Weekly Manhattan & Brooklyn Market: 7/10

Week of 7/10/23

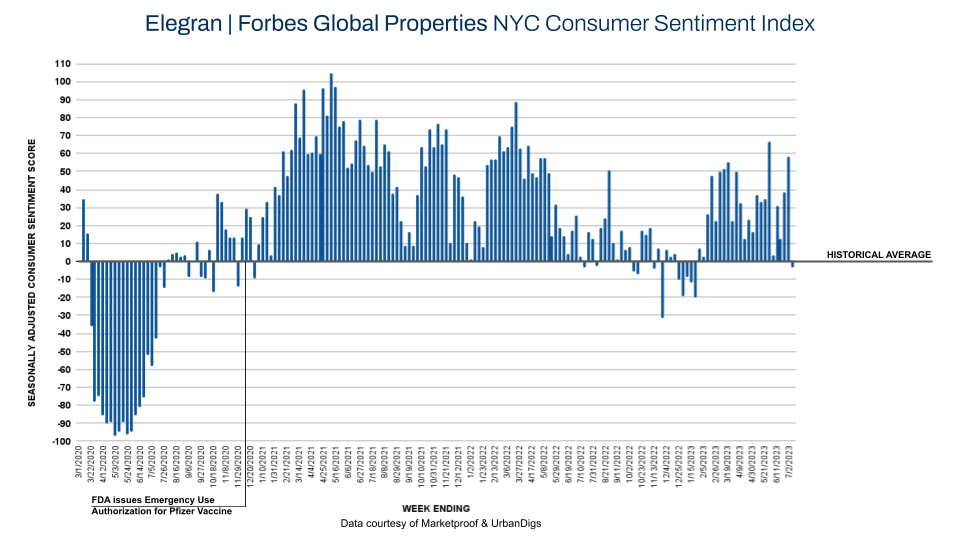

Consumer Sentiment Dips Amidst Unrestricted Summer Travel & July 4th Holiday

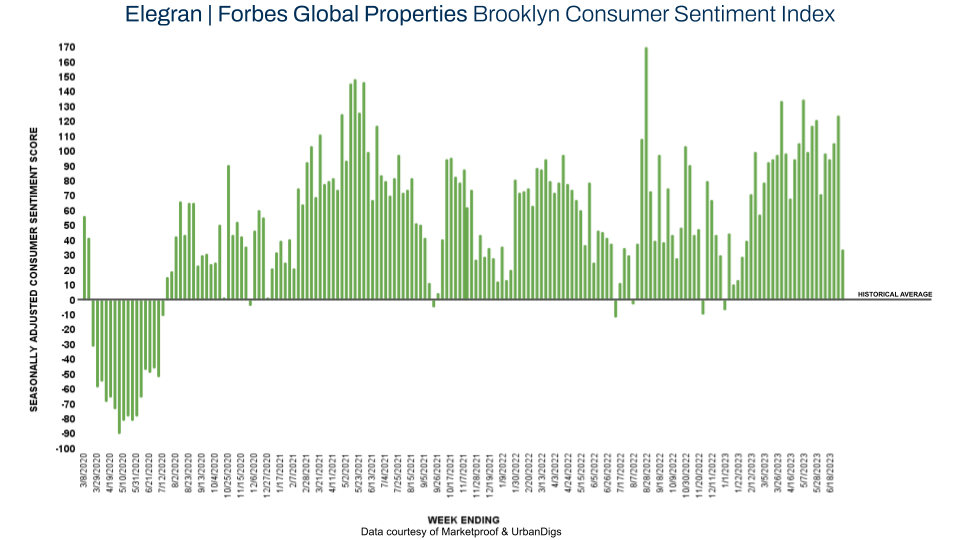

The 23-week streak of positive consumer sentiment finally came to an end this week.

The Elegran | Forbes Global Properties NYC Consumer Sentiment Index dropped from +58 last week to -4.

