Weekly Manhattan & Brooklyn Market: 7/17

Week of 7/17/23

Consumer Sentiment Makes a Comeback, While Summer Travel Poses Potential Impact

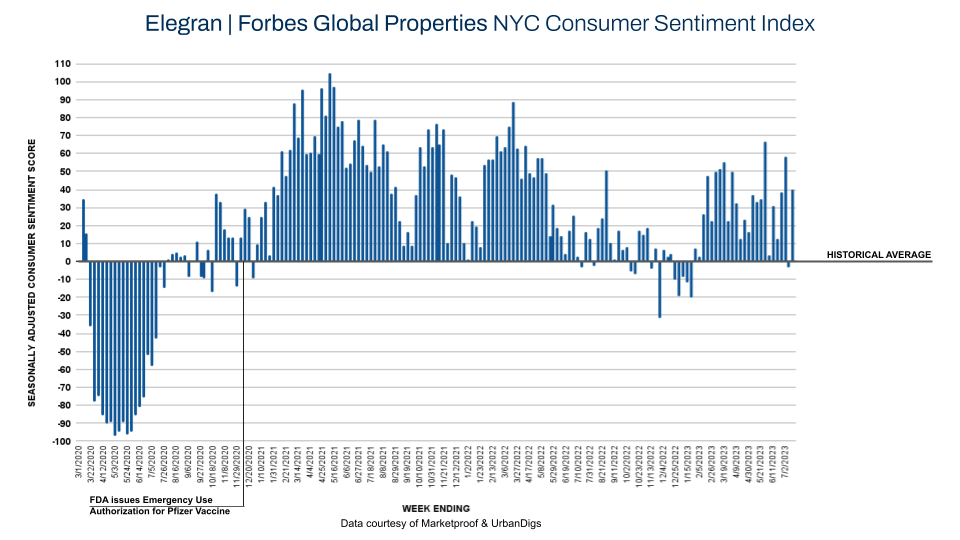

In this week's NYC Residential Real Estate Market Report, we've got some exciting news to share! Consumer Sentiment has made a remarkable comeback, bouncing back from -4 last week to a resounding +40 this week.

We called it right last week! The allure of 4th of July travel and summer vacations ultimately impacted the index. Prospective buyers and sellers are taking advantage of their newfound freedom to travel widely, with the last of many COVID restrictions coming to an end. As the summer unfolds and global travel resumes, Consumer Sentiment will likely continue to dance with the changing dynamics of the market. But we expect that the pattern of strong demand for NYC residential real estate will persist – even if we witness some dips over the summer.

By borough, Manhattan's attitude has been a mixed bag throughout the year, while Brooklyn has maintained consistently strong sentiment since July 2020. Now, let's dive into the intriguing details and discover what's in store for this captivating real estate market!

