Weekly Manhattan & Brooklyn Market: 5/22

Week of 5/22/23

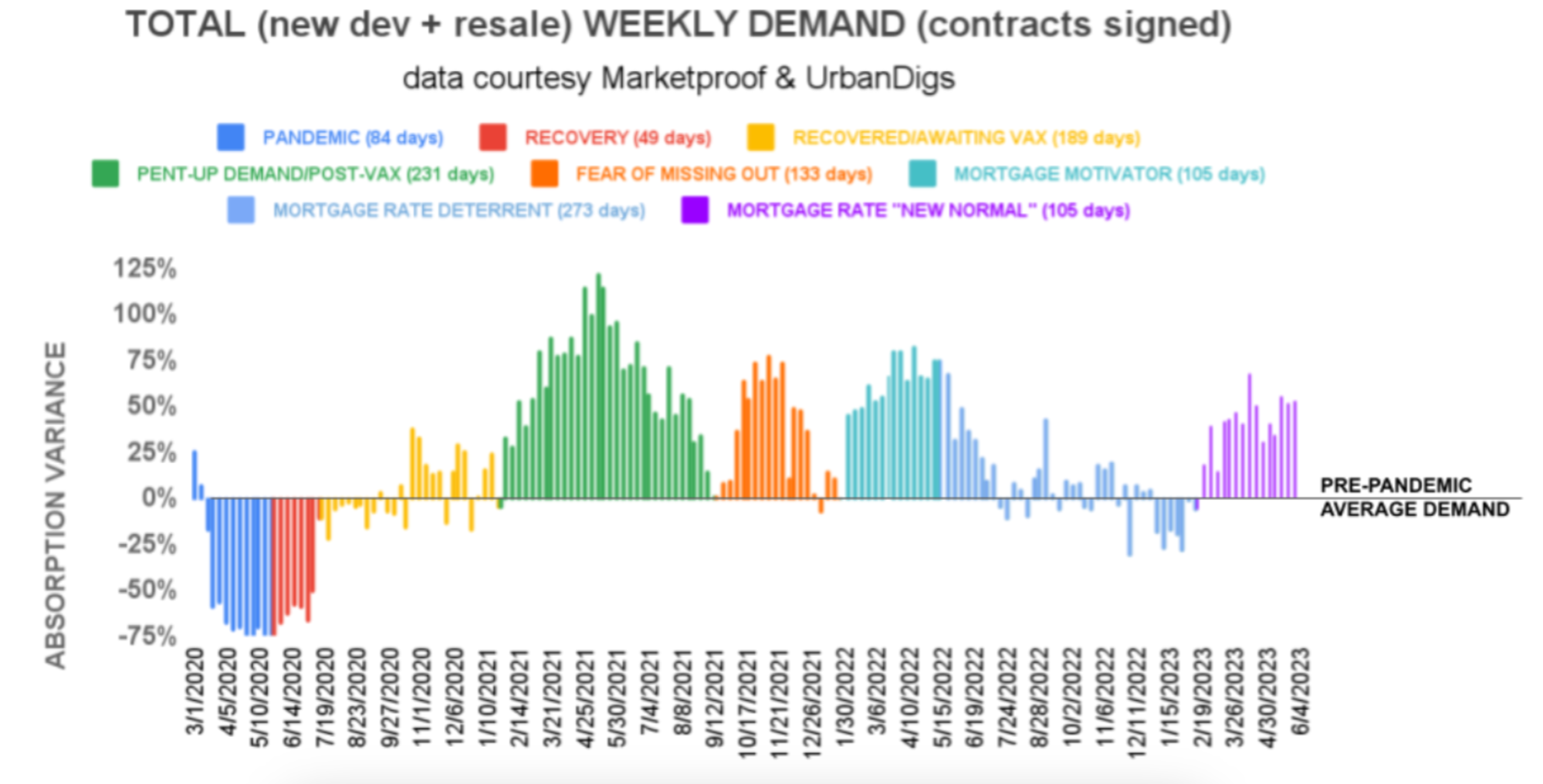

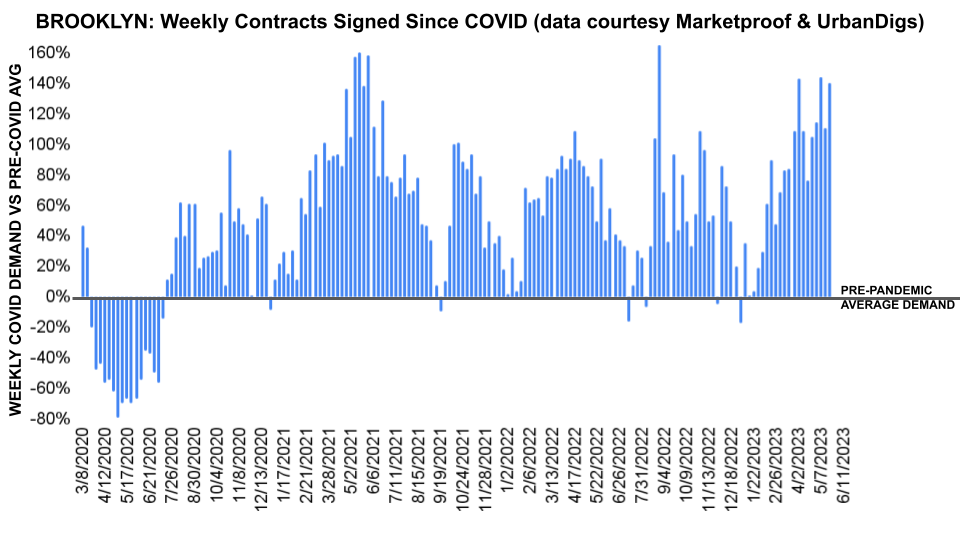

THE LATE SPRING RESURGENCE… CONTINUES

Last week, it was noted that spring demand typically reaches its peak at the end of March or the beginning of April, and this year followed that trend. But for the third week in a row, we saw a substantial rise in contract activity, continuing our late Spring resurgence.

This late-season resurgence suggests that the next few months may see higher-than-expected buyer activity.

It’s also worth noting that the number of weekly contracts signed, which signifies buyer demand, has remained above its pre-pandemic average* for 15 consecutive weeks.

*The average weekly number of contracts signed during the period January 5, 2015 to March 1, 2020.

