Weekly Manhattan & Brooklyn Market Update: 1/27

Navigating a Punishingly Efficient Market

This week’s market activity highlights the unique dynamics of today’s punishingly efficient real estate environment. Sellers of well-positioned, appropriately priced properties continue to attract buyer interest and strong offers, while those with overpriced or mispositioned listings face challenges. Today’s buyers are discerning and patient, willing to wait for the right property at the right price—without the external pressures, like fear of missing out (FOMO), that characterized frothy markets of the past.

Adding to the complexity of the NYC market, there are instances where no clearing price may work. For some sellers, the price required to close a deal is either too low to accept—or, uniquely in the case of co-ops, too low to gain board approval. This dynamic creates a de facto price floor, preserving property values in a way distinct to New York City.

Mortgage rates held steady for most of the week, with a slight uptick toward the end, remaining near levels seen at the start of 2025. While the market remains active, disruptions in the usual reporting cadence over the past two weeks led to artificially low figures last week and inflated numbers this week for new-to-market supply and contract activity. By averaging the data from the past two weeks, we arrive at more accurate figures and see that market activity has been steady and consistent throughout January.

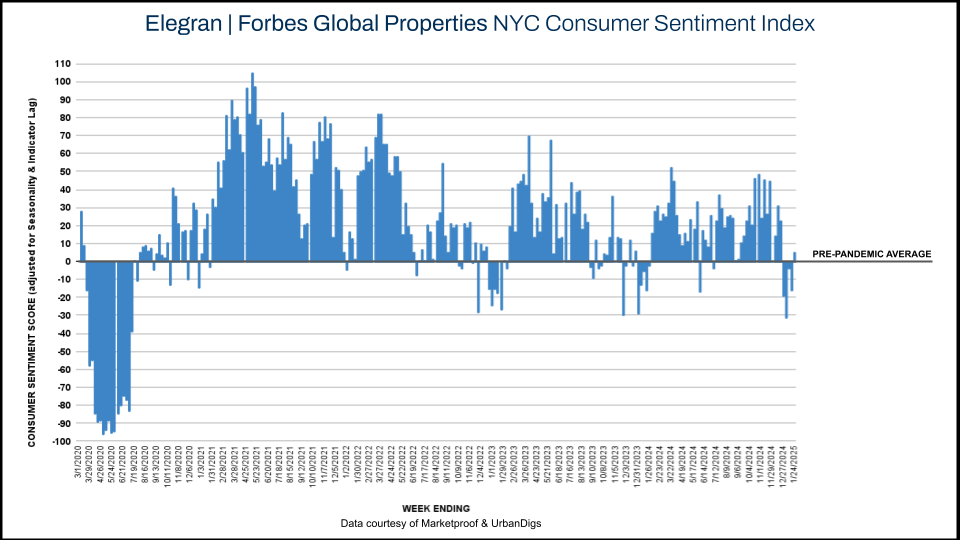

This stability is reflected in the Elegran | Forbes Global Properties NYC Consumer Sentiment Index, which rose from -17 to 5 this week. An index value of 5 indicates overall sentiment is near parity with the long-term pre-pandemic average, signaling a return to normalcy in buyer confidence and behavior.

In this environment, strategic pricing, flawless marketing, and understanding market nuances are critical for sellers who want to succeed. The market will quickly tell you if your property is overpriced—buyers aren’t compromising, and sellers must adapt to stay competitive.

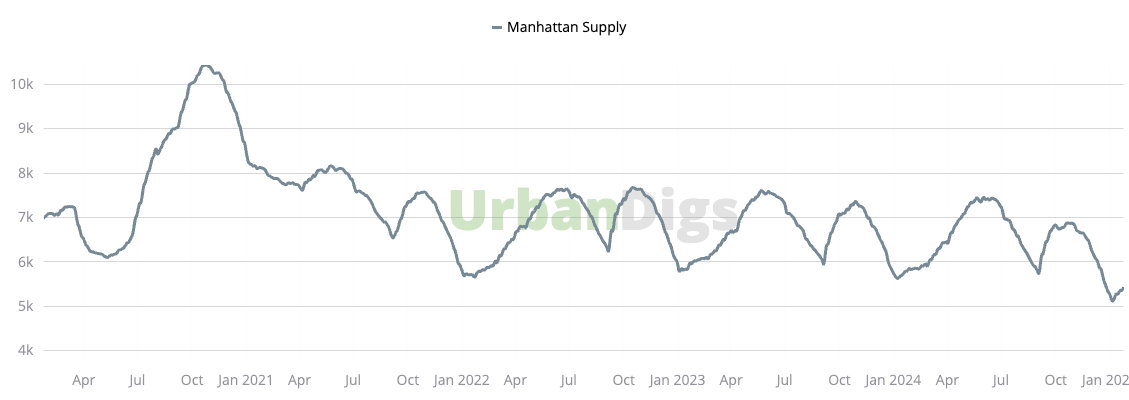

Manhattan Supply

This week, 363 new listings came on the market, a 59% increase compared to last week’s unusually low figure. However, this spike reflects disruptions in the usual reporting cadence over the past two weeks, resulting in artificially low and disproportionately high numbers this week. By averaging the past two weeks, we arrived at a more accurate figure of 296 new listings—consistent with the steady pace earlier this month. Overall, total supply rose 2%, bringing the number of properties available for sale to 5,439.

