Weekly Manhattan & Brooklyn Market: 6/20

Week of 6/20/23

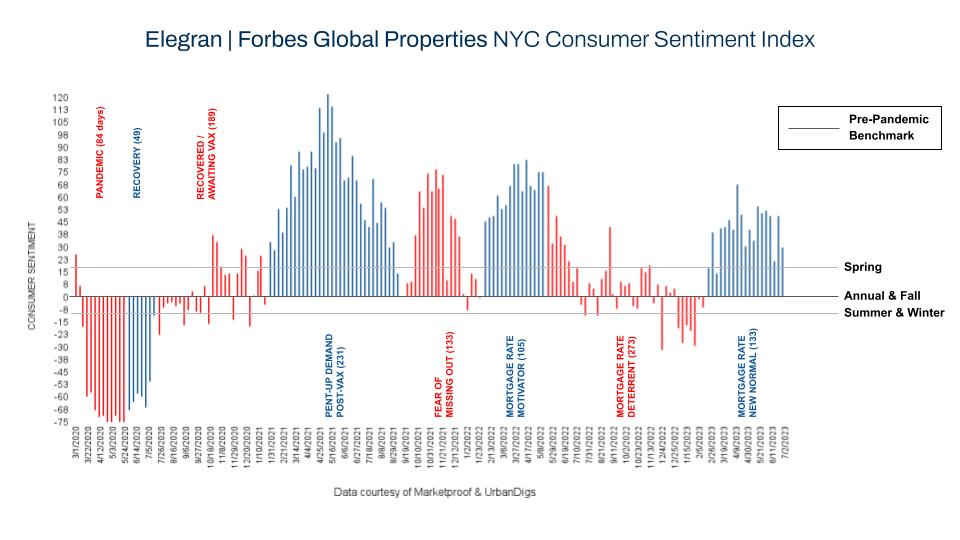

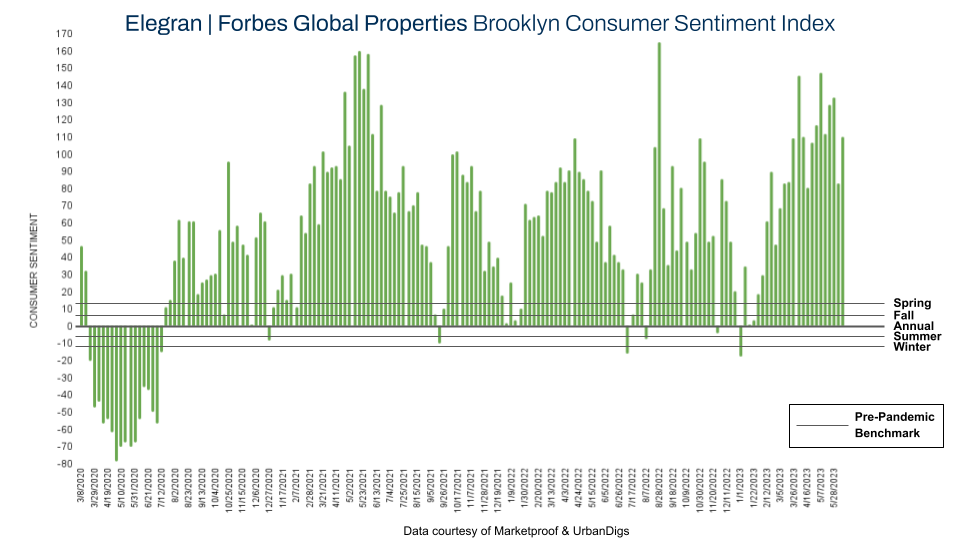

Consumer Sentiment Remains Well Above the Spring Benchmark

In the midst of an exciting and prolonged period of optimism, consumer sentiment continues to soar, well above the Spring benchmark. This exceptional performance indicates a resoundingly positive outlook among buyers in the local real estate market.

We define consumer sentiment as the measure of demand compared to historical trends. And the latest data from the Elegran | Forbes Global Properties NYC Consumer Sentiment Index leaves no room for doubt. With a remarkable score of +30, significantly surpassing the Spring benchmark* set at +18, consumer sentiment has consistently outperformed seasonal expectations for an impressive streak of 21 weeks.

Delving deeper, we've meticulously quantified NYC residential real estate's seasonal nature and adjusted our index accordingly. The Spring benchmark, our historical baseline, signifies an above-average season. Remarkably, as we transition from Spring to Summer, consumer sentiment continues to surpass expectations. This outstanding performance not only demonstrates the market's enduring strength but also points to a vibrant and robust summer market ahead.

