Elegran Manhattan Market Update: March 2022

Overall Manhattan Market Update: March 2022

Manhattan Market Update

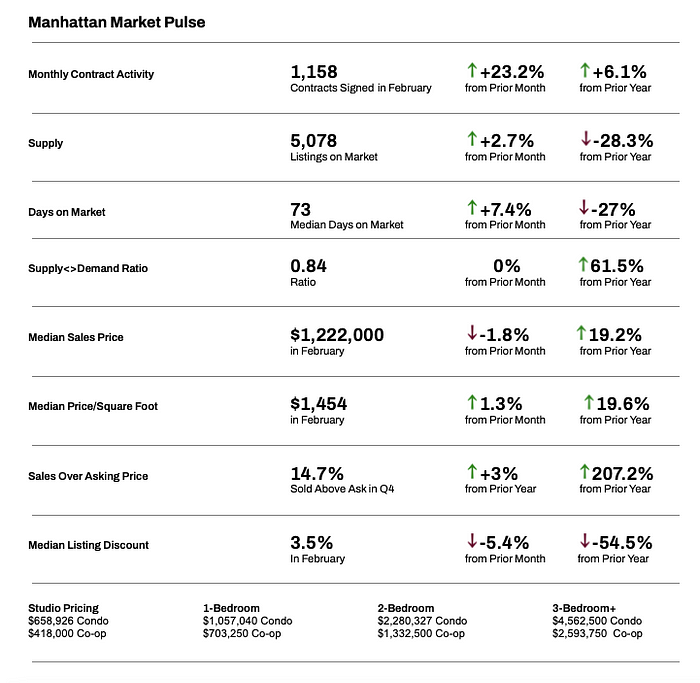

In February the supply and demand imbalance continued to widen in Manhattan, as contract activity increased by 23% while supply only increased by 3% compared to the prior month. As demand outpaces supply, leverage continues to shift towards the seller, resulting in more frequent bidding wars, rising prices and decreased negotiating power for buyers. Buyers need to be prepared to act quickly when new inventory comes to market as homes are spending 27% fewer days on the market compared to last year. Prices have increased 19% compared to last year while the median listing discount has decreased by 55% and 207% more homes sold for over the asking price compared to last year. It’s important to note that the rising median price is both a result of true price appreciation in the market and increased transaction volume in the luxury market, which directly increases the median price.

