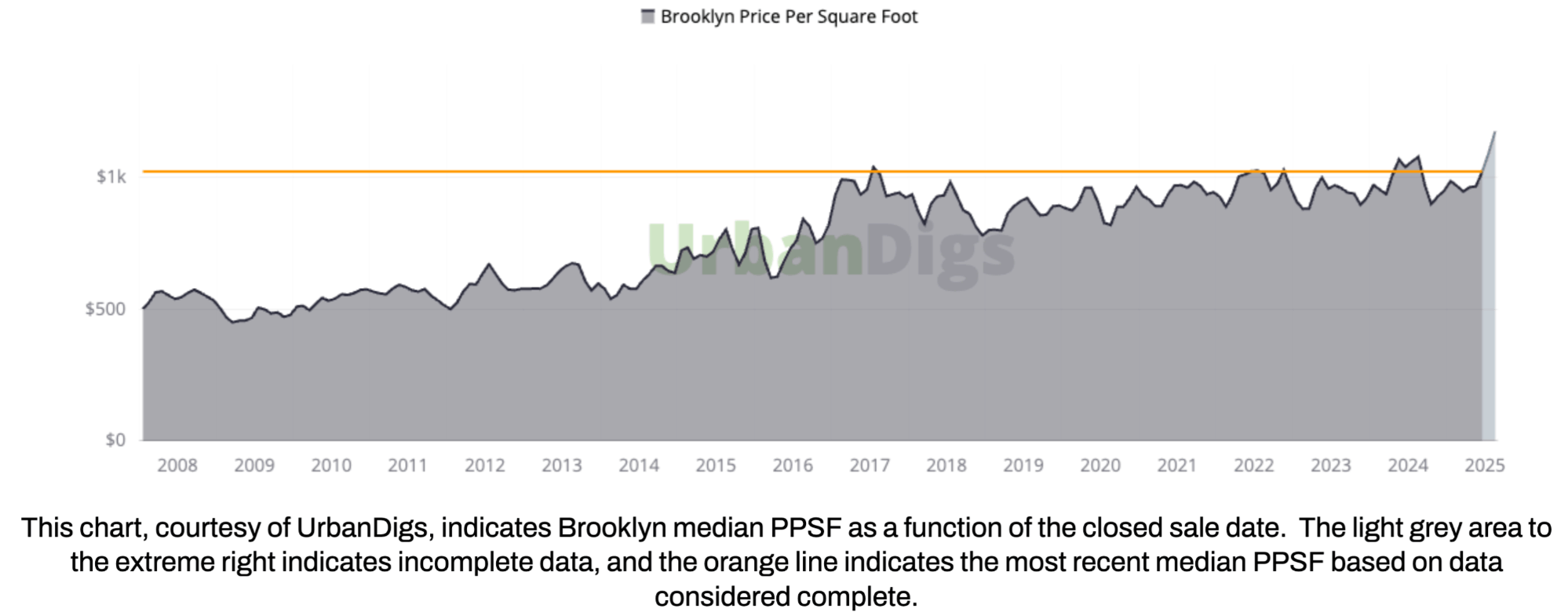

Brooklyn Median PPSF

Brooklyn Median PPSF: Price per Square Foot Hits New High

Brooklyn’s median price per square foot climbed to $1,165 in August, the highest on record. That’s a robust 7.9% increase compared to a year ago, and a 6.4% jump just since July. In other words, even as the number of sales has cooled, prices are still rising – a clear sign that demand is outstripping supply for the homes that are on the market. This kind of price strength, while great news for homeowners, is making affordability a growing challenge for many buyers. Brooklyn’s trend is clear: sales volume might ebb and flow, but pricing remains resiliently high.

What This Means for You:

BUYERS: Record-high pricing means you’ll need to budget carefully and adjust expectations. Be prepared that in many neighborhoods, Brooklyn is not a bargain – even smaller condos or co-ops are commanding high prices per square foot. To stretch your dollar, consider broadening your search to less buzzed-about areas or looking at co-ops and older properties, which often come at a relative discount. And when negotiating, remember that sellers know the market is achieving record PPSF – lowball offers are likely to be rejected, so base your strategy on recent comparable sales.

SELLERS: Soaring PPSF is a signal that you can be confident in your pricing, especially if your home is in excellent condition or a prime location. Buyers expecting Brooklyn to be “cheap” are finding that’s not the case – and they will pay for quality. This is an opportunity to highlight every value-adding feature of your property (outdoor space, modern upgrades, low carrying costs, etc.) to justify top-dollar pricing. Just be cautious: buyers are hitting their affordability limits, so while you have room to be ambitious on price, there’s still a ceiling.

Looking Ahead:

We may see price growth level off as we go through fall – not a drop, but perhaps a plateau at these high levels. If mortgage rates stay elevated and more inventory appears, price per square foot could stabilize or even dip slightly in certain segments (for example, in the luxury tier or in areas where new development adds competition). However, absent a major economic shift, Brooklyn homeowners can expect their property values to remain historically high through the end of 2025.