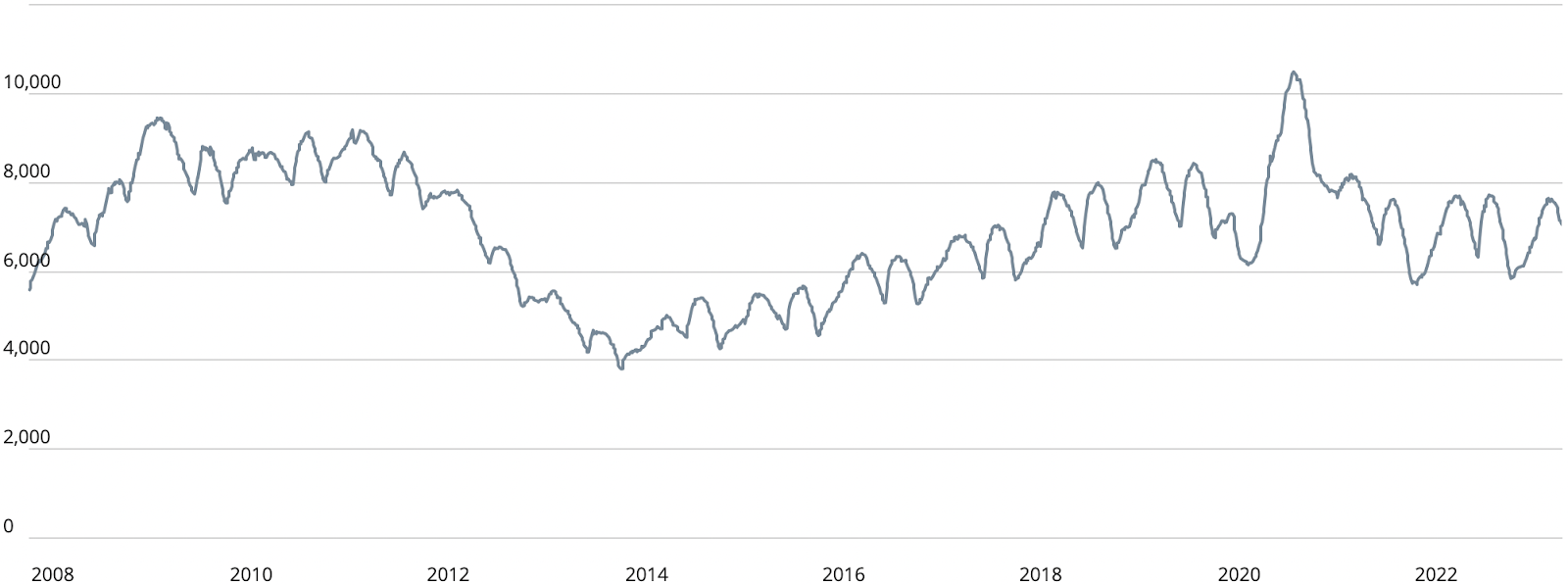

Manhattan Supply:

In Manhattan, the supply of residential real estate is following its anticipated trajectory. This week, we witnessed a decrease in supply from 7,077 to 7,033 units, indicating a gradual approach towards a low point projected for September. With weekly demand showing strong activity with 220 contracts, supply is not expected to be a significant factor influencing pricing trends at this time.

Brooklyn Supply:

In Brooklyn this week, we observed an increase in supply from 3,167 to 3,283 units, showcasing the ebb and flow of listings as the market approaches a trough later in the summer. Just like in Manhattan, the supply-demand balance is not exerting upward pressure on pricing with the weekly demand remaining at a healthy 152 units.

As we venture through the summer, we'll continue to keep a close eye on these trends, especially with the impact of summer travel and seasonal factors potentially influencing the supply dynamics.