Data courtesy of UrbanDigs

Brooklyn Supply

This week, 190 new listings came on the market, a 17% increase from last week. However, due to disruptions in the usual reporting cadence over the past two weeks, averaging the data reveals 176 new listings—a figure slightly above the pace seen earlier this month. Total supply rose by 2.7%, bringing the number of properties available for sale to 2,864.

Data courtesy of UrbanDigs

Manhattan Pending Sales: Pending sales increased by 1.2% to 2,929.

Brooklyn Pending Sales: Pending sales decreased by 0.5% to 1,833.

Manhattan Consumer Sentiment

This week, 197 contracts were signed, reflecting a 52% increase compared to last week’s low figure. However, disruptions in the usual reporting cadence over the past two weeks have skewed the data, with last week’s numbers artificially low and this week’s disproportionately high. By averaging the past two weeks, we see 164 signed contracts—a figure highlighting stable demand through January and slightly surpassing last year’s volume. The Elegran | Forbes Global Properties Manhattan Consumer Sentiment Index remains in negative territory for the fifth consecutive week, but there are signs of improvement. The index rose sharply from -35 last week to -2 this week.

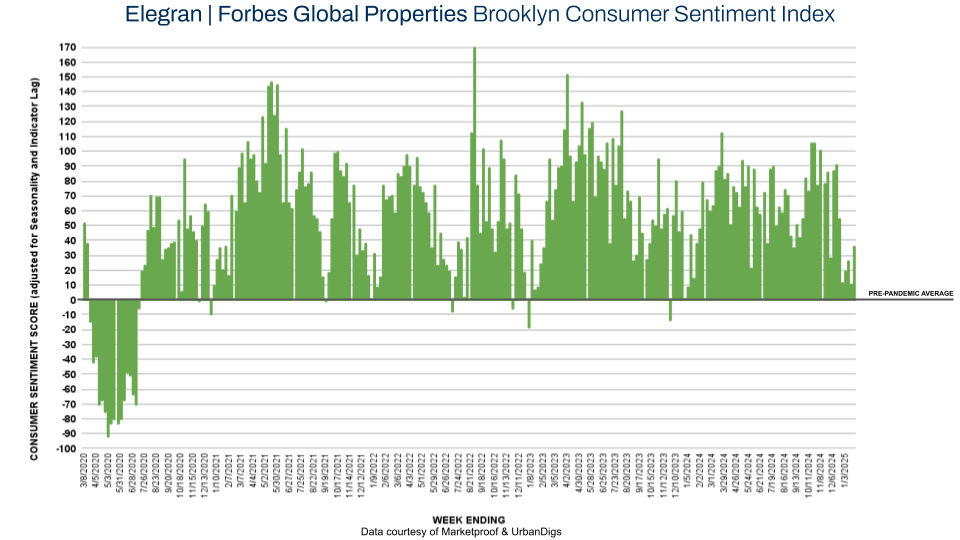

Brooklyn Consumer Sentiment

This week, 100 contracts were signed in Brooklyn, marking a 25% increase from last week’s low figure. However, due to disruptions in the usual reporting cadence over the past two weeks, the two-week average of 90 signed contracts provides a more accurate reflection of stable demand through January. While this figure is slightly lower than the same period last year, it suggests a steady market. The Elegran | Forbes Global Properties Brooklyn Consumer Sentiment Index rose from +10 to +36 this week.

New Development Insights

Marketproof reported that 32 new development contracts were signed in 26 buildings this week. The following buildings were the top-selling new developments of the week:

-

Mason LIC (Long Island City) signed 3 contracts

-

The Perrie (Turtle Bay), The Treadwell (Lenox Hill), Vandewater (Morningside Heights), and 210 Columbia St (Columbia Waterfront) each signed 2 contracts.

If you would like to chat about the most recent market activity, feel free to contact us at info@elegran.com or connect with one of our Advisors.

About Us

Welcome to Elegran | Forbes Global Properties, where our mission is to revolutionize the world of real estate. Founded in 2008 by Michael Rossi, our journey began with an unwavering drive for motivation, innovation, and a genuine care for our clients.

As an independently owned brokerage, we pride ourselves on our elite team of "advisors," offering a personalized touch that goes above and beyond the traditional real estate experience. Armed with robust data insights, we empower our clients to make informed decisions that lead to success.

Distinguished as the exclusive member of the invitation-only Forbes Global Properties network in NYC, Elegran proudly stands at the forefront of excellence. This exclusive partnership broadens our horizons, enabling us to connect buyers, sellers, and investors with extraordinary luxury properties not only in New York City but across the globe.

Our passion lies in turning your real estate dreams into reality, and we are committed to providing exceptional service at every step of the journey.

Are you ready to experience the Elegran difference? Dive into the possibilities at www.elegran.com and embark on an unforgettable real estate adventure with us.

Categories

Recent Posts

Stay in the Know!

Sign up to receive our monthly newsletter

GET MORE INFORMATION