Brooklyn Median Listing Discount

Brooklyn Median Listing Discount: Sellers Hold Firm, Discounts Shrink

August’s median listing discount (the percentage below asking price that homes ultimately sell for) was just 1.8% – down from about 2.7% a year ago and even a bit tighter than the 1.9% median in July. This is the smallest discount Brooklyn has seen since late 2022. In practical terms, many sellers are getting very close to their asking prices. Even though buyer demand isn’t frenzied, sellers have not felt pressured to slash prices in negotiations. The data indicates that well-priced homes are selling near full ask, and buyers have little room to haggle on most deals.

What This Means for You:

BUYERS: Go into negotiations expecting slim discounts. On a desirable listing, a Brooklyn seller today might only budge by a couple of percentage points (if at all) off the list price. This means you should focus on realistic offers – coming in 10% under ask on a hot property will likely get you nowhere in this market. However, if a home has been sitting on the market for a long time or has obvious issues, you may find more flexibility. Pick your battles: negotiate hard on the over-priced or stale listings, but for new-to-market, well-priced homes, assume the asking price is pretty close to what you’ll pay.

SELLERS: The extremely low discount rate is a green light to price your home confidently, but not recklessly. If you list at a fair market value, there’s a good chance you’ll achieve very near that number – as the stats show, buyers are not getting major discounts. That said, the flip side is that buyers are shying away from anything perceived as significantly over-priced. The best strategy is to price correctly from the start. You'll likely get full-price offers or better. If you overshoot, you might not even get bids – today’s buyer will move on rather than try to bargain you down 5–10%.

Looking Ahead: As inventory gradually builds and seasonal effects kick in, we could see listing discounts widen slightly by late fall or winter. A cooler market would give buyers a bit more negotiating leverage, inching the typical discount back up into the 2-3% range. Still, we’re unlikely to return to deep discounts unless there’s a more significant market shift. Sellers can expect negotiations to stay relatively tight through the end of the year. If you’re a seller looking to entice a deal in a slower winter market, you might consider offering other incentives (like covering closing costs or offering a mortgage rate buydown) rather than outright price cuts.

RENTAL REMARKS

Rents Near Record Highs Amid Policy Changes

In July 2025, the median rent hit $3,850 per month – a 3.1% increase from June and up 6.9% year-over-year. This is the second-highest median rent on record for Brooklyn (with the average rent also reaching its third-highest level ever). In other words, renters are paying very steep prices, close to the peak levels seen in NYC. However, there are a couple of signs that the rental frenzy is easing at the margins: the number of new lease signings in Brooklyn actually declined year-over-year (for the second time in three months), and the rental listing inventory fell compared to last year for the first time in 18 months (meaning fewer apartments were available to rent than a year prior).³ Those trends suggest some renters are choosing to renew leases or stay put, given the high costs.

Looking ahead to the rest of 2025, we expect seasonal relief in the rental market, but only a little. Rents typically plateau or dip slightly after the summer peak, so August through December should bring a modest slowdown in rent growth. Some renters may find a bit more negotiating room on new leases this fall than they had in midsummer. However, do not expect a major rent correction – any downturn is likely to be minor. The fundamentals (lots of demand, limited supply) are still in the landlords’ favor. Additionally, the effects of the FARE Act will continue to ripple through the market: landlords might keep rents slightly elevated to cover broker fees now baked into their costs. Unless there’s a significant increase in rental inventory or a drop in demand, Brooklyn tenants should plan for rents to remain high through the end of the year (and prepare accordingly when budgeting).

MORTGAGE REMARKS

High Rates Have Become the New Normal

Financing a home purchase remains far more expensive than it was a few years ago, but the shock has worn off – mortgage rates have plateaued, and buyers are adjusting to this new normal. As of early September 2025, 30-year fixed jumbo mortgage rates are hovering around 6.6%⁴, with typical APRs in the ~6.3%⁵ range. These figures have been fairly steady for most of the summer. In fact, rates are down just a touch from their peak in July (when jumbos briefly averaged about 6.8%).

What This Means for You:

Buyers: Plan your home purchase with these interest rates in mind. A higher rate dramatically impacts your monthly payment, so you may need to adjust your target price downward or find a larger down payment to keep payments affordable. Also, keep an eye on rate fluctuations: if you’re in contract and rates dip, consider locking in quickly. In short, build some cushion in your budget for rates around 6–7%, and don’t count on a sudden return to 3%.

Sellers: Be aware that today’s high rates directly affect the buyer pool for your home. Fewer people can afford the same price tag at 6.5% interest than could at 3.5%, which means the pool of qualified buyers for mid- and high-priced homes is smaller. Pricing strategy should take this into account – even if your home’s value has gone up, buyers are evaluating monthly payments more critically than ever. You might also encounter buyers who ask for help with closing costs or a mortgage rate buydown as part of the deal. These concessions can be worth considering if it broadens your buyer audience. The bottom line: expect a bit more time on market and perhaps fewer offers than you might have gotten in a low-rate environment, but properly priced homes will still sell.

