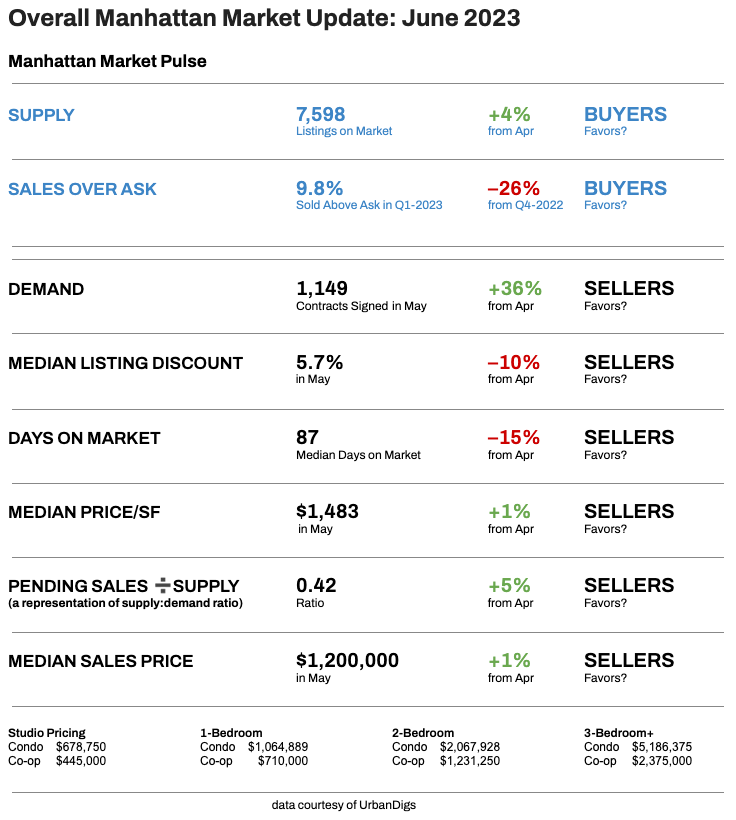

Elegran Manhattan Market Update: June 2023

Manhattan Market Update: Temporary Seller’s Advantage Within a Buyer’s Market

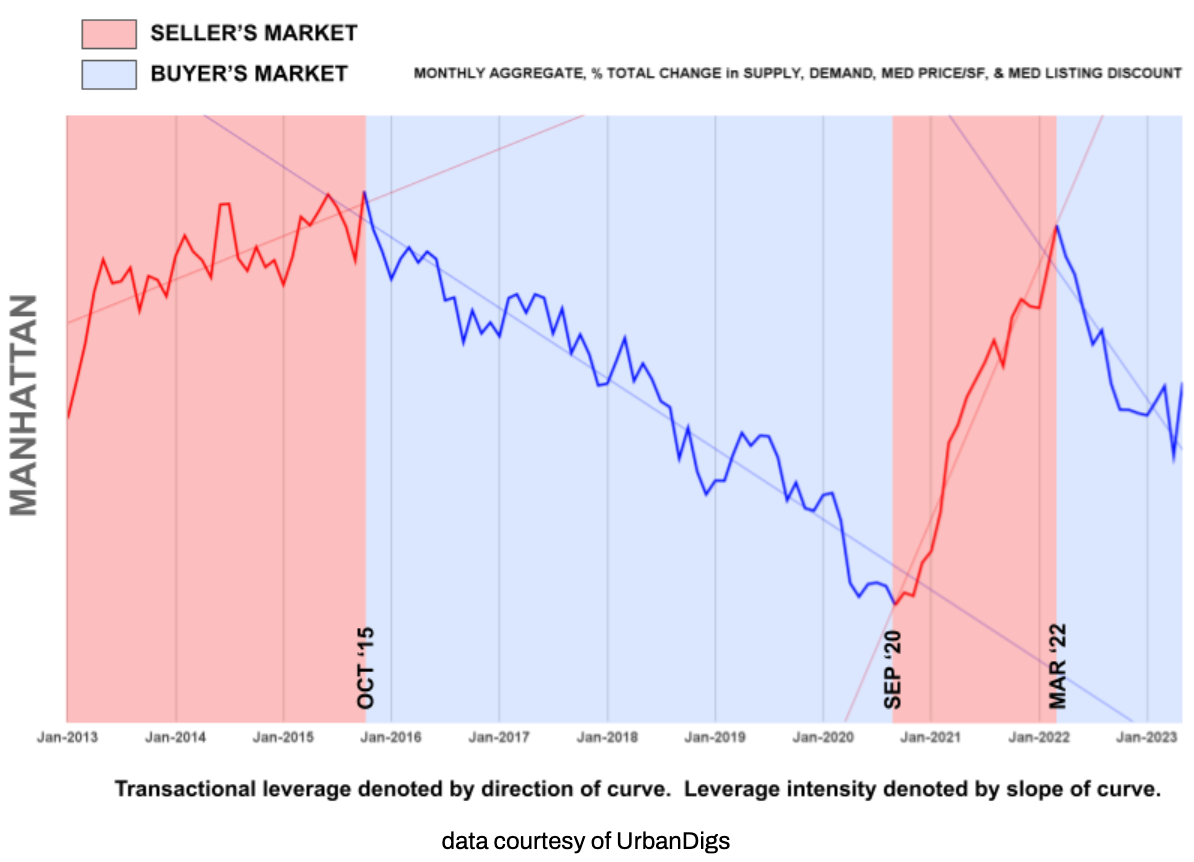

Elegran’s Leverage Indicator is a comprehensive market snapshot, providing invaluable information on transactional leverage. It tells us who the market currently favors – Buyers? or Sellers?

Our Leverage Indicator is fueled by four key metrics that shape the market dynamics:

