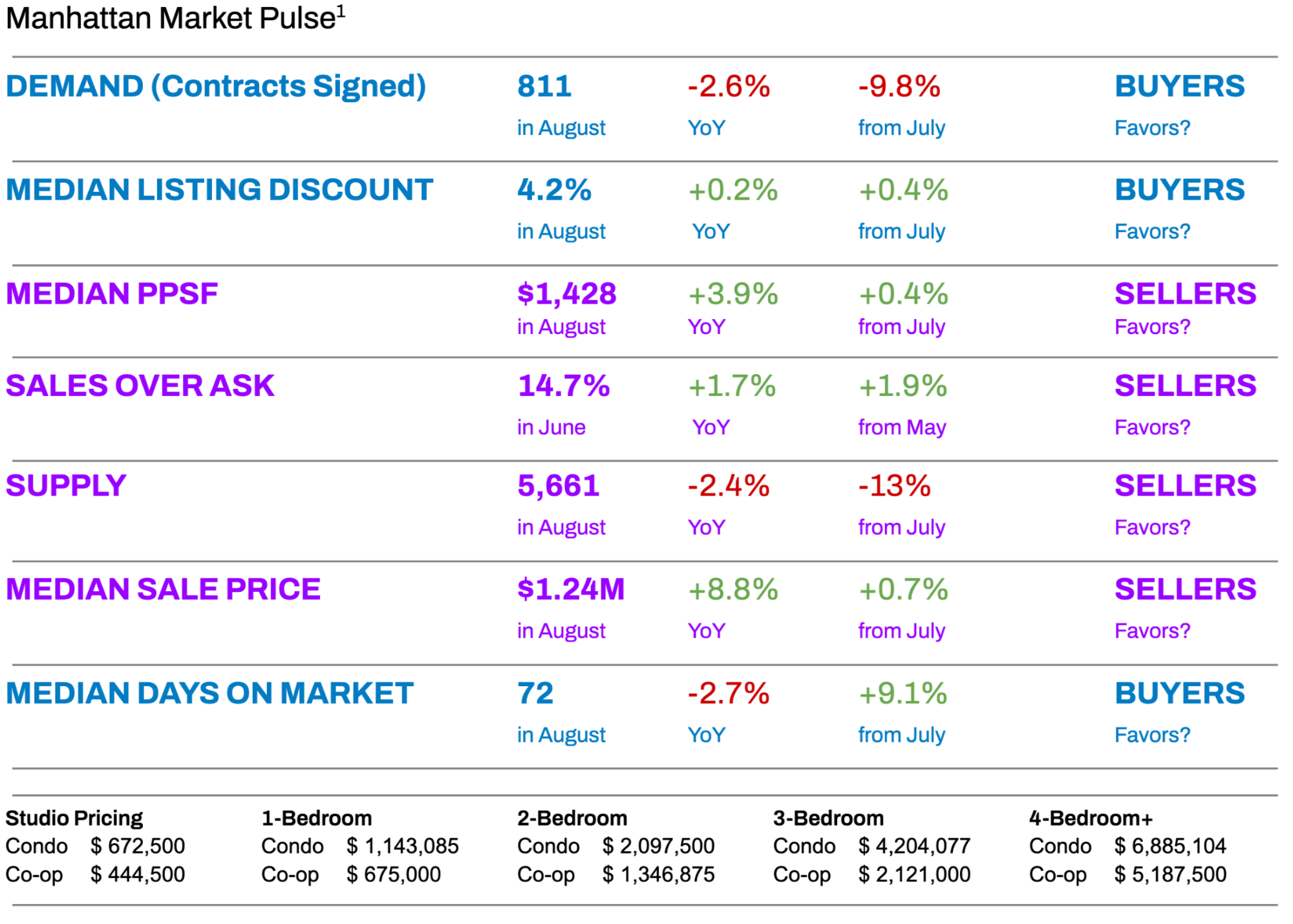

Elegran Manhattan Market Update: September 2025

Overall Manhattan Market Update: SEPTEMBER 2025

August Slowdown Offers Buyers a Breather with a Fall Uptick on the Horizon

The Manhattan market followed its usual seasonal pattern in August, cooling off after a busy spring and early summer. Contract signings fell nearly 10% from July and even dipped slightly (about 2–3%) below last August’s level – marking the sixth consecutive month of declining deal volume. At the same time, active inventory plunged to around 5,661 listings, a steep 13% drop from July and about 2% fewer homes than a year ago. Fewer buyers shopping and fewer sellers listing meant a quieter market overall. Buyers did gain a bit of relief in the form of larger listing discounts compared to last year, giving them a touch more negotiating power. However, supply cooling faster than demand has resulted in prices remaining remarkably resilient. The median price per square foot actually inched up year-over-year – thanks in part to sustained demand in the higher end of the market, fueled by all-cash purchasers and foreign buyers propping up values even as volume slowed.

On the rental side, Manhattan continued to make headlines with record-high rents. The median rent hit $4,700 in July, the fifth time in six months a new record was set. That’s a 1.6% increase from June and roughly 9.3% higher than July 2024, highlighting just how strong tenant demand has been amid limited supply. Renters faced intense competition – many apartments rented at or above asking price (the “listing discount” was effectively negative for the seventh month in a row), and the share of bidding wars in the rental market climbed to an all-time high. The new FARE Act (Fairness in Apartment Rental Expenses Act), which took effect in June and shifted broker fees from tenants to landlords, contributed to an initial jump in rents early this summer. Landlords often raised asking rents to offset taking on broker fees, resulting in an early-summer spike of around 10–12%. Now, however, that FARE Act effect has largely leveled off – recent rent increases are driven more by fundamental factors (too many renters chasing too few apartments) than by the policy change. Overall, Manhattan’s rental environment remains firmly landlord-favored heading into fall, with vacancy rates below the decade average and many renters choosing to renew leases (helped by limits on renewal increases included in last year’s Good Cause legislation) rather than braving the open market.

Meanwhile, international buyers are once again an important force in the Manhattan sales market. A weaker U.S. dollar has made New York real estate significantly more affordable for overseas investors – estimates suggest Manhattan properties are 10–15% cheaper in foreign currency terms for European, Canadian, and some Asian buyers than they were at the start of 2025. This currency-driven discount, combined with Manhattan’s perennial appeal, has drawn more global buyers back into the market. Many are targeting new development condos, luxury resale units in prime areas, and pied-à-terre apartments, providing a welcome boost to demand even as some domestic buyers took a summer pause. Their interest has helped support pricing at the upper end, offsetting some of the softness in local first-time buyer activity.

