Weekly Manhattan & Brooklyn Market: 6/12

Week of 6/12

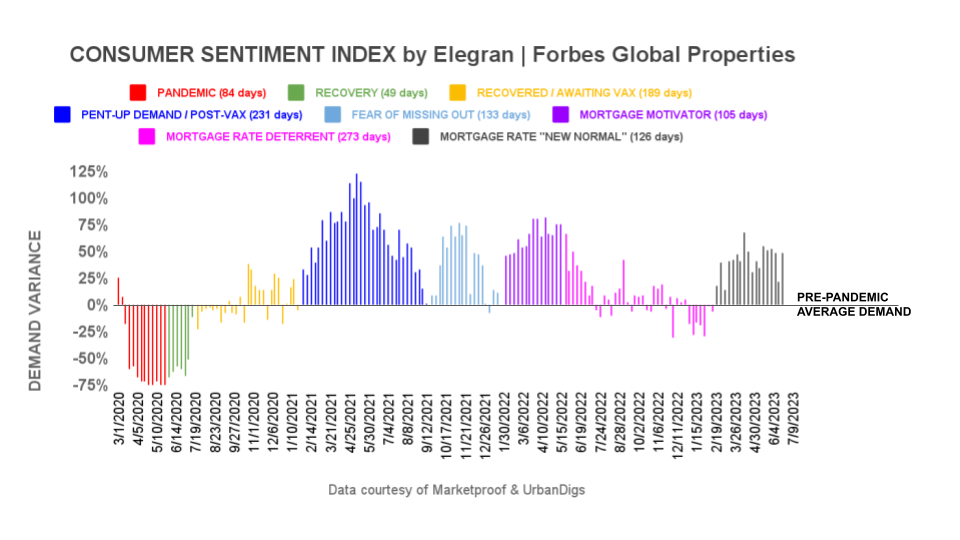

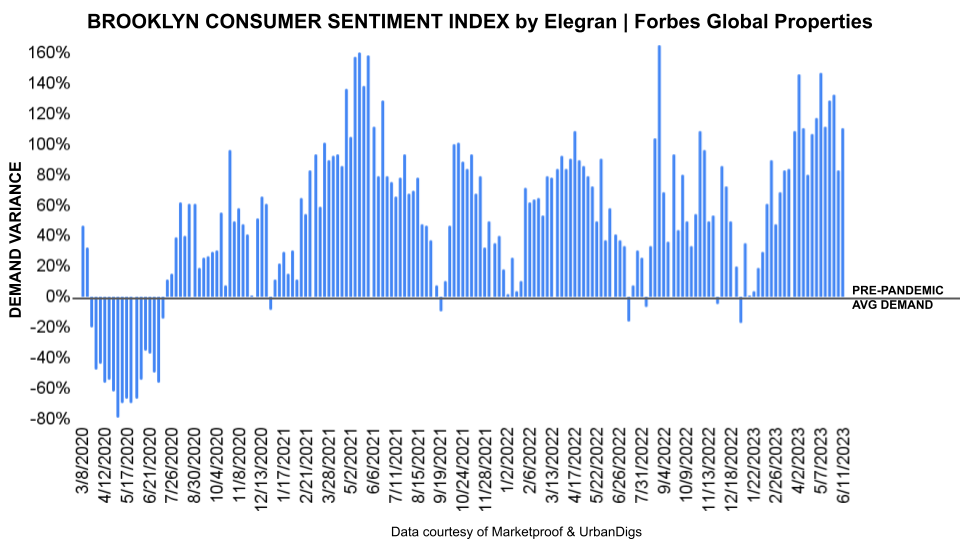

Buyers Unfazed by Interest Rate Spike: Mortgage Rates Surpass 7%, yet demand Remains Strong

Despite the 30-Year Fixed Rate Jumbo Mortgage Index raising above 7% this week, NYC's real estate market continues to experience robust demand, surpassing the pre-pandemic average* for the 18th consecutive week. This sustained consumer optimism suggests a potentially active summer with higher-than-normal buyer activity. The spill-over of strong market momentum from spring, combined with new demand entering the market, further reinforces expectations of an advantageous summer.

After waiting for price drops and lower interest rates over the past year, potential buyers are now taking action, recognizing that market conditions may not improve in the future. This shift in perspective has created pent-up demand as buyers seize the current market dynamics.

Foreign demand is also expected to contribute to the overall strength of the NYC market. Particularly in luxury segments, international buyers are less affected by interest rate fluctuations, adding to the positive market sentiment.

