Elegran Manhattan Market Update: October 2025

Overall Manhattan Market Update: OCTOBER 2025

Fall Reset: More Supply, Softer Prices, Sharper Negotiations

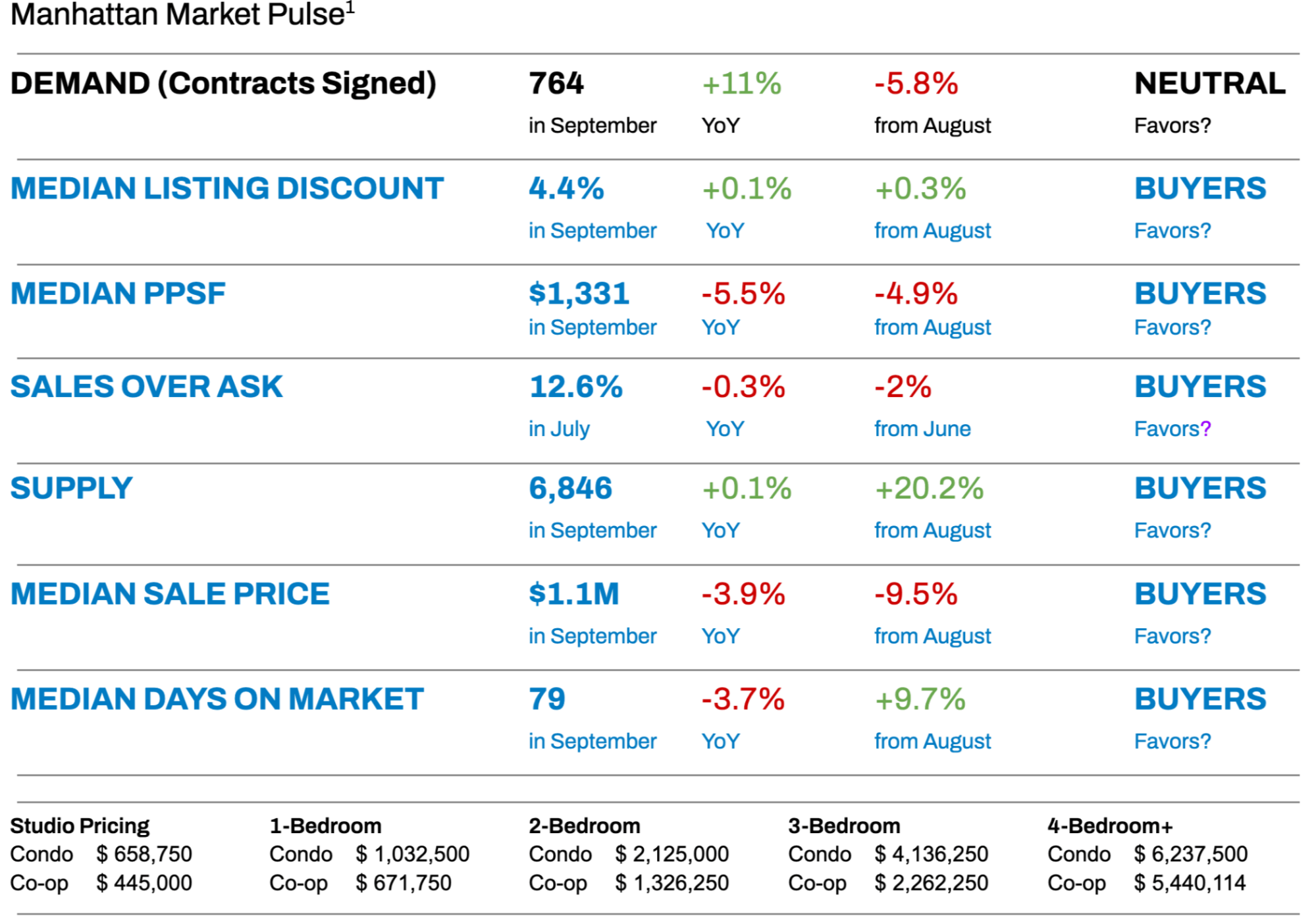

The Manhattan market tipped in favor of buyers in September as active listings surged by about 20% after the summer lull, giving house-hunters significantly more options. Contract signings dipped slightly from August’s pace (roughly a 5–6% decline month-over-month), though they remained about 11% higher than last September — 764 contracts this year compared to 680 in 2024, when activity fell by a steeper margin month-over-month. The comparison highlights that while momentum cooled this fall, the seasonal slowdown was milder than last year’s, signaling steadier buyer engagement and stronger underlying demand in 2025.

With more supply and a calmer pace of sales, prices finally showed some softening: the median price per square foot fell and listing discounts inched up, marking a modest shift toward a more negotiable market. Now, with mortgage rates stabilizing and the Federal Reserve enacting a small rate cut, all eyes are on October to see if these buyer-friendly conditions persist or if a typical fall uptick in deals, particularly in the sub-one-million segment of the market, which has been more affected by high rates, will tilt the balance back toward sellers.

Big picture: Manhattan’s investment landscape remains steady, with the global appeal of NYC real estate continuing to underpin demand even as local buyers take a more cautious stance. Foreign capital and selective domestic investors are keeping activity afloat, while the commercial sector is showing its strongest momentum since before the pandemic – driven by return-to-office mandates, renewed retail leasing, and improving office utilization. The market is neither in a boom nor a slump, but rather in a measured reset that’s laying the groundwork for renewed growth once financing conditions ease.

With the holidays around the corner, October stands out as a test. If buyers stay active, leverage could rebalance toward neutral - but if momentum stalls, the buyer’s edge may carry through year-end.