- SUPPLY

- DEMAND

- MEDIAN PRICE/SF

- MEDIAN LISTING DISCOUNT

But before we dive into the Leverage Indicator and reveal who currently holds the market advantage, let's take a closer look at each of these four metrics individually.

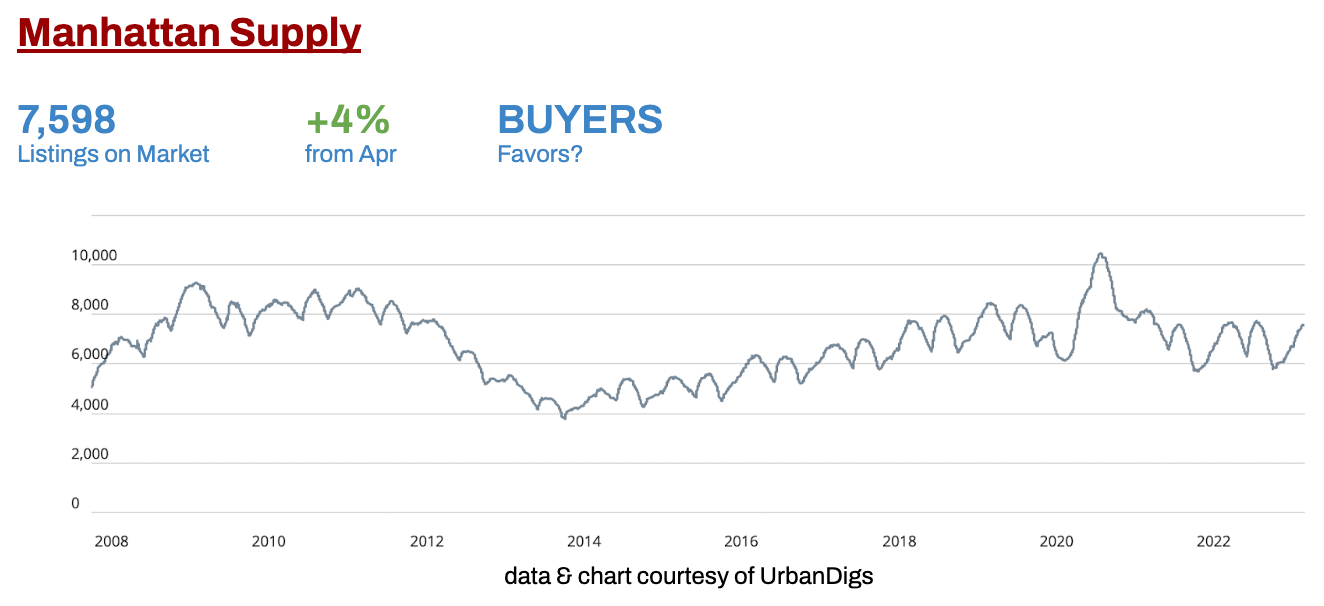

Manhattan Supply

Like the years preceding it, Manhattan supply level is increasing on its way to the June peak. What does this mean for:

- BUYERS? More choices.