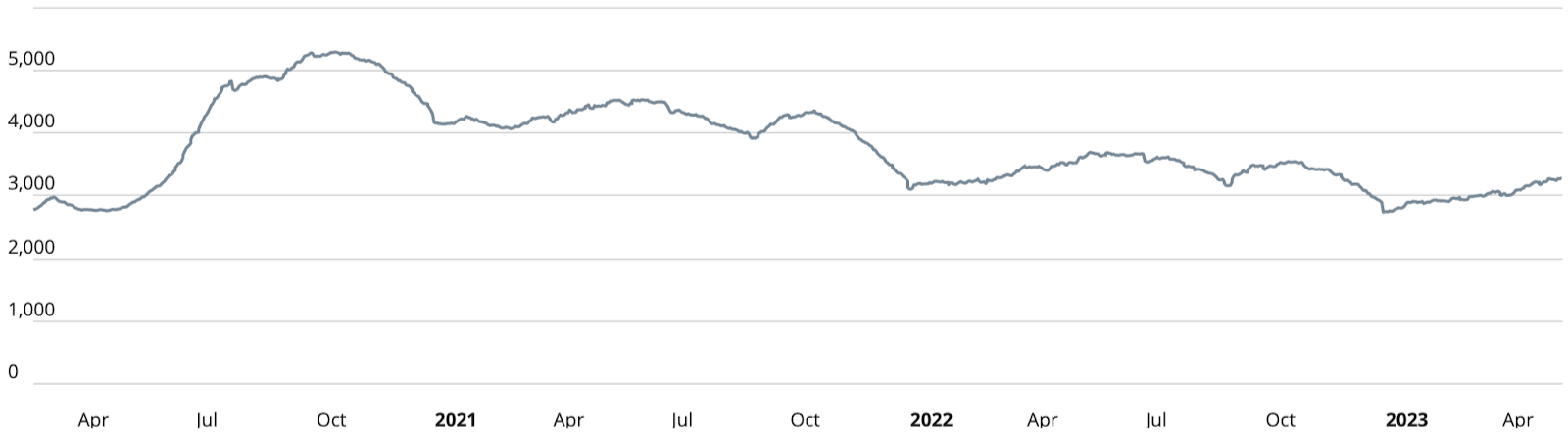

Manhattan Supply

Looking at the chart below, we can see that this year is on track with past years, and right now, we are approaching the end of our Spring listing season. This week, supply increased from 7,447 to 7,581 units, and that number should continue to increase en route to the June peak.

Why is the supply count important? Because low supply – such as is currently the case with many national markets – can assert upward pressure on pricing. But, with NYC supply at 7,581 units and demand at 254 contracts, supply is not a factor in increasing the pricing needle.

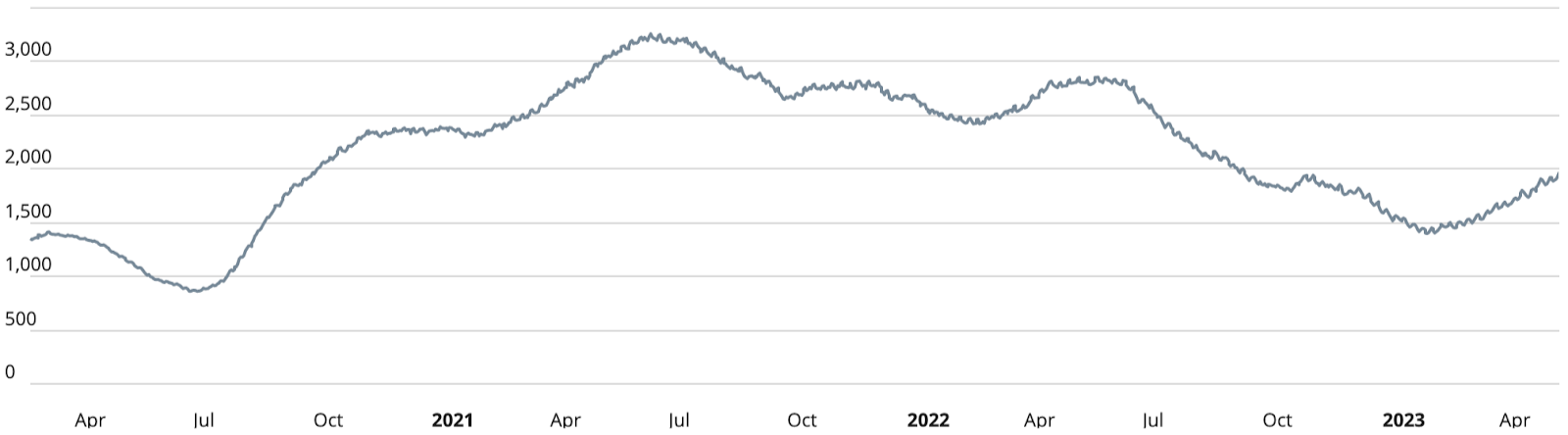

Brooklyn Supply

This week’s update shows Brooklyn’s supply increased from 3,262 to 3,287 units, which should continue to grow as we head toward the June peak. And as with Manhattan, the supply-to-demand ratio won’t cause a rise in prices since there are far more units available than what’s needed to satisfy a weekly demand of 172 units.

