Weekly Manhattan & Brooklyn Market: 7/24

Week of 7/24/23

Summer Sentiment Holds Strong

Amidst the summer season, our predictions for a thriving market have proven accurate.

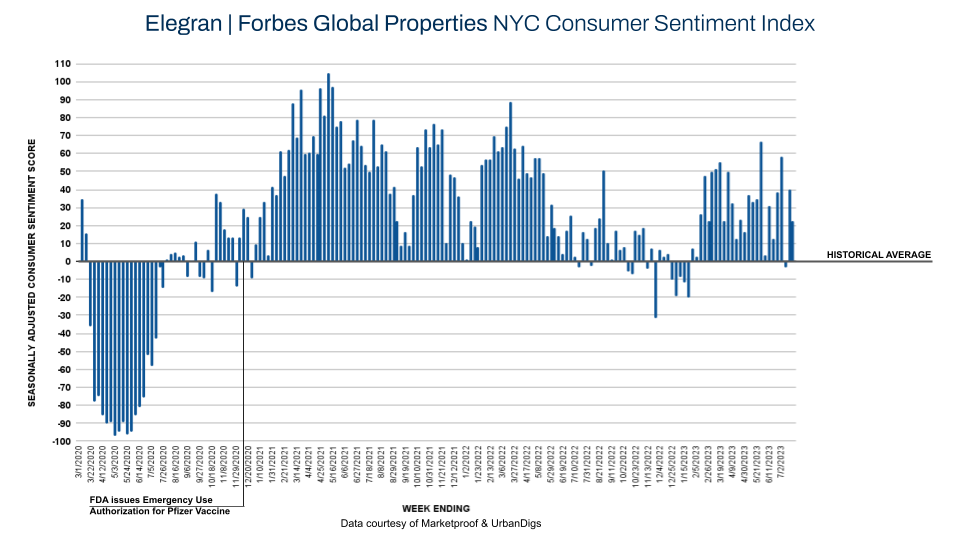

Despite a slight decline from last week, the Elegran | Forbes Global Properties NYC Consumer Sentiment Index still shows a 23% increase in demand in NYC residential real estate compared to the pre-pandemic period. This week's score is +23, sliding from +40 the previous week, but it would have marked the 26th consecutive week of positive sentiment if not for a brief dip two weeks ago.

While fluctuations may occur due to reinvigorated global travel, we remain confident in the continued strong demand for NYC real estate.

In summary, our predictions for the summer season have been largely validated by the market's performance. The current positive sentiment, along with a steady stream of new development contracts, is a testament to the strength of the NYC residential real estate market. Let's delve into this week's market updates to gain further insights into the ongoing trends.