- SELLERS? More competition.

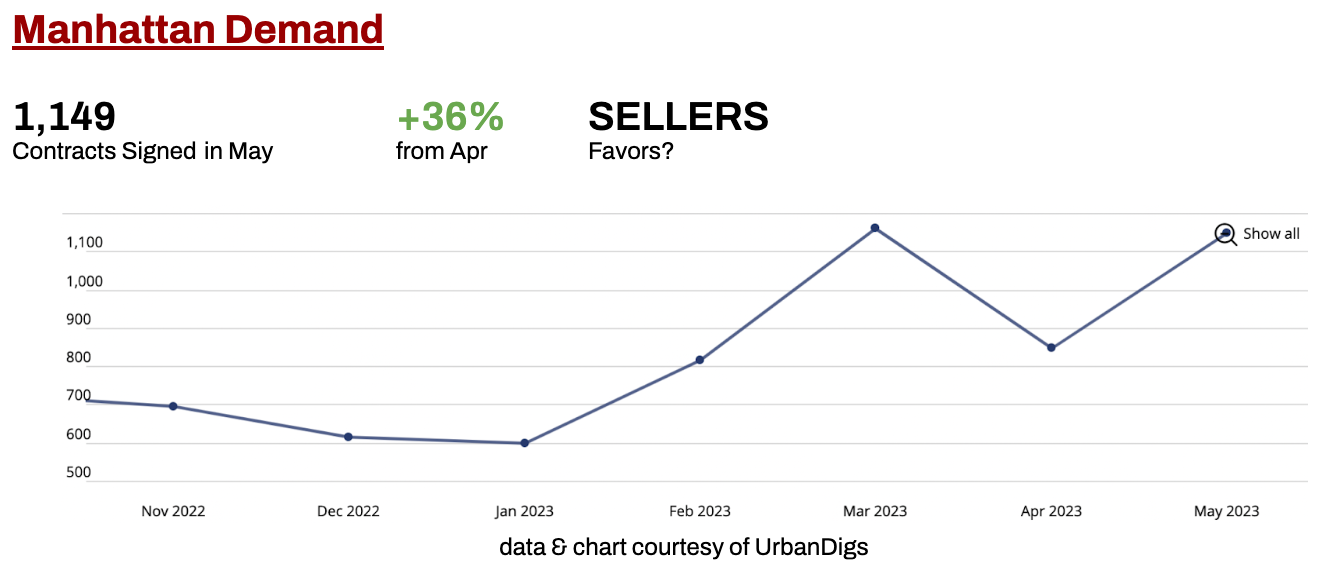

Manhattan Demand

Typical of Spring, Manhattan contract activity peaked in March, contracted in April, and peaked again in May. What does this mean for:

- BUYERS? More competition.

- SELLERS? More activity.

