Weekly Manhattan & Brooklyn Market: 8/14

Week of 8/14/23

NYC Real Estate Resilience: Navigating the Highs and Lows in a Dynamic Summer Market

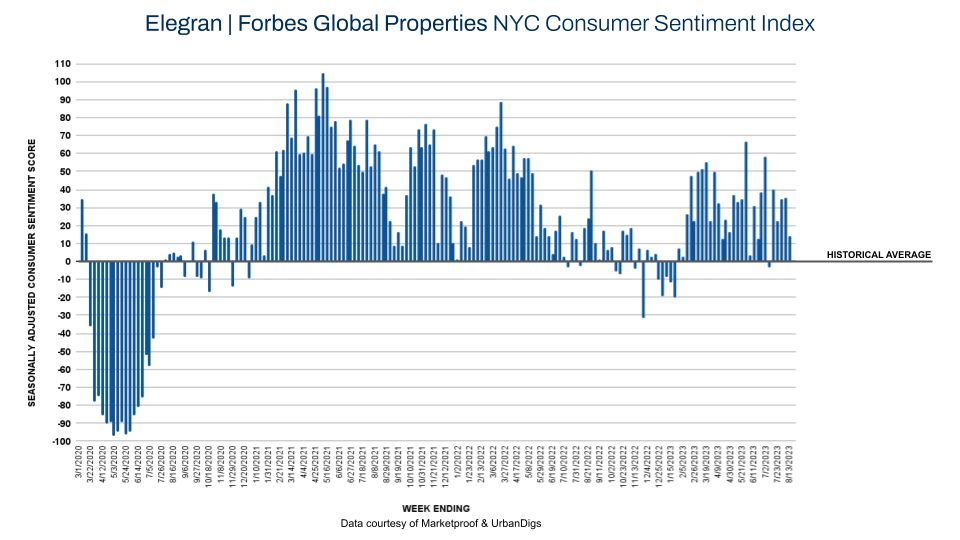

Despite 30-year mortgage rates exceeding 7% and increased summer travel from relaxed COVID-19 measures, NYC's property sentiment remains strong. The Elegran | Forbes Global Properties Index dropped from +35 to +14 this week, indicating the sentiment is still 14% stronger than in the pre-pandemic period*.

For both buyers and sellers, the market presents a double-edged sword. While current conditions might deter some, they offer discerning investors a distinct opportunity. It's a peculiar dance of supply and demand: high interest rates with a strong market backdrop, teetering on the edge of change. Consider this: a dip in these rates could release pent-up demand, causing a surge of buyers to flood the market, and inevitably pushing prices up. For those who've been on the fence, the present moment could very well be a golden opportunity.

Brooklyn and Manhattan present varied narratives, but the overarching theme is clear – demand remains steady, and the summer has been above average. It's a waiting game, but for the vigilant, the potential rewards are undeniable. Dive into this week's WMU to discern how you can strategize in this dynamic market environment.

