Elegran Manhattan Market Update: November 2022

Manhattan Market Update

The inflation rate is +151% higher than its long-term average.

JUMBO mortgage rates are up +109% YTD.

^GSPC (the S&P 500 index) has given back –22% YTD.

And yet, demand for NYC residential real estate (as measured by weekly signed contracts) continues to equal or exceed its pre-pandemic average (the period 5 Jan 2015–1 Mar 2020). Floating atop an ocean of investments that purport the primary objective of principal preservation with capital appreciation as a secondary strategy, NYC residential real estate would appear to be the new gold standard. Except that the concept of NYC weathering market volatility isn’t a new story at all; in fact, it’s a story as old as the data allows us to tell.

Manhattan Supply

Month-over-month, total supply increased modestly to 7,647 units for sale, +9% more than the historical October average. Referencing the chart below, supply is significantly less than the 2020 high mark when pandemic uncertainty catalyzed listing activity en masse, accruing into and peaking during October, before the record absorption period began. New supply is at parity with the historical average, another optimistic signal that Manhattan sellers are behaving “normally” despite national and international headwinds. Note: “Total Supply” refers to inventory on the market at a given time. “New Supply” refers to new inventory that came on the market in a specific time period.

Manhattan Buyer Activity

October’s signed contracts — the current indicator for demand — increased by +10.6% over September’s numbers. Although this month’s numbers are less than both October 2021 and the historical average, we must keep in mind that the 2021 absorption was extraordinary.

Manhattan Monthly Contract Activity

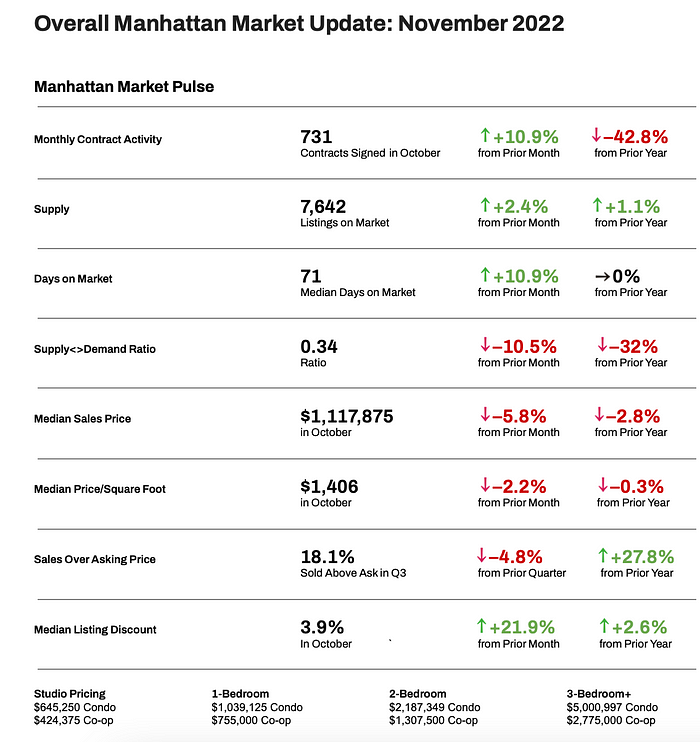

Manhattan Market Pulse

Currently at 0.34, the ratio of demand (as measured by pending sales) to supply, decreased –10.5% from September and is lower by –32% from this time last year.

The graph below tracks the monthly aggregate of demand (as measured by contracts signed), supply and median price/sf. It indicates that Manhattan remains firmly in the grips of a buyer’s market and, judging by the slope of the curve, a strong buyer’s market.

Pricing & Discounts

At $1,117,875, Manhattan median sales price has trended downhill after hitting a short-term peak in April and May, yet is still marginally higher than this time last year. Median price per square foot, currently at $1,411, indicates a very similar trend, down slightly from Q2, yet higher Y-O-Y. After reaching 8.1% in April 2021, median listing discount trended down to 2.4% in July 2022. It has since been increasing rapidly, now at 3.9%.

What this means for…

Buyers:

- Because supply and pricing became markedly overheated during 2021 and H1–2022, Manhattan is currently a strong buyer’s market. Remember, a buyer’s market means, in part, that prices are moving in the favor of buyers and that they should be rewarded for their patience.

Sellers:

- Although the current market favors buyers, demand is still at or above its pre-pandemic average. So, there are ample consumers in the market to move inventory; however, sellers need to set their expectations at pre-pandemic levels, not at 2021 levels where demand and price inflation were at record (and unsustainable and, ultimately, unhealthy) levels.

- Sellers who are not commanding their desired sales price should consider renting their home instead, at least for a year or two, and capitalize on the strong rental market and high rents.

Renters:

- Although peak rental pricing has plateaued, rents remain significantly inflated as decades high — and still climbing — mortgage rates force buyers out of the for sale market and into the for rent market.

Investors:

- Strong rents and humbled pricing create continued opportunities for cash-investors (who are either liquid, or able to trade out of another real estate investment) to invest in Manhattan real estate.

- Manhattan presents relative value compared to national markets that experienced steep price appreciation over the last 24-months, now overheated with little to no room for near-term growth.

Please contact us if you would like to learn more …

Categories

Recent Posts

Stay in the Know!

Sign up to receive our monthly newsletter

GET MORE INFORMATION