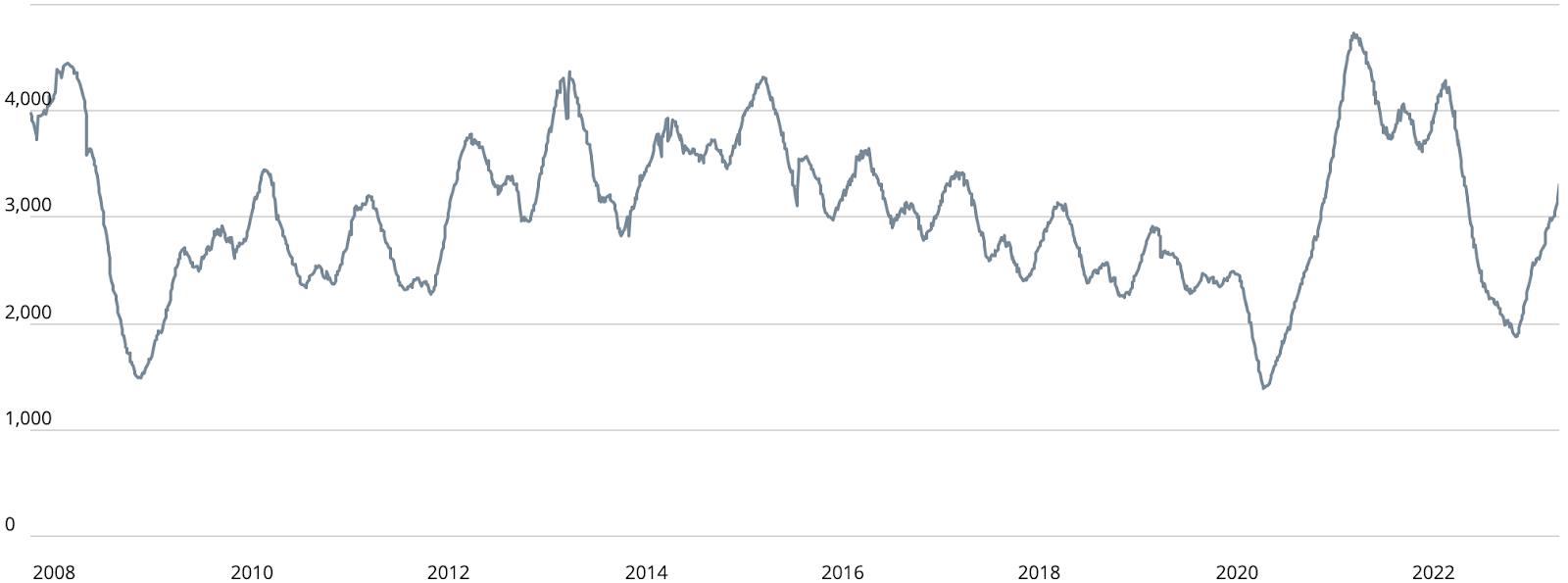

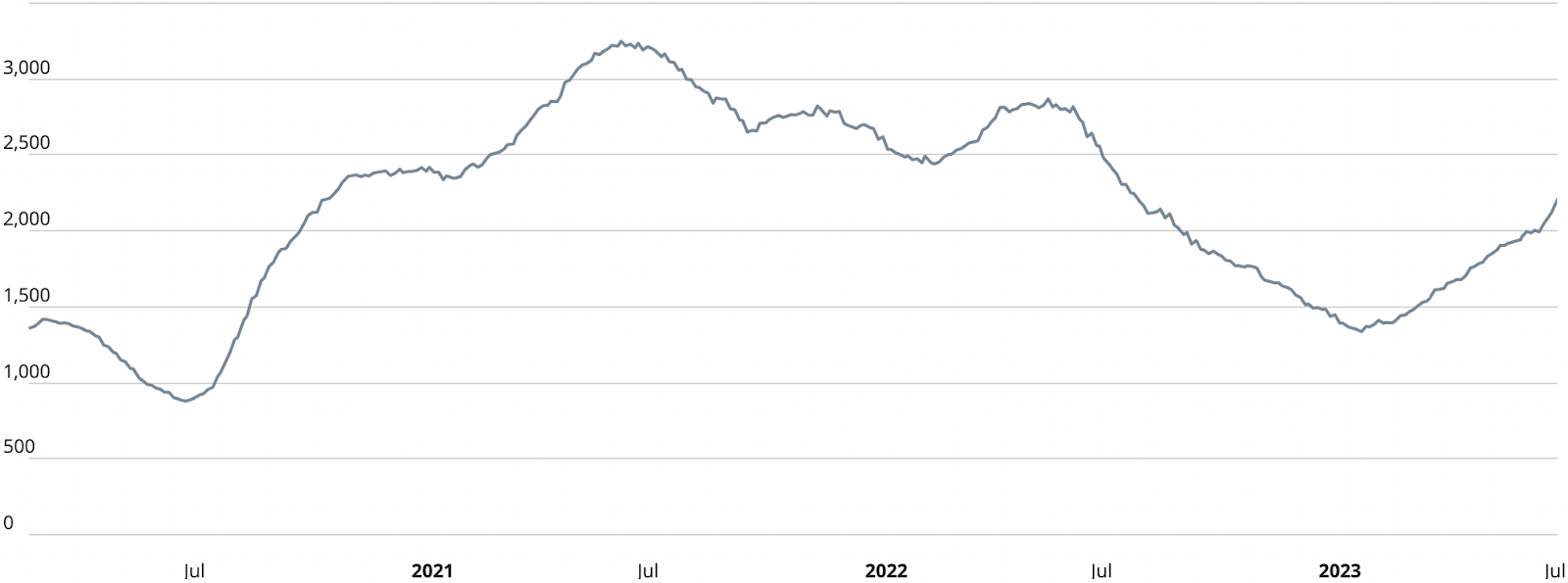

Manhattan Pending Sales:

As we are well into July, it's worth mentioning that Manhattan hasn’t reached its Pending Sales peak for the season. Based on historical data, we typically see the first of two annual peaks occur in June. However, this week, pending sales increased from 3,305 to 3,356 units, illustrating that the borough has NOT reached its peak. If the year returns to its usual pattern, we can anticipate a potential trough in October.

Brooklyn Pending Sales:

Like Manhattan, pending sales in Brooklyn have not yet reached their expected June peak, given that the metric increased from 2,135 to 2,213 units this week. Once that peak is reached, we expect pending sales to decline through October.

As the summer unfolds, we'll be closely monitoring the trends and eagerly anticipate the pending sales peak.

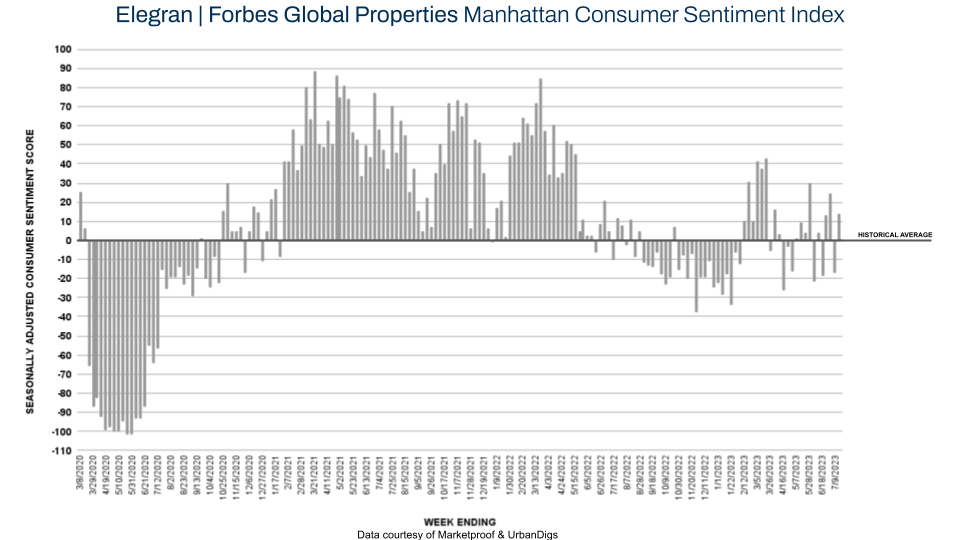

Manhattan Consumer Sentiment:

This week, the Elegran | Forbes Global Properties Manhattan Consumer Sentiment Index registered a Consumer Sentiment Score of +14, a significant improvement from -17 last week.

This suggests that the attitude towards Manhattan's residential real estate, which has been a mixed bag throughout the year, is currently 14% stronger than its seasonally adjusted pre-pandemic average. Furthermore, contracts have been steadily flowing, with 220 signed this week compared to 152 the previous week.

The chart below reveals the fluctuations in Consumer Sentiment, and while there may be occasional ups and downs, the overall trajectory remains on an upward trend. As the summer unfolds and global travel resumes, Manhattan's Consumer Sentiment will likely continue to dance with the changing dynamics of the market. With heightened interest and increasing activity, the city's real estate landscape promises an exhilarating journey for both buyers and sellers.

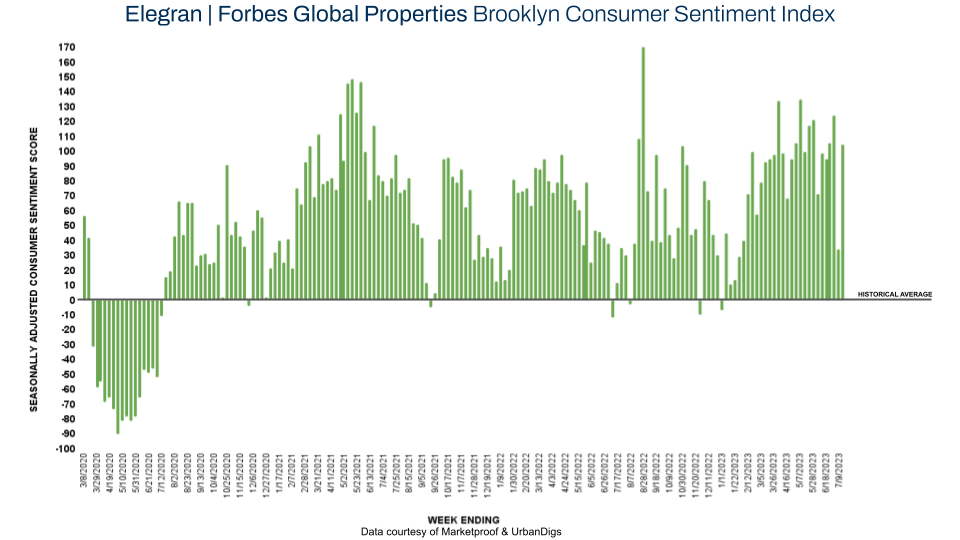

Brooklyn Consumer Sentiment:

This week, the Elegran | Forbes Global Properties Brooklyn Consumer Sentiment Index registered a remarkable Consumer Sentiment Score of +104, a substantial surge from +34 last week.

This signifies that consumer sentiment in Brooklyn is currently a whopping 104% greater than its seasonally adjusted pre-pandemic average, maintaining its consistently strong performance since July 2020. The buzz of activity is palpable, with contracts soaring from 102 to 152 this week. With strong demand and unwavering enthusiasm from prospective buyers, the borough's real estate market presents an exciting landscape of opportunities.

New Development Insights:

New Development Insights:

As reported by Marketproof, this week, 60 new development contracts were reported across 46 buildings. The following were the top-selling new developments of the week:

- THE CORTLAND (West Chelsea)

- ONE HIGH LINE (West Chelsea)

- 111 MONTGOMERY (Crown Heights)

Each reported 3 contracts.

If you would like to chat about the most recent market activity, feel free to contact us at info@elegran.com or connect with one of our Advisors.

About Us

Elegran’s mission is to ‘humanize the world of real estate’ through a client-first and thoughtful technology philosophy. A distinguished Forbes Global Properties member for New York City’s five boroughs and winner of the Most Innovative Brokerage Award from Inman, Elegran’s talented team of agents delivers client-centered service, resulting in eight times more sales volume sold per agent than the industry average.

Categories

Recent Posts

Stay in the Know!

Sign up to receive our monthly newsletter

GET MORE INFORMATION