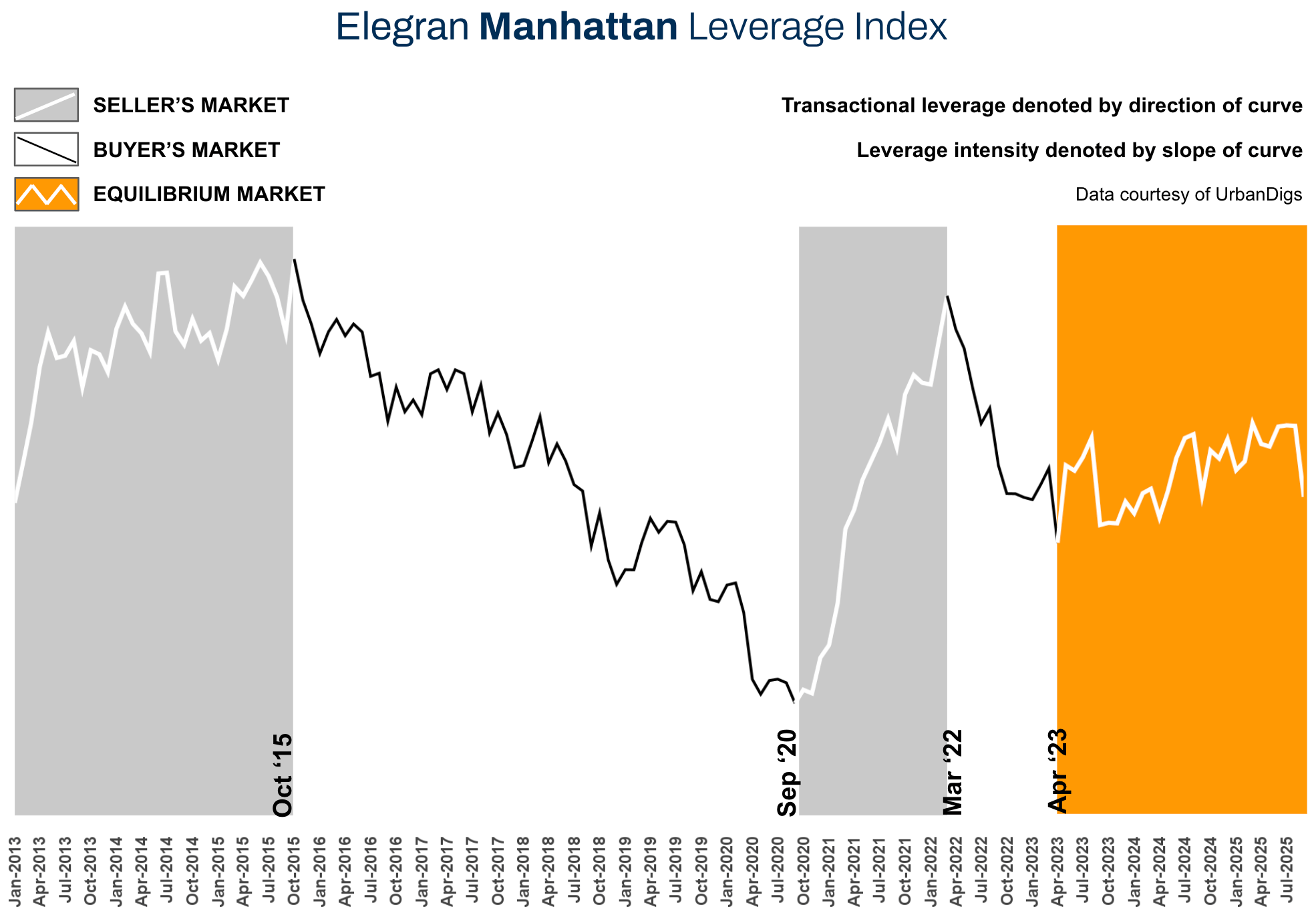

Elegran Manhattan Leverage Index

The Elegran Manhattan Leverage Index² blends four market signals - supply, demand, median price per square foot, and median listing discount - to capture the balance of power between buyers and sellers.

Direction Matters:

- An upward-sloping curve = seller’s market

- A downward-sloping curve = buyer’s market

- The steeper the slope, the stronger the advantage for either side

In September, three of the four key levers tipped toward buyers: supply jumped by more than 20%, median prices per square foot softened, and listing discounts ticked higher. Demand, however, held steady, with contract signings slightly below August but still stronger than a year ago. The result? A clear shift toward a buyer-leaning market.

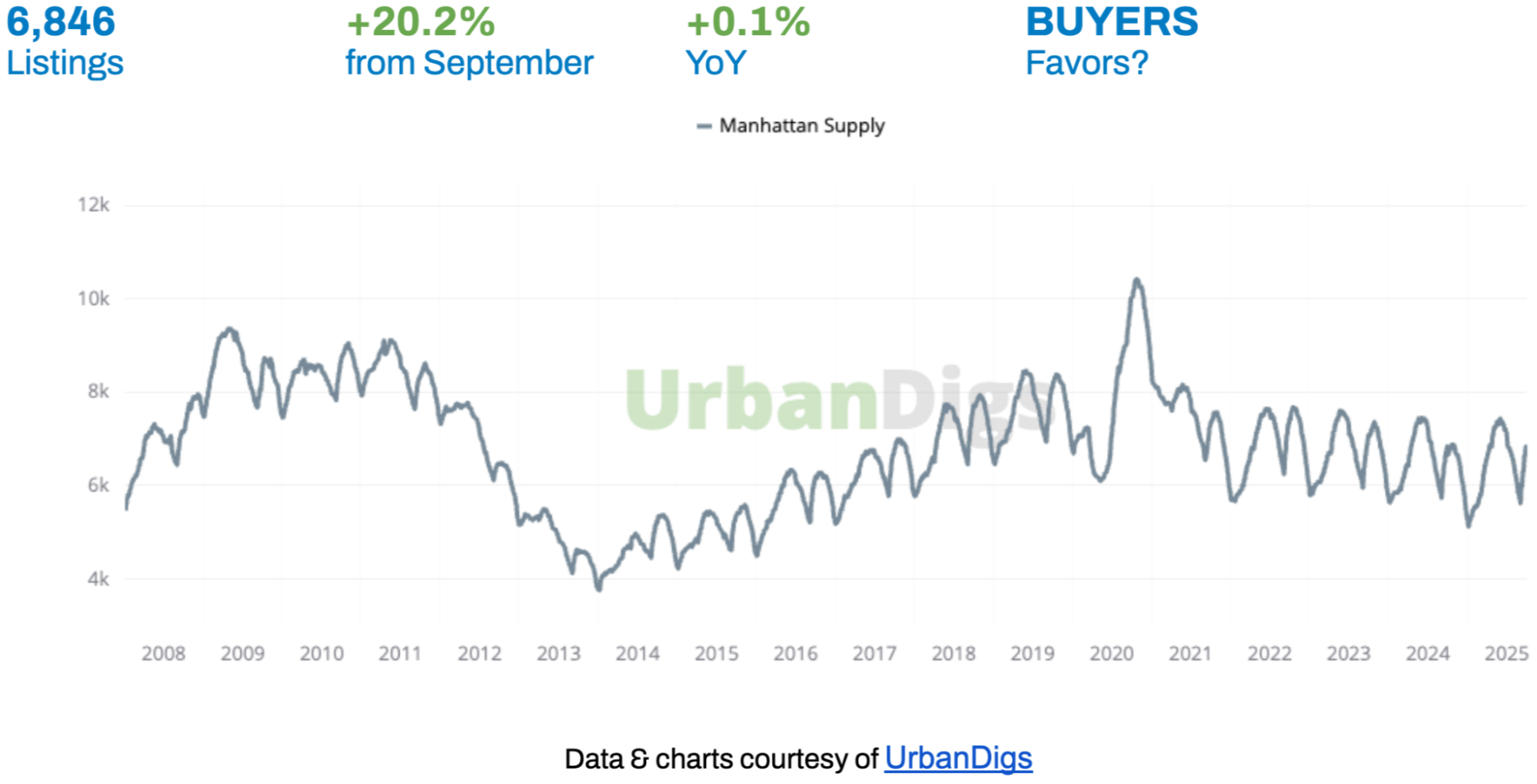

Manhattan Supply

Manhattan Supply: Inventory Jumps 20% in One Month

With 6,846 homes on the market, Manhattan’s inventory at the end of September saw a pronounced post-summer rebound. Active listings jumped about 20.2% from August, a steep one-month increase that brought supply back in line with last year’s level (virtually flat year-over-year at +0.1%). In fact, this late-September surge lifted inventory above the 6,800 mark, roughly on par with early 2025’s spring highs and a stark reversal from August’s unusually lean inventory of around 5,661.

Much of this boost came from would-be sellers entering the market after Labor Day, a typical seasonal pattern. The influx of new listings has expanded choices for buyers and eased some of the scarcity pressure that characterized the summer market.

What This Means for You:

BUYERS: With more listings hitting the market, you have a wider selection and a bit more breathing room than just a month or two ago. This increased supply can translate into slightly less competition per property – you may find it easier to negotiate or take a moment longer to consider your options than during the tight summer market.

SELLERS: You’re facing more competition now. A surge of new inventory means buyers have more choices, so standing out is crucial. Pricing your home realistically from the start is more important than ever – overpricing in a bloated fall market will likely cause your listing to languish.

LOOKING AHEAD: Expect inventory to level off or even pull back slightly as we move later into the fall and towards the holidays. October often sees a continued flow of listings early in the month, but by November many unsold homes get pulled off the market or delayed until spring. Heading into 2026, keep an eye on whether new development launches or economic changes add substantially more inventory – for now, the autumn surge appears seasonal, not a sign of a permanent glut.