Manhattan Supply

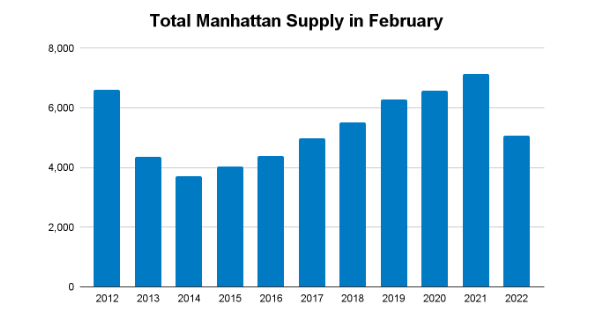

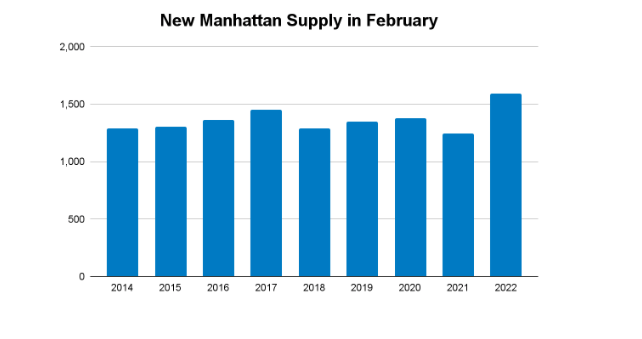

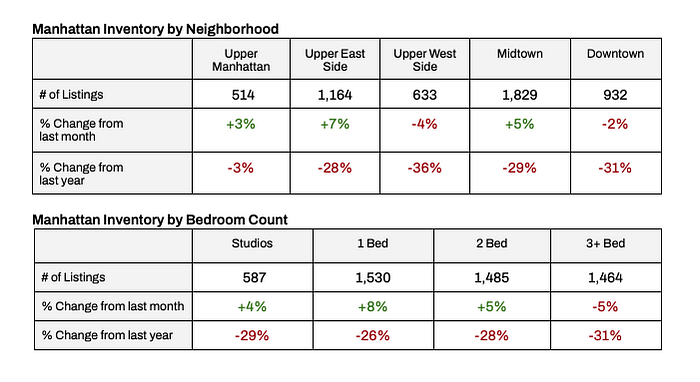

Total supply increased in February as just over 1,600 new listings came to market in the month, increasing total supply by 2% to 5,080 units available for sale. Although more listings came to market this February than in any of the ten preceding February’s, seasonally adjusted total supply is at the lowest level since 2017. Compared to last year, supply has decreased by 28%.

Note: “Total Supply” refers to the amount of inventory on the market at a given time. “New Supply” or “New-to-Market” refers to the amount of new inventory that came on the market in a specific time period.

INVENTORY: Key Takeaway

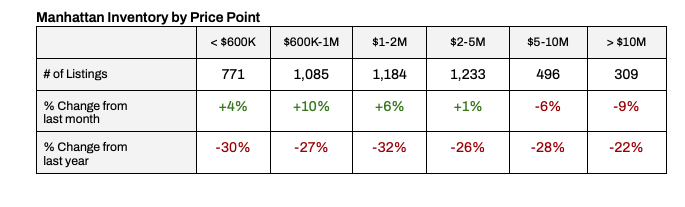

- Compared to last year there is less inventory across all price ranges, neighborhoods and apartment sizes.

- Compared to last month, inventory increased in the price ranges under $5M and for apartments with two or fewer bedrooms.

- In the last month, inventory increased in Upper Manhattan, the Upper East Side and Midtown, while it decreased in the other neighborhoods.

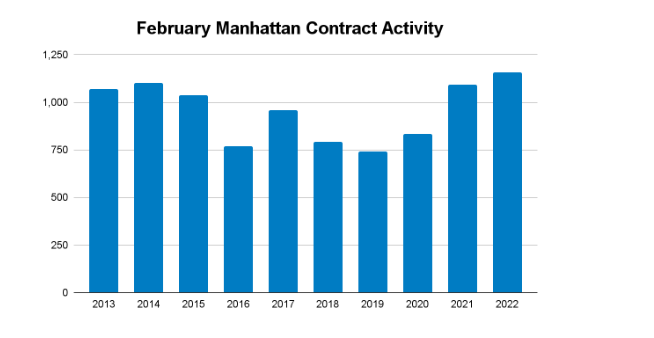

Manhattan Buyer Activity as measured by signed contracts, continued to set a decade high for the month of February with 1,158 contracts signed, narrowly surpassing last February when 1,091 contracts were signed. Contract activity increased 23% compared to last month and increased 6% compared to last year. Accelerating buyer demand coupled with declining supply has led to increased prices, decreased negotiability and a higher percentage of homes selling for above the asking price in the last year.

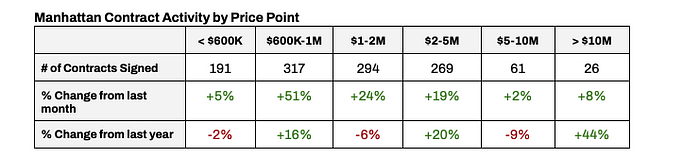

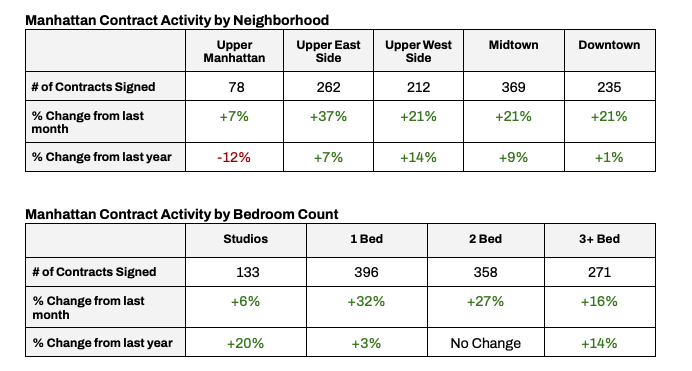

CONTRACT ACTIVITY: Key Takeaways

- Compared to last month, contract activity increased across all price ranges, neighborhoods and apartment sizes.