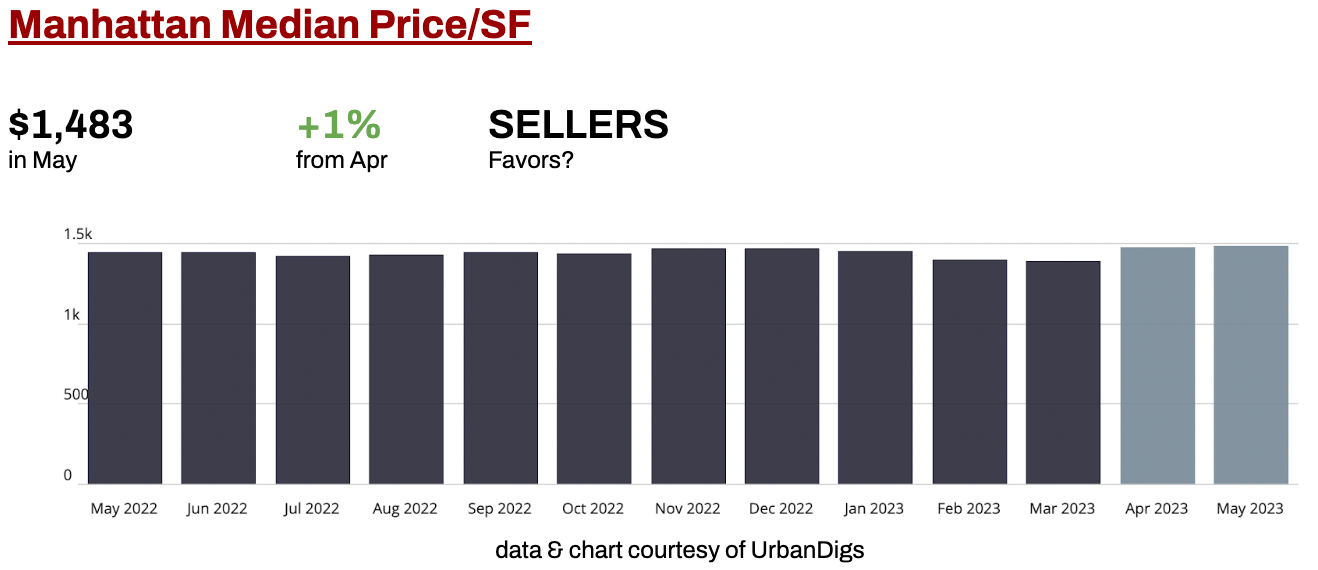

Manhattan Median Price/SF

After a recent downward trend, the median price per square foot increased in April and May. What does this mean for:

- BUYERS? Price/SF is moving against their interest.

- SELLERS? Price/SF is moving in their favor.

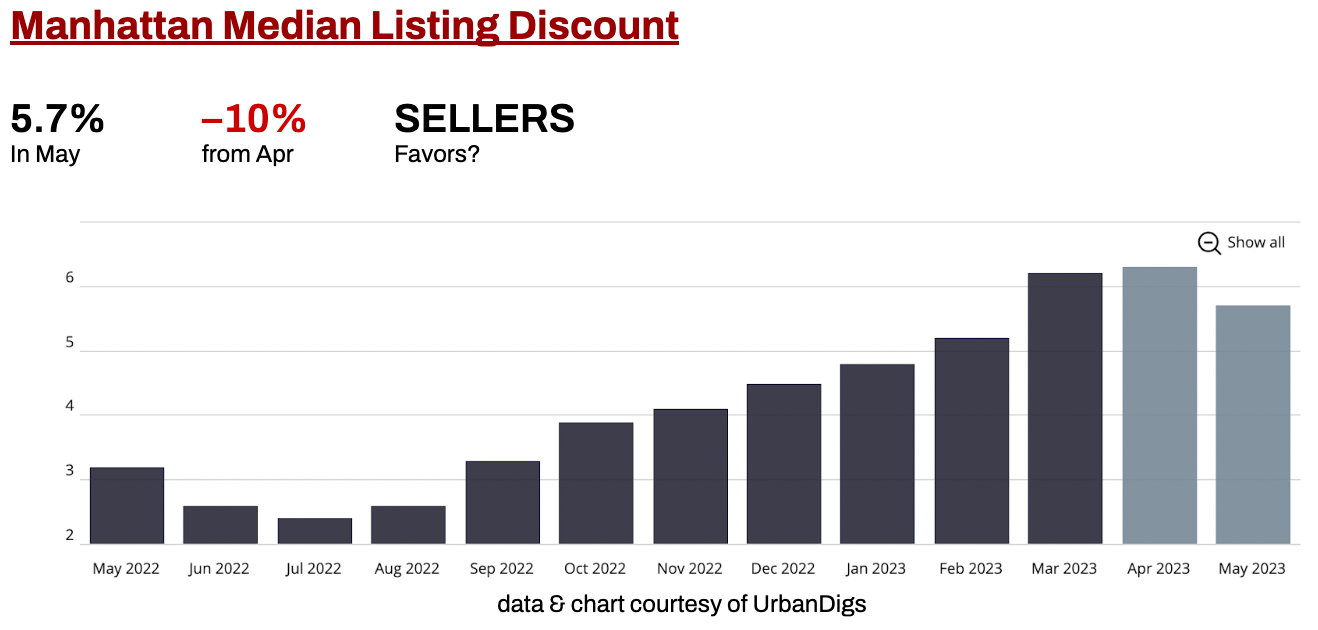

Manhattan Median Listing Discount

Median listing discount receded for the first time in 9 months, so what does this mean for:

- BUYERS? Prices are temporarily moving against their interest.

- SELLERS? Prices are temporarily moving in their favor.