* The average Spring consumer sentiment during the period January 5, 2015, to March 1, 2020

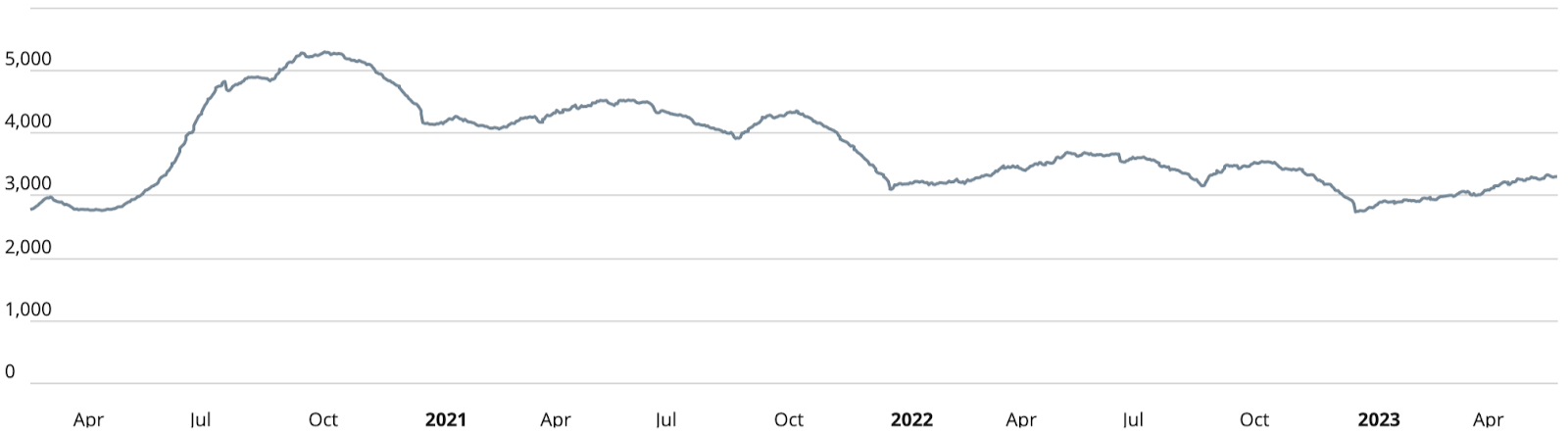

Manhattan Supply

During this week, the supply of available units in Manhattan decreased from 7,543 to 7,479 units. This decline confirms that the anticipated peak for June has been reached right on schedule. As we progress from here, we can expect the supply to decline precipitously, ultimately reaching a trough in late August or early September.

Now, why does the supply count matter? It's because the interplay between supply and demand often influences pricing trends. Low inventory exerts upward pressure on prices in many national markets where supply is limited. However, with the current supply standing at 7,479 units and a weekly demand of 207 contracts, the supply factor alone is not likely to significantly impact the pricing needle.

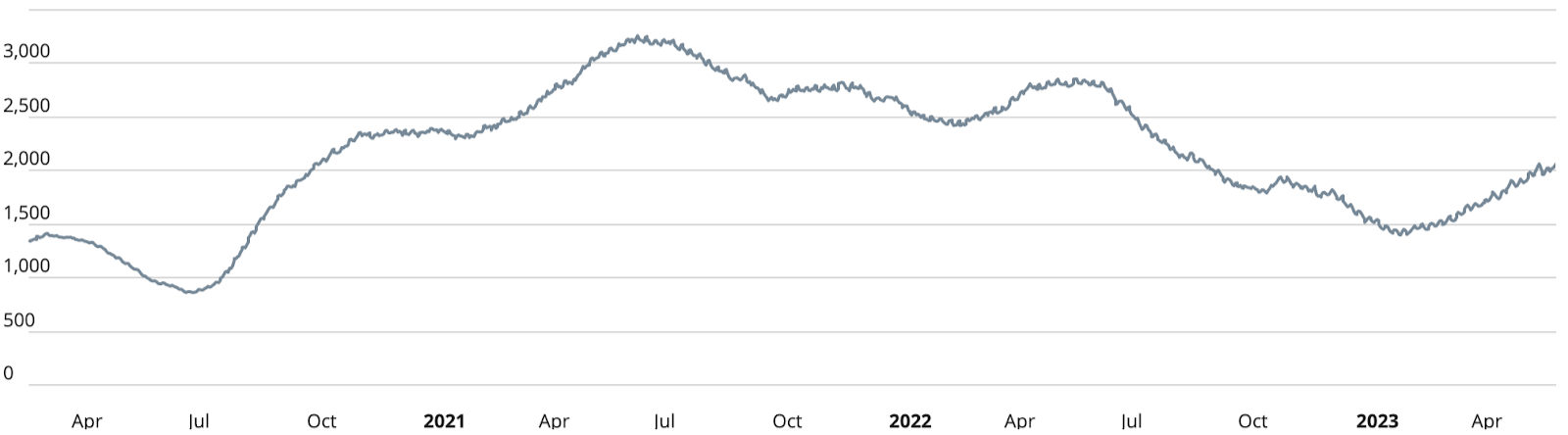

Brooklyn Supply

In the past week, the supply of available units in Brooklyn experienced a slight decrease, moving from 3,312 to 3,303 units. This decline confirms that, as expected, the borough has reached its peak for June right on cue. As we move forward, we anticipate a gradual decrease in supply, eventually reaching a trough in late August or early September.