- In the last month, apartments priced between $600K and $1M had the largest percentage increase in contract activity.

- In the last year, on a percentage basis, contract activity increased more for the higher price ranges than the lower price ranges.

- The Upper West Side and the Upper East Side continue to experience strong demand and a high percentage increase in contract activity over the last month and year.

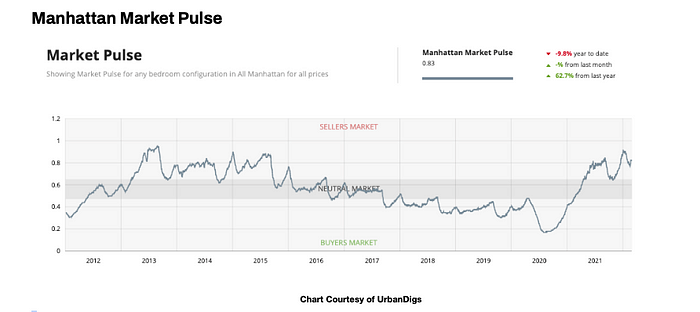

Manhattan’s Market Pulse [a ratio between pending sales and supply] remained unchanged compared to last month to 0.84 and has increased by 62% compared to last year. The rising Market Pulse is a result of the declining supply and increasing contract activity in which leverage has continued to shift from the buyer to the seller. As a result, homes are selling 27% fewer days now compared to last year and nearly 15% of homes are selling over the asking price, which is an increase of 3% from January and 207% over last year.

A Market Pulse below 0.4 is considered a buyer’s market, a Market Pulse between 0.4 and 0.6 is considered a neutral market and a Market Pulse above 0.6 is considered a seller’s market.] In a seller’s market, sellers often have more leverage than buyers because demand is greater than supply, resulting in apartments selling quickly, fewer discounts and increased bidding wars.

Manhattan Market Pulse

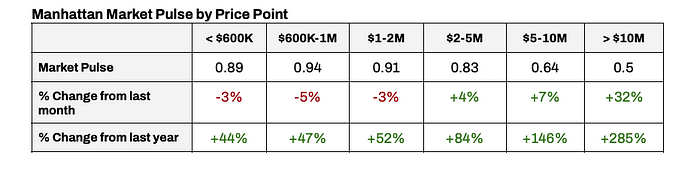

MARKET PULSE: Key Takeaways

- Over the last month and year the Market Pulse has increased the most on a percentage basis for apartments priced above $2M, reflective of the resurgence in the luxury market.

- The Market Pulse remains the highest for apartments priced under $2M, but is also very high [leverage favoring the seller] for apartments priced $2–5M.

- The Market Pulse for $5–10M and $10+M properties have risen and are no longer reflective of a buyer’s market, as leverage has continued to shift towards the seller’s even in the higher price ranges.

- The Upper West Side is the neighborhood with the highest Market Pulse followed by Downtown. Upper Manhattan continued to have the lowest.