It's a significant decline that can't be ignored, but don’t start to worry. We believe this sharp drop is nothing more than a temporary blip on the radar, most likely influenced by the recent July 4th celebrations and the newfound freedom of unrestricted travel post-COVID.

Let's dive into the details and uncover the real story behind this unexpected twist in consumer sentiment.

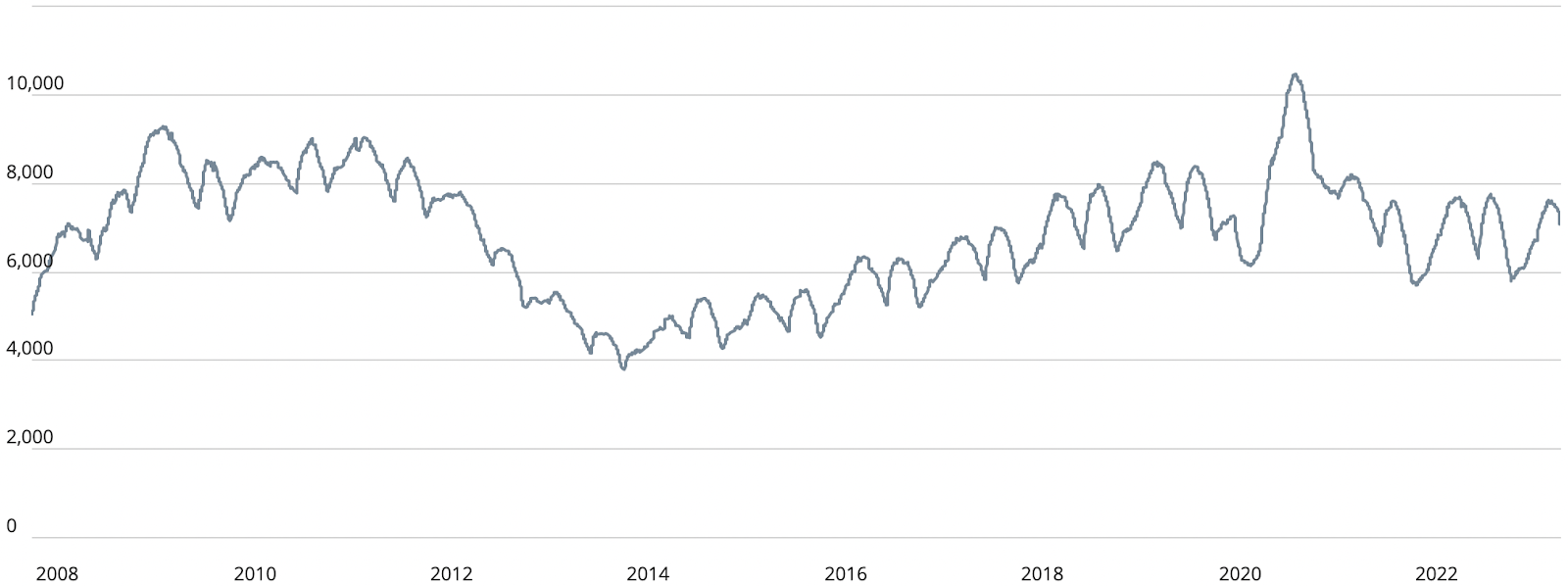

Manhattan Supply:

In Manhattan, the supply of available units witnessed a sharp decrease this week, as anticipated. The supply count dwindled from 7,308 to 7,077 units, indicating a continued downward trend. This decline is expected to persist, ultimately reaching its lowest point in late August or early September.

While a tightening of supply typically exerts upward pressure on prices, the current market scenario in Manhattan tells a different story. With 7,077 units available and a weekly demand of 152 contracts, the supply alone is not substantial enough to significantly impact pricing dynamics.