Despite the late-summer lull, the Manhattan market is gearing up for a rebound as we head into the fall. Historically, the period right after Labor Day brings a surge of new listings and a wave of buyers returning from summer vacations. Indeed, by late August we already saw an uptick in new listings hitting the market – an early sign that sellers are preparing for the post–Labor Day activity bump. The big question for the remainder of 2025 is whether the slight shift toward buyer-friendlier conditions seen in August will persist once the market re-energizes in the fall, or if it was merely a seasonal breather. Many sellers have held off listing until the fall, and many buyers have been waiting in the wings – so September and October will be a true test of the market’s direction. For now, Manhattan remains balanced but taut, with neither side running away with the market. The following sections break down the key metrics – Supply, Demand, Pricing, Discounts, Rentals, Mortgage Rates, and Investor Insights – to paint a full picture of where things stand and where they may be headed.

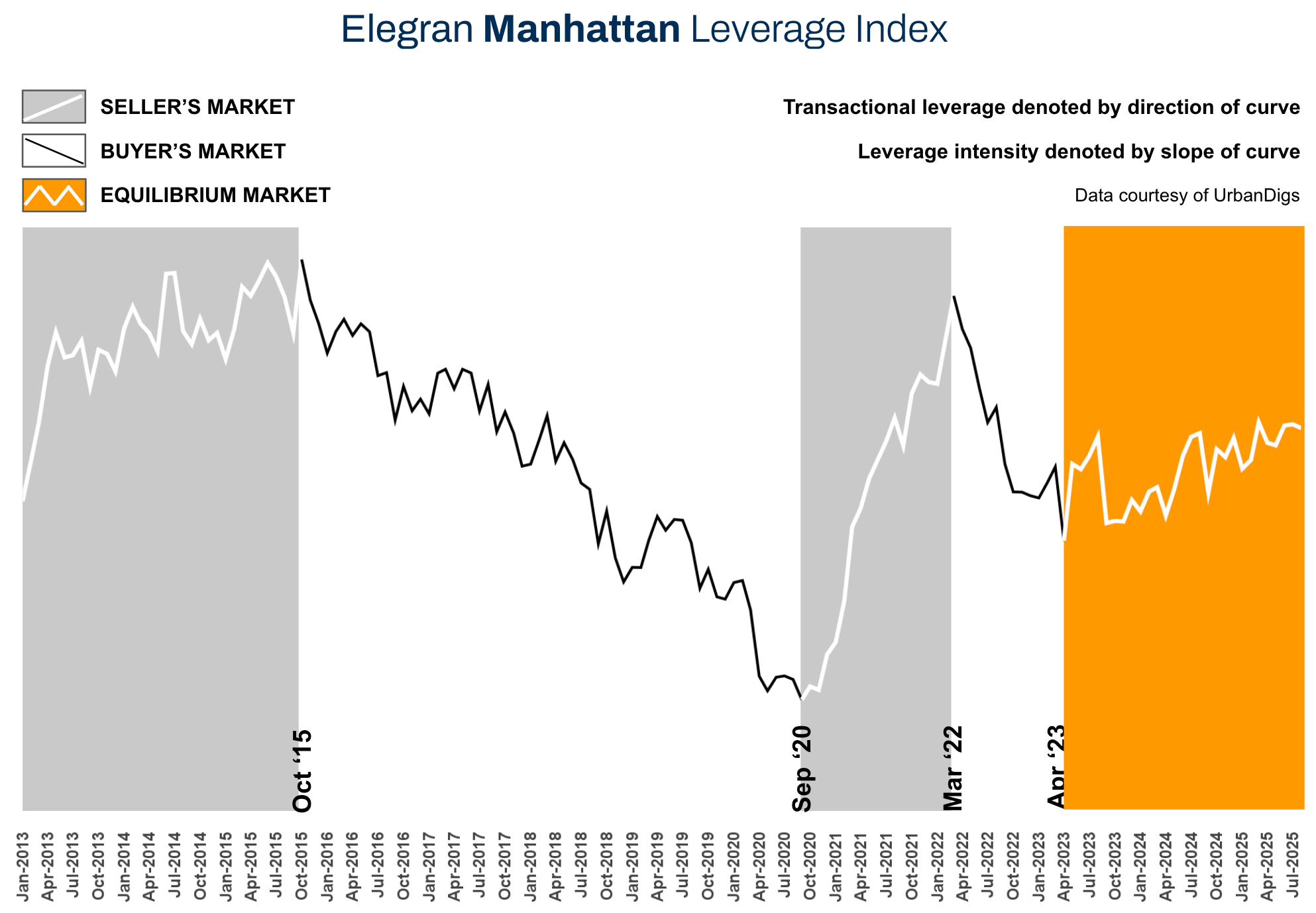

Elegran Manhattan Leverage Index

The Elegran Manhattan Leverage Index² is powered by four indicators: supply, demand, median price per square foot (PPSF), and median listing discount.

Direction Matters:

- An upward-sloping curve = seller’s market

- A downward-sloping curve = buyer’s market

- The steeper the slope, the stronger the advantage for either side

August’s data show that three of the four components – supply, demand, and listing discount – moved modestly in buyers’ favor (both month-over-month and year-over-year), while only PPSF trended in favor of sellers. In other words, inventory is down and sales pace is slower (helping buyers), discounts widened (helping buyers), but prices per square foot ticked up (helping sellers).

Overall, the Elegran Manhattan Leverage Index suggests that sellers’ strong grip on the market loosened slightly in late summer, giving buyers a bit more breathing room. It will take the fall influx of activity to see if this was just a seasonal blip or the beginning of a larger trend. If the index starts sloping downward more steeply in the coming months, that would indicate a broader shift toward buyer advantage. If it ticks back up, sellers may regain their edge as the market heats up again.