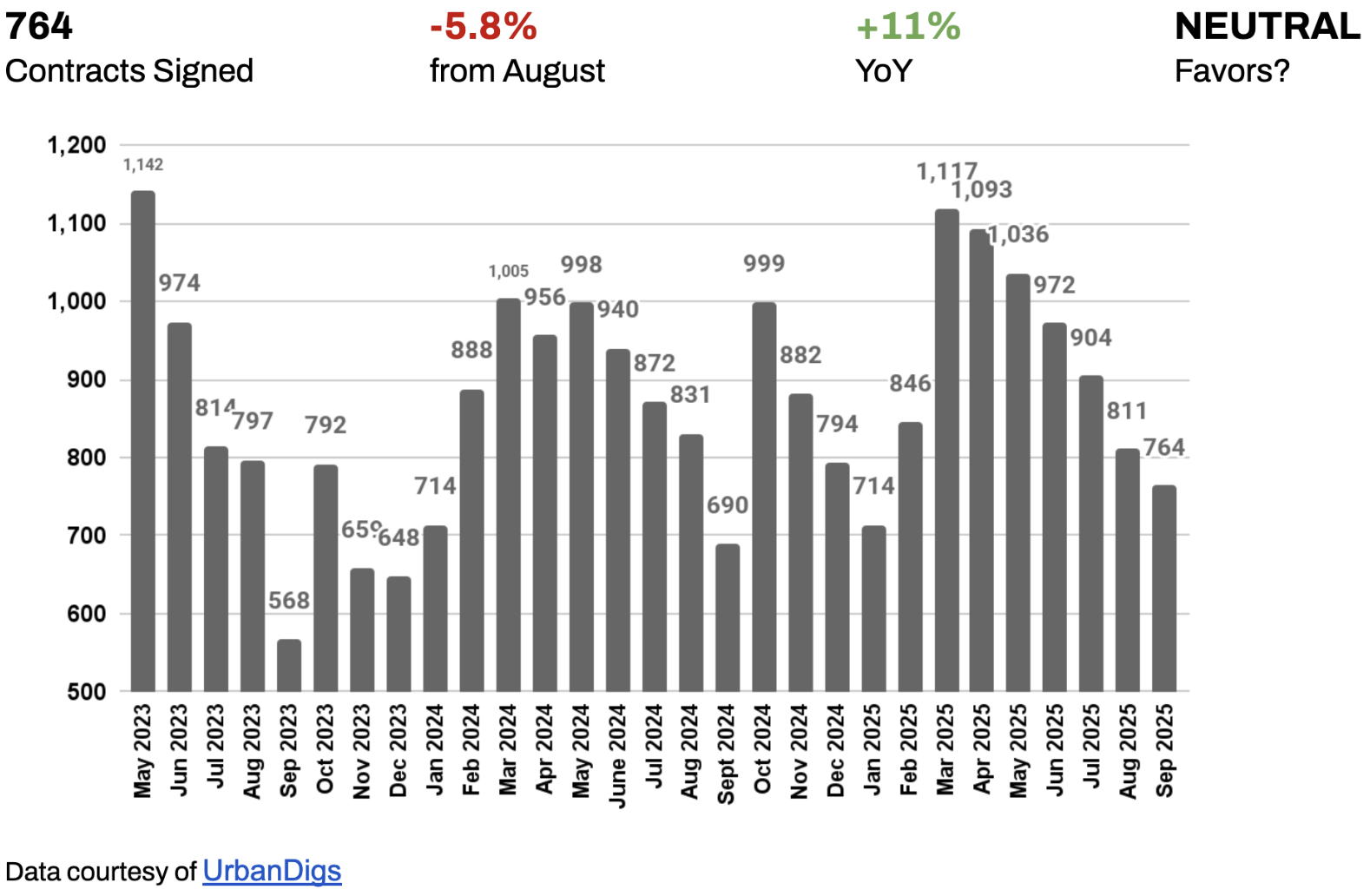

Manhattan Demand

Manhattan Demand: Contract Signings Dip from August, but Exceed Last Year

Buyer activity in September was tepid relative to the new supply. Only 764 contracts were signed for Manhattan homes during the month – about 5.8% fewer deals than in August. The anticipated post-Labor Day jump in sales did not fully materialize, as many buyers remained selective or slow to act despite the influx of listings.

However, viewed year-over-year, contract volume was actually up ~11% compared to September 2024, highlighting that demand in fall 2025 is still stronger than the same time last year. In essence, the market saw a modest pullback in deal pace from the summer month prior, but maintained a higher baseline of activity than last year’s early fall.

This suggests buyers are out there – just moving carefully. Some were likely negotiating harder or waiting for price adjustments, given the greater choice available. Overall, September’s demand can be characterized as lukewarm: neither a surge nor a slump.

What This Means for You:

BUYERS: You currently face less competition per listing than you might have earlier in the year. So you have a better chance to negotiate price or contingencies without feeling pressured to immediately outbid others. Use this moment to your advantage: if a property you like has been on the market for a few weeks, you might secure it under asking or with favorable terms that were hard to get in the spring.

SELLERS: buyers are more cautious and price-sensitive right now. In September, many shoppers felt little urgency, which means an overpriced or poorly presented listing will be quickly passed over. To get your home sold, strategic pricing is key. Consult recent fall comps (even the last few weeks of data) and position your asking price to reflect the current reality – buyers have more choices and will gravitate to value. If your home has been sitting since summer, consider a price improvement or a fresh marketing push before the holiday slowdown kicks in.

LOOKING AHEAD: We’re approaching a part of the year that often brings a brief resurgence in activity. Many buyers who paused over the summer or early fall could refocus on their search in October and early November, aiming to secure a home before year-end. We anticipate contract signings to tick up in October compared to September, though perhaps not dramatically above normal seasonal levels. Much will depend on mortgage rates staying stable – a sudden rate drop could entice more buyers off the sidelines, while any spike could scare some away.

In summary, October is likely to be the last “busy” month of 2025 for demand.