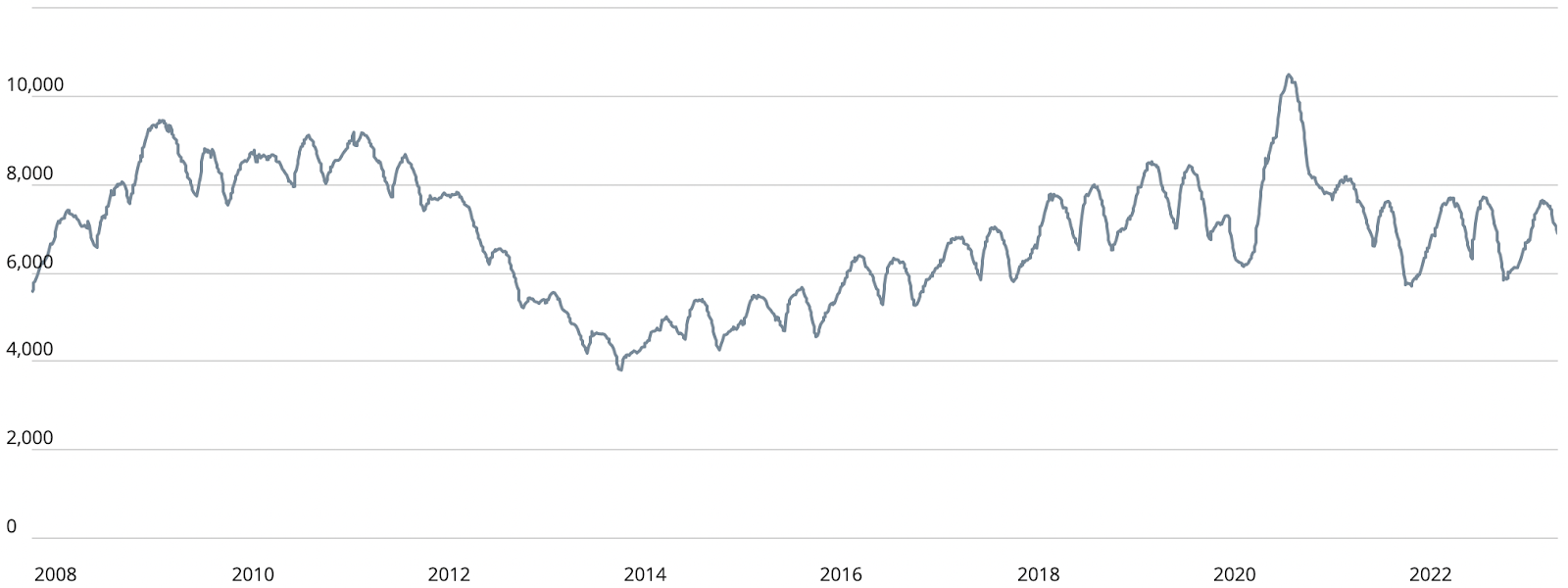

Manhattan Supply

This week's market update reveals an expected decrease in supply for Manhattan residential real estate, further signaling the tightening conditions in the market. The number of available units declined from 7,033 to 6,879, and this trend is projected to continue toward a low point in September.

Low supply levels, a prevalent trend in many national markets, can exert upward pricing pressure. However, in Manhattan, with the current supply standing at 6,879 units and a maximum weekly demand of approximately 400 contracts, supply is not expected to be a significant factor in driving prices higher.

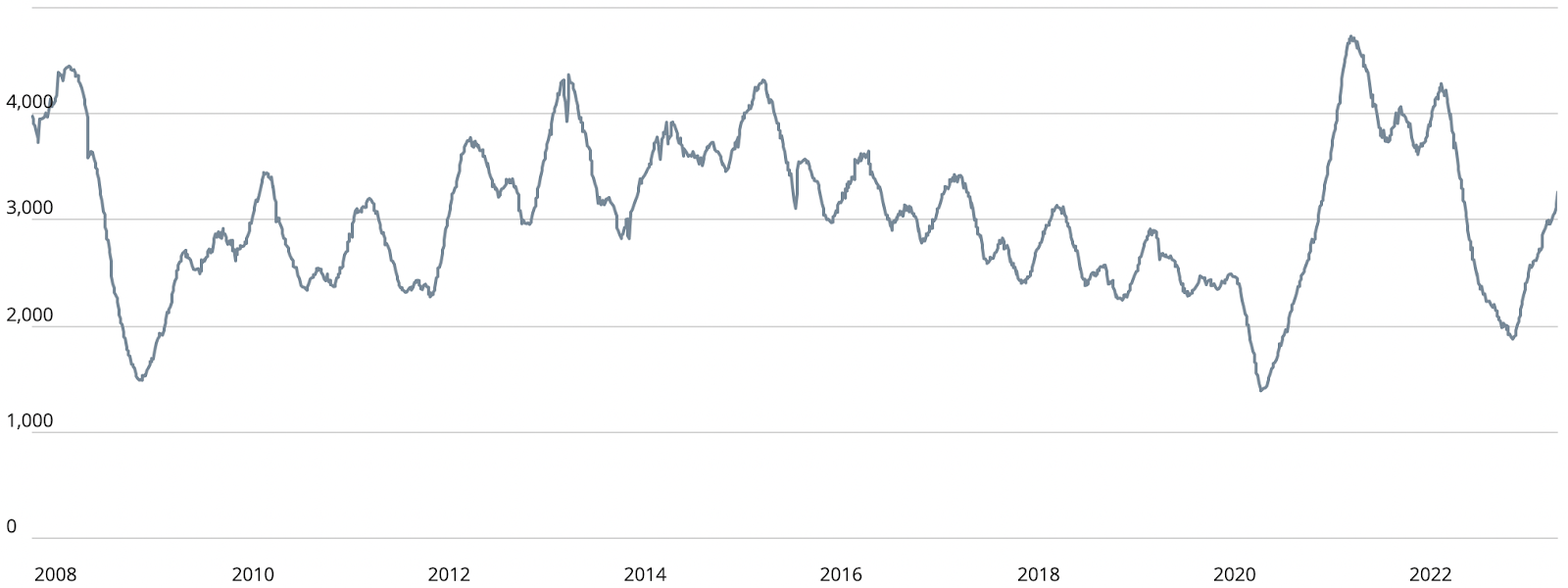

Brooklyn Supply

This week, we saw a decrease in supply from 3,283 to 3,242 units, as the market moves towards a trough expected in late Summer.

The current supply-demand ratio indicates ample availability, exceeding the maximum weekly demand of approximately 200 units. Though supply might not have an immediate impact on pricing dynamics, the overall market health creates favorable conditions for buyers to explore the wide range of available options.