Pricing & Discounts

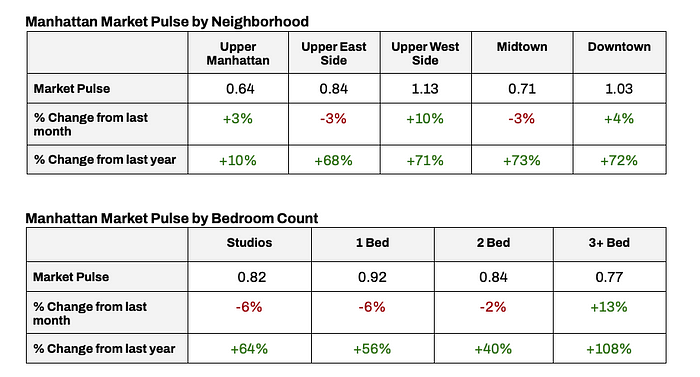

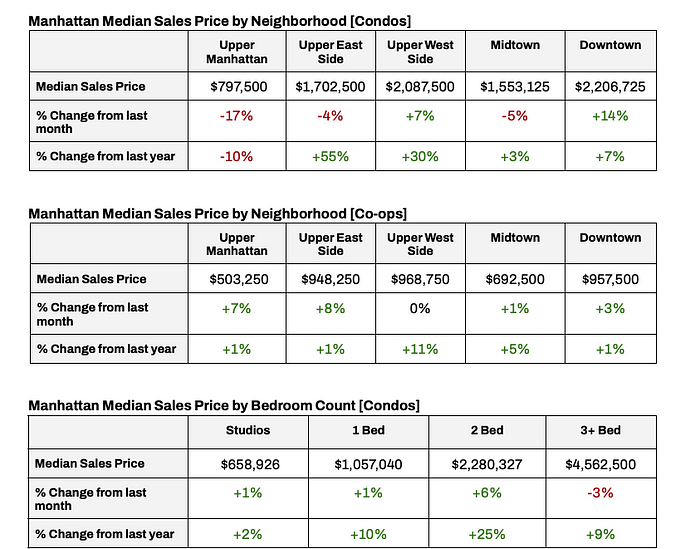

The Median Sales Price across Manhattan for the month of February was $1,222,000, a decrease of 2% compared to January and an increase of 19% compared to last year. On a price per square foot (PPSF) basis, the Median PPSF is $1,454, an increase of 1% from the previous month and an increase of 20% compared to last year. The continued strength of the luxury market is one reason why the price increases are as high as they are. The increase in price captured in the statistic is both the result of true market appreciation, as demand outpaces supply, and a result of more expensive homes being sold, increasing the median price. Furthermore, the median listing discount in February was 3.5%, a decrease of 5% compared to last month and 55% lower than last year. Rising prices and decreasing negotiability are the result of a prolonged supply and demand imbalance, which favor the seller as demand outpaces supply.

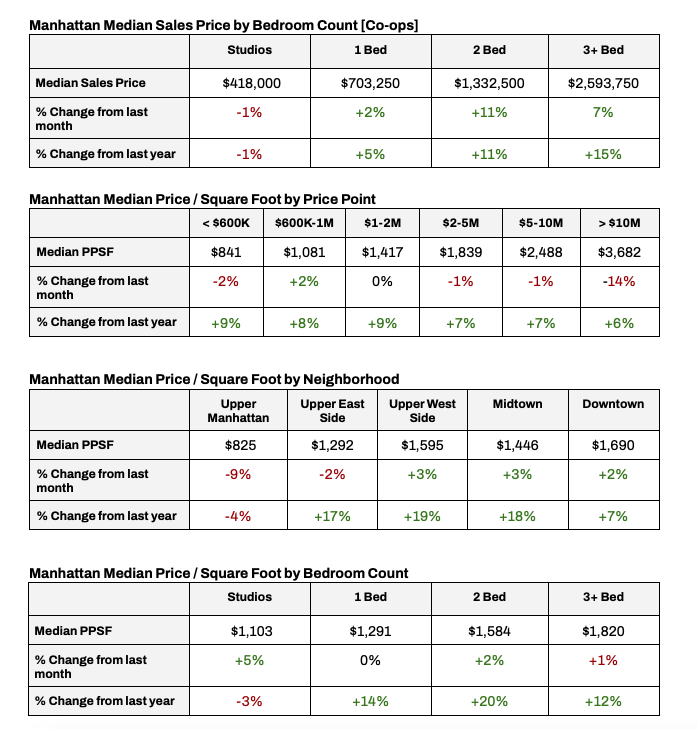

PRICING: Key Takeaways

- In the last month, price appreciation was more consistent for coops than condos, as coops have benefited from an increase in demand from local buyers who may not need some of the additional flexibility offered in condos.

- Homes located Downtown and on the Upper West Side remain the most expensive in the city.