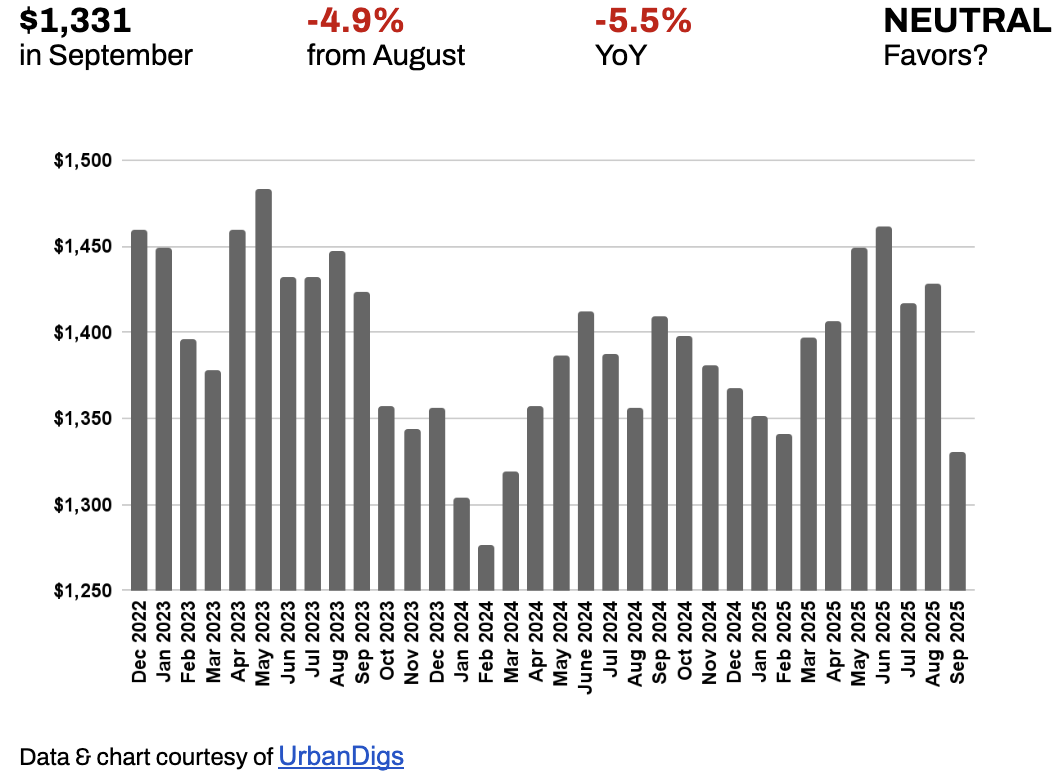

Manhattan Median PPSF

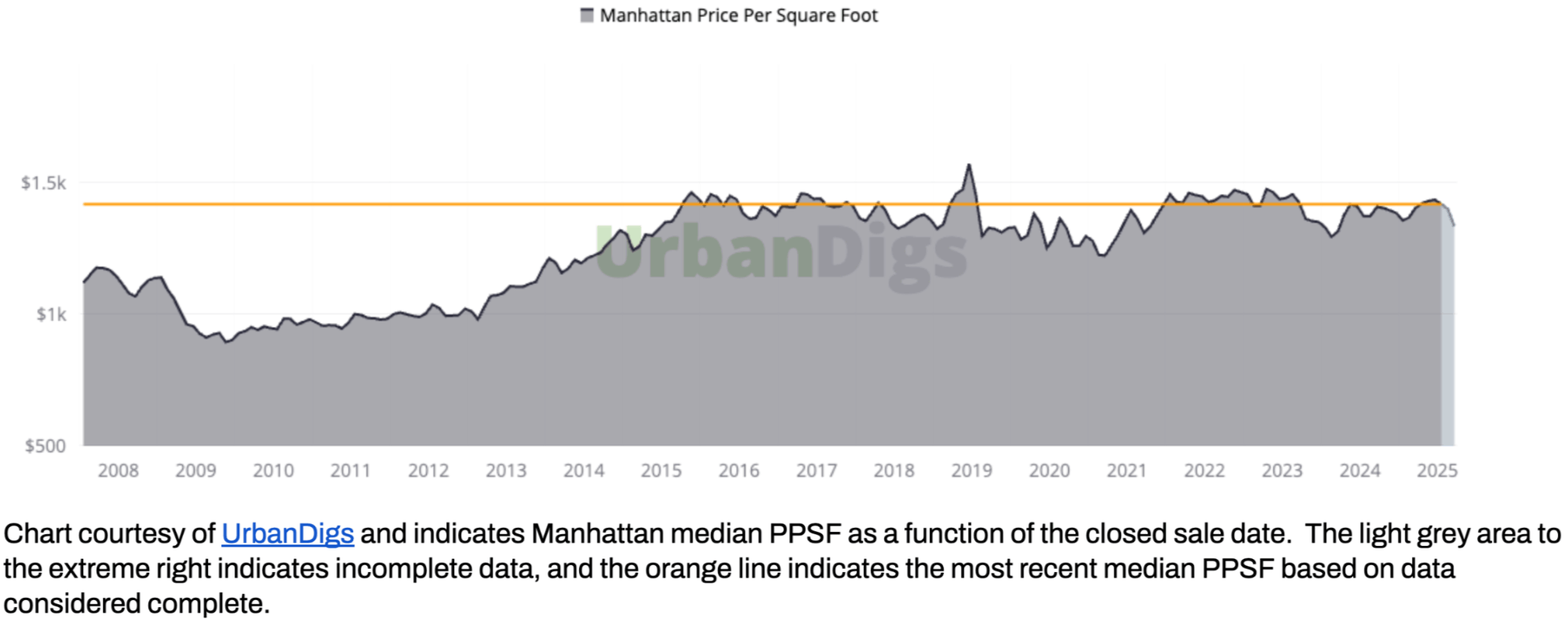

Manhattan Median PPSF: Prices Slip – Median PPSF Down ~5% Year-Over-Year

The median price per square foot (PPSF) for closed sales in September was about $1,331, which represents a noticeable decline from recent levels. This figure is down roughly 4.9% from August (when the median PPSF was higher, around $1,400) and approximately 5.5% lower than in September 2024. It’s a noteworthy development, considering that throughout the spring and summer, Manhattan’s PPSF was often flat or even up year-over-year.

In September, however, we finally saw year-on-year price erosion – an indication that the slower market is translating into slight concessions on pricing. In practical terms, sellers had to trim expectations a bit to get deals done, and buyers were able to purchase at prices that, on a per-square-foot basis, were a touch more reasonable than a year ago.

What This Means for You:

BUYERS: The slight drop in PPSF is encouraging if you’ve been frustrated by high prices – it means the market is bending in your favor on pricing, albeit gradually. But remember, Manhattan is still an ultra-competitive, low-supply market in many segments; we’re talking modest price relief, not bargains galore. Your best opportunity to capitalize on the price softening is to identify listings with motivated sellers – perhaps those that didn’t move over the summer or new listings priced on the aggressive side that haven’t found traction.

SELLERS: For much of this year, you’ve heard that Manhattan prices were holding firm – but the latest data shows a bit of slippage, so calibrate your expectations accordingly. If you're coming to market now, price your property based on today’s reality, not last year’s. The good news is that prices are not plummeting; they’re easing, and Manhattan homes are largely still selling at strong values by historical standards. But if you’re in a segment with plenty of competition (say, an $1M one-bedroom or a $3M three-bedroom where multiple similar units are for sale), know that buyers have options and will gravitate to the best-priced offering. In short: aim to be the “compelling” listing on price in your category.

LOOKING AHEAD: The recent uptick in inventory could put a bit more pressure on prices in the next month or two, but not drastically – think gradual adjustments rather than any sudden drop. In essence, the “plateau” we saw in prices is tilting gently downward. As we go into 2026, the trajectory of prices will hinge on factors like interest rates, the broader economy, and inventory levels, but for now anticipate small, incremental price movements rather than anything seismic.