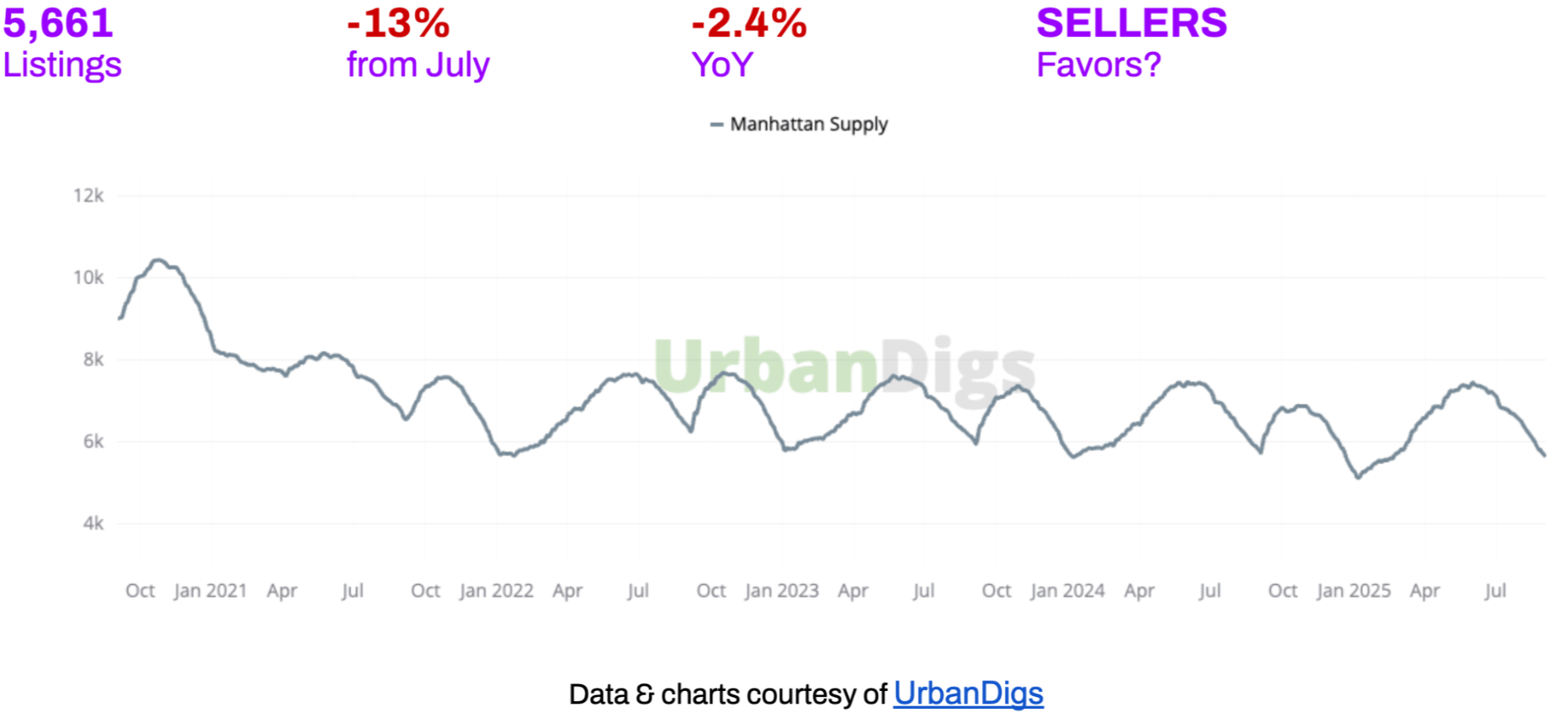

Manhattan Supply

Manhattan Supply: Summer Lull Pushes Active Listings Below 6,000

With roughly 5,661 homes on the market, Manhattan’s inventory at the end of August was noticeably lean. Active listings plunged about 13% from July – a steep one-month drop – and are about 2.4% lower than this time last year. In fact, late August’s inventory count is one of the lowest levels of the year, dipping below the 6,000 mark.

Many would-be sellers opted to hold off until fall, and that restraint kept supply tight through the end of summer. For context, last year at this time inventory was slightly higher, so the year-over-year decline in supply indicates that Manhattan’s available stock has tightened relative to 2024.

What This Means for You:

BUYERS: With so few listings on the market, you’ll have limited options to choose from, especially in the entry and mid-level price points. Do your homework now – identify your target neighborhoods and must-haves – so that you can confidently jump on a new listing as soon as it appears. In this low-supply environment, hesitation can mean losing out to another buyer who was better prepared.

SELLERS: The steep drop in inventory means less competition from other sellers in late summer. If your home is properly priced and shows well, it can attract strong attention even in a quieter market. Take advantage of this moment – price your property realistically (based on recent comparable sales) and make sure it’s showcased in its best light (think staging and high-quality photos).

Looking Ahead: Expect inventory to rebound as we move into the fall. September and October historically bring a wave of new listings as sellers who sat out the summer enter the market. Toward the end of 2025, as the holidays approach, inventory may tighten again (many unsold listings typically get pulled off the market in November/December).