*The average weekly number of contracts signed during the period January 5, 2015, to March 1, 2020

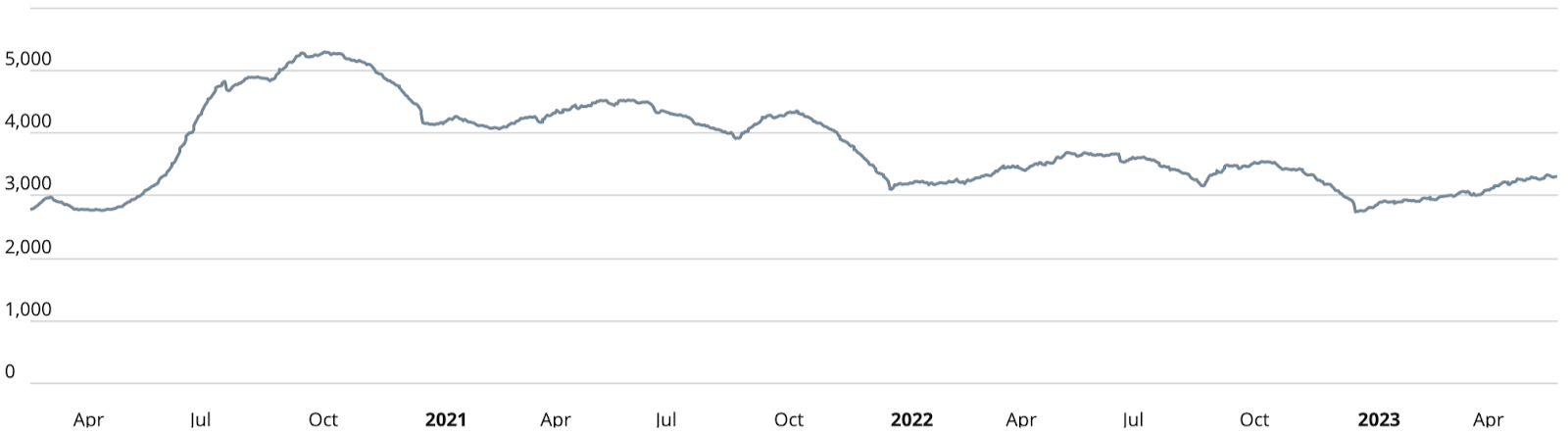

Manhattan Supply

The long-awaited June supply peak has arrived in Manhattan's real estate market, as the number of available units decreased from 7,584 to 7,543 this week. This aligns with historical trends and suggests a potential impact on pricing as low supply can drive prices upward. However, the current supply level, combined with strong weekly demand indicated by the number of contracts signed, indicates that supply alone may not be a significant factor influencing price increases. Understanding the supply count is crucial in evaluating the market dynamics and its potential effects on pricing trends.

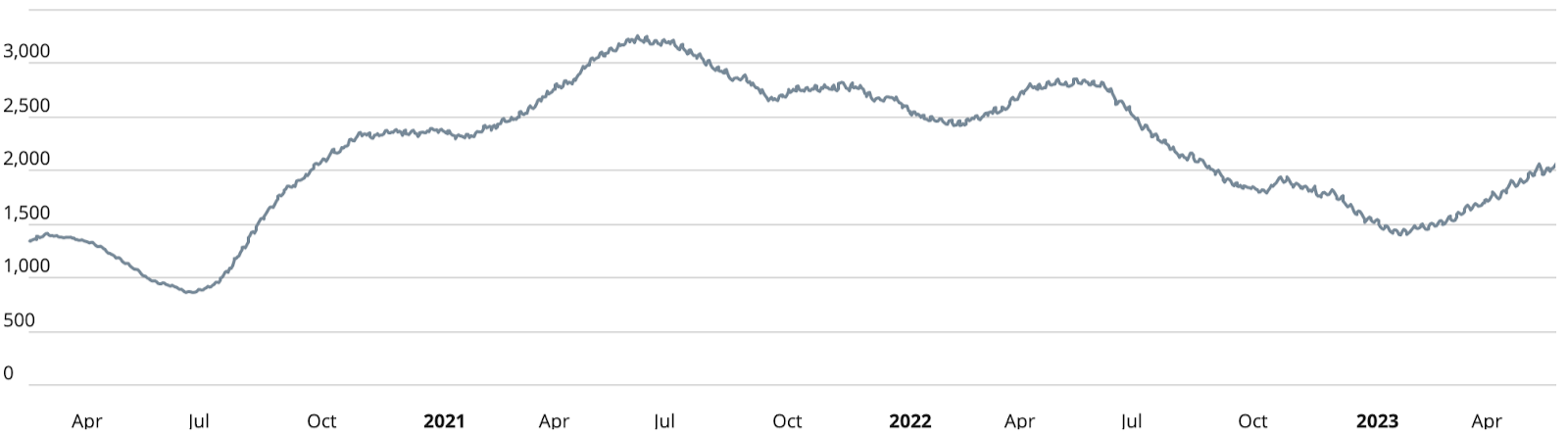

Brooklyn Supply

In Brooklyn's real estate market, we have also reached the anticipated peak for June. The supply of available units decreased from 3,332 to 3,312 this week right on cue with seasonal trends. As with Manhattan, the supply-to-demand ratio alone won’t raise prices since there are far more units available than what’s needed to satisfy a weekly demand of 149 units.