* January 5, 2015, to March 1, 2020

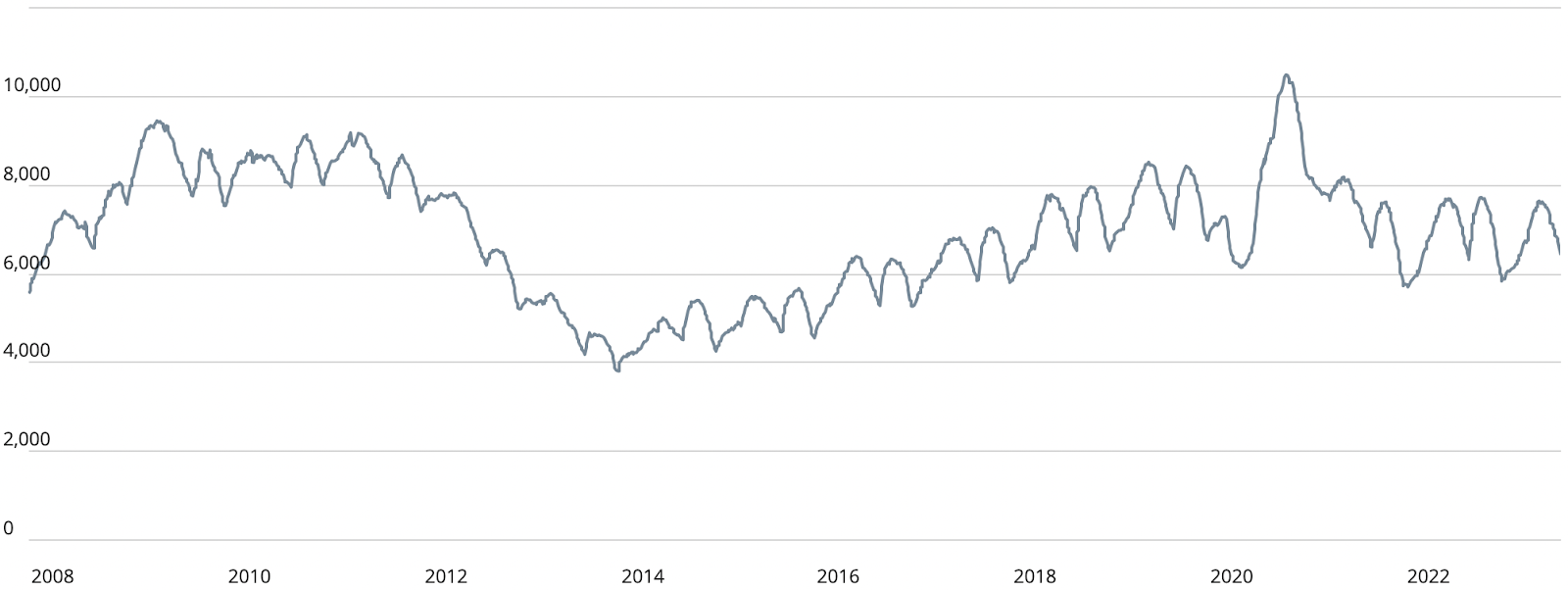

Manhattan Supply

This week saw a predictable decline in available units. With numbers dropping from 6,553 to 6,427, we're inching closer to a forecasted low next month. But why does this matter? In the larger scheme of things, reduced supply, mirroring national trends, could put an upward strain on prices. However, with a current inventory of 6,427 units juxtaposed against a peak weekly demand of approximately 400 contracts, it's unlikely that supply alone will significantly shift the pricing landscape.