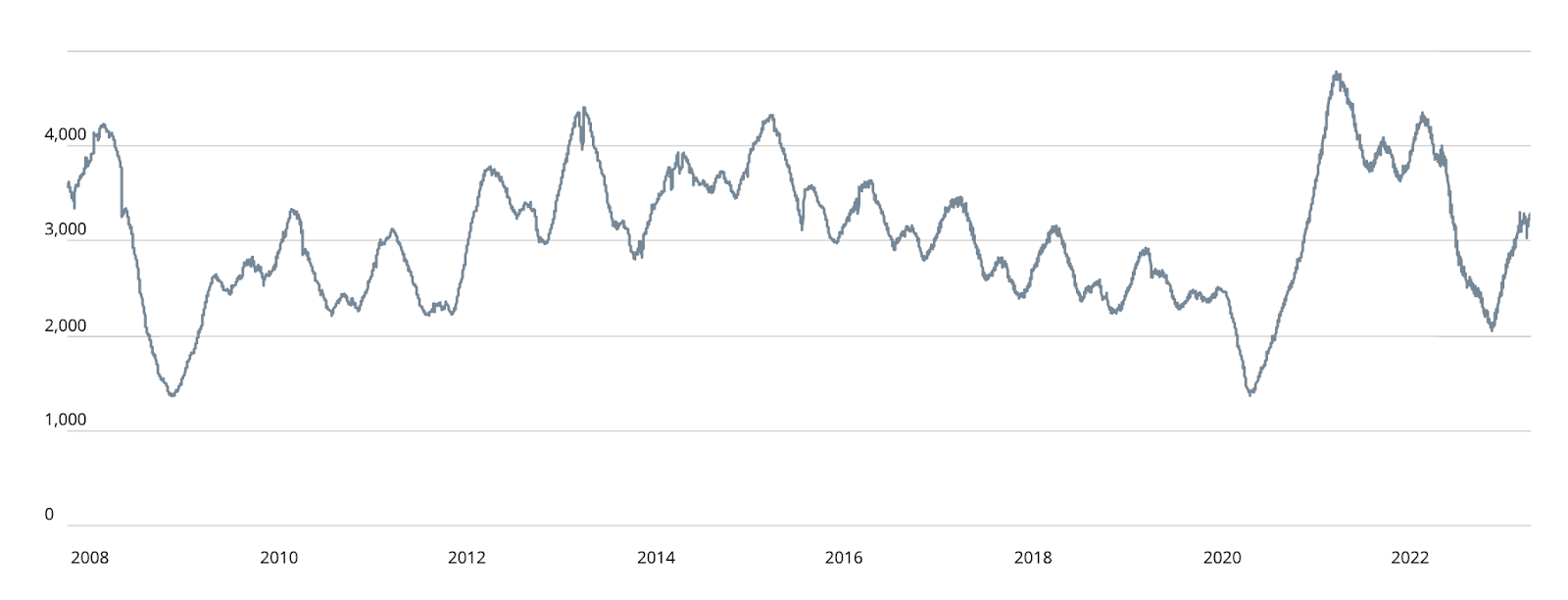

Brooklyn Supply:

This week, the supply continued its anticipated decline in Brooklyn as well, decreasing from 3,258 to 3,167 units. The data reaffirms the pattern that the supply metric reached its peak in June and is now steadily heading towards a late Summer/early Fall trough.