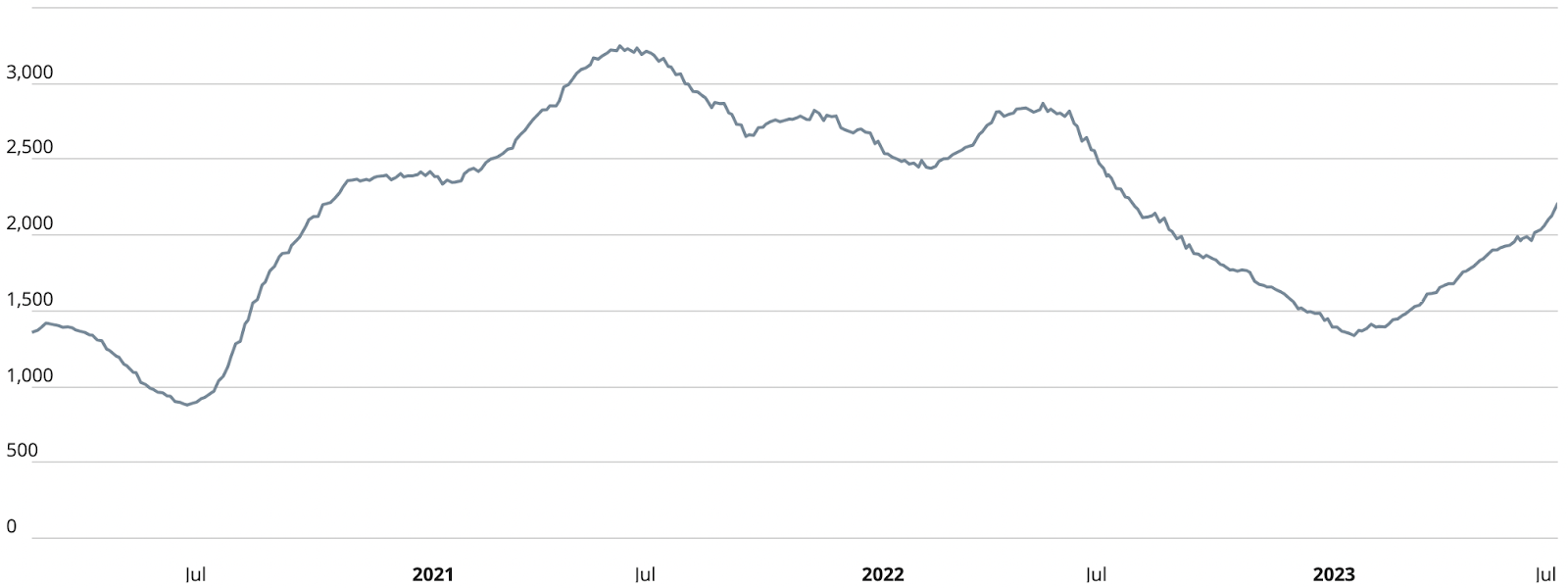

Manhattan Pending Sales

As projected, Manhattan has now reached the peak of its summer pending sales. This week's update indicates a slight decrease in pending sales from 3,356 to 3,271 units, as the market moves towards its seasonal trough in October. The ongoing market trends showcase a dynamic and active real estate landscape in Manhattan, further validating our earlier predictions.

The summer peak in pending sales reflects the continued strong demand for properties in this sought-after borough. As we progress through the season, buyers and sellers can expect a vibrant market with ample opportunities.

Brooklyn Pending Sales

In line with the trends observed in Manhattan, Brooklyn has also experienced its summer peak in pending sales. This week's update reveals a marginal decrease in pending sales from 2,213 to 2,212 units. As the market moves forward, pending sales are expected to decline further through October.

The summer peak in pending sales showcases the strong and sustained demand for residential properties in Brooklyn.