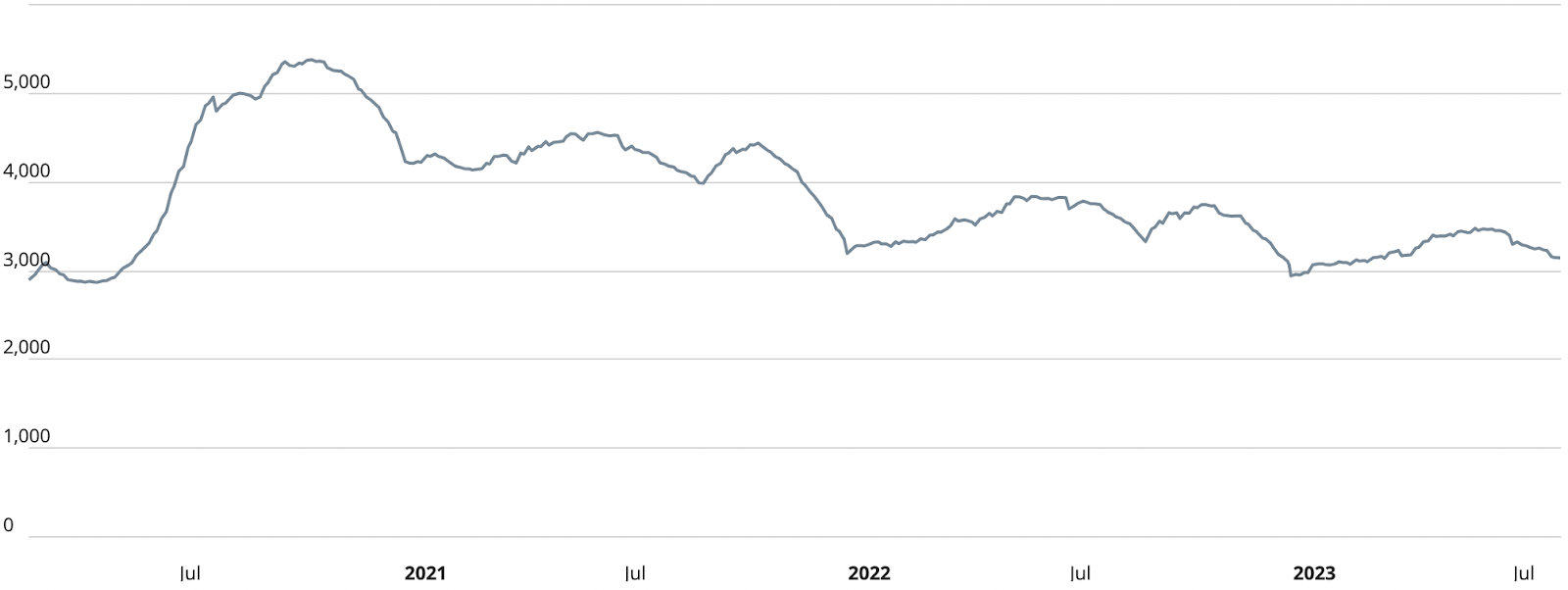

Brooklyn Supply

This week, we've observed a subtle contraction in available units, moving from 3,155 to 3,145. While this dip is expected to reach its nadir next month, it's crucial to note Brooklyn's supply trends, which exhibit a less pronounced bi-annual cycle. Even with this decrease, the current stock seems ample, especially when measured against a peak weekly demand of roughly 200 units. This balance suggests that the supply-demand dynamics, in isolation, aren't poised to propel prices immediately.

Manhattan Pending Sales

Manhattan's pending sales serve as a barometer for upcoming market shifts. Drawing from historical patterns, we're currently navigating a typical ebb: sales have descended from 3,043 to 2,979 units this week. Projections indicate that this trend is likely to continue, hitting its trough in October. With the first of two annual peaks generally observed in June, this year has adhered to the customary trajectory. As we approach the fall season, stakeholders should remain alert to this natural contraction, interpreting it not as a market decline but as a periodic adjustment. The coming months will reveal if this ebb sets the stage for a strong resurgence in Manhattan real estate activity.

Brooklyn Pending Sales

Brooklyn's pending sales chart mirrors its Manhattan sibling in many ways, offering foresight into the borough's property transaction trends. As of this week, there's been a dip in pending sales, moving from 2,093 to 2,032 units. Like Manhattan, Brooklyn too has recently witnessed one of its bi-annual peaks. Historically, the trend indicates a decline continuing through October. However, the essence of Brooklyn's real estate market is its unpredictability and vibrancy. As we transition into the later months of the year, watching how these pending sales evolve will provide invaluable insights for both buyers and sellers keen on tapping into Brooklyn's ever-evolving property market.

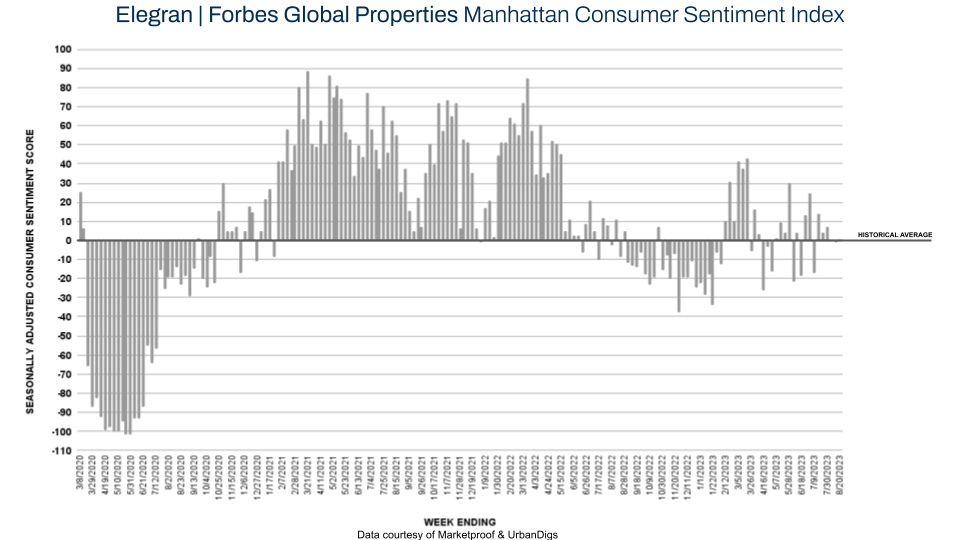

Manhattan Consumer Sentiment

Consumer sentiment plays a pivotal role in forecasting market behaviors. This week, the Elegran | Forbes Global Properties Manhattan Consumer Sentiment Index offers a nuanced perspective, registering a score of -1. This subtle dip from last week's score of 0 suggests that current attitudes toward Manhattan residential real estate are almost in alignment with its seasonally adjusted pre-pandemic average. With 181 contracts signed this week, compared to 187 the previous week, the sentiment remains cautious yet hopeful. Understanding these nuanced shifts is paramount for stakeholders, as sentiment often precedes tangible market shifts. As we progress through the year, keeping a finger on the pulse of consumer perceptions in Manhattan will be crucial for strategizing effectively.