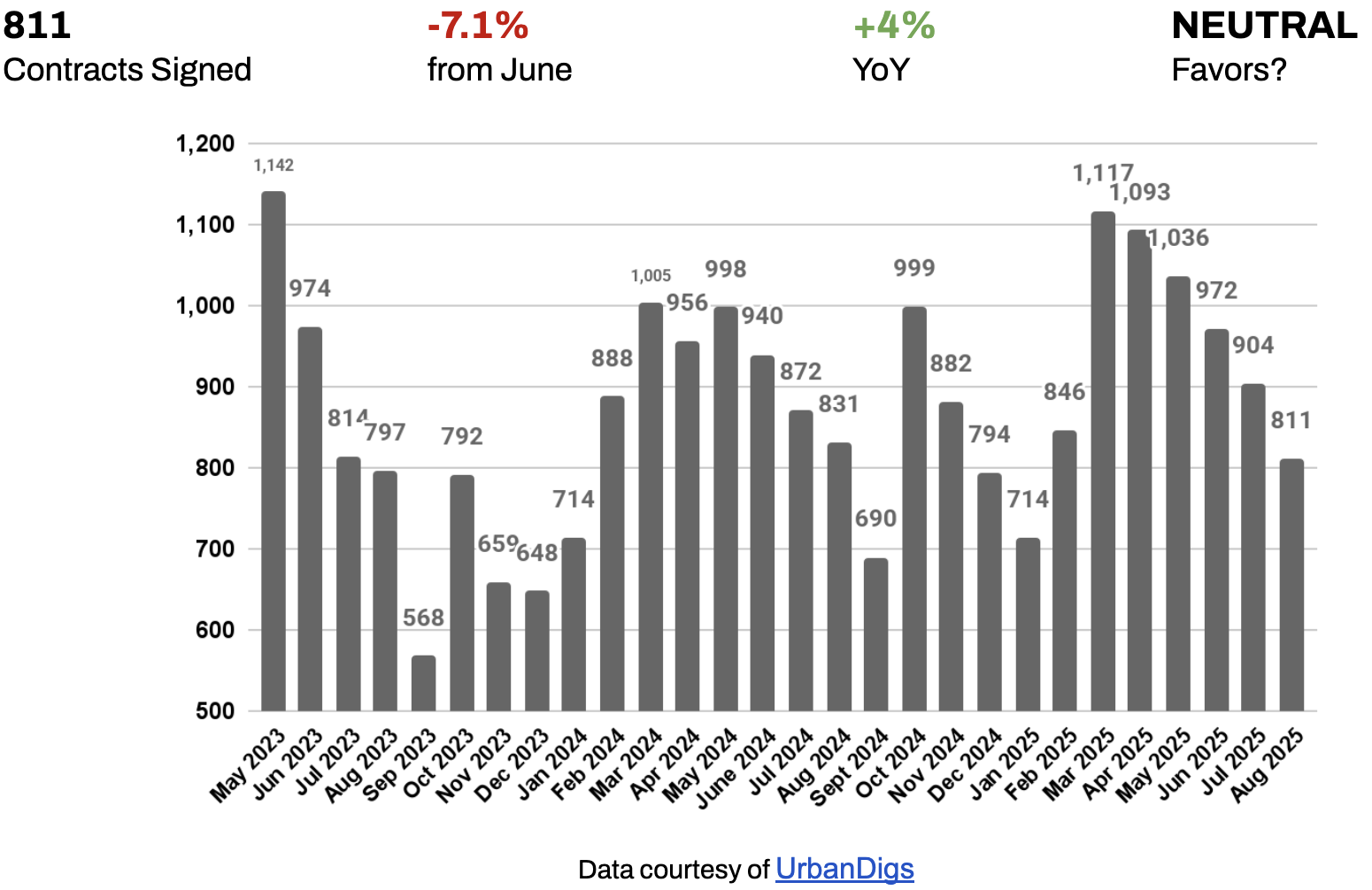

Manhattan Demand

Manhattan Demand: Contract Signings Slide Again, Falling Below Last Year’s Pace

Only 811 purchase contracts were signed for Manhattan homes in August, which is down roughly 9.8% from July’s total. For the first time this year, monthly contract volume also fell below year-ago levels – August 2025 saw about 2.6% fewer deals than August 2024. This marks the sixth straight month of declining contract activity on a month-to-month basis, as the market has steadily slowed from its March peak.

Overall, August’s demand can be characterized as subdued but not dead – buyers are out there, just more selective and moving at a slower pace than earlier in the year.

What This Means for You:

BUYERS: With many house-hunters sidelined on vacation or waiting for fall, you’ll likely face less competition in August and early September. This means you might avoid the bidding wars that were common in the spring. Use this relative calm to your advantage: you may have a bit more negotiating leverage on price or terms for a property that’s been on the market through the summer.

SELLERS: Pricing is key: buyers have more negotiating confidence after seeing the market calm down, so an overpriced listing will likely get passed over. Work with your agent to look at very recent comps (even July/August sales) and set a realistic price from the outset. Highlight any features that make your home move-in-ready or a “best on the block” value, since buyers are choosier in a slower market.

Looking Ahead:

Many families and individuals pause their searches in late summer, then return energized in the fall to find a home before the end of the year. This year should be no exception. By mid-September, open house traffic and new deal signings are likely to pick up. October could be a particularly active month if mortgage rates stay relatively steady, since buyers who sat out the summer might re-engage. That said, it’s not guaranteed that fall 2025 will outpace fall 2024 – last year’s autumn market was fairly robust.