The supply-to-demand ratio alone is not expected to exert significant upward pressure on prices. Currently, there are more units available in Brooklyn than what's needed to satisfy the weekly demand of 150 units. As we progress through the summer months, changes in supply levels may impact buyer behavior and contribute to the overall market sentiment.

Manhattan Pending Sales

The metric for pending sales decreased from 3,288 to 3,253 units, suggesting that the borough has reached its anticipated peak for June. This aligns with historical trends and reinforces our understanding of the market's seasonal patterns. Looking ahead, we can anticipate a rapid contraction in pending sales, ultimately leading to a trough expected to occur in late September or early October.

As pending sales decline, it may indicate a shift in buyer demand or a change in market conditions. This insight allows market participants to adapt their strategies and make informed decisions based on the evolving market dynamics. Stay tuned as we continue to unravel the intricacies of consumer sentiment, housing supply, and new development trends.

Brooklyn Pending Sales

During this week, pending sales in Brooklyn decreased from 2,068 to 2,050 units. This decline signifies that, just as expected, the borough has reached its projected peak for June. This pattern falls in line with historical trends and provides valuable insights into the cyclical nature of the market. Looking ahead, we can anticipate a decline in pending sales as we progress towards late September or early October. As pending sales decrease, it may indicate a shift in buyer preferences or market dynamics, influencing pricing and overall market sentiment.

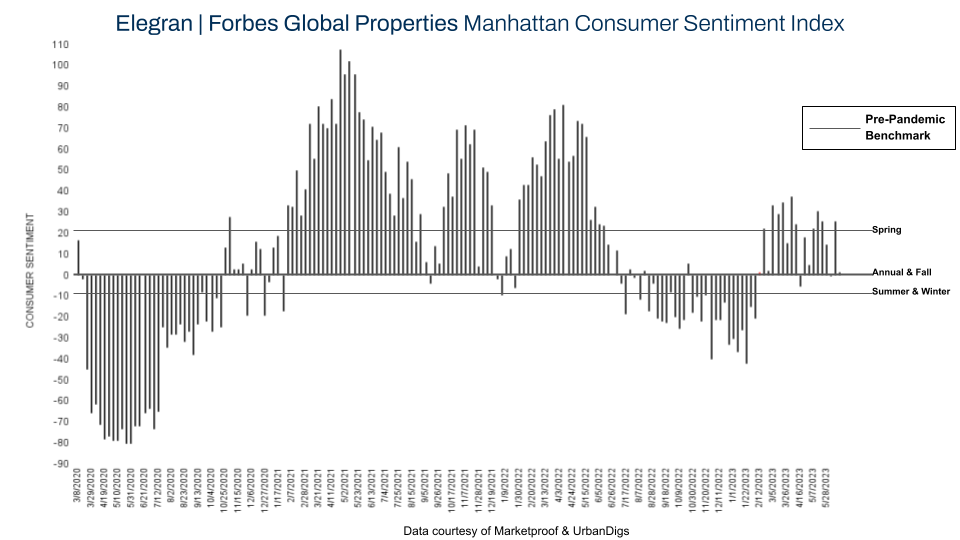

Manhattan Consumer Sentiment

While optimism remains prevalent, there are some nuances to consider that paint a mixed picture of the current sentiment.

According to the Elegran | Forbes Global Properties Manhattan Consumer Sentiment Index, consumer sentiment scored +1.40 this week, which, although positive, falls well below the borough's pre-pandemic Spring benchmark of +21. Comparing the data to historical averages from January 5, 2015, to March 1, 2020, it is evident that there is still some ground to cover before reaching the levels seen in the past.

Despite the lower score, it's essential to note that 207 contracts were signed in Manhattan during this week. While this represents a 14% decrease compared to the previous week's 242 signed contracts, it is still indicative of notable buyer activity in the market.

The combination of a positive consumer sentiment score, albeit below historical benchmarks, and a significant number of signed contracts suggests that buyers remain active and engaged in the Manhattan real estate market.

Brooklyn Consumer Sentiment

According to the Elegran | Forbes Global Properties Brooklyn Consumer Sentiment Index, consumer sentiment scored an impressive +105 this week. This score is well above the pre-pandemic Spring benchmark of +12, representing a substantial leap in buyer confidence. Comparing it to historical averages from January 5, 2015, to March 1, 2020, we can see a significant upward shift in consumer sentiment.

Notably, 150 contracts were signed in Brooklyn during this week, with an additional contract compared to the previous week. This consistent activity further reinforces the positive sentiment among buyers, indicating sustained interest in the Brooklyn real estate market.

The combination of an outstanding consumer sentiment score, surpassing historical benchmarks, and steady contract signings demonstrates Brooklyn's buoyant spirit and ongoing momentum.

New Development Insights

As reported by Marketproof, this week, 64 new development contracts were reported across 48 buildings. The following were the top-selling new developments of the week:

- TRIBECA GREEN (Battery Park City) reported 6 contracts

- LANTERN HOUSE (West Chelsea) and EDEN CONDOMINIUM (LIC) reported 3 contracts

Categories

Recent Posts

Stay in the Know!

Sign up to receive our monthly newsletter

GET MORE INFORMATION