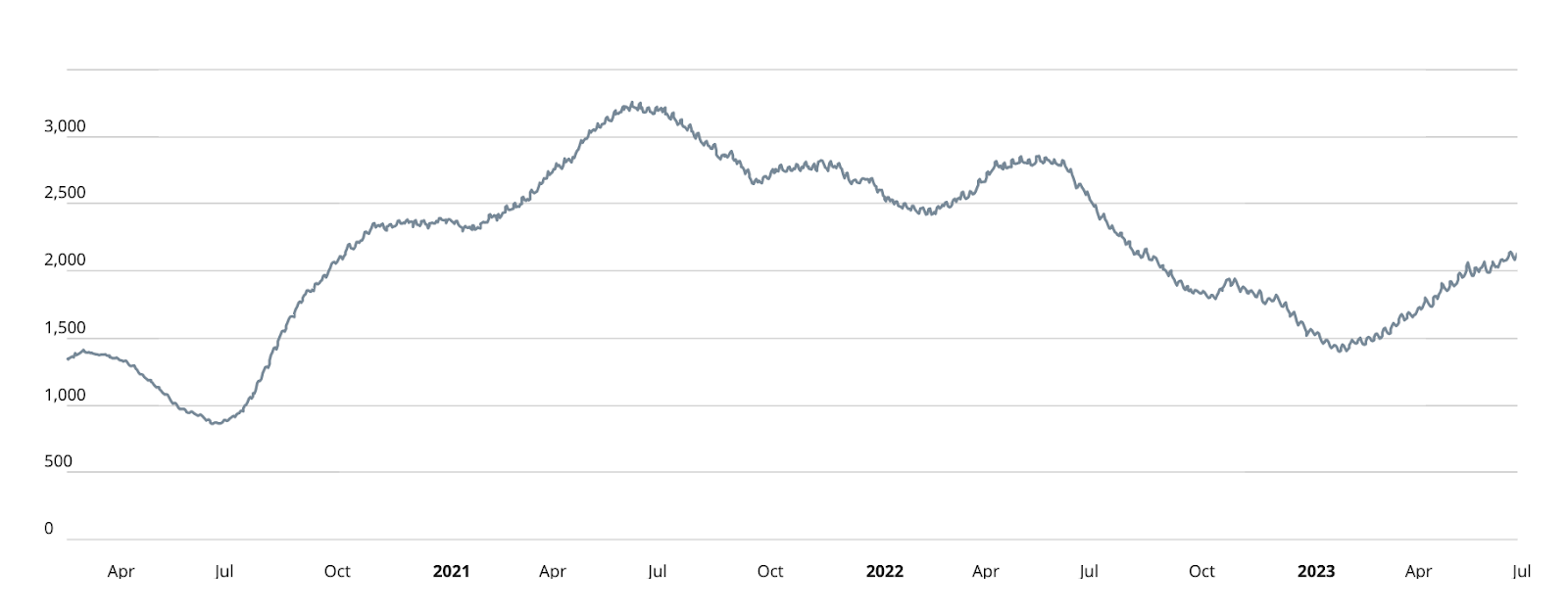

Manhattan Pending Sales:

This week, despite an unexpected slight increase from 3,251 to 3,305 units, we anticipate pending sales to undergo a rapid pullback in the near future. This pattern aligns with historical trends, indicating that we are on track to reach a trough in late September to early October.

While the temporary uptick in pending sales might raise some eyebrows, it is important to note that the overall trend remains consistent with previous market cycles. As we move forward, it is crucial to keep a close watch on pending sales data, as any significant deviation from the expected downward trajectory would indeed be noteworthy news.

Brooklyn Pending Sales:

In Brooklyn, pending sales have followed a distinct seasonal pattern, mirroring that of Manhattan. After reaching a trough in February, pending sales have steadily climbed and are on the cusp of their expected peak. This week, pending sales increased from 2,123 to 2,135 units, indicating a gradual ascent towards the anticipated peak.

As we approach this peak, it is essential to closely monitor the market dynamics. Once the peak is reached, we can expect pending sales to gradually decline through late September or early October, aligning with historical trends.

While the current increase in pending sales may not be surprising given the market cycle, it is noteworthy that the expected peak has yet to be attained. This suggests that there may still be room for further growth before the anticipated decline.