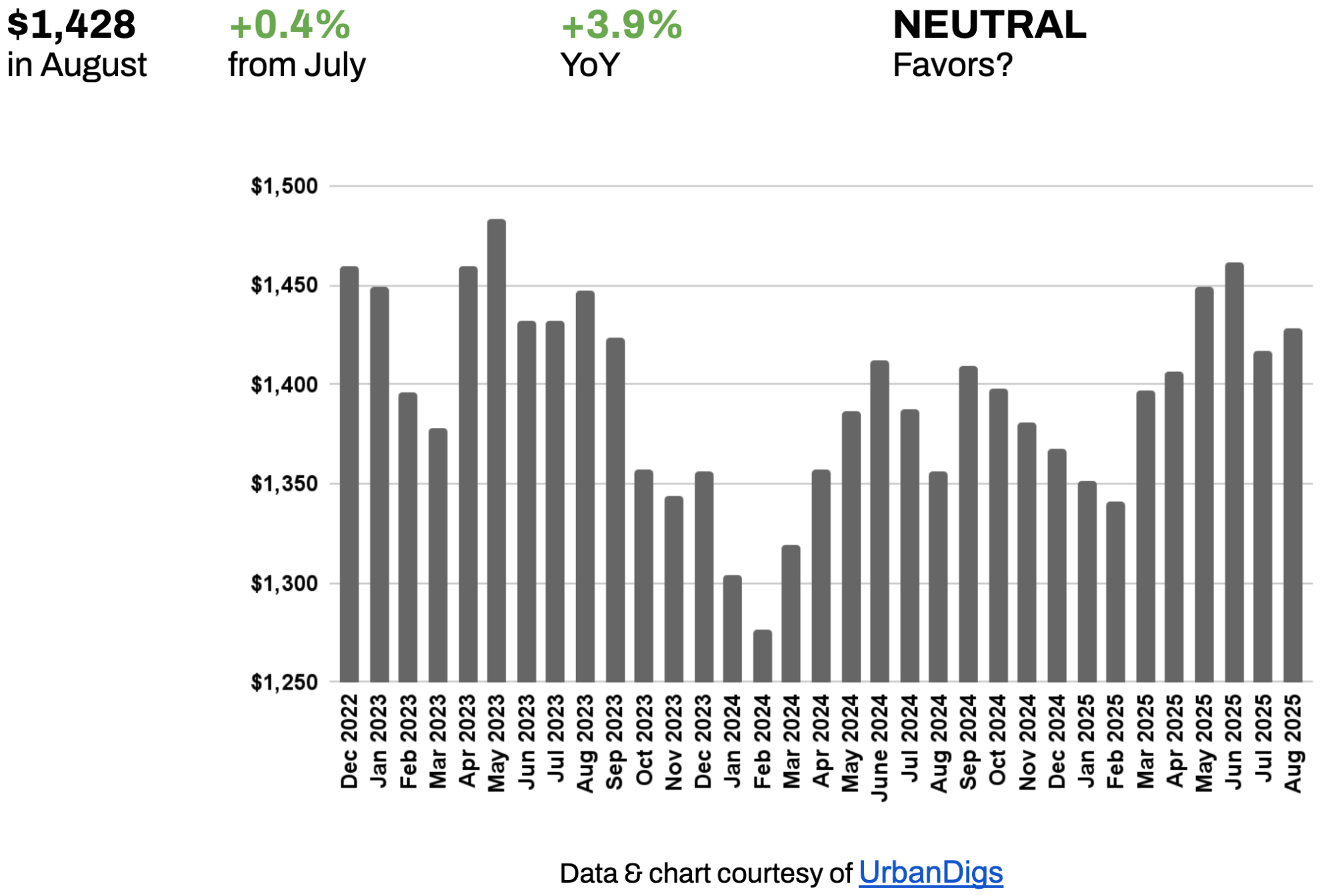

Manhattan Median PPSF

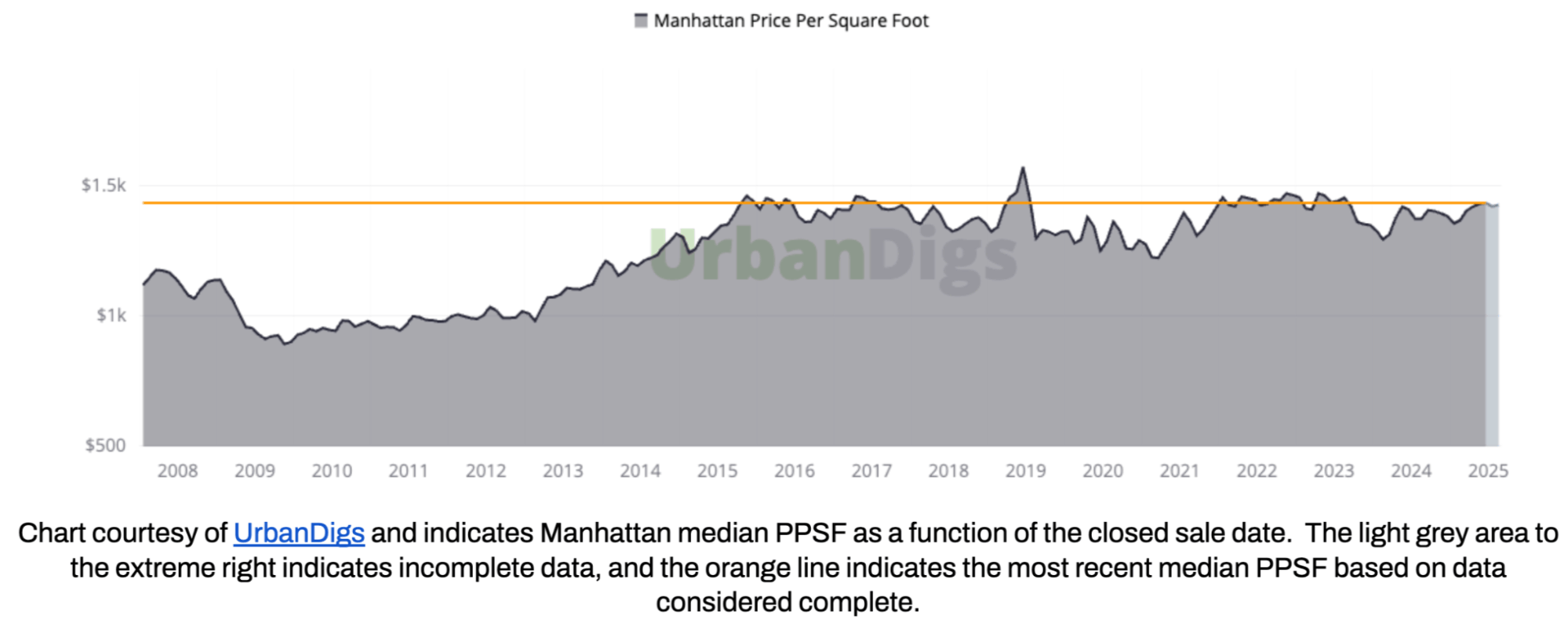

Manhattan Median PPSF: Pricing Resilient – Cash and Foreign Buyers Help Keep Values Afloat

The median price per square foot (PPSF) for closed sales in August came in at $1,428. This is a slight uptick (+0.4%) from July’s level, and about +3.9% higher than August 2024 – a notable year-over-year increase. In a softer market you might expect prices to sag, but that hasn’t really happened here. Even though fewer deals were happening, the ones that did close were often at strong price points.

Additionally, continued interest from all-cash buyers and foreign investors provided support to pricing. These buyers are less sensitive to interest rates and more focused on Manhattan’s long-term value; their willingness to pay top dollar for prime properties has helped keep median values elevated.

What This Means for You:

BUYERS: The data shows prices per square foot haven’t really dropped – in fact, they’re up from last year – so if you’re hoping for a major price correction, you may be disappointed. If you’re shopping in popular neighborhoods or buildings, expect to pay a premium for a move-in-ready unit.

SELLERS: Even with fewer buyers out shopping, the market values remain near recent highs. For you, this means if you price your home correctly, you stand a strong chance of achieving a sale price close to your expectations. Bottom line: pricing power is still in your hands.

Looking Ahead:

We expect prices to remain relatively stable through the fall of 2025. With more inventory coming to market, there could be a bit of pressure on sellers to be competitive, which might lead to small pricing adjustments on individual listings. However, it’s hard to envision a significant dip in city-wide PPSF unless there’s a major economic event. Demand from cash buyers and international purchasers should continue to put a floor under prices, especially for desirable assets. If anything, as the market picks up in early fall, we could see median PPSF stay at this elevated plateau or even edge higher if the mix of sales skews toward luxury properties.