Manhattan Pending Sales

Manhattan's pending sales chart provides a clear picture of market expectations, and this week, the number of pending sales increased from 3,183 to 3,288 units. This suggests that the borough has not yet reached its expected peak for June.

Brooklyn Pending Sales

Like Manhattan, pending sales in Brooklyn reached a seasonal trough in February, and we expect a peak in June. This week, the number of pending sales increased from 2,023 to 2,068 units, suggesting that the borough is moving closer to its anticipated June peak — but we are not quite there yet.

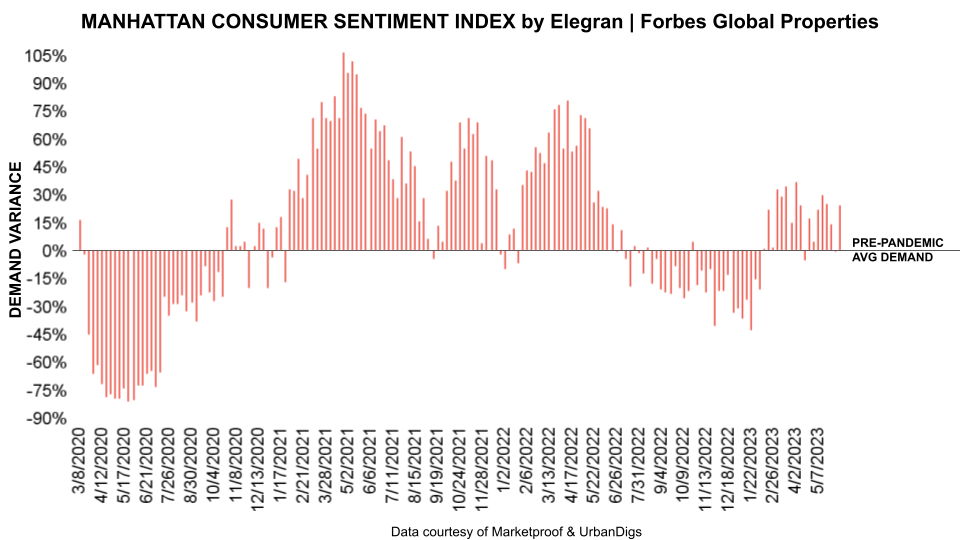

Manhattan Contracts Signed

242 contracts were signed this week, well above the pre-pandemic benchmark.*

*The average weekly number of signed contracts from Jan 5, 2015, to Mar 1, 2020.

Brooklyn Contracts Signed

This week, 149 contracts were signed, indicating sustained buyer interest and engagement in the market. It is worth noting that Brooklyn has experienced six consecutive peaks since the pandemic, with contract signings surpassing the pre-pandemic average.

New Development Insights

As reported by Marketproof, this week, 75 new development contracts were reported across 44 buildings. The following was the top-selling new developments of the week:

- THE HARPER (Yorkville) and TRIBECA GREEN (Battery Park City) reported 6 contracts

- ONE MANHATTAN SQUARE (Two Bridges) reported 5 contracts

If you would like to chat about the most recent market activity, feel free to contact us at info@elegran.com or connect with one of our Advisors.

About Us

Our goal is simple: to humanize the world of real estate. Michael Rossi founded Elegran in 2008 on the dual premise of motivation and innovation, with a third sustaining principle added over the years: care. Unique in the industry as an independently owned brokerage with agents known as “advisors” and a data-centered approach, the firm has become a key player in the New York brokerage world. The exclusive NYC member of the invitation-only Forbes Global Properties network, Elegran oversaw well over $500 million in sales volume in 2019, tripled market share in 2020, and sold US $1B in 2021. Headquartered in the center of Manhattan, Elegran is solely dedicated to serving the incomparable needs of the New York City metropolitan region. For more information about Elegran, visit www.elegran.com.

Categories

Recent Posts

Stay in the Know!

Sign up to receive our monthly newsletter

GET MORE INFORMATION