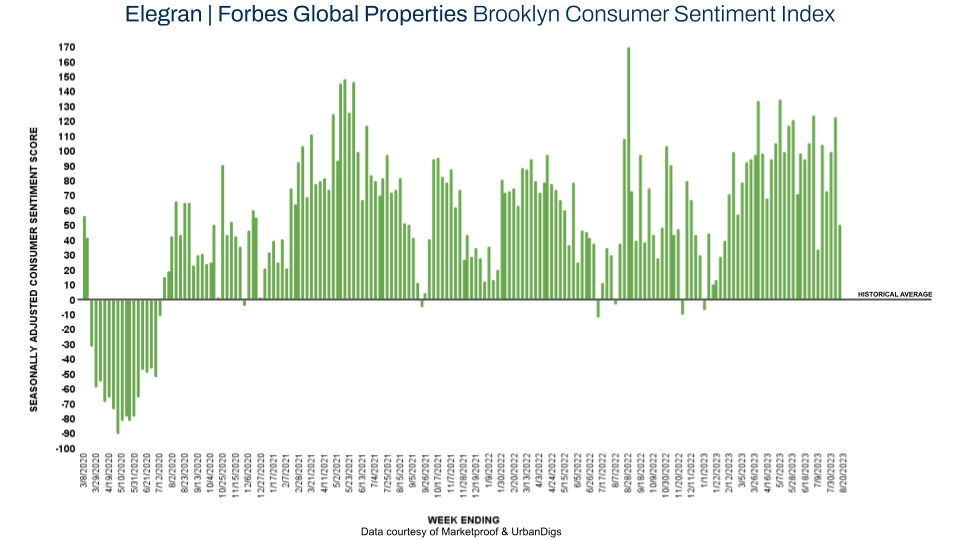

Brooklyn Consumer Sentiment

Brooklyn's real estate realm continues to surprise with its resilience and dynamism. The Elegran | Forbes Global Properties Brooklyn Consumer Sentiment Index for this week presents an intriguing snapshot: a score of +51, indicating that current sentiments are robustly positive, standing 51% above the seasonally adjusted pre-pandemic benchmark. Though there's been a decline from last week's staggering +123, it's vital to note that the sentiment has consistently outpaced the historical average since July 2020. With 117 contracts finalized this week, in contrast to 154 the previous week, there's a slight contraction in activity, yet the overarching positivity remains. For those considering a dive into Brooklyn's property market, these sentiment metrics offer a wealth of insights, hinting at both prevailing trends and possible future trajectories.

New Development Insights

As reported by Marketproof, this week, 46 new development contracts were reported across 35 buildings. The following were the top-selling new developments of the week:

- TRIBECA GREEN (Battery Park City)

- CLAREMONT HALL (Morningside Heights)

- SKYLINE TOWER (Long Island City)

Each reported 3 contracts.

If you would like to chat about the most recent market activity, feel free to contact us at info@elegran.com or connect with one of our Advisors.

About Us

Welcome to Elegran, where our mission is to revolutionize the world of real estate. Founded in 2008 by Michael Rossi, our journey began with an unwavering drive for motivation, innovation, and a genuine care for our clients.

As an independently owned brokerage, we pride ourselves on our elite team of "advisors," offering a personalized touch that goes above and beyond the traditional real estate experience. Armed with robust data insights, we empower our clients to make informed decisions that lead to success.

Distinguished as the exclusive member of the invitation-only Forbes Global Properties network in NYC, Elegran proudly stands at the forefront of excellence. This exclusive partnership broadens our horizons, enabling us to connect buyers, sellers, and investors with extraordinary luxury properties not only in New York City but across the globe.

Our passion lies in turning your real estate dreams into reality, and we are committed to providing exceptional service at every step of the journey.

Are you ready to experience the Elegran difference? Dive into the possibilities at www.elegran.com and embark on an unforgettable real estate adventure with us.

Categories

Recent Posts

Stay in the Know!

Sign up to receive our monthly newsletter

GET MORE INFORMATION