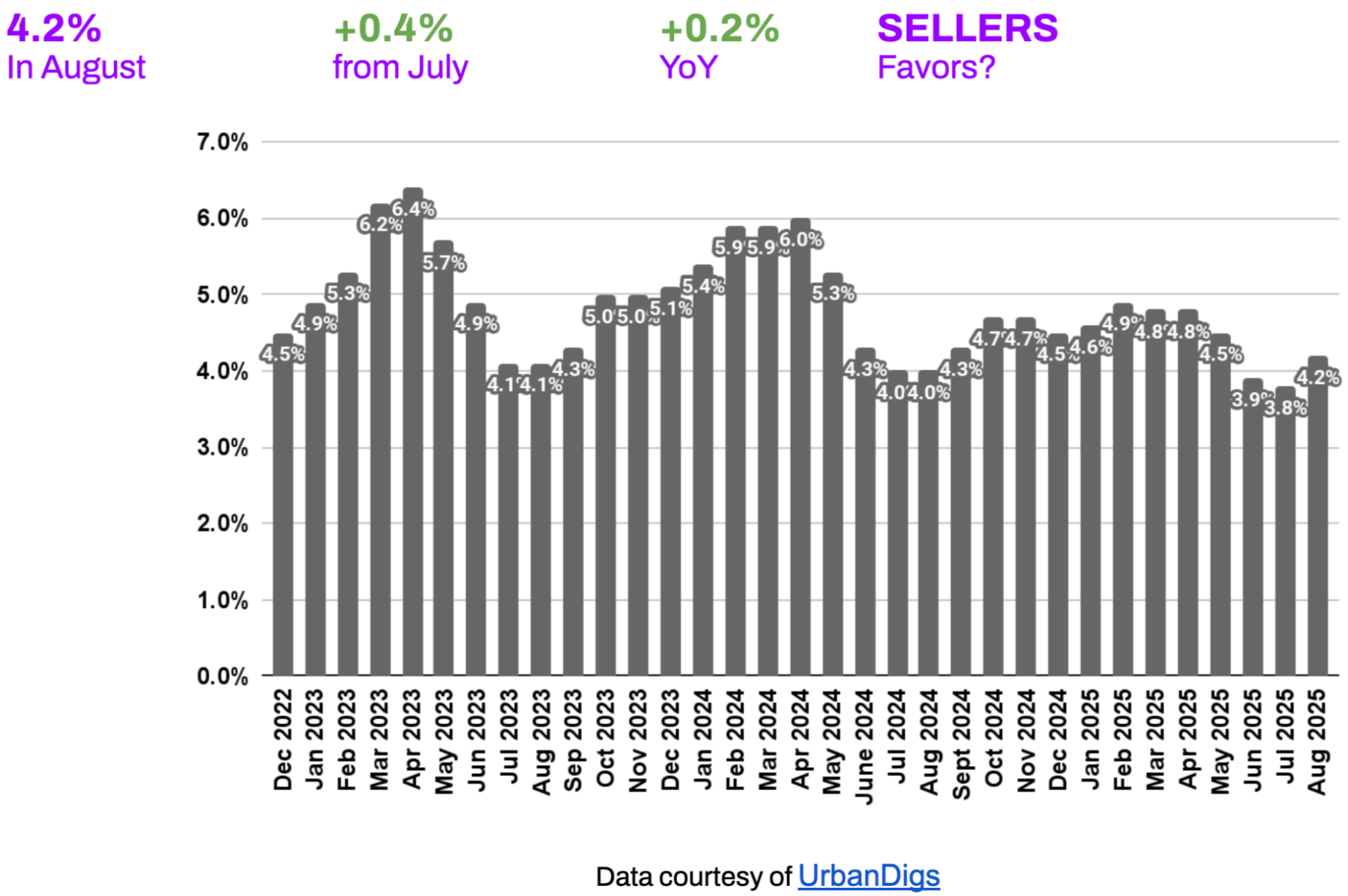

Manhattan Median Listing Discount

Manhattan Median Listing Discount: Buyers Regain a Negotiating Room as Discounts Tick Up

After hitting historic lows earlier in the summer, listing discounts in Manhattan widened slightly in August – offering a small sigh of relief for buyers. The median listing discount (the percentage below the last asking price that a home ultimately sells for) was 4.2% in August. That’s up from roughly 3.8% in July and also a touch higher than the ~4.0% median discount a year ago. In June and July, Manhattan saw some of the tightest discounts in years.

A 4.2% discount is still quite small by historical standards. So we’re still in an environment of tight negotiation ranges – but the pendulum in August inched back toward the middle. This aligns with the overall cooling: with fewer buyers competing, some sellers had to budge on price to seal the deal, bringing discounts more in line with typical seasonal norms.

What This Means for You:

BUYERS: In early summer, it was common to have to pay at or above asking to win a place; now, seeing a 4-5% discount on a successful offer is realistic in many cases. However, don’t misconstrue this as a buyer’s paradise – deep discounts are still rare. To improve your odds, focus on listings that have been on the market for more than a month or that have undergone a price cut; those sellers are signaling openness to negotiation.

SELLERS: The best strategy is still to price correctly from the start. If you do, chances are you’ll sell near your asking price without much back-and-forth. Overpricing, on the other hand, can be dangerous now: buyers have more confidence to walk away or wait, and an overpriced listing could linger and ultimately force a larger price cut than if you had priced right initially. In this market, a small concession can go a long way to getting to the closing table faster.

Looking Ahead:

We anticipate listing discounts will hover in the low-to-mid 4% range through the fall. As the market gets a jolt of new inventory, buyers might expect a bit more flexibility, which could widen discounts slightly (perhaps into the 4–5% range median) by the end of the year. If a glut of listings hits without an equal surge in demand, sellers may indeed have to negotiate more. Still, barring any major economic shifts, don’t expect a return to double-digit discounts; Manhattan’s market fundamentals (limited supply, decent demand) should keep negotiations relatively modest.

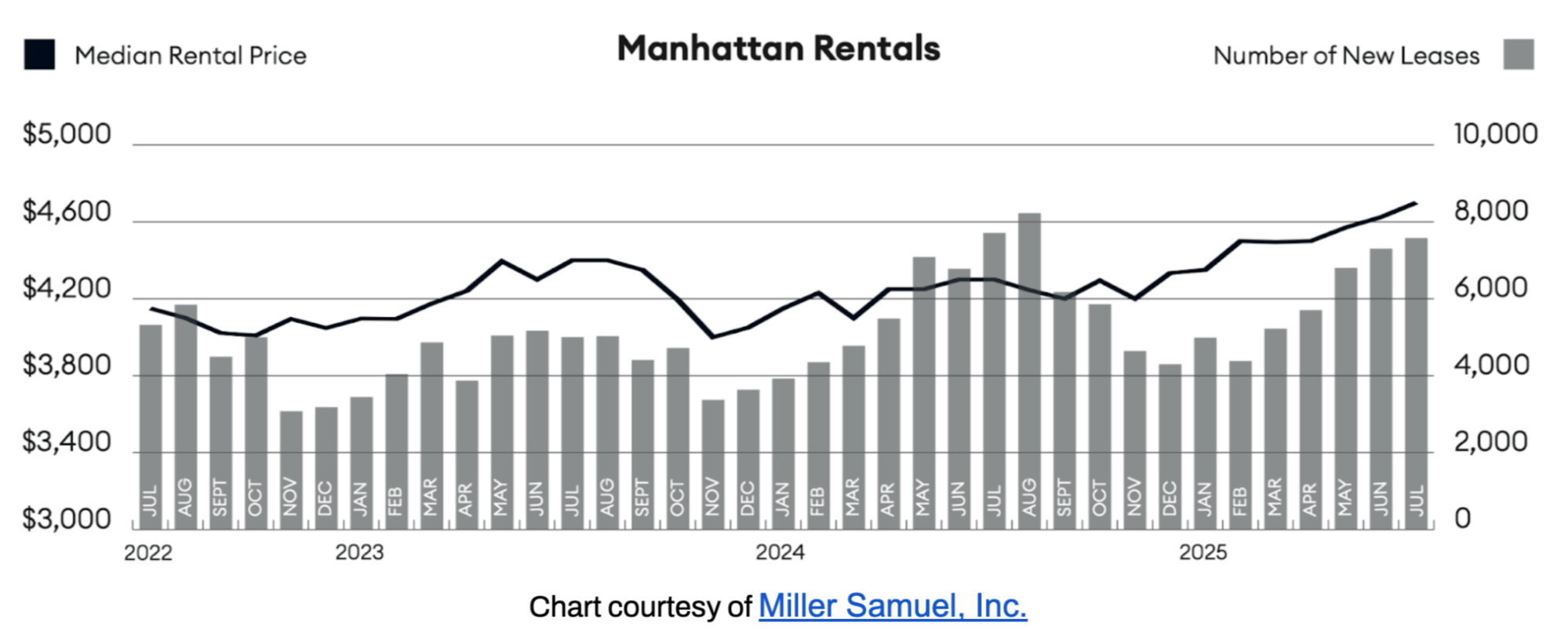

RENTAL REMARKS

Rental Market: Manhattan Rents Soar with FARE Act Influence Still Developing

Manhattan’s rental market sizzled through the summer, setting yet another record in July. The median rent in Manhattan hit $4,700 in July 2025, the highest figure ever recorded. This is the fifth time in six months that Manhattan rents have reached a new peak, underscoring just how extreme the rent surge has been. July’s median was up 1.6% from June (which was the previous record) and a hefty 9.3% higher than a year ago³. Simply put, renting in Manhattan this summer was more expensive than ever before.