Elegran Leverage Indicator: Manhattan

Elegran's Leverage Indicator tells us which party has transactional leverage, whether it's a buyer's or seller's market. The graph below displays trendlines that show the market influence, while the slope of these trendlines reveals the strength of the leverage.

According to the data below, a buyer’s market has been in place since March 2022. However, recently, we see two pronounced directional changes, one in March and the other in May.

Does this predict a shift to a seller’s market? We think the answer is “no.”

In the previous buyer's market that prevailed in Manhattan from October 2015 to September 2020, there were notable shifts in direction during certain months. Specifically, in 2016, 2017, and 2018, there were two temporary changes in March and May, represented as peaks on the chart. However, in 2019, these dual peaks were slightly shifted to occur later in the season, specifically in April and June.

This data supports our claims that demand is robust during Spring and the market tends to favor sellers during the season, even if it’s part of a more significant trend favoring buyers.

History also suggests that there will be another period of high demand in October, which will create a temporary seller's market.

THE VERDICT

Three out of the 4 metrics that power our leverage indicator favor sellers, so sellers possess temporary transactional leverage within a buyer’s market. What does this mean for:

- BUYERS? When the market shifts towards sellers in March and May (and October), there is urgency to transact quickly. However, the larger market trend remains in favor of buyers, suggesting that sellers' advantage is temporary.

- SELLERS? When the market dynamics favor buyers, transact quickly. It is advisable to engage in transactions during March or May (and October). The next favorable opportunity will be in the fall.