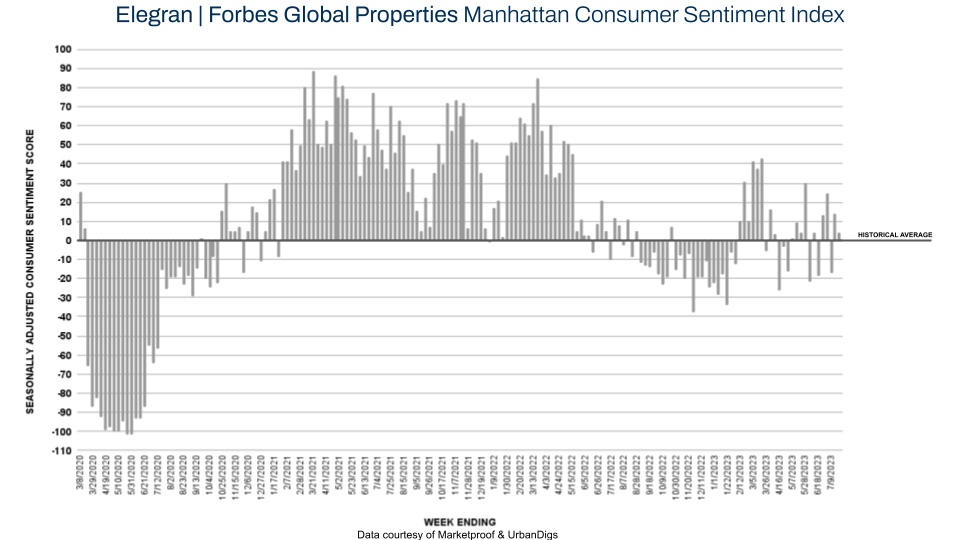

Manhattan Consumer Sentiment

This week's update reveals a slight decrease in consumer sentiment towards Manhattan residential real estate. The Elegran | Forbes Global Properties Manhattan Consumer Sentiment Index now registers a score of +4, down from +14 last week. Despite this dip, it's essential to note that the attitude towards Manhattan properties remains 4% stronger than its seasonally adjusted pre-pandemic average.

In terms of signed contracts, there were 196 contracts signed this week, compared to 220 contracts the previous week.

As we navigate through the summer, consumer sentiment may experience fluctuations due to various seasonal factors. Despite these potential variations, the overall market conditions suggest a positive outlook, providing favorable opportunities for both buyers and sellers.

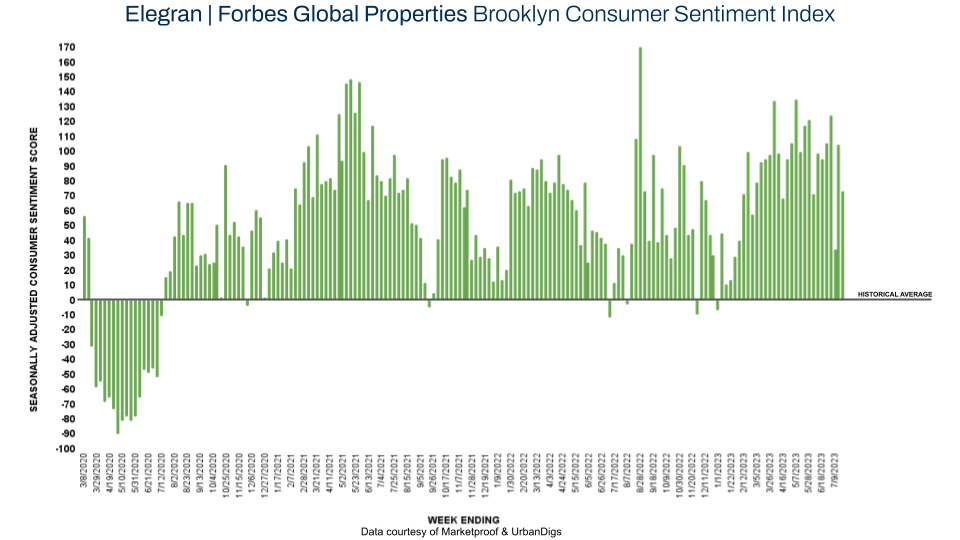

Brooklyn Consumer Sentiment

This week's update on Brooklyn Consumer Sentiment reveals a Consumer Sentiment Score of +73, down from +104 last week. Despite the decline, consumer sentiment remains high, currently 73% stronger than its seasonally adjusted pre-pandemic average. Overall, the index reflects the continued positive outlook in the Brooklyn residential real estate market.

In terms of signed contracts, there were 131 contracts signed this week, compared to 152 contracts the previous week. This data points to the sustained demand for properties in Brooklyn, as buyers and sellers actively engage in the market.

The consistent high sentiment score and active contract signings create a vibrant real estate landscape in Brooklyn.

New Development Insights

As reported by Marketproof, this week, 61 new development contracts were reported across 43 buildings. The following were the top-selling new developments of the week:

- CLAREMONT HALL (Morningside Heights)

- H70 CONDOMINIUM (Midwood)

Each reported 4 contracts.

- 212 WEST 72ND STREET (Lincoln Square)

- ONE HIGH LINE (West Chelsea)

- 171 NORTH 1ST STREET (Williamsburg)

Each reported 3 contracts.

If you would like to chat about the most recent market activity, feel free to contact us at info@elegran.com or connect with one of our Advisors.

About Us

Elegran’s mission is to ‘humanize the world of real estate’ through a client-first and thoughtful technology philosophy. A distinguished Forbes Global Properties member for New York City’s five boroughs and winner of the Most Innovative Brokerage Award from Inman, Elegran’s talented team of agents delivers client-centered service, resulting in eight times more sales volume sold per agent than the industry average.

Categories

Recent Posts

Stay in the Know!

Sign up to receive our monthly newsletter

GET MORE INFORMATION