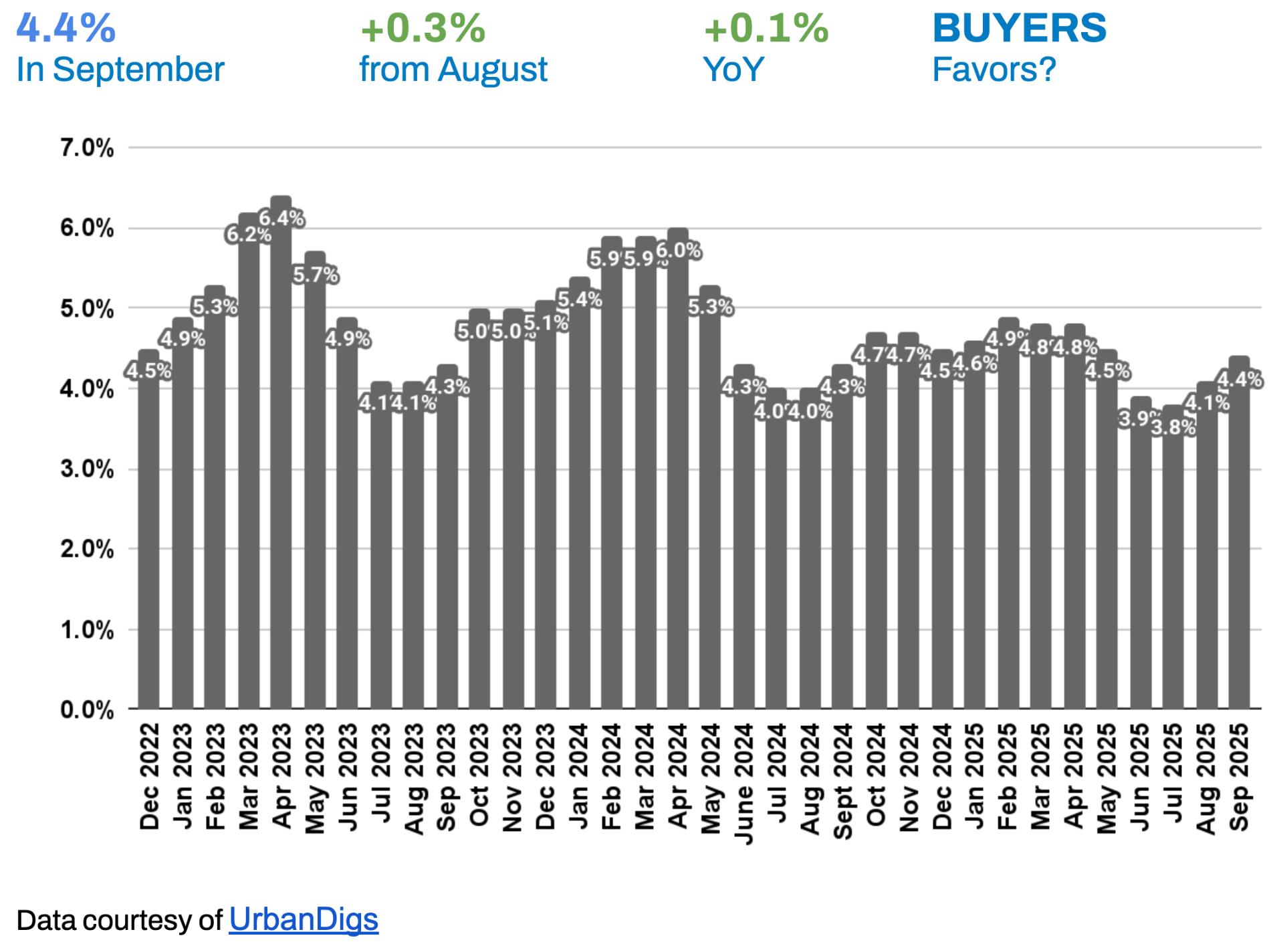

Manhattan Median Listing Discount

Manhattan Median Listing Discount: Discounts Inch Up Again, Buyers Gain a Bit More Leverage

The median listing discount – i.e., how much below the last asking price homes are selling for – was 4.4% in September. That’s up from roughly 4.1% in August, and a touch higher than the ~4.3% median discount recorded a year ago. This marks the second month in a row of rising discounts, reversing the trend from last spring when many properties were fetching at or above asking price. To put 4.4% in context: it remains very low by historic standards (Manhattan often saw 5–10% discounts in a balanced market years ago), so we’re still in an environment of tight negotiations. However, the pendulum has indeed swung slightly toward buyers

What This Means for You:

BUYERS: You’re no longer almost always forced to pay full ask or above – seeing a 3–5% discount on a successful offer is becoming common again. This doesn’t mean you can throw out lowball offers left and right (Manhattan isn’t suddenly a bargain bin), but you do have a bit more leverage. The general trend is that you can negotiate in good faith and expect to save a few percentage points off list price in many deals.

SELLERS: If you overprice, though, today’s buyers will likely wait you out, and your listing could stagnate. The longer it sits, the more buyers assume there’s a deal to be had, and you might end up conceding more than you would have with a sharper initial price. In short, to minimize discounts: be proactive, not reactive. Remember, even at 4–5% discounts, you’re still doing quite well historically – this is about not letting that number creep higher on your particular sale. As we reach the peak of Fall activity, it is important to make any price adjustments decisively in order to prevent missing the last cyclical surge of buyer activity due to pricing errors.

LOOKING AHEAD: We anticipate listing discounts will hover in the low-to-mid 4% range through the fall. They might widen slightly if the market remains slow – perhaps we’ll see median discounts approach 5% by year’s end. So, expect a continuation of this gradual, modest uptick in discounts rather than any dramatic swing.

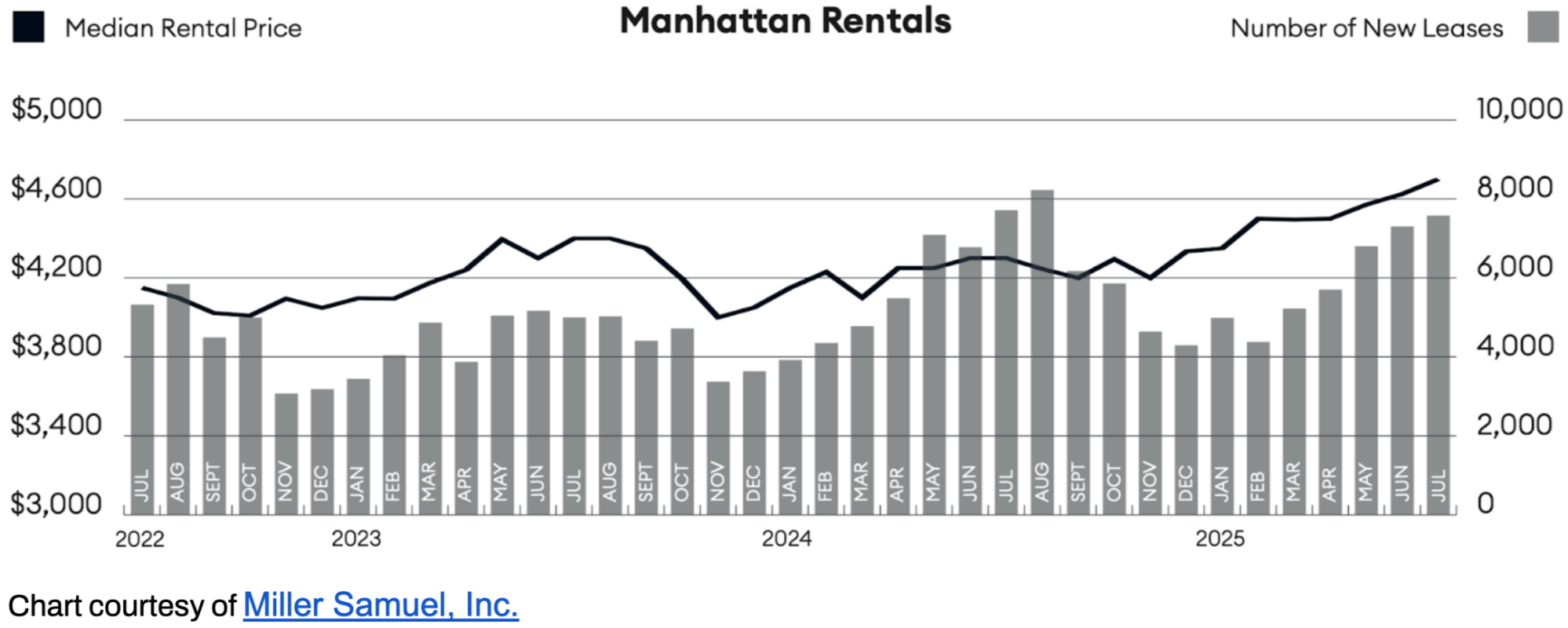

RENTAL REMARKS

Rental Market: Rents Retreat Slightly from Summer Highs, Remain Elevated

Several factors underpinned this slight retreat. Seasonality played a role: late summer often represents the tail end of peak rental season, and it’s typical for rents to plateau or dip moving into fall. We also saw a unique supply crunch – rental inventory was down roughly 13% year-over-year in August.