Manhattan Pending Sales

This week, the metric increased from 3,059 to 3,143 units as the borough heads towards its first peak. Any deviation from the large peak in June and a smaller peak in December would be reported as “news,” but so far, we are on track with the historical pending sales data.

Brooklyn Pending Sales

In February, right on cue, the metric reached its seasonal trough and then reversed direction. Seeing how we have been on track so far this year, we can also “predict” that the first of two peaks should occur in June. This week, pending sales increased from 1,921 to 1,971 units.

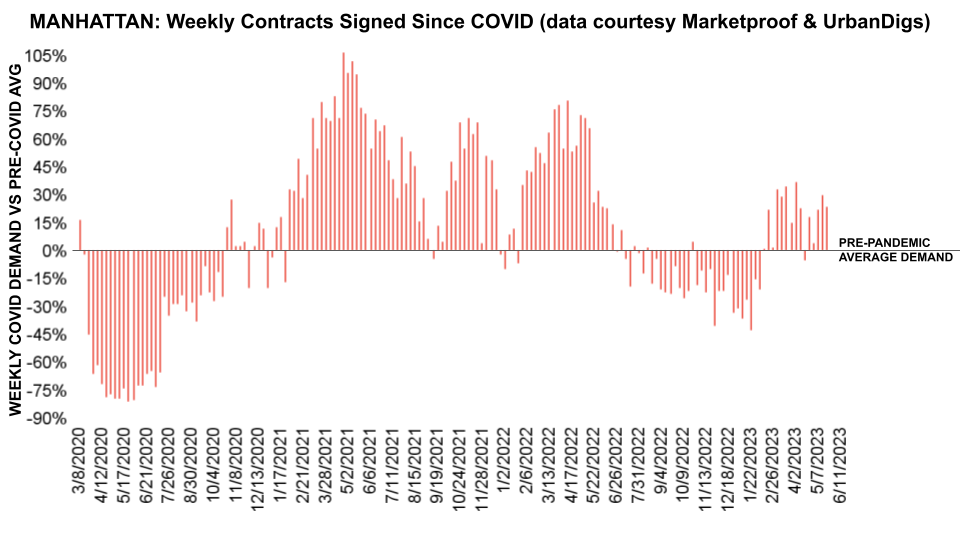

Manhattan Contracts Signed

At 254 contracts, the metric was once again well above its pre-pandemic benchmark.

Brooklyn Contracts Signed

Brooklyn is peaking for the 6th consecutive time since the pandemic. In mid-January, the metric briefly touched the pre-pandemic average, which has become the metric’s support level for more than 2 years. Since then, however, signed contracts have skyrocketed. This week, 172 deals were signed.

New Development Insights

As reported by Marketproof, this week, 71 new development contracts were reported across 43 buildings. The following were the top-selling new developments of the week:

- One11 (Midtown)

- ONE MANHATTAN SQUARE (Two Bridges)

- THE CORTLAND (West Chelsea)

- ONE HIGH LINE (West Chelsea)

- BROOKLYN POINT (Downtown Brooklyn)

If you would like to chat about the most recent market activity, feel free to contact us at info@elegran.com or connect with one of our Advisors.

About Us

Our goal is simple: to humanize the world of real estate. Michael Rossi founded Elegran in 2008 on the dual premise of motivation and innovation, with a third sustaining principle added over the years: care. Unique in the industry as an independently owned brokerage with agents known as “advisors” and a data-centered approach, the firm has become a key player in the New York brokerage world. The exclusive NYC member of

Weekly Manhattan & Brooklyn Market: 5/15 6 the invitation-only Forbes Global Properties network, Elegran oversaw well over $500 million in sales volume in 2019, tripled market share in 2020, and sold US $1B in 2021. Headquartered in the center of Manhattan, Elegran is solely dedicated to serving the incomparable needs of the New York City metropolitan region. For more information about Elegran, visit www.elegran.com.

Categories

Recent Posts

Stay in the Know!

Sign up to receive our monthly newsletter

GET MORE INFORMATION