Elegran Manhattan Market Update: July 2022

Overall Manhattan Market Update: July 2022

Manhattan Market Update

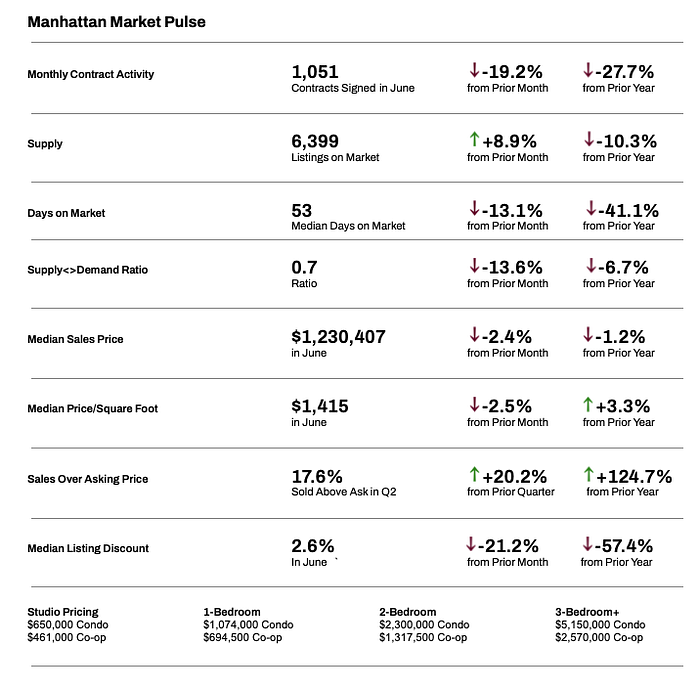

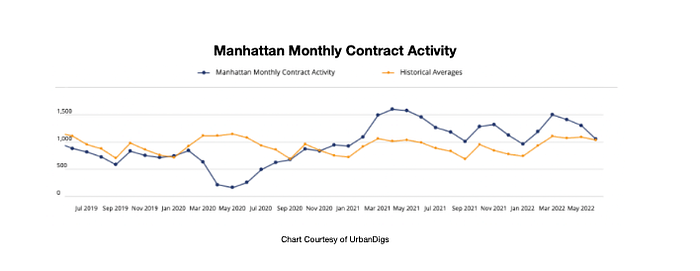

June marks the first month of Manhattan’s summer market and all indicators point to a return to seasonal patterns. Summer for Manhattan real estate means decreased new-to-market supply and lower contract volume. Compared to prior months, both new-to-market supply and contract volume have decreased, as seasonally normal. New-to-market supply remained 24% above the historical average in June, while contract activity was only 2% above the historical average. After 19 consecutive months of above-average contract activity, the trend is returning to average levels and Manhattan likely will experience below-average contract volume this summer.

In the face of growing uncertainty, rising interest rates and falling equities, some buyers are pressing pause. As a result, the market is slowing and liquidity is decreasing. For sellers, this means it will take more time to sell your home and you’ll likely need to reduce your asking price or offer a larger discount. For buyers, this means you’ll experience a market with less competition and a bit more negotiability. Cash buyers may experience even greater negotiating power [compared to financing buyers] as there is less uncertainty for a seller.

There’s a case to be made for the return of the [all-cash] investor to Manhattan real estate. While other markets across the country have seen rapid, and arguably unsustainable appreciation, Manhattan has not. While, yes, Manhattan is up 20–25% from COVID lows, Manhattan is only up about 15% from the start of COVID, far lower than the 50–75%+ appreciation seen in Tampa, Phoenix, Boise and Austin. Amongst locations to invest in real estate, Manhattan is long considered a AAA investment in terms of capital preservation and long-term appreciation. For the first time in many years, a case can be made that Manhattan is a good investment, as prices are not elevated and, despite the short-term peak, are poised to rise. Additionally, with rising rental rates, owners are experiencing rising cap rates. Strong rental prices can also create a backstop for the sales market, as it creates both demand for investors to purchase property and it creates an alternative for sellers unable to command their desired sales price.

While a lot may be changing, what remains the same is that NYC is hyper-local. Even though the aggregate Manhattan market is going through a gearshift, specific micro-markets may already be luke-warm or may be red-hot. Whether you are a buyer or seller, It’s important to speak with your real estate advisor to assemble your gameplan.