Looking Ahead:

Most experts anticipate rates will remain in this general range through the end of 2025. We might see small ups and downs – for example, if inflation data improves, mortgage rates could dip into the low-6% range. If there’s economic turbulence or more Fed tightening, they could flirt with 7% again. However, a significant drop in rates likely won’t happen until there are clear signs that inflation is under control and the Fed can ease policy. For now, buyers and sellers should operate under the assumption that ~6-7% mortgage rates are here to stay in the near term. If and when rates do meaningfully decline, it could unleash a new wave of buyer demand – something to watch for possibly in 2026.

INVESTOR INSIGHTS

Global Buyers Push Into Brooklyn as Dollar Weakens

Brooklyn is back on the radar for global real estate investors. With the U.S. dollar weakening against other major currencies in 2025, international buyers find themselves with a bit more purchasing power stateside – and they’re increasingly looking at Brooklyn as an attractive opportunity. Compared to Manhattan, Brooklyn offers several enticements for investors:

- Better price-per-square-foot value – You generally get more space for the dollar in Brooklyn, meaning higher potential upside as the borough continues to develop.

- Strong cultural and lifestyle appeal – Brooklyn’s neighborhoods (from Williamsburg to Park Slope to DUMBO) have a worldwide reputation now. That cultural cachet helps drive both rental demand and long-term property value.

- Growing rental yields in select areas – Emerging neighborhoods like Crown Heights and Greenpoint are seeing rent growth, which can translate to improving cap rates for landlords.

- Steady cap rates around 3.0%–3.4% – For small multi-family buildings and other income properties, cap rates in Brooklyn have remained relatively stable in the low-to-mid 3% range. That’s similar to Manhattan, but coupled with Brooklyn’s lower entry prices, it can mean a slightly better return on investment for the price.

Domestic Investors: For local investors, Brooklyn’s market presents a chance to acquire solid assets even in a high-rate environment. While cap rates ~3.2% may not turn heads at first glance, remember that rents are rising and Brooklyn’s popularity isn’t waning. There’s potential to find value-add deals – for example, a small multi-family where renovations or improved management could push the rent roll higher (and thus the cap rate). With interest rates high, highly leveraged plays are tough, but if you have capital or financing lined up, you might face less competition from institutional players right now. Focus on properties with strong rental demand (near transit, etc.) and consider that today’s higher cash flow yields could look very attractive if financing costs come down in a couple of years.

International Buyers: A softer dollar and Brooklyn’s comparatively lower prices (versus Manhattan or London) create an appealing window for overseas buyers. Simply put, your money goes further in Brooklyn. This is a chance to acquire a slice of New York City in a borough that still has growth ahead. Many international buyers are eyeing condos in prime Brooklyn areas as pieds-à-terre or investment rentals; others are looking at townhouse and multi-family opportunities. If you’re international, be mindful of currency risk (today’s favorable exchange rates could change in the future), and factor in property management if you won’t be local. But overall, Brooklyn real estate offers diversification and a hedge – it’s a tangible asset in a stable market

Looking Ahead: If the dollar remains weak into 2026, expect international investment in Brooklyn to keep gaining momentum – potentially driving up competition for high-end and investment properties in the borough. Brooklyn’s long-term fundamentals – a diverse economy, limited housing supply, and cultural appeal – continue to make it a compelling investment destination. Any savvy investor, local or global, would do well to secure assets in Brooklyn before the next uptick in the market cycle.

References

1. Data courtesy of UrbanDigs

2. According to the Elegran Brooklyn Leverage Index

3. Data courtesy of Miller Samuel, Inc.

4. Data courtesy of Federal Reserve Bank of St. Louis

5. JUMBO mortgage rate APR data courtesy of Bank of America, Chase, and Wells Fargo

If you would like to chat about the most recent market activity,

feel free to contact us at info@elegran.com or

connect with one of our Advisors.

About Us

Welcome to Elegran, where our mission is to revolutionize the world of real estate. Founded in 2008 by Michael Rossi, our journey began with an unwavering drive for motivation, innovation, and a genuine care for our clients.

As an independently owned brokerage, we pride ourselves on our elite team of "advisors," offering a personalized touch that goes above and beyond the traditional real estate experience. Armed with robust data insights, we empower our clients to make informed decisions that lead to success.

Elegran proudly stands at the forefront of excellence. Our passion lies in turning your real estate dreams into reality, and we are committed to providing exceptional service at every step of the journey.

Are you ready to experience the Elegran difference? Dive into the possibilities at www.elegran.com and embark on an unforgettable real estate adventure with us.

Categories

Recent Posts

Stay in the Know!

Sign up to receive our monthly newsletter

GET MORE INFORMATION