One reason is that we’re just now seeing the impact of April 2024’s Good Cause Eviction Law, which limits rent increases upon lease renewal to no more than 10% or 5% plus the Consumer Price Index (CPI), whichever is lower. This year, the maximum was 8.79%.

Another reason is the new FARE Act (Fairness in Apartment Rental Expenses Act) that took effect in June, which prohibited broker fees from being passed to tenants. In Manhattan, this triggered dramatic rent increases. Other landlords responded by pulling listings or delaying putting units on the market (to avoid paying fees or to recalibrate rents), contributing to an unusually tight inventory during peak season. These two laws also combined to change consumer behavior - the lease renewal increased drastically, also reducing inventory. That lack of available apartments earlier in the summer drove rents to extreme highs.

According to Miller Samuel, Manhattan’s median rent reached $4,600 in August 2025 — down 2.1% month over month but still 8.4% higher than the same time last year, marking one of the highest levels on record.³ By August, most of the FARE Act adjustment was baked in, and the slight improvement in inventory (plus perhaps some renter fatigue at sky-high prices) meant rents couldn’t climb much further.

What This Means for You:

RENTERS: After months of relentless rent increases, you might finally get a small breather. The post-summer period typically brings a seasonal lull in the rental market. Also, consider timing: if you have flexibility, the late fall and winter months are generally the slowest for rentals, and you could land a comparatively better deal in November or December when demand is at a nadir. Be ready to demonstrate you’re a strong applicant (have your paperwork and references in order).

LANDLORDS: Heading into the fall, be aware that the market is shifting from boiling to just hot. If your unit becomes vacant now, consider pricing it just at or slightly below the peak summer level to ensure you capture one of the still-limited pool of renters out shopping. Many landlords are still getting the asking price (or close) this fall, but if you’re aiming well above what the last similar unit rented for, you might get soft interest.

LOOKING AHEAD: We expect a gradual seasonal cooling in the rental market through the end of 2025. The fourth quarter in NYC typically sees rents plateau or dip slightly as the influx of new renters wanes. This year should follow that pattern: by November and December, median rents will likely be a bit lower than the summer peak (perhaps a further small single-digit percentage off). However, any relief for renters will probably be limited – the structural issue of high demand and low supply isn’t going away quickly.

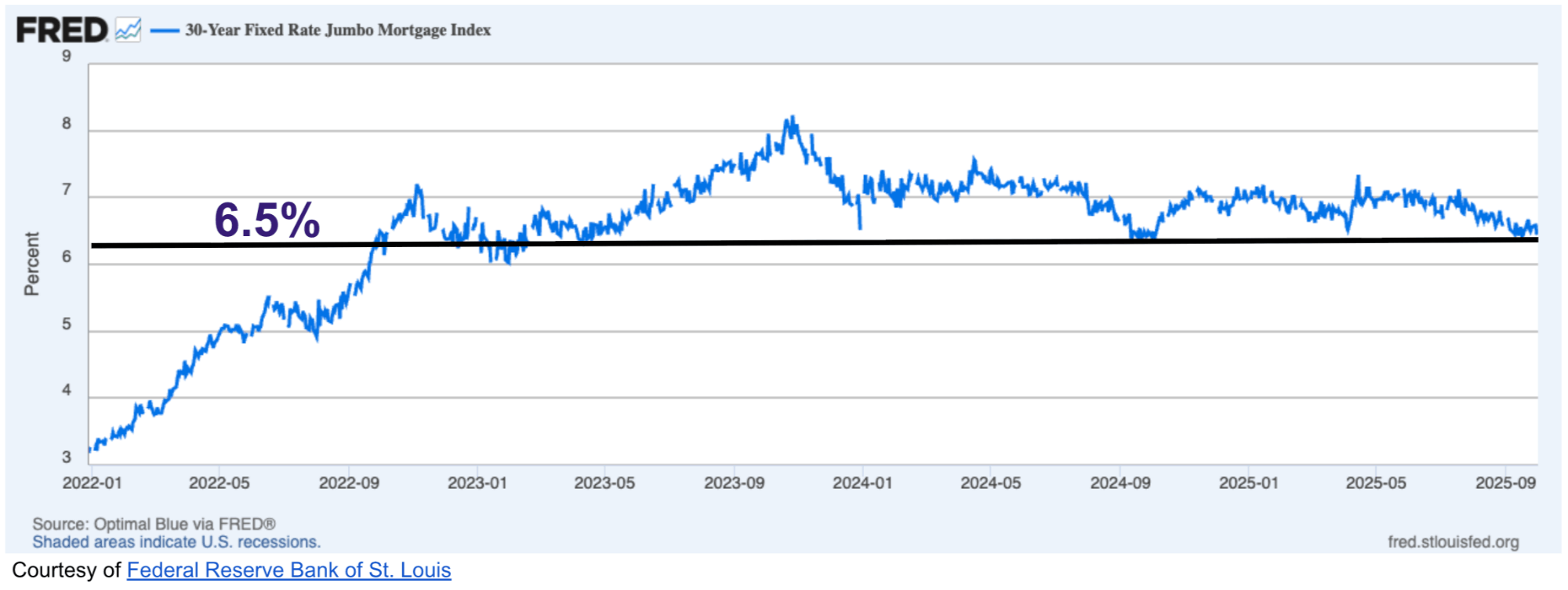

MORTGAGE REMARKS

Mortgage Rates: High but Stabilizing ~6.5% with Hints of Easing

Financing a home purchase remains considerably more expensive than it was a few years ago, but there are signs that the worst may be behind us. As of early October 2025, 30-year fixed jumbo mortgage rates (which many Manhattan buyers rely on, given high purchase prices) are hovering around 6.5%⁴, with average APRs in the low 6%⁵ range. These figures are roughly on par with where rates stood for most of the summer, and actually a hair below the peaks seen in mid-2025 when some jumbo quotes touched 6.8–7%. In other words, mortgage rates have plateaued, establishing a new normal in the mid-6s for now.

A notable development influencing sentiment is the Federal Reserve’s recent rate policy shift. In late September, the Fed announced a 0.25 percentage point cut to its benchmark interest rate – the first rate reduction in years, bringing the federal funds target range down to around 4.0–4.25%. While this doesn’t directly and immediately slash mortgage rates, it’s an early signal that the era of tightening monetary policy is ending.

What This Means for You:

BUYERS: Be prepared to budget for high monthly payments – even though rates have dipped slightly, we’re still in the mid-6% range for 30-year loans. As a rule of thumb, every $100,000 of mortgage at ~6.5% interest translates to around $620-630 per month in principal and interest. That adds up quickly in Manhattan, where loan sizes often run into the hundreds of thousands or millions. To navigate this, consider strategies like putting down a larger down payment (to borrow less), looking at slightly lower-priced properties to stay within a comfortable monthly payment.

SELLERS: High mortgage rates shrink the buyer pool for any given price point. Even wealthy, qualified buyers pay attention to monthly costs and banks’ lending limits. This means you might notice fewer total bidders in the market, and those who are shopping often have firm ceilings on what they can pay. In practice, this environment rewards sellers who price competitively and work with serious, finance-approved buyers. Overall, understanding the financial pinch buyers are in will help you strategize with your agent to make your listing attractive despite the high-rate backdrop.