Several factors contributed to these record rents. Demand was strong – the city’s economic rebound and office return drew people in, and many would-be buyers opted to rent amid high mortgage rates, adding even more competition for apartments. Meanwhile, supply stayed tight – vacancy rates hovered around multi-year lows (back to or even below pre-pandemic levels). This imbalance meant that landlords often had the upper hand in lease negotiations.

The much-discussed FARE Act (Fairness in Apartment Rental Expenses Act) also played a role in this summer’s rent dynamics. The FARE Act, which took effect on June 11, 2025, prohibits landlords’ agents from passing broker fees on to tenants – effectively making landlords pay the brokers in most cases. In response, many landlords raised rents in June/July to compensate for this new expense. We saw an initial 10–12% jump in rents early in the summer that can be partly attributed to landlords baking the broker fee into the rent. However, that was mostly a one-time adjustment. By July, the FARE Act’s impact had stabilized. The continued climb in July was less about the FARE Act, per se, and more about traditional factors: a large number of people needing apartments and not enough available to meet the demand.

Looking ahead at the remainder of 2025, the key question is whether Manhattan rents will finally cool off after this summer’s extreme highs. Typically, the rental market calms down in the fall – the surge of summer roommates, interns, and new hires subsides, and some units free up as people leave the city or move at the end of peak season. We do expect some relief for renters in the coming months, though it may be modest.

In summary, Manhattan rents should plateau in the fall, and we might even see a slight downtick in the average rent by November or December. But given how tight the market is, renters shouldn’t bank on significant relief.

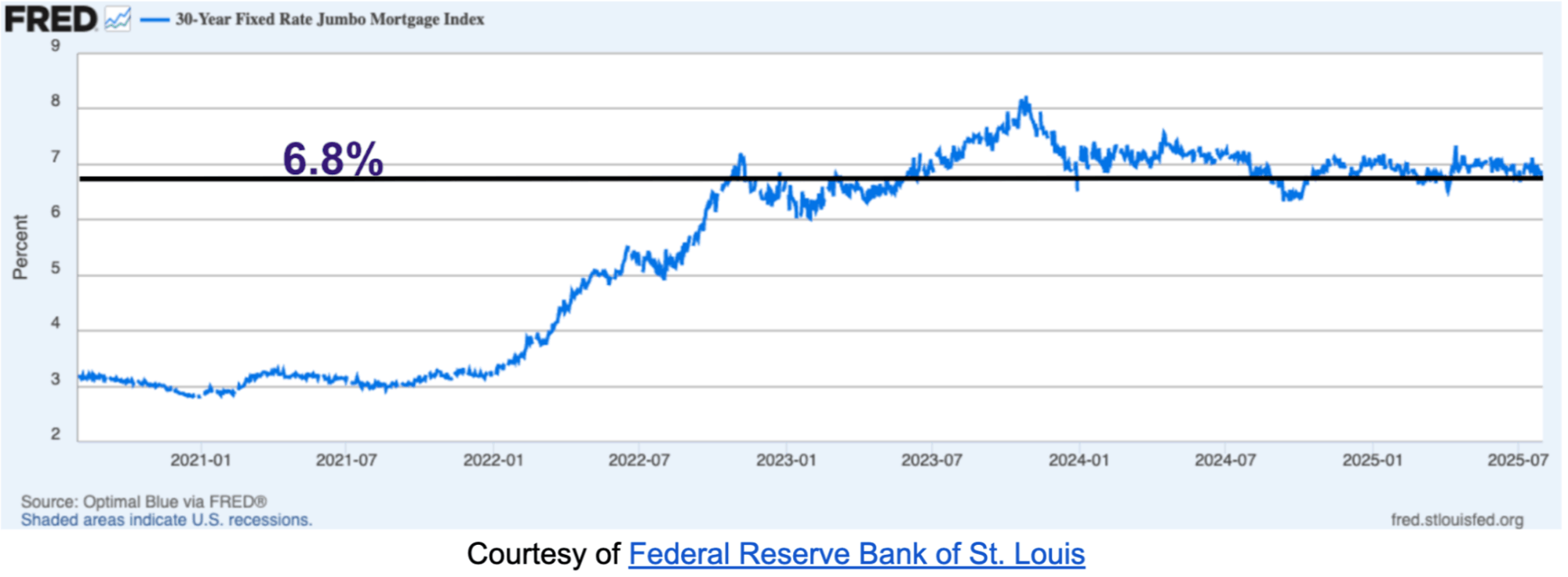

MORTGAGE REMARKS

Mortgage Rates: High but Steady – The “New Normal” Around 6.5% for Borrowers

Financing a home purchase remains considerably more expensive than it was a few years ago, but the situation has stabilized to a degree, and buyers have largely adjusted their expectations. As of early September 2025, 30-year fixed jumbo mortgage rates (typical for Manhattan’s high-priced market) are hovering around 6.6%⁴, with average APRs (annual percentage rates) in the 6.3%⁵ range. These figures are roughly on par with where rates have been for most of the summer. In fact, mortgage rates have ticked down just slightly from their peak in July (when jumbos were around 6.8%).

Even though the market has adapted, affordability is still a major challenge. At a 6.6% interest rate, the monthly payment on a typical Manhattan apartment (often $1M+ mortgages) is substantially higher than it would have been at 3% or 4%. This disproportionately impacts first-time buyers or those moving up to larger homes – the added monthly cost can be thousands of dollars. High rates also mean buyers need higher incomes to qualify for loans under bank debt-to-income ratios. So the pool of qualified buyers in each price tier has narrowed compared to a few years ago.

What This Means for You:

Buyers: Be prepared to budget for higher monthly payments than you might have a couple of years back. With 30-year rates in the mid-6% range, every $100,000 of mortgage translates to roughly a $600+ monthly payment (principal & interest), so a big loan can mean a hefty check each month.

You might decide to target a slightly cheaper property or put down more cash to keep the loan smaller. Don’t stretch to your absolute max purchase price without leaving room for these higher financing costs.