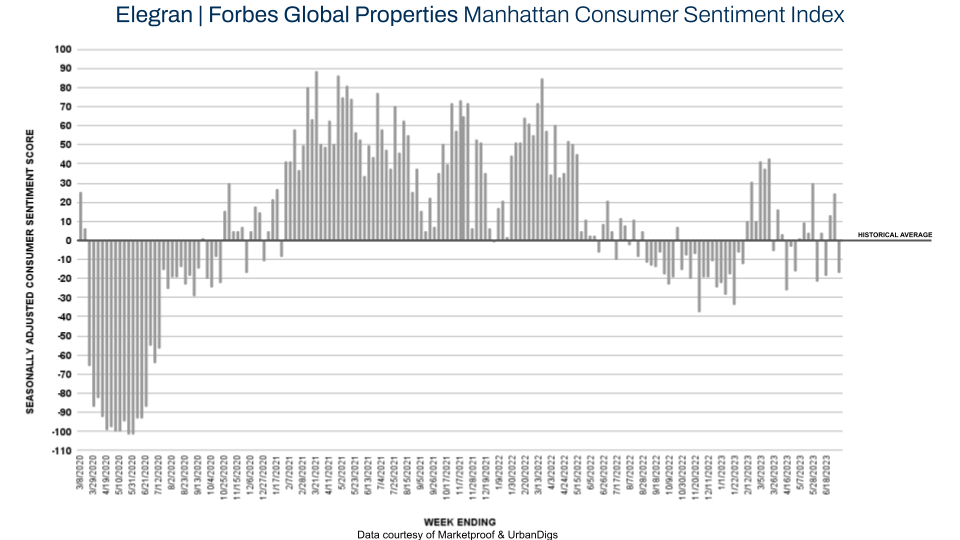

Manhattan Consumer Sentiment:

The Elegran | Forbes Global Properties Manhattan Consumer Sentiment Index has experienced a sudden and significant decline. This week, the Consumer Sentiment Score plunged from +25 to -17, indicating a 17% drop below its seasonally adjusted pre-pandemic average. Moreover, contract signings also decreased, with only 152 signed compared to 236 in the previous week.

The abrupt shift in consumer sentiment raises questions about the underlying factors at play. While the recent decline may be influenced by the July 4th holiday and the surge in travel following the removal of COVID restrictions, it is crucial to closely monitor how this dip evolves in the coming weeks.

Brooklyn Consumer Sentiment:

Brooklyn's consumer sentiment took a notable hit this week too, causing a considerable decline in market optimism. The Elegran | Forbes Global Properties Brooklyn Consumer Sentiment Index recorded a Consumer Sentiment Score of +34, down from a robust +124 in the previous week. Despite this significant drop, it is important to highlight that consumer sentiment remains 34% higher than its seasonally adjusted pre-pandemic average.

Contract signings also saw a decline, decreasing from 164 to 102 compared to the previous week. While these numbers indicate a temporary setback, it is crucial to consider the broader context and factors that might contribute to this decline.

Brooklyn has demonstrated remarkable resilience throughout various market conditions. The current drop in consumer sentiment, albeit substantial, should be analyzed in conjunction with other market indicators to gain a comprehensive understanding of the borough's real estate landscape.

New Development Insights

As reported by Marketproof, this week, 30 new development contracts were reported across 24 buildings. The following were the top-selling new developments of the week:

- 200 AMSTERDAM AVE (Lincoln Square)

- CENTRAL PARK TOWER (Midtown)

- 450 WASHINGTON (Tribeca)

- ONE HIGH LINE (West Chelsea)

- THE RED HOOK LOFTS (Red Hook)

- 182 MINNA ST (Borough Park)

- and NOVA (Long Island City)

Each reported 2 contracts.

If you would like to chat about the most recent market activity, feel free to contact us at info@elegran.com or connect with one of our Advisors.

About Us

Elegran’s mission is to ‘humanize the world of real estate’ through a client-first and thoughtful technology philosophy. A distinguished Forbes Global Properties member for New York City’s five boroughs and winner of the Most Innovative Brokerage Award from Inman, Elegran’s talented team of agents delivers client-centered service, resulting in eight times more sales volume sold per agent than the industry average.

Categories

Recent Posts

Stay in the Know!

Sign up to receive our monthly newsletter

GET MORE INFORMATION