LOOKING AHEAD: The consensus among many economists and housing experts is that mortgage rates will likely stay in this mid-6% neighborhood for the rest of 2025. The Fed’s recent rate cut is a turning point, but it’s a small one – they are signaling caution and a slow approach to easing. For planning purposes, though, buyers and sellers alike should probably assume that 6%± mortgage rates will be the norm for the coming months. If you’re a buyer on the fence hoping for 4% rates again – that’s not likely in the near future.

INVESTOR INSIGHTS

Weak Dollar Keeps Foreign Demand Strong; Local Investors Play the Long Game

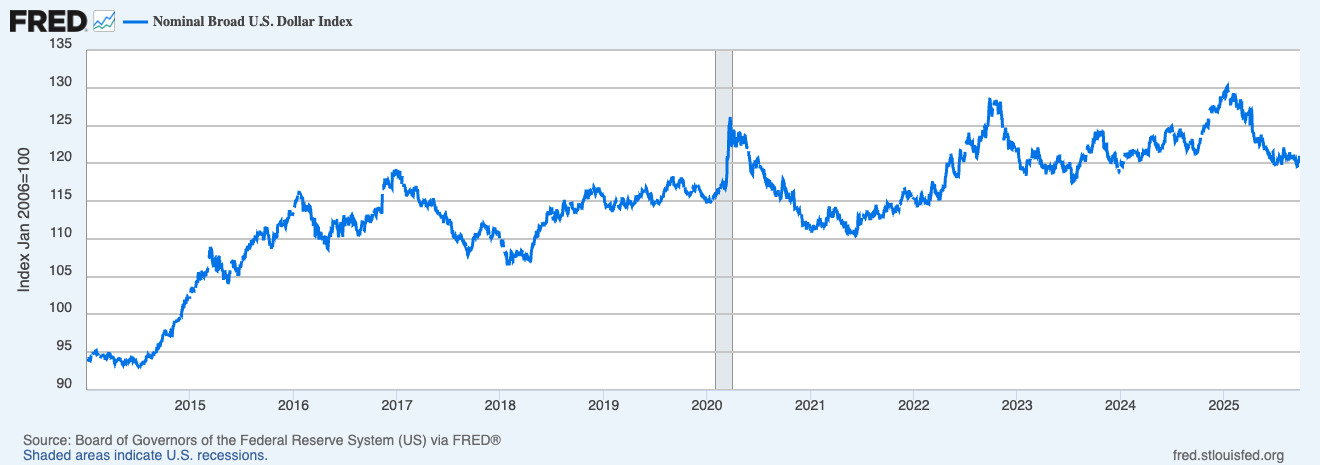

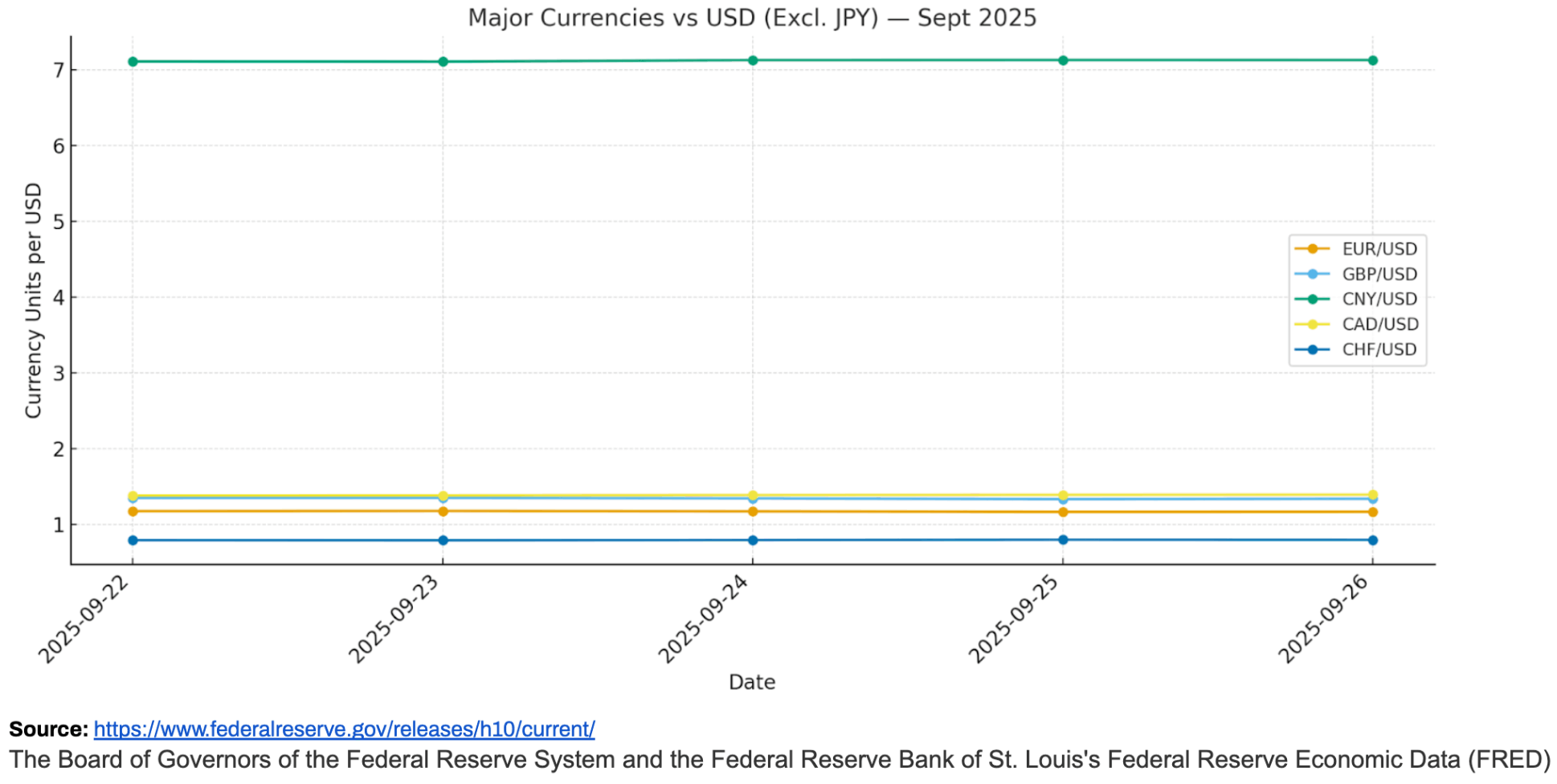

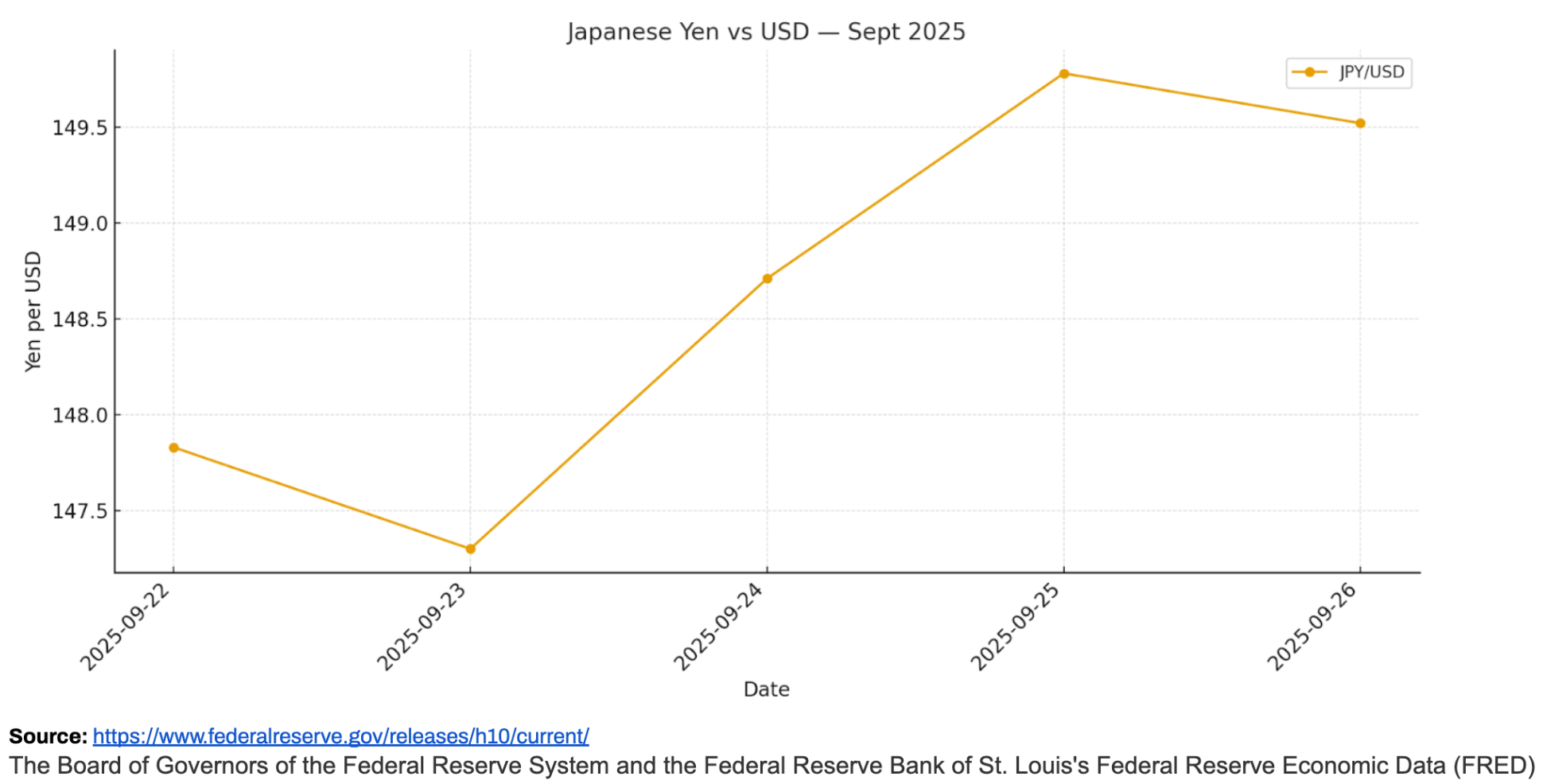

The current Manhattan market presents a two-sided story for real estate investors. On one hand, global investors are taking advantage of currency shifts – a weaker U.S. dollar in 2025 has effectively put Manhattan real estate “on sale” for those buying with stronger foreign currencies. On the other side, domestic investors and everyday New York landlords are navigating the harsh math of high interest rates and slim rental yields, prompting a more cautious approach.

International buyers have been notably active, and September kept that trend going. The U.S. dollar has depreciated on the order of 10–15% against currencies like the euro, British pound, and Canadian dollar since early 2025. This means an apartment that might have cost an overseas buyer €1,000,000 equivalent last year might be only ~€850,000–900,000 today purely due to exchange rates – a substantial discount before negotiations even begin.

Unsurprisingly, savvy foreign buyers are seizing this opportunity. We’re seeing continued strong interest in new development condos, which offer hassle-free ownership (no co-op boards, often tax abatements, and amenity-rich packages), as well as in luxury resale properties in marquee Manhattan locations (think Billionaires’ Row, Central Park West, Tribeca, etc.).

Many of these international purchasers are also looking for pied-à-terre arrangements – a foothold in NYC that they can use occasionally and rent out or hold long-term. The influx of global capital is effectively bolstering demand, especially in the higher price tiers, at a time when some local buyers and investors have hit pause.

It’s a reminder that Manhattan real estate is a global asset class – when conditions align (like favorable exchange rates and a perception of New York as stable or undervalued), international money flows in and helps support the market.

What This Means for You:

DOMESTIC INVESTORS: Meanwhile, domestic investors (from individual condo landlords to professional developers) are contending with the highest financing costs in over 15 years. Borrowing at 6-7% when rental yields (cap rates) in Manhattan are often only 3-4% means many investments have a negative carry in the short term – monthly expenses (mortgage, taxes, common charges, etc.) outpace rental income unless a huge down payment is made. This squeeze is leading local investors to be much more selective and strategic.

Rather than chasing marginal deals, many are focusing on unique opportunities: for instance, small multi-family buildings or townhouses where cap rates might be a bit higher (or where they can add value through renovation); estate sales or listings that have lingered and can be acquired at a relative discount; or properties that might not yield much now but are expected to appreciate significantly (like buying in an up-and-coming neighborhood or snagging a premier property at a good price and holding it as a long-term store of value).