Sellers: Keep in mind that today’s buyers are budget-constrained in ways they weren’t a few years ago. A buyer’s ability to “stretch” for your asking price is limited by what their mortgage payment will be, and at 6.5%+ rates, those payments get large quickly. This means the pool of buyers at each price point is a bit thinner, and they’re choosier. Overpricing your property in a high-rate environment is a recipe for a longer time on market. The main takeaway is to be realistic and empathetic to what buyers are experiencing. A well-priced home will still sell, but you may need to exercise a bit more patience.

Looking Ahead: The consensus among many economists and real estate professionals is that mortgage rates will likely stay in this general range through the end of 2025. The Federal Reserve has signaled that it’s near or at the peak of its rate hike cycle, but they also aren’t poised to cut rates dramatically unless the economy weakens significantly. So, barring any big surprises (like inflation flaring up again or, conversely, a sharp economic downturn), we should see 30-year rates oscillate somewhere between, say, 6% and 7% for the rest of the year. It’s possible we might get a small dip into the low 6’s or even high 5’s if there’s very positive news on inflation, but planning for mid-6’s is prudent. As 2026 approaches, if inflation continues to cool and the Fed starts easing policy, then mortgage rates could gradually trend down. But unless something big changes, expect the Manhattan real estate market to continue operating in a high-rate environment for the time being, with all the accompanying adjustments we’ve discussed.

INVESTOR INSIGHTS

Weaker Dollar Draws Global Buyers, While Locals Focus on Long-Term Value

The current Manhattan market is presenting an interesting duality for real estate investors. On one side, we have a surge of interest from international buyers, and on the other, a more cautious approach from domestic investors contending with high financing costs.

What This Means for You:

Domestic Investors:

For U.S.-based real estate investors (including New Yorkers investing in their own backyard), the landscape is a bit more challenging. High interest rates mean borrowing costs are steep, which squeezes investment returns. The typical cap rates (annual net operating income divided by purchase price) in Manhattan are still in the low- to mid-3% range for many rental properties. When your borrowing cost is 6-7%, a 3% yield means you’re likely running at a negative carry (losing money each month) unless you have a large equity cushion or you’re banking on price appreciation. As a result, many local investors are being more selective and strategic.

Others are looking at unique niches: small multifamily buildings in Manhattan or emerging neighborhoods just on the fringe, where cap rates might be a bit higher. There’s also interest in properties that can serve as a hedge or store of wealth – for instance, buying a high-end property in an iconic building as a long-term hold, even if it just breaks even on rent, because the owner expects it to appreciate and also provides a tangible asset in a volatile world.

Think of Manhattan real estate as a relatively safe, tangible asset that might not yield much today, but historically has appreciated and can be refinanced if rates drop.

International Buyers:

International Influence: The U.S. dollar’s weakness in 2025 has effectively put Manhattan real estate on sale for foreign buyers. Compared to the start of the year, the dollar has lost ground against currencies like the euro, pound, Canadian dollar, yuan, and yen. For overseas investors, this currency shift means they’re getting a built-in discount on NYC properties – in some cases, paying 10–15% less in their home currency than they would have back in January. This has not gone unnoticed. We’re seeing a notable uptick in foreign inquiries and purchases, particularly in segments of the market that traditionally appeal to international buyers.

New development condos are a prime example – these often come with amenities, rental-friendly policies, and less hassle (no co-op board approvals), making them attractive to non-U.S. buyers. Similarly, luxury resale units in areas like Midtown, Downtown (e.g., FiDi, Tribeca), and around Central Park are drawing overseas interest, especially when priced below their 2015–2019 peaks. Many foreign investors are also seeking pied-à-terre apartments – smaller, well-located units they can use when in New York and rent out or hold as an investment otherwise. The influx of global capital is effectively helping to prop up demand in Manhattan at a time when some domestic buyers have pulled back. It’s a reminder that Manhattan real estate is a global asset class – when conditions align (like favorable exchange rates), the world’s wealthy step in to take advantage.

Also, pay attention to buildings’ policies: many condos have no restrictions on rentals, but co-ops often limit subletting and are tougher for foreign buyers to get through board approval. Sectors to watch include:

- New development condos – often come with tax abatements or developer incentives, and everything is brand new (lower immediate maintenance costs). Developers might negotiate on price or offer freebies (like covering transfer taxes or common charges for a year) in this market.

- Luxury resales in prime areas – some high-end properties that were priced ambitiously have seen price adjustments. If you can negotiate a good deal on a trophy property (think a Billionaires’ Row condo or a Soho penthouse) while the dollar is weak, it could be a brilliant long-term hold.

- Pied-à-terre apartments – one-bedroom and studio units in prestige buildings (Upper East Side, West Village, etc.) that you can use when in town and rent out otherwise. These units often have strong demand from tenants like corporate executives or visiting professors.

Looking Ahead: We expect global investor interest in Manhattan to remain high through the fall and into 2026, particularly if the U.S. dollar stays weak. Currency markets can fluctuate, but many analysts foresee the dollar staying softer as U.S. interest rates level off and other economies catch up. This means the foreign buyer boost we’re seeing could be sustained, adding a layer of demand in the market.

For domestic investors, if anything, the savvy investors might use this period (when competition for deals is lower) to pick up assets that are hard to find in a boom – for example, a small multi-unit building or a discounted estate sale condo – positioning themselves for outsized gains when the market cycle eventually turns up.

In summary, Manhattan’s investment landscape for the rest of 2025 will be shaped by a convergence of global and local factors: a world of money that sees opportunity in New York, and a local base that is playing the long game in a challenging rate environment. The city’s brick and mortar keeps its allure, and those who navigate the current challenges thoughtfully are likely to reap rewards in the years to come.

References

1. Data courtesy of UrbanDigs

2. According to the Elegran Manhattan Leverage Index

3. Data courtesy of Miller Samuel, Inc.

4. Data courtesy of Federal Reserve Bank of St. Louis

5. JUMBO mortgage rate APR data courtesy of Bank of America, Chase, and Wells Fargo

If you would like to chat about the most recent market activity,

feel free to contact us at info@elegran.com or

connect with one of our Advisors.

About Us

Welcome to Elegran, where our mission is to revolutionize the world of real estate. Founded in 2008 by Michael Rossi, our journey began with an unwavering drive for motivation, innovation, and a genuine care for our clients.

As an independently owned brokerage, we pride ourselves on our elite team of "advisors," offering a personalized touch that goes above and beyond the traditional real estate experience. Armed with robust data insights, we empower our clients to make informed decisions that lead to success.

Elegran proudly stands at the forefront of excellence. Our passion lies in turning your real estate dreams into reality, and we are committed to providing exceptional service at every step of the journey.

Are you ready to experience the Elegran difference? Dive into the possibilities at www.elegran.com and embark on an unforgettable real estate adventure with us.

Categories

Recent Posts

Stay in the Know!

Sign up to receive our monthly newsletter

GET MORE INFORMATION