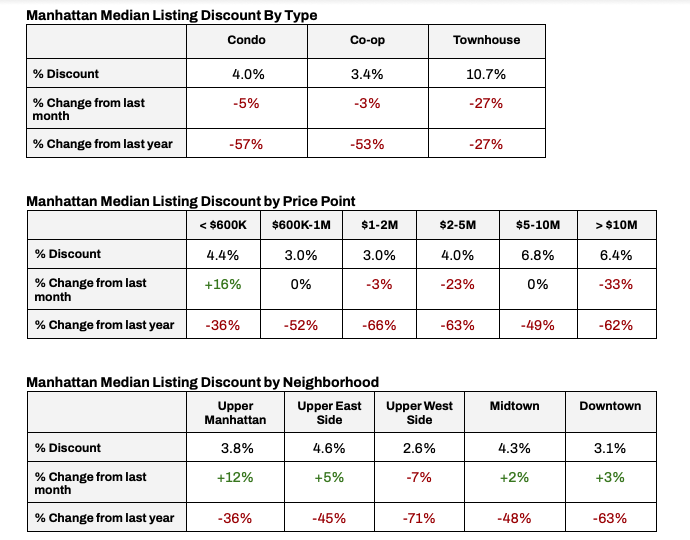

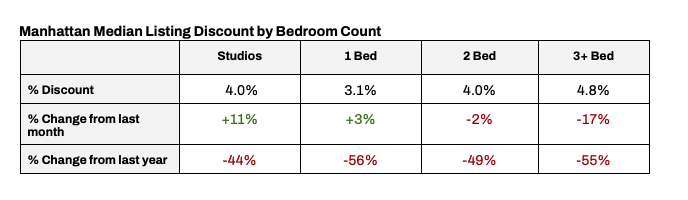

MEDIAN LISTING DISCOUNT: Key Takeaways

- Median listing discounts have increased the most, on a percentage basis, for homes priced $2–5M and $10M+, another data point illustrating the recent strength of the luxury market.

- Discounts have not decreased as much in the lower price ranges, in part because supply has not decreased as much and contract activity hasn’t increased as much compared to the higher price ranges recently.

- In the last year, discounts have decreased across all building types, price ranges, neighborhoods and apartment sizes.

- In the last month, discounts have increased for homes priced under $600K, and in all neighborhoods except for the Upper West Side.

What this means for…

Buyers:

- This can be a tough market for buyers given increased competition and decreased supply.

- The market remains supply constrained causing prices to rise and negotiability to decrease.

- It’s important to position you and your offer in the most favorable way, consider removing contingencies when and where appropriate to strengthen an offer.

- Buyers should be prepared to act quickly and expect to encounter a multiple bid situation when submitting offers.

- To win bidding wars, buyers should consider paying tomorrow’s price today.

- The luxury market in particular continues to see increased contract activity, rising prices and decreasing negotiability as leverage shifts further towards the seller.

- Mortgage interest rates are increasing, and are projected to increase throughout 2022, potentially spurring buyers to act sooner than later.

Sellers:

- More new inventory is coming to the market, but given the strong demand, the market remains supply constrained.

- While prices are rising, sellers will often fare better by pricing realistically to drive demand, rather than pricing aspirationally.

- When positioned properly, expect to sell in 73 days on the median, 27% quicker than a year ago.

- Nearly 15% of homes sold for above ask in Q4 2021.

- The Market Pulse has increased 62% in the last year, reflective of a transition from a buyer’s market towards a seller’s market.

Renters:

- Rents have increased significantly over the last year and are hitting new records.

- Rental supply has dropped drastically, contributing to the rising prices as demand far outpaces supply.

- In the face of rising inflation and increased rent renewal rates, now can be an ideal time to consider buying rather than renting.

- Tenants facing a lease renewal will experience rising rent prices and landlords unwilling to negotiate or offer concessions.

- Competition is fierce amongst tenants, with apartments often receiving multiple offers and frequently going to bidding wars.

Investors:

- As Manhattan real estate begins to appreciate again, NYC presents a compelling alternative to other domestic markets that have already experienced incredible price growth over the last two years.

- With attention to rising inflation, real estate offers a hedge against inflation.

- Rising rental rates and increasing cap rates are creating an incentive for investors to explore investment opportunities in Manhattan.

Please contact us if you would like to learn more…

About Us

Our goal is simple: to humanize the world of real estate. Michael Rossi founded Elegran in 2008 on the dual premise of motivation and innovation, with a third sustaining principle added over the years: care. Unique in the industry, the firm has quietly become a key player in the New York brokerage world. Elegran oversaw well over $500 million in sales volume in 2019, tripled market share in 2020 and sold $1B in 2021. Headquartered in the center of Manhattan, Elegran is solely dedicated to serving the incomparable needs of the New York City metropolitan region.

Categories

Recent Posts

Stay in the Know!

Sign up to receive our monthly newsletter

GET MORE INFORMATION