Essentially, domestic players are often taking the long view – betting on Manhattan’s resilience over time, even if the short-term returns are thin or even negative.

INTERNATIONAL BUYERS: This is a moment of opportunity. With the dollar weaker, your foreign capital can secure you a property in Manhattan at what amounts to a significant discount compared to just a year ago. Additionally, the cooling of the market means you’re often not fighting off as many competitors as you would have in the frenzied market of 2021 or 2022. If you’re purchasing in cash (as many international buyers do), you are especially insulated from the current interest rate issues, and that can make you an attractive bidder to sellers.

LOOKING AHEAD: The foreign buyer wave is likely to persist through the coming months, especially if the U.S. dollar remains soft. Many analysts predict the dollar will stay relatively range-bound or weak as the Fed slows down its tightening and other economies catch up. This means Manhattan could continue to see elevated international interest into 2026. We’ll be watching if this demand starts pushing certain segments of the market back up (for instance, will luxury prices firm up or even rise due to foreign capital?). For domestic investors, the outlook will improve if and when financing costs come down.

Should mortgage rates dip in 2026, we’d expect more local investors to re-enter the market aggressively, potentially snapping up properties before prices climb again. In the meantime, those domestic players who strategize and invest selectively now – while a lot of others sit on the sidelines – could be in a great position. They may face less competition for deals in the short term and stand to benefit from both operational improvements and market appreciation over the long term.

References

1. Data courtesy of UrbanDigs

2. According to the Elegran Manhattan Leverage Index

3. Data courtesy of Miller Samuel, Inc.

4. Data courtesy of Federal Reserve Bank of St. Louis

5. JUMBO mortgage rate APR data courtesy of Bank of America, Chase, and Wells Fargo

If you would like to chat about the most recent market activity,

feel free to contact us at contact@hhnyc.com or

connect with one of our Advisors.

About Us

Welcome to Elegran, where our mission is to revolutionize the world of real estate. Founded in 2008 by Michael Rossi, our journey began with an unwavering drive for motivation, innovation, and a genuine care for our clients.

As an independently owned brokerage, we pride ourselves on our elite team of "advisors," offering a personalized touch that goes above and beyond the traditional real estate experience. Armed with robust data insights, we empower our clients to make informed decisions that lead to success.

Elegran proudly stands at the forefront of excellence. Our passion lies in turning your real estate dreams into reality, and we are committed to providing exceptional service at every step of the journey.

Are you ready to experience the Elegran difference? Dive into the possibilities at www.elegran.com and embark on an unforgettable real estate adventure with us.

Categories

Recent Posts

Stay in the Know!

Sign up to receive our monthly newsletter

GET MORE INFORMATION