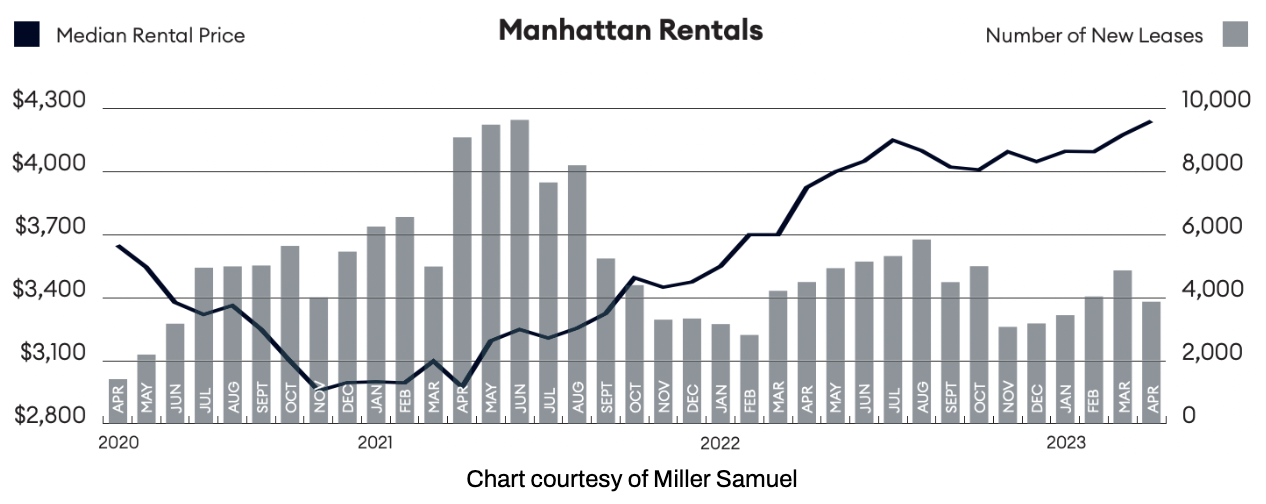

Rental Remarks

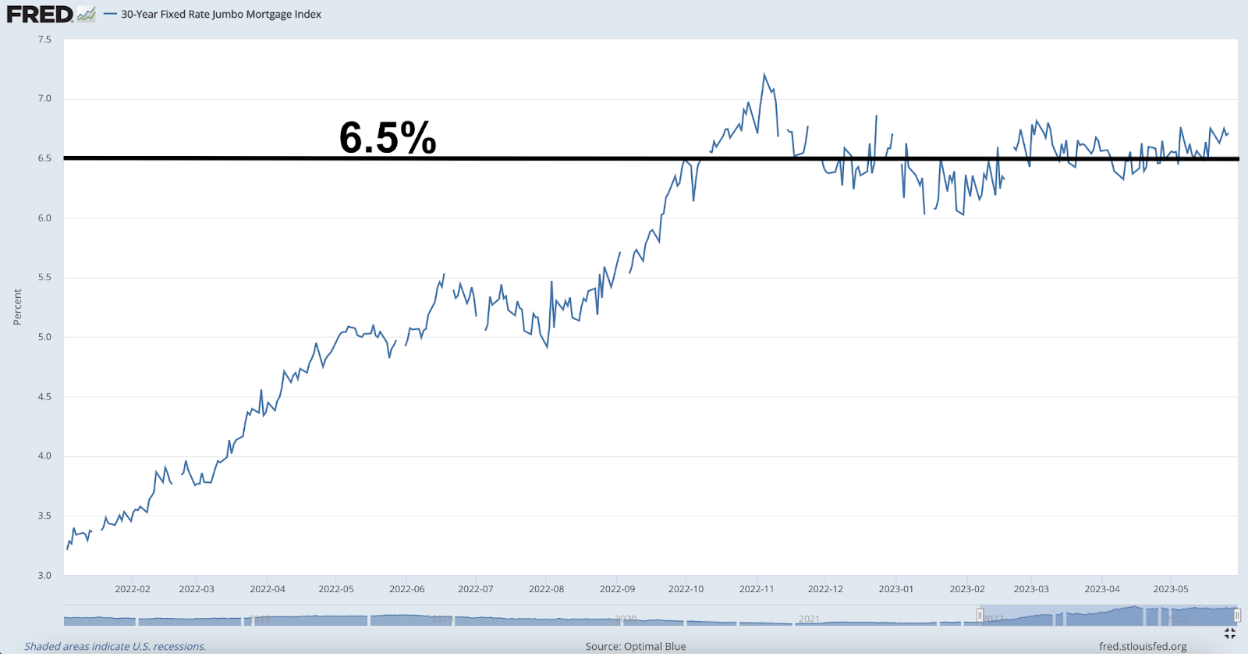

The median rent in Manhattan just hit a new high*, and the average 30-yr JUMBO mortgage rate is 6.7%. It’s a “catch-22” for renters, as the rent versus buy scale may feel equally punitive on both sides.

* April 2023 numbers, as May 2023 data is not yet available

Investor Insights

With Manhattan cap rates between 2.5 - 3.0% and mortgage rates at 6.7%, there is simply no net income potential on leveraged investments. However, with rents at all-time highs, opportunities exist for all-cash buyers.

On the sell side, a relatively strong USD affords foreign investors, depending on their native currency, the opportunity to realize significant capital gains upon selling their assets.

On the buy side, the weakening dollar creates opportunities for foreigners to purchase Manhattan real estate and lock in its notorious stability and potential for price appreciation.

About Us

Elegran’s mission is to ‘humanize the world of real estate’ through a client-first and a thoughtful technology philosophy. A distinguished Forbes Global Properties member for New York City’s five boroughs and winner of the Most Innovative Brokerage Award from Inman, Elegran’s talented team of agents delivers client-centered service, resulting in eight times more sales volume sold per agent than the industry average,

If you would like to chat about the most recent market activity, feel free to contact us at info@elegran.com or connect with one of our Advisors.

© Copyright 2021 Elegran Real Estate LLC (“Elegran”). All rights reserved. No part of this publication may be reproduced in any form, whether electronic, mechanical, photocopying, recording

or by any other means, without the prior written permission of Elegran. All contents are for informational purposes only and does not constitute an offer or solicitation to buy or an offer to sell any property mentioned herein. This publication includes information obtained from published and non-published sources believed to be reliable, but accuracy cannot be guaranteed. Unless otherwise specified, opinions expressed are those of the authors and/or Elegran and are subject to change without notice, In no way does anything herein express or constitute investment advice, nor is it intended to provide (and should not be relied upon for) accounting, legal or tax advice. This publication may contain forward-looking statements, and due to various risks and uncertainties, actual events or results may differ materially from those reflected or contemplated in such forward-looking statements. No representation is made as to the accuracy of any description (ie: listing, close sale data, and/or building description) of any building or individual unit, and all measurements and square footage should be considered approximate. Elegran LLC, its members, affiliates, and contributors adhere to New Your City, New York State, and United States Fair Housing Laws.

Categories

Recent Posts

Stay in the Know!

Sign up to receive our monthly newsletter

GET MORE INFORMATION