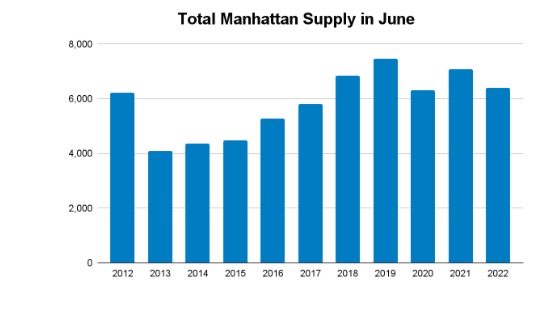

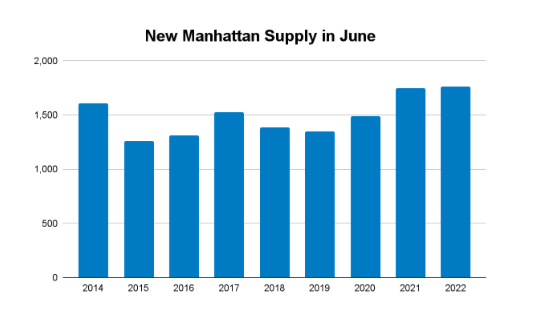

Manhattan Supply

Total supply increased by 9% in June to 6,399 units for sale. In June, 1,766 new listings came to the market, setting a decade high for new-to-market inventory in the month of June. Nearly 1% more units came to market this June than in June 2021 and this year’s new-to-market total is nearly 24% above the average June new-to-market-supply. Rising supply is one component contributing to the Market Pulse declining and leverage shifting away from sellers. In the face of a normalizing market and rising supply, it becomes essential for seller’s to price accurately and apply a discount to comps that closed in Q1 and Q2 2022.

Note: “Total Supply” refers to the amount of inventory on the market at a given time. “New Supply” or “New-to-Market” refers to the amount of new inventory that came on the market in a specific time period.

Manhattan Buyer Activity as measured by signed contracts, reverted to the mean, after 19 consecutive months of above average contract activity. In June, 1,051 contracts were signed, just above the historical seasonal average of 1,033 signed contracts in June. After an elevated market in 2021 and in Q1 2022, the difference between the historical average and the volume in April, May and June 2022 narrowed.

Manhattan’s Market Pulse [a ratio between pending sales and supply] increased by 14% in June as supply rose and contract activity declined. While the current Market Pulse of 0.7 is still indicating a seller’s market, leverage is shifting away from seller’s and the market is shifting towards a balanced [neutral] market.

Pricing & Discounts

Manhattan prices, after hitting a short-term peak in March and April, have trended down slightly in May and June in the face of rising interest rates and downward pressure on equities, crypto and other risk assets. In June, Manhattan’s median sales price was $1,230,407, a decrease of 2.4% from May and a decrease of 1.2% from last year. Manhattan’s median price per square foot was $1,415 in June, a decrease of 2.5% from May and an increase of 3.3% from last year. The median listing discount also declined in June to 2.6%, which is a decrease of 21% from last month and a decrease of 57% from last year. It’s expected that the median listing discount will increase through the summer as demand wanes and supply increases.

With the slight decline in prices over the last two months, sellers need to factor in a 2–5% discount when comparing against homes that sold in Q1 2022. Buyers may experience increased negotiability this summer given the shifting market. The strength of the rental market may create a backstop for prices to decrease any meaningful amount as sellers, if they are unable to command their desired sale prices, may choose to rent instead since rents are elevated.

What this means for…

Buyers:

- Buyers will experience a less-competitive market this summer offering more negotiability and choice.

- Interest rates have ticked down slightly in the second half of June. Interest rates on jumbo mortgages remain lower than conforming loans.

- Prices have hit their short-term peak and have decreased slightly in the last month. While price appreciation may be taking a breather for a few months, prices are not projected to fall noticeably in the near-term.

- Cash buyers should have more negotiating power than financing buyers as there is less risk in a cash deal for a seller.

- The current downshift in the market will show up in Q3 and Q4 market statistics.

Sellers:

- Thinking of listing this fall? It may be beneficial to list this summer and face less competition.

- Prices peaked in March and April. Sellers need to be realistic about their pricing and apply a 2–5% discount to comps that sold earlier this year.

- Sellers who are not commanding their desired sales price should consider renting instead and capitalize on the strong rental market and high rents.

Renters:

- The rental market is as competitive as ever and supply is decreasing again.

- While in June about 33% fewer leases were signed this year compared to last year, about 36% fewer apartments came to the market.

- While the overall supply of rental apartments increased by just over 3% in June, seasonal demand increased substantially more than supply creating even more competition amongst tenants.

- Between existing tenants renewing their lease rather than moving, and a steady flow of recent graduates moving to NYC, the rental market is very tight, resulting in rising rents, lines at open houses and often multiple applications for apartments.

Investors:

- Current market conditions create an opportunity for cash-investors (who are either liquid, or able to trade out of another real estate investment) to invest in Manhattan real estate.

- The strong rental market may create a price floor for sales prices, offering sellers the option to rent their home for 1–2 years if they are unable to command their desired sales price.

Please contact us if you would like to learn more …

Categories

Recent Posts

Stay in the Know!

Sign up to receive our monthly newsletter

GET MORE INFORMATION