Less Than you May Think: Quantifying the Per Day Cost From Rising Interest Rates

We all know that mortgage rate and total monthly payment are directly proportional. It’s intuitive — the higher the rate, the greater the monthly payment.

However, what will be news to most is that the ratio between principal and interest varies with the rate. In fact, the higher the rate, the greater the proportion of interest.

Why is that significant? Because interest is tax deductible. (Please note that we’ve accounted for the $750,000 cap in mortgage interest deductibility in our calculations.)

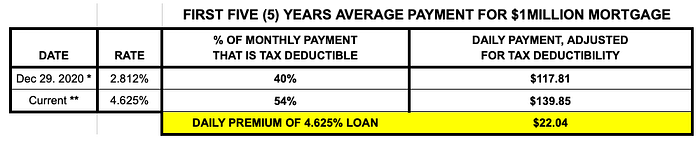

In the table above, we’ve compared the average payment over the first five (5) years of two $1MILLION JUMBO rate mortgages (30-year fixed payment), one from the historical low level reached on Dec 29, 2020 * (2.812%) and another currently offered by Wells Fargo ** (4.625%).

Although the total payment associated with the higher rate is greater, so too is the percentage of total payment allocated to interest.

In the case of the current rate (4.625%), 54% of the monthly payment is interest and, thus, 54% of that monthly payment is tax deductible. With the 2.812% mortgage rate, only 40% of the monthly payment is tax deductible.

Assuming a 32% Federal tax bracket, the total annual payment of the larger interest rate loan is offset by nearly $4,300 in tax savings.

Tax savings applied, the 4.625% rate loan costs only $22 more per day than the 2.812% loan.

* according to the 30-year Fixed Rate Jumbo Mortgage Index; Federal Reserve Bank of St. Louis

- * Wells Fargo 30-year Fixed Rate Jumbo Mortgage as of 07/21/2022

Categories

Recent Posts

Stay in the Know!

Sign up to receive our monthly newsletter

GET MORE INFORMATION